Investec Market Review April 2023

The Investec Market Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM) and public M&A, whilst also reflecting on wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

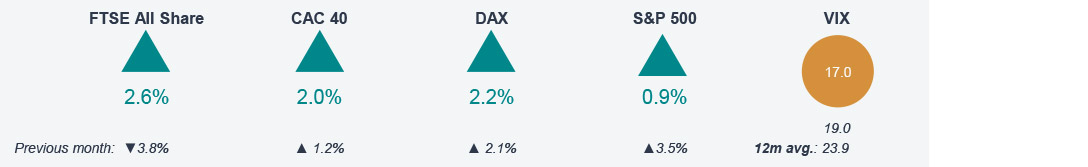

- Global indices recovered over the course of April as macro economic data continues to show signs of resilience.

- UK Consumer confidence rose to its highest level since February 2022 in April. This follows data released by the ONS which indicated the UK labour market continues to be at a low unemployment rate (3.8% in the period from December 2022 to February 2023) and private sector wages, excluding bonuses, grew by 6.6% in the same period.

- UK ECM activity remained broadly in-line with March as deal value only declined by 3%.

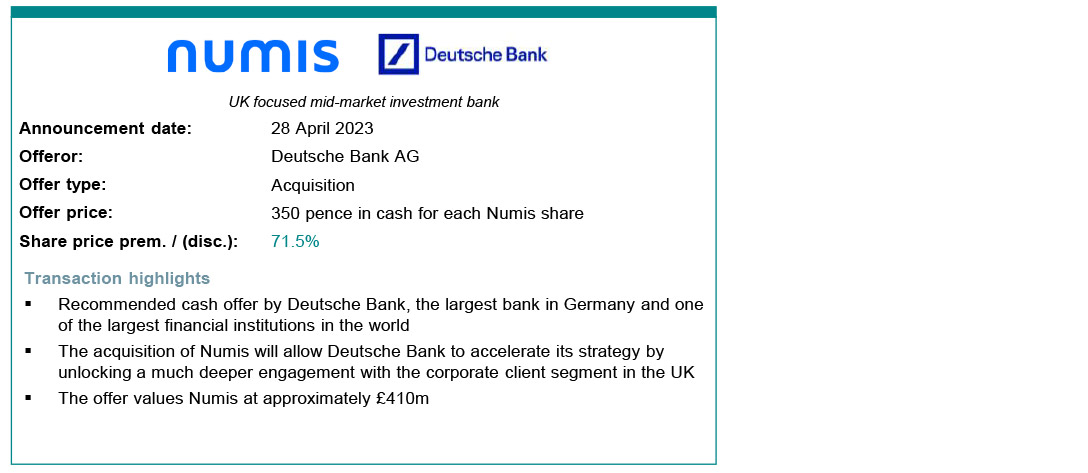

- UK public M&A activity gathered significant pace in April as thirteen new deals were announced, of which seven included a private equity offeror.

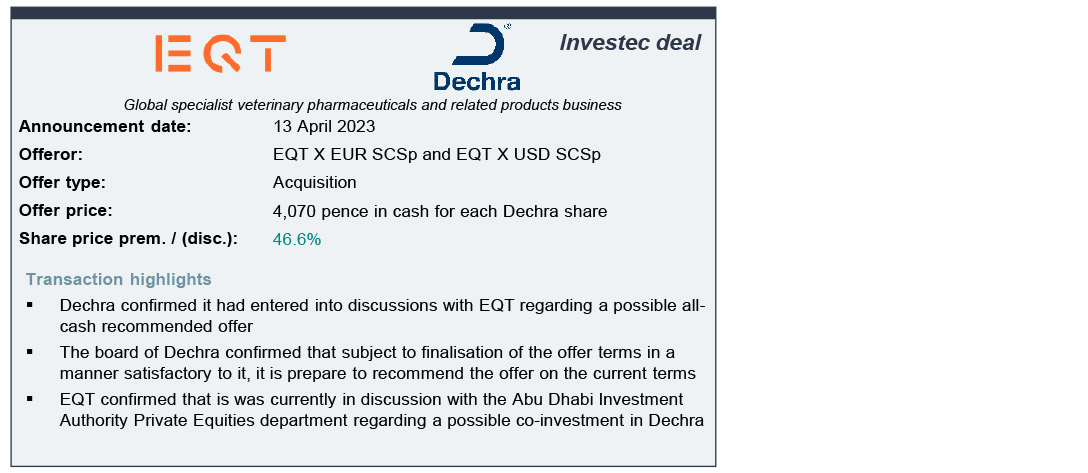

- Investec is pleased to act as sole financial adviser and broker to DechraPharmaceuticals plc with regards to the possible offer from EQT.

Market backdrop

Monthly market snapshot

April's key market drivers

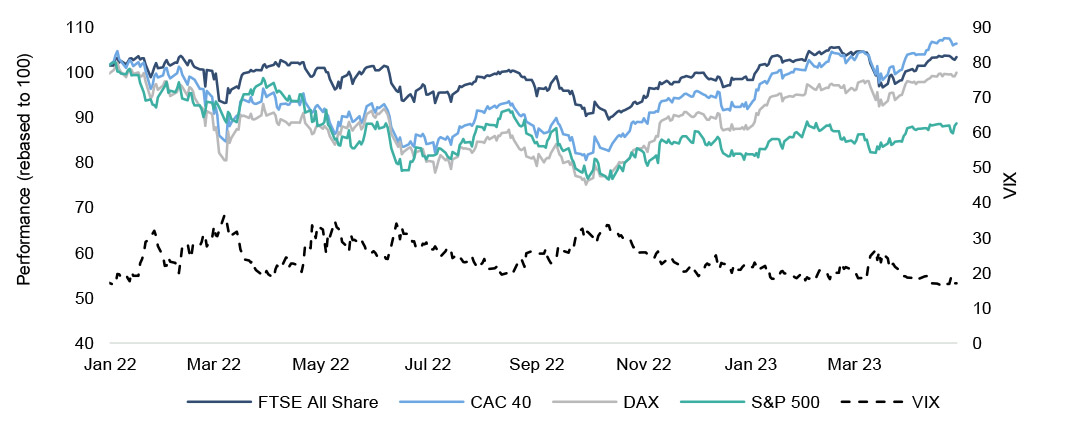

- UK inflation decreased from 10.4% (Y/Y) in February to 10.1% (Y/Y) in March

- UK Composite PMI increased from 52.2 in March to 53.9 in April

- UK public sector net borrowing stood at £21.5bn in March, c.100% of UK GDP

- UK consumer confidence rose from -36 in March to -30 in April, reaching the highest level since February 2022

- Eurozone’s Composite PMI index rose to an 11 month high of 54.4, rising 0.7pts on the month

- The Eurozone marginally avoided a recession after growing by 0.1% (Q/Q) in Q1 2023

- The US economy grew by 1.1% (Q/Q) n Q1, a significant deceleration relative to Q4 22 where the growth rate was 2.6% (Q/Q)

- US inflation decreased from 6.0% (Y/Y) in February to 5.0% (Y/Y) in March

Global equity market performance & equity market volatility

Source: Bloomberg, FactSet, Macrobond

Inflation slows down across key geographies

Source: Bloomberg, FactSet, Macrobond

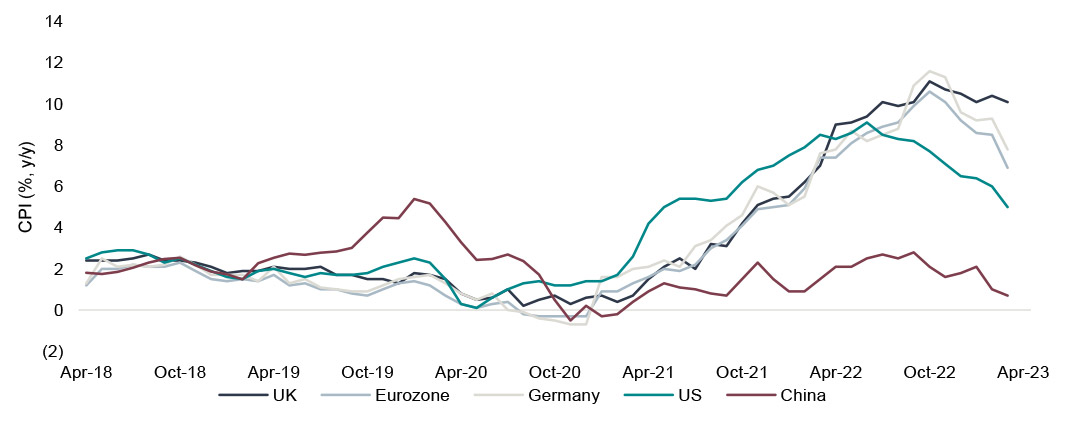

UK interest rate projections show signs of stabilising in the near-term

Source: Bloomberg, FactSet, Macrobond

UK sector performance

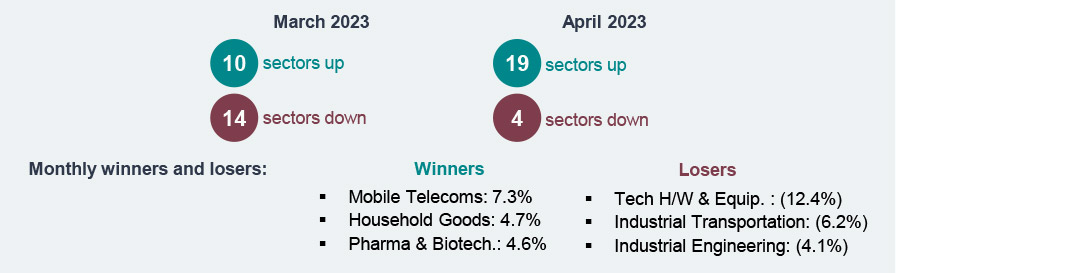

Monthly sector snapshot

Sector performance drivers and outlook commentary

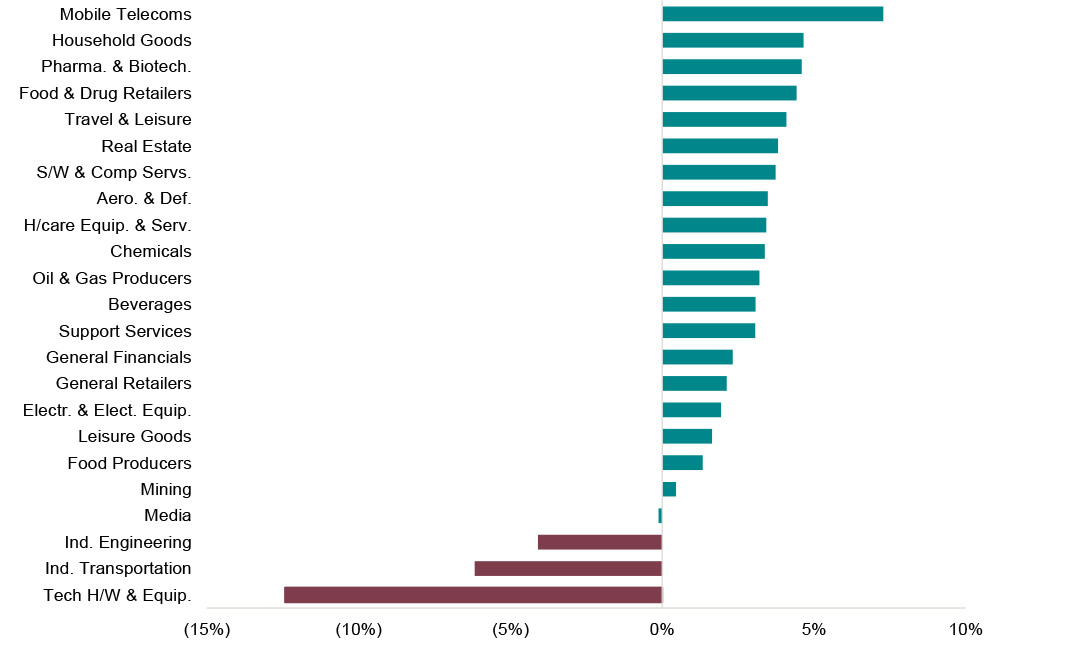

- Mobile Telecoms was the best performing sector in April aided but the strong performances of Vodaphone and Gamma Communications. Vodaphone’s share price rallied after e& entered negotiations with the group to enact changes to the board. On the other hand, Gamma Communications’ share price gathered pace following the release of its FY22 results

- Pharmaceuticals & Biotech gained considerable ground in April following the potential take private of DechraPharmaceuticals plc by EQT

- Tech Hardware and Equipment declined in April amid higher than expected inflation and further hikes in interest rates. Moreover, the Semiconductor Industry Association released figures earlier in the month, which showed global semiconductor sales decreased by 4% (M/M) and by 20.7% (Y/Y) in February

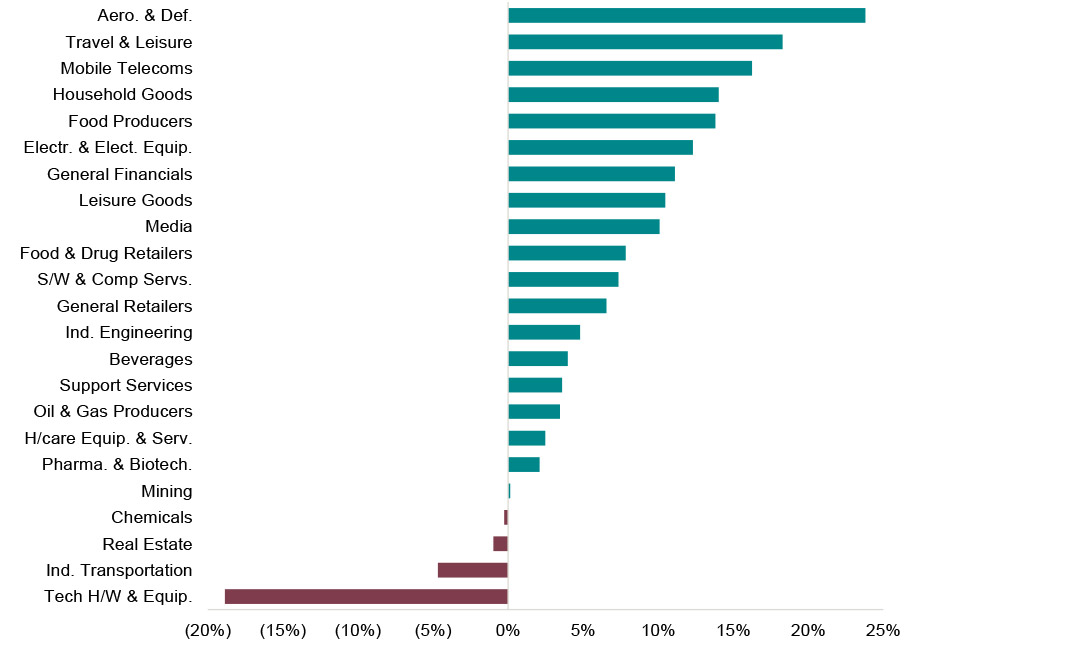

Sector performance (Year to date)

Source: FactSet, Financial Times, Investegate, OPEC, Semiconductor Industry Association, Global Comms

Sector performance (April 2023)

Source: FactSet, Financial Times, Investegate, OPEC, Semiconductor Industry Association, Global Comms

Prefer to download?

You can read the full December Market review

Never miss an update

Subscribe to the monthly Market review

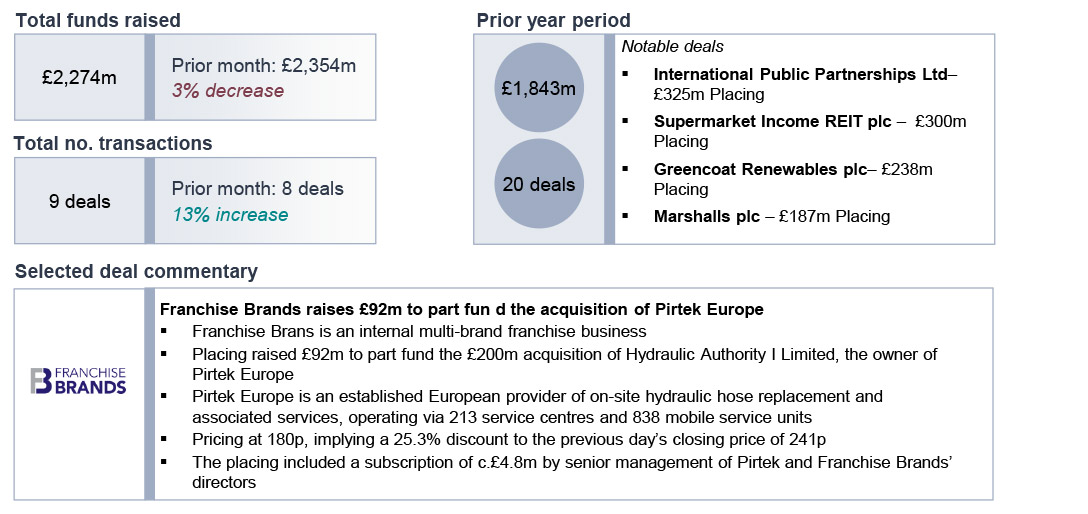

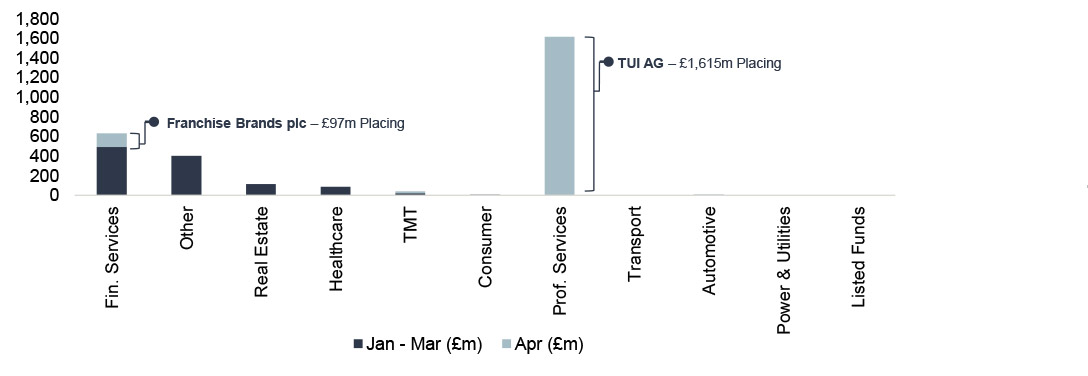

UK ECM activity remains stable in April

Deal value and number in-line with March

Public equity fund-raises by sector and highlighted deals

Sell-down activity over April

ECM issuance across the deal size spectrum in April

The UK IPO pipeline

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances

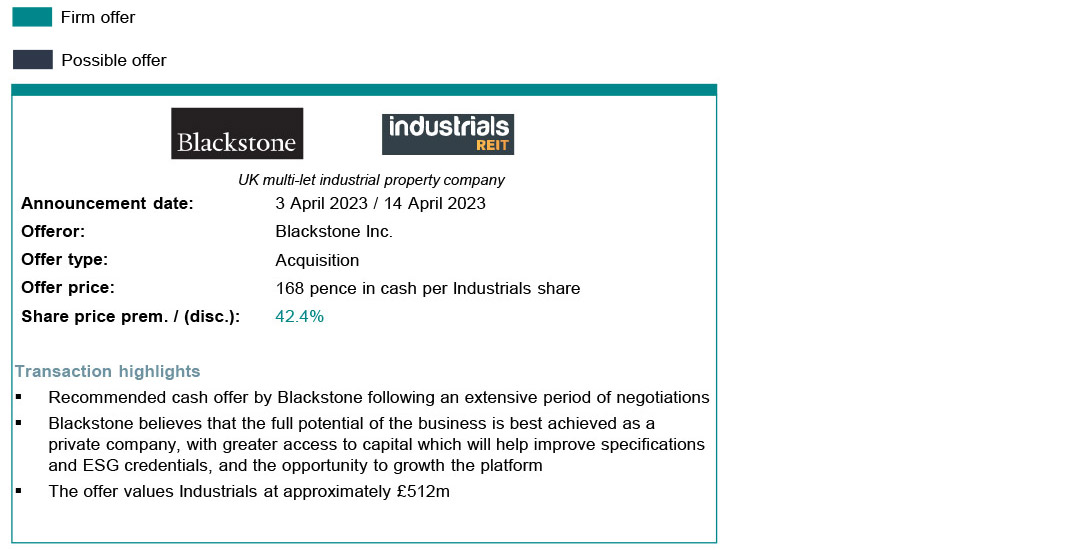

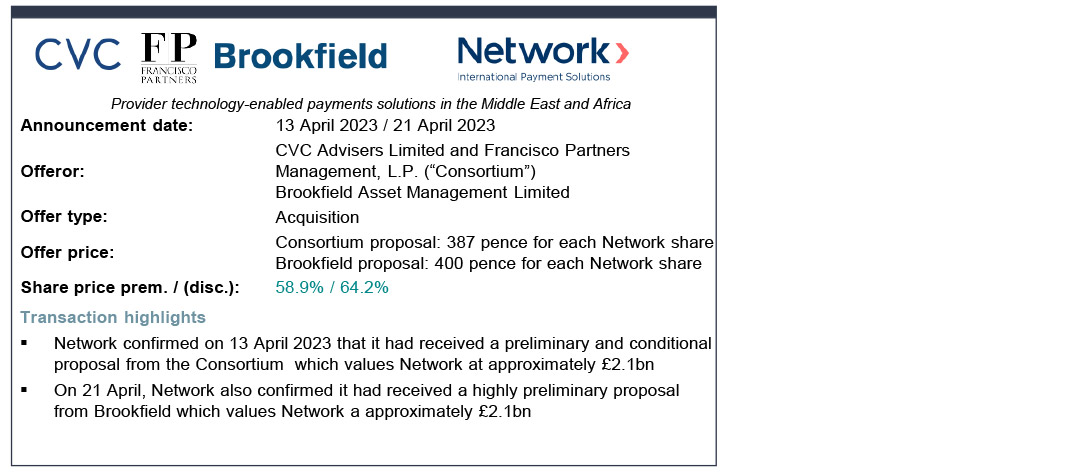

A snapshot of the current UK public M&A market

UK public M&A activity gathered significant pace in April as thirteen new deals were announced

Get the monthly Investec Market Review delivered to your inbox

Browse articles in