Whatever your views on Brexit, most of us really had no idea what the future would look like outside the EU. Between 24 June 2016, when the referendum result was confirmed, and the 24 December 2020, when a deal was announced, the future for the UK economy was definitely uncertain.

Perhaps the most clichéd of all stock market expressions must be “markets don’t like uncertainty”. But just because the expression is a cliché doesn’t make it any less indisputable. I have always thought this expression slightly paradoxical given so much of stockbrokers, analysts and fund manager time is spent forecasting the future, which by definition must be uncertain. But there is, of course, a nuance here to paraphrase Former Secretary of Defence Donald Rumsfeld, there is a subtle difference between “certain uncertainties” and “uncertain uncertainties”.

The market likes “certain uncertainties”. The market likes to able to forecast based on what has happened in the past and the assumption it will happen in the future. For example, economists have developed concepts like ‘trend growth’ for gross domestic product (GDP). A rather grandiose term for looking at what has happened in the past and assuming it will happen in the future. Furthermore, as a starting point, when forecasting individual companies futures we tend to categorise companies as “GDP plus” or “GDP minus” when say looking at their likely revenue growth. Does a company tend to have sales that grow at more than GDP or less? How geared is a company to that GDP forecast, both to the up or the down? So in a normal year using concepts like “trend' GDP growth” we can forecast with some certainty by using past experience and extrapolation as a pretty good guide to the future, rather than just relying on a “finger in the air” or even a crystal ball.

The stock market in the summer of 2016 was not expecting a Leave vote. It was so “certain” that we would vote to remain in the EU that sterling rose around 5% to almost $1.50 in the 10 days immediately before the vote, a level we have yet to see since the referendum. UK domestic stocks like Lloyds Bank or Housebuilders like Barrett Developments rose 18% and 13% respectively over the same period. The stock market liked a Remain vote as it represented stability and continuity... the future would be as predictable as the past, there would be certainty.

"The stock market in the summer of 2016 was not expecting a Leave vote. It was so “certain” that we would vote to remain in the EU that sterling rose around 5% to almost $1.50 in the 10 days immediately before the vote."

However the electorate delivered the complete opposite, and perhaps not surprisingly, the UK stock market didn’t like a Leave vote at all. Sterling fell more than 8% on 24 June and by 27 June Lloyds Bank was down over 30% and Barrett Developments was down closer to 40%. Overnight the future had gone from being “certain” to anything but. Like most of us, the stock market didn’t know what Brexit actually meant. The market only started to stabilise after the Bank of England offered to intervene. There were weeks of political uncertainty before we had a new Prime Minister. It then took months for Theresa May to even define what Brexit meant, and it would seem that defining what Brexit meant and then delivering it, was to prove too much for her Premiership.

And so the “uncertain uncertainties” grew. How would Brexit affect the UK economy? There had been gloomy forecasts from the Remain side during the referendum and they grew even shriller with ever-louder warnings of “no deal” and “cliff edges”.

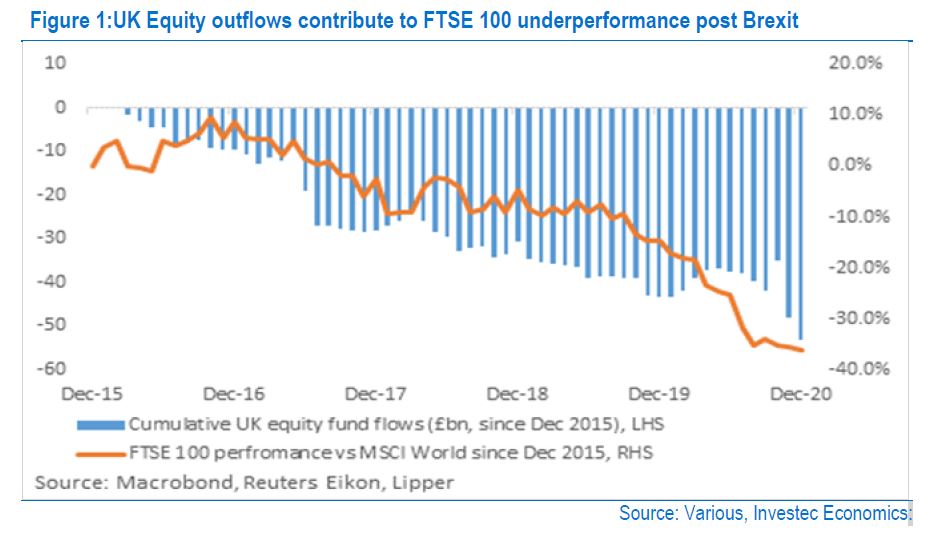

A member of the EU had never left the bloc before, so how do you forecast the impact of something that has never happened? The economic impact of leaving the EU to many investors was simply unforecastable, too difficult, too uncertain. And of course, the majority of investors in UK equities are overseas investors who have a choice of where to allocate their capital. How would an asset allocator weigh up an investment decision of any other asset versus an investment in the UK given the outlook for the UK was so uncertain? What for instance would that all-important UK trend growth look like in the future? So over the last four and a half years making an investment decision involving the UK had become too difficult. As a result many international investors simply moved onto other investment opportunities and that trend starts to feed on itself. As investors sell UK assets to reduce or exit the asset class completely “supply” starts to exceed “demand” and therefore price must fall. So UK stocks start to underperform and so the selling pressure accelerates resulting in a vicious circle as can be seen so clearly on the chart below of fund flows and the relative performance of FTSE vs MSCI World Equity Index:

But what now given a Brexit deal has been agreed? Well, at least some of that uncertainty has been resolved. There will be no “cliff-edge no deal”. There is still plenty of uncertainty, especially in how the UK’s services will be treated going forward, which clearly makes up the majority of the UK economy. How will the inevitable trade frictions affect the UK economy going forward? Will these frictions be offset by lower regulations or Free Trade Agreements with other countries as part of the “global Britain” strategy? The market doesn’t know, so there are still uncertainties but crucially less than there were before the deal was agreed. As it becomes clearer how our new position in the world impacts our economy, those uncertainties will continue to be resolved.

However, on Christmas Eve 2020 the UK started to become more forecastable again and therefore more investible. As those international investors take tentative steps back into UK equities they now become the marginal buyer. That supply-demand imbalance is reversed as demand for UK equities exceeds supply and so prices start to rise. The benchmark FTSE 100 having been the laggard in Developed Markets performance was one of the best performing major markets for the first two weeks of 2021, up over 5% versus MSCI World Equity Index gaining just under 2%.

Its early days but that “vicious circle” of uncertainty has hopefully, been replaced by a “virtuous circle” of increased confidence in the UK and most importantly increased ‘’certainty’’. And as we have seen at the start of this year, clichéd or not, markets really do like ‘’certainty’’.

Get Roger Lee’s Equities delivered to your inbox

Browse articles in