Get Focus insights straight to your inbox

It’s normal that when markets are in turmoil, investors start to get nervous and deliberate on whether to withdraw or reduce their investments. However, if you’re investing for the medium to long term, making an emotional decision to disinvest when shares are falling can have a devastating impact on your portfolio, says Siobhain O’Mahony, Head of My Investments at Investec.

Overreacting can impede future growth

It’s worth looking into the reasons why investors would withdraw before investments reach full-term. The first is fear. Whenever there are drastic changes to the market, investors tend to react emotionally and are tempted to make big moves, even though the numbers have repeatedly shown that timing the market is virtually impossible.

Counter-intuitive as it may seem, reacting less rather than more during periods of high market volatility pays off in the long run.

This is because pulling out of a market in which share prices are falling in an attempt to protect your portfolio from further losses will only lock in the losses you’ve made so far.

In addition, waiting to reinvest once the markets have recovered means you’ll miss out on the recovery journey – which is much of what makes up your portfolio’s growth.

The truth is that market fluctuations are par for the course when it comes to investing. Yes, you may show a perceived loss of capital in periods of downturn, and this is to be expected. But acting on that in the short term will impede your opportunity to make up for it in the long term.

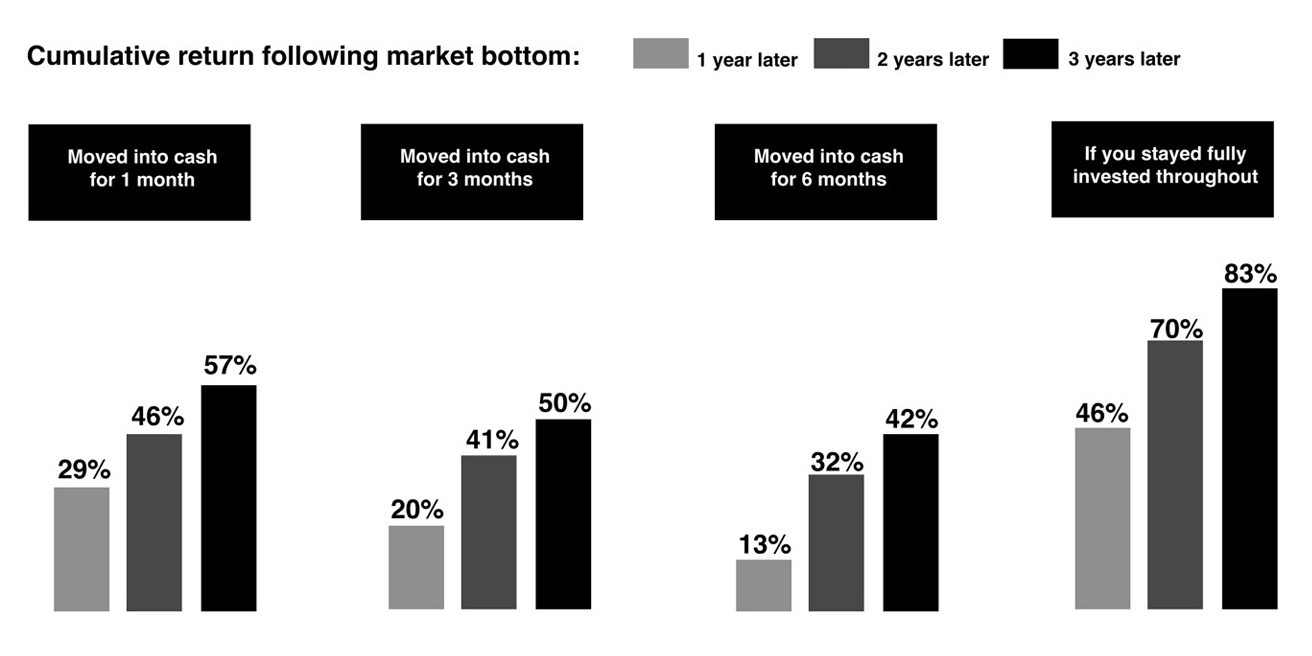

The graph below uses actual data taken from the Schwab Centre for Financial Research and Morningstar to demonstrate how this scenario can play out. Note how the biggest investment gains were generated in the first 12 months of a recovery. Missing just the first month of gains after the market hit bottom resulted in substantially lower returns over time.

A key thing to remember is that as long as you remain invested, your losses are only theoretical, not realised, and anything you’ve lost on paper can be regained by staying the course.

The markets will recover eventually, and historical data shows that investors with medium and long-term horizons are rewarded for remaining calm and riding out downturns.

Balance out your bias

It’s important to recognise the behavioural bias all humans are predisposed to, and how it can work against you, says O’Mahony.

“Make a conscious effort to guard yourself from making emotional decisions based on short-term uncertainty. For example, try not to check your investment balances too regularly, as this can fuel anxiety and prompt impulsive behaviours. Rather, remind yourself that you created an investment plan for a reason, and that sticking to it is the surest way to accomplish your goals over time.”

“To get a balanced, big-picture idea of the health of your investments, you should only assess them over the medium to long term,” she continues. “This takes a lot of discipline and a degree of faith. If you feel too uncomfortable – it may be a sign that you need to reassess your tolerance for risk.”

It may also be a sign that you don’t feel secure enough in the diversification of your investments. If your portfolio is well-diversified, there should be enough risk spread across different asset classes, industries, currencies and geographies that your gains will cover – and hopefully exceed – any losses over time.

Ask questions to better understand the products you are investing in, and prepare yourself for fluctuations in the course of your investment period.

Make a conscious effort to guard yourself from making emotional decisions based on short-term uncertainty. Rather, remind yourself that you created an investment plan for a reason, and that sticking to it is the surest way to accomplish your goals over time.

Use an emergency fund to secure liquidity

The second reason people disinvest too early (within three years of starting an investment) is because they want the security of ‘cash on hand’ in case disaster strikes.

This is a perfectly valid concern – but pulling funds out of your portfolio when compounding is busy working hard for you should not be the first port of call when trying to create liquidity.

“Having an emergency savings fund is an essential step for all investors,” says O’Mahony. “If you don’t yet have one, or you need to top yours up, make a list of all your non-essential expenditures, including any recurring subscriptions and memberships.

Rank them in order of importance, and then cut out the items ranked near the bottom of your list for a few weeks or months. Be ruthless until you have at least three to six months’ worth of expenses saved up in an easily-accessible account.”

A long-term view will guard you from disinvesting too early

Staying committed to your investment plan throughout periods of market volatility will protect you from losing out on the growth opportunities of recovery, and provide the magic of compounding, O’Mahony adds. “Before you waver on whether or not to disinvest, remember the wealth of research that proves: setting your sights on time in the market is key to achieving your investment goals.”