Investec Market Review February 2024

The Investec Market Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM) and public M&A, whilst also reflecting on wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

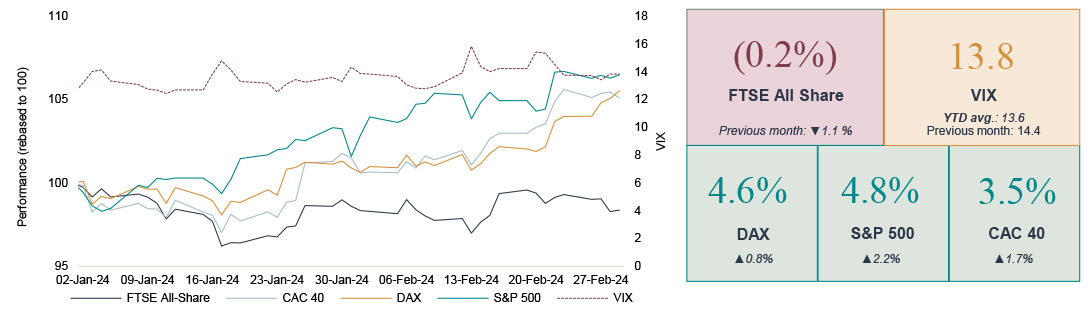

- February was a good month for global equities as S&P 500 , DAX and CAC 40 gained 4.8%, 4.6% and 3.5% respectively. UK markets continued to lose ground - FTSE All-Share and FTSE 250 dropped by (0.2%) & (1.6%) respectively whilst FTSE100 remained unchanged from January.

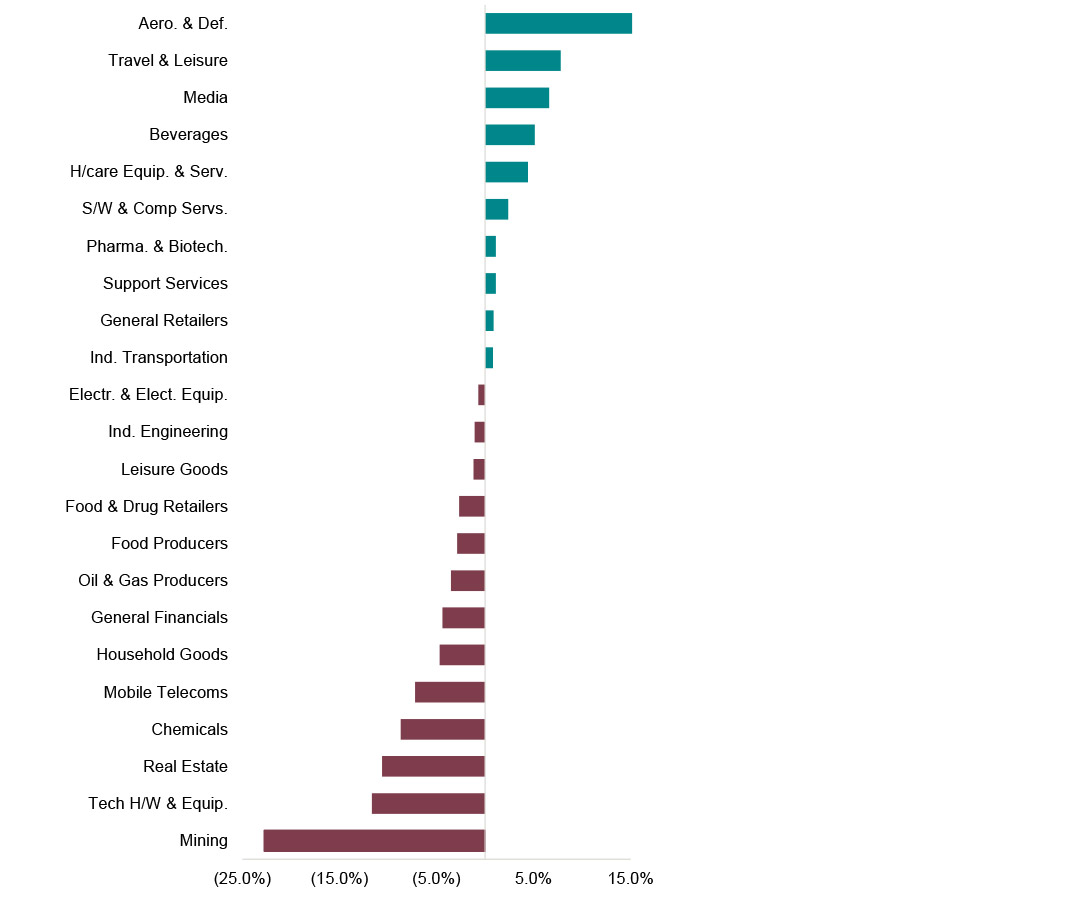

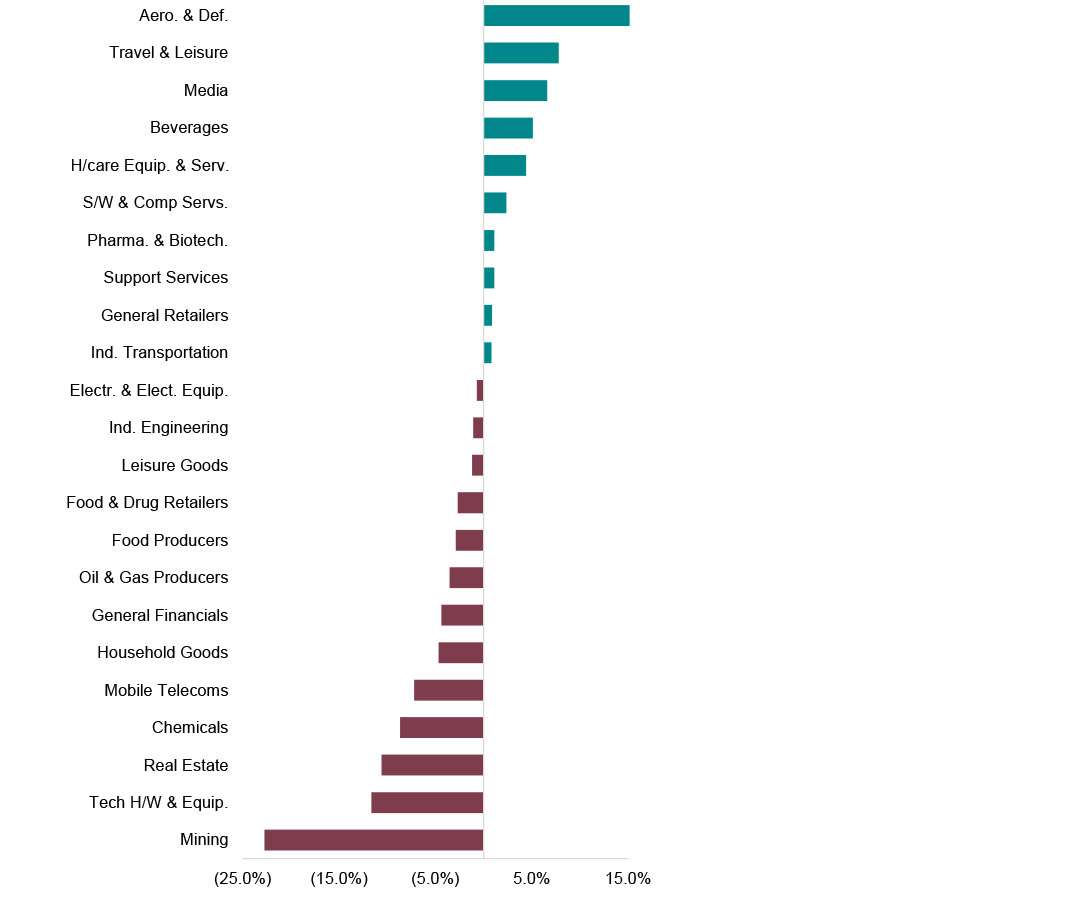

- Sector performance worsened in February with 13 out 23 sectors registering loses this month. The picture continues to be very similar to 2023 with Aerospace and Defence stocks leading the pack and Mining stocks significantly underperforming the wider market amid numerous headwinds in commodity markets.

- Net outflows from UK funds persist, however, at a reduced rate as Decembe r2023 registered the second smallest figure in the last 21 months.

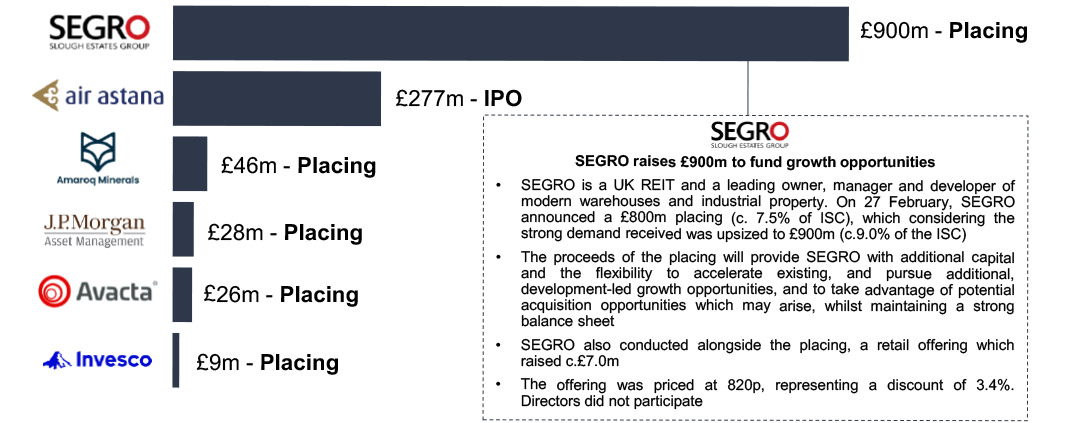

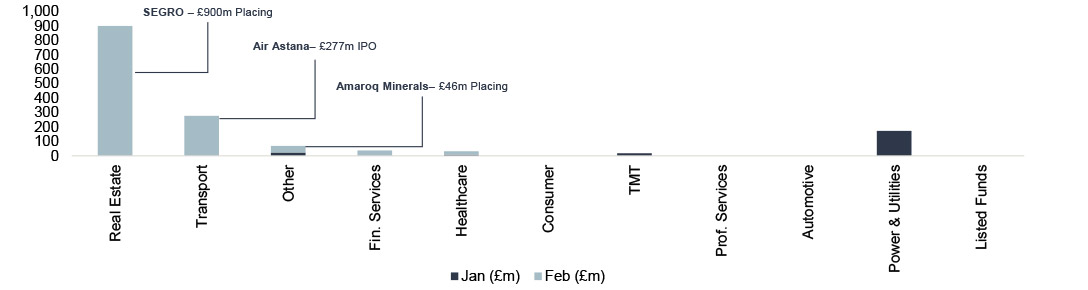

- UK ECM activity was in-line with January as total funds raised only decreased by a mere 3% following SEGRO’s upsized placing of £900m. The market also saw the first IPO of the year - Air Astana’s £277m IPO. The London Stock Exchange emphasised at the time of the delivery of its results on 29 February that they are currently seeing more activity, more preparation, than they have seen in a number of years.

- February was a busy month for UK public M&A activity - as the total enterprise value of offers announced reached c.£9.0bn. However, only two firm offers were announced – Barrat’s £2.5bn offer for Redrow and GXO’s £762m offer for Wincanton.

Market drivers in February

UK markets continue to lose ground in February whilst global markets register strong gains

Economic headlines in February

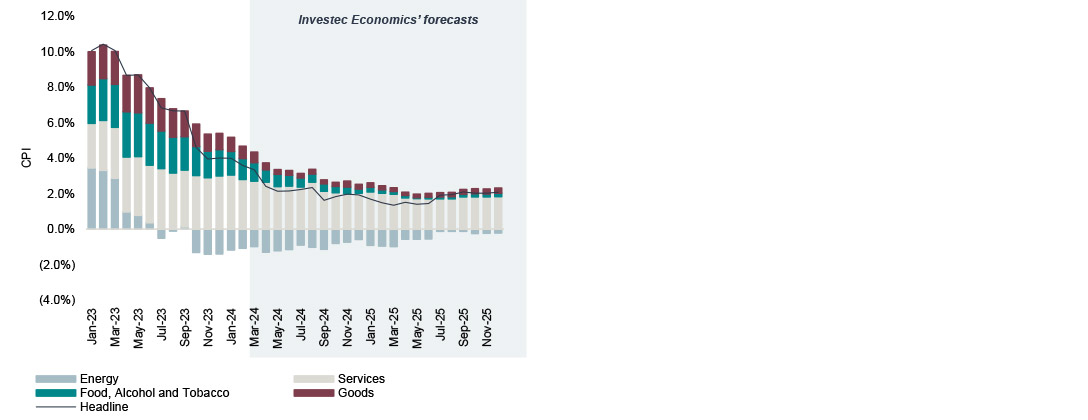

- UK CPI remained flat in January at 4.0%. The core measure was similarly unchanged.

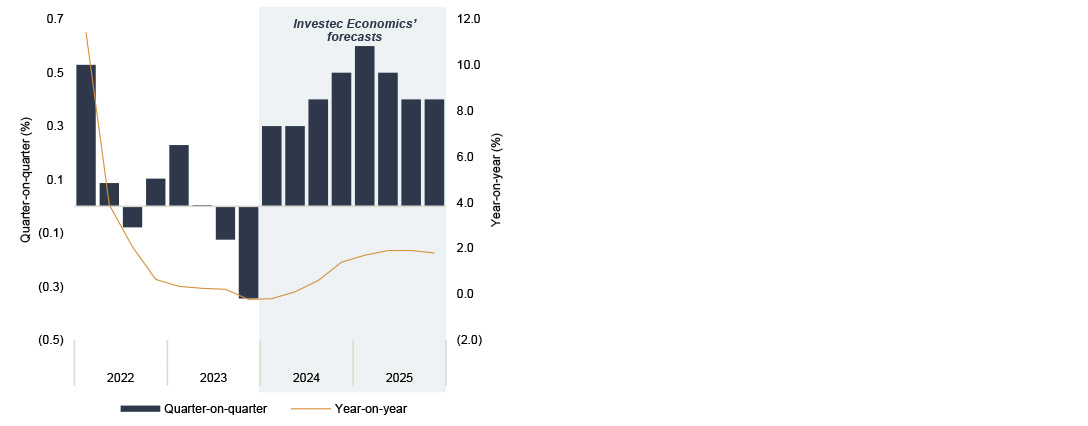

- UK GDP contracted by 0.1% in Q3 23 and 0.3% in Q4 23 in part due to a contraction in retail volumes and human health & social activities as industrial action constrained output.

- UK GfK consumer confidence index retreated by two points in February to -21. UK household’s outlook for their personal finances remained unchanged (at 0) from January, best number registered since December 2022.

- Flash PMIs for the Euro area pointed to some further improvement in economic activity in February: the Composite index increased by 1pt to 48.9, beating the consensus of 48.4. This was the highest reading since June 2022.

- US retail sales values dropped by 0.8% on the month in January, a worse outcome than consensus was expecting of -0.1% and the weakest monthly rate since last March.

- US CPI inflation declined relative to the December print; at 3.1% year-on-year it exceeded consensus estimates that looked for a sharper fall to 2.9%.

UK markets remain on a downward path whilst the performance gap between global peers widens

Source: FactSet, Macrobond, ONS, Investec Economics

The UK economy was in recession in H2 2023

Source: FactSet, Macrobond, ONS, Investec Economics

UK inflation is expected to reach 2% by the end of 2024

Source: FactSet, Macrobond, ONS, Investec Economics

Prefer to download?

You can read the full January Market review

Never miss an update

Subscribe to the monthly Market review

Sector performance in February

Aerospace and Defence continues to lead the way in 2024 after registering a gain of 63.4% in 2023

Monthly sector snapshot

Drivers of sector performance in February

- Aerospace & Defence continue to post impressive gains as tensions in key areas of the globe continue to escalate. BAE Systems announced an excellent set of results as EPS rose by 14% and the order book reached a record level of £69.8bn thanks to the conflict in Ukraine and the conflicts in the Middle East.

- On the other hand, Mining stocks continue to experience the downward trend registered in 2023 as a drop in Nickel prices delivers the latest blow. Nickel prices were impacted in February by a flood of cheap Indonesian nickel coming to global markets. Apart from Antofagasta, all FTSE 350 miners experienced material retreats in February.

Sector performance - February 2024

Source: FactSet, Financial Times, London Stock Exchange, Investec Economics

YTD Sector performance

Source: FactSet, Financial Times, London Stock Exchange, Investec Economics

UK ECM activity in February

February witnessed the first UK IPO of 2024 whilst funds raised were in-line with January’s following SEGRO’s upsized £900m placing

ECM activity snapshot

Primary ECM issuance across the deal size spectrum in February

Public equity fund-raises by sector and highlighted deals

Sell-downs in February 2024

Announced IPOs in February 2024

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances.

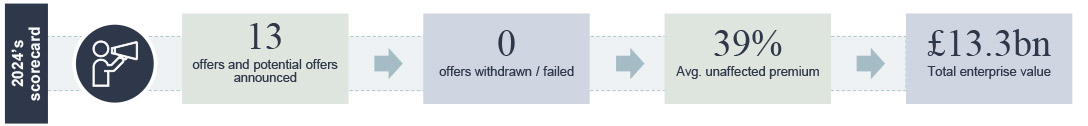

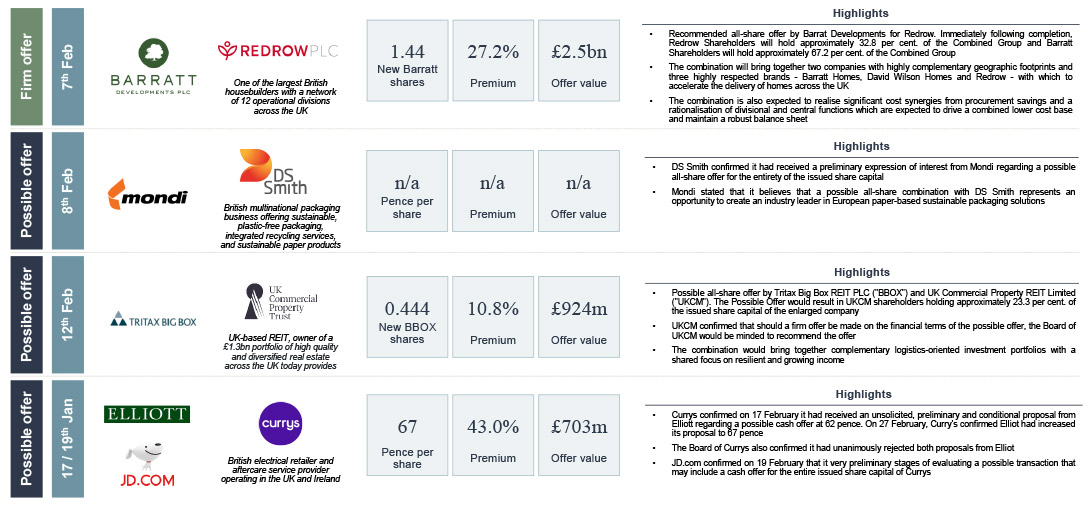

UK Public M&A activity in February

2024's scorecard

Selected deals

Source: Company announcements, FactSet, Practical Law.

Note: Scorecard includes competing offers and withdrawn of companies subject to the Takeover Code quoted on AIM or the Main Market. Formal sales processes are not included unless a buyer has been identified. Only newly announced offers in the month are included in the count (i.e. possible offers announced in December 2023 will be included in that month even if it becomes a firm offer in January 2024).

Get the monthly Investec Market Review delivered to your inbox

Browse articles in