Investec Market Review March 2023

The Investec Market Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM) and public M&A, whilst also reflecting on wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

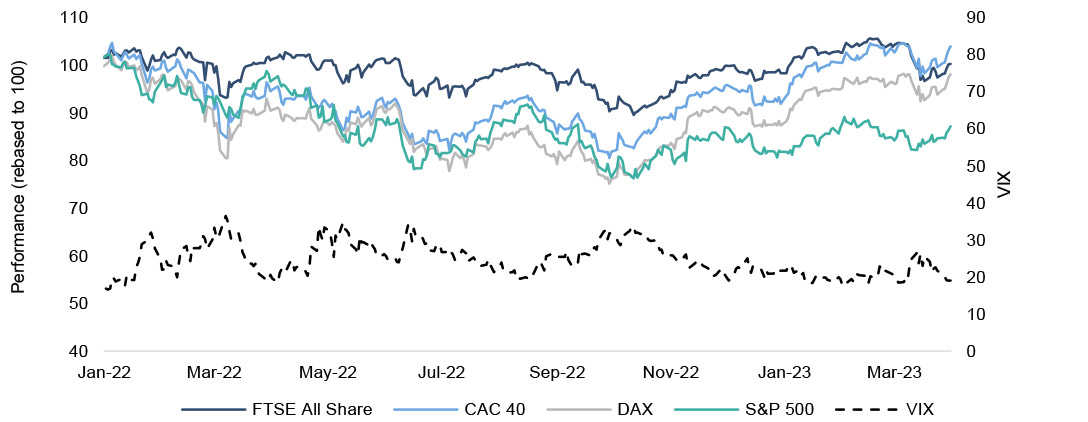

- The recovery in global indices slowed in March as market participants reacted to jitters in the global banking sector.

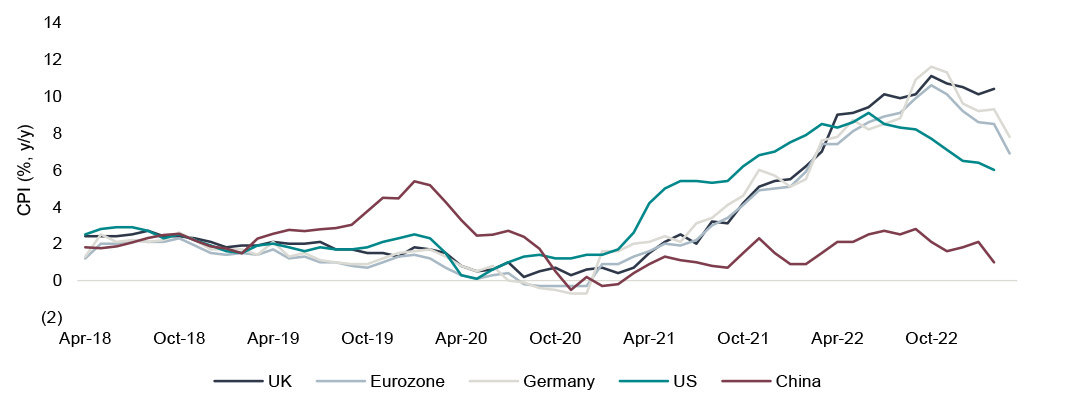

- After three months of consecutive decline, UK inflation data surprised on the upside as it reached 10.4% month on month (“MoM”). However, macro economic data remains resilient as UK economic activity rebounded in January and consumer confidence continues to improve.

- UK ECM activity deal value gathered pace in March as the London Stock Exchange Group plc completed a £2.0bn sell down.

- Investec is pleased to have acted as joint broker for CHP Software and Consulting Limited with regards to its 16 million share (equivalent to £22 million) sell down of Alfa Financial Software Holdings plc’ shares.

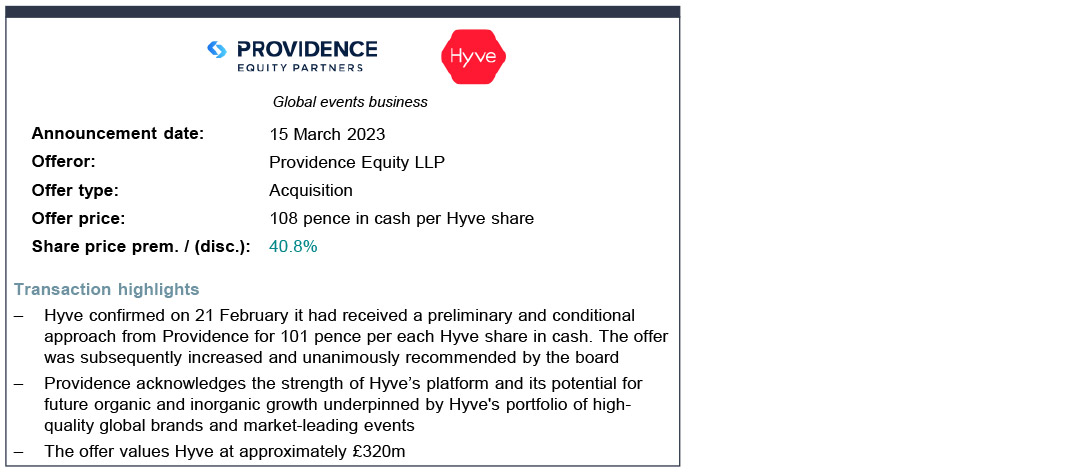

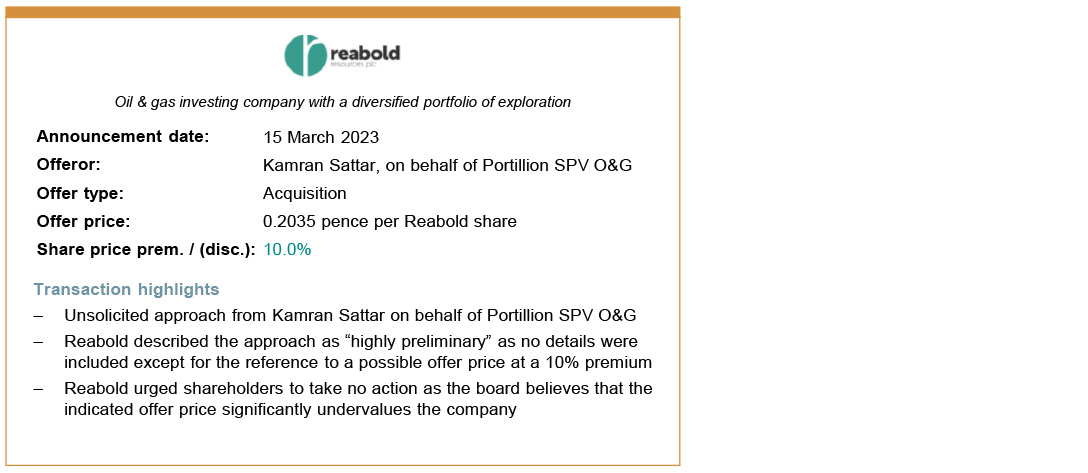

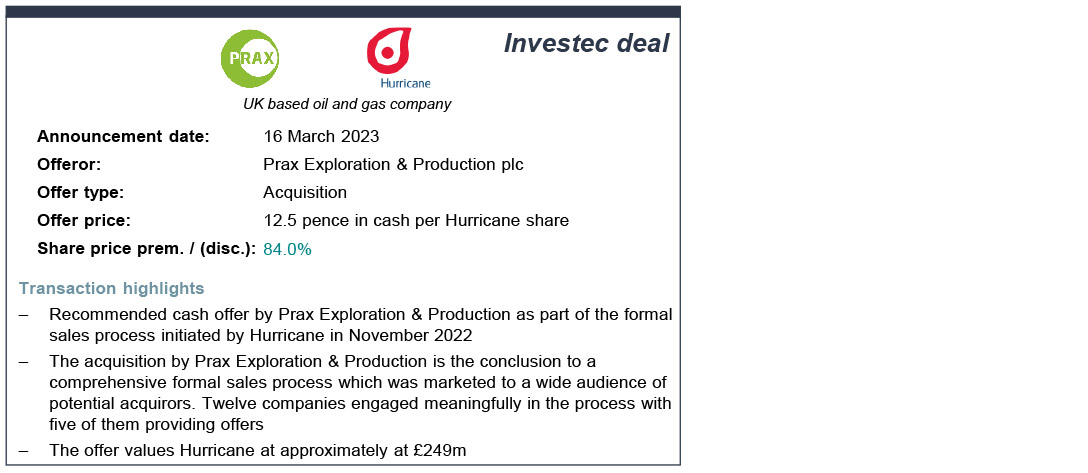

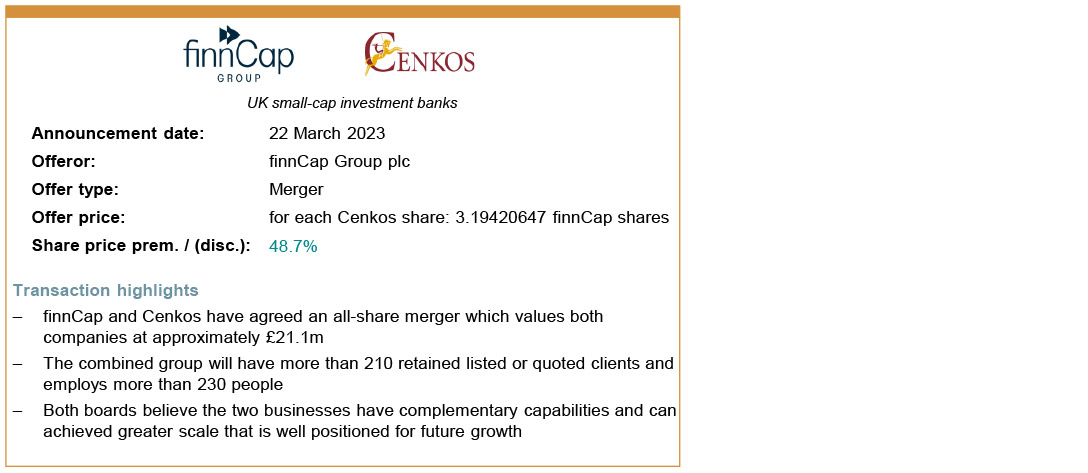

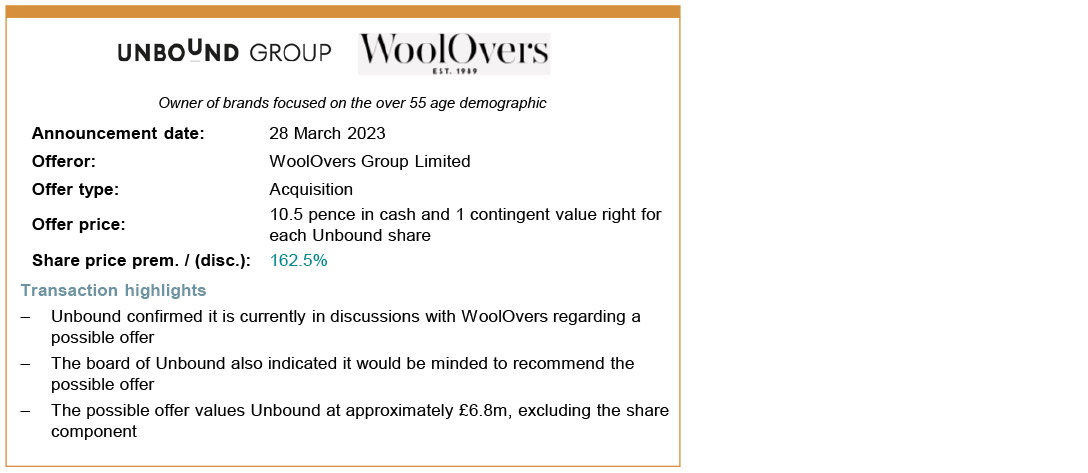

- UK public M&A activity was quieter in March with only three new deals announced Please contact your usual Investec contact if you would like to discuss the contents of this pack.

Market backdrop

Monthly market snapshot

March's key market drivers

- UK inflation increased unexpectedly from 10.1% (Y/Y) in January to 10.4% (Y/Y) in February

- UK retail sales grow by 1.2% (M/M) in February, the strongest rise since October 2022

- UK GDP figures for January revealed that economic activity rebounded by 0.3% in the month

- Jeremy Hunt’s 2023 Budget included a larger-than-expected spending of £20bn

- Eurozone’s GDP growth softer than expected in Q4 as forecasts were revised down to 0.0% (Q/Q)

- European & US bank stocks were under pressure following the collapses of Credit Suisse and SVB

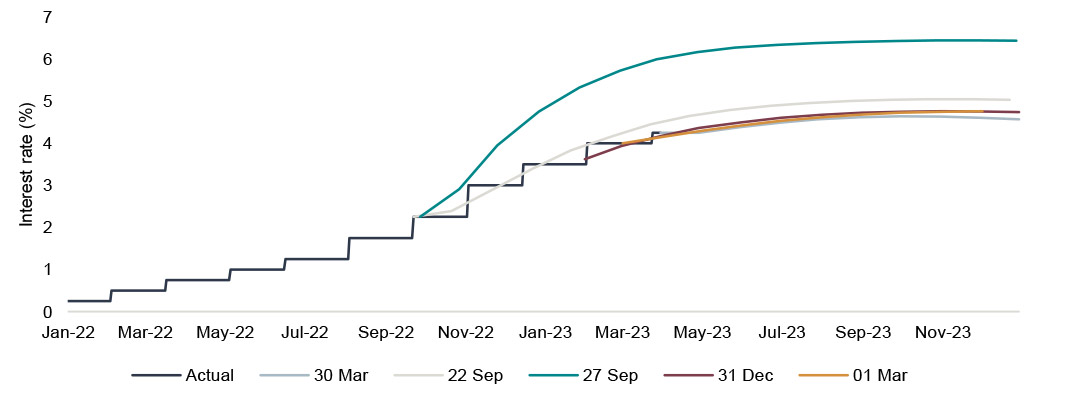

- Fed and BoE hike rates by 25bp to 4.75%-5.00% and 4.25% respectively

- Eurozone inflation fell sharply in March to 6.9% from 8.5% in February

Global equity market performance & equity market volatility

Source: Bloomberg, FactSet, Macrobond

Inflation slows down across key geographies with the exception of the UK

Source: Bloomberg, FactSet, Macrobond

UK interest rate projections show signs of stabilising

Source: Bloomberg, FactSet, Macrobond

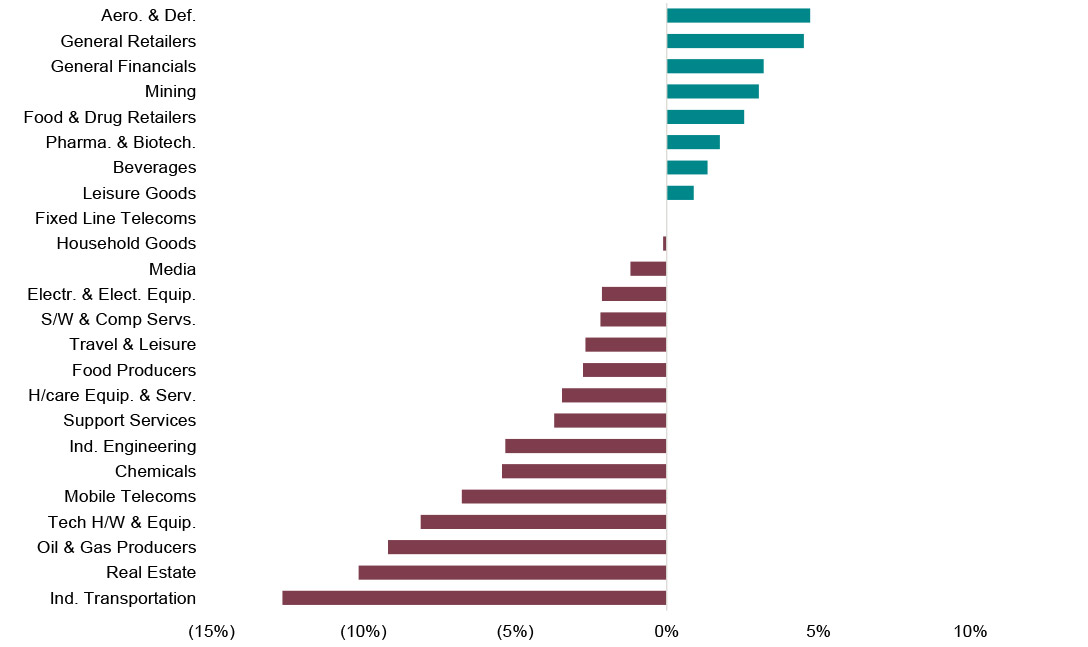

UK sector performance

Monthly sector snapshot

Sector performance drivers and outlook commentary

- General Retailers recovered some of the lost ground in February following encouraging retail sales figures for February –retail sales value grew by 2.2% (MoM) and volume by 1.5% (MoM) -and improving consumer confidence –which moved from -38 points to -36 points in February

- Aerospace & Defence stocks continued their rally in March as western governments reiterate their promise to increase military spending to help Ukraine’s war effort. Moreover, the Financial Times reported that global deal activity in aerospace and defence companies reached $20bn in 2022

- Oil & Gas Producers fell as oil prices hit their lowest level in 15 months on 20 March (West Texas Intermediate futures reached $65.9 and Brent futures reached $72.1) following the announcement of the acquisition of Credit Suisse by UBS

Sector performance (LTM)

Source: FactSet, Financial Times, Investegate

Sector performance (March 2023)

Source: FactSet, Financial Times, Investegate

Prefer to download?

You can read the full December Market review

Never miss an update

Subscribe to the monthly Market review

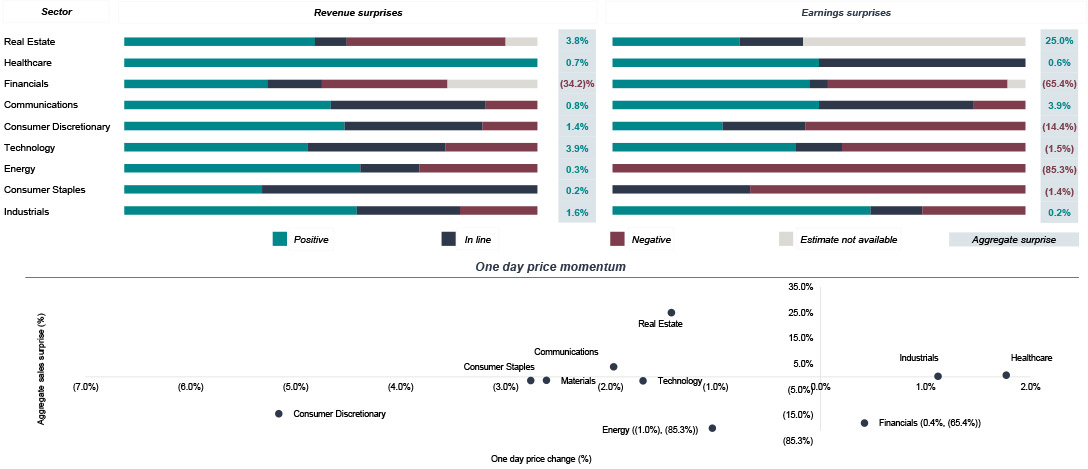

UK full year earnings season snapshot

Of those UK companies who reported results in March, Technology and Real Estate stocks generally managed to outperform consensusestimates. Results were less positive for stocks sensitive to current macroeconomic headwinds such as Financials and Energy stocks.

Source: Bloomberg

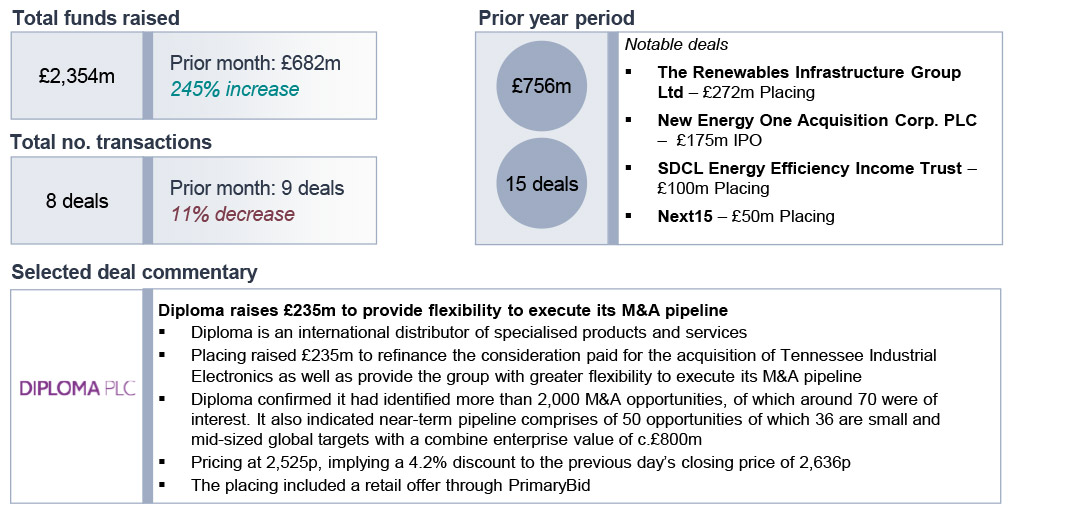

UK ECM activity retreats in March

Deal value increased sharply in March. However, the number of deals retreated in March

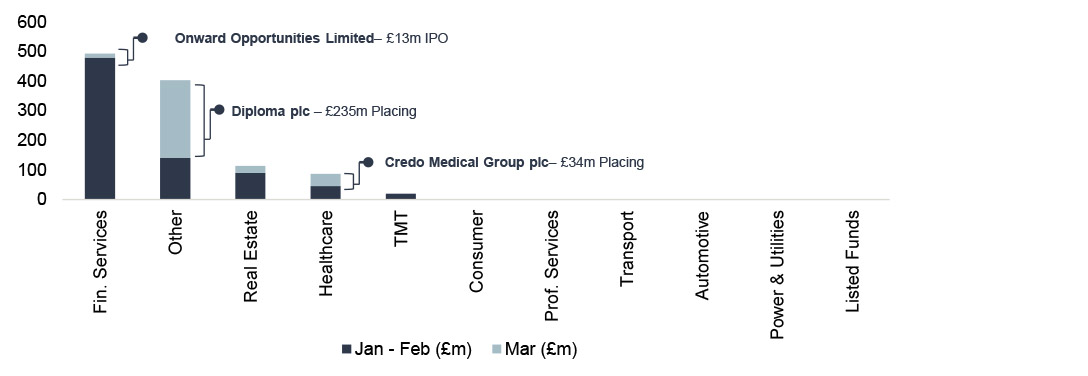

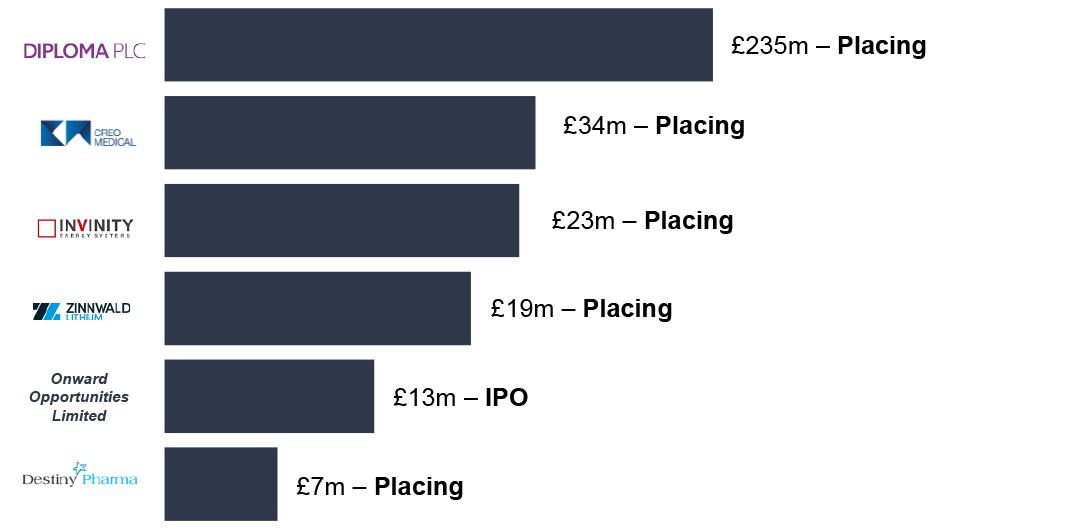

Public equity fund-raises by sector and highlighted deals

Sell-down activity over March

ECM issuance across the deal size spectrum in February

The UK IPO pipeline

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances

A snapshot of the current UK public M&A market

UK PLC takeover activity slowed down in March as only two new deals were announced

Get the monthly Investec Market Review delivered to your inbox

Browse articles in