Investec Market Review January 2024

The Investec Market Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM) and public M&A, whilst also reflecting on wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

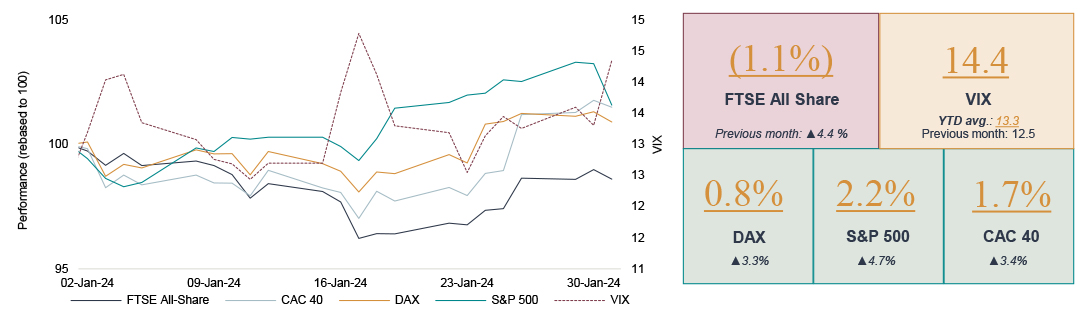

- January has been a mixed month for global equities – performance diverged with US and European indices hitting record highs whilst UK indices lagged. FTSE 250 lost (1.7%), S&P and DAX gained 1.6% and 0.9% respectively.

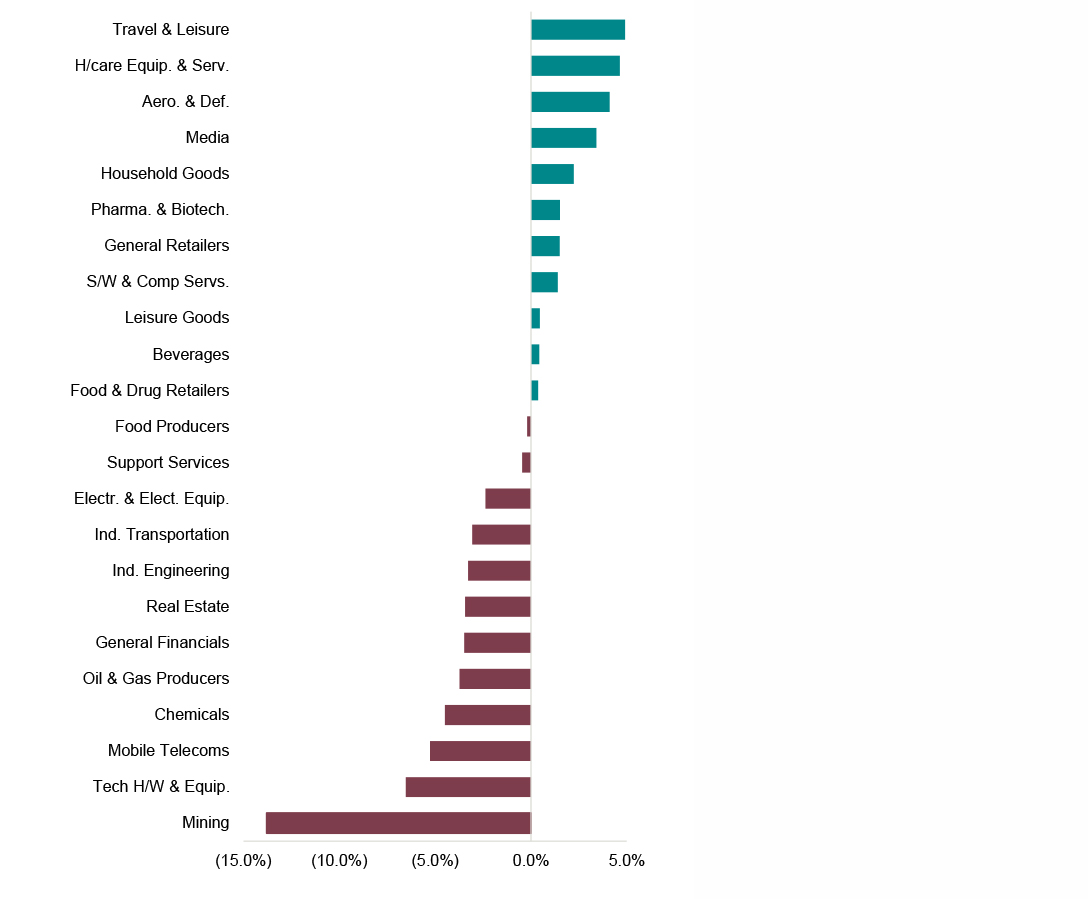

- Sector performance was balanced – 11 out 23 sectors registered gains this month, notably Travel & Leisure stocks, which rallied on the back of positive booking trends noted by airlines.

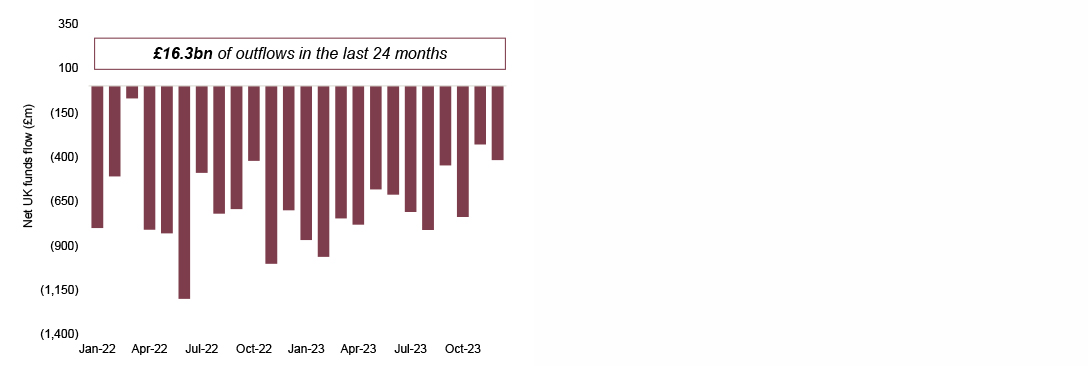

- Net outflows from UK funds persist, however, at a reduced rate as Decembe r2023 registered the second smallest figure in the last 21 months.

- Despite deal value increasing by c.44% in January, sell-downs stole the show once again as Haleon, Deliveroo, and Baltic Classifieds Group shareholders sold over £1bn worth of shares.

- UK public M&A activity remained robust in January with 3 firm offers announced in the month with a total value comprising c.£2.8bn.

Market drivers in January

Global equity markets diverged in January with US indices hitting records as domestic markets underperformed

Economic headlines in January

- UK CPI surprised on the upside in December, increasing to 4.0% (November: 3.9%). The core measure was up by 0.6% to 5.1%.

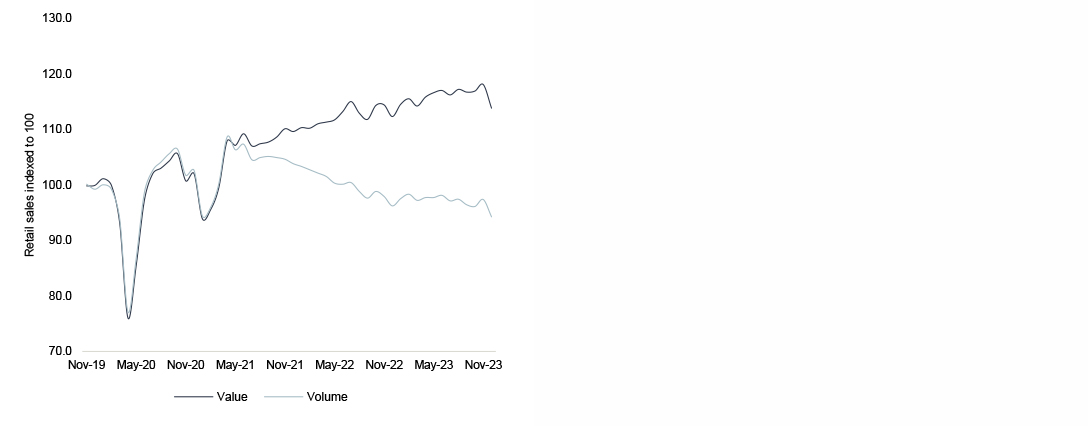

- UK Retail sales declined by 3.2% overall in December, the largest single-month fall since January 2021.

- UK GfK consumer confidence for January posted a third consecutive monthly gain, rising from a level of -22 in December to -19. This represents the highest level since January 2022.

- The US Q4 GDP print came in hotter-than-expected with output expanding by 3.3% in annualised terms (+0.8% QoQ), relative to consensus expectations ofa2.0% increase.

- The ECB kept key interest rates unchanged, as widely expected, with President Lagarde’s narrative looking to temper market expectations for rate cuts early this year.

- Composite PMIs in the Eurozone, UK and US all rose relative to the December figures driven by increased demand and rising business optimism.

After a slow start to the year, global markets maintained last month’s momentum, albeit key UK indices lagged

Source: Source: FactSet, Calastone, ONS, Investec Economics

UK Retail sales weakened

Source: FactSet, Calastone, ONS, Investec Economics

UK equity outflows persist, but show signs of easing

Source: FactSet, Calastone, ONS, Investec Economics

Prefer to download?

You can read the full January Market review

Never miss an update

Subscribe to the monthly Market review

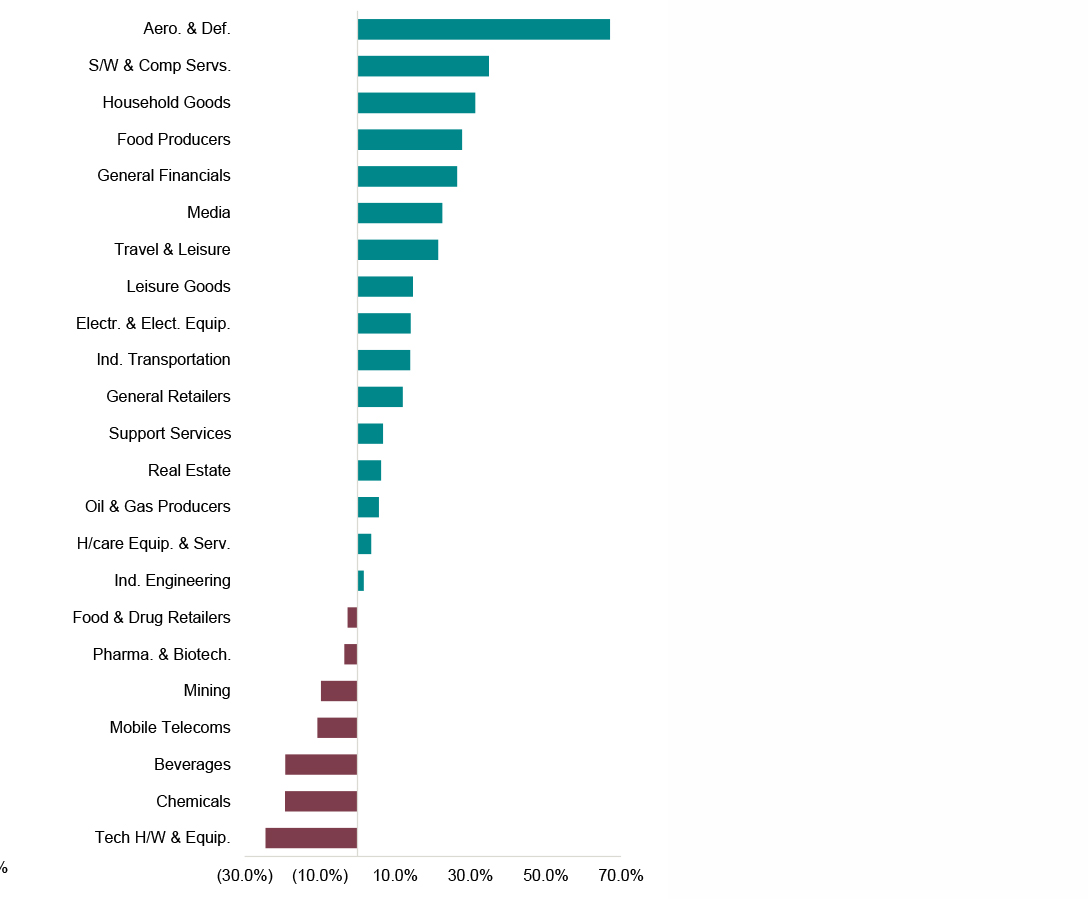

Sector performance in January

January was a disappointing month after the strong gains registered in November and December

Monthly sector snapshot

Drivers of sector performance in January

- Travel & Leisure stocks were the top performers over January, continuing their strong momentum as the top performing sector last month. Airlines delivered a strong performance as easyJet noted positive booking trends in its Q1 update.

- Aerospace & Defence stocks also delivered a strong performance against a backdrop of continued conflict in the Middle East and escalating tensions in the Red Sea. Notably, QinetiQ rose 15.9% in the month as itr eaffirmed full year expectations in a Q3u pdate and announced a £100m share buy back.

- At the other end of the spectrum, Mining stocks under performed on the back of softer economic data from China, a key market. Fresnillo was a notable laggard following its Q4 update, declining 10.6% for the month.

Sector performance - January 2024

Source: FactSet, Financial Times, London Stock Exchange, Investec Economics

Sector performance in 2023

Source: FactSet, Financial Times, London Stock Exchange, Investec Economics

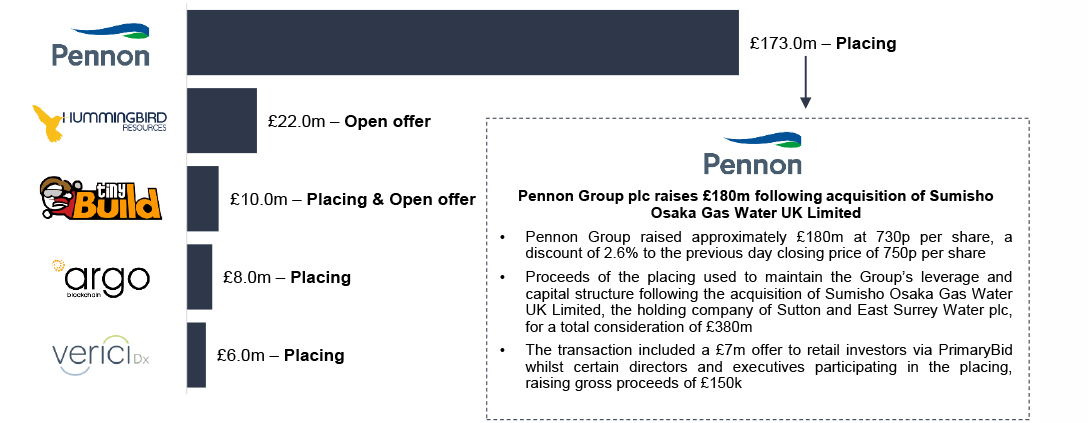

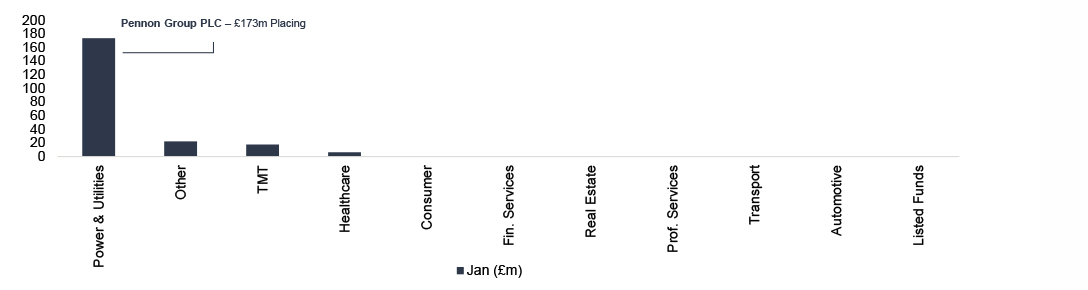

UK ECM activity in January

Following on from last month, primary issuance remained subdued at £219 in January as sell-downs continued to dominate UK ECM activity

ECM activity snapshot

Primary ECM issuance across the deal size spectrum in January

Public equity fund-raises by sector and highlighted deals

Sell-downs in January 2024

Announced IPOs in January 2024

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances.

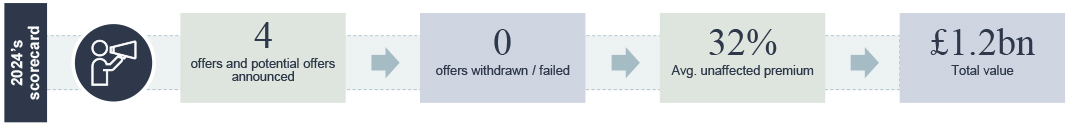

UK Public M&A activity in January

2024's scorecard

Selected deals

Source: Company announcements, FactSet, Practical Law.

Note: Scorecard includes competing offers, withdrawn offers and formal sales processes of companies subject to the Takeover Codequoted on AIM or the Main Market. From November 2023, we have included 2.4 announcements with undisclosed premia data

Get the monthly Investec Market Review delivered to your inbox

Browse articles in