Listen on the go

Kirsten Leeuw, founder and MD of Dcoded, shares insights on three trends that are shaping the world post-pandemic.

- Milk Money

- Health Spanning

- Ikigai Wealth

The last 29 months have shaken us, exposed us, exhausted us, taught us and humbled us. Somehow keeping our masks on forced us to take some of our other masks off, as Covid-19 cracked open both visible and invisible fault lines that were already long and deep in many of our lives.

The pandemic accelerated the sharpest rate of change the world has ever seen and opened pathways to some of the greatest materialisation of opportunities, not to mention the growth rate of technological advancement, adoption and access. The world we are making is remaking us.

Never before in human history have so many generations been alive and earning at the same time, creating opportunities for intergenerational connection that have until now been largely impossible. However, in our efforts to build legacy in the age of precarity, we often find ourselves more financially frustrated than free. Our ambition has evolved beyond just financing retirement, to building financial resilience and security throughout our lives.

I love the brutal honesty and depth of this answer I received recently when asking an interviewee how the journey to financial freedom and legacy building was going. “You want the truth. I am working so hard I’m not even living. I’m just making a living. The rate at which we have to spend grows painfully faster than the rate of change in my earnings, no matter how good I am - my money is quite literally worth less and less as I progress. There’s a tug of war between saving me and supporting them - I have big dreams, but I feel like my duties are drowning them.”

The cost of living has put us all under pressure and the cost of supporting others multiplies that pressure. According to Old Mutual savings & investment monitor 2021, The ‘Sandwich Generation’ was at a record-breaking high prior to Covid and now one third of people surveyed are giving financial support to more people since the pandemic began. The Sandwich Generation is defined as a generation of people responsible for bringing up their own children and for the care of their ageing parents. Today, the notion and diversity of a ‘sandwich’ has taken on a life of its own. Many of us are taking care of much more than the classic sandwich dictates including siblings, siblings’ children, aunts and uncles, grandparents, employees and their families, pets and even friends. This intensifying level of support traps us in the present, often suffocating and squeezing savings and/or the mindset that equips us to build something for the future.

With all of this mounting pressure for more, there are three trends that come to mind directly permeating out of the pressure.

Milk Money

One income just doesn’t quite seem as stable as it used to. Many of us have become active surplus seekers. We used to diversify our investments as a 101 rule, but now many of us are diversifying our incomes too. We want our earnings to grow significantly faster than our expenses.

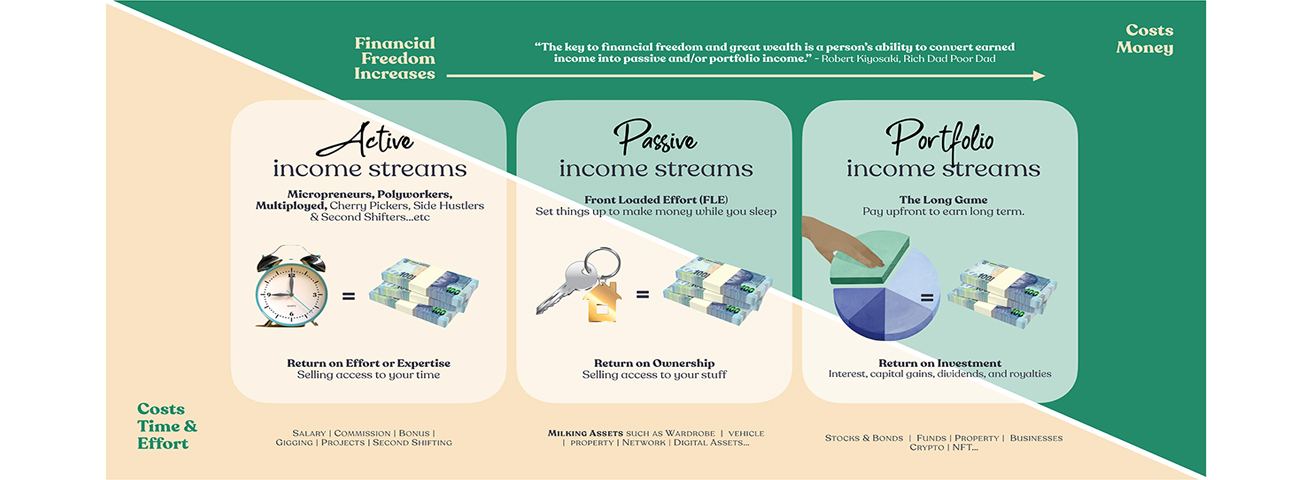

As uncertainty grows, there is a shift from a default earnings mentality to a design earnings mentality. As a result, the pursuit of multiple streams of income persists. It was recently and rather eloquently described to me this way. “It is the shift from a singular stream of income to a bustling river mindset, where multiple streams converge into an ecosystem that sustainably feeds and frees the potential of every cent”. A river mentality is orchestrated to facilitate a flow of extra earnings that releases the pressure valve and creates a mechanism for more. Multiple streams of income can typically take on three shapes and all three are trending astronomically.

Active income streams is a return on time and effort (RoT/E) in the form of salaries, commissions, gig or project fees, billable hours, etc. Active Incomes take on many forms, from a side-business or craft completely unrelated to a primary job to other side hustles, second jobs, or extra freelancing and contract work. Despite age or earnings, more people are open to ‘Polyployment’’ than ever before (whether pushed or pulled). An interview said “When you add my multi-earnings together, I do very well. I earn more than most of my ‘uni-employed’ peers and technically qualify for far higher-end financial products, but old school systems can’t seem to do the math.”

Then on the complete opposite side of the spectrum, costing you far more money than time, is the pinnacle, portfolio income streams. These create avenues for Return on Investment (RoI), such as interest, capital gains, dividends and royalties. This is playing the long game with the classics such as stocks, bonds, debt/equity investments, cash, commodities and property. Today, portfolios are stretching into the Metaverse with NFTs or crypto-portfolios, however, both are far too volatile to dethrone the classics.

Finally, the fastest growing territory, passive income streams. These are selling access to your stuff or gaining return on ownership (RoO). From asset sharing, creating digital assets, such as courses, content or e-books, selling goods through Fulfilment by Amazon or monetising access to your network and so much more.

It is time we start milking our assets and not just let them milk us. Unused assets and ‘stuff’, ranging from cars and rooftops to clothes and accessories are becoming somewhat of an instigator of innovation.

A fascinating global example is Swimply, a marketplace for homeowners to rent out their under-utilised swimming pools. This business grew astronomically through Covid, having received an additional $40 million in funding in December 2021. They have now expanded into what they call ‘joy spaces’ including tennis courts, picnic spots, etc.

Many of us are going through our ‘things’ and assessing the value they hold beyond the space at the top of our cupboard or the unshared usage rights like that incredible kitchen that no-one uses between 8:00 and 16:00 on weekdays, that wedding suit that just doesn’t fit anymore or that revered luxury handbag loved, but hardly used.

Sharing and renting are not only great stream makers, but they are also natural debt diminishers. There is so much we own that we can earn from and there is so much potential to transform that which we owe into that which we own.

Health Spanning

According to the UN, by 2050, living to 100 years of age will be (globally) common. The Stanford Center on Longevity Report speaks about how we are continuing a remarkable trend that saw human life expectancies double between 1900 and 2000, increasing more in a single century than across all prior millennia of human existence combined.

Health span is a new longevity metric. We are living longer, but not necessarily better. Health span measures the quality of life vs the duration of it. Your health span is the amount of years you are healthy, mobile, mentally sharp and free of pain. It’s not about survival of the fittest, but rather whether the fittest have thrived enough to actually survive.

In Thrive, Ariana Huffington speaks about the fact that over the long term, money and power, on its own are like a two-legged stool - you can balance on them for a while, but eventually you’re going to topple over. More and more people - very successful people - are toppling over.

To live the lives we truly want and deserve, and not just the lives we settle for, we need a third measure of success that consists of four pillars, namely: wellbeing, wisdom, wonder, and giving.

We have never ached as much for sleep and unconsciousness in human history as we do today. According to the latest Philips Global Sleep Survey, over 60% of adults don’t sleep as well as they’d like and 44% of adults around the world said that the quality of their sleep has gotten worse over the past five years.

The wellness world has unleashed devices and solutions beyond most of our wildest imaginations, from sleep robots that cuddle us and control our breathing, watches that produce sleep reports, pricey sleep supplements and subscription plans, to sleep ice-creams and influencers. According to Statista, the global sleep economy is forecast to be worth 585 billion U.S. dollars by 2024. Our inability to sleep is fuelling a gargantuan industry’s rise and rippling into serious mental health implications.

Self Space, A mental health shop in the UK believes that everyday mental maintenance is an essential part of not just surviving, but thriving. Their mission is to transform and modernise the culture around mental health by supporting committed individuals and companies to reach their full potential. It’s essentially a gym, for mental fitness.

Your mind is your greatest asset because it is the captain of every other asset you will ever possess. Are you taking care of the captain?

We have four types of energy as human beings, which means four types of exhaustion. Physical, mental, emotional and spiritual - three of these are invisible, although sadly for most of us all four are invisible. If only we could see our battery status even half as attentively as we see our phone’s battery status. Imagine you actually treated your mind as an asset - the kind that can either appreciate or depreciate, depending on how well you maintain it. Many of us are on a mission to not only revitalise, but stretch our health span to align with our life span.

Ikigai Wealth

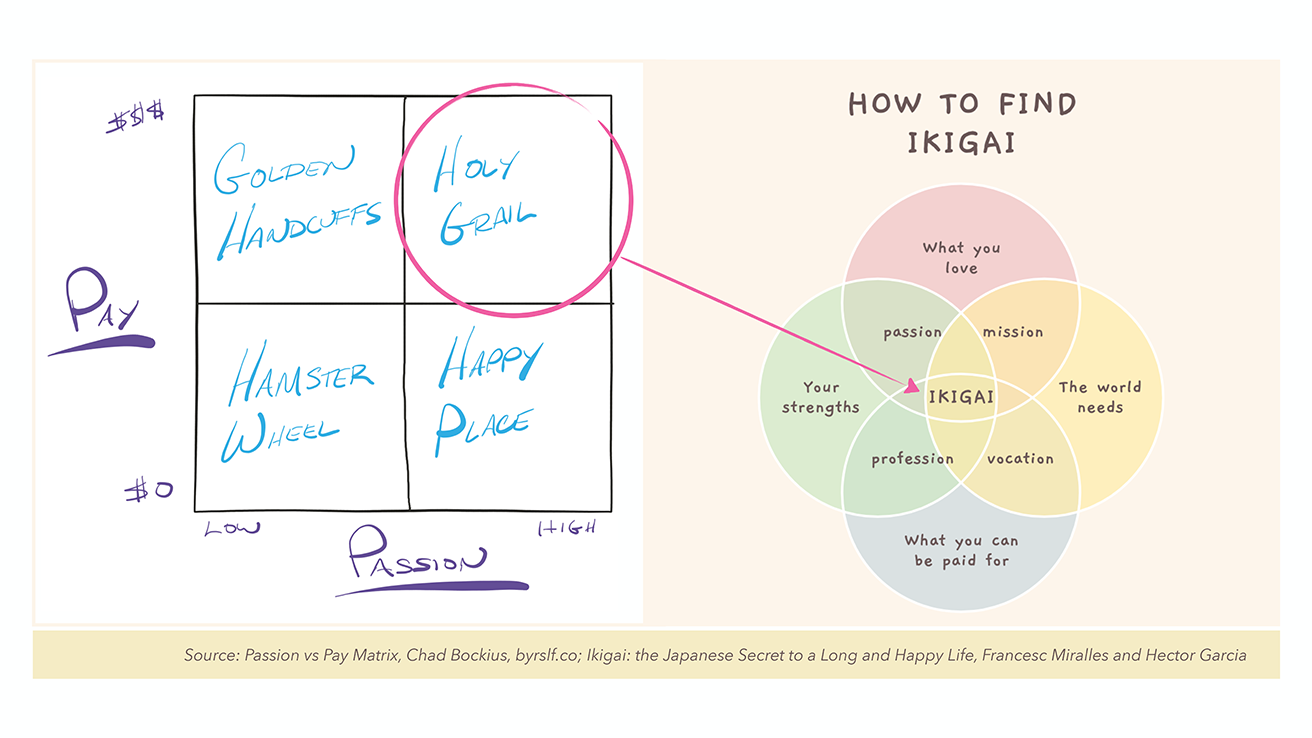

Ikigai (ee-key-guy) is a Japanese concept that combines the terms iki, meaning’“alive’ or 'life’, and gai, meaning 'benefit’ or’“worth’. The people of Japan believe that everyone has an Ikigai - a reason for being that can also be wealth generating. There are some fascinating studies linking ikigai to productivity and performance - it is said to be the holy grail of fulfilment.

Ultimately, you find where passion, profession, vocation and mission collide either through multiple pursuits, or, for the lucky few, one idea born out of passion that creates a path of profitability Ikigai (ee-key-guy) is a Japanese concept that combines the terms iki, meaning’“alive’ or 'life’, and gai, meaning 'benefit’ or’“worth’. The people of Japan believe that everyone has an Ikigai - a reason for being that can also be wealth generating. There are some fascinating studies linking ikigai to productivity and performance - it is said to be the holy grail of fulfilment.

Passion is the genesis of genius - it will keep whispering in your ear until you either try or die. A client in the Venture Capital space shared this with me recently. “My wealth is made of other people’s passion. When I invest, I look for founders with passion and in my experience, if they don’t have passion I won’t make a profit. I’ll take passion for the problem/product over experience any day. It can never be outsourced.”

Paul’s Homemade Ice Cream began with an ice cream machine as a 21st birthday present and a young man’s passion. Today, they supply ice cream to over 15 scoop cafés and over 180 shops and restaurants nationwide. A more global example could be the most famous candle in the world. Yankee Candle. In 1969, 16-year-old Mike Kittredge made a candle out of crayons as a gift for his mom. Eventually, Kittredge turned it into a side hustle, operating out of his parent's garage and basement. Today, Yankee Candle has over 500 stores worldwide with over 19,000 retailers selling Yankee Candle products.

Finding a passion is finding a sustainable obsession. Meaningful wealth is when passion, purpose and profit can play together. Ikigai Wealth is birthing all sorts of industries all over the world, but none greater than the creator economy, estimated to be worth over $100 billion.

The creator economy is a software-enabled economy that allows creators to earn revenue from their content creations on platforms like YouTube, TikTok, Instagram, Twitch or Spotify. The creator economy gives anyone with internet an invitation to create an edge and see if they can sell it.

Khaby Lame went from losing his job in 2020 to amassing over 140 million followers the most followed TikToker on the planet. As I watch his story unfold, I am increasingly fascinated by his ‘silent’ edge. This Italian Senegalese, now 22 years old, creates video content that includes him silently reacting to absurd life-hack videos and recreating the video himself to show an easier and more logical hack.

I believe that the future is a game of edges - we have to carve out an edge and continuously sharpen it. It’s not about being the best at what you do, but rather about being the only one who can do what you do the way that you do it. The future is not a destination, it’s a daily practice so you can either take it as it comes or make it as it comes, but it always has been and always will be, entirely up to you.

About Kirsten

Kirsten is the founder and MD of Dcoded, a Strategy & insights consultancy that aims to foster creativity, innovation and impact in Africa. Driven to understand both progress and people, Kirsten delivers her fascinating insights with an unequivocal human edge and through highly engaging presentations.

Before launching Dcoded, she was head of strategy for TBWA/ Hunt Lascaris, where she became one of the custodians and developers of TBWA’s Disruption Strategy across the African continent. Kirsten is a sought-after keynote speaker at local and global conferences.