Investec Market Review October 2022

The Investec Equity Capital Markets Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM), whilst also reflecting on wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

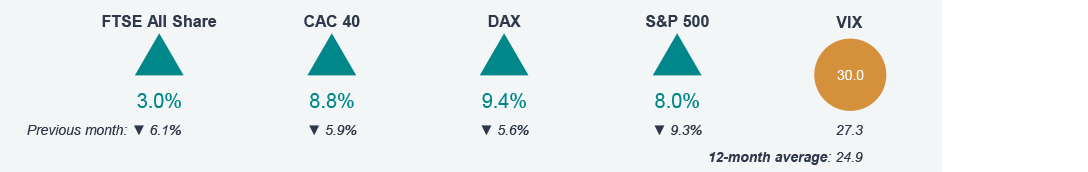

- October saw global indices recover some of the ground lost over September, although global equity volatility levels remain elevated.

- Interest rates hikes continued in October, following the European Central Bank increasing its base rate during the month, however interest rate velocity is now widely expected to slow from December 2022.

- Economic data released over the month painted a dimmer picture of the UK’s economic backdrop, as inflation levels rose to a 40 year high of 10.1%, and consumer confidence reached its lowest point in 30 years.

- Investec Equity Strategy posit the view that UK interest rate expectations have peaked, and therefore the FTSE 250 is poised to finally begin outperforming.

- UK ECM activity remain subdued, with October seeing a further decline in the aggregate volume of UK public equity fund-raisings relative to September. The number of ECM transactions that completed was slightly elevated relative to the prior month.

- Momentum in UK public M&A activity appeared to have slowed over October, with only three transactions being announced. It will be interesting to see how the landscape evolves over the remainder of the year in the context of a general increase in interest rates.

Market backdrop

Monthly market snapshot

October's key market drivers

- UK gilts stabilise amid hopes of improved domestic political situation

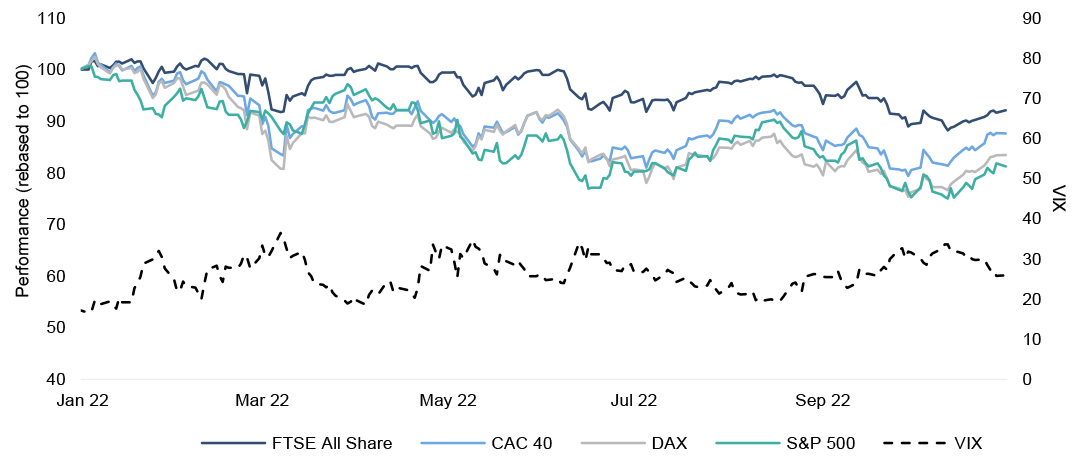

- UK pound recovers lost growth against the US Dollar

- UK consumer confidence registered a 50-year low in the month of October

- Eurozone business activity contracted for a fourth month running in October

- UK inflation rose 10.1%, matching July’s 40-year high

- ECB lifted its key rate by 75bps to 1.5%

- General expectation of slowing momentum in pace of interest rate increases

- President Xi Jinping elected for a third term

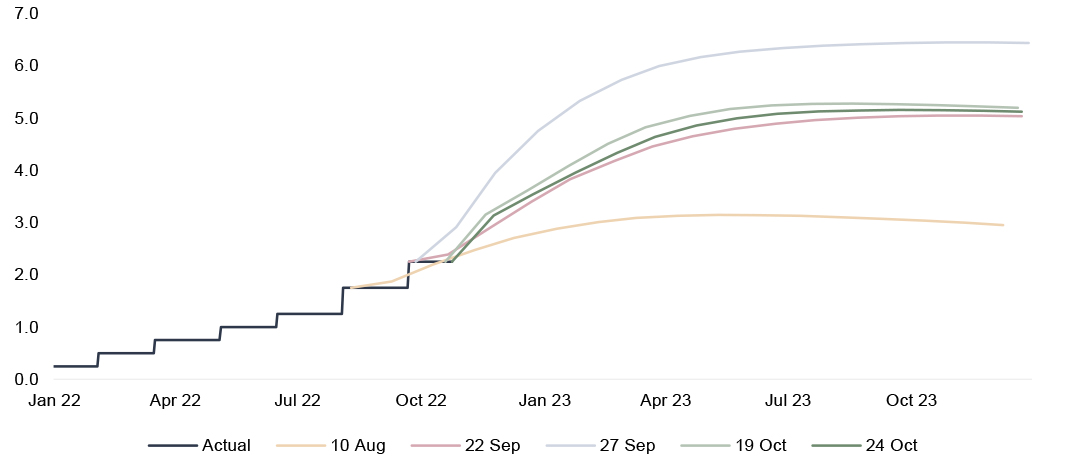

Global equity market performance & equity market volatility

Source: Bloomberg, FactSet

The dollar continues its onward march

Source: Bloomberg, FactSet

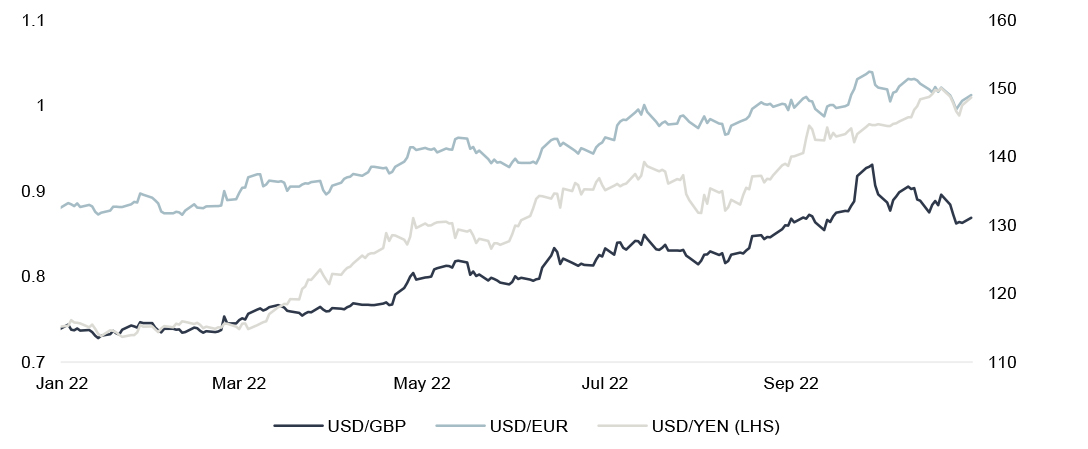

UK interest rate projections have risen and have potentially peaked

Source: Bloomberg, FactSet

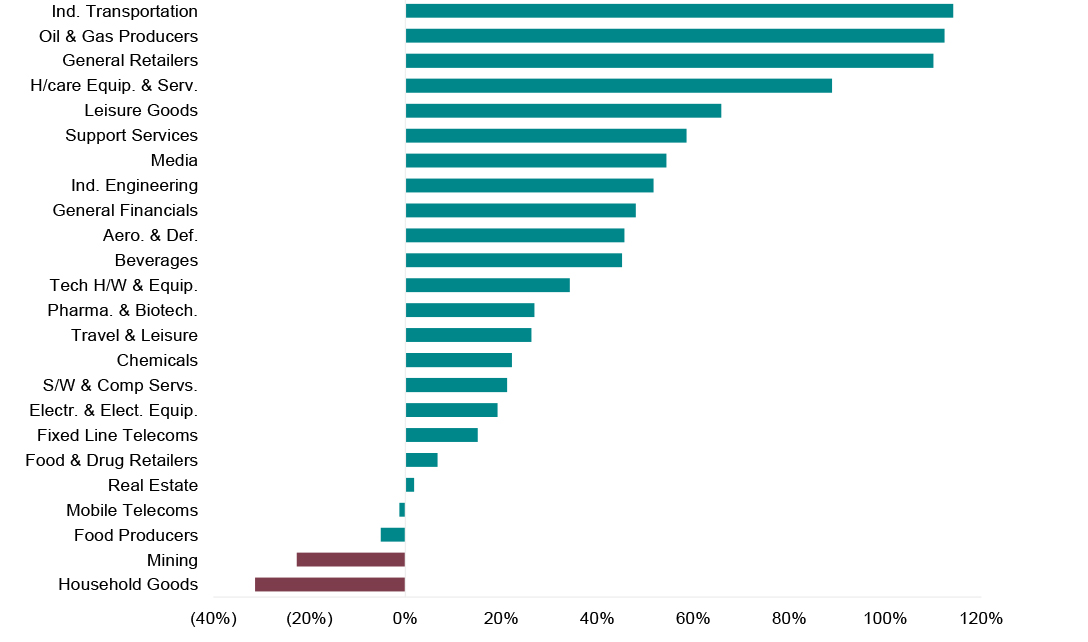

UK sector performance

Monthly sector snapshot

Sector performance drivers and outlook commentary

- Mining stocks retreated towards the end of the month. Uncertainty over wider economic activity and therefore demand levels may be a motivating factor behind the sectors share price fall

- General Financials lost some ground as the anticipated pace of interest rate hikes is anticipated to fall over the medium term

- The potential of a slower pace of interest rates hikes, helped recovery in growth orientated stocks, such as Tech Hardware & Equipment

- Leisure Goods and Travel & Leisure stocks benefited from recent shifts in UK economic policy and numerous corporates have reported a recovery in consumer activity

Sector performance (since mid-March 2020)

Source: FactSet

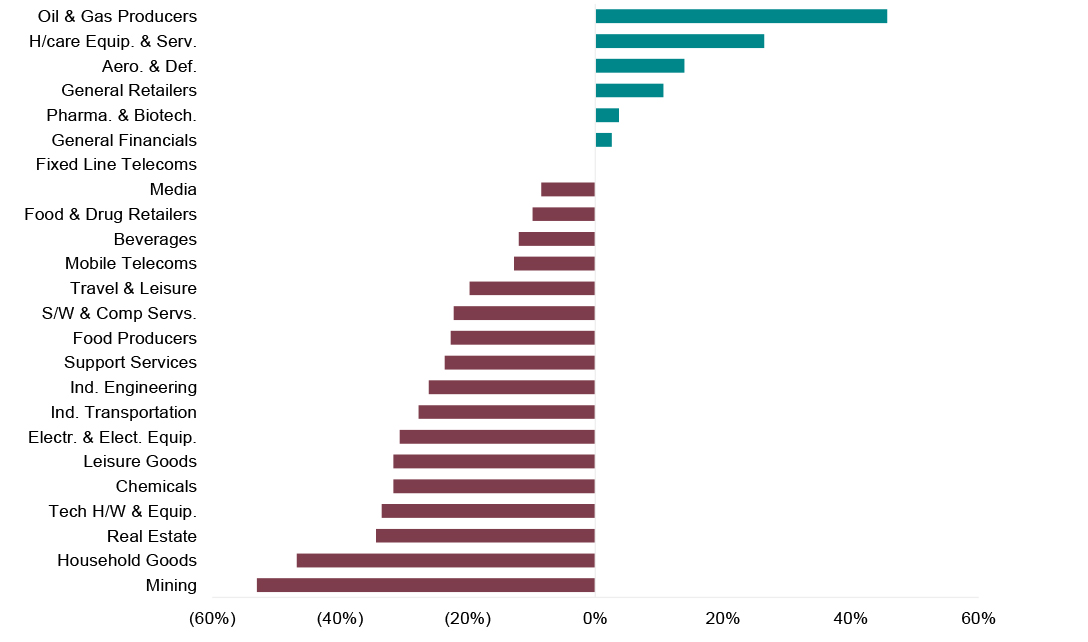

Sector performance (YTD)

Source: FactSet

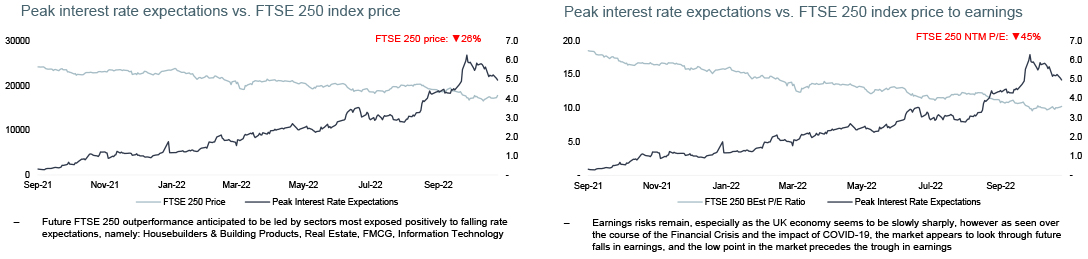

Looking beyond peak interest rate expectations

Investec analysts believe that the UK has passed the point of peak interest rate expectations. Given the close correlation between the performance of the FTSE 250 and interest rate expectations, it may be reasonable to expect that a fall in interest rates will be met with an outperformance by the FTSE 250.

- Recent extreme moves in Gilt yield and interest rate expectations following the ‘mini-budget’ and LDI pension crisis supports the view that we’ve reached ‘maximum strain’

- If we have seen peak Gilt yields and interest rate expectations: perhaps we have seen ‘the low’ for the FTSE 250 index

- We have seen peak interest rate expectations: almost doubling over the past few weeks to a high of c.6% for Summer 2023, before falling to the current level of c.5%

- Sterling made a low against the US Dollar and Euro on 26 September

- 10 year and 30 year Gilt yields have retreated since their high on 27 September

- Key to peak interest rate expectations falling significantly is a fall in core inflation, and Investec economists expect inflation to peak in Q4 2022, as energy prices and the Energy Price Guarantee come into effect

- Tighter fiscal stance may necessitate less monetary tightening to slow to UK economy in order to reduce inflation, and so interest rates reductions may still have further room to run

- This may result in the FTSE 250 finally starting to outperform, led by sectors most exposed positively to falling rate expectations

Source: Bloomberg

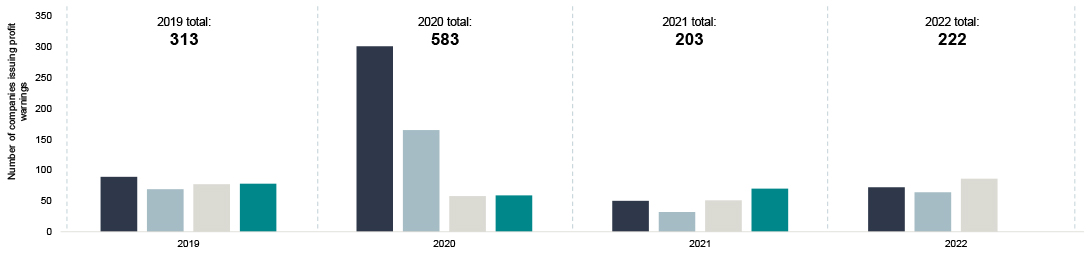

Q3 2022 saw a rise in profit warnings across UK PLCs

The third quarter of 2022 saw the highest Q3 total since 2008 and a third higher than the post-financial crisis average

Source: EY-Parthenon

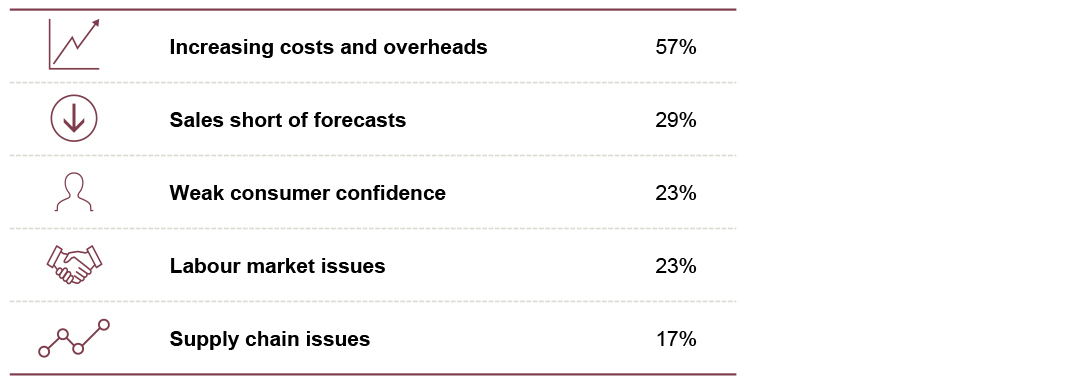

Factors catalysing profit warnings in Q3

Source: EY-Parthenon

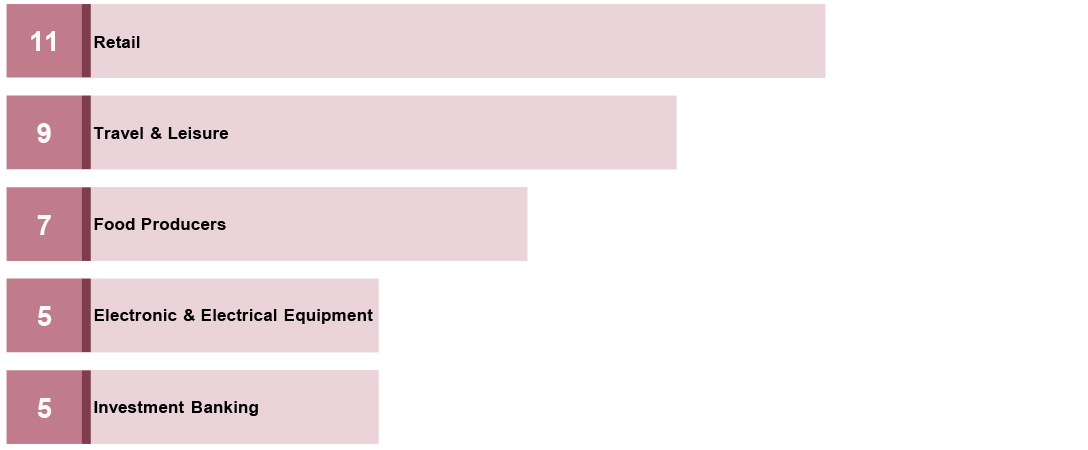

Top 5 sectors warning on profit in Q3

Source: EY-Parthenon

86

57%

23%

44

28

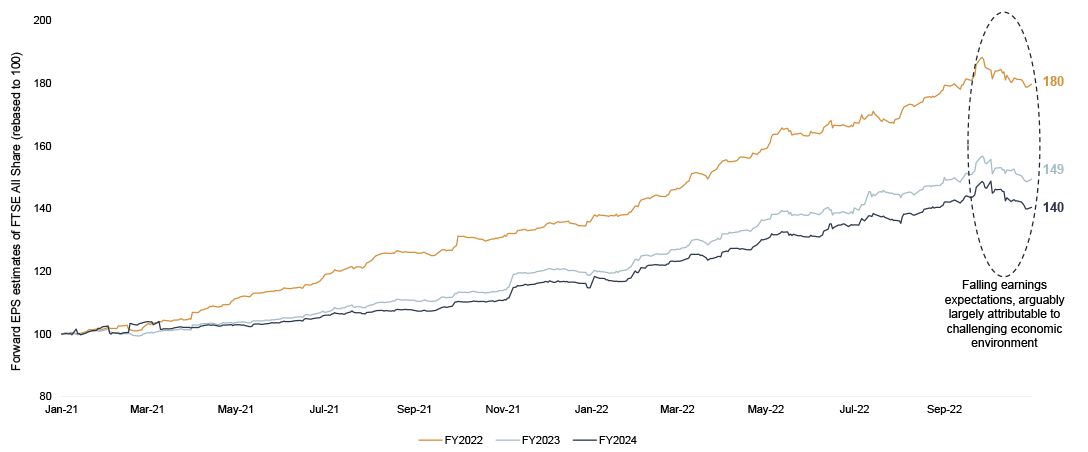

Overview of UK earnings forecast

Following numerous sessions of rising earning expectations across the FTSE All Share, we saw consensus EPS forecasts dipping over the course of October.

Source: Bloomberg

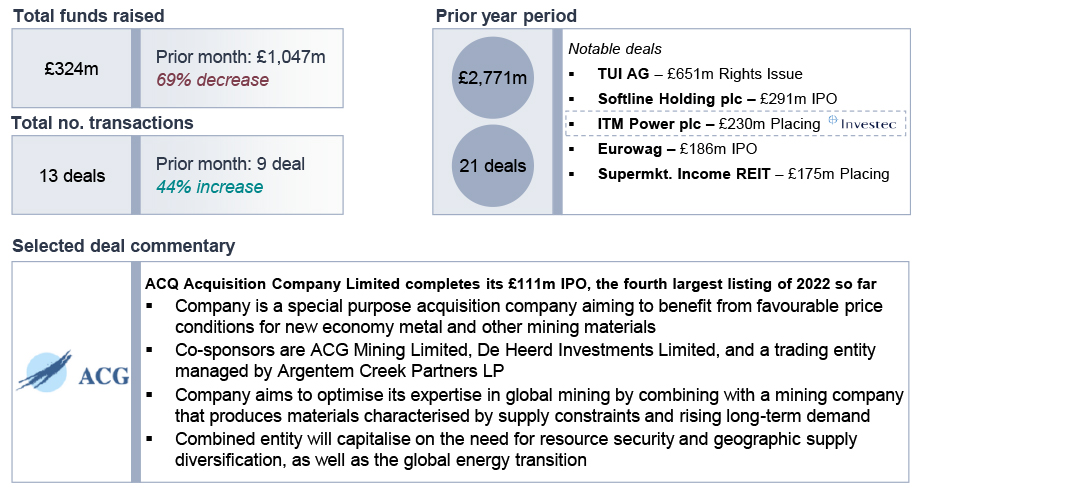

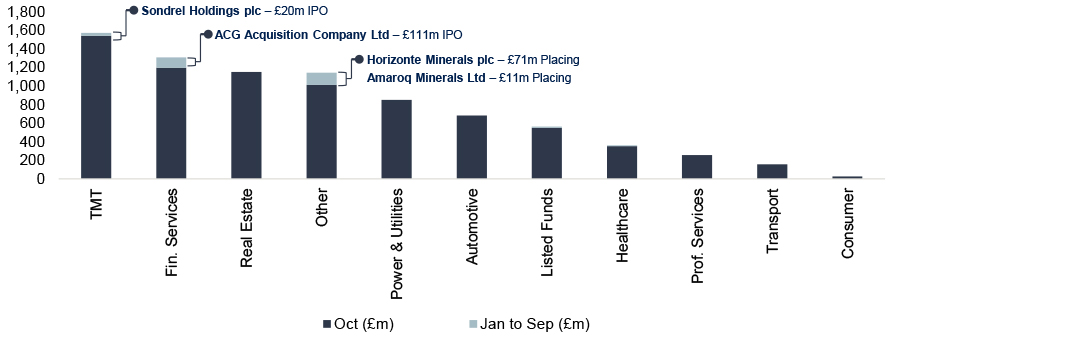

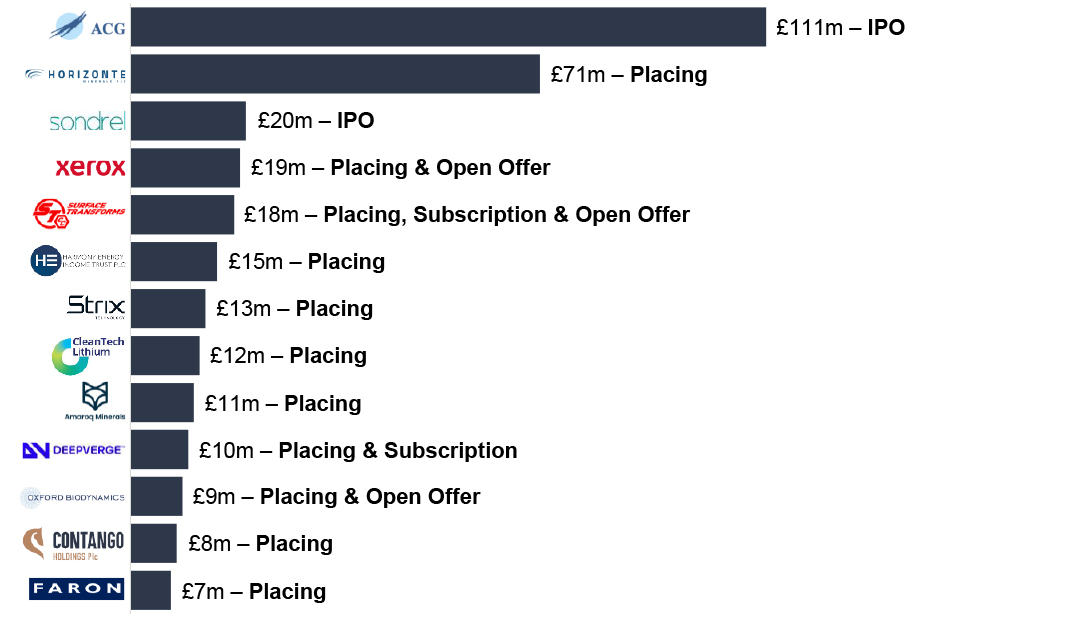

UK ECM UK ECM activity continues to stutter over October

Deal numbers increase slightly on September, but aggregate equity-issuance levels slump to the second lowest monthly amount seen this year

Public equity fund-raises by sector and highlighted deals

Sell-down activity over October

ECM issuance across the deal size spectrum in October

The UK IPO pipeline

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances

Get the monthly Investec Market Review delivered to your inbox

Browse articles in