Buy-out market is darkest before the dawn

There’s been no escaping the Brexit chill in UK buy-outs over the past six months. But with hotspots in Europe, the mid-market, the tech sector – and a well stocked deal pipeline – the latest CMBOR data suggests a thaw is coming once UK/EU uncertainties are resolved.

There’s no way to sugar-coat it: the European private equity market has not fared well in the first half of 2019. A Brexit-fuelled chill has taken hold after a record-breaking 2018 for deals, according to provisional half-year data from the Centre for Management Buy-Out Research (CMBOR) at Imperial College Business School, sponsored by Equistone Partners Europe and Investec Corporate and Investment Banking.

The number of private equity-backed deals across Europe in H1 2019 dropped 28% to 276, with total deal value down 41% to €38.8 billion versus H1 2018.

The UK showed the most pronounced fall, with deals valued at just £6.1 billion – which includes Europe’s biggest transaction of the half, Travelport’s £3.5 billion public-to-private deal. That compares to £10.1 billion in H1 2018 and £12 billion for the second half of last year.

UK mid-market remains resilient despite Brexit chill

While the UK may have ceded its crown for aggregate value of deals completed to the Netherlands, it remains the most active region in Europe (in terms of deal numbers) bolstered by a robust mid-market.

71

>85%

There’s no escaping the effect Brexit has had on deal activity, of course. “The EU referendum cooled buy-out levels in 2016, only to be followed by two record years for the post-crisis period, firstly in the UK and then across Europe,” says Christian Hess, Private Equity Client Group Head at Investec. “It’s unsurprising that the formal departure date and subsequent delay proved to be the next ‘crunch point’, prompting dealmakers to push deals over the line late last year or hold off in the short term.”

Dealmakers, then, will be ruing the decision to extend Article 50 beyond 31 March, and will be hoping the new PM will be able to provide clarity ahead of the 31 October deadline to avoid further delays. But the low level of exits that have taken place in the UK, in particular, means there is pressure building in the pipeline to do deals once clarity emerges.

“Despite a fall in value, the UK retained its status as Europe’s most active buyout market with more than 70 deals over the period. Over 85% of these were valued at £50m or less, underlining the expanded role of private equity in supporting the growth of the next generation of British businesses,” said Shaun Mullin, Investec Growth & Leveraged Finance.

Europe: a mixed bag

The CMBOR data was considerably lumpier in continental Europe, where lower overall deal activity masked interesting local variances. H1 2019 saw 205 deals, down 23% on H2 2018 and a third on the same period last year. Deal values were down by an even bigger percentage.

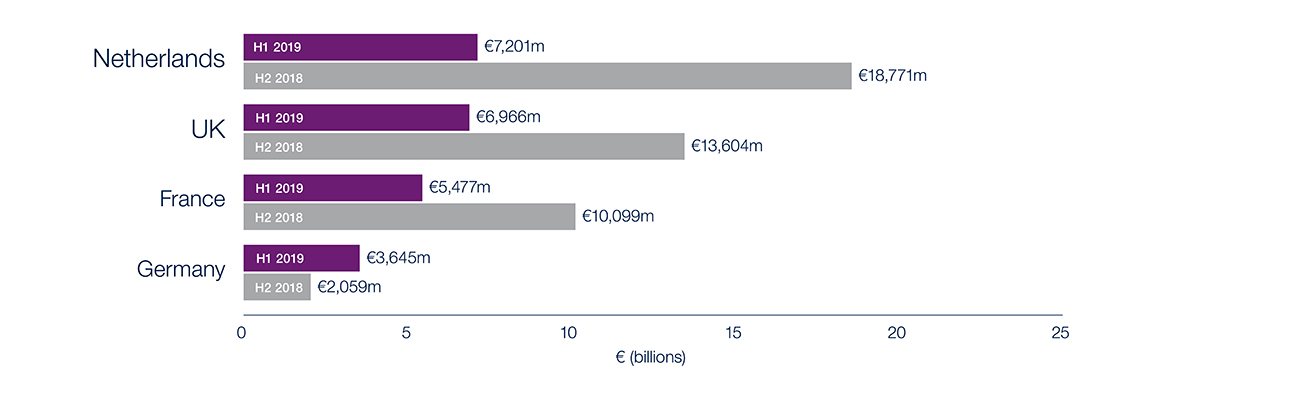

But the Netherlands continued to punch above its weight, with 31 deals for €7.2bn in H1 – including three of the continent’s seven biggest buy-outs so far this year. In Germany, meanwhile, buy-out values picked up from the preceding six months in 34 deals valued at €3.6bn, up from €2.1bn, a 72% increase.

Despite the UK delivering the biggest deal in the first half, outside that, it’s the Europeans that are dominating the upper end of the market right now. There’s €30bn-worth of major deals looking likely in the second half – as much, by value, as all the deals in continental Europe in H1. These include an EQT-led consortium’s prospective €9bn acquisition of Nestlé Skin Health and Apax Partners and Warburg Pincus’s £2.6bn take-private of Inmarsat.

Value of private equity-backed acquisitions by country

This chart demonstrates the value of private-equity backed acquisitions by country H2 2018 vs H1 2019.

Hot-spots amid the chill

Even with macro-economic, geopolitical and Brexit-related uncertainties subduing overall deal activity, there have been welcome signs of resilience in the market.

Its not just the UK lower mid-market that held up well: Continental European buy-outs valued at between €50m and €500m, dipped only slightly in volume from the prior half year (from 58 to 52), and rose in terms of aggregate value, from €7.6bn to €8.3bn. And with 208 transactions worth between £10m and £25m, Q1 2019 delivered the fifth-highest quarterly total in the past five years for smaller deals.

“Overall it is not that surprising to see the quarterly volatility around key Brexit events. What is encouraging is that there remains a strong underpin to deal doing – the pipeline is good, there is a ready supply of attractively priced equity and debt capital, and high levels of pent-up demand. Market participants we talk with remain keen to transact for quality businesses,” says Investec’s Callum Bell, Head of Lending.

The CMBOR research shows the technology sector to have proved particularly resilient, as it has since the original Brexit vote. Despite a slowdown in the second quarter, H1 2019 saw 66 deals – well in line with the average over the past five years – for a total of €12.7bn. That’s by far the sector’s best half for deal value in the past five years and makes TMT (technology), for the first time, the most valuable sector in CMBOR’s dataset.

Exits pursued by bears?

The marked fall in private equity exits in Europe – 153 deals for €32.5bn for the half – follows a six-year bull run of €99bn-plus exit totals each year. But it’s notable that 2018 was the first year since 2009 that the total value of new investments across Europe exceeded exits.

A big driver of that uptick is likely to be a fall in secondary buy-out (SBO) activity: 76 SBO exits valued at €12.3bn accounted for 38% of European deal value in H1 2019. That compares with 45% in H1 2018 – when 113 SBOs delivered €24.9bn of exit value. Take privates, by contrast, have risen from seven to nine year-on-year.

| Exit type | H1 2018 | H2 2018 | H1 2019 |

| Secondary buy-out | £3.5bn | £5.9bn | £0.8bn |

| Trade sale | £3.9bn | £10.6bn | £1.1bn |

Exits in the UK dried up in H1 – but that suggests massive pent-up demand once Brexit uncertainties clear, especially given the UK’s historically robust MBO/MBI activity.

“Private equity has made a concerted effort to harvest portfolios in recent years but now appears to be leaning towards holding onto quality remaining assets,” explains Hess. “On the buy-side, investors have responded by looking for potential buy-out opportunities outside of secondary deals, including in partnership with entrepreneurs and through PTPs.”

Renewed confidence in the medium term outlook should see UK SBOs bounce back from historic lows, driving a surge in transactions for PE overall – and building on the hotspots in Europe and the UK to deliver a more robust second half.

Discover our private equity offering

Browse articles in

Please note: this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This page does not constitute a personal recommendation and is not investment advice.