Get Focus insights straight to your inbox

Emerging economies that embrace emerging technologies will outperform

Investments in emerging technologies or sectors have outperformed investments in emerging market equity indices in the past six years. This trend is likely to continue for as long as these new technologies disrupt traditional development patterns for developing economies, as entrepreneurs take time to adjust to these new means of production.

As a result, direct portfolio investment in emerging or frontier economies may not be the best way to gain exposure to these new and exciting technological advances in the near term, but rather investments into these sectors directly in developed economies.

In the long term, however, those developing economies that adopt and integrate emerging technologies into their socio-economic systems will outperform those that don’t on the growth and productivity fronts.

Here we like Kenya and Rwanda as leading adopters of frontier technologies in sub-Saharan Africa.

Those developing economies that adopt and integrate emerging technologies into their socio-economic systems will outperform those that don’t on the growth and productivity front.

In July 2017 the number of cryptocurrencies was over 900 and growing, according to Wikipedia. Of these, the largest by market capitalisation was Bitcoin (US$64bn as at 26 September 2017), followed by Ethereum (US$27bn), Bitcoin Cash (US$7.5bn), Ripple (US$7bn) and Litecoin (US$2.7bn).

Background and context of emerging market and G7 equity market performance since 2003

Investment in emerging (EM) and frontier (FM) economies has been a major theme of the past two decades. Massive amounts of capital flowed into emerging economies during the 1990s when the Chinese economy and Asian tigers were opening up and becoming more productive, followed in the 2000s by booming US and European housing markets that helped stimulate a worldwide commodity and energy boom.

Together these global trends reinforced rapid growth in emerging economies, which led to a growing middle class that helped to lower political risk in these economies. The mix of lower risk, coupled with outsized returns, galvanised a wave of investment flows to this investment strategy, but this strategy came unstuck around 2012 when the global commodity boom turned to bust - which coincided with a growth slowdown in emerging economies.

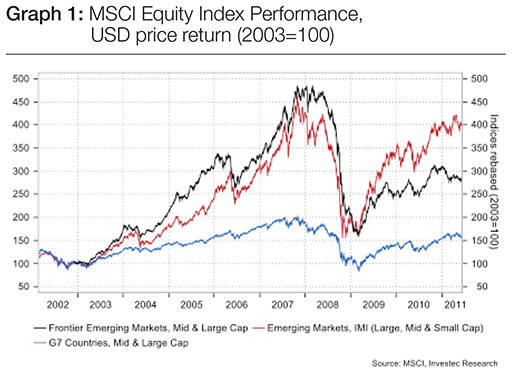

From 2003 to the global equities peak in late 2007, the MSCI FM and EM indices increased by 300% and 400% respectively, while the MSCI G7 index rose by 100% (see graph 1 below).

The MSCI FM and EM indices collapsed by 65%and 60% respectively in 2008, while the MSCI G7 index dropped 26%, but the former rebounded far more strongly while the emerging market growth theme was still alive.

By mid-2011 the MSCI FM and EM indices had managed to rebound strongly off their lows, still handily beating the MSCI G7 index over the prior eight years.

EM equity markets start to underperform in mid-2011

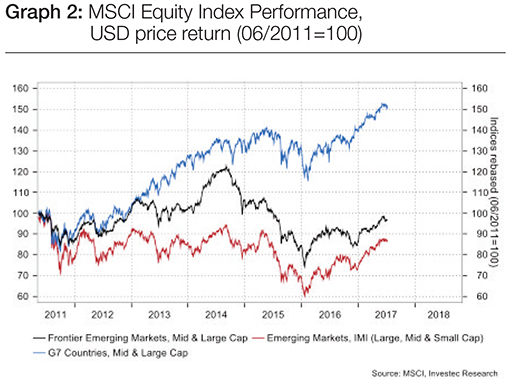

This investment theme changed around mid-2011 and since then the MSCI and EM/FM equity indices have steadily underperformed G7 indices.

Since mid-2011 the MSCI G7 index is up 50%, while the FM/EM indices are down3% and 13% respectively (see graph 2 below).

Our hypothesis is that during this period, a self-reinforcing bullish feedback developed with loose monetary policies in G7 economies fuelling a housing boom in advanced economies. This drove commodity demand higher and boosted emerging economies, which were mostly still reliant on commodity exports terms of trade and growth profiles. This, in turn, attracted investments into and growth of other areas of these emerging economies.

As the housing and commodity bubbles burst between 2007 and 2011, all the tailwinds that supported growth and investment flows to emerging economies turned into headwinds.

Keep an eye on the edge of the technological frontier

Meanwhile, technological frontiers have been progressing rapidly in advanced economies. Innovators combine software, hardware, and the internet in a way that has changed interpersonal relations through online social networks.

The major innovators in this area are the likes of Facebook, Apple, and Google.

Advanced economies are facing a demographic and productivity crisis as baby boomers are set to enter retirement.

This has catalysed new innovations in the field of robotics and artificial intelligence, where most mundane manual factory work can now be automated, reducing the impact of a shrinking workforce on productivity and growth. Boston Dynamics, now owned by Google, and Rethink Robotics are major innovators in this field.

Furthermore, with the global financial system on the precipice of collapse in 2008, major central banks embarked on unprecedented monetary intervention. In the same year, Satoshi Nakamoto released a whitepaper introducing the technology behind Bitcoin, a version of electronic cash that allows online payments to be sent directly from one party to another without going through a financial institution or central bank.

Read more: Making cents of cryptocurrencies

As experts began to warn about the impact of climate change and worldwide risks to food security, innovators poured capital into genetically modified organisms (GMOs) to produce food variants that are more resistant to disease and less reliant on water.

(Pictured: genetically modified rice)

Facing these various challenges, innovators in the advanced economies have started to create solutions that simultaneously alter the developmental patterns of old. This has dislocated economic development patterns that have a direct impact on investment patterns in developing economies.

Frontier technologies have underpinned G7 equity market performance.

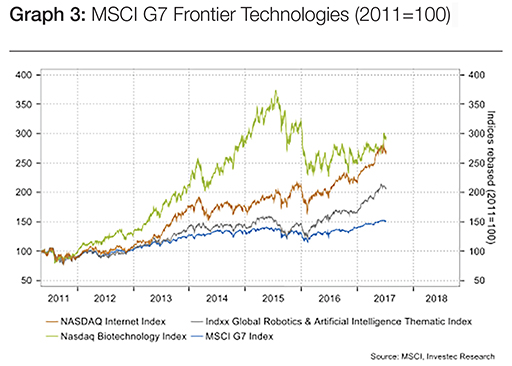

It's important to note that investment returns in these frontier technologies have led the outperformance of the overall MSCI G7 index since 2011.

The Nasdaq internet index, Nasdaq Biotech index, and Indxx Global Robotics and AI index are all up around 100-200% since mid-2011, compared with the MSCI G7 index’ 50% gains (see graph 3 below).

Although not listed on an equity exchange, note that Bitcoin is up 50,000% since mid-2011, with the price gaining from $8 in May 2011 to $4,200 today. It dwarfs any traditional asset class returns over this period (see graph 4 below).

Frontier technologies allow developing economies to leapfrog slow development patterns

New technologies such as mobile telephony and solar energy have already enabled frontier economies to leapfrog traditional capital and savings-intensive development patterns. Similarly, new financial and manufacturing technologies could enable entrepreneurs in frontier economies to leapfrog stale financial systems and stifling labour markets.

We’re excited about frontier and emerging economies that integrate frontier technologies into their social and production structures, expecting that these will be the economies that produce the most invigorating and rapid generational change to their economies (in a similar way that China managed in the past two decades).

In our view, those countries that embrace frontier technologies with open arms, such as Kenya and Rwanda in sub-Saharan Africa, are likely to be the strongest economic performers in the next few decades.

The fact that this technological innovation is happening predominantly in advanced economies before being scaled to and adopted in emerging economies, means that this investment opportunity will reside in developed economies, before developing economies benefit from the growth and productivity benefits these technologies bring.

New technologies such as mobile telephony and solar energy have already enabled frontier economies to leapfrog traditional capital and savings-intensive development patterns.

How to invest in this theme

To profit directly from the companies at the forefront of innovation and the scaling of frontier technologies around the world, one, for now, has to invest in related companies listed in developed economies such as the US, Japan, UK, and Europe.

If one is to take a longer-term view and wants to invest in economies that adopt these technologies in order to boost productivity and growth in sub-Saharan Africa, one way to do this would be through a basket of investments with holdings in each of Morocco, Mauritius, Kenya and Rwanda.

These are the countries where the opportunity to “leapfrog” through new technologies is the greatest.

About the author

Chris Becker

Blockchain technologies lead

Chris commercialises decentralised blockchain technologies and digital assets for the benefit of Investec Private Banking clients. In his previous role, he was an economist and strategist conducting research for large corporates, asset managers and hedge funds for a decade before entering blockchain technologies full time in 2017.