This article is intended for professional Advisers only

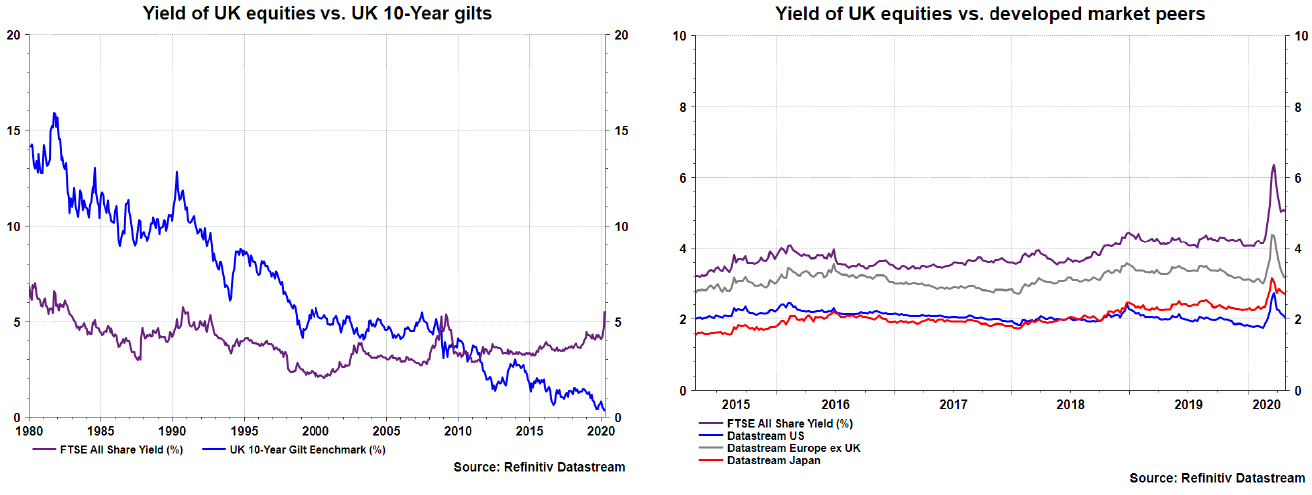

For much of the last 40 years, investors seeking income would skew their portfolio towards fixed interest assets (see the charts below). Not only did this typically offer a superior level of income, it also gave greater security. The timings of regular cashflows were known over the life of the bond, as long as the issuer remained solvent.

Then everything changed. ‘Lower for longer’ interest rates were introduced as a response to the Global Financial Crisis (GFC). Following the response of central bankers to COVID-19, this is now unlikely to change.

Today, in most developed world markets, the level of income is now greater from equities than it is from fixed income. UK domiciled investors have been particularly well served by our domestic stock market. It has consistently offered a dividend yield comfortably in excess of its developed market peers (as shown in the chart below). Much of this is down to the mix of typically long-lived businesses in mature industries that dominate the list of the largest companies in the UK.

Such is the focus on achieving income from both retail and institutional investors alike that, according to the UK’s Investment Association, the ‘equity income’ segment of the UK fund universe stood at £46bn at the end of February 2020.

Income-seeking shareholders look for two main attributes from a company: the predictability of the dividend and its ability to grow (at least in line with inflation). The first means certainty of cashflows to investors who see it as a priority (like charities or pension funds). The growth ensures that the value of those cashflows is at least maintained in real terms.

Shell last cut its dividend during the Great Depression, whilst Halma has grown its dividend for the last 40 years by at least 5% every year.

The pressure on management teams to maintain dividend payments is high. Successive management teams of PLCs will, rightly, boast of many years of consecutive dividend growth which, in some cases, will stretch back decades; Shell last cut its dividend during the Great Depression, whilst Halma has grown its dividend for the last 40 years by at least 5% every year. Companies that can boast such a track record are often deemed ‘dividend aristocrats’ in both the UK and US, and whilst this is a laudable achievement, for some companies it also creates something of a millstone.

So sacrosanct has the dividend become that it has to be maintained. As such, it must be either prioritised over other discretionary uses of a company’s cash flow, such as investing capital to organically grow the business, or maintained only by the company incurring incremental debt to cover any shortfall in its internally-generated cash flow. In the short term the latter is acceptable; if a company is facing a temporary drop in profitability or has an unusually large organic investment opportunity. Borrowing to cover the funding shortfall is then justified in anticipation of growing future cashflows and restoration of the equilibrium amount of leverage in a business.

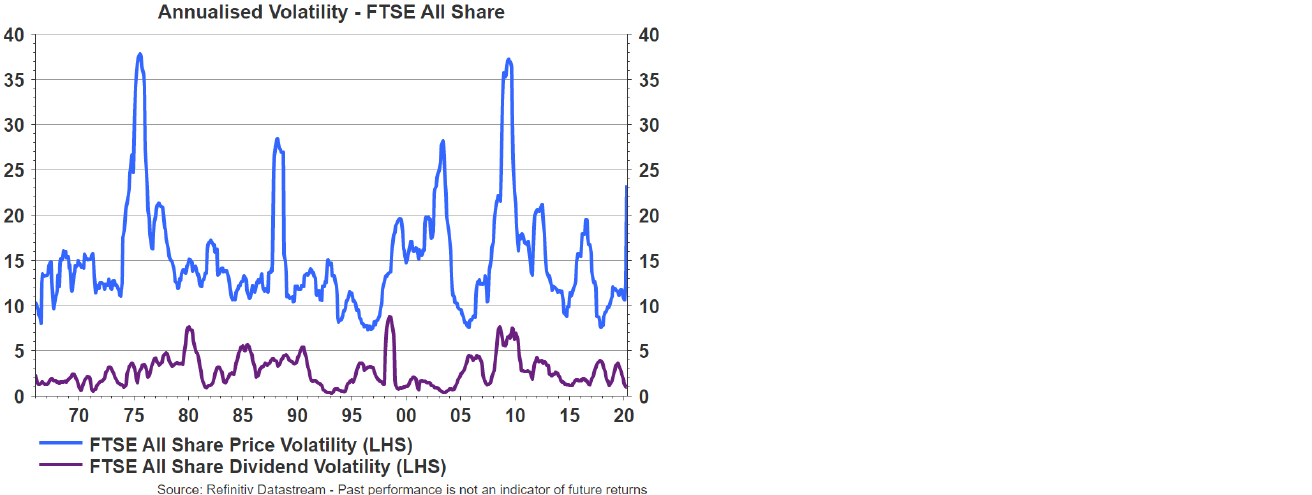

In recent history the predictability of dividends has not been too much of a concern, and companies have been only too ready to look through periods of earnings and cashflow volatility whilst maintaining dividend payments. The chart below shows, relatively, how stable dividends have been with regard to share prices:

This time it is different. With COVID-19 affecting whole industries so dramatically that “toughing it out” from a cashflow perspective and maintaining the dividend by drawing on borrowings is not an option. Many companies are now fighting for their survival.

We have performed several iterations of analysis looking at what level of dividend income might be expected from the UK’s All Share Index in 2020.

Initially our analysis looked at who had the financial wherewithal to maintain payments through the crisis. This cohort typically contained companies that were naturally very resilient to this crisis (such as supermarkets or utilities). The others had sufficiently strong financial reserves (and perhaps a relatively small dividend obligation) that they could continue paying despite any deleterious impact on cashflows.

It is now increasingly common to see that even if a company has the ability to keep on paying, they are questioning whether it is right from a moral perspective.

This analysis of who ‘could’ theoretically maintain payments has since morphed into a consideration of who ‘should’ maintain payments. It is now increasingly common to see that even if a company has the ability to keep on paying, they are questioning whether it is right from a moral perspective. Certainly, companies that have benefitted from taxpayer support through this crisis, such as the government’s support for furloughed employees or the Bank of England’s Covid Corporate Finance Facility, will need to think hard about whether effectively returning some of that money back to private shareholders is the right thing to do. Most are deciding that in the short-term it isn’t; BAE Systems has agreed to defer the payment of its final dividend as they’re aware of the pressure its customers (mostly governments) are under, even though there has been relatively little impact on its operations so far.

Our analysis of which companies will continue to pay dividends through 2020 is therefore not only an analysis of financial fundamentals (themselves less predictable than usual due to this crisis) but a consideration of the moral zeitgeist with regard to paying dividends at all in the current climate.

According to FactSet data, at the start of the year the total level of income from the FTSE All Share was anticipated to be c.£107bn. Of this, the top 10 contributors accounted for 47% of the total, led by Shell at 11%, HSBC at 8% and BP at 7%. The UK Prudential Regulation Authority have issued clear guidance to the UK Banking sector that it should cancel dividend payments and share buybacks for 2020. This alone removes c.15% of the anticipated income. If the Oil Majors were to abandon their payments as well, this removes another 18%. Though encouraging, despite oil prices at multi-year lows, BP has recently confirmed that it will be paying a dividend for its first quarter of 2020.

Due to the nature of their operations, other contributors to the top 10 should be more dependable, such as GlaxoSmithKline, AstraZeneca and British American Tobacco. Having applied probabilities of maintaining payments to the main FTSE All Share names, we now believe income could be down c.50% in 2020. It is worth noting that the margin of error around this is significant, as it will be sensitive to assumptions about how long the lockdowns continues and how quick economies will rebound.

Given the significance of income investors on the shareholder registers of many of these companies, we suspect that if economic conditions normalise, those who have been forced to, or opted to, suspend dividends in 2020 will be under pressure to swiftly return payments to historic levels. Even if many finance directors wished they didn’t have to.

Discover how you could benefit from our Advisers services.

Browse articles in