Get Focus insights straight to your inbox

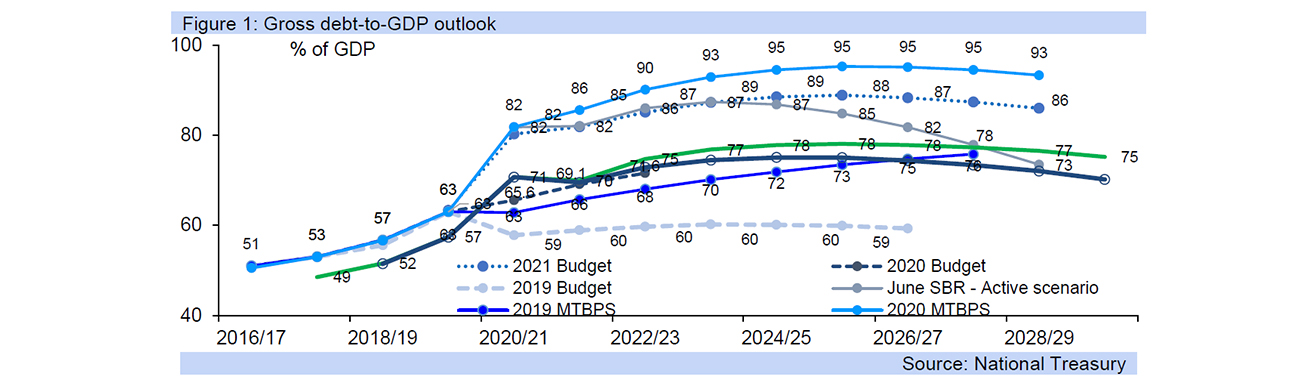

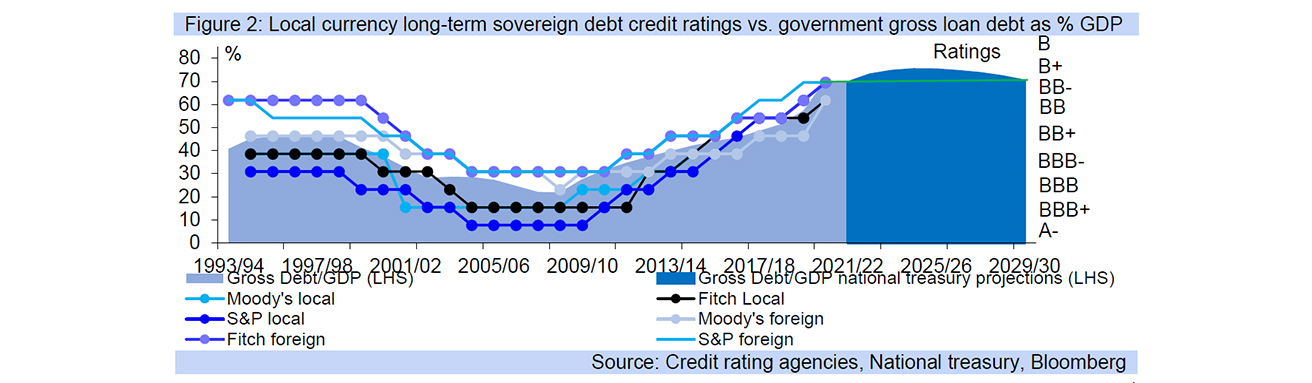

In his maiden full-year Budget Review, Finance Minister Enoch Godongwana announced a significant improvement in government’s debt to GDP projections and fiscal deficits. Over the medium-term, gross debt is now projected to stabilise at 75.1% of GDP in 2024/25, compared to previous projections of a 78.1% peak in 2025/26. This places SA on a firmer footing to avoid a downgrade from Moody’s. the rating agency currently has South Africa on a negative outlook, which should now become stable.

The borrowing requirement has been reduced, by R135.8 billion in 2021/22, and by R131.5 billion over 2021/22 and 2022/23 combined. Fiscal consolidation has clearly been deepened, and the revenue overrun is being used to shore up state finances, avoiding unsustainable expenditure hikes.

As a consequence of the R182bn revenue overrun from the 2021 Budget estimate for this fiscal year, and a R62bn overrun compared to 2021 MTBPS estimate for 2021/22’s revenue, the estimated budget deficit has dropped sharply to -5.7% y/y for this year (from the MTBPS’s -7.8% of GDP). However the deficit is still substantially wider than the -3.0% of GDP limit for recognised fiscal health.

A primary surplus is envisioned by 2024/25. Minister Godongwana has shown strong fiscal gains with the core message being that government is “on course to close key fiscal imbalances and restore the health of public finances."

With debt still to escalate to R5.4trillion (from R4.8trillion this year), gross debt has not yet peaked as a % of GDP and as such does not portend credit rating upgrades. But downgrades are also unlikely as long as the debt ratio returns to the current position by 2029/30 without slipping into B+ territory.

The budget deficit for 2022/23 is still forecast at -6.0% of GDP, as it was in the MTBPS, but then drops to -4.8% of GDP for 2023/24. Debt ratio projections are also lower than those in 2021’s MTBPS..

South Africa has benefited temporarily from the commodity boom, but without a dependable higher state revenue stream, longer-term consolidation will be more difficult, requiring a shift away from accelerating current expenditure. The Minister spoke against permanent social welfare increases, pressure from the public services wage bill and further bailouts for SOE’s.

Tax payers will be slightly releived, and the Minister's focus on debt reduction is positive for bond market as borrowings ease compared to projections. On balance, the budget is like to be viewed as credit neutral by the rating agencies. The NHI was not mentioned, while alcohol, sugar and tobacco product (sin taxes) rose again.

Overall, the budget is solid and pleasing, but there are still multiple risks which could derail it, including domestic political factors.

In addition to the commodity price dividend, substantially higher revenue collections reflect improved efficiencies at SARS. The rebuilding of SARS includes a multi-year modernization programme, while higher revenue collections have been recorded from personal income and value-added tax, as well as other sectors and other tax instruments.

As expected, the Minister highlighted that the economy is too weak for higher taxes and made good on the promise to cut the corporate income tax rate, to 27% from 28%. However, this on its own will not stimulate economic growth and employment in the private sector without a gamut of structural reforms repairing the necessary fundamentals for SA’s economy, including sufficient electricity and water supply, more efficient rail and port operations, a sharply reduced regulatory burden and increased ease of doing business.

Debt service costs (interest expenditure) continue to climb and are expected to average R333.4 billion a year over the medium term. However, government has been firm on increases in other forms of current expenditure, including SOE bailouts and higher civil servant renumeration, with the latter two highlighted as significant risks to fiscal sustainability. The Minister highlighted that South Africa needs to “reduce the continual demands on South Africa’s limited public resources from state-owned companies... SOCs need to develop and implement sustainable turnaround plans. The future of our state-owned companies is under consideration by the Presidential State-Owned Enterprises Council.”

Helpful to economic growth was the lack of increase in the petrol price, and indeed National Treasury has highlighted that a “combination of regulatory amendments can reduce the petrol price by 103.82 cents/litre, increasing GDP by 0.67 percentage points, by 2028.”

This was one of many factors in the budget which will boost confidence, but positive impact on the rand was muted. The domestic currency has instead been shaken by the Russian/Ukraine conflict. For SA, a net importer of oil, higher oil prices from an escalation in the Russian/Ukraine conflict would push up inflation.

Government did lift its GDP forecast, to 2.1% y/y from 1.8% y/y for 2022, as the commodity boom and global recovery has aided immediate growth prospects, but left 2023 and 2024 unchanged at 1.6% y/y and 1.7% y/y respectively, appearing to evince little expectation of a major growth impact from structural reform implementation that government outlined in the ERRP. Our growth forecasts in comparison remain above 2.0% y/y over the 2023 to 2026 period and reach 2.5% y/y by 2024 and close to 3.0% y/y by 2026.

However, the Minister highlighted that “we do not aspire to be a below 2 per cent growth economy. We are capable of so much more. In this regard, we are refining proposals for an expanded reform agenda – to shift our economy towards a higher growth trajectory.” This will likely tie in with the social compact for economic growth announced at the SONA and planned for later this year.

Get all Investec's insights on the latest Budget Speech and SONA

Our economists, tax experts, personal finance and investment strategists unpack what the latest fiscal measures mean for income, savings and daily expenses of individuals and businesses.