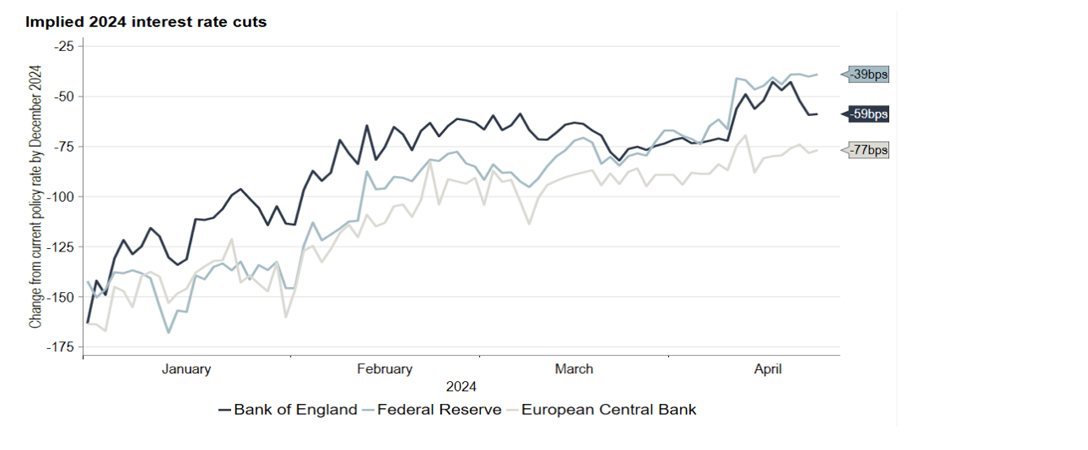

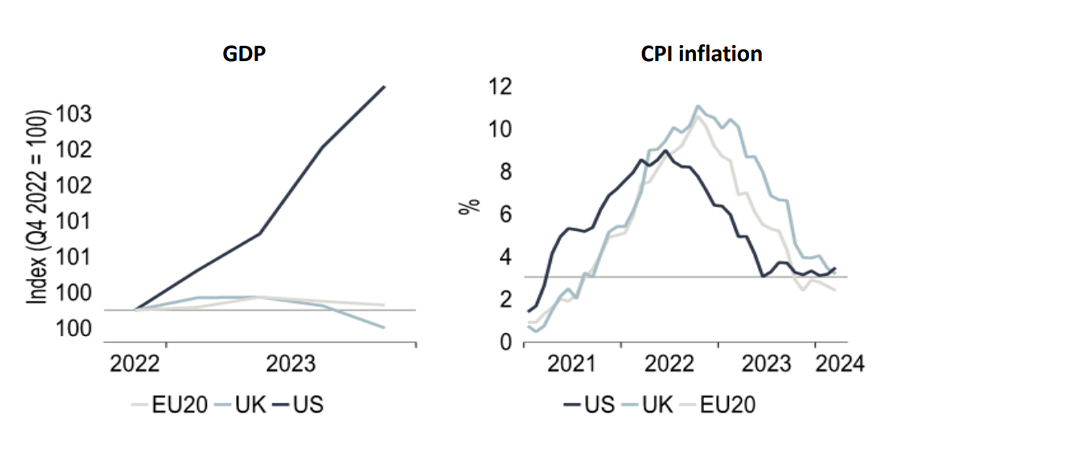

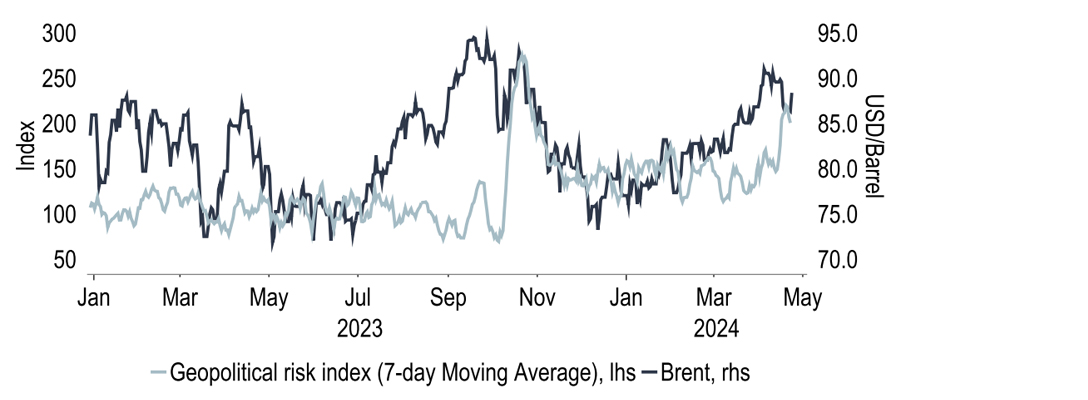

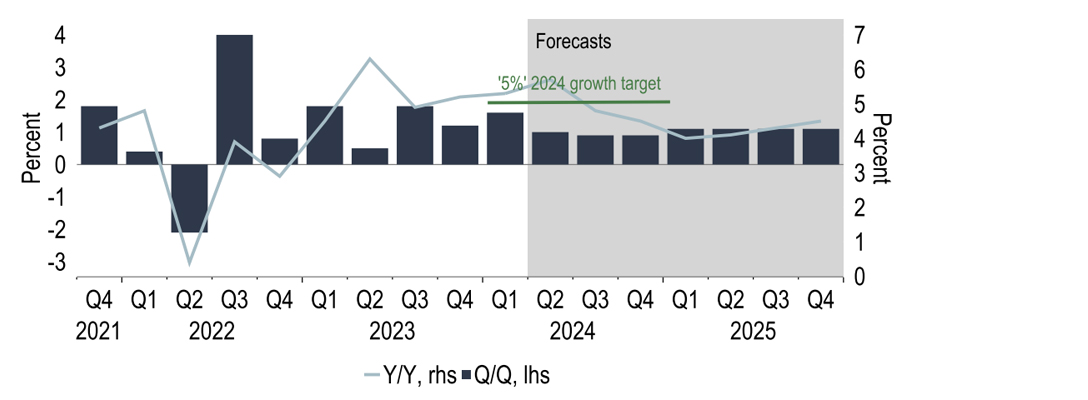

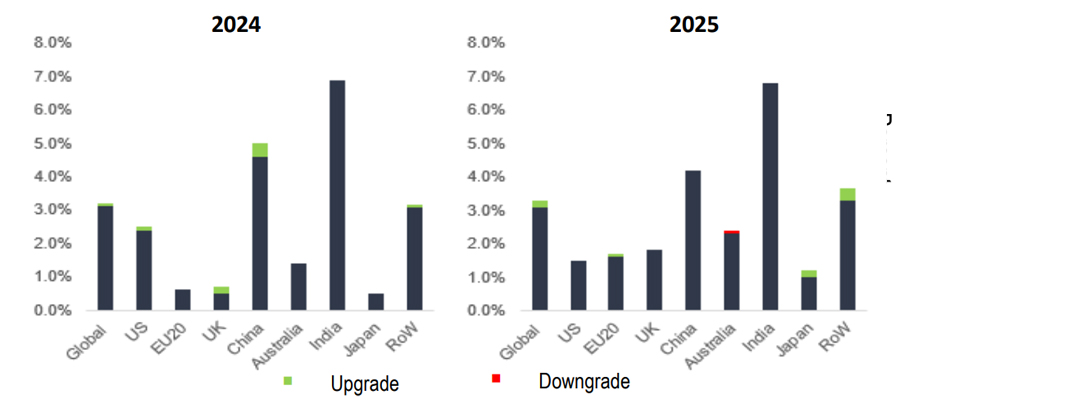

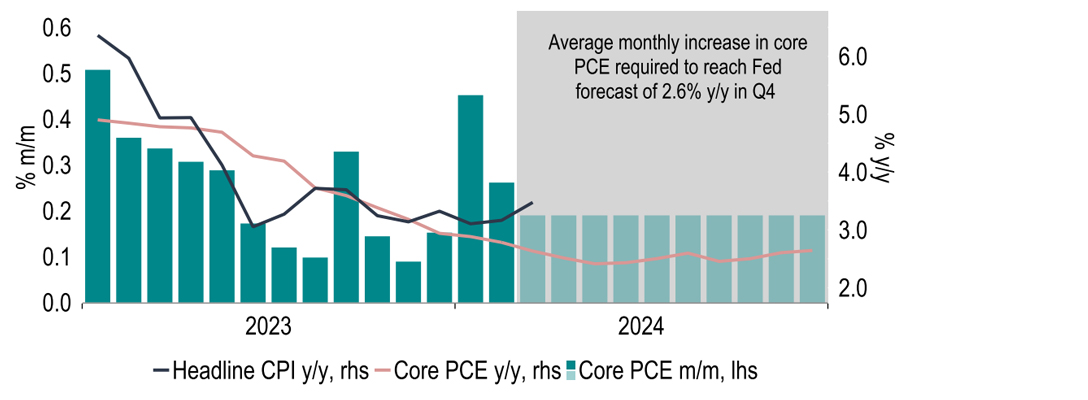

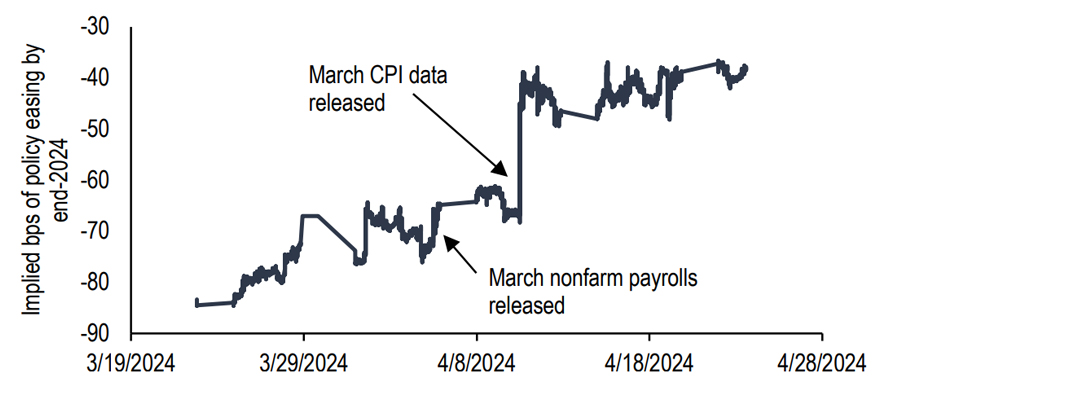

Markets have again reassessed the Fed outlook this month following another disappointing CPI print. This is a fact that has had ripple effects across global bond markets and expectations for monetary policy this year. However, does a later Fed cut really have an impact on the timing of easing elsewhere? We suspect not given the divergent economic trends between the US and the likes of the UK and Euro area. As such we suspect that there will be a decoupling in the timing of policy easing, with the ECB and BoE assumed to cut rates before the Fed. Any easing this year however remains dependent on the path of inflation, with geopolitical developments in the Middle East adding a renewed upside risk, although absent a regional conflagration we do not foresee this derailing Western monetary policy easing. Meanwhile, our view of global growth has seen a small upgrade with 2024 now standing at 3.2% thanks to upgrades to China and the US. Whilst 2025 has also been lifted to 3.3%.

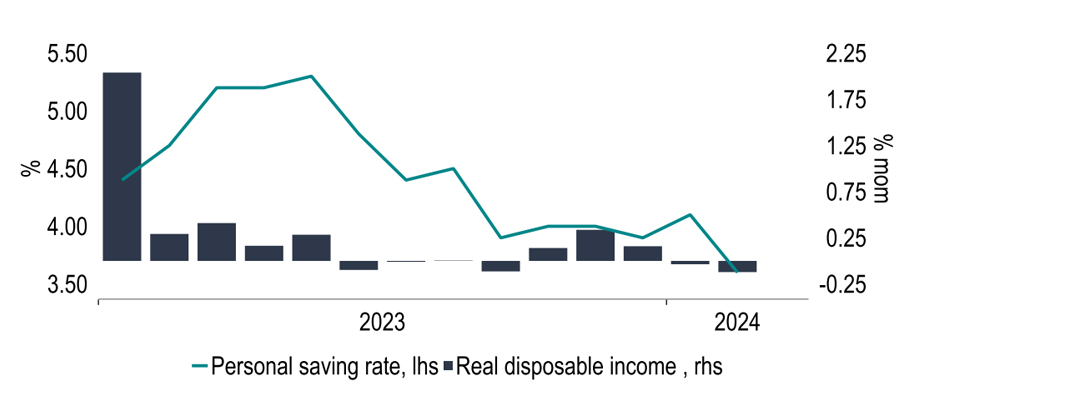

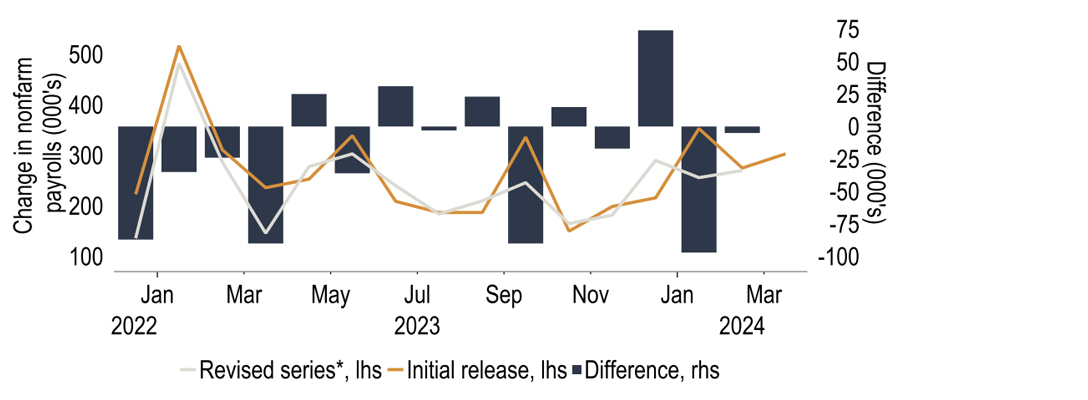

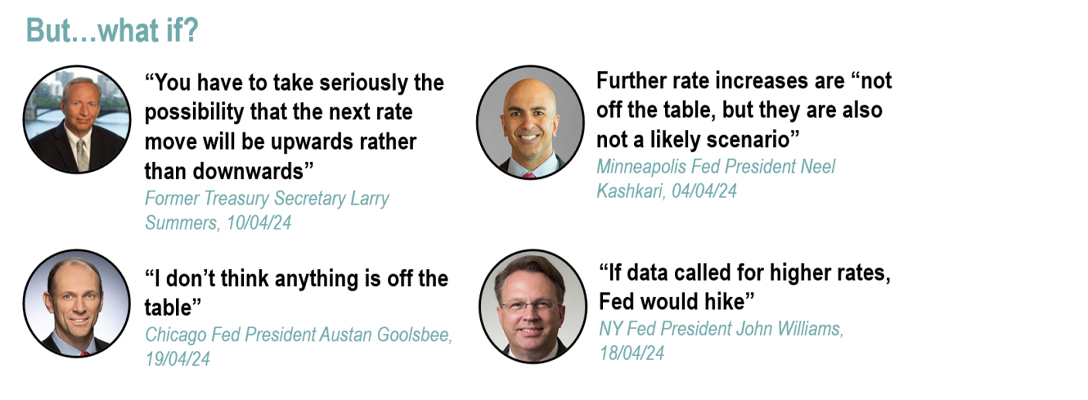

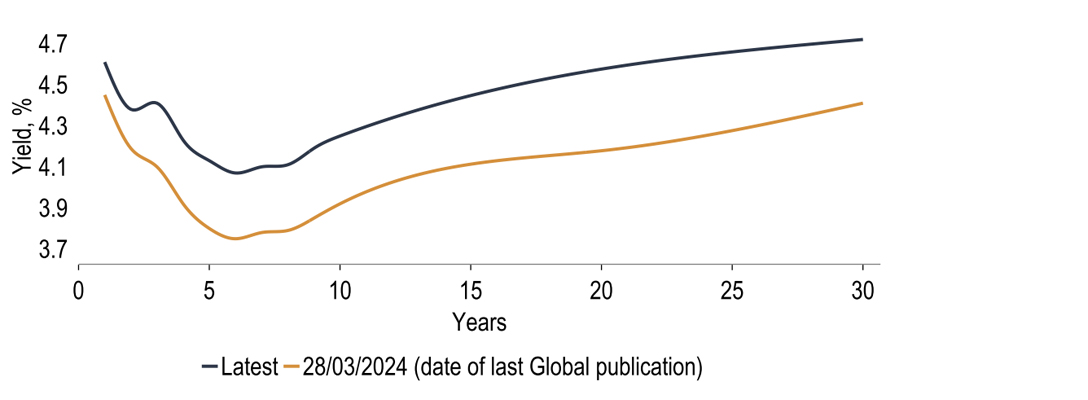

Market expectations of Fed rate cuts have been scaled back again, primarily due to a poor March CPI and continued strong economic momentum. Also, job growth has been buoyant, but we note that non-farm payrolls have tended to be revised down over the past year or so and other indicators hint at a loosening labour market. A restrictive stance of monetary policy ought to slow demand and we stand by our call of a September rate cut followed by a December move. We have though trimmed our view for 2025 to four cuts from five. The current curve is pricing in a policy rate in excess of 4% in the medium-to-long term, which we consider to be unrealistic and our base case is that Treasury yields subside again following another nervous sell-off. There has been more public talk over the possibility that the next FOMC move could be a tightening. This is not our central view, but one which we cannot totally dismiss.

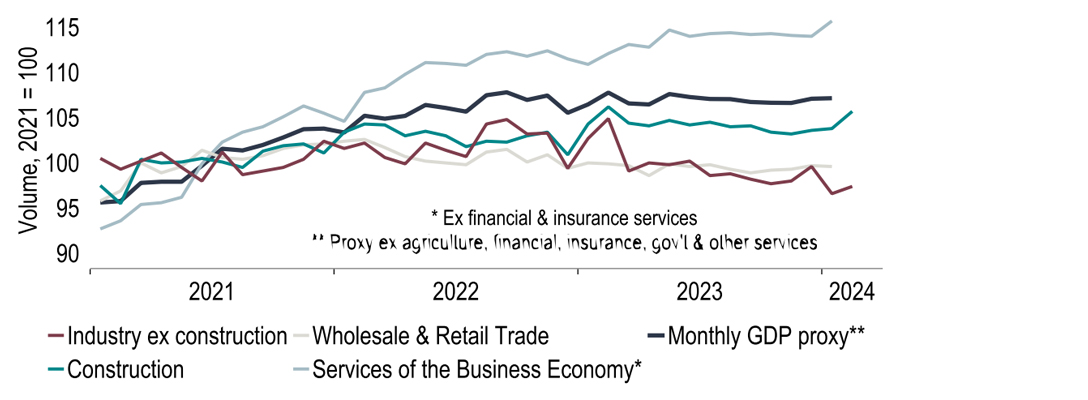

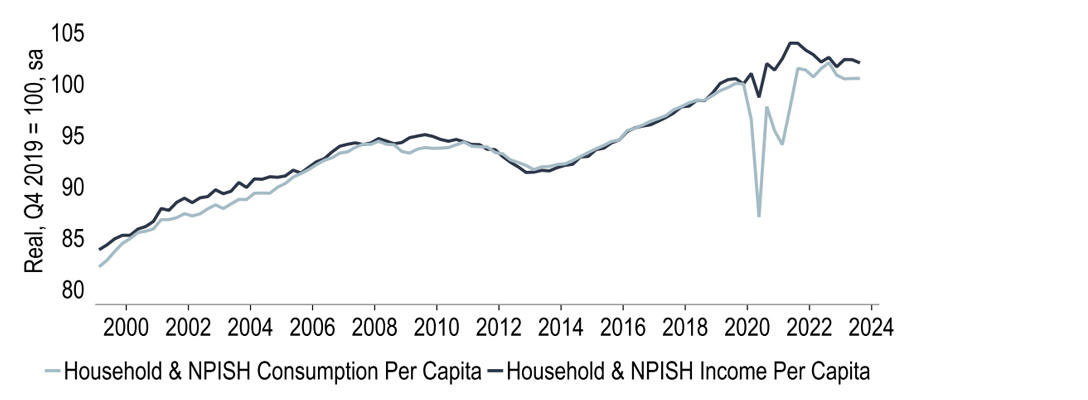

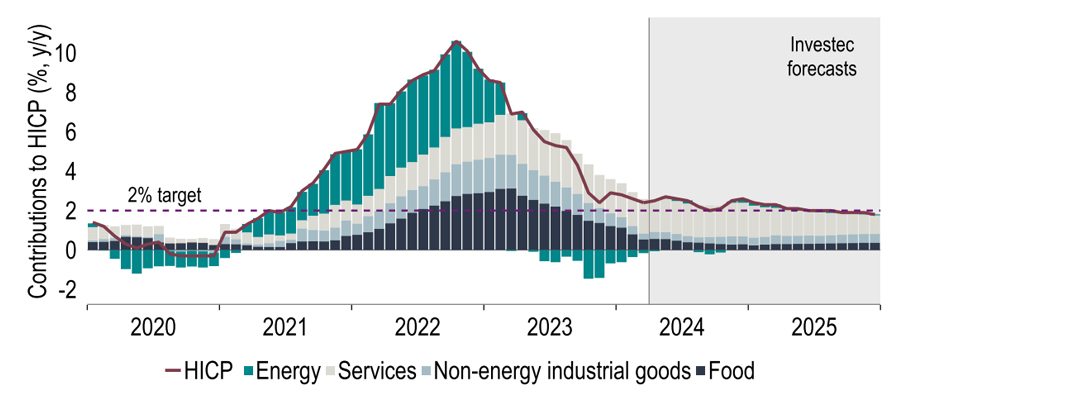

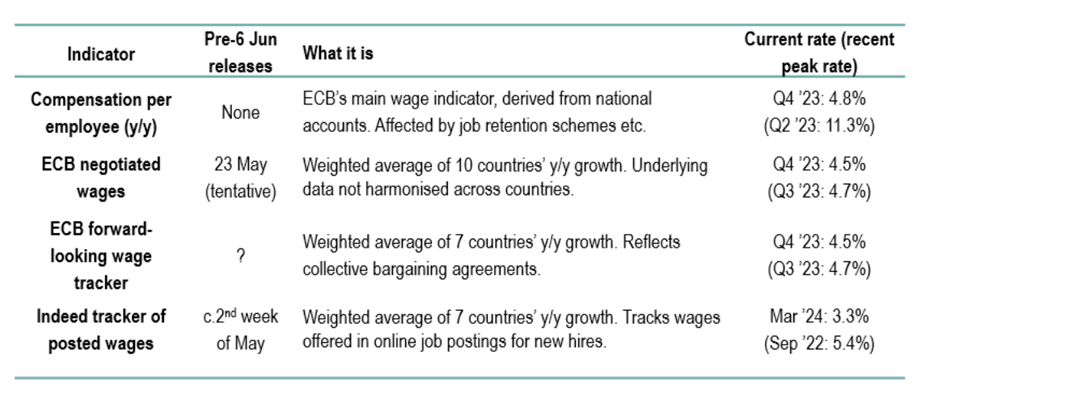

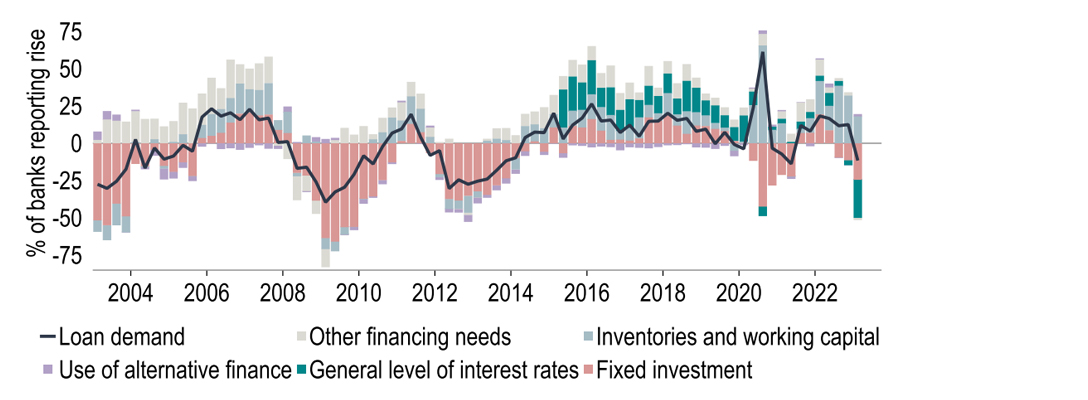

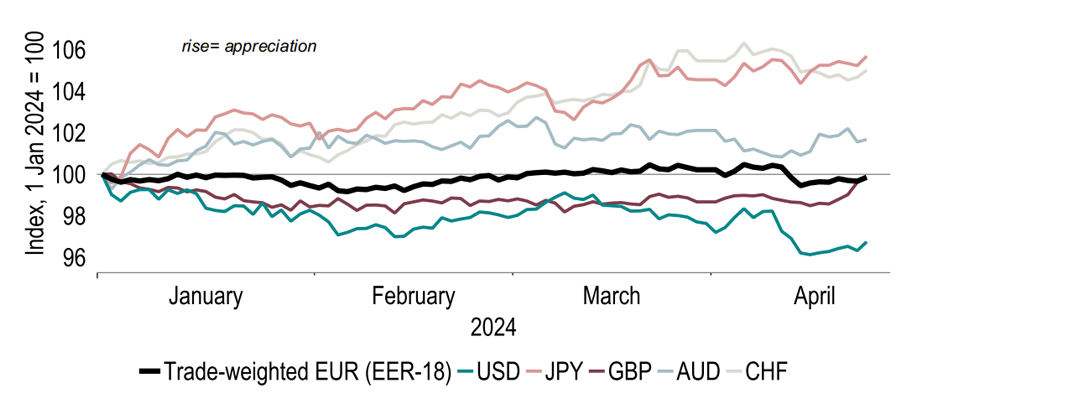

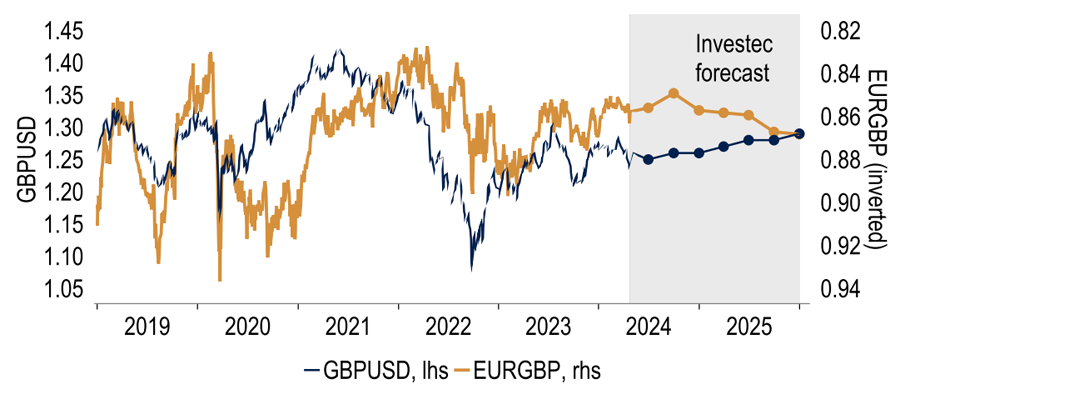

Revisions show the Eurozone to have tipped into a recession after all during H2 2023, albeit by the narrowest of margins. But the latest ‘hard’ monthly data corroborates the improved trend in surveys and points to renewed expansion from Q1. Our GDP growth forecast for this year is unchanged at 0.6%; for 2025 it is 0.1%pt higher, at 1.7%. Rising real incomes, amid lower inflation, should aid recovery, as should rate cuts. We continue to expect three 25bp cuts from the ECB this year, starting in June, and four further moves in ‘25: the pre-conditions for rate reductions the Governing Council had set out now look met. Less helpful for growth, in some countries, is fiscal policy: France too has had to find extra savings in its 2024 budget plans, joining Germany. For the euro, we expect some appreciation against USD and, to a lesser extent, against GBP.

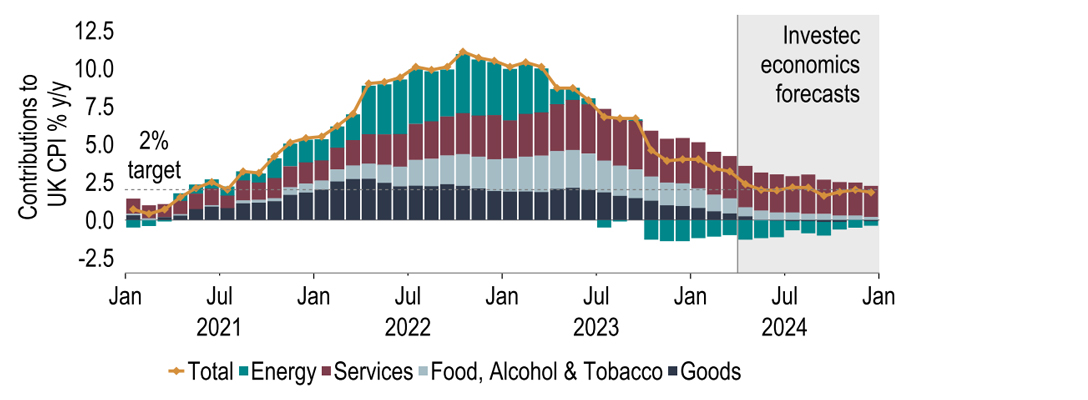

The data published so far this year have pointed to the UK economy having exited recession in Q1, as we expected. In fact, the recovery has been a little stronger than we anticipated, leading us to lift our GDP forecast for this year by 0.2%pts to 0.7%. Next year’s forecast remains unchanged at 1.8%. The economic outlook is brighter thanks to lower inflation and fiscal measures supporting growth. This naturally prompts the question as to whether interest rate cuts will be appropriate in this environment. We think so. There is a risk that rates remain higher for longer, but considering lower inflation expectations make real rates increasingly restrictive, we think the MPC will opt to dial down some of this restrictiveness, possibly from June. We expect three 25bp reductions this year, and 100bp of cuts next year (prior: 125bps in ‘25).

For more information contact our economists

Philip Shaw

Chief Economist

I head up the Economics team for Investec in London after joining in 1997. I am a regular commentator on the economy and financial markets in the press and on TV. I graduated with an Economics degree from Bath University and a master’s in Econometrics from the University of Manchester. I started my career in the Government Economic Service at the Department of Energy before joining Barclays as an economist/econometrician.

Ryan Djajasaputra

Economist

In 2007, I joined Investec as part of the Kensington acquisition, before joining the Economics team in 2010. I provide macroeconomic, interest rate and foreign exchange analysis to Investec Group and its corporate clients. After graduating with a Bachelor’s degree in Economics from UWE Bristol.

Lottie Gosling

Economist

I joined the London Economics team at Investec as a graduate in September 2023. I graduated with a Bachelor’s degree in Economics from the University of Bath with a year-long placement working as an Economic Research Analyst at HSBC.

Ellie Henderson

Economist

I joined Investec in February 2021 as part of the London Economics team, providing economic advice and analysis for the company and its clients. Before joining Investec I worked as an economist for Fathom Consulting, where I predominantly focused on China research. I hold a Bachelor’s degree in Economics from the University of Surrey, as well as a Master’s degree in Economics from Birkbeck, University of London.

Sandra Horsfield

Economist

I am part of the London Economics team, having joined in 2020, providing macroeconomic analysis and advice to the Investec Group and its clients. I hold a Bachelor’s and a Master’s degree in Economics, both from the London School of Economics. I have over 20 years’ experience as a financial markets economist on the buy and sell side as well as in consulting.

Get more FX market insights

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.