Investec Market Review May 2024

The Investec Market Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM) and public M&A, whilst also reflecting on wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

UK ECM activity rebounded strongly with c. £10.9bn of fundraises announced in May1 as UK markets rose for a third consecutive month

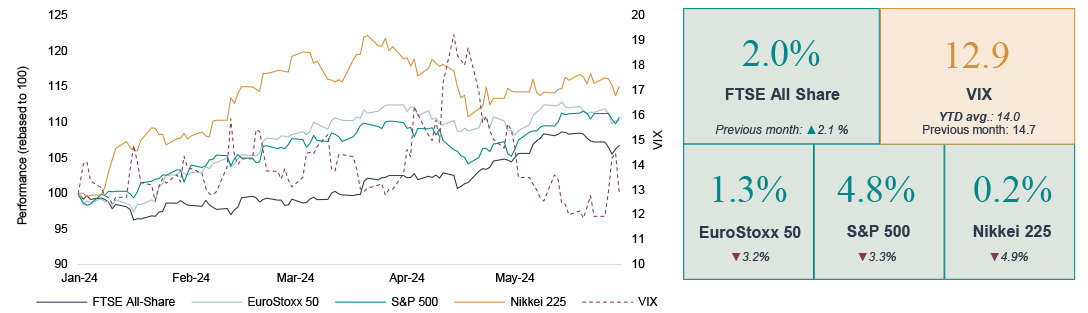

- Domestic stocks continued their upward trajectory in May, with mid-caps outperforming as the FTSE 250 gained 3.8% whilst the FTSE All-Share and FTSE 100 added 2.0% and 1.6%, respectively. Meanwhile global markets rebounded following a softer April to deliver gains across all key indices – the S&P 500, EuroStoxx 50 and Nikkei 225 gained by 4.8%, 1.3% and 0.2% respectively.

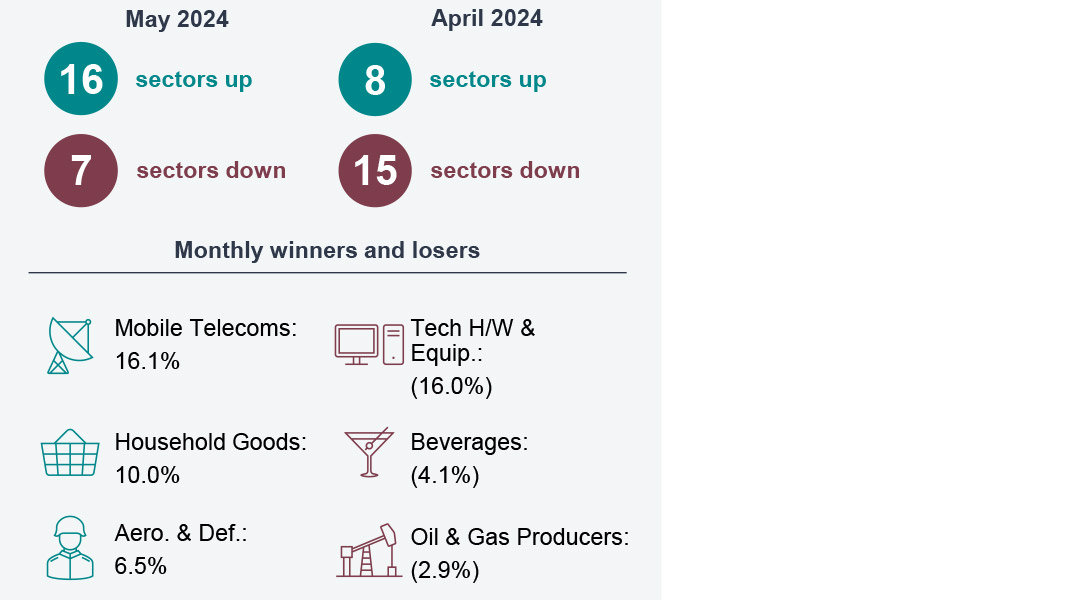

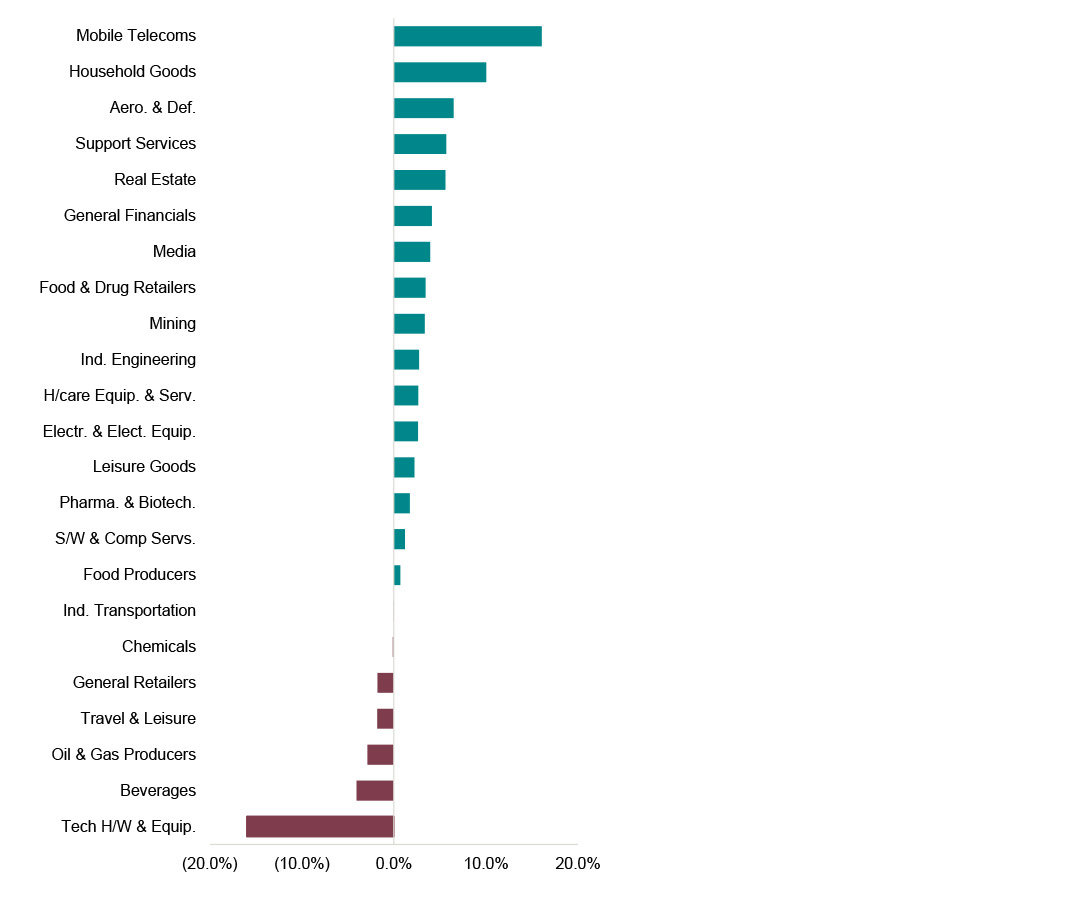

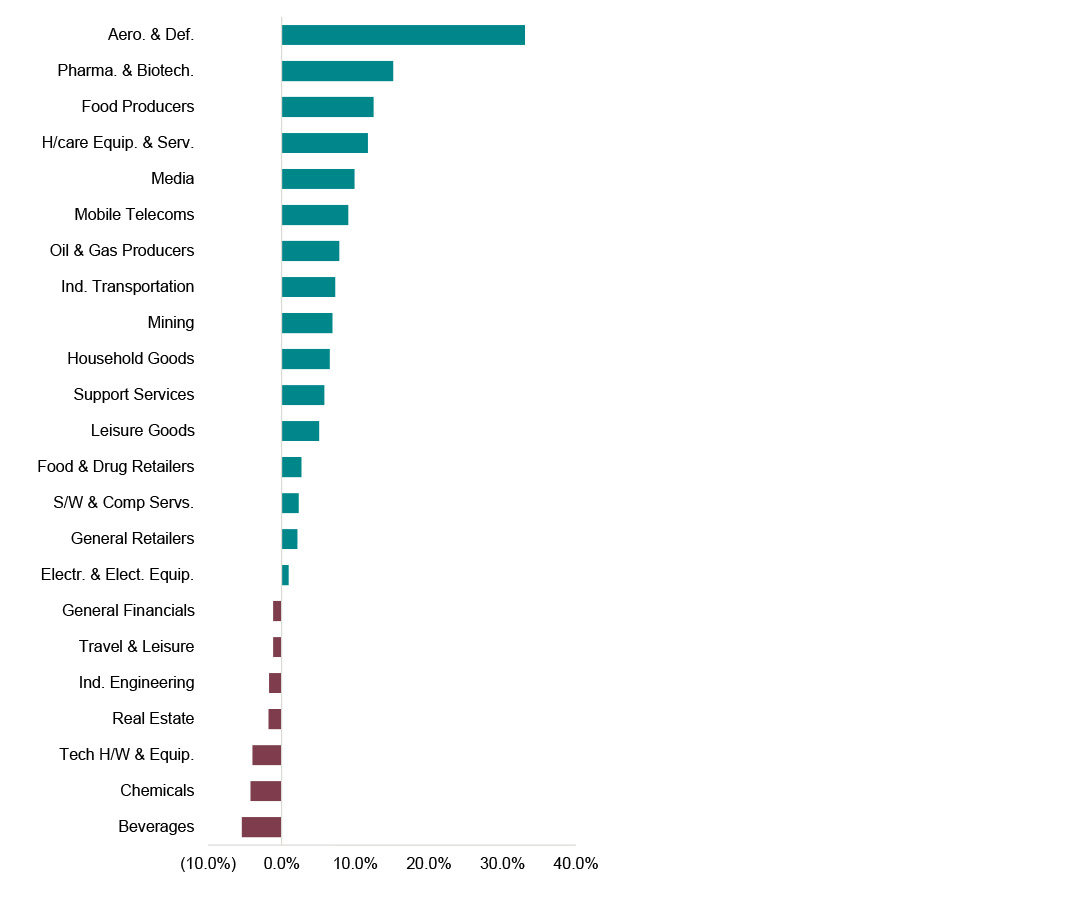

- Sector performance improved in May with 16 out 23 sectors delivering gains this month. Mobile Telecoms stocks were top performers this month with both BT and Vodafone shares rallying on the back of respective results announcements. Aerospace and Defence names continued to lead the way on a year-to-date basis amid heightened global conflict and increased forecast defence spending.

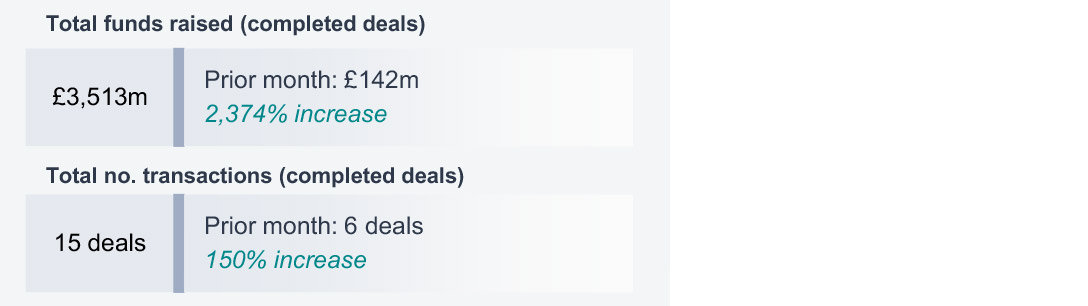

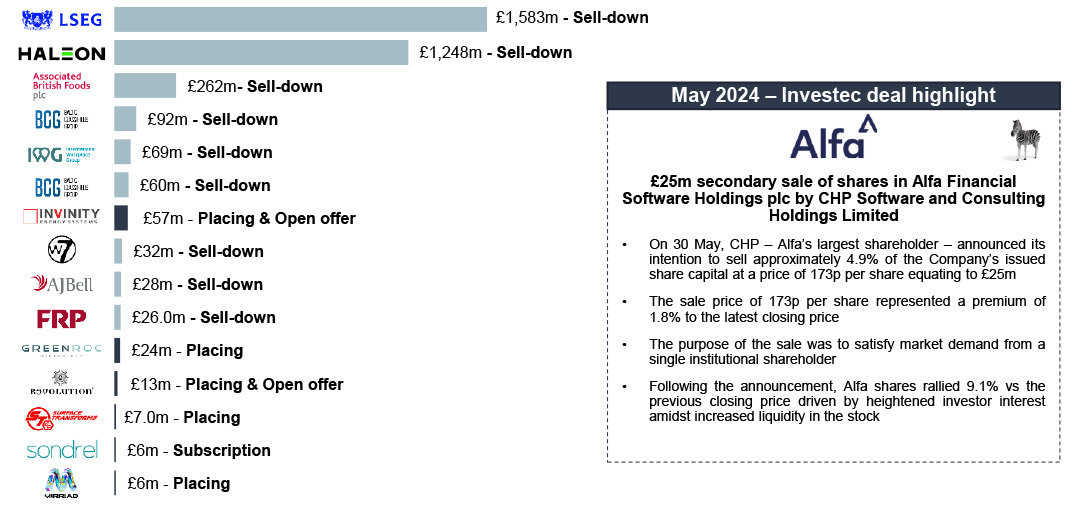

- UK ECM bounced back strongly this month with the total funds raised increasing by 2,374% vs April, albeit from a low base. Secondary issuance continued to dominate with notable sell-downs from LSEG, Haleon, and Associated British Foods whilst National Grid announced a £7bn rights issue, the largest in the UK since 2009.

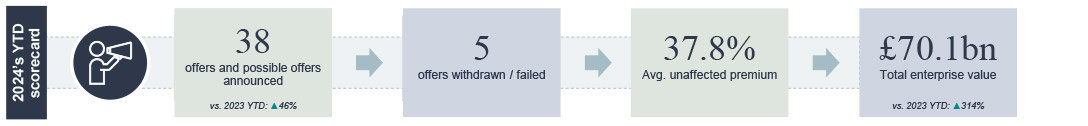

- UK public M&A activity remained a prevalent theme in May – the total enterprise value of offers announced year-to-date increased by £10.3bn to £70.1bn, with 12 new offers and possible offers announced in the month.

Source: Factset; 1Includes National Grid £7bn rights issue and Great Portland Estates £350m rights issue which have been announced but are yet to complete

Market drivers in May

UK indices continue to travel on an upward trajectory as the inflationary outlook continues to improve

Economic headlines in May

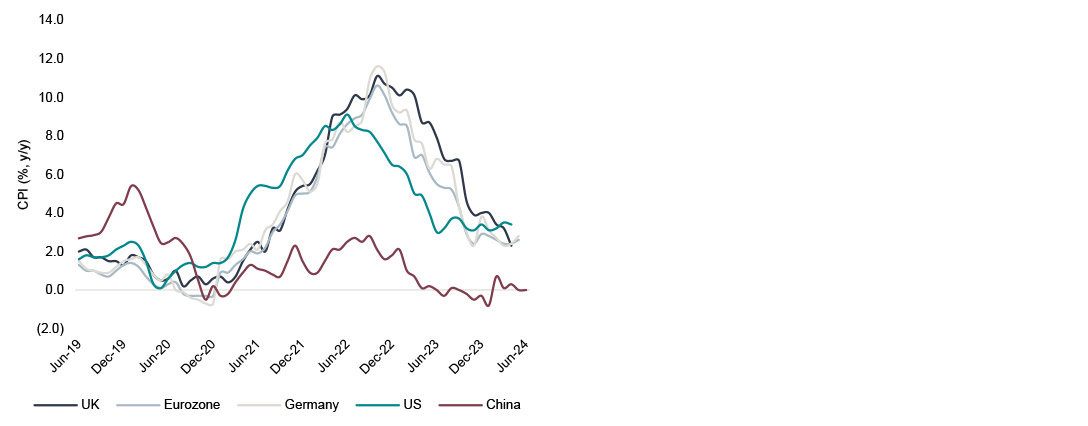

- Headline UK CPI fell sharply in April to 2.3% from 3.2% in the prior month, its lowest level since July 2021, but still ahead of consensus expectations looking for a decline to 2.1%.

- The BoE held the Bank rate at 5.25%, in line with Economists’ expectations; 7 MPC members voted in favour of holding rates whilst 2 voted for a 25bp cut.

- UK retail sales declined by 2.3% in April, well below expectations with consensus looking for a 0.5% decline, driven by wet weather reducing footfall on the high street.

- Eurozone inflation increased by 2.6% year-on-year in May, up from 2.4% in April and exceeding the forecast of 2.5%.

- Following three consecutive expectation-beating prints, US CPI inflation for April came in at 3.4%, in line with expectations.

- US non-farm payrolls missed consensus, with jobs growth in April +175k, relative to consensus expectations of +243k whilst the average hourly earnings print of +0.2% was also slightly softer than expectations.

UK markets rise for a third consecutive month

Source: FactSet, Macrobond, ONS, Investec Economics, EPFR

UK inflation continues to moderate

Source: FactSet, Macrobond, ONS, Investec Economics, EPFR

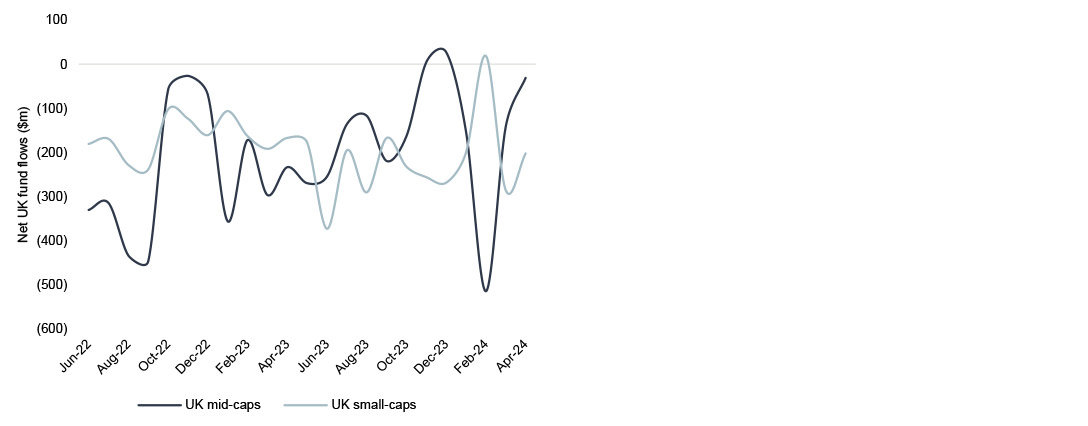

UK fund flows showing signs of improvement

Source: FactSet, Macrobond, ONS, Investec Economics, EPFR

Prefer to download?

You can read the full March Market review

Never miss an update

Subscribe to the monthly Market review

Sector performance in May

Mobile Telecoms stocks outperform, whilst overall sector performance improved vs April

Monthly sector snapshot

Drivers of sector performance in May

- Mobile Telecoms stocks were the top performers this month with BT and Vodafone shares gaining 27.3% and 11.8% respectively on the day of their full year results. BT shares surged on the back of announcing a cost transformation targeting £3bn of gross annualised cost savings by the end of FY29 at a £1bn cost to achieve. Meanwhile, Vodafone announced the approval of the sale of its Spain entity alongside a €2bn share buyback programme.

- At the other end of the spectrum, Tech Hardware & Equipment stocks were notable laggards this month, declining by nearly 4x the next worst performing sector. Ensilica shares declined by 19.6% as the Company announced a £4.3m placing at an 18% discount to the previous closing price.

Sector performance - May 2024

Source: FactSet, Financial Times, Reuters, London Stock Exchange, Investec Economics

YTD Sector performance

Source: FactSet, Financial Times, Reuters, London Stock Exchange, Investec Economics

UK ECM activity in May

UK ECM activity rebounded strongly in May following a softer April; initial signs of UK IPO market thawing

ECM activity snapshot

Comparison: activity in May 2023

ECM issuance across the deal size spectrum in May

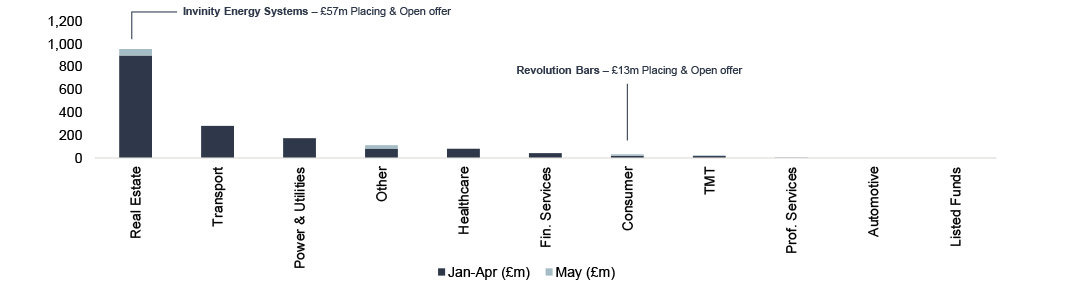

Public equity fund-raises by sector and highlighted deals YTD

Selected sell-downs in May 2024

Live in-the-market UK IPOs

Rumoured UK IPOs

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances; IFR ECM.

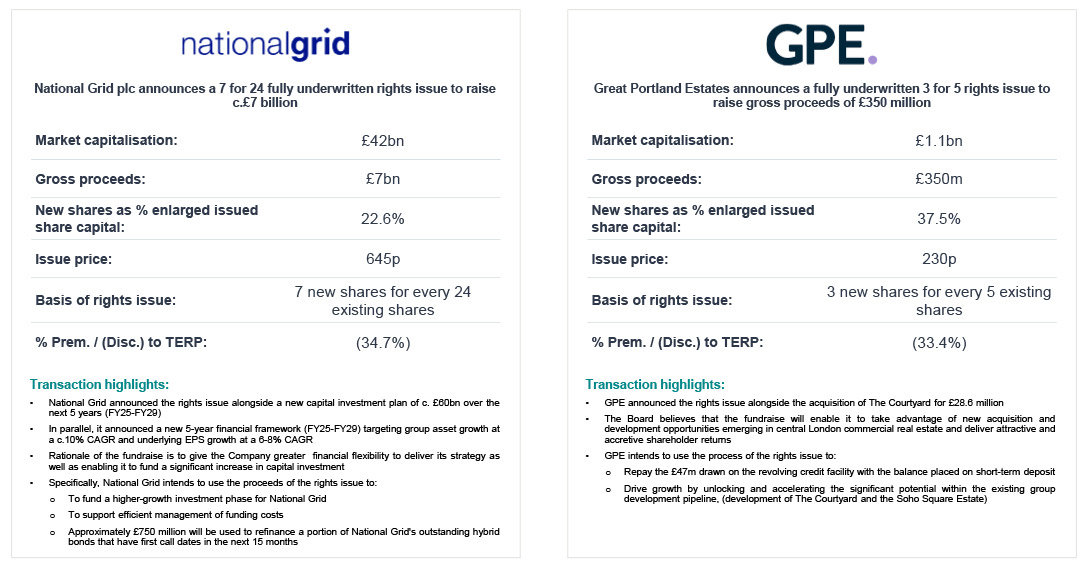

Return of the front-foot rights issue

May saw the announcement of two significant rights issues, with National Grid’s being the largest since 2009 and the largest follow-on offering globally in 2024

Source: Dealogic, Practical Law, Company filings

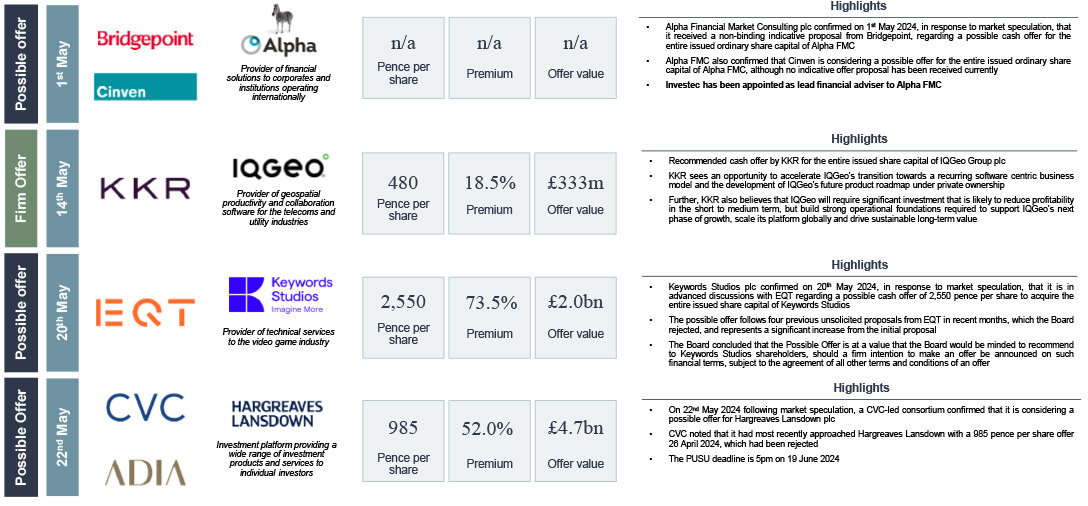

UK Public M&A activity in May

May saw £10.3bn of transaction value announced across 12 deals

2024's YTD scorecard

Selected deals

Source: Company announcements, FactSet, Practical Law

Note: Scorecard includes competing offers and withdrawn of companies subject to the Takeover Code quoted on AIM or the Main Market. Formal sales processes are not included unless a buyer has been identified. Only newly announced offers in the month are included in the count (i.e. possible offers announced in December 2023 will be included in that month even if it becomes a firm offer in January 2024)

Get the monthly Investec Market Review delivered to your inbox

Browse articles in