Investec Market Review June 2024 - H1 review

The Investec Market Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM) and public mergers and acquisitions (M&A). We also reflect on the wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

UK ECM and public M&A activity accelerates in H1 2024 amid an improving inflationary backdrop

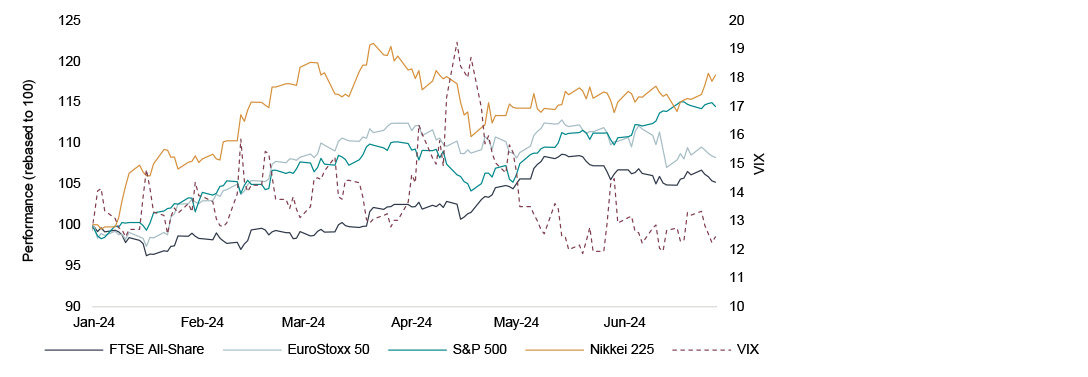

- Following a slow start to the year, domestic stocks advanced to narrow the performance gap between global peers, although continued to lag. UK mid-caps underperformed in the first half with the FTSE 250 gaining 3.0% whilst the FTSE All-Share and FTSE 100 added 5.2% and 5.6%, respectively. Meanwhile global markets rallied despite expectations for rate cuts moving out to the right - the S&P 500, EuroStoxx 50 and Nikkei 225 gained by 14.5%, 8.2% and 18.3% respectively in H1 2024

- Sector performance improved in H1 2024 with 16 out 23 sectors delivering gains vs 12 sectors in H1 2023. Aerospace and Defence names led the way on a year-to-date basis amid heightened global conflict and increased forecast defence spending whilst Chemicals stocks continued to underperform due to prolonged customer destocking

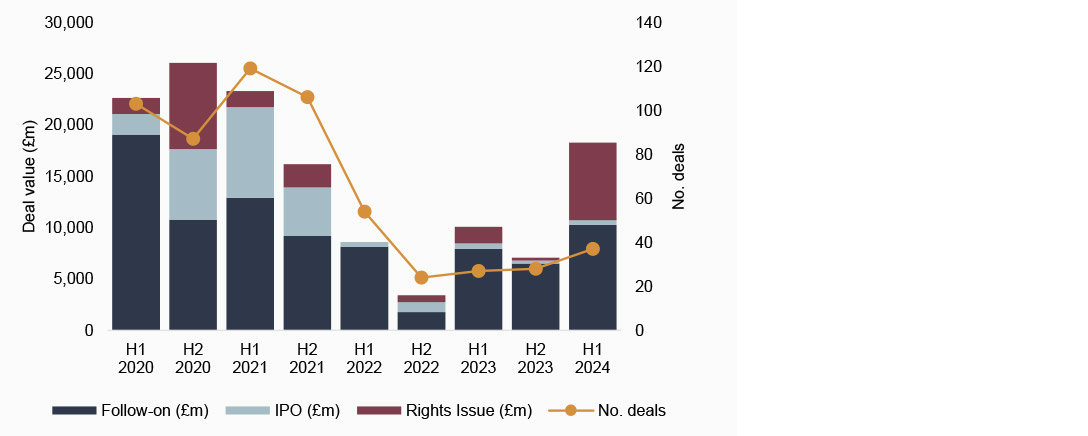

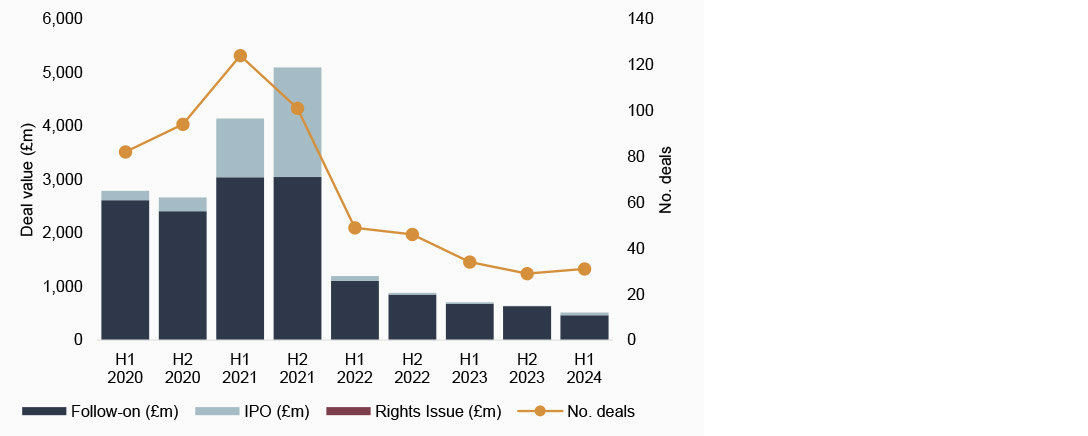

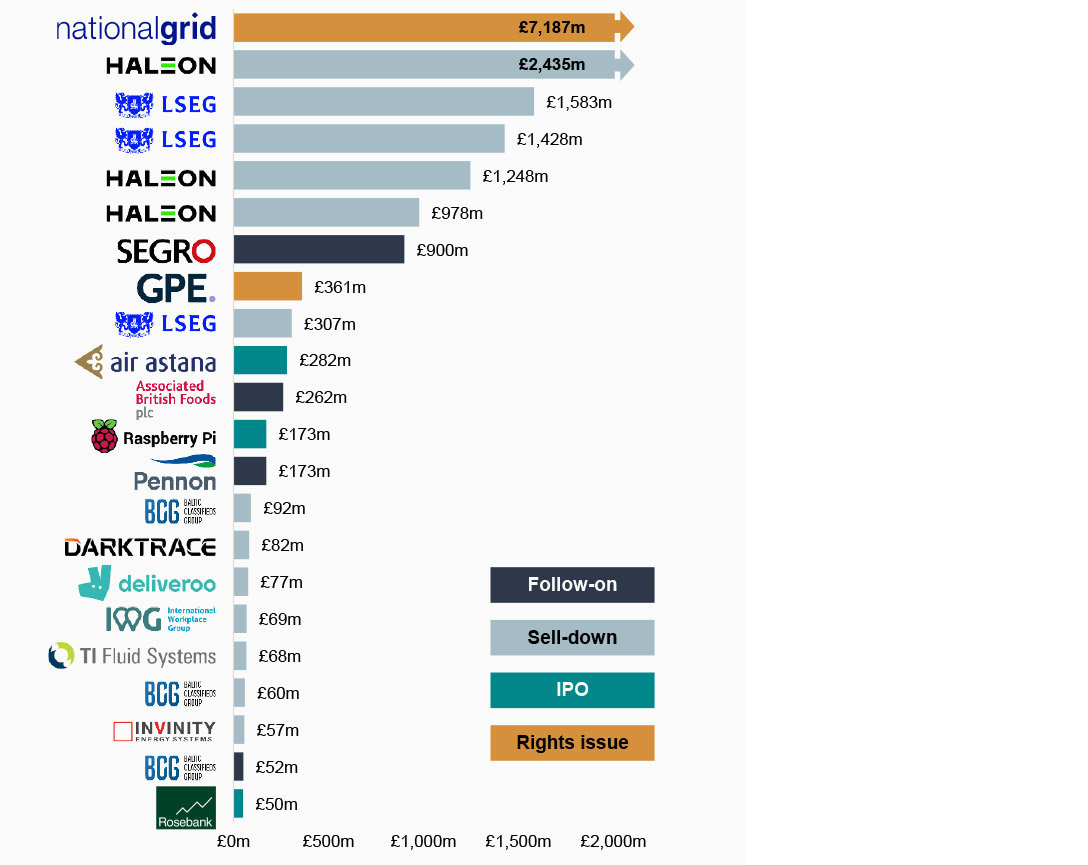

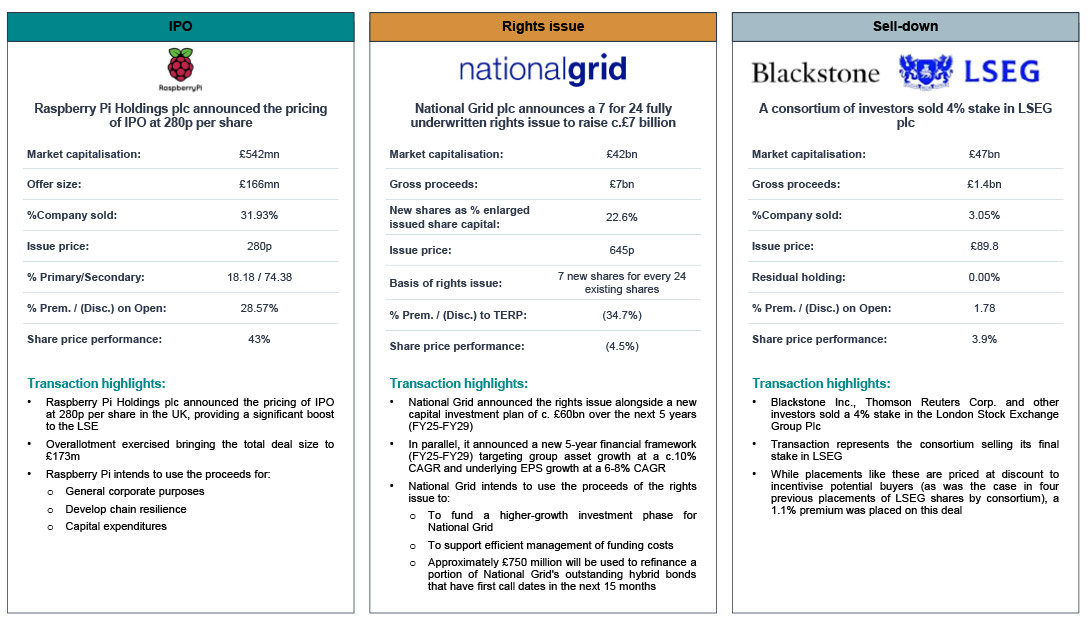

- UK ECM activity continued to rebound from 2022 lows, with the total funds raised in H1 2024 increasing by 74.1% vs H1 2023 whilst deal volumes increased by 11.5%. Secondary issuance continued to dominate amid several sizeable sell-downs from LSEG and Haleon whilst National Grid’s £7bn rights issue represented the largest of its nature in the UK since 2009

- Investec completed the £50m AIM IPO of Rosebank Industries, a vehicle for acquisitions of up to $3bn in the Industrials sector. The initial public offering (IPO) received very strong backing from a group of global blue chip institutional investors and Sovereign Wealth Funds, with day share price performance of +90%

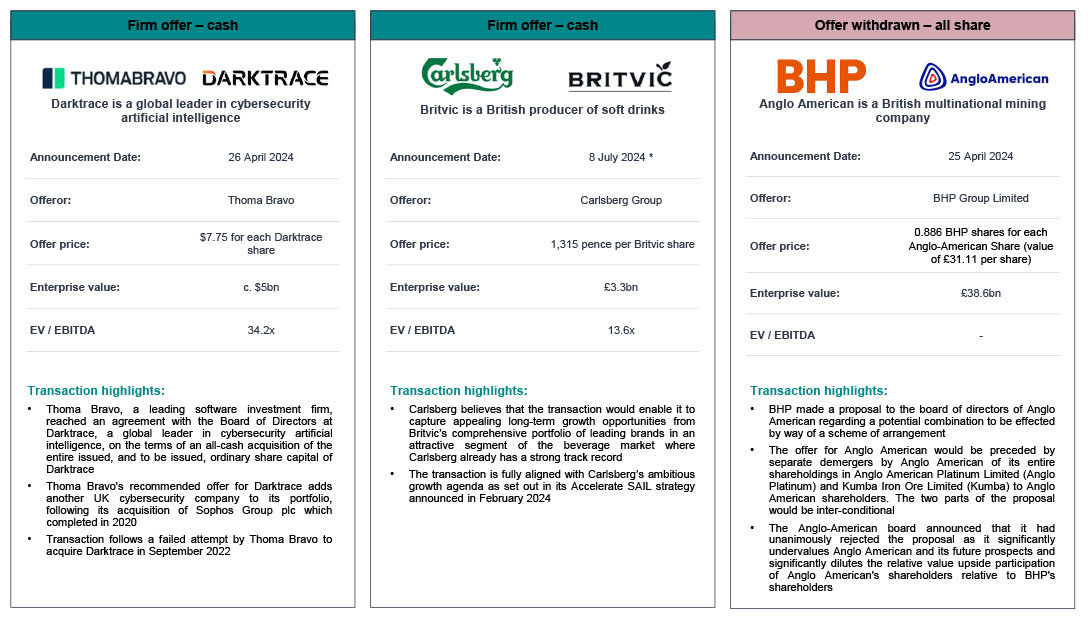

- UK public M&A activity also accelerated in the first half – the total enterprise value of firm or possible offers announced in H1 2024 was £74.4bn, representing a 313.3% increase.

Source: Factset; 1 Includes National Grid £7bn rights issue and Great Portland Estates £350m rights issue which have been announced but are yet to complete

Market drivers in H1 2024

Global equity markets make a strong start to the year with US and Japanese indices leading the rally

Key economic headlines in H1 2024

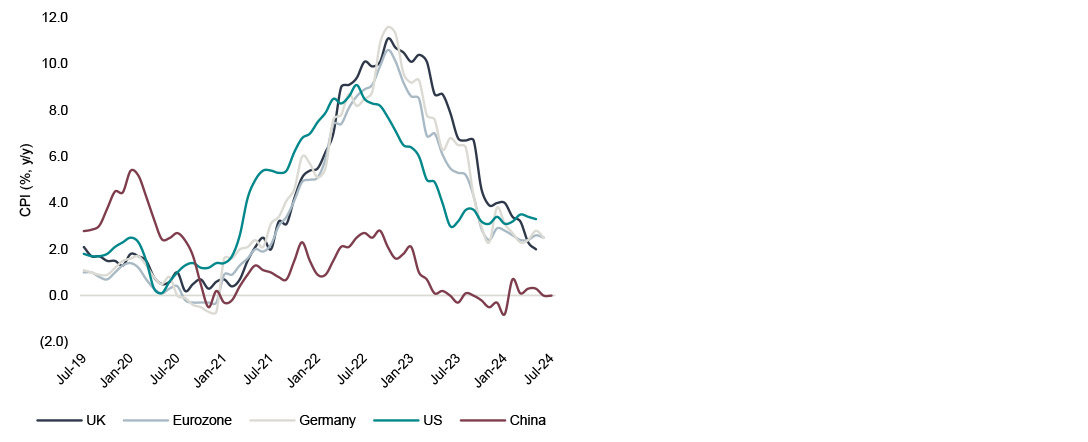

- Headline UK CPI fell back to 2.0% in May, back in line with the Bank of England’s target for the first time in nearly three years

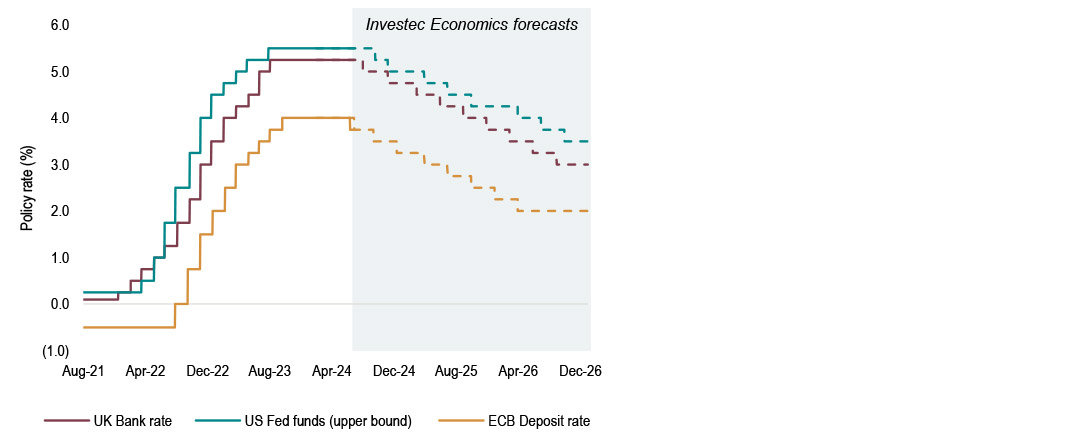

- The Bank of England (BoE) held the Bank rate at 5.25%, although the first-rate cut is expected in H2 2024

- The UK unemployment rate nudged up in the three months to April to 4.4% although wage growth remained robust, with average weekly earnings rising by 5.9% (y/y) in the same period, exceeding consensus of 5.7%

- The European Central Bank (ECB) became the second major central bank (following Canada) to cut rates, reducing its main rate from an all-time high of 4.0% to 3.75%

- Following three consecutive expectationbeating prints, US CPI inflation for April came in at 3.4%, in line with expectations

- The US Federal Reserve (Fed) maintained its key rate at a range of 5.25% to 5.50%, although is expected to cut rates in H2 2024.

UK Indices recover ground against global peers in H1 2024

Source: FactSet, Macrobond, ONS, Investec Economics, EPFR

Global market performance H1 2024

Source: FactSet, Macrobond, ONS, Investec Economics, EPFR

Decelerating inflation eases pressure on central banks

Source: FactSet, Macrobond, ONS, Investec Economics, EPFR

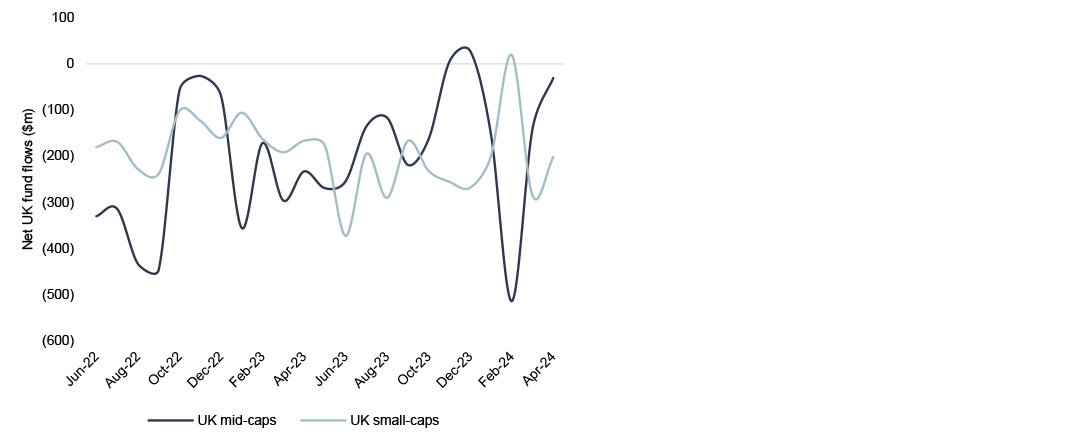

UK fund flows showing signs of improvement

Source: FactSet, Macrobond, ONS, Investec Economics, EPFR

Macroeconomic outlook for H2 2024

Global monetary policy expected to loosen in H2, geopolitical uncertainty remains

Key macroeconomic themes in H2 2024

- UK continues recovery from recession

- Strong wage growth keeping services inflation sticky

- Global monetary cycle starting to turn

- Increasing UK political clarity.

The Bank of England and Fed expected to follow the ECB in rate cuts…

Source: FactSet, Macrobond, Investec Economics

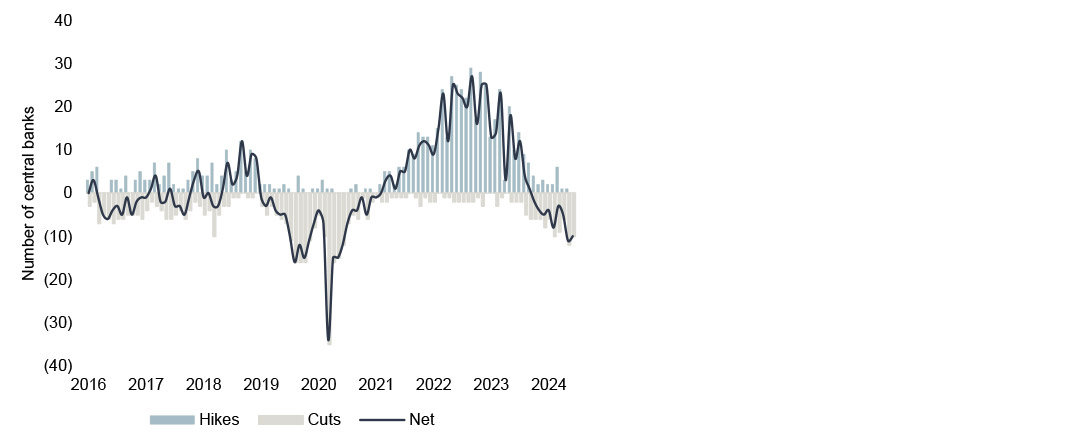

…with the global monetary cycle already starting to turn

Source: FactSet, Macrobond, Investec Economics

Key global macroeconomic events in H2 2024

Source: FactSet, Macrobond, Investec Economics

Prefer to download?

Click to download the full market review below.

Never miss an update

Subscribe to the monthly Market review

Sector performance H1 2024 vs H1 2023

Aerospace and Defence stocks continued last year’s strong momentum whilst the Chemicals sector remained under pressure

Sector snapshot

Drivers of sector performance in H1 2024

- Aerospace and Defence stocks were the top performers in H1 2024 as global conflict levels remained elevated amidst heightened geopolitical tension. The sector was bolstered by news that the UK will increase defence spending to 2.5% of GDP by 2030

- At the other end of the spectrum, Chemicals stocks underperformed. Croda issued a warning over margin contraction in its full year results as its profit before tax fell 70% vs the prior year citing prolonged customer destocking and a weaker macro environment

- Beverages stocks also lagged with Diageo noting consumers in the Americas trading down to cheaper alternatives. In terms of corporate activity, Britvic agreed a £3.3bn takeover by Carlsberg whilst Carlsberg also announced separately that it had agreed a deal to acquire Marston’s minority stake in Carlsberg Marston’s, the company’s brewing business in the UK.

Sector performance - H1 2024

Source: FactSet, Financial Times, Reuters, City AM, London Stock Exchange, Investec Economics

Sector performance - H1 2023

Source: FactSet, Financial Times, Reuters, City AM, London Stock Exchange, Investec Economics

Investec IPO case study

Successful £50m AIM IPO to support the company’s M&A growth ambitions

Background to the transaction

- The Rosebank team consists of two of the three original Melrose Industries PLC Co-Founders and four other members of its senior management team

- Rosebank’s objective is to recreate the same successful ‘Buy, Improve, Sell’ business model which the Rosebank team successfully implemented during their time at Melrose, creating over £6bn of shareholder value

- The team will aim to acquire quality industrial or manufacturing businesses with an indicative enterprise value of up to approximately US$3bn whose performance may be improved

- Rosebank will then invest heavily to improve the performance of any such business, typically over a three- to five-year investment horizon, before selling it to a new owner and returning the net cash proceeds to shareholders

- The IPO provides the company with seed capital and a blue-chip investor base to support future material equity issuance and M&A ambitions

- Investec has a long-term relationship with the Rosebank team, having Advised Melrose on a consistent basis since its AIM IPO in 2003.

Transaction overview

| Investec's role | Nominated Adviser, Joint Bookrunner, Joint Broker cand Financial Adviser |

| Structure type: | IPO (100% primary) |

| Gross proceeds: | £50.0m (£45.0m institutional offer / £5.0m subscription) |

| Issue price: | 250 pence per share |

| Free float: | c.44% |

| Admission date: | 11 July 2024 |

Investors by type and geography

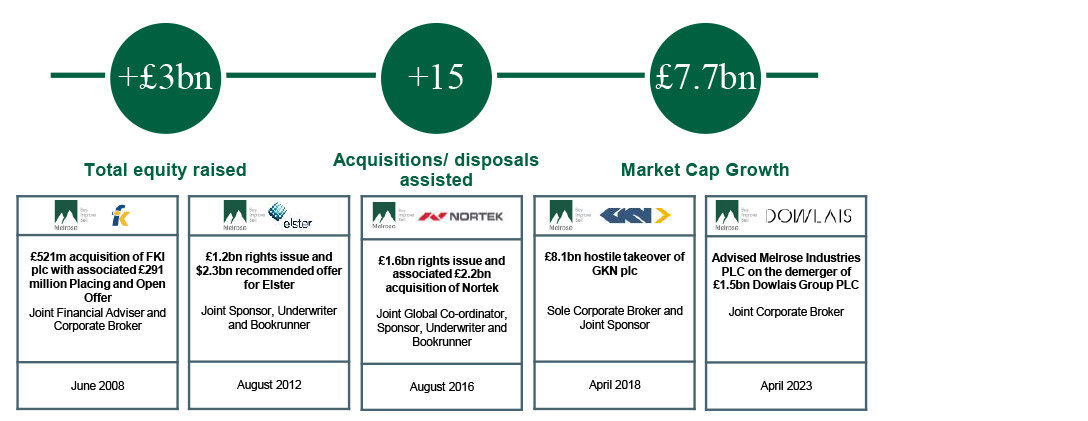

Continuation of Investec partnership with ambitious management team

Book multiple times covered with strong support from global blue-chip institutional investors

Source: London Stock Exchange, Company filings, Investec

UK ECM H1 2024 overview

UK ECM activity in H1 2024 improved strongly year-over-year with both transaction value and volume increasing; sell-downs continued to dominate

H1 2024 at a glance

Main Market ECM activity

AIM ECM activity

H1 2024 UK ECM deals above £50m; sell-downs dominant

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m; IFR ECM

UK ECM further selected deal highlights – H1 2024

Deal activity across the transaction spectrum

Source: Dealogic, Practical Law, Company filings; FactSet (Share price performance relates to performance from transaction announcement date to 30/06/2024)

UK public M&A activity in H1 2024

The first half of 2024 has seen a significant uptick in UK public M&A activity, driven predominantly by strategic bidders

2024's H1 2024 scorecard

UK public M&A activity spiked in H1 2024, although private equity bid volumes were subdued with interest rates remaining higher for longer

Investec M&A case study

Investec is acting as sole Rule 3 adviser, lead financial adviser, NOMAD and joint corporate broker to Alpha FMC on its recommended cash acquisition by Bridgepoint

Overview of Alpha FMC

- A leading global consultancy to the financial services industry with significant experience in the asset and wealth management, alternatives and insurance end markets

- Alpha FMC has the largest dedicated team across those industries, with around 1,000 consultants globally, operating from 17 client-facing offices spanning the UK, North America, Europe and APAC

- Alpha FMC supports the client transformation lifecycle by providing management consulting and complementary technology services that are highly focused on the industries in which it operates

- Alpha FMC has worked with all of the world’s top 20 and 80% of the world’s top 50 asset managers by assets under management, along with a wide range of insurance and other buy-side firms

- Alpha FMC operates in a market with long-term structural growth drivers which underpin client demand for the Group’s consulting services.

Overview of transaction

- Recommended cash offer announced on 20 June, with acquisition expected to complete during Q3 2024 subject to shareholder approval

- Following longstanding interest in Alpha from various parties the Board decided to engage with a small number of parties, resulting in a number of expressions of interest and proposals being received.

Strong track record of growth

Overview of transaction

Source: RNS 20 June 2024 – ‘Recommended Final Cash Acquisition of Alpha FMC’; *Stated on a pre-IFRS 16 basis; **premium to closing price of 335p on last business day before the commencement of the Offer Period

UK Public M&A selected deal highlights – H1 2024

Sector consolidation a prevalent theme

Source: Dealogic, Practical Law, Company filings; * Britvic Carlsberg transaction possible offer announcement 21 June 2024.

Get the monthly Investec Market Review delivered to your inbox

Browse articles in