Investec Market Review February 2023

The Investec Market Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM) and public M&A, whilst also reflecting on wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

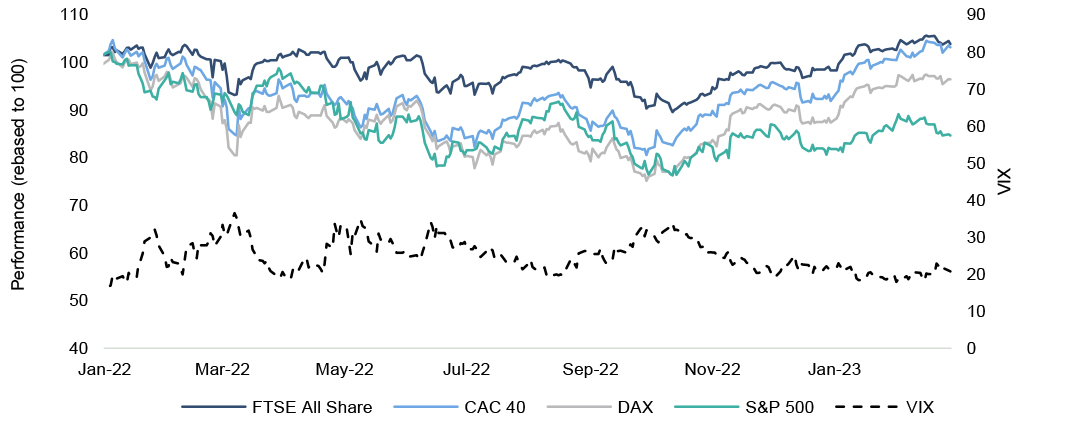

- Global indices’ recovery slowed down in February albeit posted modest gains vs January.

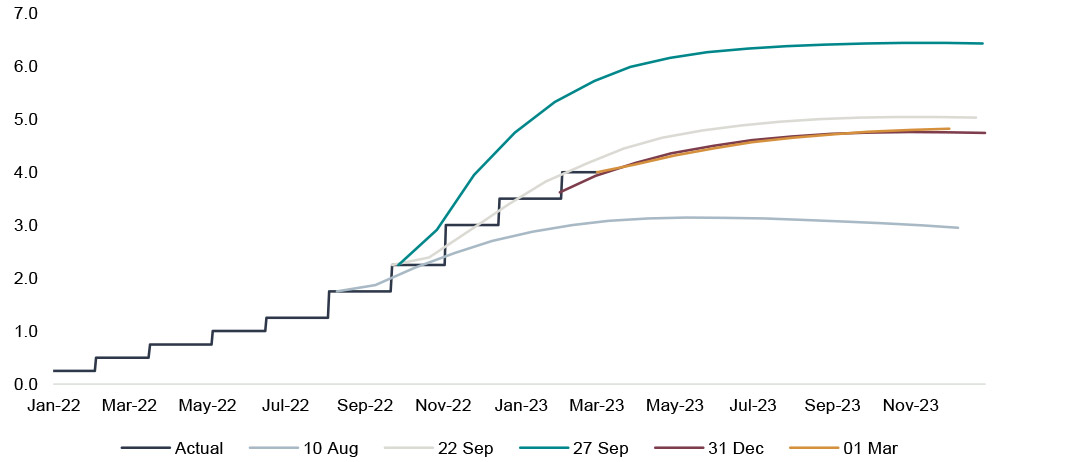

- Resilient economic data in the US, Europe and the UK as well as signs that inflation could prove tougher to control, raised the prospect of higher than expected interest rates. However, strong corporate earnings helped outweigh the negative impact of further hikes on markets.

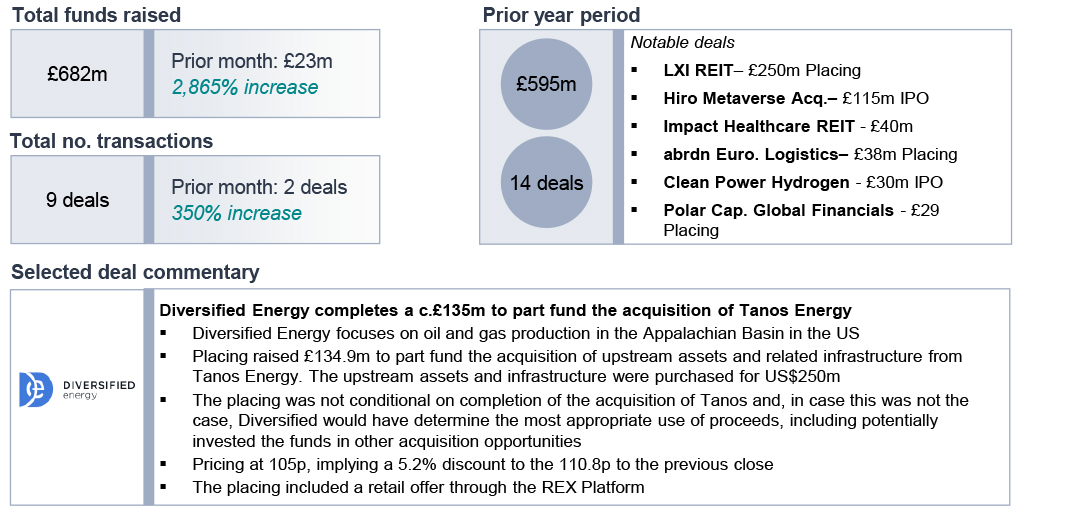

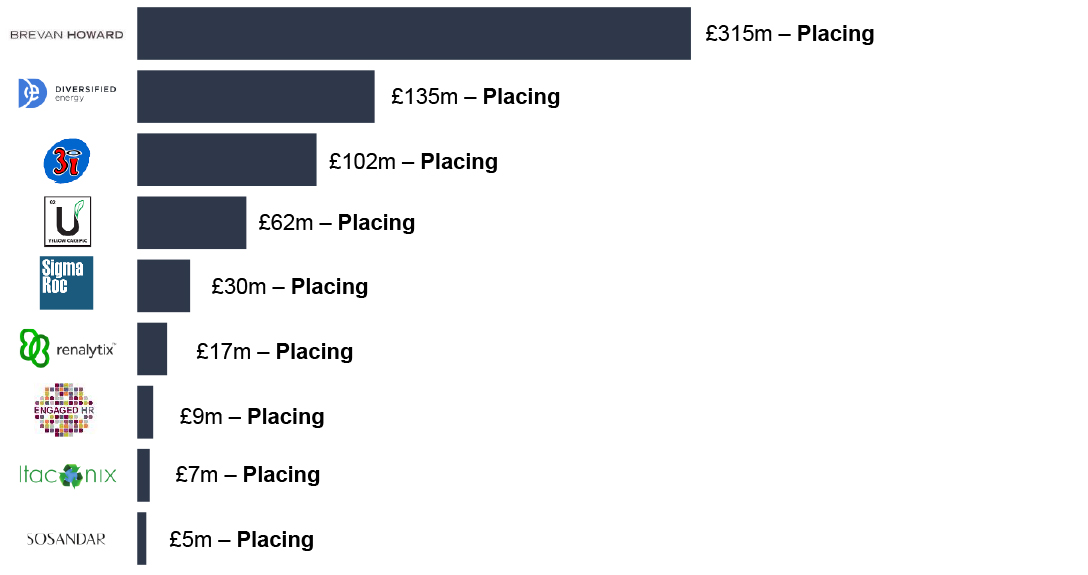

- UK ECM activity showed signs of recovery with deal value increasing from £23m in January to £682m in February after 9 placings were announced throughout the month.

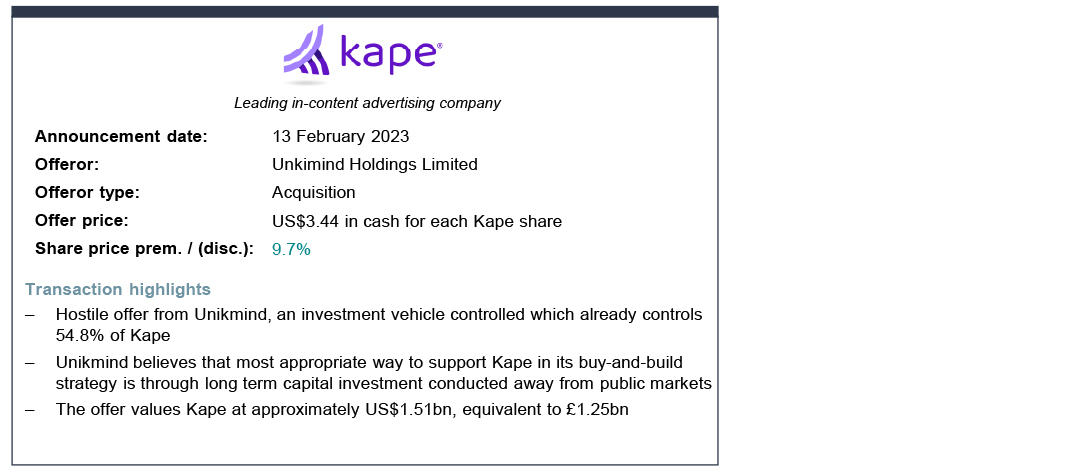

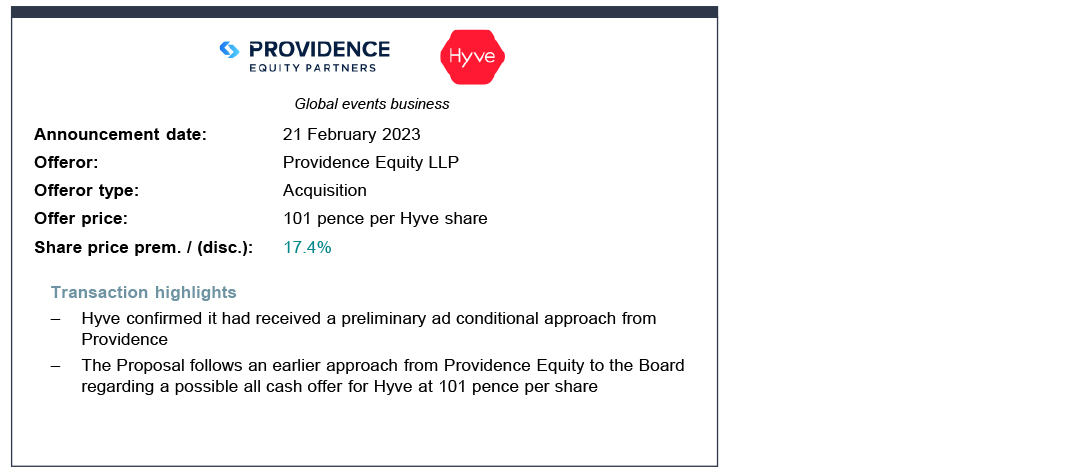

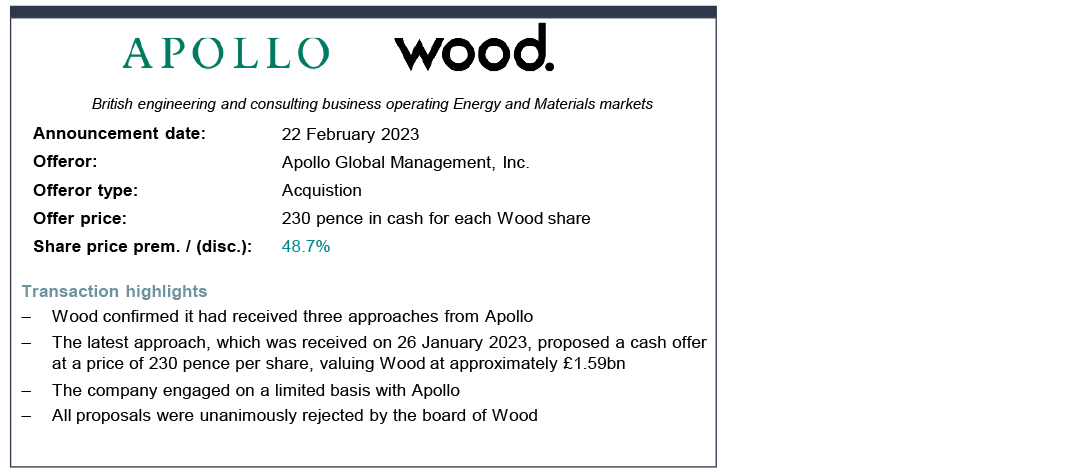

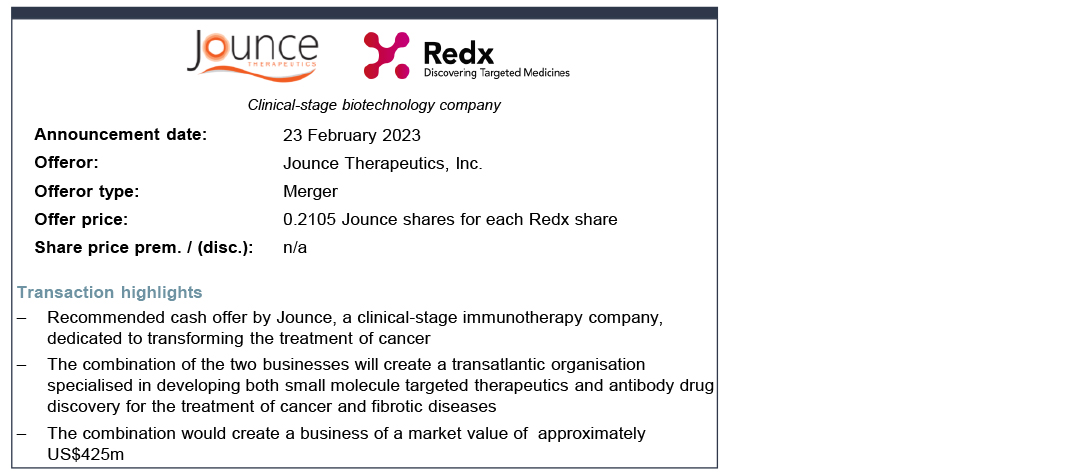

- Momentum in UK public M&A continued to gather pace relative to January and saw two potential deal values of over £1bn.

Market backdrop

Monthly market snapshot

February's key market drivers

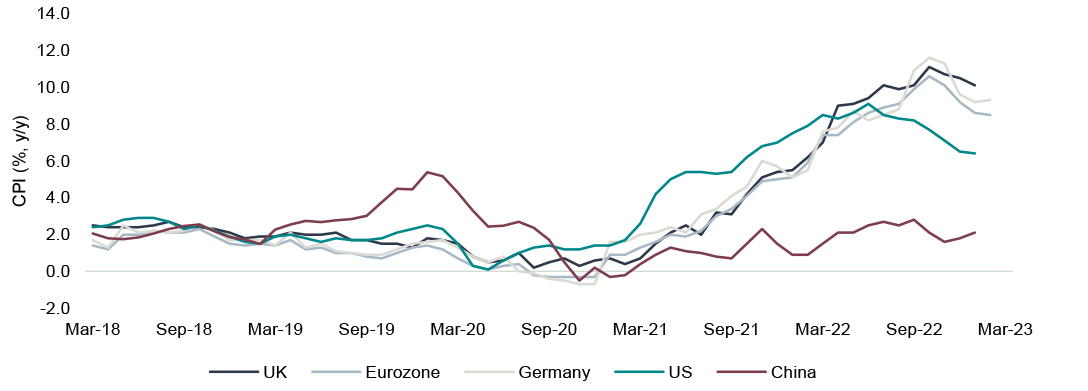

- UK inflation slipped to 10.1% (Y/Y) in January, the third consecutive decrease

- UK retail sales rebounded in January falling by 5.1% (Y/Y) vs 5.8% (Y/Y) in February

- UK unemployment rate – 3.7% in Q4 2022 -remains close to record low

- Russia suspends the nuclear weapons treaty

- US inflation surprised on the upside coming at 6.1% (Y/Y) but at slowest pace since October

- US PMI rebounded to eight month high after seven consecutive months of contraction

- US jobless claim fell unexpectedly in the third week of February from 195k to 192

- US consumer confidence retreated in January whilst UK consumer hits highest level since April 2022

Global equity market performance & equity market volatility

Source: Bloomberg, FactSet, Macrobond

Inflation remains slows across key geographies with the exception of China

Source: Bloomberg, FactSet, Macrobond

UK interest rate projections show signs of stabilising

Source: Bloomberg, FactSet, Macrobond

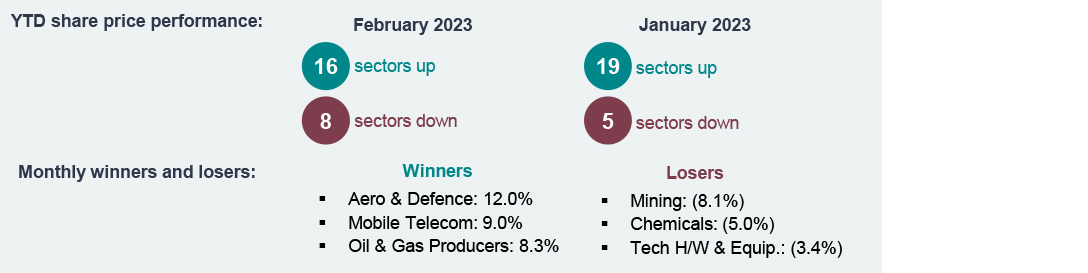

UK sector performance

Monthly sector snapshot

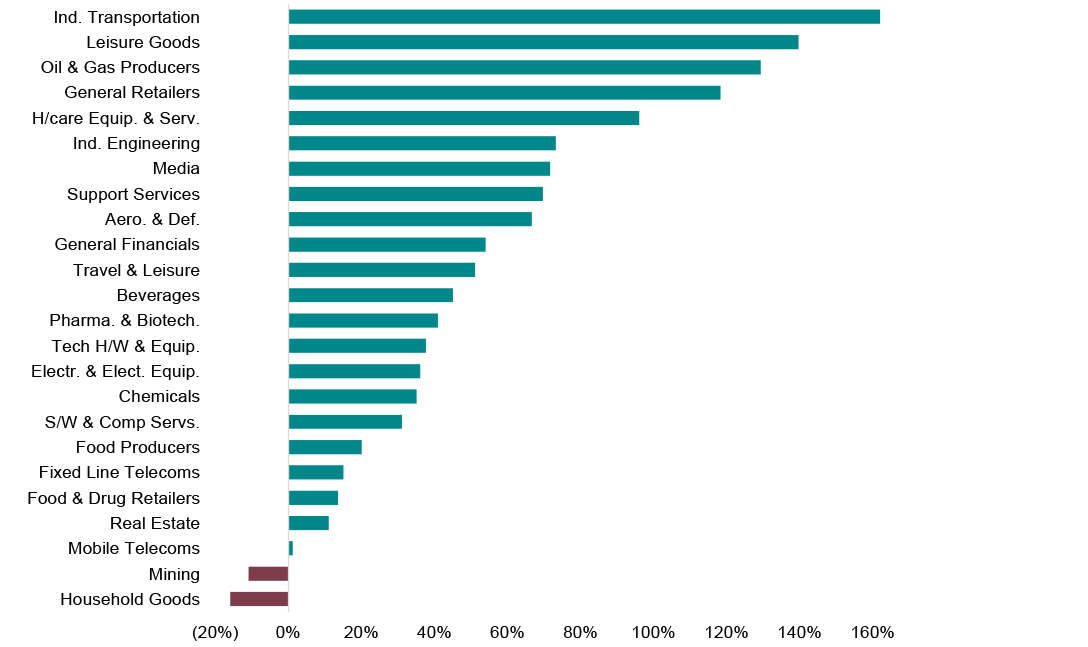

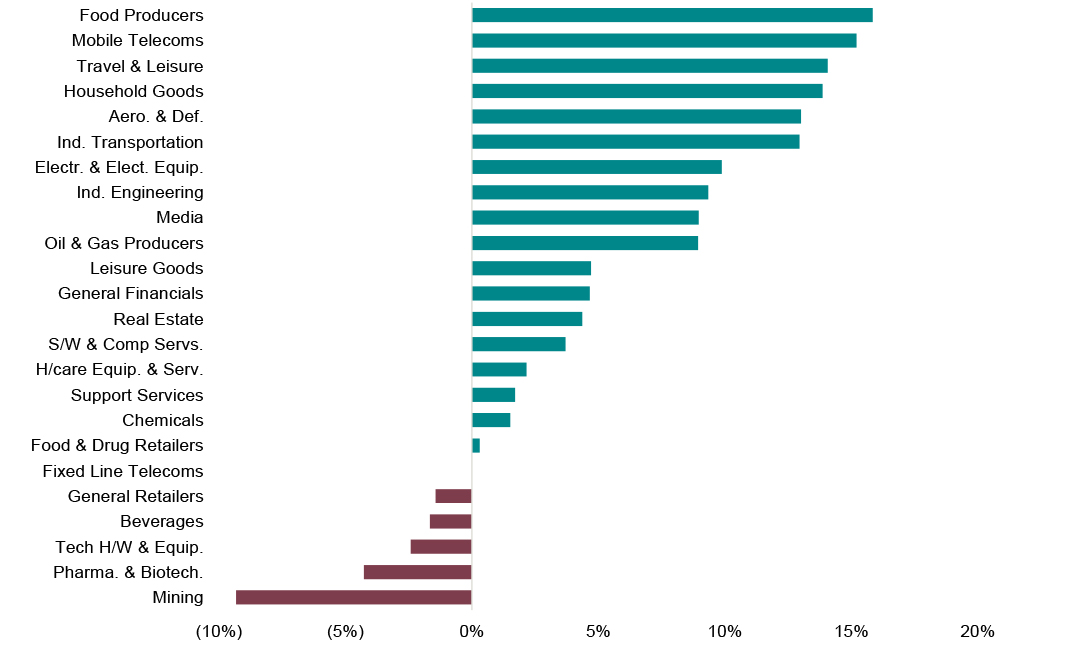

Sector performance drivers and outlook commentary

- Aerospace & Defence stocks surged in February as western governments promised to increased military spending to help Ukraine’s war effort

- Record profits from BP, Eni, and Shell contributed towards the performance of Oil & Gas Producers’

- On the other hand, Tech Hardware & Equipment stocks were hit by the increasing likelihood that central banks could raise interest rates further than previously expected

- Mining stocks were also under pressure. Rio Tinto reported a 41% drop in net earnings which were partially a results of the drop in commodity prices and higher energy and raw material prices

Sector performance (since mid-March 2020)

Source: FactSet, Financial Times, Investegate

Sector performance (YTD)

Source: FactSet, Financial Times, Investegate

Prefer to download?

You can read the full December Market review

Never miss an update

Subscribe to the monthly Market review

UK ECM activity bounces back in February

Deal numbers and value increased sharply in February

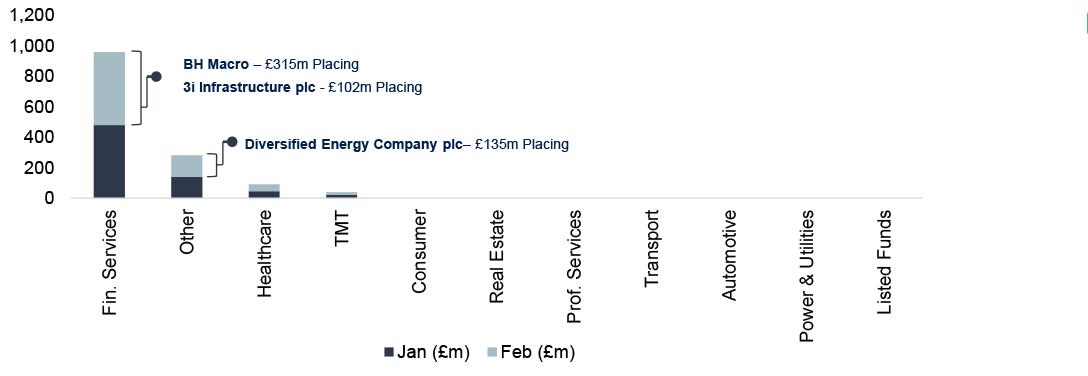

Public equity fund-raises by sector and highlighted deals

ECM issuance across the deal size spectrum in February

The UK IPO pipeline

Broader European IPO pipeline

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances.

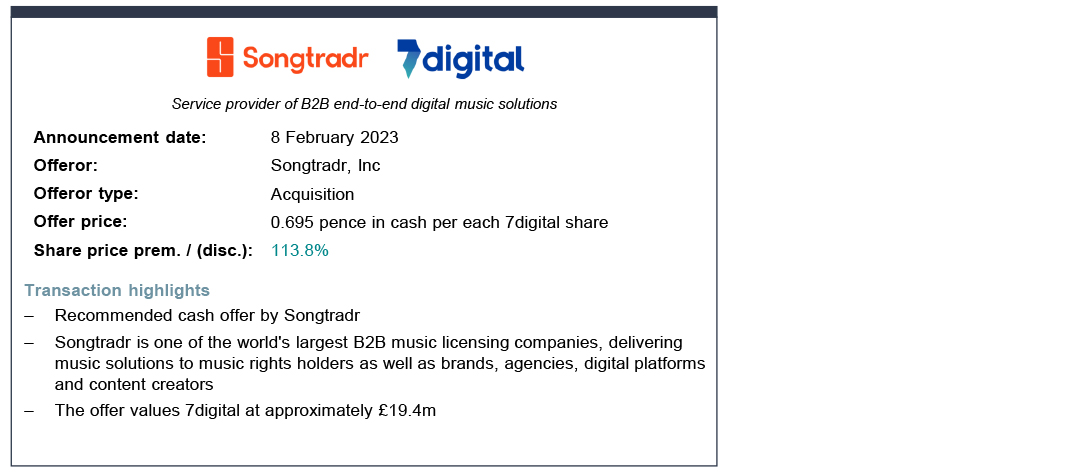

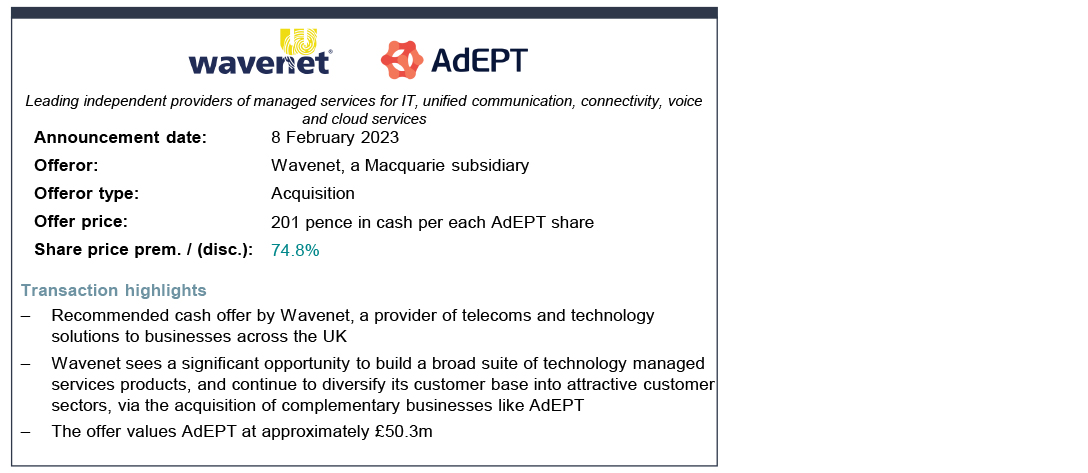

A snapshot of the current UK public M&A market

UK PLC takeover activity increased in February with eight deals announced, of which four were formal offers

Get the monthly Investec Market Review delivered to your inbox

Browse articles in