Get Focus insights straight to your inbox

Spotting danger comes easily to us as South Africans. But a keen eye for the threatening also makes it hard to stay upbeat. The nonchalance with which South Africa was taken to the brink of economic and political collapse has slashed our capacity for optimism. As whispers of corruption turned to brazen looting, sans consequence, the narrative that our country had entered a downward spiral became lore.

“For business SA, that often meant investing their capital offshore,” explains Will Ridge, Investec’s institutional equity head. “For the most part, their thinking was sound; nine wasted years of governance had resulted in serious economic decline.”

But the now infamous names of New Look, David Jones and Gourmet Burger Kitchen are just a few of the reminders that you can destroy capital and wealth offshore too. In fact, these foreign forays gone wrong are the rule, rather than the exception. “Even so, the idea that the grass is greener still holds weight in our boardrooms, particularly when juxtaposed against a domestic investment opportunity,” says Ridge.

Our collective view of SA’s future, it seems, remains a grey one.

Perhaps what we’re missing here – and all are forgiven for losing sight of it – is that the future is shaped by the present. If we let go of our preconceptions about the trajectory of our country, focusing instead on what’s happening right now, business SA might find reason to invest closer to home.

What doesn’t kill your institutions

Recep Erdogen is hiring and firing Turkish finance ministers. Vladimir Putin allegedly poisons and then, jails his political opponents. Narendra Modi is threatening Indian journalists with sedition charges for reporting on the truth. There’s no schadenfreude here. We have our own problems. But where other emerging markets are clearly suffering weakened institutions that embolden lawless government officials, South Africans stand steadfast, despite an almighty assault.

“Never forget that these are the institutions that held firm during the height of state capture. Their strength is what separates SA from other emerging markets. Politicians come and go, but it’s the resilience of our institutions that counts,” says Ridge.

Consider, too, that the current ruling party doesn’t need to show signs of reform to stay in power – its opposition is the personification of tatters. So, if they wanted to have another go at the trough, now would be the time.

Some may argue that they’ve just been given a reprieve, that eventually SA’s institutions will be broken down. We’re still in the downward spiral, remember? But this line of thought ignores two powerful subtleties:

- Once you’ve defended something it’s much easier to do so again; and

- We know what an attack would look like and how damaging it would be if successful.

We have a blueprint of how to mobilise the forces needed to defend our institutions, as well as an acute understanding of the importance of doing so.

“The significance of our institutions surviving a full-frontal attack cannot be stressed enough in the context of believing in a brighter future for SA. At worst, their continued resilience limits the amount of damage bad politicians can inflict. As a base case, it gives us a foundation to rebuild our country,” says Ridge. And right now, in the present, the building materials to do just that are surprisingly abundant.

Never forget that these are the institutions that held firm during the height of state capture. Their strength is what separates SA from other emerging markets.

Commodity prices smiling down

Whether we admit it or not, luck plays a large role in most success.

“Our record trade and current account surpluses – generally bullish economic indicators – have less to do with our efforts and more to do with the rocketing prices of the commodities we export,” explains Ridge. “Ordinarily, oil prices would have risen in tandem, offsetting these gains. But compared to the extreme price behaviour of our key exports, oil has hardly budged.”

Commodity prices are notoriously cyclical and so cannot be relied upon indefinitely. But the unfurling global economic backdrop suggests we could see a commodity boom with legs.

The better-than-expected Q1 GDP growth of 4,6% year on year (YoY) illustrates just how strong commodity prices have been. Inside Investec, there’s a growing belief that SA’s annual GDP growth could top 5% in 2021 and the windfalls could drive a step-change in fiscal consolidation.

“With less corruption, the increased tax receipts have a reasonable chance of bolstering our fiscus, helping to lower the peak of gross loan debt. In turn, that reduces the risk of our government defaulting and their cost of borrowing,” says Ridge. All in, that should attract stickier FDI and promote higher levels of confidence for both SA consumers and businesses alike. So begins the start of a virtuous, upward spiral.

A surprising consumer

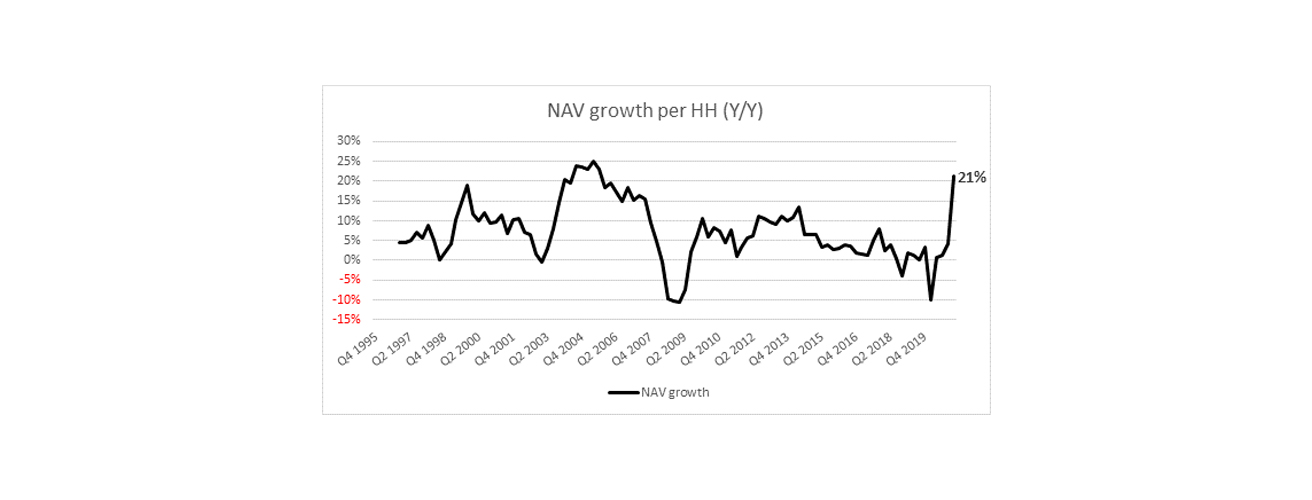

There’s no doubt that the pandemic has exacerbated our already dire state of unemployment. In general, it’s also worsened inequality. Those fortunate enough to own financial and physical assets have seen the value of their portfolios rise steeply, whereas those in lower LSM have had no such shield. But if we look at the SA consumer as a whole, there is once again evidence of surprising strength and serious NAV growth. (See graph below. Source: StatsSA / SARB / Investec Securities estimates).

“Stronger house prices account for a decent whack of this rise, not something you’d expect to see if economic prospects weren’t improving. Pair this rise in NAV with the current household savings rate – the highest it’s been in 15 years – and you have a recipe for buoyant consumer spending,” explains Ridge.

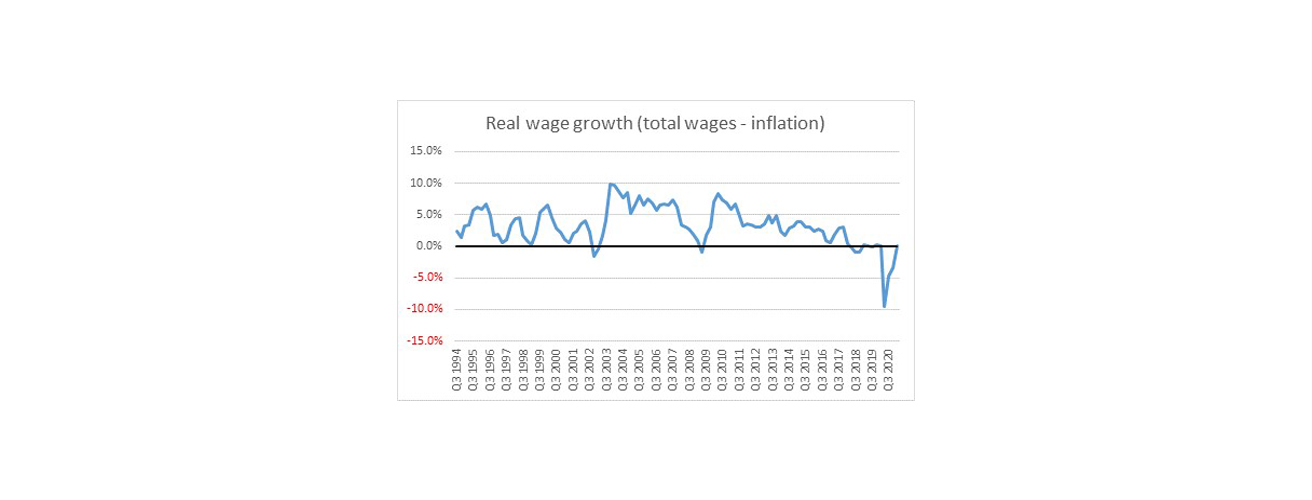

The case for the consumer doesn’t end there. Real wage growth (yoy) in the first quarter of 2021 was flat (+3,2% nominal) which is astonishing when you consider how many jobs have been lost. It’s another bittersweet data point because it suggests higher inequality. But it’s unquestionably good news for SA’s consumer-facing businesses. (See graph below. Source: StatsSA & Investec Research)

The fate of the lower LSMs is tied to a sustainable rise in consumer and business confidence; pervasive and persistent inequality begets political and economic instability.

While their capacity to create jobs is inferior to that of the private sector, the government is nonetheless trying to ameliorate the unemployment problem through its planned infrastructure rollout. It’s wholly natural to roll one’s eyes at such a promise after more than a decade of infrastructure spending on hot air.

But when construction companies start talking about capacity constraints and swelling order books, then maybe we should scale back our skepticism just a bit.

It’s about the direction of risk

Is SA a risky place to make investments? Sure. But, really, that’s the wrong question.

“Every investment carries risk. What matters is how that risk evolves once you’ve bought that business, built that factory, or hired that employee. Those investments will pay handsome dividends if risk dissipates in a sustainable fashion,” says Ridge.

For business SA, the risks of investing offshore remain in place and look unlikely to diminish. Not so for the direction of risk back home.

With our own institutions looking more and more like bastions, a global economic environment that has the power to financially de-risk our country, and a consumer poised to spend, the risks of investing in SA look to be abating faster than many of us appreciate.

To reiterate, it’s only natural to harbour doubtful thoughts about our county’s future – we’re wired that way and the threats we’ve seen were real. But if we can give more weight to the present than to the past then perhaps more of us will come to see the spiral as upwards. Those who do could see their businesses caught up in it.

This article originally appeared in Daily Maverick.