Buy-to-let outlook: What has happened during previous downturns?

Amid reports that the UK is entering a shallow but long-lasting recession, our previous research explored how the residential housing market is likely to be affected by high inflation and weakened consumer sentiment. Here, we explore the complex impact the economic environment has on buy-to-let.

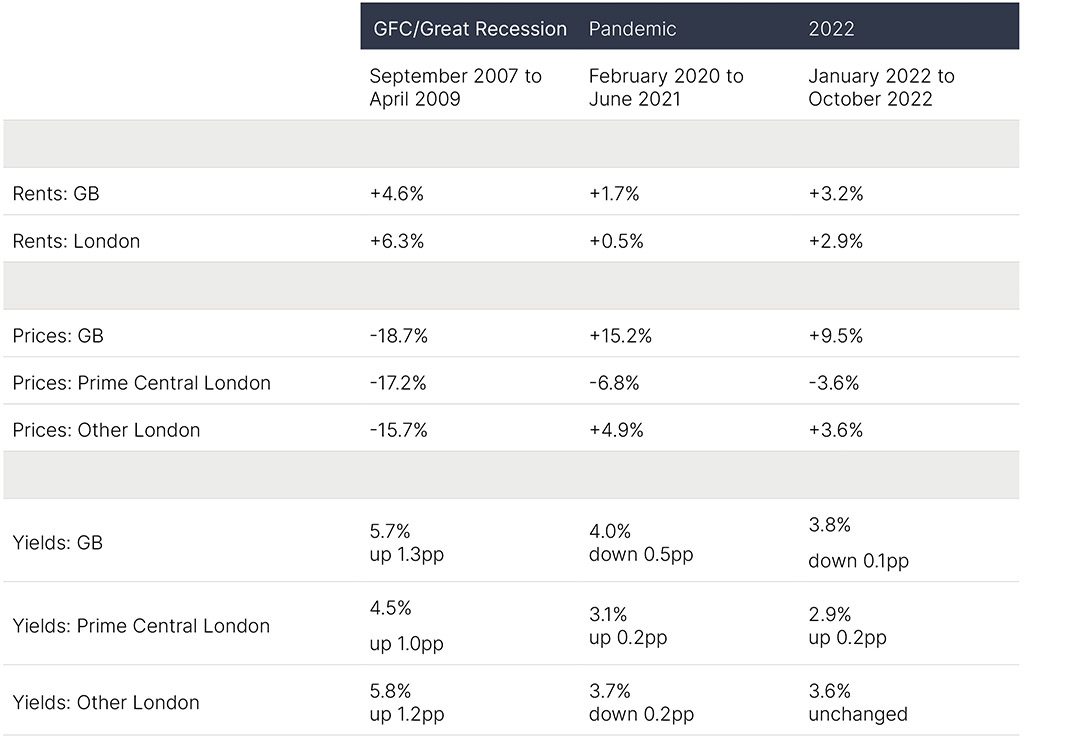

What has happened in previous downturns?

Previous downturns could help identify the buy-to-let market trends we will see.

Source: ONS/Investec

2008-2010: Low mortgage approvals led to rental inflation

In 2008-09 the supply of property finance was severely curtailed, at first by fears of counterparty risk and then by the need for bank liquidity. According to UK Finance1, between 2008 and 2010 the volume of loans for buy-to-let house purchases fell from 103,990 to 49,400.

The volume of mortgages approved for owner-occupied properties also fell and a reduction in buy-to-let supply was reflected in rental inflation of 4.6% between September 2007 and April 20092.

However, the year 2008 saw a negative total return for landlords because house price declines of around 18% were larger than rental income3.

2010-2015: Buy-to-let returns can be impacted by policy changes

In the low interest rate environment following the Global Financial Crisis (GFC), the value of buy-to-let lending increased. It rose from £9.6bn in 2010 to £37.9bn in 20154.

UK property transaction volumes increased overall, and the average house price stood at £204,920 in December 20155.

However, to support first time-buyers, the government introduced a 3% stamp duty surcharge for second homes in 2016 and cancelled the tax relief on mortgage interest payments for landlords in 2017. The relief has since been replaced with a flat 20% reduction.

These increased costs for investors affected the volume of new buy-to-let purchases, with the annual number of buy-to-let loans falling from 117,000 in 2015 to 72,400 in 20186.

2020-2021: Lifestyle trends play a role in rents

The UK economy contracted by a record 11% in 20207 as the government shut down large sections of society to slow the spread of Covid-19.

Monthly UK transaction volumes plunged by more than two thirds to a low point of 27,686 in April 20208, before a reduction in stamp duty from 8 July 2020 saw transaction volumes increase and prices eventually boom.

While ONS figures show that between February 2020 and June 2021 rents rose 1.7% across the UK on average, there were small month-on-month declines in London of less than one per cent. However, this data captures existing contracts and does not capture reductions negotiated informally.

In Prime Central London, rents also held on average, with a reported gain of 0.5%. Yields increased because average property prices dropped 8% between their April 2020 peak and June 2021. Prices fell most in Westminster, Kensington & Chelsea and the City9.

What has happened in the last 12 months?

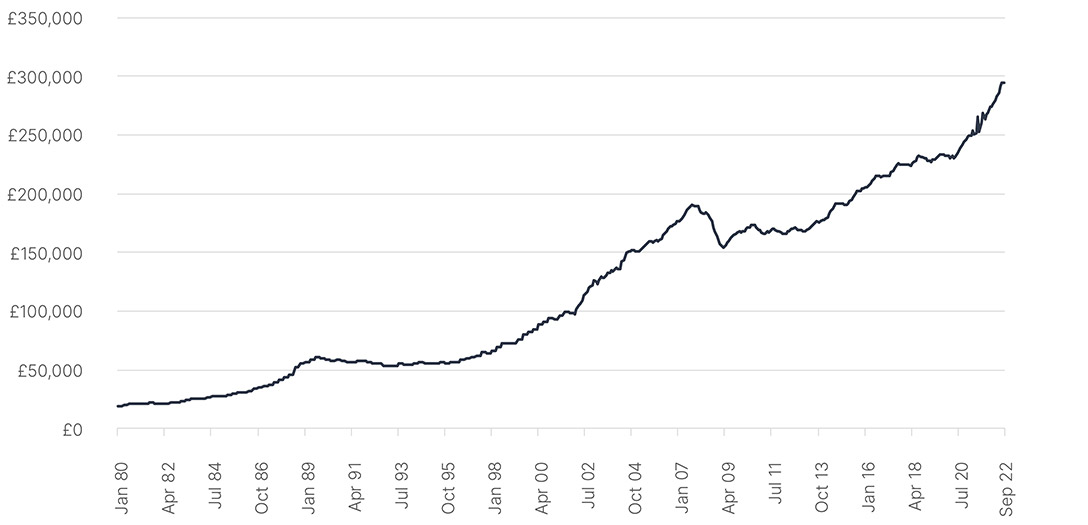

House prices

The average UK house price rose 9.5% year-on-year to £294,559 in September 202210. However, it has fallen since then.

Graph: Average UK House Prices

Source: ONS

In November 2022, Rightmove’s index of asking prices showed a national month-on-month decline of 1.1%. Moreover, the stock of unsold property on agents’ books is 50% higher than a year ago.

In Prime Central London, prices were down 5% year-on-year. This is in stark contrast to the rest of London, where prices were up 5%, but began falling 3.8% month-on-month2. Rightmove’s survey reported that asking prices were down 1.9%.

Graph: Average UK House Prices by segment

Source: ONS

Tenant demand

UK mortgage approvals were down 7% month on-on-month in September 2022 and tenant demand remains elevated. According to RICS’ November 2022 survey, the balance of estate agents reporting rising demand is 35%. Appetite is strongest in cities in the North West of England, and in Wales, but London is close behind, with a positive balance of nearly 30%11.

Rental appetite is set to remain strong as first-time-buyers defer house purchases in a challenging economic environment12.

Rental inflation

Rents in Great Britain increased at their fastest rate on record13 in October 2022, rising 3.7% year-on-year. The average monthly rent now stands at £925.14

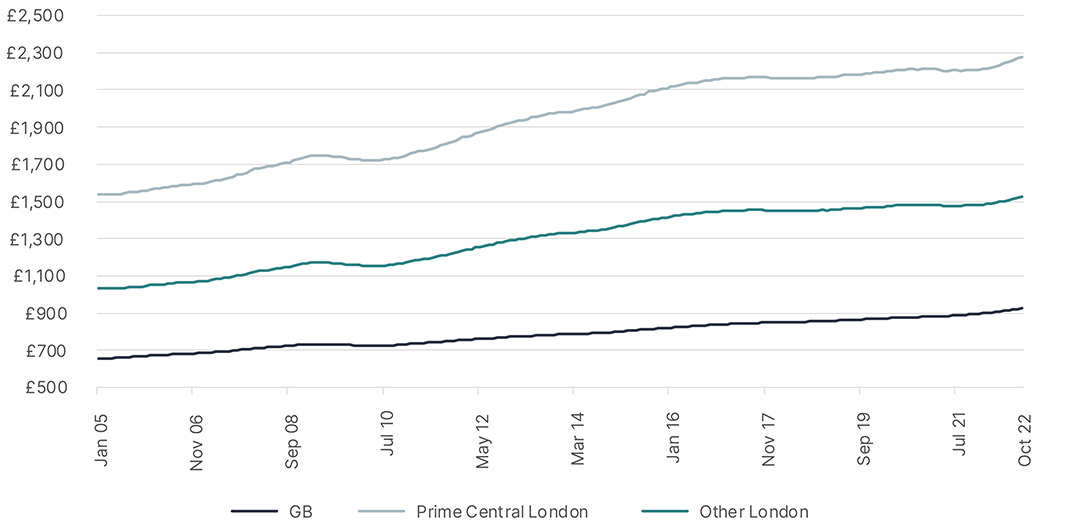

Graph: Average Monthly Rent

Source: ONS/Investec

London rents rose more slowly than the national average in October (+3.0%), but they have accelerated more dramatically over time. In October 2022, Prime Central London rents stood at £2,274, compared to £1,524 for the rest of the city15.

While real-time disposable income is set to fall by 3.4% according to Investec, strong tenant demand and a fall in supply of new property to rent suggests that the upward trend is somewhat supported. RICS reports that the balance of agents expecting higher rents remains high at 43%16. Meanwhile, figures from Rightmove show that advertised rents were 16.1% higher in London year-on-year in November 2022, the highest rate of growth on Rightmove’s record.

Property supply

The supply of property to rent is falling, according to multiple sources. Data from property analytics firm TwentyCI suggests that rental listings were almost a third lower in September 2022 than three years before. The volume is said to be down in all 20 of the UK’s biggest cities and in half of these by more than 40%. In London, there are 35% fewer rental homes available17.

In addition, RICS data shows more agents report a decline in instructions, than a rise. In London specifically, 30% more agents said they had seen lower volumes.

Void periods

With tenant demand remaining elevated and a limited supply of rental property, the length of time that properties remain vacant has fallen. Lettings specialist Rentd reported UK void periods had fallen to an average of 20 days earlier this year, down by a fifth year-on-year, with the average in London falling from 25 days to 17.

Rental yield

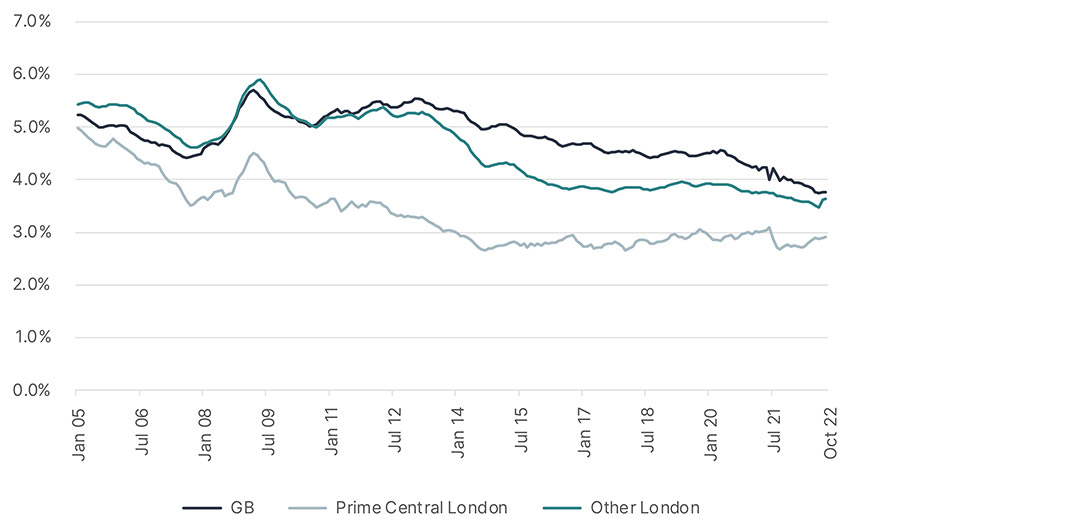

Against a backdrop of rental inflation, yields have risen.

Graph: Average Rental Yield

Source: ONS/Investec

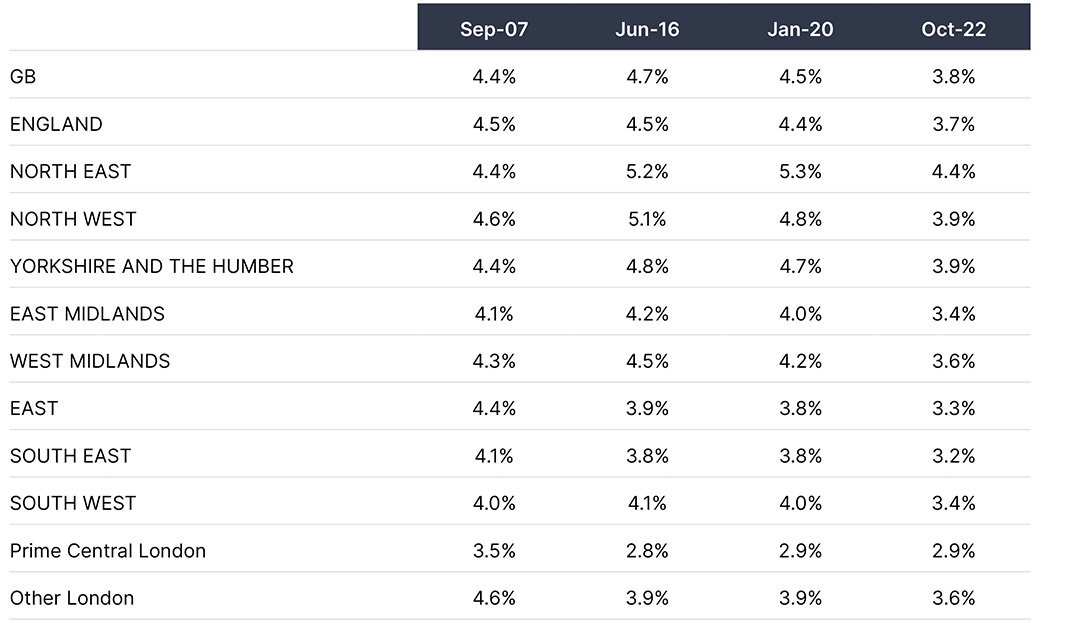

Table: Average Rental Yield

When calculated by dividing average annual rent by the average UK property value, in October 2022 yields stood at 3.8%. However, regional variation is wide – from 4.4% in the North East to 2.9% in Prime Central London.18

Rising rents and lower prices have pushed Prime Central London yields higher too. They reached 2.9% in October 2022.

Total returns

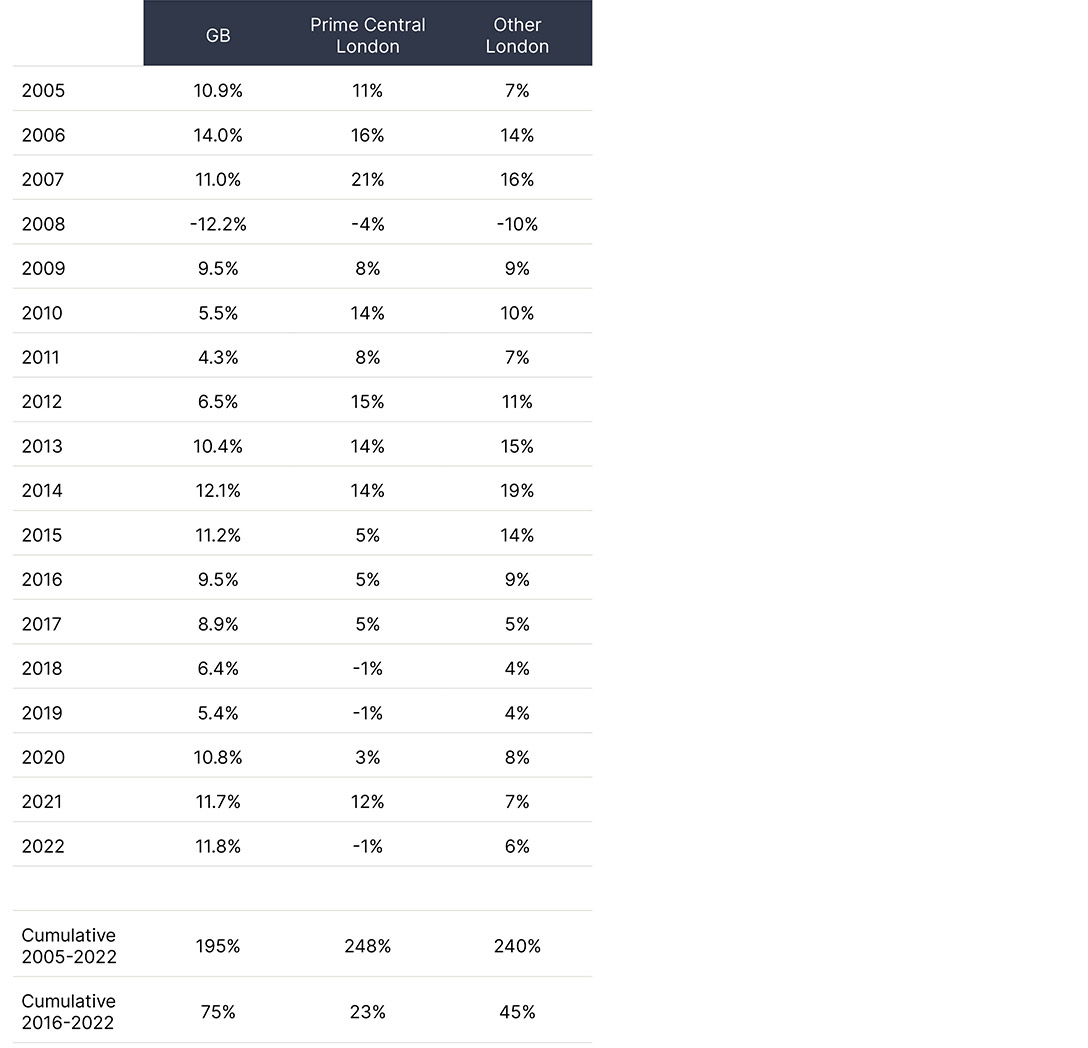

When considering capital gains plus rental income, landlords have made a total return of 195% on the typical British property held since 200519.

Table: Average Annual Return

On average, Prime Central London has delivered the strongest long-term total return over this long period (248%), although cumulative total returns are behind the national average for properties purchased in any year after 2009.

UK property owned between January and September 2022, delivered an estimated total return of 12%. Double-digit returns have been seen everywhere except London, where Prime Central London suffered a negative 1% total return between Q1 and Q3 2022, and Other London a positive 6%.

What might happen next?

If house prices fall, buy-to-let investors may be able to purchase property at a lower cost as the recession plays out. The Office for Budget Responsibility sees UK house prices falling 9% by late 2024, though there is considerable uncertainty. Market forecasts range from -5% to -18% peak-to-trough. However, this also means the value of existing investments may decline during the same period.

Unlike during the credit crunch of 2008, mortgage finance is available, however interest rates are higher which may push up costs and reduce returns.

Conversely, the Bank Rate means there is a tendency for potential first-time buyers to accumulate in the rented sector and this could increase tenant demand and lead to rent inflation. A long-term lack of housing supply is likely to further support the need for rental accommodation.

While investment must be considered on a case-by-case basis and independent advice should be sought, it is clear that yields could rise notably over the next 18 months. For example, a 7% fall in property values – predicted by Investec economists – combined with an increase in rents, could push the average UK yield higher and create potential opportunities for buy-to-let investors.

However, the policy environment has undoubtedly become more difficult and includes a stamp duty surcharge and the abolition in mortgage tax relief for individuals.

Summary

Overall, while the outlook for buy-to-let may appear positive, in a challenging economic environment it is important to work with the right mortgage provider if considering investing in property or restructuring an existing portfolio. Lenders like Investec can help tailor mortgage repayment plans to support cash flow, as well as looking beyond an estimated buy-to-let return to calculate loan affordability.

It may also be possible to explore purchasing a property as a limited company so that some costs can be offset. Investec is among banks who can offer mortgages to Special Purpose Vehicles (SPVs).

Need more information on buy-to-let mortgages? Please get in touch today.

Our Private Bankers are highly experienced with a history in complex lending and relationship management.

Important information:

Article produced by 5iresearch for Investec in November 2022.

The information in this article is believed to be correct but cannot be guaranteed. Opinions featured are not to be considered as the opinions of Investec Bank plc. Your use of and reliance on any of this content is entirely at your own risk.

This article is for general information purposes only and should not be used or relied upon as professional advice. Past performance is not an indicator of future performance. The value of investments and the income derived from them may go down as well as up and you may not necessarily get back the amount you invested. It is advisable to contact a professional advisor if you need financial advice.

Browse articles in