Investec Market Review November 2022

The Investec Equity Capital Markets Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM), whilst also reflecting on wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

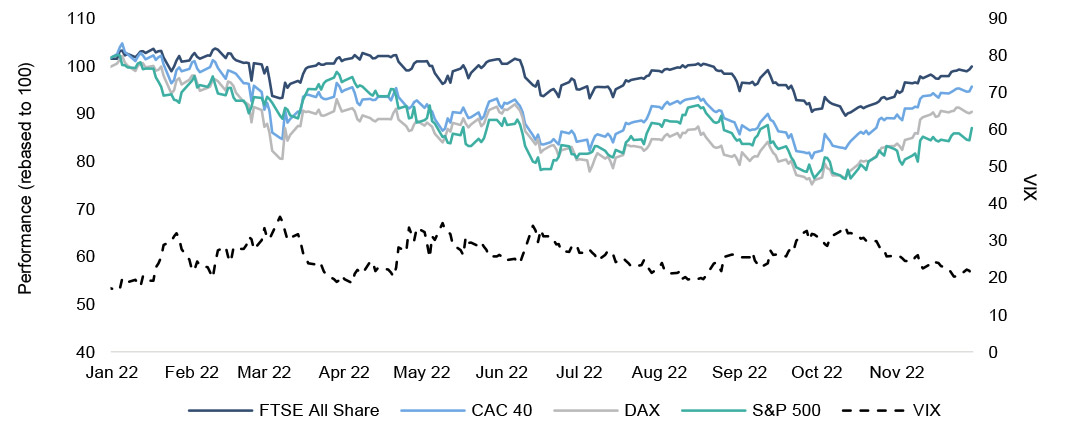

- Global indices continued to recover lost ground over November, and market volatility eased throughout the month.

- Inflation and a generally downbeat outlook for the global economy continue to drive cautious investor sentiment, though thereare some expectations for a slow-down in the pace of interest rate rises.

- UK ECM activity remains sluggish, with the number of deals completing in November dipping relative to the prior month.

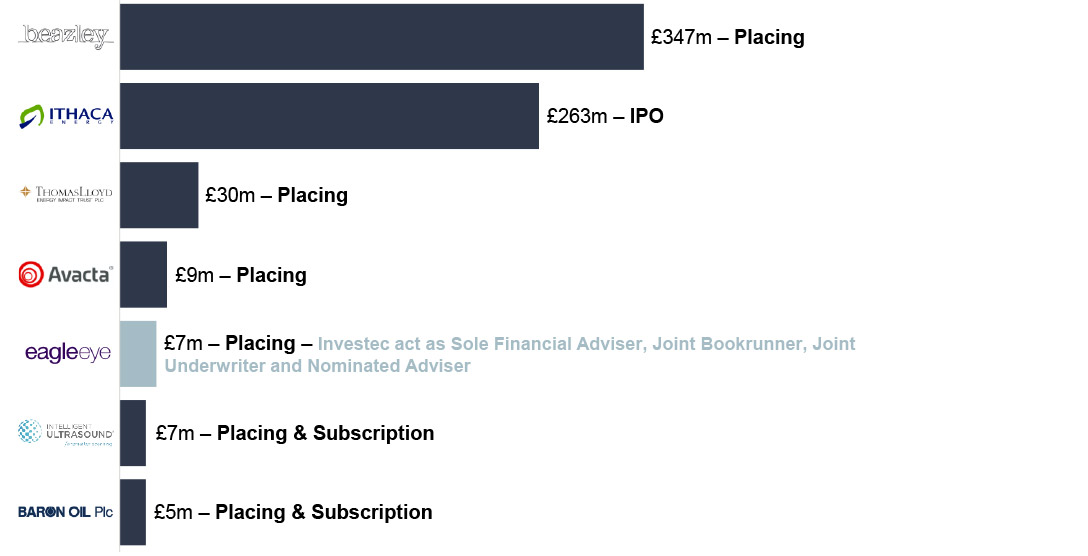

- Beazley plc completed its £347m Placing, the fourth largest follow-on transaction of 2022 so far.

- Investec acted as Sole Financial Adviser, Joint Bookrunner, Joint Underwriter and Nominated Adviser to Eagle Eye on its €38m acquisition of Untie Nots and £7m Placing.

- Momentum in UK public M&A gathered pace relative to October, though at low levels.

Market backdrop

Monthly market snapshot

November's key market drivers

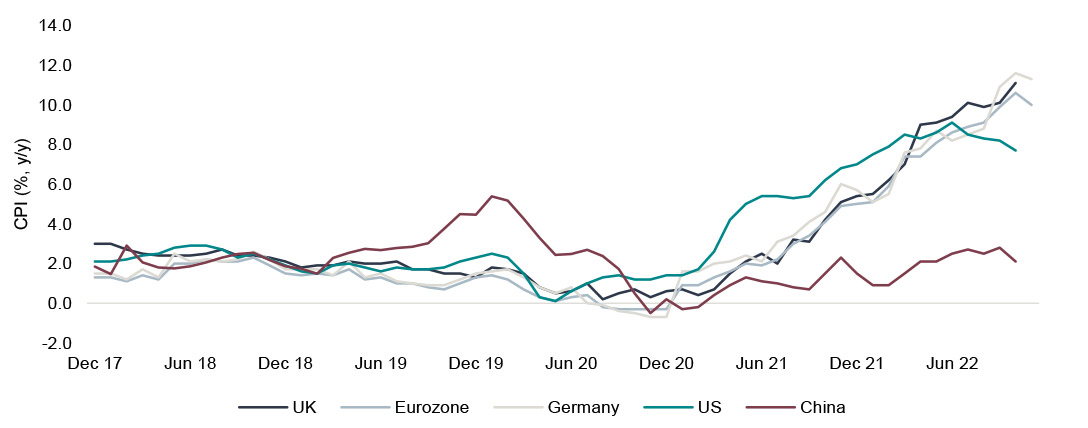

- UK inflation accelerated to 41-year high of 11.1%

- Meanwhile, US CPI for October came in at 7.7%, down from 8.2% in September

- German, French and UK PMI data improved but remain in contraction territory

- UK pound continues to climb against the US Dollar

- China’s zero-COVID protests added uncertainty about China’s outlook

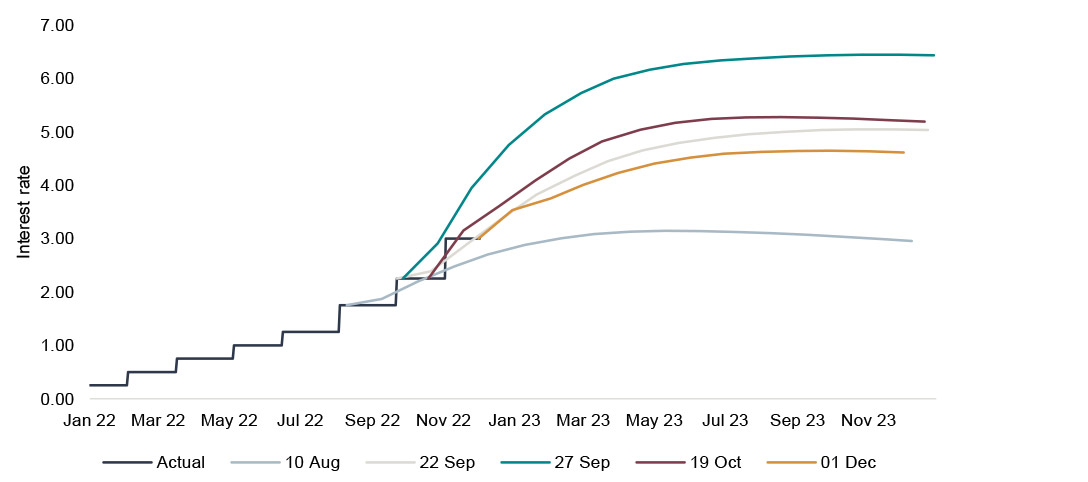

- Signalling by central banks that pace of interest rate hikes may be slowing

- Oil prices exhibit volatility amid reports of a potential output increase by Opec

- Mortgage approval rate in UK fall to lowest level since COVID-19 lockdown in June 2020

Global equity market performance & equity market volatility

Source: Bloomberg, FactSet

Inflation remains on the rise in the UK and Europe but slows down in the US

Source: Bloomberg, FactSet

UK interest rate projections show signs of stabilising

Source: Bloomberg, FactSet

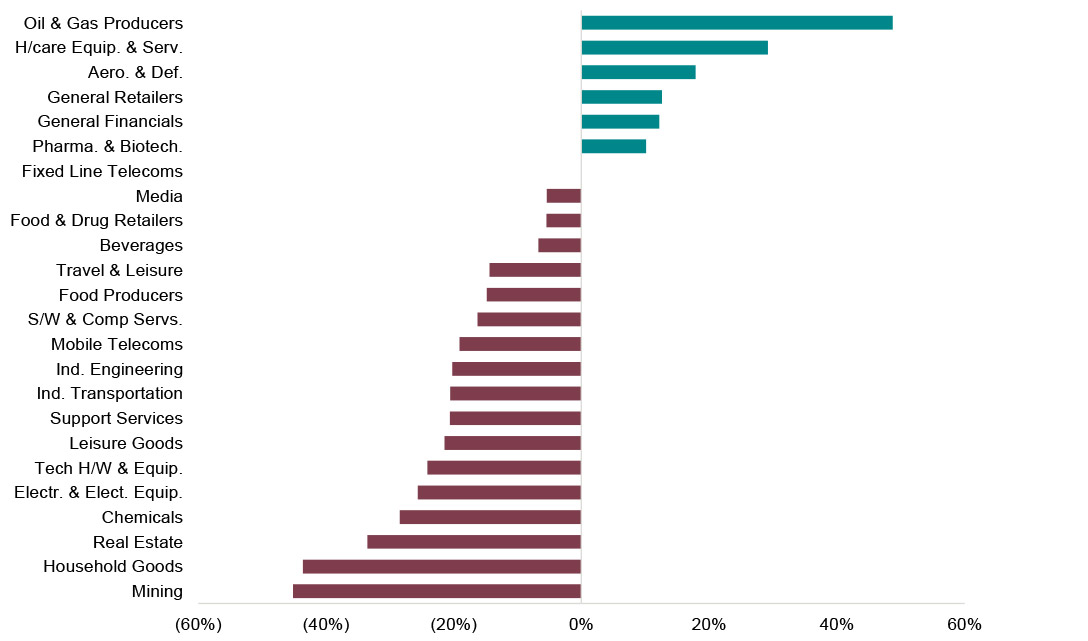

UK sector performance

Monthly sector snapshot

Sector performance drivers and outlook commentary

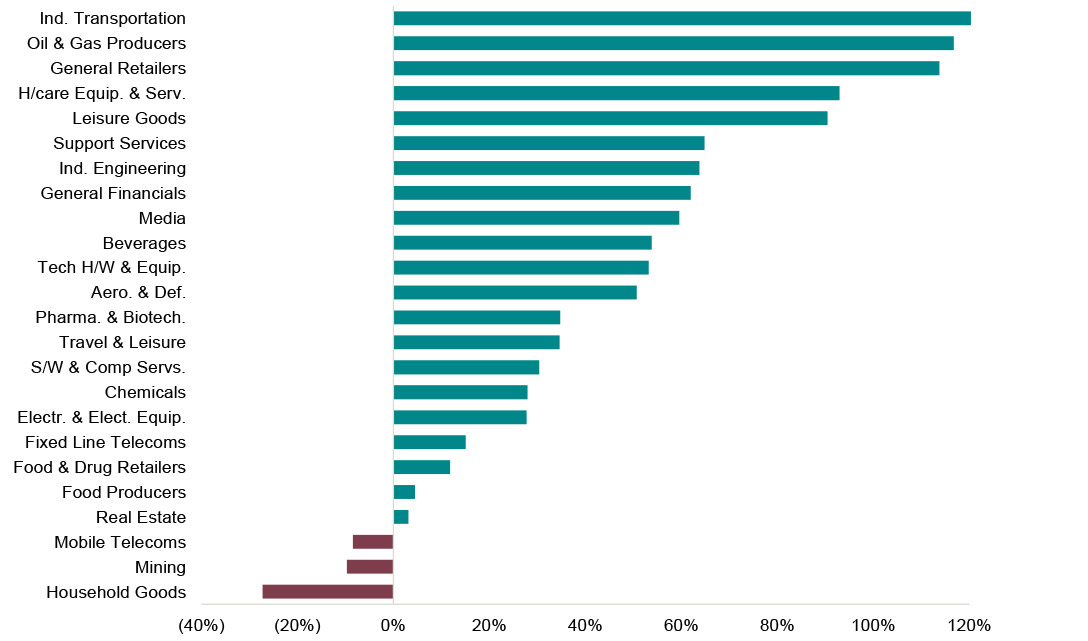

- Mining stocks benefited from a hike in commodity prices towards the end of the month, in-part supported by a drop in COVID-19 cases in China for first time since 19 November, boosting hopes for economic activity in the country

- Tech Hardware & Equipment, and some other growth orientatedsectors registered a strong monthofshare price performances, as market expectations around further interest rate hikes cool

- Despite the expected slowdown of interest rate hikes, Real Estate stocks ended the month moderately down and continue to be one of the big losers on a year-to-date share price basis given downward pressure on domestic mortgage rate approvals and UK house prices

Sector performance (since mid-March 2020)

Source: FactSet

Sector performance (YTD)

Source: FactSet

Prefer to download?

You can read the full November Market review

Never miss an update

Subscribe to the monthly Market review

Investec’s Economics –Summary of the Autumn Statement

- On 18 November, Chancellor Hunt announced details of the Autumn Statement 2022.

- Focus of the statement was to help households in the near-term whilst consolidate the public finances via a combination of windfall and stealth taxes, plus spending cuts in the second half of the five-year forecast horizon.

- Coming at a time of significant economic challenge for UK and global economy, the statement sought to reverse nearly all of the measures in the government’s so-called Growth Plan 2022, also known as the ‘mini-Budget’.

Summary of the key measures

Expansionary fiscal measures

- Energy Price Guarantees to stay in place at £3,000 rather than £2,500

- Option to reduce the scale of support should energy prices increase further

- No clarity provided on energy bill support for businesses past April 2023

- Cancellation of NIC hike maintained

- Pensions ‘triple lock’ to remain in place

- Benefits and benefit cap to be upgradedwith inflation

- Additional £900 cost of living payment along with equivalent £300 to pensioners

- National Living Wage (aged 23+) increaseof 9.7% to £10.42 an hour from 1 April 2023

- NHS andSchool budget increased to help absorb the extra burden from inflation

- Spending to be restrained by c.£30bn by 2027-28

Contractionary fiscal measures

- Temporary 45% levy on “excess returns” on low-carbon electricity producers

- Energy Profits Levy on oil and gas producers is raised by 10% to 35% from 2023 to 2028

- Frozen nominal thresholds for income tax, National Insurance Contributions and Inheritance tax until 2028

- Decline in dividend allowances from £2,000 to £1,000 in 2023/24 and then to £500 from 2024

- Additional rate of income tax to apply from £125,140 instead of from £150,000

- Councils in England allowed to raise council tax bills by 5% without needing to hold a local referendum

Source: Investec Research, UK Government website

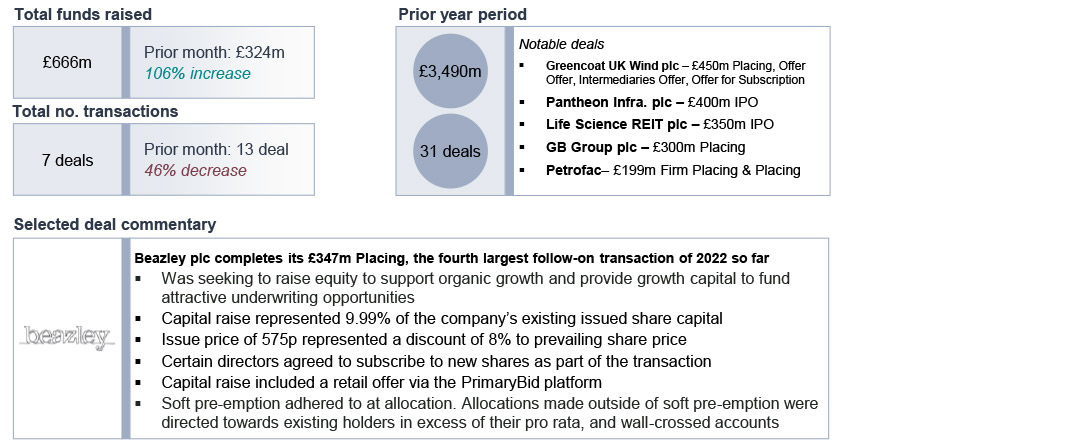

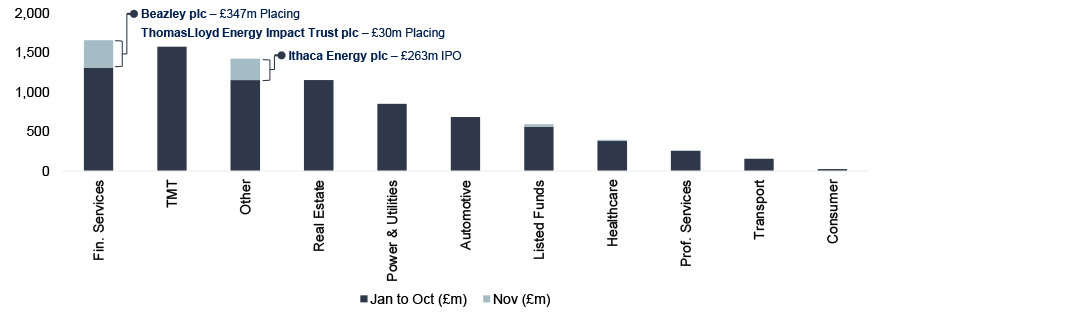

UK ECM UK ECM activity continues to fall over November

Deal numbers fell relative to October. Aggregate equity-issuance levels rise, but still remain relatively muted when compared to more ‘normal’ times

Public equity fund-raises by sector and highlighted deals

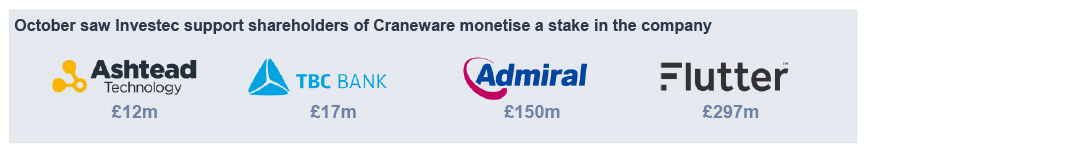

Sell-down activity over November

ECM issuance across the deal size spectrum in November

The UK IPO pipeline

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances

Get the monthly Investec Market Review delivered to your inbox

Browse articles in