Ratings agencies - the elephant in the room

Tough fiscal environment

Following several years in which net debt has escalated from 18% of GDP in 2008/09 to an estimated 46% of GDP for 2017/18, and in which the Budget deficit has risen from -1.2% of GDP to an estimated -4.3% of GDP – with expenditure climbing from R0.7trn to R1.6trn as revenue lagged (R0.7trn to R1.4trn), 2018’s tabling of the Budget was always likely to show a tough fiscal environment.

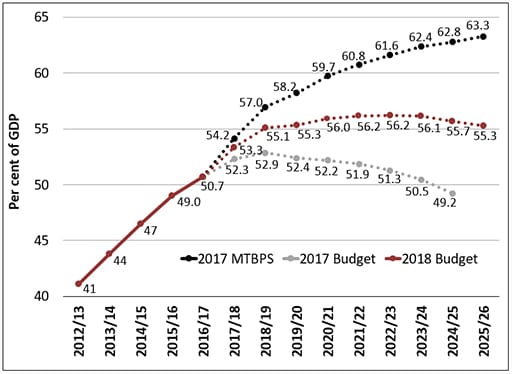

The commitment to turning this story around now, with the projected fiscal deficit falling to 3.5% GDP by 2020/21 (the end of the MTEF), coupled with the gross debt projections stabilising at 56% of GDP and then falling to 55% by 2025/26 (versus the 63% presented in the 2017 MTBPS), has likely made SA’s projected government finances more palatable to the rating agencies, and could be enough to avoid a Moody’s downgrade.

Get all Investec's insights on the latest Budget Speech and SONA

Our economists, tax experts, personal finance and investment experts unpack what the latest fiscal measures mean for income, savings and daily expenses of individuals and businesses.

Gross debt-to-GDP outlook

Source: National Treasury, Budget 2018

Download: Full Budget Review 2018

Moody's has already said that SA has made a number of credit positive strides since December 2017, and today’s Budget on its own does not necessarily argue for a credit rating downgrade. Certain components of the Budget are credit positive, especially the marked decline in projected borrowings.

Also read: SA downgraded but not out

Moody’s is expected to deliver judgement on or before 23rd March. Looking forward, the expected cabinet reshuffle is the next event which could provide further support to investor sentiment and the rand.

Is this budget sustainable?

Revenue plans

Government proposes to raise an additional R36billion in revenue in 2018/19, which along with expenditure cuts will reduce the Budget deficit, and fund the free education announced for poor and working class students . Proposals to raise another R15 billion in both 2017/18 and 2018/19 will be put forward in future budgets.

Download: Division of Reveue Bill

The value-added tax (VAT) rate has been increased by one percentage point to 15% and ad valorem excise duties for luxury purchases has been increased while the top four personal income tax brackets have not been adjusted for bracket creep (inflation), and estate duty has risen for estates worth more than R30m.

VAT will increase the cost of living for South Africans and we estimate a rise of at least 0.1% in CPI inflation over the next three quarter of this year and the first quarter of next, although the prior rand strength and lower fuel price increases have reduced the CPI inflation forecast for 2018 somewhat. CPI inflation should come out around 5.0% y/y this year and 5.3% y/y in 2019.

VAT will increase the cost of living for South Africans

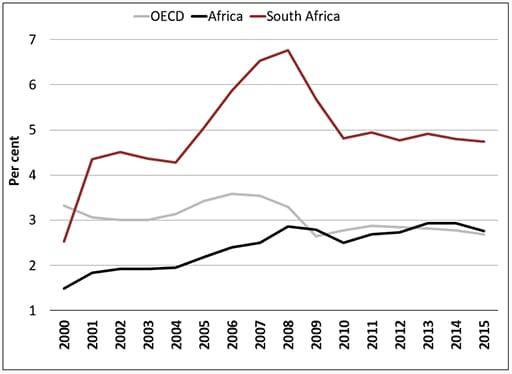

South Africa’s declining tax buoyancy has declined on weak economic growth, leading to the decision not to adjust income taxes further, while recognition was also given to last year’s increase in income taxes, and the lengthy period which has passed since a VAT increase (1993).

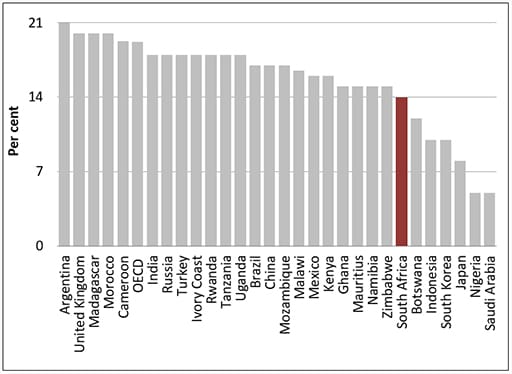

Corporate tax was not adjusted as this would reduce SA competitiveness globally, and have a negative growth impact. The US has reduced its corporate tax rate from 35% to 21% and the UK from 30% to 19%, while at 28% SA’s corporate tax rate is increasingly becoming an outlier, even to many other African countries.

Greater efficiency

SA managed to reduce the huge budget deficit it inherited, of above 6% of GDP in 1994 to a fiscal surplus in the 2000s, engendering tax cuts, credit rating upgrades to an eventual A grade status and strong economic growth and notable SOE infrastructure investment. Key to this consolidation of public finances was substantially increased efficiency and collections at SARS, and tax administration.

On SOEs and their governance, this year’s Budget says “in order to ensure proper governance of public entities and encourage accountability, government proposes that losses or expenditure classified as fruitless and wasteful will not qualify for a tax deduction”. The credit rating agencies have highlighted governance at SOEs as a key concern.

In order to ensure proper governance of public entities and encourage accountability, government proposes that losses or expenditure classified as fruitless and wasteful will not qualify for a tax deduction.

Other revenue changes

-

Carbon Tax Bill

The Carbon Tax Bill in August 2017 is expected to be enacted before the end of 2018, with the tax implemented from 1 January 2019 to the 2015 Paris Agreement of the United Nations Framework Convention on Climate Change.

-

Vehicle emissions tax

The vehicle emissions tax will be increased to R110 for every gram above 120 gCO2/km for passenger vehicles and R150 for every gram above 175 gCO2/km for double cab vehicles, effective 1 April 2018.

-

General fuel levy

Government proposes to increase the general fuel levy by 22c/litre and the Road Accident Fund levy by 30c/litre, effective 4 April 2018.

-

Plastic bag levy

The plastic bag levy is to be increased by 50% to 12c per bag, effective 1 April 2018, and the environmental levy on incandescent light bulbs will increase from R6 to R8 also from 1 April 2018.

-

Health promotion levy

The health promotion levy, which taxes sugary beverages, will be implemented from 1 April 2018.

-

Sin tax

Government proposes to increase excise duties on tobacco products by 8.5 %, and excise duties on alcohol by between 6% and 10%.

-

Medical tax credits

Over the next three years below-inflation increases in medical tax credits will help government to fund the rollout of national health insurance. The medical tax credit rises from R303 to R310 per month for the first two beneficiaries, and from R204 to R209 per month for the remaining beneficiaries.

-

Estate Duty

In line with Davis Tax Committee recommendations and the progressive structure of the tax system, estate duty will rise from 20% to 25% for estates worth R30 million and more. To limit the staggering of donations to avoid the higher estate duty rate, any donations above R30 million in one tax year will also be taxed at 25%. Both measures are effective from1 March 2018.

Comparative standard VAT rates by country*

Source: National Treasury, Budget 2018

* Rates are for 2017 and 2018. The OECD rate refers to an unweighted average

Initiatives to support growth

Government has examined areas to support economic growth initiatives, although little fiscal space is currently available for substantial help. SA will need to improve on this area to drive faster economic growth and job creation. The announcements include the pending approval of six special economic zones to benefit from additional tax incentives.

To further encourage investment, government is looking at ways to reduce complexity and backlogs relating to the R&D tax incentive that allows taxpayers to deduct 150% of expenditure on qualifying projects.

Government is also reviewing the generally successful employment tax incentive before it expires on 28 February 2019.

Corporate income tax as a share of GDP*

Source: National Treasury, Budget 2018

* Average corporate income tax to GDP ratios for OECD and 16 African countries (Cape Verde, Cameroon, the Democratic Republic of the Congo,

Ivory Coast, Ghana, Kenya, Mauritius, Morocco, Niger, Rwanda, Senegal, South Africa, Swaziland, Togo, Tunisia and Uganda)

On the expenditure side

Two major spending changes occur compared to the 2017 Medium Term Budget Policy Statement (MTBPS), namely “cuts identified by a Cabinet subcommittee amounting to R85 billion over the medium term, and an additional allocation of R57 billion for fee-free higher education and training".

Download: 2018 Estimates of National Expenditure

Improving economic outlook

National Treasury notes that “(t)he economic and fiscal outlook has improved since the October 2017 MTBPS. Investor confidence has grown on the promise of renewed policy coordination and effective implementation. Yet the challenges highlighted in October – rising national debt, significant revenue shortfalls and the precarious financial condition of several state-owned companies – remain central policy concerns.”

Also read: Gigaba's medium term budget is 'lacking in detail'

These are likely to also be the sentiments of the credit rating agencies, and Moody’s in particular.

Reducing the deficit

SA’s 2018 Budget shows lower than previously projected deficit figures and a stabilisation of debt over the medium term period, where the Budget deficit falls to -3.5% of GDP by the end of the period from the MTBPS’s estimate of -3.9%. Projected revenue collection for 2017/18 is projected to be R2.6bn higher than in the October 2017 estimate, but compared to the Budget in 2017 leaves a shortfall of R48.2bn.

The expenditure ceiling has been revised marginally down over the medium term but rises by R2.9bn in 2017/18.

Where the cuts are coming from

The expenditure cuts totalling R85bn over the MTEF period show “about R53bn has been cut at national government level, including large programmes and transfers to public entities. … [C]onditional infrastructure grants of provincial and local government have been reduced by R28bn. In addition, all national and provincial departments were required to reduce their spending on administration. The reductions exclude compensation of employees, which is already subject to a ceiling.”

The major additions to the framework following the 2017 MTBPS are:

-

National health insurance

Allocations of R4.2bn for national health insurance funded through adjustments to the medical tax credit, R490m to establish the Tirisano Construction Fund Trust and R1bn for the 2021 census.

-

Drought relief

A provisional allocation of R6 billion set aside in 2018/19 for drought relief in several provinces, assistance to the water sector, and public investment projects supported by improved infrastructure planning.

-

Fiscal risks and unforeseen developments

Additions of R5bn in 2018/19, R3bn in 2019/20 and R2bn in 2020/21 for fiscal risks and unforeseen developments, bringing the total contingency reserve to R26bn over the medium term.”

-

Social grants

An additional amount of R2.6bn to enable an above-inflation increase to social grants to partially offset the impact of tax increases on the poor.

-

Fee-free higher education and training

Allocations to fee-free higher education and training for poor and working-class students amount to R12.4bn in 2018/19, R20.3bn in 2019/20 and R24.3bn in 2020/21. This is in addition to a R10bn provisional allocation made in the 2017 Budget.

About the author

Annabel Bishop

Chief Economist of Investec Ltd

Annabel holds an MCom Cum Laude (Economics and econometrics) and has worked in the macroeconomic, risk, financial market and econometric fields, among others, for around 25 years. Working in the economic field at Investec, Annabel heads up a team, which focusses on the macroeconomic, financial market and global impact on the domestic environment. She authors a wide range of in-house and external articles published both abroad and in South Africa.