Investec Market Review August 2023

The Investec Market Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM) and public M&A, whilst also reflecting on wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

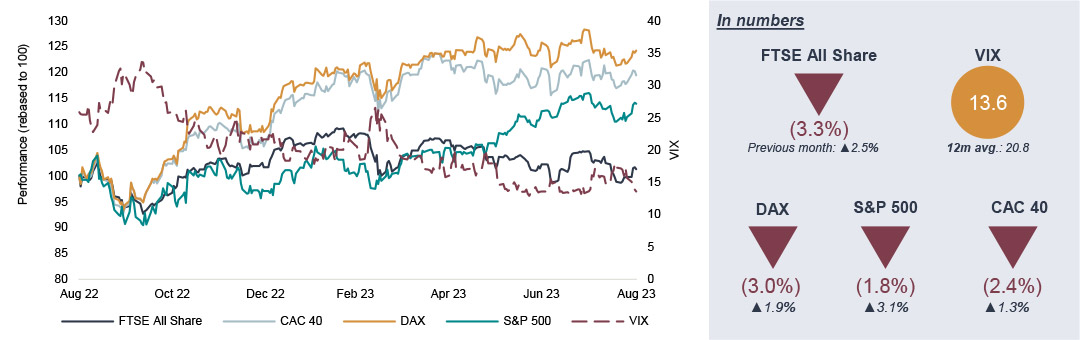

- UK equities slid in August - the FTSE All-Share fell by (2.9%) - following a number of disappointing economic readings and a seasonally quieter market.

- 20 of 23 sectors registered negative performance in August, with Industrial Engineering and Leisure Goods as the weakest sectors, and Tech Hardware and Equipment performing strongest.

- ECM activity continued to decline, by both volume and value compared to July.

- UK public M&A quietened down significantly in August with only four deals announced in the month.

Market drivers in August

UK markets slid amid disappointing economic data

Economic headlines in August

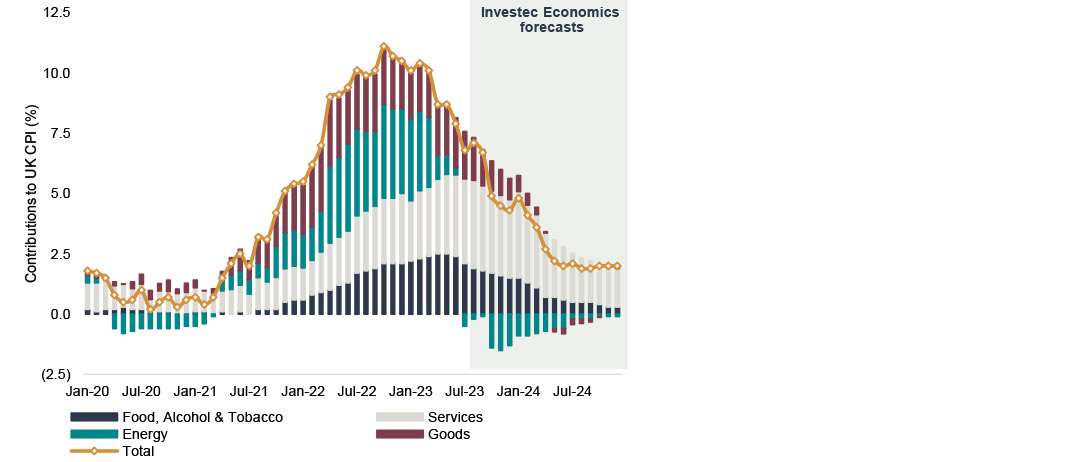

- UK inflation continued to decrease coming at 6.8% (Y/Y) in July as gas and electricity prices dropped.

- Bank of England raised the Bank Rate from 5.00% to 5.25%, the highest level in 15 years.

- RICS house price balance feel to a net balance of -53% in July, the lowest level since Great Financial Crisis.

- UK composite PMI fell from 50.8 in July to 47.9 in August, a sizeable miss on expatiations for 50.3 and marked a 31-month low.

- Eurozone Services PMI fell from 50.9 in July to 48.3 in August, entering contraction territory.

- US inflation increased slightly to 3.3% (Y/Y) in July from 3.0% (Y/Y) in June.

UK markets continue to lag behind European and US peers

Source: Bloomberg, FactSet, Macrobond, Calastone, Investec Economics

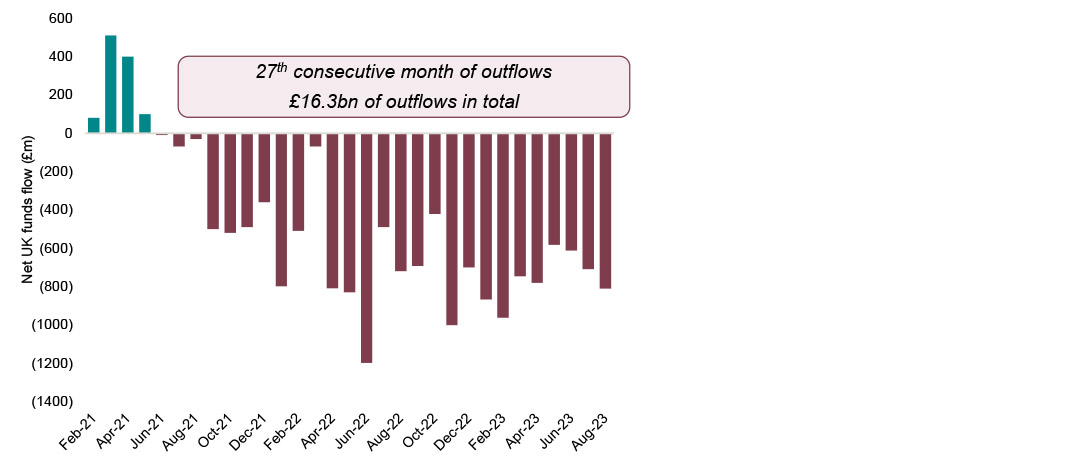

Outflows exacerbated over the summer

Source: Bloomberg, FactSet, Macrobond, Calastone, Investec Economics

MPC has a long road ahead when it comes to inflation

Source: Bloomberg, FactSet, Macrobond, Calastone, Investec Economics

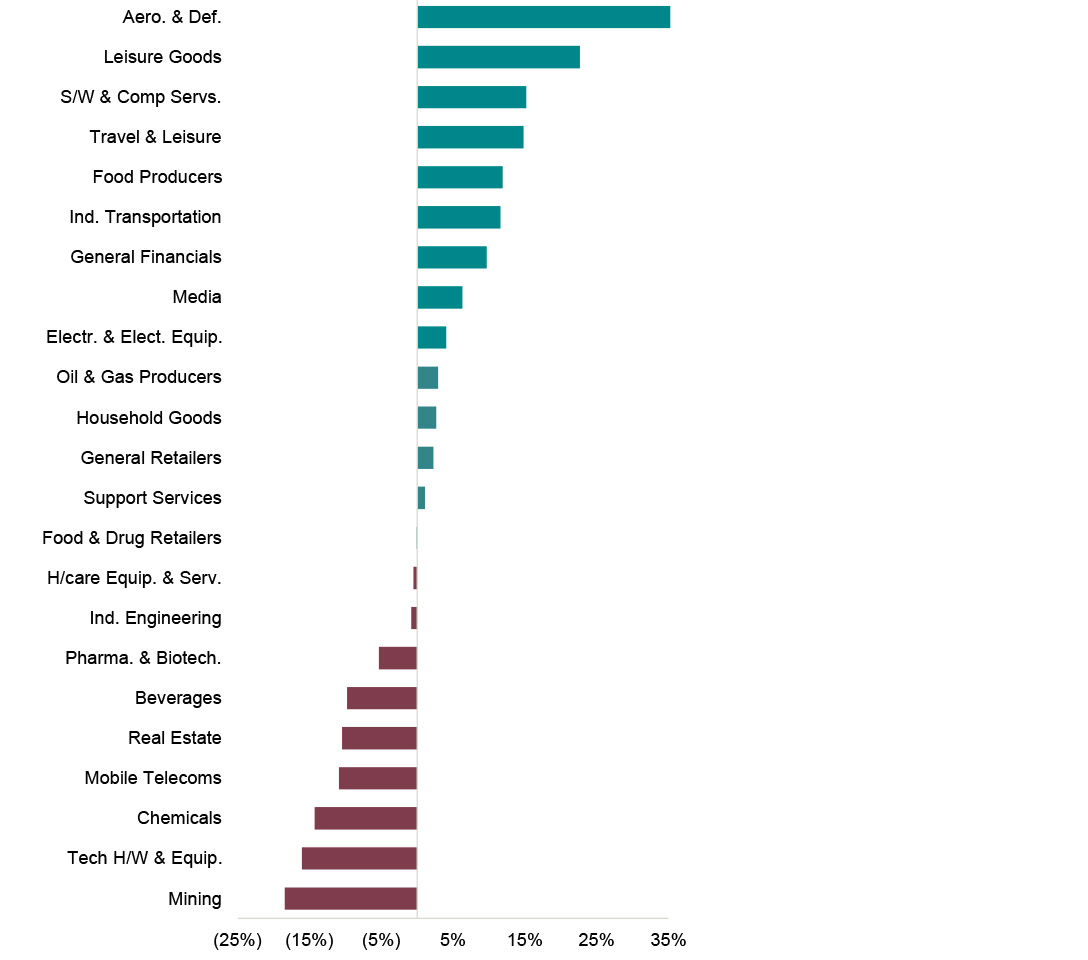

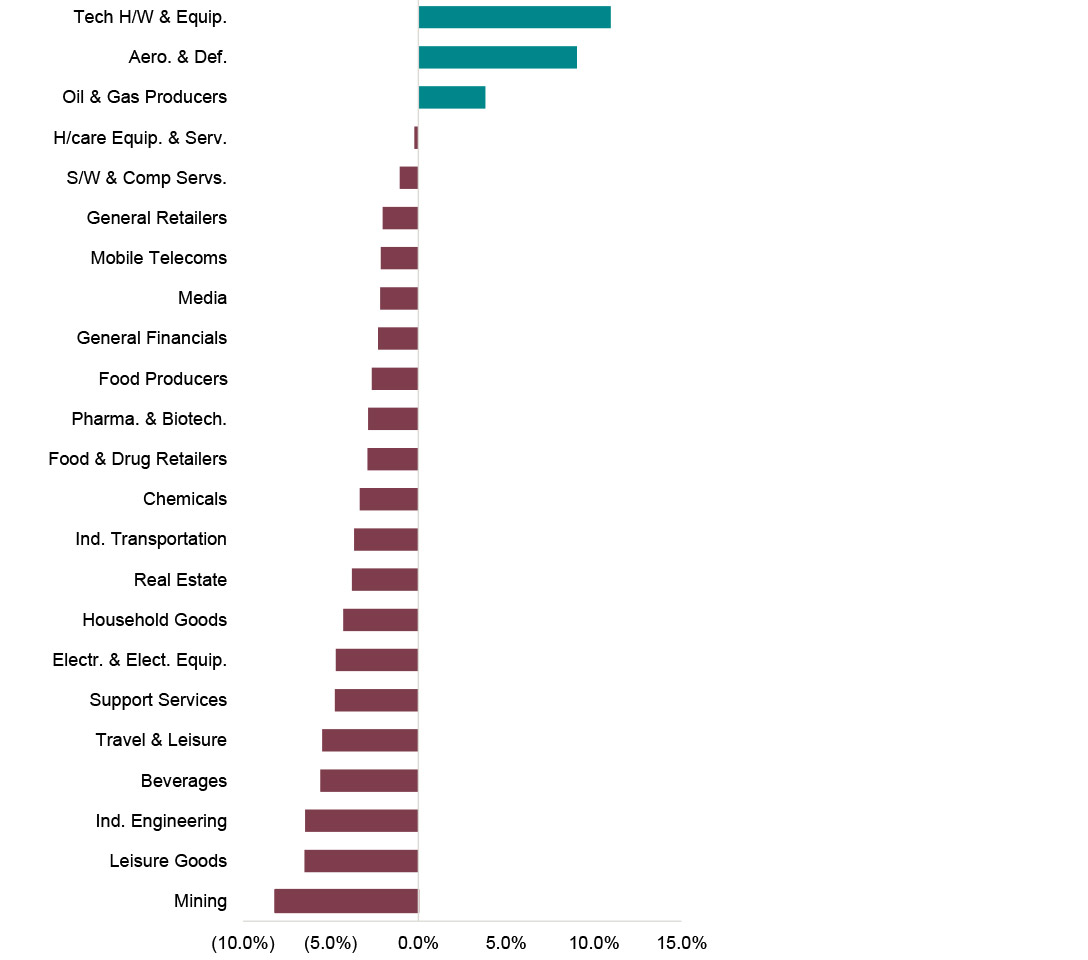

How did UK sectors fared in August

August lost some of the ground gained in July for most sectors

Monthly sector snapshot

Drivers of sector performance in August

- Aerospace & Defence stocks continued their rally in August and posted another month of significant gains. BAE Systems share price increased by c.8.3% as it announced the acquisition of the aerospace of Ball Corporation for c.$5.6bn.

- Despite an impressive performance in August, Tech Hardware and Equipment stocks continue to be among the worst performers year-to-date having been heavily impacted by high interest rates and rising inflation.

- Oil prices continue to be a tailwind for Oil & Gas Producers. Prices rose throughout August, with the WTI benchmark up c. 17% over the last three months.

Sector performance (Year to date)

Source: FactSet, Financial Times, Investegate, ONS, Investec Economics

Sector performance (August 2023)

Source: FactSet, Financial Times, Investegate, ONS, Investec Economics

Prefer to download?

You can read the full July Market review

Never miss an update

Subscribe to the monthly Market review

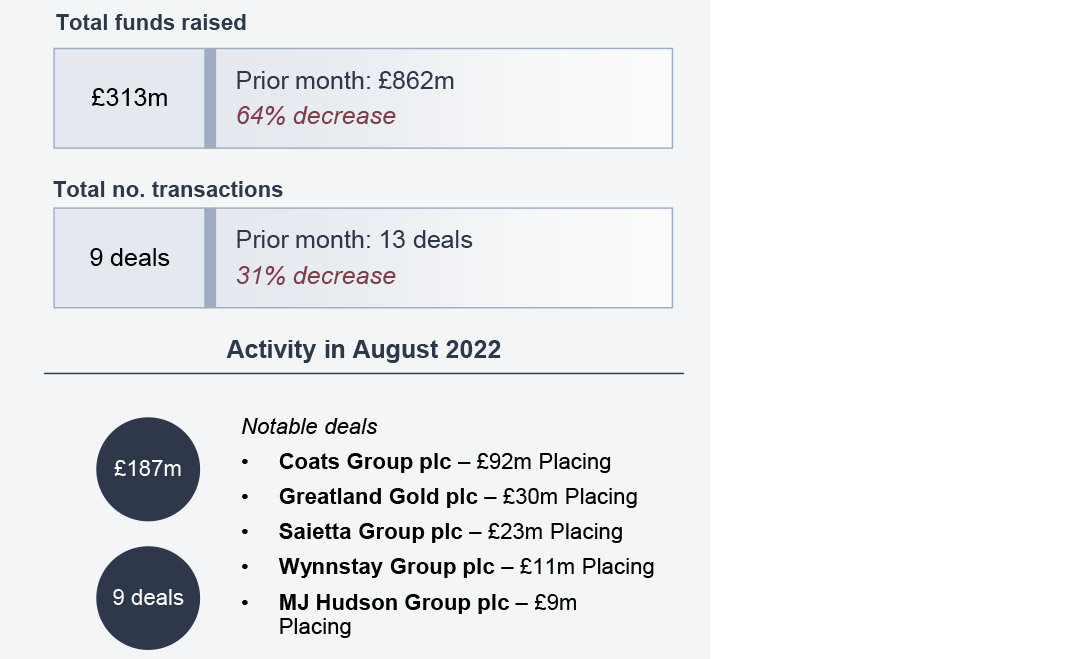

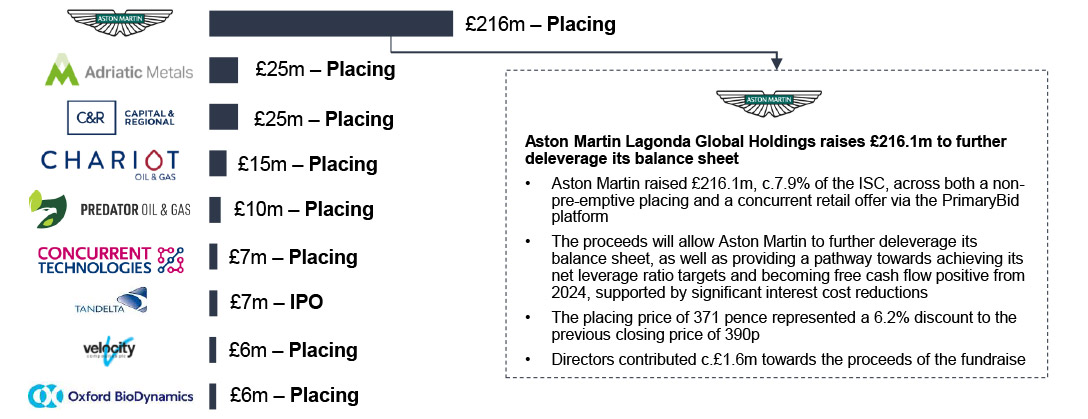

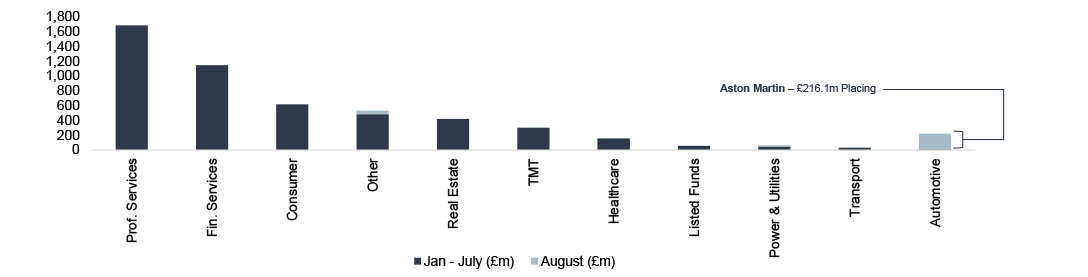

UK ECM activity takes a break in August

ECM activity quietened down as we reached the height of summer

ECM activity snapshot

Primary ECM issuance across the deal size spectrum in August

Public equity fund-raises by sector and highlighted deals

Selldowns

Announced IPOs in August 2023

Source: Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances.

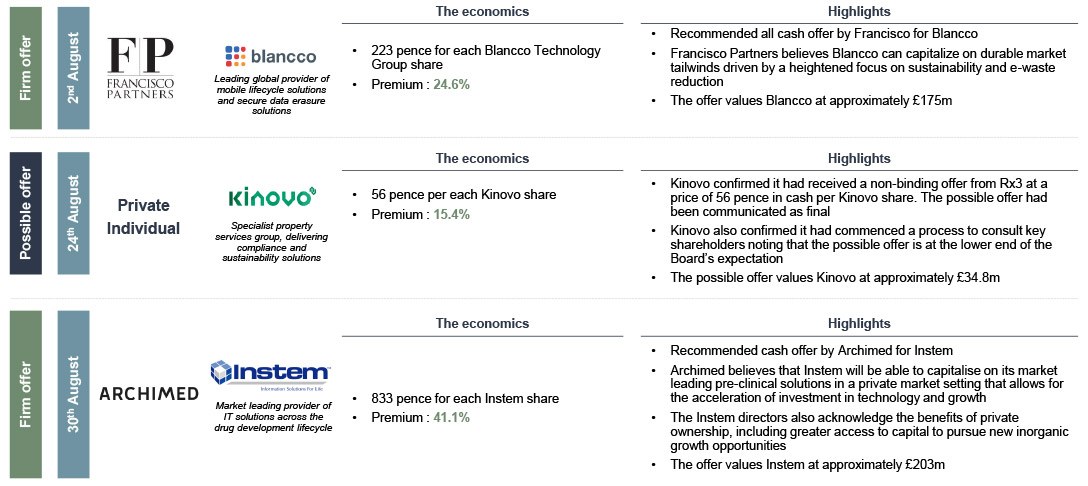

UK Public M&A activity in August

2023's scorecard

Selected deals

Source: Company announcements, FactSet, Practical Law

Get the monthly Investec Market Review delivered to your inbox

Browse articles in