Executive summary

- After some significant volatility over the summer period, September has seen global equity markets return (quickly) to relative stability with several indices.

- There were a number of drivers behind the summer sell off, including an unwinding of the ‘Japanese carry trade’ as the BoJ raised rates but at the core of the sell off was concern that the Fed was behind the curve and the US economy was weaker than markets had conditioned for.

- Stock markets had largely recovered by the end of August as corporate results and more encouraging economic data helped stabilise sentiment but investors entered into September with expectations of rate cuts building, particularly in the US and EU.

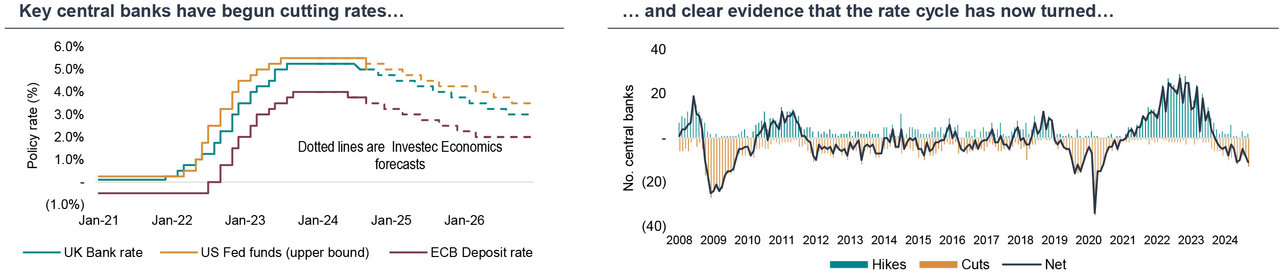

- Those reductions did come through over the month with the Fed clearly pivoting and cutting by 50bps (taking the Fed Funds rate to 4.75-5%) which has given US equity markets an extra boost and the ECB making its second 25bps cut of this easing cycle (taking the European Deposit rate to 3.5%).

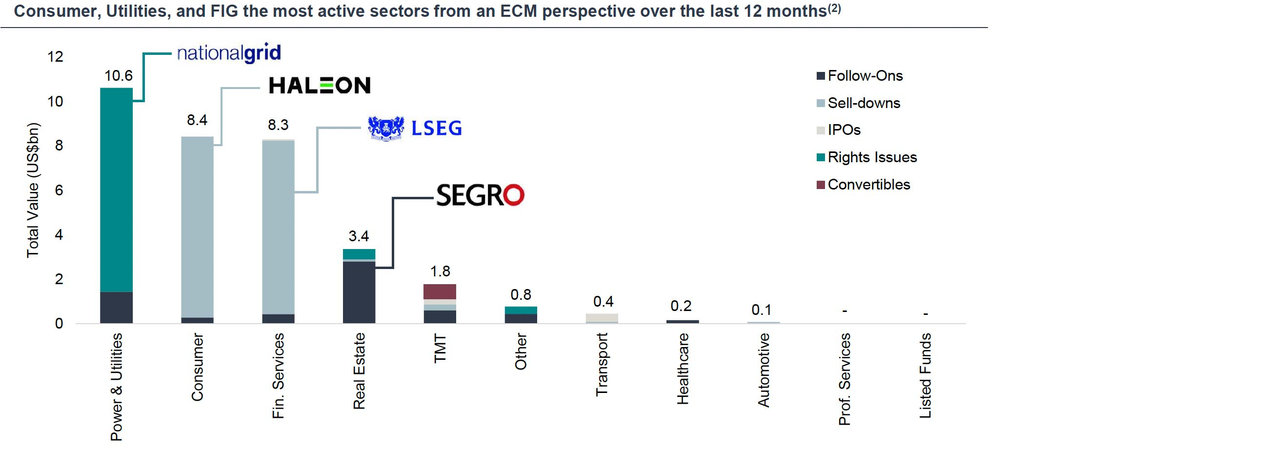

- European ECM activity has been relatively robust over the month of September with $8.1bn of issuance from 38 transactions(1) – much of that volume has been from secondary offerings and shareholder sell-downs, but the second half of the month has seen the launch (and re-launch) of a number of IPOs including Spinger Nature and Europastry.

- UK equity markets recovered through August but drifted through September with the FTSE All-Share down -1.4% and the FTSE 250 down -0.2%, with overall sentiment marginally impacted by concerns about the October 30th Budget and what some see as overly cautious commentary from the new Government.

- As has been the case in Europe, UK ECM volume has been driven by secondary offerings and shareholder sell downs. IPO activity is still muted but there are reasons to be hopeful of a recovery over coming quarters with Applied Nutrition announcing its Intention to Float this month.

Source: Factset; (1) Dealogic – analysis only includes transactions greater or equal to $US50m; European ECM activity inclusive of UK.

Equity Market Overview | robust performance YTD

Increasing confidence of ‘soft landings’ as rate cuts provide support for equity markets

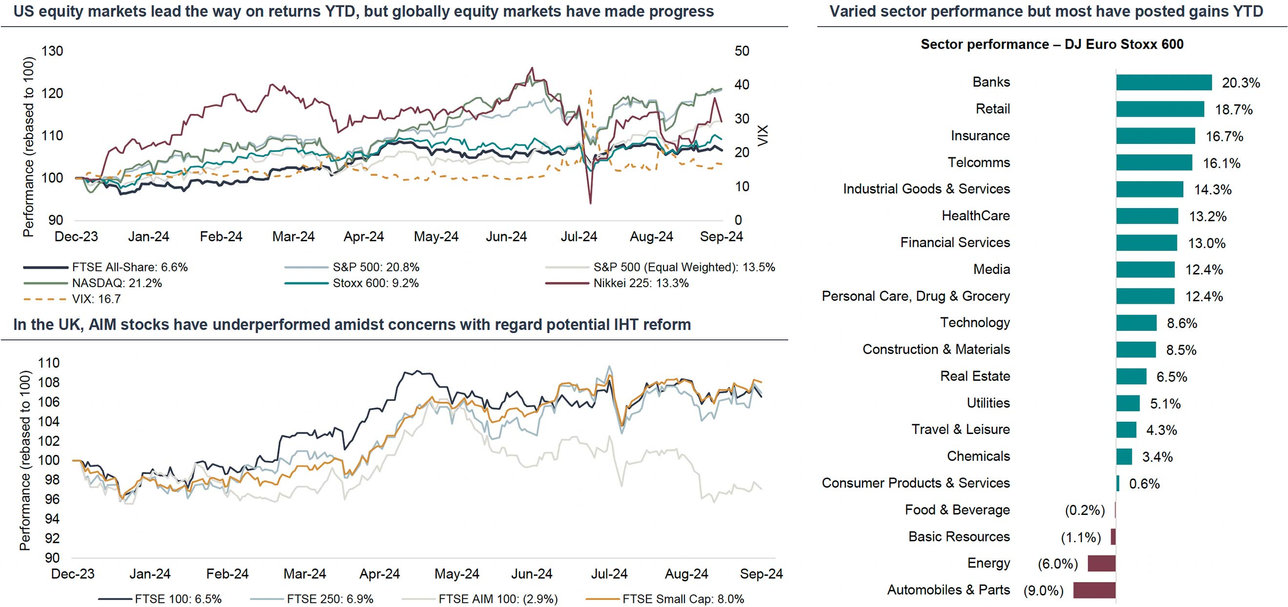

- Leading global indices have delivered gains across the board year-to-date, with US stocks leading the rally.

- US outperformance has been driven primarily by the so-called ‘MAG-7’, mega-cap technology orientated stocks whose strong performance has been further fuelled by the Artificial Intelligence boom. These 7 stocks have had an outsized impact on the market-cap weighted S&P 500 – its performance on an equal-weighted basis is more moderate (see chart).

- Equity markets experienced heightened volatility in late July and early August as weak economic and employment data sparked fears of a possible US recession, triggering a sharp sell-off in global stocks and a spike in the VIX.

- However global equities quickly rebounded with more positive economic data providing confidence that central banks (and in particular the Fed) can manufacture soft landings. The S&P500 and Stoxx600 hit new all-time record highs during September.

Source: FactSet; Bloomberg

Equity Market Overview | valuation disconnect

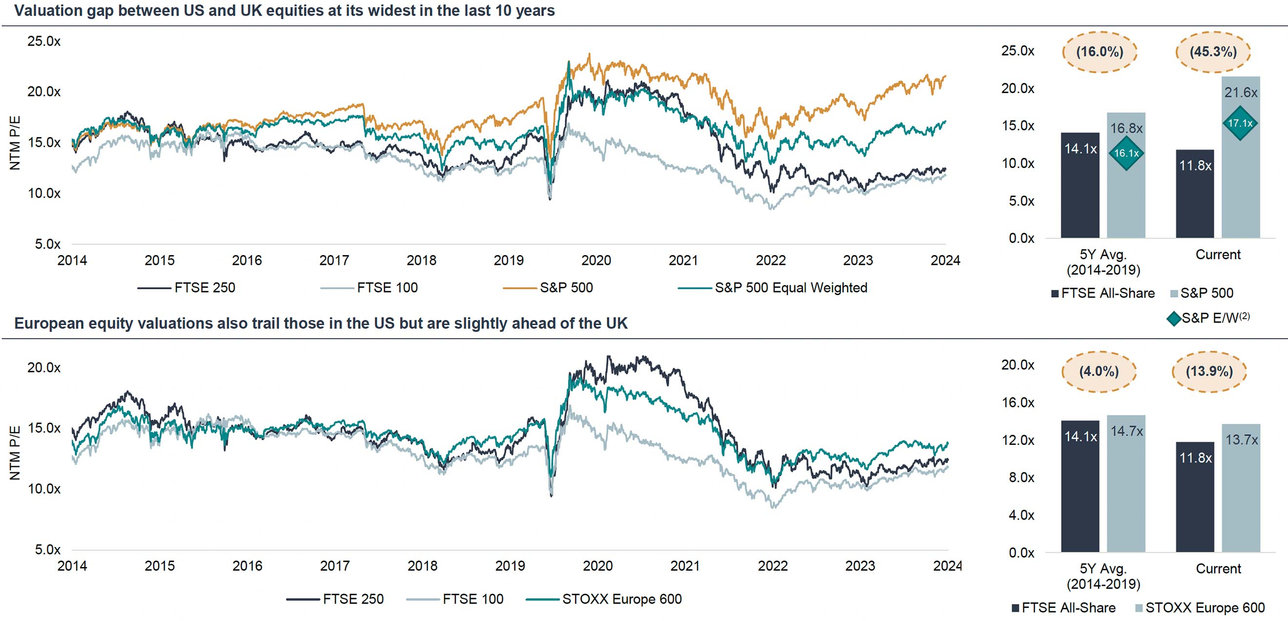

UK valuations look attractive on a global and historical relative basis

- Since Brexit in 2016, the spread between UK and US equity valuations has increased with further divergence evident since the start of the pandemic and subsequently over the period of UK Government instability.

- Index composition does partly explain the divergence – the S&P 500’s premium-rating is driven by a high concentration of mega-cap technology orientated stocks given their market leadership and (AI influenced) growth prospects.

- Private equity and strategic acquirors have recognised the value on offer in UK public equity markets with 33 companies taken private over the past 12 months(1), but there are signs that public market investors are also starting to act on what they too have recognised for some time.

Source: FactSet; (1) Refers to completed transactions only; (2) S&P E/W refers to the S&P500 Equal Weighted index

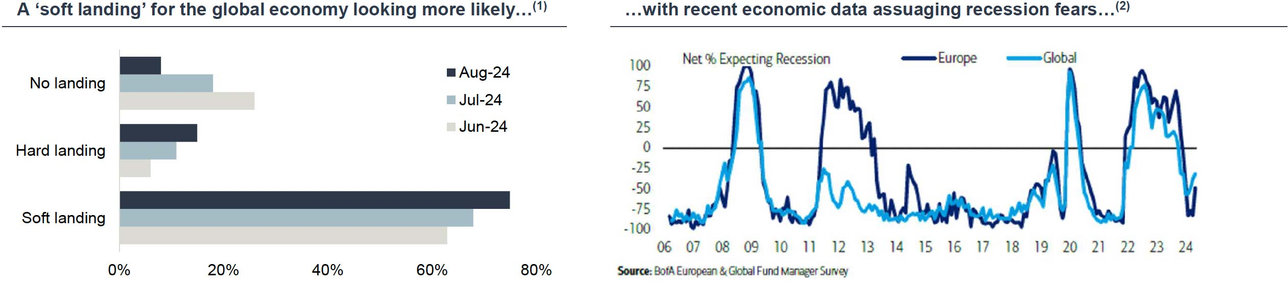

Macro Outlook | improving backdrop

Inflation heading to 2%, a rate cutting cycle underway and growing confidence in economic ‘soft landings’

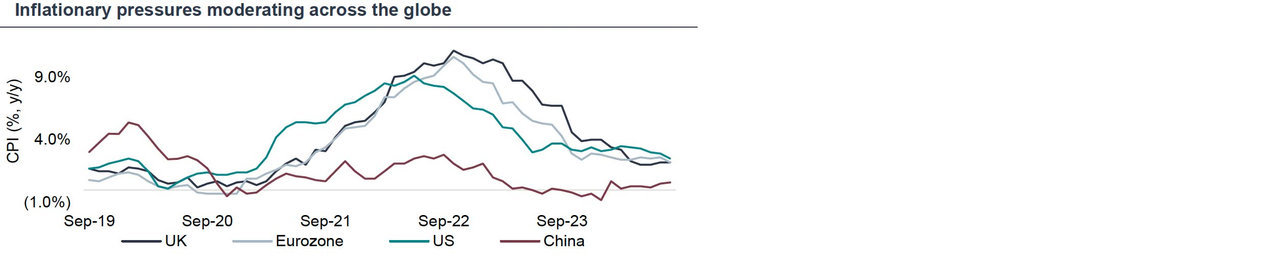

1 Inflation is trending towards central bank target levels…

- Inflationary pressures across the globe have eased

- Inflection of interest rate cycle underway, providing a more favourable backdrop for equity markets

- Clarity on UK political outlook driving Sterling strength vs other key global currencies

- Global economy proving resilient despite continued geopolitical uncertainty

- Improving outlook for ‘soft-landing’, despite recent market jitters

2…and the ratecutting cyclelooks wellunderway…

3…supporting amore optimisticmacro-outlook

Source: FactSet; Macrobond; ONS; Investec Economics; BofA European Fund Manager Survey – (1) Global investors’ view on the global economy; (2) European investors’ view on the European economy

Prefer to download?

Click to download the full market review below.

Never miss an update

Subscribe to the monthly Market review

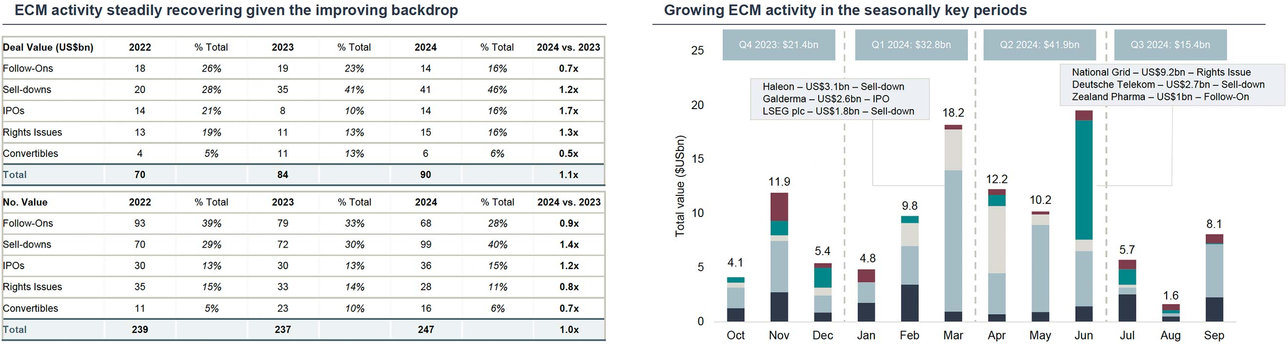

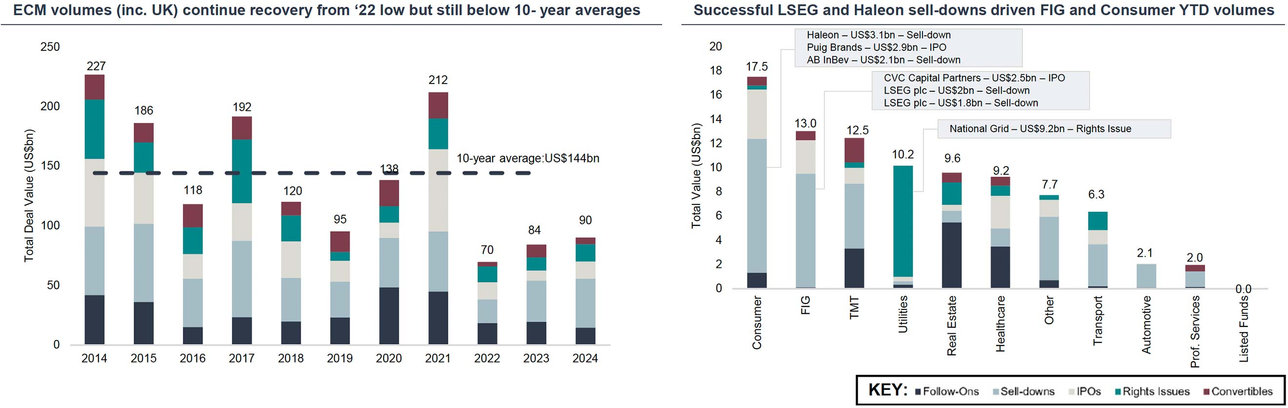

European Equity Issuance 2024 YTD | Overview

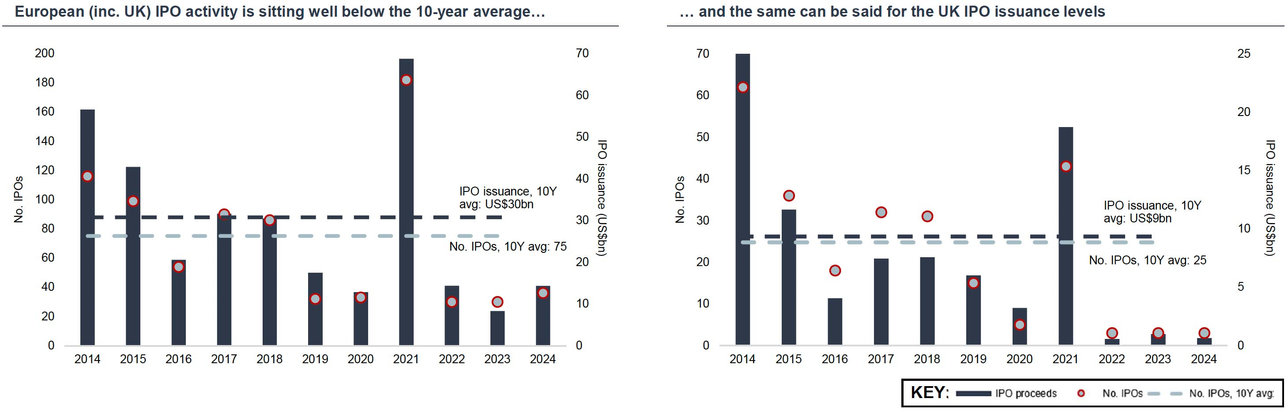

European equity issuance remains well below 10-year averages, but YoY improvements and positive aftermarket performances provide for optimism

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East andAfrica. Includes Investment Funds. Charts show year-to-date activity levels

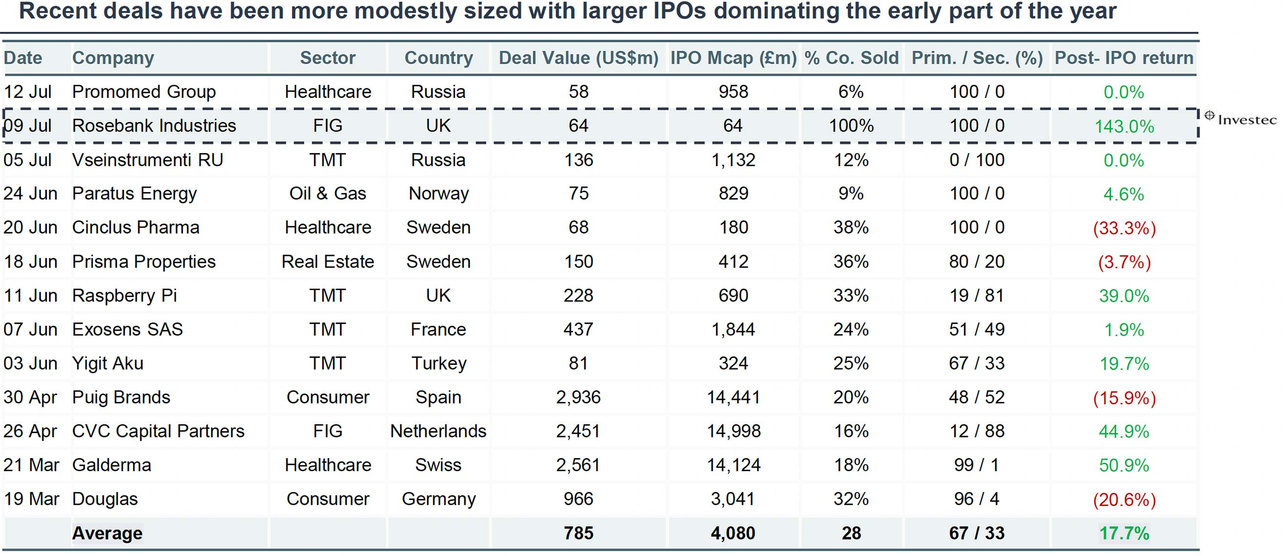

European IPO Issuance 2024 YTD | Improving Outlook

IPO volumes remain subdued across Europe relative to 10-year averages, however volumes are up YoY and successfully completed transactions across the region have generally performed well

IPO issuance in Europe

- US$14bn raised across 36 transactions so far in 2024, up by 72% and 20% respectively versus the $8bn raised across 30 deals in 2023 YTD

- Average IPO size so far this year of US$398m vs. US$278m last YTD

- Average YTD post-IPO share price gain of c.16%. 22 transactions out of 36 have delivered positive after-market returns for shareholders

- Consumer sector been busiest this year, raising US$4bn over 4 IPOs

- There have been three deals over US$2bn this year: Spanish fashion company Puig Brands (US$2.4bn); prescription drug and aesthetic solutions provider Galderma (US$2.6bn) and private equity firm CVC (US$2.5bn)

- August and September saw no deals over US$50m, with the average deal size being US$27m and US$16m respectively

- As we enter Q4 2024, we remain cautiously optimistic on the outlook for European and UK IPOs. Global equity markets continue to attract capital, and equity market performance has been robust so far this year. Additionally, we think this summer’s FCA Listing Rule reforms will serve as helpful tailwinds for UK IPOs

- Market will continue taking cues from growth- orientated macro-data releases against a reducing-rate backdrop

- Clarity over the domestic budget in October should support an up-tick in UK issuance activity

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East andAfrica. Includes Investment Funds. Charts show year-to-date activity levels

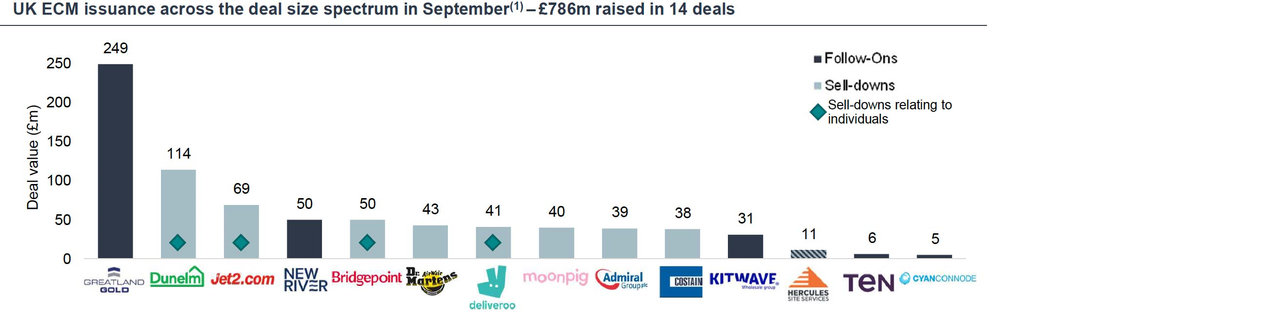

UK ECM activity | September

UK ECM issuance picked up in September after the usual summer slowdown, with shareholder sell-downs continuing to dominate amidst CGT uncertainty

2024 UK ECM YTD activity vs 2023 snapshot

| 2024 YTD | 2023 YTD | Variance | |

| Total funds raised (£m) | 20,942 | 15,398 | +36.0% |

| Total no. transactions | 105 | 93 | +12.9% |

Source: Dealogic; (1) Analysis and commentary only includes transactions greater or equal to £5m; (2) Analysis and commentary only includes transactions greater or equal to $US50m – chartabove show year-to-date activity levels; IFR ECM

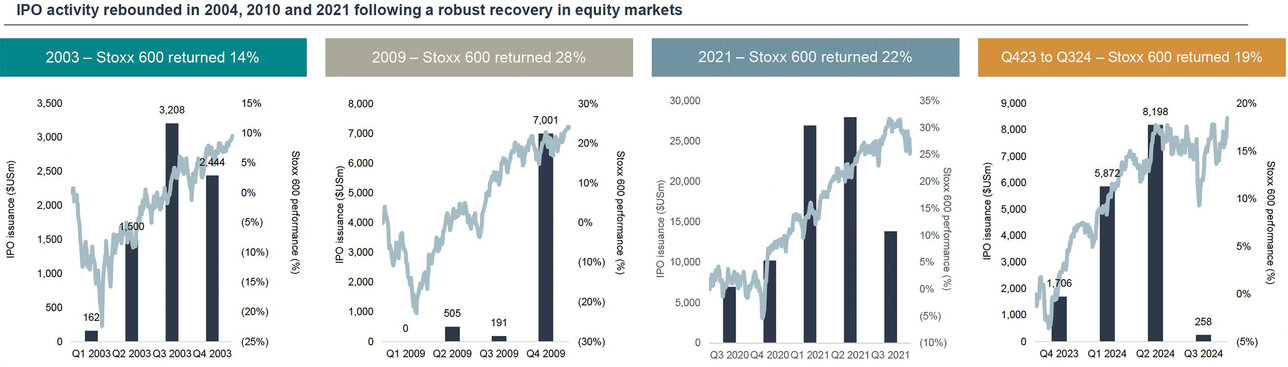

2025 Equity Issuance | Primed for Recovery

Strong secondary market performance a precursor to a recovery in ECM volumes and very important for IPO activity

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels

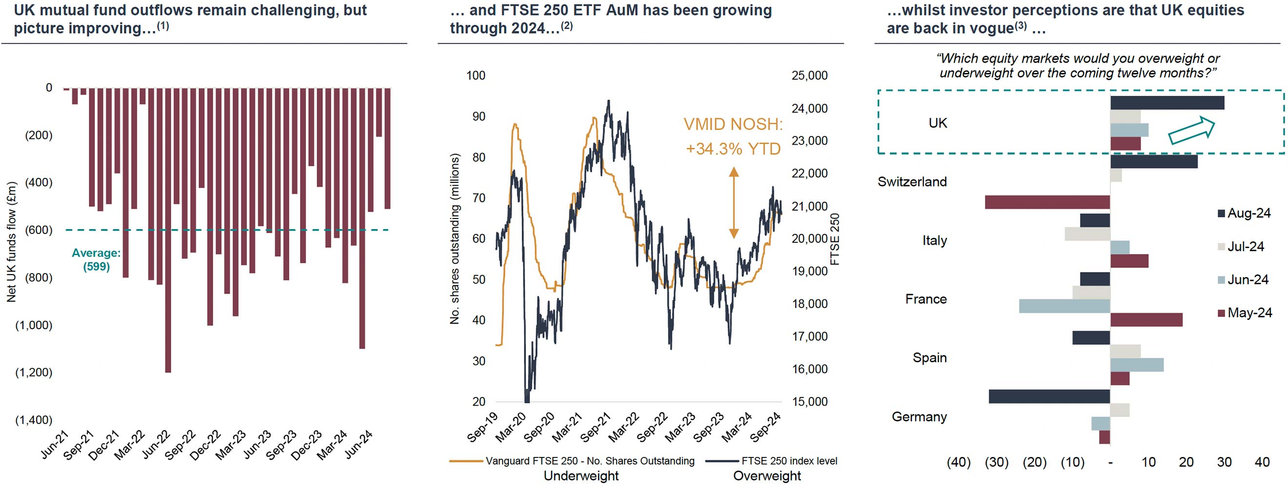

UK Funds Flow Overview | Perceptions changing

Despite a challenging funds flow environment for UK equities since 2021, there are signs of improvement

- Flow at the aggerate level still looks mildly down but anecdotal evidence suggests that several funds have had positive flows since Q2 2024

- Several institutions including the likes of Janus Henderson, Artemis, JO Hambro, and TT have had inflows into their European / UK equity funds

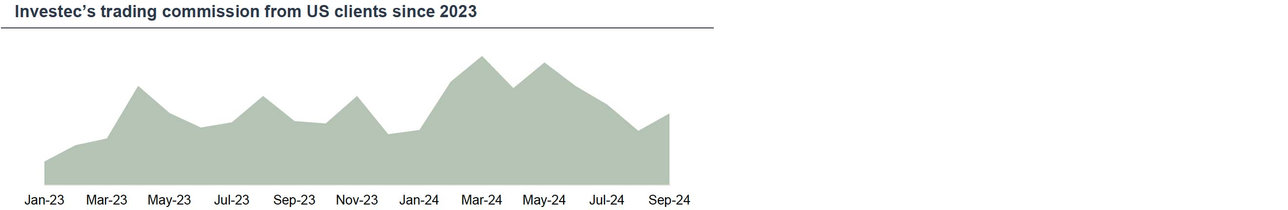

- US Investors continue to make up an increasing % of Investec’s trading commissions although has plateaued very recently as some are now looking for further clarity from the UK Budget

UK Public M&A activity | September

UK public market valuations continue to attract significant interest from trade and private capital

Selected deals

Source: Company announcements; FactSet; Practical Law

Note: Scorecard includes competing offers and withdrawn of companies subject to the Takeover Code quoted on AIM or the Main Market. Formal sales processes are not included unless a buyer has been identified. Only newly announced offers in the month are included in the count (i.e. possible offers announced in December 2023 will be included in that month even if it becomes a firm offer in January 2024)

Get the monthly Investec Market Review delivered to your inbox

Browse articles in