Energy market podcast

17 November 2025

Head of commodities, Callum Macpherson, provides a weekly update on the movements and changes impacting the oil market.

8 min podcast

Practically, this means that oil-consuming companies – in particular fuel-intensive businesses such as transport and logistics companies – have been able to make material cost savings.

At some point though, lock-downs will ease and demand will increase again.

In the meantime OPEC and other producers such as Russia have committed to cutting production in May by the equivalent of nearly 10% of the pre-coronavirus global level of demand. They have said that some level of cuts will continue until 2022 in order to draw down the large amount of oil that is currently going into storage.

The market may remain in oversupply for some time to come, but this situation will not last forever and it’s possible that some sources of oil production that go off-line during this period cannot be brought back into production again, unless oil prices move much higher.

To hedge against this risk, consumers are using swaps to lock in lower pricing over the next one or two years. In recent weeks, we have seen more and more enquiries from diesel consumers, and over the page, we look at how these swaps work in practice.

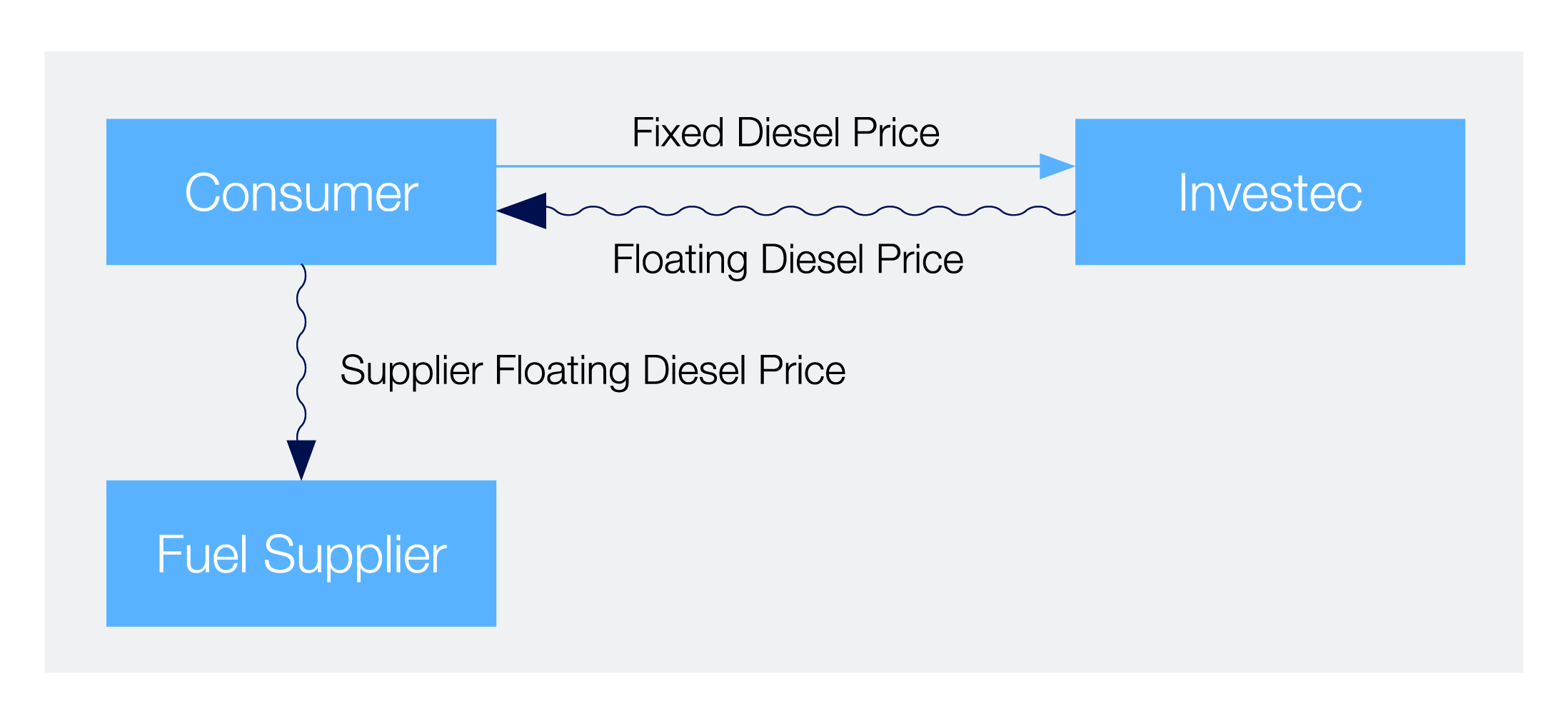

A swap contract provides a way to offset changes in the cost of physical product purchases. It has the effect of locking in the cost of buying the diesel, without having to change physical supply arrangements.

Here's how it works:

If the price of diesel falls, because the swap leaves the consumer locked into a fixed price, the consumer will not benefit from the price falls – they are locked into an above market price. If diesel consumption turns out to be less than the volume hedged and the market falls, then the consumer will experience a loss. This is because they will still need to pay out on the full volume of diesel pre-agreed in the swap.

Browse articles in