Investec Market Review April 2024

The Investec Market Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM) and public M&A, whilst also reflecting on wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

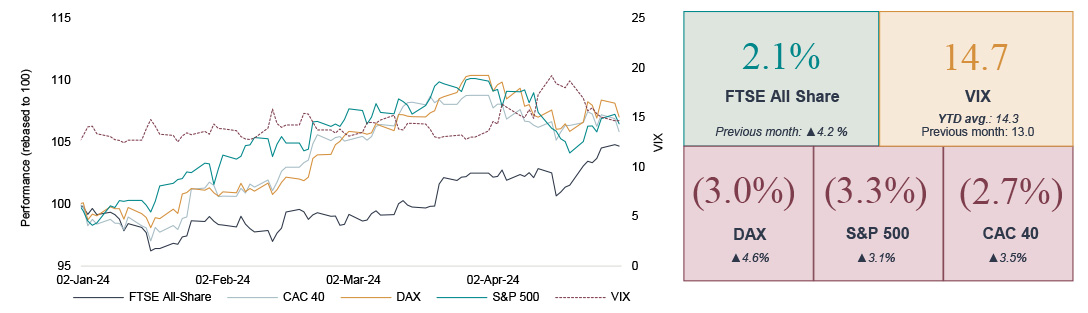

- April was another positive month for UK equities, which outperformed global markets to narrow the performance gap year-to-date – UK blue-chips led the way with the FTSE 100 gaining 2.4% to hit a record high whilst the FTSE 250 and FTSE All-Share added 0.4% and 2.1% respectively. Meanwhile, global markets were weaker across the board with the S&P 500, DAX and CAC 40 declining by (3.3%), (3.0%) and (2.7%) respectively.

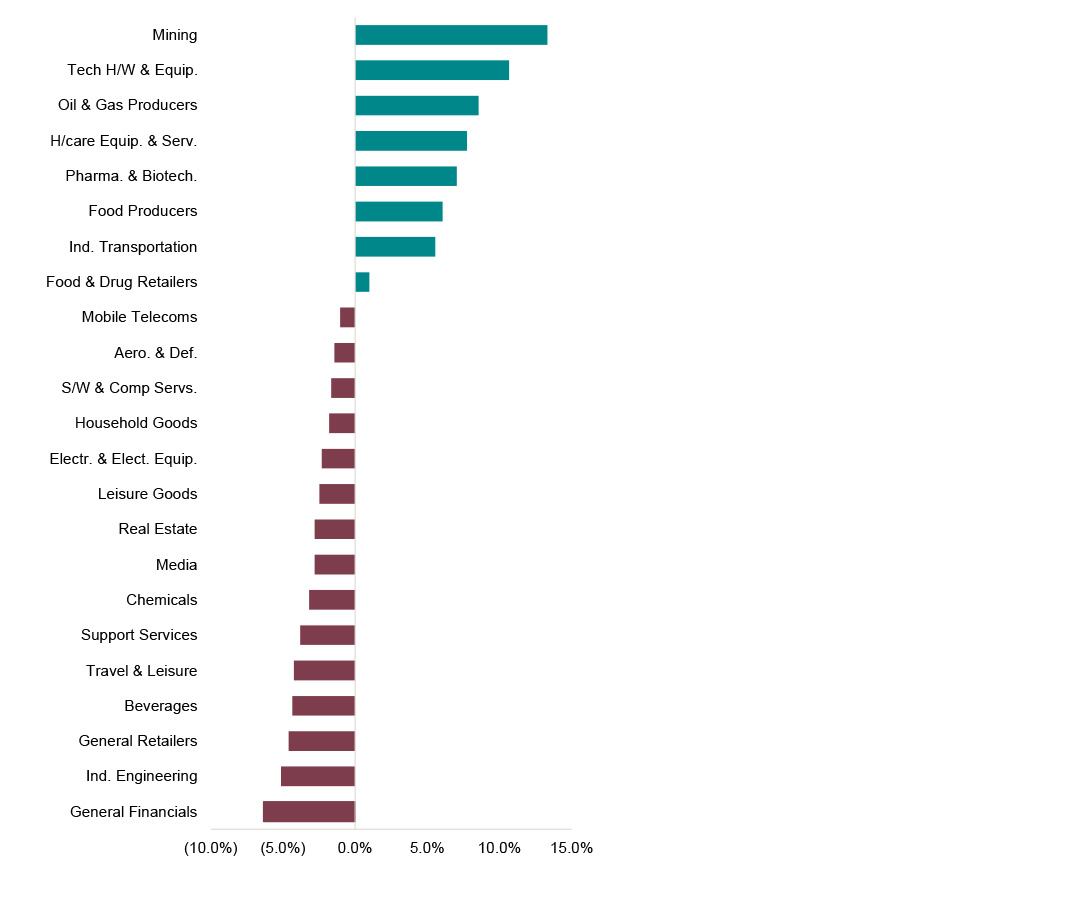

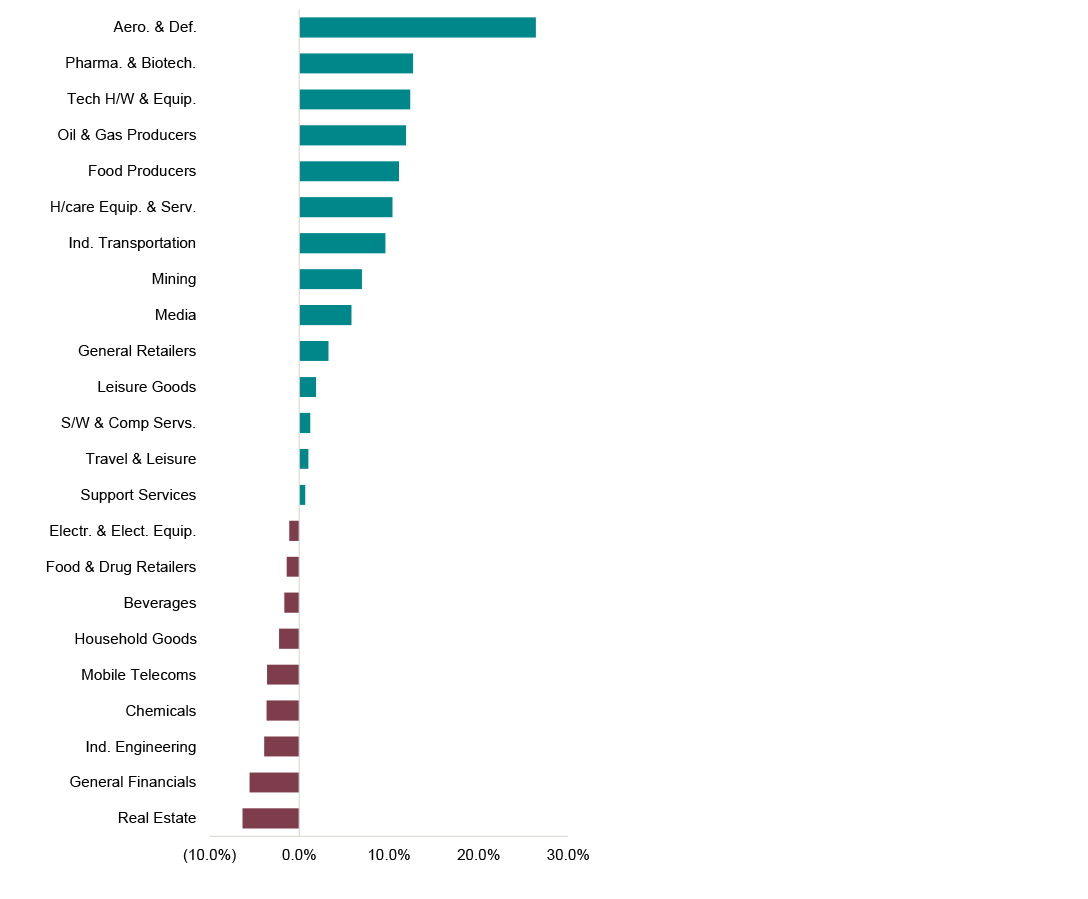

- Sector performance was mixed in April with just 8 out 23 sectors delivering gains this month. Performance continued to reverse in some sectors in April relative to year-to-date, with Mining stocks continuing to outperform the wider market amid surging copper prices and significant M&A activity in the sector.

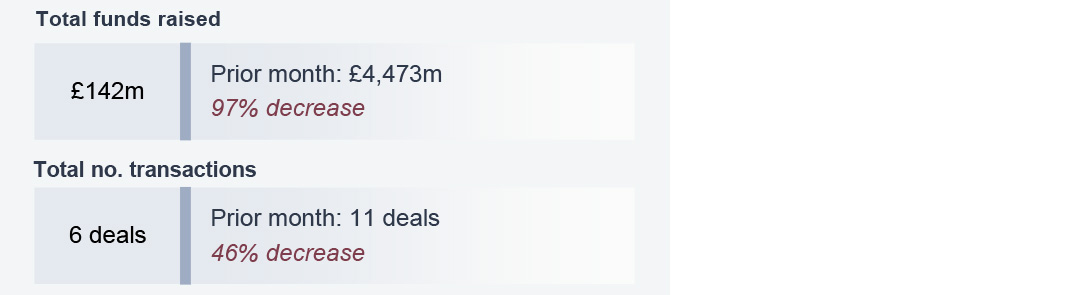

- UK ECM activity was muted this month as the total funds raised declined by 97% vs March. Secondary issuance continued to dominate, however, with notable sell-downs from Moonpig and MITIE.

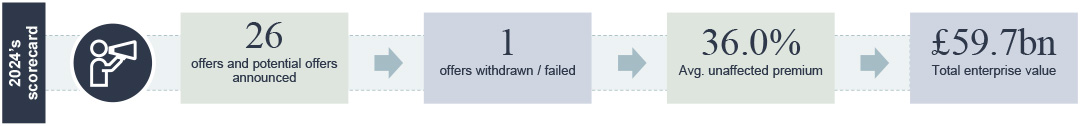

- UK public M&A activity continued to run hot in April – the total enterprise value of offers announced year-to-date increased by £42.1bn to £59.7bn, predominately due to BHP Group’s £31.1bn proposed offer for Anglo American.

Market drivers in April

UK markets continued last month’s momentum, delivering gains to narrow the performance gap with global indices

Economic headlines in April

- Headline UK CPI inflation for March eased to 3.2% YoY, its lowest since September 2021 but slightly above consensus of 3.1%.

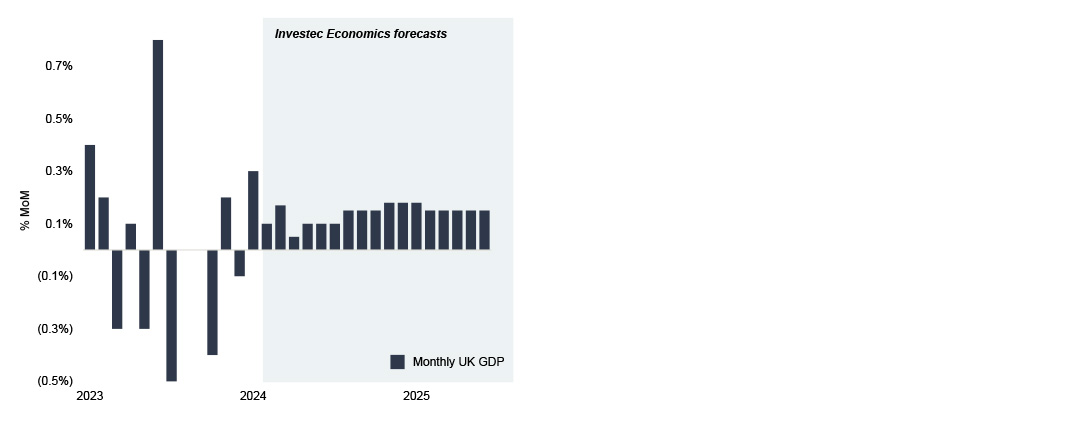

- UK GDP data for February rose by 0.1%, in line with consensus forecasts. This follows a 0.3% increase in January, revised up from +0.2%.

- UK GfK consumer confidence increased in April, gaining two points to -19, a joint two-year high, and ahead of consensus.

- Eurozone Composite PMIs rose 1.1pts to 51.4, an 11-month high. The reading was better than expected, with the market consensus standing at 50.7.

- US CPI inflation rose by a stronger-than- expected 3.5% YoY in March, driven by higher energy and shelter costs.

- US non-farm payrolls climbed by 303k in March, above consensus estimates of a 214k gain, meanwhile unemployment edged down to 3.8% from 3.9%, in line with expectations.

UK markets outperform global peers

Source: FactSet, Macrobond, ONS, Investec Economics

Recession fears abate; UK economy returning to growth

Source: FactSet, Macrobond, ONS, Investec Economics

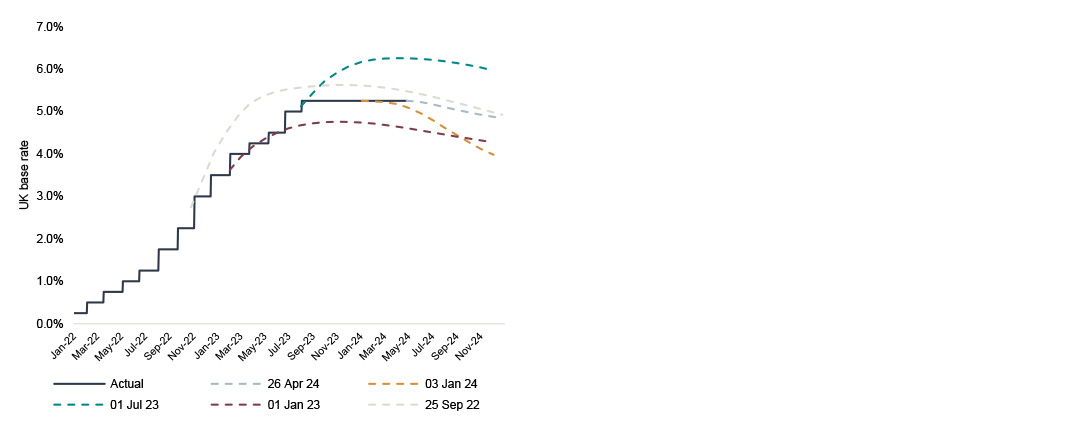

Expectations for UK interest rate cuts shift out to the right

Source: FactSet, Macrobond, ONS, Investec Economics

Prefer to download?

You can read the full March Market review

Never miss an update

Subscribe to the monthly Market review

Sector performance in April

Mining stocks continued to outperform to reverse a slow start to the year, whilst overall sector performance was weaker vs March

Monthly sector snapshot

Drivers of sector performance in April

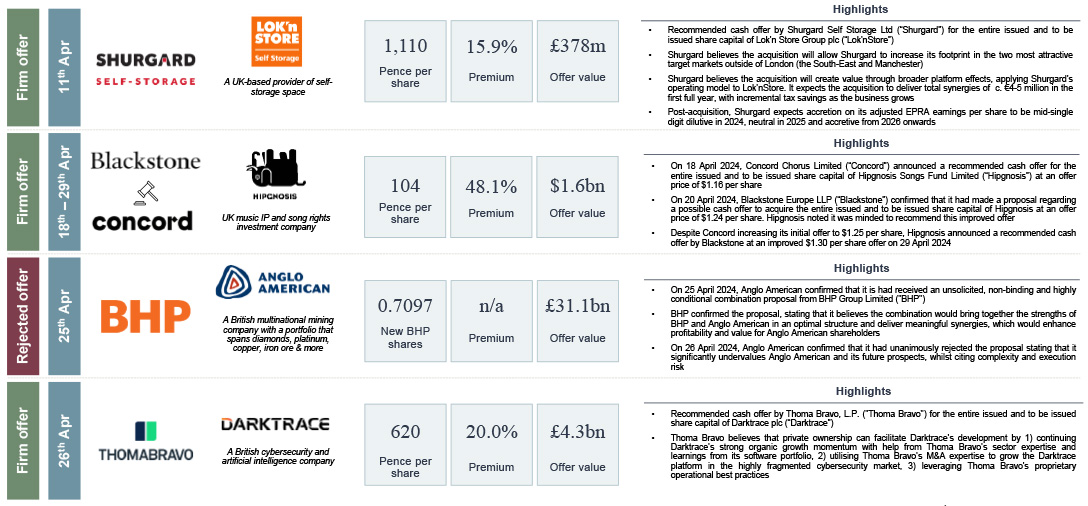

- Mining stocks were the top performers again this month as the sector continued to rebound following a slow start to the year. This came amidst rising copper prices and M&A activity, which brought the sector into focus. BHP Group’s £31bn offer for Anglo American, which has been rejected, sent its shares soaring 35.0% for the month, boosting sector performance.

- Oil & Gas Producers also enjoyed a strong April as escalating conflict in the Middle East pushed brent crude oil prices higher, touching a 6-month high of over $91 per barrel.

- At the other end of the spectrum, Travel & Leisure stocks underperformed this month as the latest consumer data indicated cost of living pressures have impacted Leisure spending. The latest Deloitte survey showed sentiment in ‘eating out’ and ‘drinking in pubs and bars’ had declined by c. 6% vs the previous quarter.

Sector performance - April 2024

Source: FactSet, Financial Times, Reuters, London Stock Exchange, Investec Economics

YTD Sector performance

Source: FactSet, Financial Times, Reuters, London Stock Exchange, Investec Economics

UK ECM activity in April

Following a spike in transaction values in March, UK ECM activity declined sharply in April; sell-downs continued to dominate

ECM activity snapshot

ECM issuance across the deal size spectrum in April

European IPO market opens up in Q1 2024

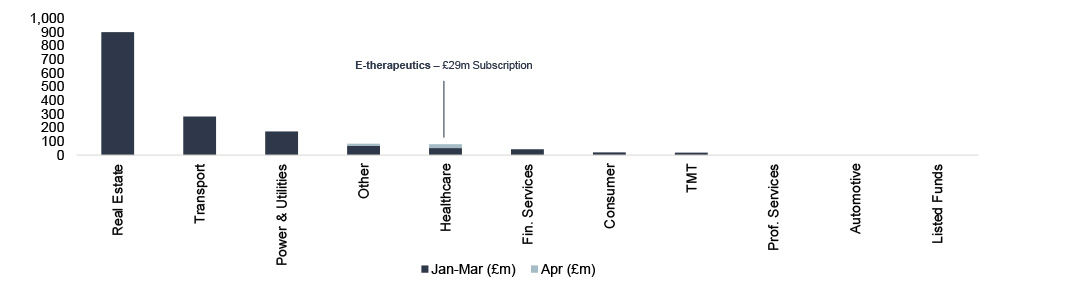

Public equity fund-raises by sector and highlighted deals YTD

Sell-downs in April 2024

Announced IPOs in April 2024

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances; IFR ECM.

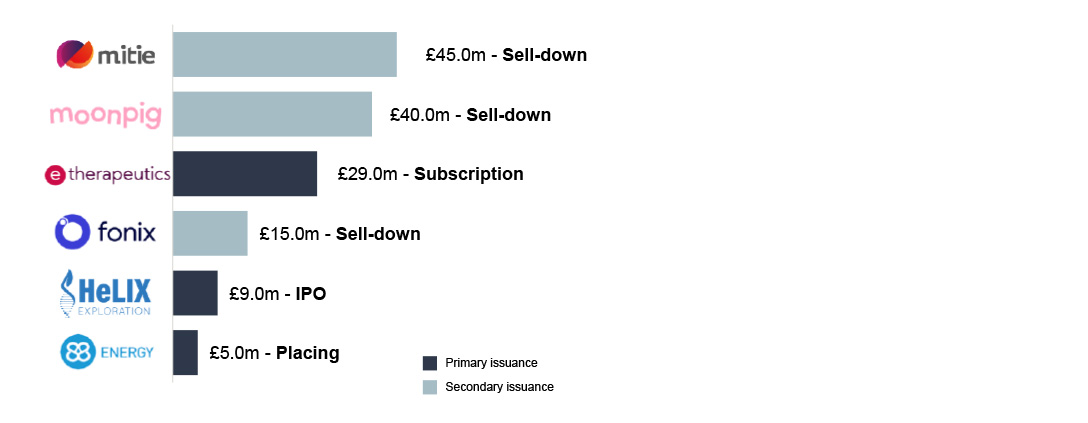

UK Public M&A activity in April

2024's scorecard

Selected deals

Source: Company announcements, FactSet, Practical Law

Note: Scorecard includes competing offers and withdrawn of companies subject to the Takeover Code quoted on AIM or the Main Market. Formal sales processes are not included unless a buyer has been identified. Only newly announced offers in the month are included in the count (i.e. possible offers announced in December 2023 will be included in that month even if it becomes a firm offer in January 2024)

Get the monthly Investec Market Review delivered to your inbox

Browse articles in