Investec Market Review January 2023

The Investec Market Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM) and public M&A, whilst also reflecting on wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

- Global indices have had a robust start to the year, with markets exhibiting steady gains following a challenging 2022.

- Macro and geo-political pressures continue to weigh on investor risk appetite, though improving expectations for easing interestrates and fiscal policies later in the year have given cause for some optimism.

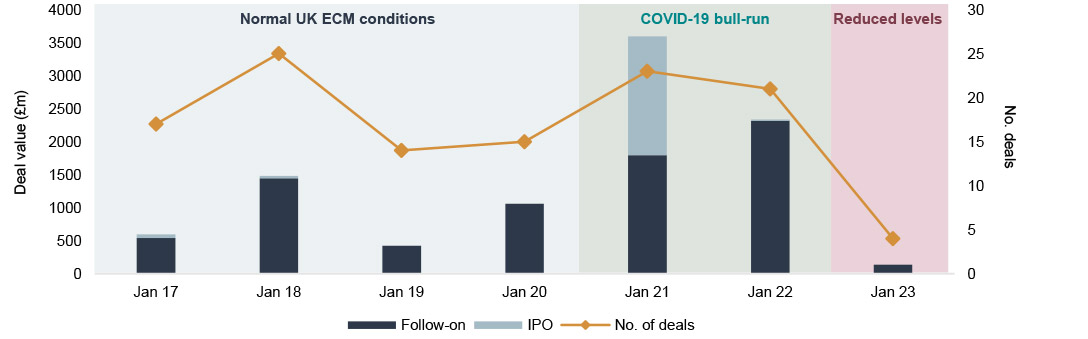

- UK ECM activity in December was very low with £53m raised in 6 deals, closing a disappointing year for UK ECM activity, particularly for IPOs. Challenging macro-economic headwinds made for challenging deal-making.

- In the meantime, UK ECM activity continues its sluggish pace, with the number of deals completing in January dipping relative to an already quiet December, and fundraising levels remaining well below more normalised volumes.

- Momentum in UK public M&A gathered pace relative to December, although activity levels are still low.

- Investec is acting as Financial Adviser to Mayfair Equity Partners on its acquisition of Seraphine Group plc.

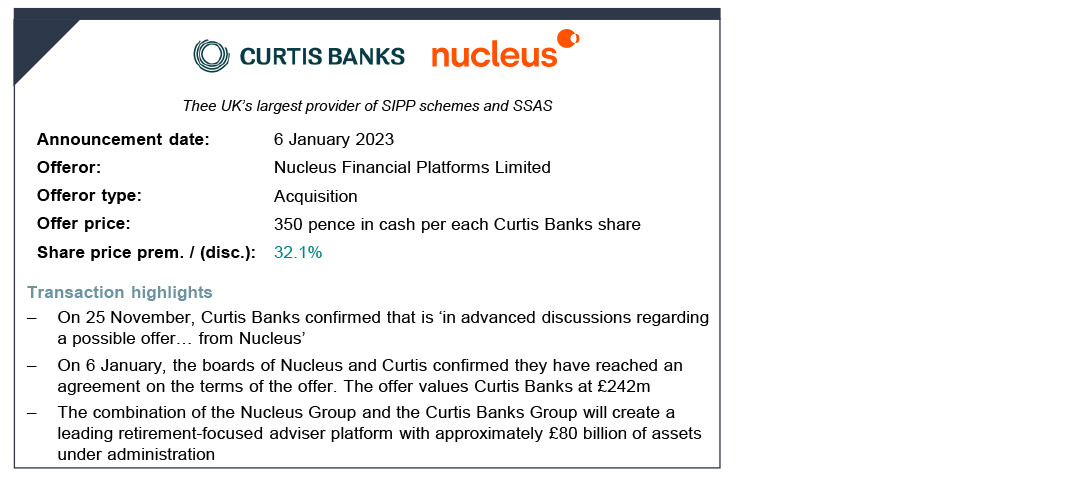

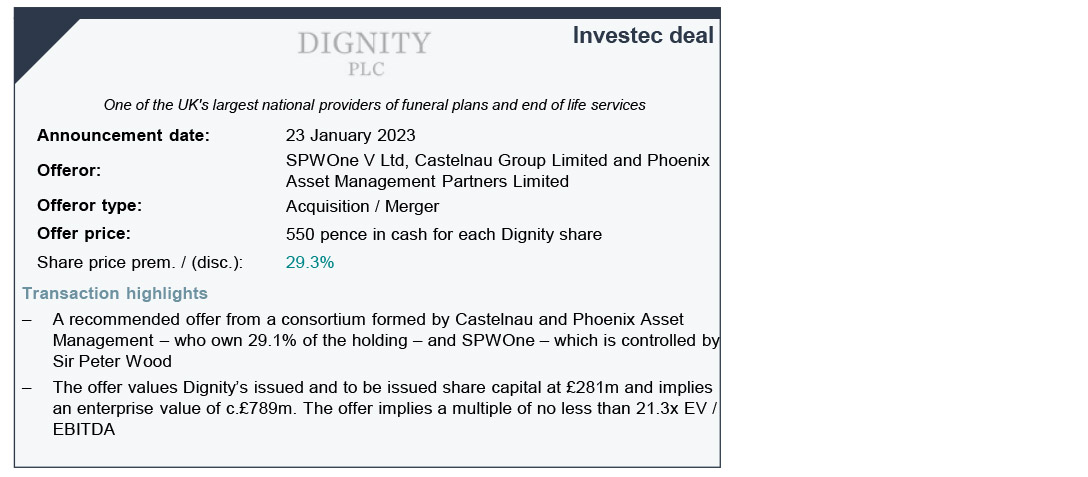

- Investec is also acting as Corporate Broker on the acquisition of Dignity by SPWOneV Ltd, CastelnauGroup Limited and Phoenix Asset Management Partners Limited.

Market backdrop

Monthly market snapshot

January's key market drivers

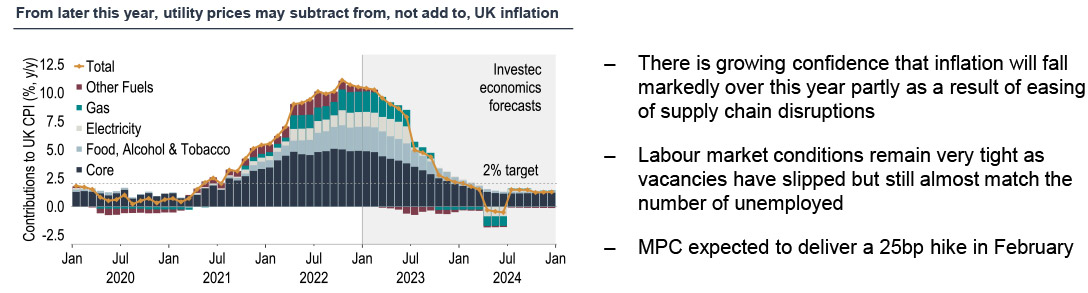

- UK inflation slipped to 10.5% in December from 10.7% in November

- Andrew Bailey, BoE, anticipates “long, but shallow” UK recession for 2023

- UK mortgage approvals hit a two year low

- UK unemployment rate remains close to record low

- British retail sales fell by 1% between November and December

- Global central banks expected to continue with rate rises, but at slower pace

- US economy expands 2.9% in Q4 2022, ahead of 2.6% estimate

- UK GDP grew 0.1% sequentially in November

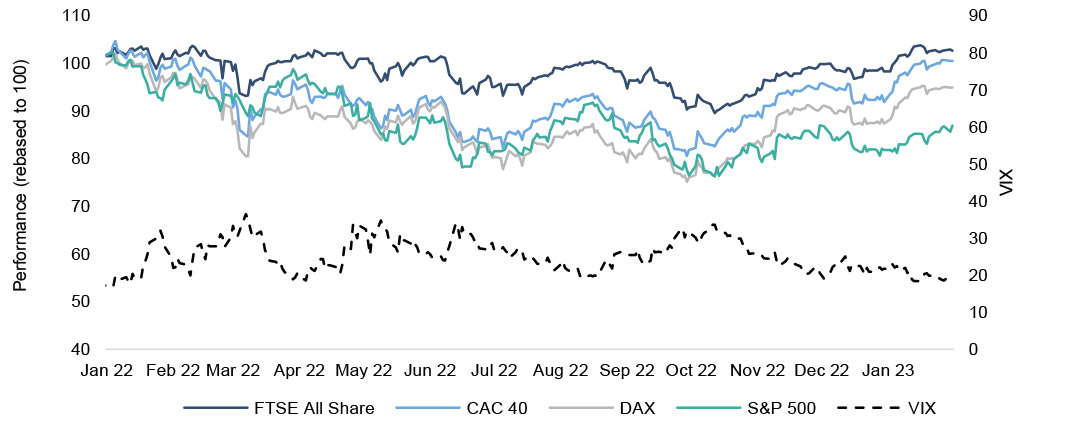

Global equity market performance & equity market volatility

Source: Bloomberg, FactSet

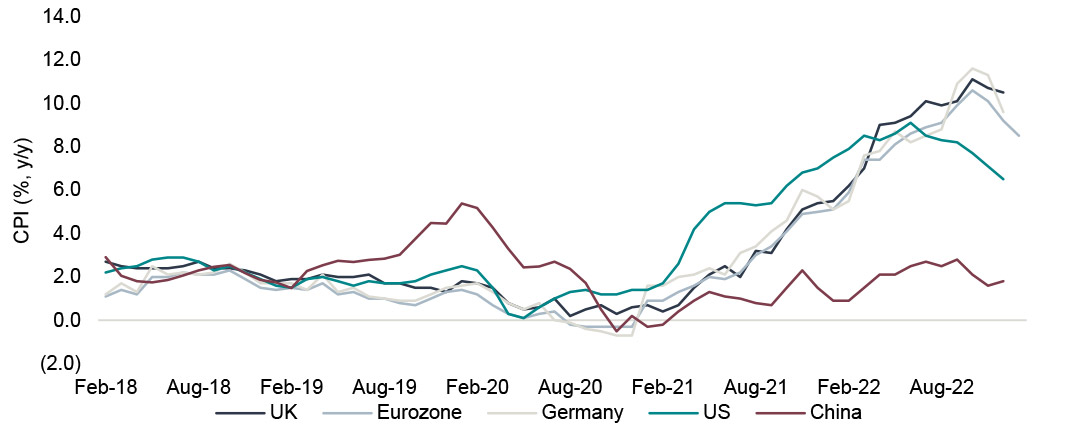

Inflation remains slows across key geographies with the exception of China

Source: Bloomberg, FactSet

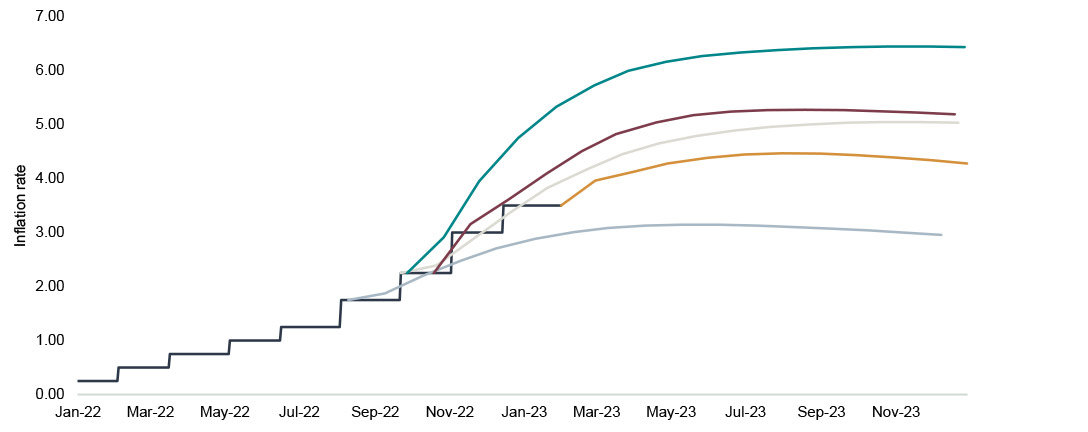

UK interest rate projections show signs of stabilising

Source: Bloomberg, FactSet

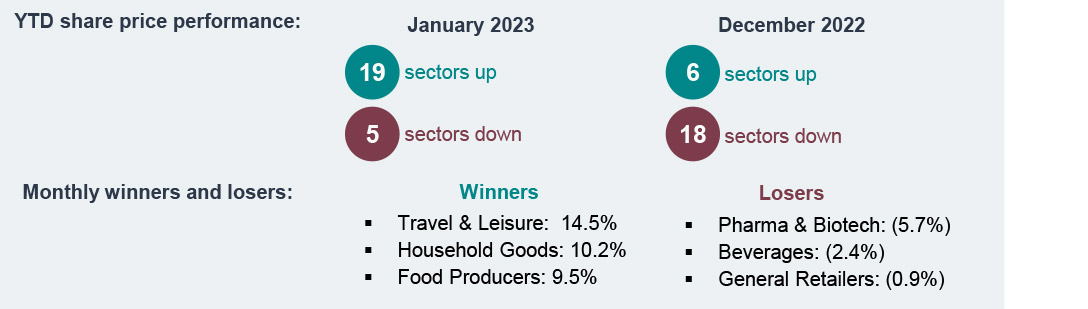

UK sector performance

Monthly sector snapshot

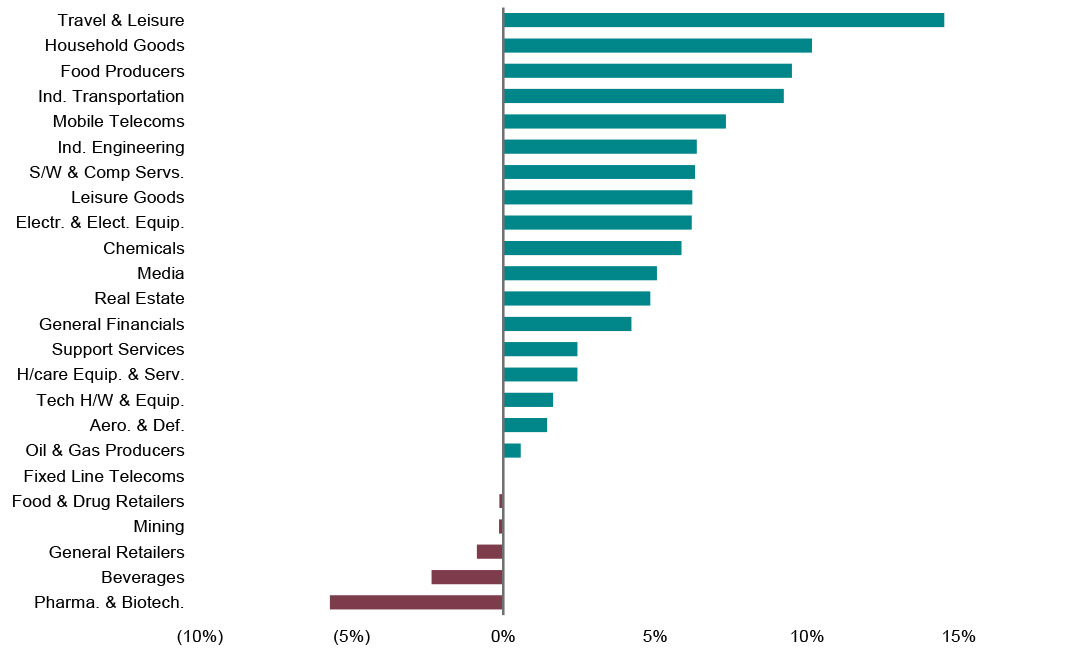

Sector performance drivers and outlook commentary

- Travel & Leisure stocks benefited from a set of positive updates from Ryanair, EasyJet and IAG with industry players citing pent-up travel demand behind a generally positive outlook for the year

- Better than expected UK GDP data coupled with the consecutive two months slowdown in inflation helped stocks in the Household Goods sector gain significant traction in the new year. Food Producers stocks reported resilient results in January, with a general increase in cost ‘pass-through’ bolstering financial performance

- Beverages and General Retailers suffered a sluggish performance in January as levels of consumer foot-fall in the UK remain subdued versus pre-COVID levels and consumer confidence dropped to a record low

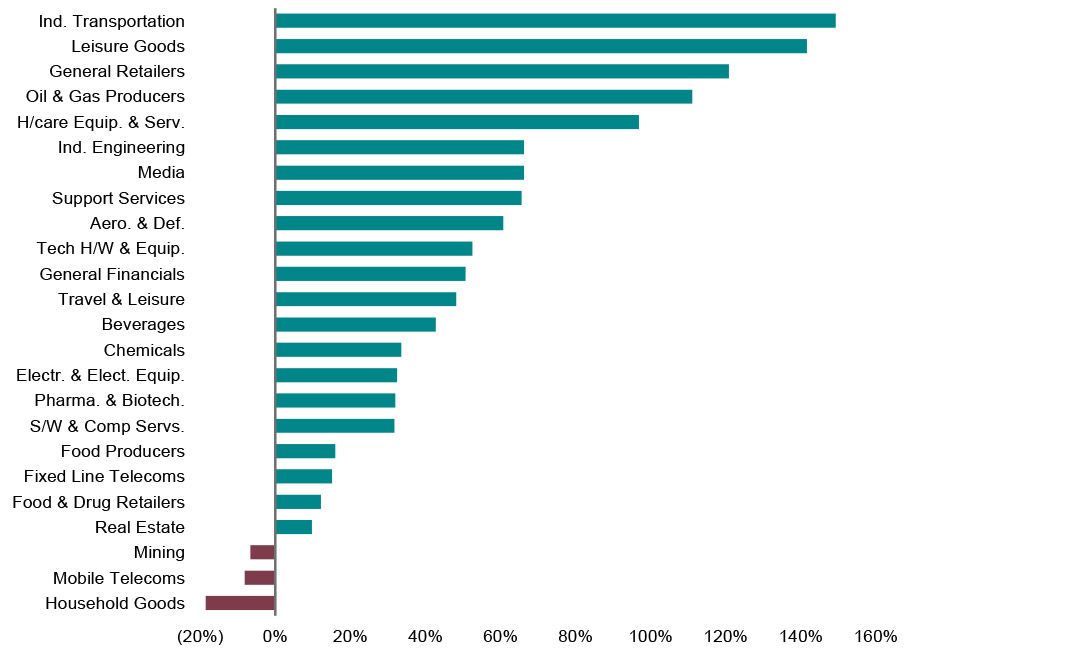

Sector performance (since mid-March 2020)

Source: FactSet

Sector performance (YTD)

Source: FactSet

Prefer to download?

You can read the full December Market review

Never miss an update

Subscribe to the monthly Market review

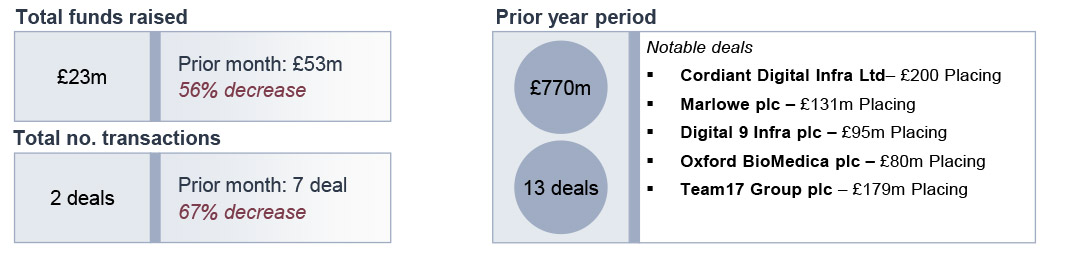

UK ECM activity continues to fall over January

Deal numbers continued to fall in January as value drops to its lowest level in the past thirteen months

Public equity fund-raises by sector and highlighted deals

Sell-down activity over January

The IPO market: looking ahead through 2023

- Activity expected to increase in 2023, particularly in H2

- Once markets do re-open, the strategy for European IPOs is expected to focus on short periods in the market, heavy pre-marketing and cornerstone validation

- Investors are increasingly open to looking at IPOs, but with discipline and sensitivity –there is a general perception that they are holding pricing power for near-terms situations

- Recent investor feedback has reiterated IPO investors are focused on good quality companies which have visibility on growth and earnings

- Key investor sensitivities for IPOs include:

- Attractive valuations

- Conservative leverage profiles amid a rising rates backdrop

- Large enough deal size to support after-market liquidity

- Attractive valuations

UK IPO pipeline: Rumoured and announced deals

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances

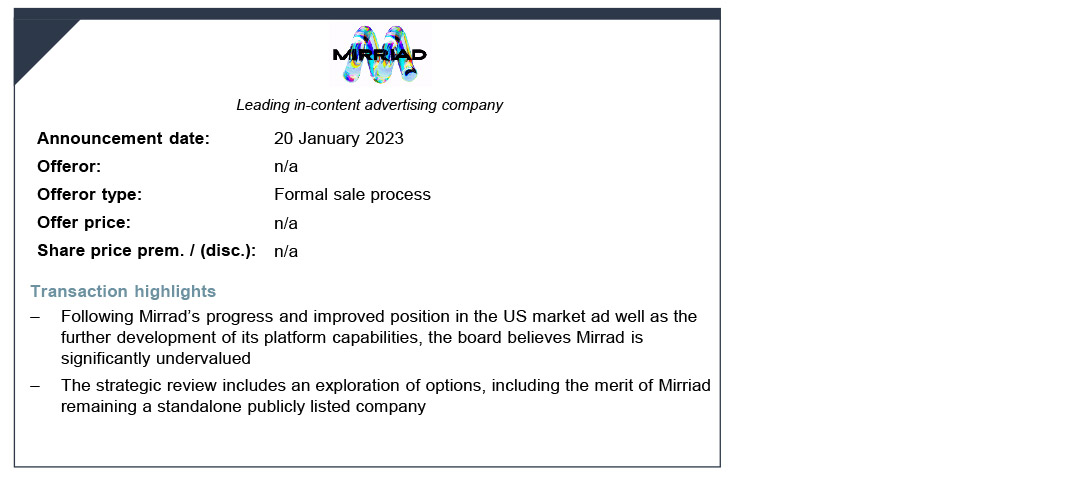

A snapshot of the current UK public M&A market

UK PLC takeover activity continued at the same pace it ended 2022 with three deals announced in the month

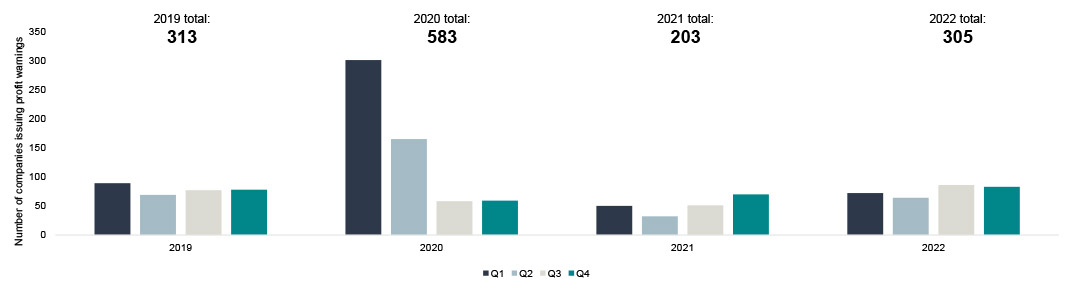

2022 saw a 50% rise in profit warnings across UK PLCs

According to EY Parthenon,the number of profit warnings in Q4 2022 remained in-line with Q3 2022

Source: EY-Parthenon

Factors catalysing profit warnings in Q4

Source: EY-Parthenon

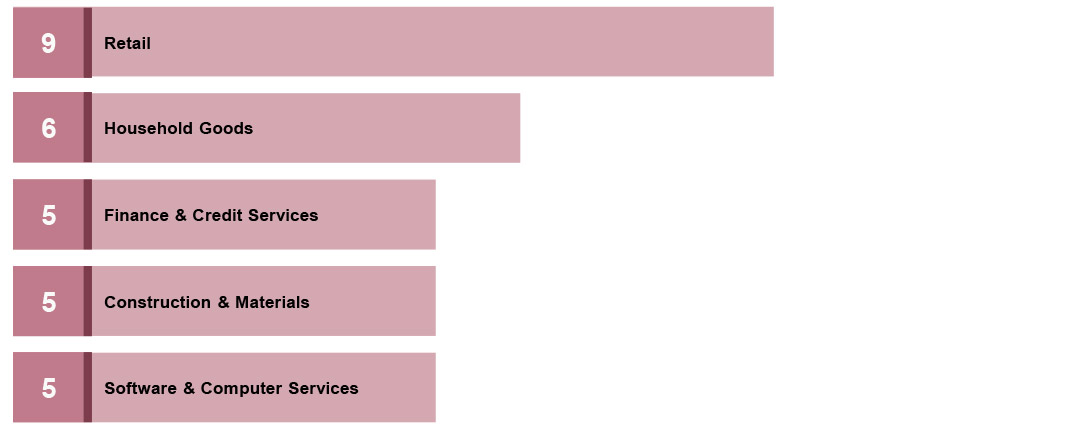

Top 5 sectors warning on profit in Q4

Source: EY-Parthenon

305

50%

48%

13%

11%

Investec’s global economic overview

Thawing growth prospects coupled with further monetary policy tightening

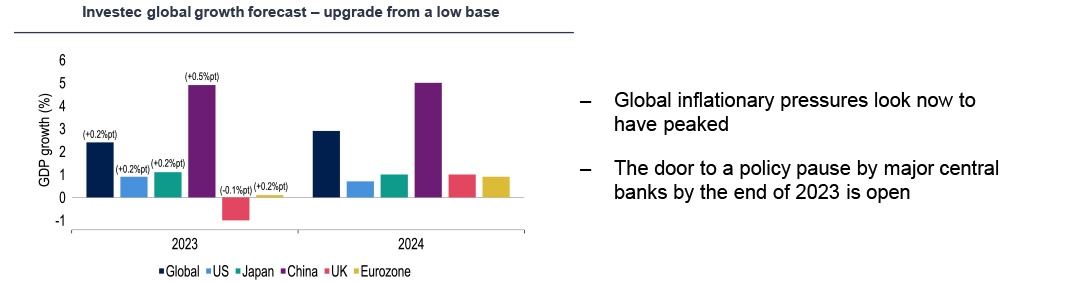

Global view

The Global economic outlook looks more upbeat

Brackets represent differences from November forecasts

Source: Investec, Macrobond

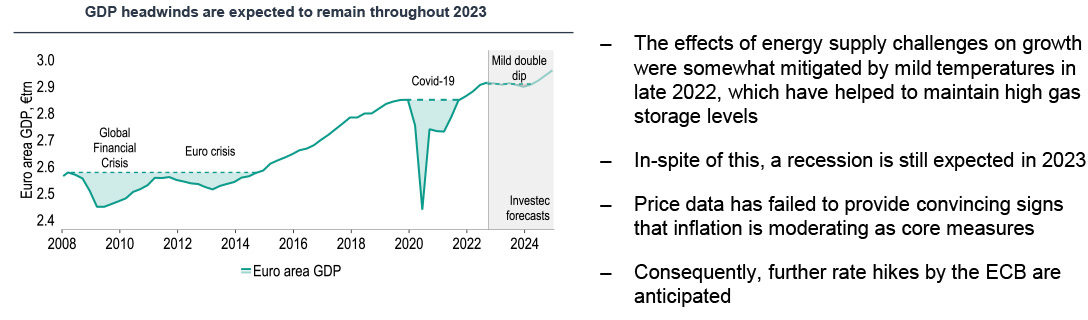

Eurozone view

Recession expected in 2023

Source: Investec, Macrobond

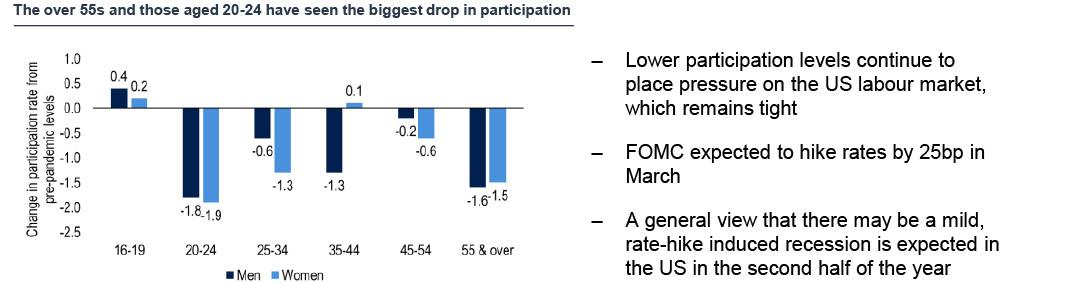

US view

US labour market participation increasingly a concern

Source: Investec, Macrobond

UK view

Inflation continues to be the main worry in the UK

Source: Investec, Macrobond

Get the monthly Investec Market Review delivered to your inbox

Browse articles in