Get Focus insights straight to your inbox

Ian Kantor, an engineer by qualification, never wanted to work for a bank. In fact, he quit a perfectly good job because the company he worked for was acquired by a big bank.

He went on to start a small leasing business in 1974 that became Investec – now an international bank and wealth management company with a multi-billion pound market cap, dual listings in London and Johannesburg and nearly 10,000 employees across five continents.

While remaining a director of Investec, Kantor moved to the Netherlands in 1988 to develop a private bank called the Insinger de Beaufort Group, which is today one of the leading wealth managers in the country.

This year, Kantor retired from the Investec board. Investec Focus spoke to him about his journey and the lessons he’s learned along the way.

Listen to podcast: Ian Kantor’s lessons in leadership

Investec co-founder Ian Kantor chats about his 45 years with Investec, and some of the lessons in life and leadership that he has learned along the way.

Subscribe to Investec Focus Radio SA

You don't need a grand vision on day one

When Kantor started Investec there was no long-term game plan. “The vision was very simple: what do we need to do to put bread on the table tomorrow? I've yet to meet anybody who had a vision and said ‘this is what I'm going to do, and do it’.”

Pointing to Bill Gates’ famous goal of “a computer on every desk and in every home,” Kantor says, “Gates was already well into the business by then. That wasn't day one when he was fiddling around in his dad's garage trying to build a computer with a soldering iron”.

The value of “progressive insight”

Kantor believes strongly in something the Dutch call “voortschrijdend inzicht”, or “progressive insight” – a process that compels executives to consider problems from multiple angles before taking a decision.

“It’s a kind of growing awareness,” he explains. “So you are working with the problem or you're dealing with issues and you're not sure, it's not clear and you discuss and debate and argue and then suddenly you say ‘hang on, but if you look at it this way... and find a solution.”

The power of process

“I think one of the things that we learnt early on was that you don't have all the answers, and when you think you do, you're wrong.” Referring to process as the “brain behind the business” and the “motor” that drove it, Kantor explains how in the early days, everyone had a right to veto a decision – a practice that led to innumerable heated arguments between the founders, and also a great many innovative ideas.

I think one of the things that we learnt early on was that you don't have all the answers, and when you think you do, you're wrong.

“I think for me the rule is very simple: you have to have up to six people to make a decision. You can decide anything you like as long as it's unanimous. That's the code, the secret code.”

It was those lengthy debates that Kantor credits with Investec’s early success. “I think people called it ‘consensus through confrontation’ and I never enjoyed that because I thought, you don't need to confront to find consensus, which I still believe, and I practice,” he says. “Those discussions taught us a lot. We learnt a lot about the material; we learnt a lot about each other… You also learn a lot about yourself.”

“I think for me the rule is very simple: you have to have up to six people to make a decision. You can decide anything you like as long as it's unanimous. That's the code, the secret code.”

If a leadership group is confronted with someone who is dead set on their own idea, it is important to invite them to explain their position, says Kantor, by expressing interest and curiosity rather than challenging the thinking outright.

“That’s interesting,” for example. “Have you thought about the threats, the risks, the timing, the people?” This enables one to “turn a conversation that would have been polarised and confrontational into a far more creative process with far less friction and less difficulty”.

The Investec Story

Investec founders Stephen Koseff and Ian and Bernard Kantor reminisce about the establishment of the global bank and wealth manager in this Biznews webcast with Alec Hogg.

Embrace the "dwarsliggers"

Embrace the naysayers, says Kantor: they serve a critical function by improving the robustness of your decision-making process. In Dutch, such a person is referred to as a “dwarsligger” – which literally means a railway sleeper, but also an obstinate person, he explains.

The analogy has stuck with him for many years, since someone asked him if he’d ever seen anybody build a railway line without dwarsliggers. “[We realised] that somebody who would object to everything forced us to go through a really serious process to better understand what we were doing and find an answer which wasn't immediately obvious.”

Progressive summarisation

A key leadership lesson Kantor learned early on from one of his mentors was a negotiation technique called progressive summarisation. He credits former Investec chairman Bas Kardol with elevating this idea to an art.

During a standoff, Kardol would identify points of agreement and quickly summarise them, thereby creating new baselines from which the discussion could progress. And if no agreement could be reached, he’d assign a few people to go away to examine the issue in more detail and then return to the larger group with some ideas.

“And so, you build agreements. It wasn't that we would have to fight it out and necessarily have agreement in a day. It took time.” It was this technique, along with an ability to listen to each other, that enabled a strong, opinionated leadership team to achieve consensus.

Silence is golden

While he was starting Investec, Kantor took a second job as a lecturer in business finance at Wits and it was here that he learned the power of silence. He recalls his first day in the lecture theatre, standing in front of 300 noisy students before the lecture began. Overcome by stage fright, he just stood quietly at the front of the class and dropped his head. Suddenly the whole hall went quiet.

“I guess I've used that trick ever since, which is, when I'm not sure, just look down and say nothing. And if anybody said anything, if there was a murmur, I would stop mid-sentence. Boom. Keep quiet. I never had to send anybody out. I never had to reprimand anybody.”

Pictured from left to right: Ian kantor, Fani Titi, Bernard Kantor, Larry Nestadt, Stephen Koseff and Glynn Burger.

Avoid the head of the table

In the boardroom, Kantor recalls that he made a habit of not sitting at the head of the table. He rather took a seat in the middle of his colleagues. “I felt I had more contact with everybody from the middle of the table than from the head of the table. I had a habit of scanning the room, so I'd keep moving from one to the other in any discussion that was happening to see where people were.”

If you can’t say something nice…

Kantor learnt a valuable lesson from another co-founder, Larry Nestadt, which was the virtue of simply being nice. “If you ever thought that you would say something mean or nasty about somebody and we could and we did, Larry's response was ‘if you can't say something nice say nothing’. In my life, I will never forget that.”

Never forget a name

Another trick he learnt from Kardol, was how never to forget a face or a name, which is simply to be curious about it, and to ask questions about it. “The Dutch have a way; they put their hand forward like this and they say, what’s your name? And you say, Tim. Is that your full name? No, you'll say. Timothy. So that's interesting, Timothy. How do you spell that? There's no ways I'm going to forget Tim and Timothy again. Impossible.”

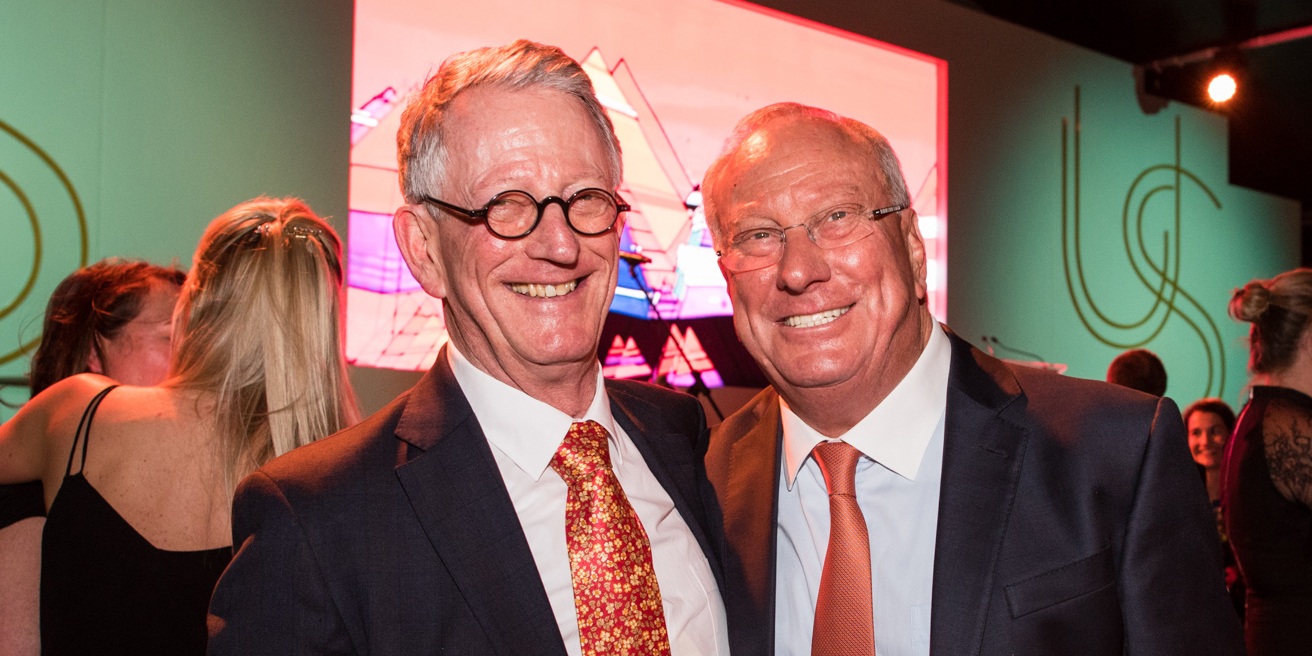

Brothers in business: Ian and Bernard Kantor

Don’t be too busy watching the pennies…

“Don’t be so busy watching the pennies roll across the table that you miss the deal,” is an old adage Kantor has adhered to during his career. If you’re stuck on the details, you will miss the bigger picture of the deal. “There are a lot of things that are not always obvious and definitely not from the detail. I used to say we need to operate like helicopters: so you’ve got to drop down into the detail and then come back up again; get an overview.”

Good, better, best

Kantor, a keen runner, always said he’d never run a marathon. Investec was his marathon. “Forty-five years was my marathon, I’ve crossed the finish line. I'm happy to cross the finish line and I'm happy about the fact that I could cross the finish line with my arms up.”

Reflecting on Investec’s future, Kantor believes that it will continue to be well-served by its culture of robust debate, grounded in a collective commitment to continuous improvement. “You know the story: good, better, best… better. I think that's hardwired into Investec, into that motor that drives it. A very simple thing: decide to do anything you like as long as you all agree.”