Investec Market Review March 2024

The Investec Market Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM) and public M&A, whilst also reflecting on wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

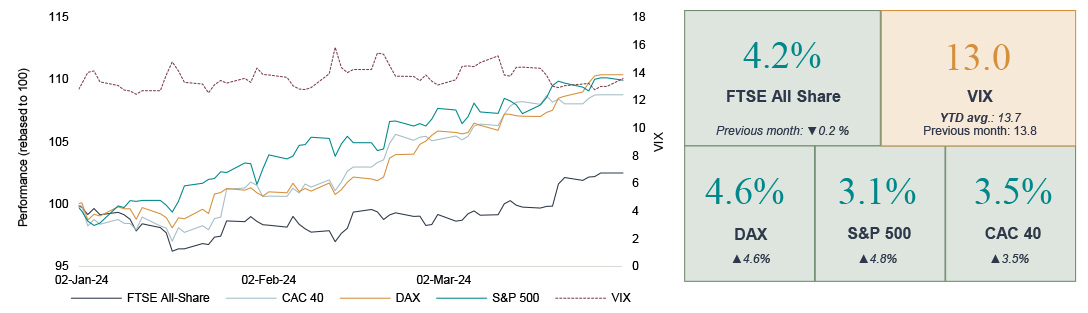

- March was another positive month for global equities as UK markets gathered momentum – UK midcaps outperformed with the FTSE 250 adding 4.4% whilst the FTSE All-Share gained 4.2% and global markets maintained their strong performance with the S&P 500, DAX and CAC 40 adding 3.1%, 4.6% and 3.5% respectively.

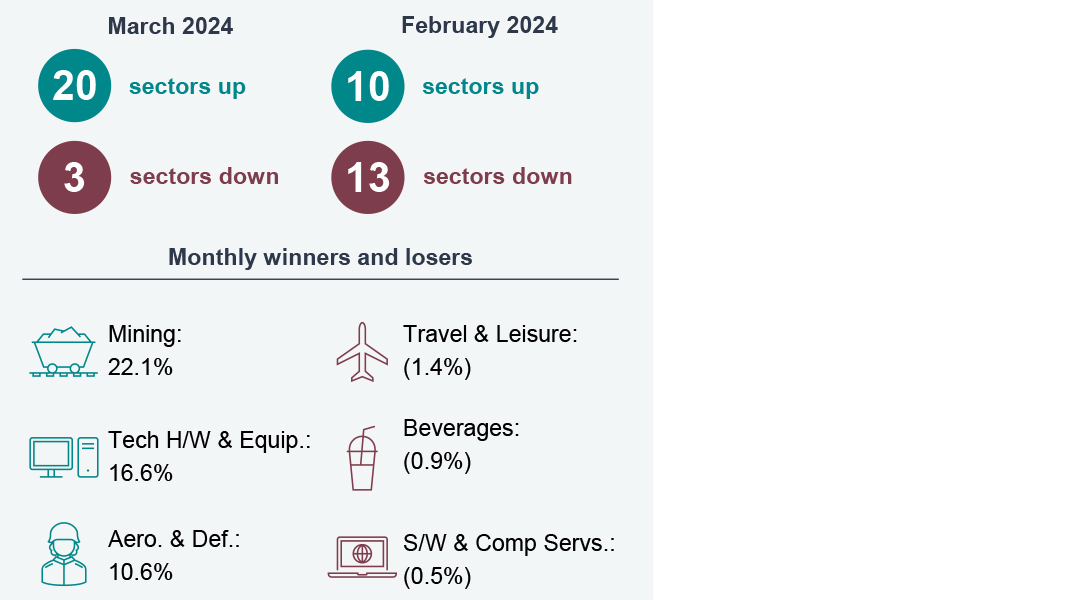

- Sector performance improved in March with 20 out 23 sectors delivering gains this month. Performance reversed in some sectors in March relative to year-to-date, with Mining stocks outperforming the wider market as the price of gold hit record highs meanwhile better-than- expected Chinese industrial production data lifted sentiment.

- UK ECM activity was elevated this month in terms of total funds raised, which increased by 246% vs February following sizable sell-downs, most notably from Haleon as Pfizer reduced its stake in the Company from 32% to 24%. Primary issuance was muted with only £39m raised in three transactions.

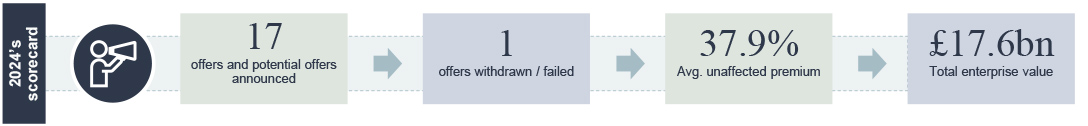

- UK public M&A activity remained prevalent in March – the total enterprise value of offers announced year-to-date increased by £4.3bn to £17.6bn. Five firm offers were announced, with all offerors being trade buyers.

Market drivers in March

UK markets gathered momentum in March whilst global indices continued their strong start to the year

Economic headlines in February

- Headline UK CPI inflation for February came in at 3.4% (y/y), marginally below consensus of 3.5%, marking a sharp fall relative to January’s print.

- UK monthly GDP data reported a monthly rise in output of 0.2% in January, in line with consensus expectations, indicating that the UK economy is on track to exit recession in Q1.

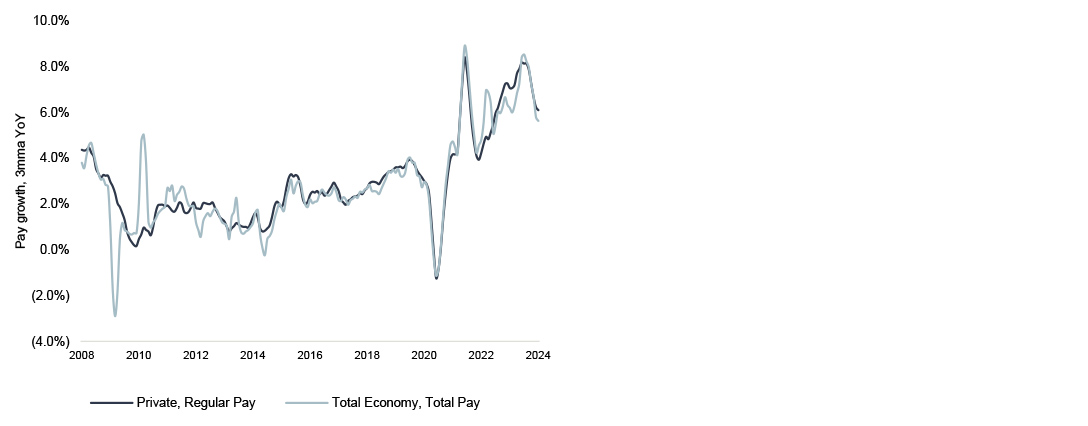

- UK unemployment inched up in the three months to January to 3.9% from 3.8% whilst private sector wage growth slowed to 6.1% (y/y).

- The ECB kept its three key rates unchanged but lowered its inflation expectations to average 2.3% in 2024, 2.0% in 2025 and 1.9% in 2026.

- US CPI for February was 3.2%, marginally above consensus at 3.1% driven by a rise in energy costs. The core measure was also slightly hotter than expected at 3.8%.

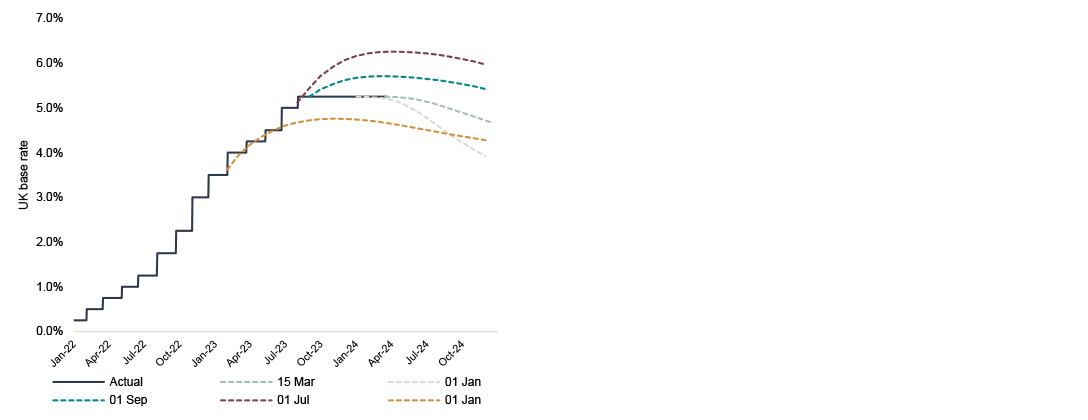

- The Fed kept its benchmark rate in the 5.25% -5.50% range and reiterated its expectations to cut the rate by 0.75% by the end of the year.

UK markets deliver gains but continue to lag global peers

Source: FactSet, Macrobond, ONS, Investec Economics

UK wage growth decelerates 2023

Source: FactSet, Macrobond, ONS, Investec Economics

UK interest rate projections show signs of stabilisation

Source: FactSet, Macrobond, ONS, Investec Economics

Prefer to download?

You can read the full March Market review

Never miss an update

Subscribe to the monthly Market review

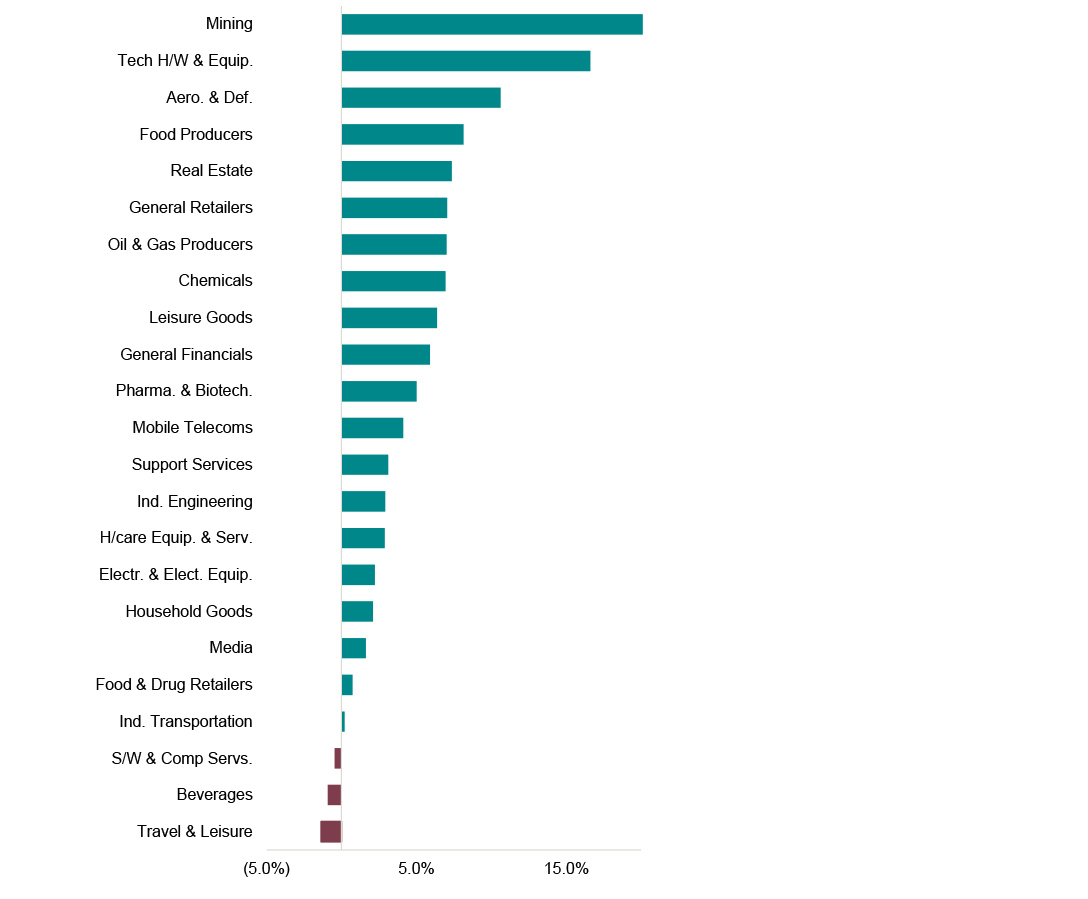

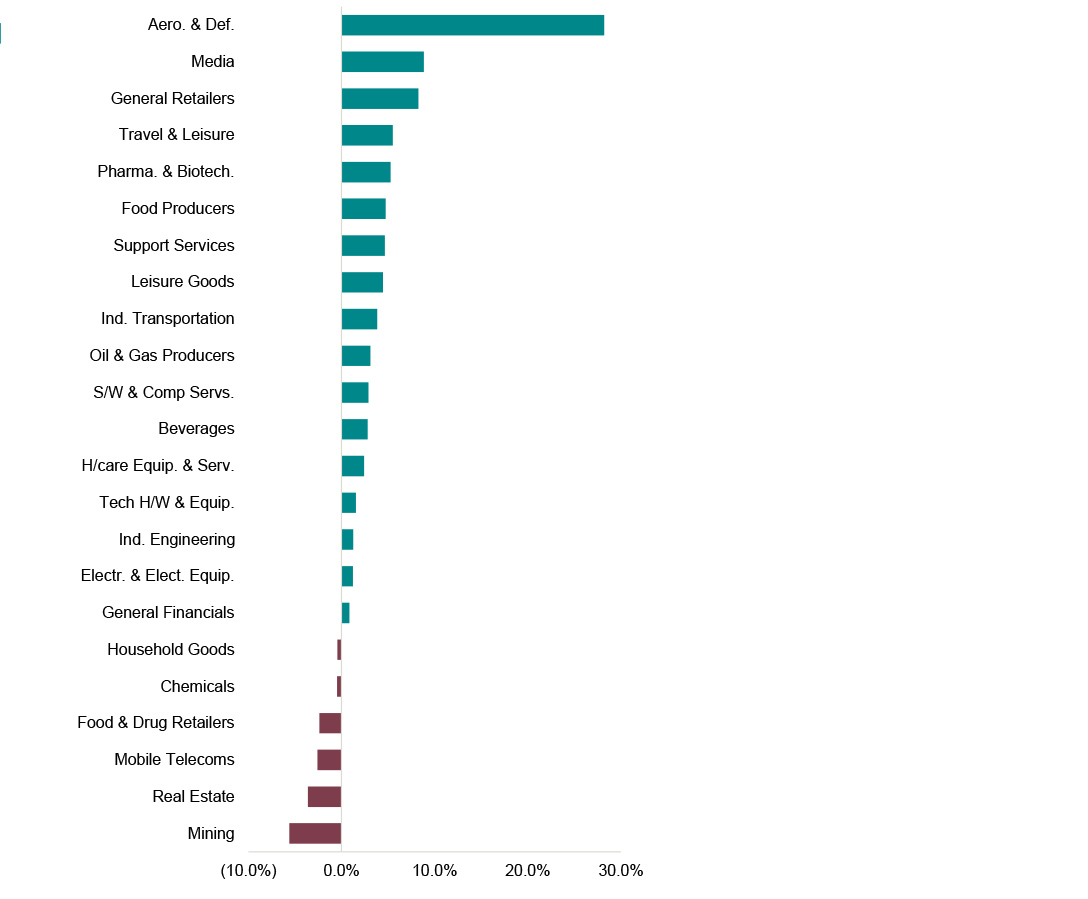

Sector performance in March

Mining stocks bounced back following a weak start to the year, whilst Travel & Leisure reversed to underperform in March

Monthly sector snapshot

Drivers of sector performance in February

- Mining stocks reversed their fortunes this month, delivering strong gains following a weak start to the year. This came amidst the price of gold rising 9.1% in March, hitting record highs and marking its strongest monthly performance since July 2020. Endeavour Mining correspondingly gained 26.2%, leading performance across the sector. In addition, Chinese Industrial output data jumped 7% YoY in January and February, ahead of expectations, boosting sentiment for the sector..

- At the other end of the spectrum, Food & Drug Retailer stocks underperformed as Reckitt Benckiser shares declined c. 9.7% this month erasing c. £3.6bn of market value. This follows the verdict of an Illinois jury which ordered its Mead Johnson unit to pay $60 million in compensation for the death of a premature baby.

Sector performance - March 2024

Source: FactSet, Financial Times, Reuters, London Stock Exchange, Investec Economics

YTD Sector performance

Source: FactSet, Financial Times, Reuters, London Stock Exchange, Investec Economics

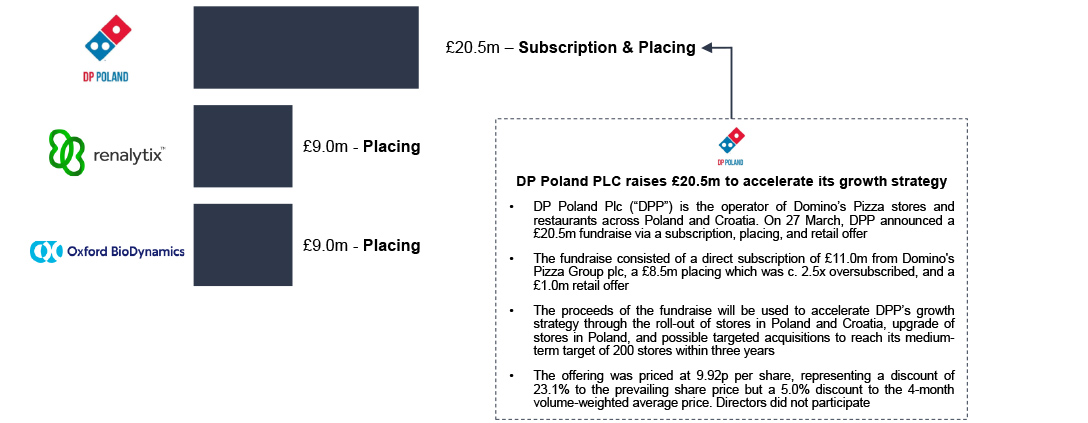

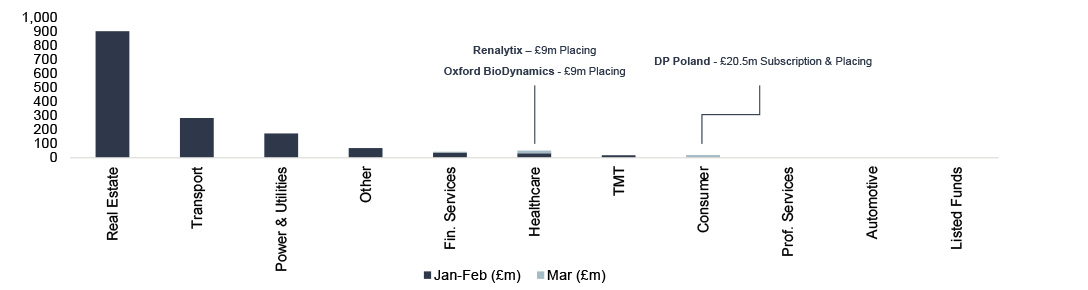

UK ECM activity in March

ECM activity ticked higher in March with transaction value rising sharply vs February due to a significant increase in sell-downs

ECM activity snapshot

Primary ECM issuance across the deal size spectrum in March

Public equity fund-raises by sector and highlighted deals

Sell-downs in March 2024

Announced IPOs in March 2024

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances.

UK Public M&A activity in March

2024's scorecard

Selected deals

Source: Company announcements, FactSet, Practical Law

Note: Scorecard includes competing offers and withdrawn of companies subject to the Takeover Code quoted on AIM or the Main Market. Formal sales processes are not included unless a buyer has been identified. Only newly announced offers in the month are included in the count (i.e. possible offers announced in December 2023 will be included in that month even if it becomes a firm offer in January 2024).

Get the monthly Investec Market Review delivered to your inbox

Browse articles in