DevOps: “The need for (software release) speed”

At Investec, we see huge opportunities open to DevOps companies, across both software and services, and the investors backing them. As the industry continues to develop, we also expect the sector to heat up with more M&A opportunities on the horizon.

Organisations are under increasing pressure to innovate and deliver new digital experiences to their customers, partners and employees. As they seek to respond to these challenges, companies are realising the importance of efficient software development and deployment, coupled with new working practices that bring teams together effectively.

DevOps aims to solve these issues, bridging the gap between software development and IT operations to deliver applications and services at high velocity. The importance of DevOps is clear when you consider the high growth forecasts for the market – which is expected to grow at a 20% CAGR from 2020-2026 with an estimated total market size of $18 billion by 2026.

As Investec’s advisory team for the Technology sector, we see huge opportunities open to DevOps companies, across both software and services, and the investors backing them. As the industry continues to develop, we also expect the sector to heat up with more M&A opportunities on the horizon.

Read our report for more insight

Whether you are a DevOps company looking to explore strategic options for your business, or an investor / strategic buyer looking for advice on evaluating and financing an acquisition in the DevOps market, Investec can help by providing buyside or sellside advice, raising investment from private equity / venture capital or via an IPO.

What is DevOps?

Combining the words ‘development’ and ‘operations’, DevOps is a combination of practices, tools and philosophies that increases an organisations’ ability to deliver and deploy software applications and services at high velocity.

A DevOps approach removes the barriers between development and operations divisions. These formerly siloed teams, often merge into a single team where the engineers work across the entire software development lifecycle and have multidisciplinary skills.

You can visualise a DevOps process as an infinite loop, comprising six phases (the software development lifecycle or SDLC):

- initial process planning

- software code creation

- integration and delivery

- testing

- deployment

- monitoring and management

Enterprises are looking to DevOps to exploit modern technologies across their application lifecycle. The result of this is shorter release cycles and time-to-value, higher-quality, better consistency, reliable deployments and increased agility.

By automating the software development pipeline, it becomes possible to ensure the reliability and stability of an application after every new release. When the applications perform correctly in production, companies reap the benefit of greater customer satisfaction.

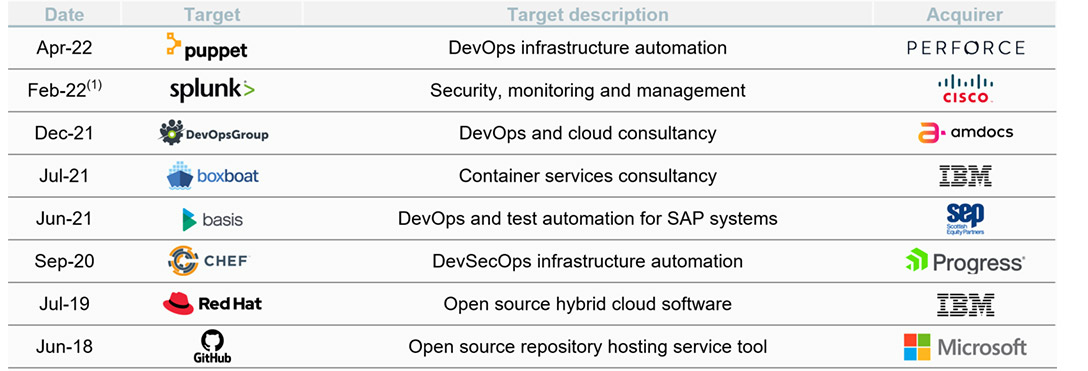

M&A Activity Is Picking Up

According to IDC, over 500 million new digital applications and services will be developed and deployed by 2023 – the same number of apps that have been developed over the last 40 years. With such high demand, it’s no surprise that M&A activity has been growing over the past few years.

While M&A activity has historically been dominated by trade buyers, interest from the private equity community is increasing – and now accounts for 40% of deal volume.

As the DevOps market continues to rapidly expand in an already fragmented and competitive market, we expect this to drive increasing sector consolidation as large and better funded acquirers look to increase their capabilities.

We expect the services providers to be net beneficiaries of the DevOps market growth; in particular, those that have demonstrated significant technical expertise and achieved stellar growth. Both trade and PE-backed assets recognise the need for talent, resulting in increased M&A consolidation for scaled, high-end consultancy assets in the market.

There is significant room for further services businesses to enter the market, particularly as the software landscape is continually evolving – which is why we expect further M&A consolidation to occur in 2022.

Selected transactions:

Notes: (1) Unsolicited takeover approach announced Feb-22, not completed

Read our report for more insight

Whether you are a DevOps company looking to explore strategic options for your business, or an investor / strategic buyer looking for advice on evaluating and financing an acquisition in the DevOps market, Investec can help by providing buyside or sellside advice, raising investment from private equity / venture capital or via an IPO.

Browse articles in