The World Ahead 2022: global trends to watch

02 December 2021

These are the top ten forces that will be shaping the world in 2022, according to The Economist.

6 min read | 60 min video

Heading into 2022, pandemic-induced inflation and supply chain concerns are driving the global economy. In our annual look ahead, we explore whether these will be temporary and what the coming year has in store for us.

As we turn to 2022, we expect the coming year to be one of transition from the immediate post-Covid crisis recovery towards the ‘new normal’.

That is not to say these conditions are in store as yet. At least to begin with, the global economy is dealing with hangover effects in the form of ongoing mismatches in product and labour markets, which will take some time to work off. The worries about inflation that have sprung up during the latter part of 2021 therefore look likely to stay for a while longer.

But high prices give ample incentives to ramp up production of goods in particularly high demand, such as semi-conductors. This should help supply chains gradually unclog. Higher wages too will pull more people back into the labour market, alleviating some of the current global labour shortages. There is therefore a self-correcting element to high inflation. But in the transition to more normal conditions, higher interest rates will also become part of the wider picture, with the UK and the US both embarking on a path of tightening to prevent above-target inflation from becoming entrenched.

All this, however, rests on the crucial assumption that Covid-19 will be kept at bay through the existing vaccination programmes and recently developed therapeutics – without the Omicron variant, B.1.1.529, tarnishing their efficacy. Should this not be the case, all cards are in the air once more.

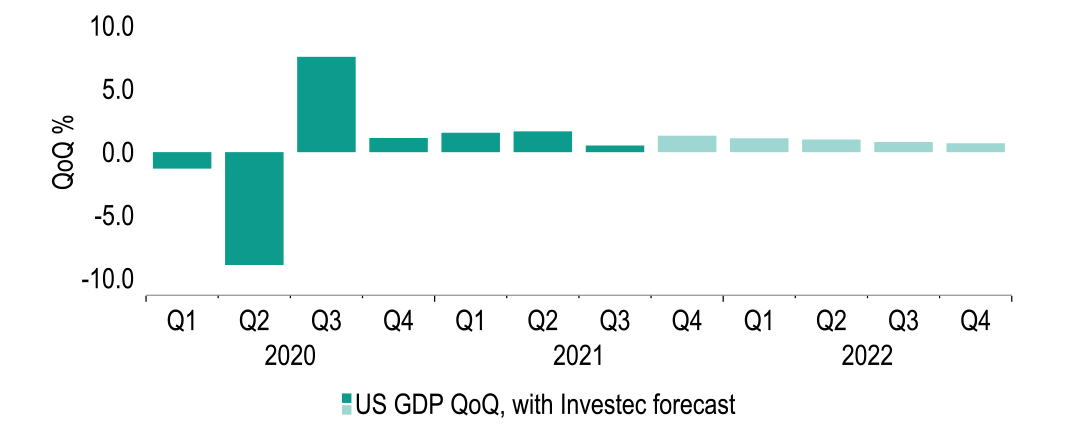

As 2021 draws to a close, global economic performance continues to be influenced by Covid-19, as well as supply issues and inflation pressures that have intensified over the second half of the year. Nonetheless, activity on the whole should end the year on a solid note, with indicators from the US and the UK surprising on the upside. The US in particular looks set to record robust fourth quarter growth of 1.3%. Overall, 2021 is expected to see global growth of 5.5%, which was slightly downgraded from 5.6%. Looking into 2022, some familiar themes are set to be carried over into the new year. Elevated levels of inflation and whether this ultimately proves transitory will be key. We believe elevated inflation is a temporary phenomenon, as are the supply issues that are showing tentative signs of improvement.

One such supply side issue that impacted economic activity in 2021 was labour shortages, as factors such as lifestyle changes in response to the pandemic –for instance early retirement – and changing migration trends resulted in a decline in available labour. Specific areas, such as HGV drivers, have been harder hit than others, with employees reportedly failing to return to the industry after finding alternative employment at the height of the pandemic. The shortages, particularly in terms of the misallocation of labour, are contributing to the wider goods shortages and the inflation outlook. This can be seen in Malaysia, where a decline in migrant labour has hit vegetable oil production, pushing up global food prices.

Although the shortfall in labour supply is certainly exacerbating goods shortages, a host of factors are contributing to the reported deficits. Production of semiconductors, for example, has also been limited by Covid-19 lockdowns, adverse weather and power shortages. When met with a burst in demand for goods during the pandemic, output struggled to keep pace with new orders, resulting in shortages. However, looking ahead to next year, there are promising signals that pressures are easing. One such indication is semiconductor lead times, which in October increased at the slowest pace for nearly a year.

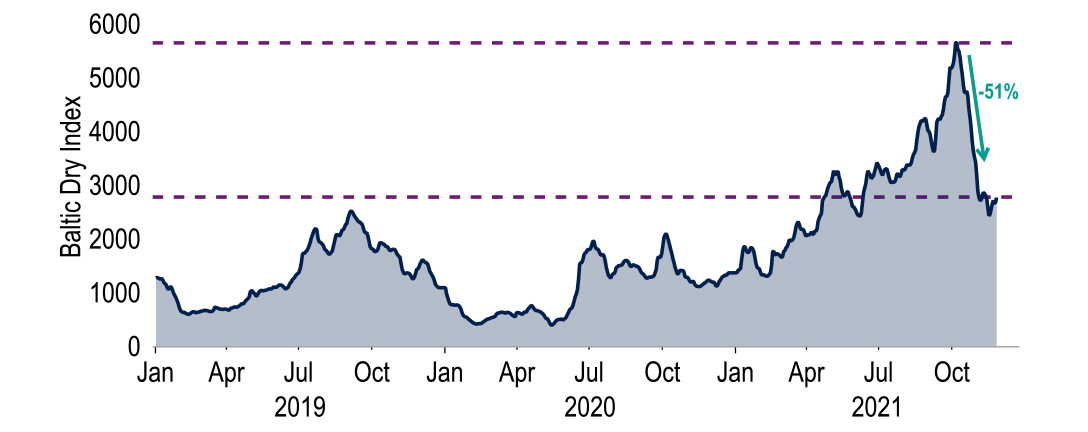

A fall in shipping costs also points to an easing in disruptions heading into 2022

*Baltic Dry Index measures average prices paid for the shipping of dry bulk, such as iron ore. Source: Macrobond

What has become clear is the current shortages are due to a multitude of pressure points across the supply chain being triggered at once. The shipping of goods is included in this, with pandemic-related disruptions resulting in a lack of effective container ships – at the peak, over 37% of ships were stuck in ports. This was reflected in spiralling shipping costs. Encouragingly, these have since started to decline, suggesting that shipping constraints are also showing signs of peaking. That said, supply shortfalls are still severe, and any easing will no doubt be a gradual process as backlogs are cleared. As such, shortages are highly likely to continue into 2022, impacting the economic outlook.

“The 2022 outlook for global growth remains favourable and our forecast stands unchanged at 4.5%.”

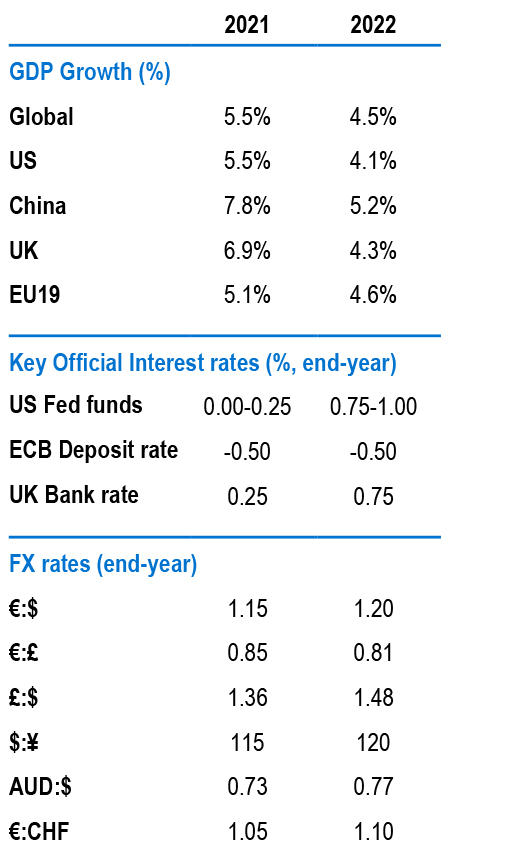

However, on the basis that these headwinds do fade, the 2022 outlook for global growth remains favourable and our forecast stands unchanged at 4.5%. This should be supported by some recovery in output as supply issues, such as the semi-conductor shortage, ease. Fiscal policy will also remain supportive in some jurisdictions, such as the EU, Japan and the US. At the country level, the major advanced markets are expected to grow in excess of 4%. Meanwhile, China is expected to grow by 5.2%, with an easing of the recent power supply issues supporting a near-term rebound. However, the emergence of the Omicron variant puts our baseline case at risk. At present, we have not reflected this in our forecasts as we await clear information on its characteristics.

Covid-19 will remain a question for markets, as will monetary policy. On the latter, 2022 should see a concerted effort globally to rein in the ultra-loose policy of the last 18 months. Most critically, we expect the Federal Reserve to raise rates by 75 basis points over the year. Tighter interest rate policy should also be seen from the BoE, the Reserve Bank of New Zealand, the Reserve Bank of Australia and the Bank of Canada. Rates will, however, not be the only tool being addressed, with quantitative easing (QE) likely to end amongst all the major central banks, except perhaps the Bank of Japan. The BoE is likely to begin QT. Questions remain around the reaction of risk assets, especially if pay accelerates sharply, threatening more aggressive tightening. However, for now, the Omicron news is the key driver.

The pace of economic growth in the US moderated somewhat in the third quarter, as activity was held back by a resurgence in Covid-19 infections and Hurricane Ida. Although we are expecting a rebound in the fourth quarter, this is unlikely to offset the softer third quarter and, as such, we have downgraded our 2021 forecast to 5.5% from 5.8%. Heading into the new year, we expect the economy to maintain the strong momentum from the fourth quarter and receive a further boost from a levelling off in supply constraints. Accordingly, we have upgraded our 2022 forecast to 4.1% – up from 3.8%. The spike in inflation does remain a risk to this view, but current data indicates that high levels of excess savings accumulated over the pandemic are cushioning the impact on households.

US GDP growth slowed in Q3, but the outlook is positive further ahead

Source: Macrobond, Investec forecasts

However, this protection largely depends on the extent of the rise in prices. On an annual basis, inflation measured by the Consumer Price Index (CPI) exceeded 6% in October – the fastest rate of increase in over three decades – and is set to rise further. Despite this, we – as well as the Fed – still deem the current price spike to be ultimately transitory, although there are increasing concerns regarding the broadening out in price pressures. The majority of sectors, 60 out of 68, are now reporting price increases, with nearly 90% of these clocking increases of above 2% on the year. This measure of inflation breadth demonstrates that price pressures are no longer concentrated within specific areas of the US economy.

In addition to the spread of inflation is a broadening in wage increases. The US Employment Cost Index (ECI) rose by 1.3% in the third quarter, a joint 30-year high. Though pandemic-hit sectors saw the biggest increases, a whopping 26 of the 28 categorised industries saw rises of 1% or greater. An important feature of the ECI is that it is mix-adjusted and not easily distorted by compositional factors, such as salary-based proportions. The view that inflation is transitory is difficult to defend if wages accelerate, with the potential for second-round inflationary effects. This conundrum is likely to give the Federal Open Market Committee (FOMC) a headache going forward.

“FOMC rate hike timing will be a major story over 2022. Due to upside inflation surprises, we now expect three increases next year, starting mid-year. This should take the Federal Funds Rate target range to 0.75%-1.00% by year-end.”

FOMC rate hike timing will be a major story over 2022. Due to upside inflation surprises, we now expect three increases next year, starting mid-year – instead of our previous forecast starting in the first quarter of 2023 – taking the Federal Funds Rate target range to 0.75%-1.00% by year-end. The Federal Reserve has only set the pace of tapering of its monthly QE purchases for November and December this year – to $105bn and $90bn, down from $120bn. A $15bn per month ‘autopilot’ tapering would result in QE ceasing by June. Instead, we expect the central bank to use its optionality and speed up subsequent tapering, perhaps to $30bn per month, enabling it to finish QE in March and allowing it to prepare markets for a second quarter hike, which we think will occur in June. This is not a slam dunk.

The Federal Reserve could adopt a very broad interpretation of full employment, a key threshold for raising rates. In October, employment was still 4.2 million below its pre-pandemic peak. But the committee might also want to take into account population growth and assume that the employment-to-population ratio for over 16s will return to February 2020's level of 61.1% – compared to October’s 58.8%. Across a population of 262 million, waiting for this to occur, rather than pre-empting it, would imply that six million extra jobs are necessary before rate lift-off. Nor can we speculate over the impact of the new Omicron Covid-19 variant, which could delay the start of policy normalisation beyond next June, perhaps even to 2023.

President Joe Biden’s Build Back Better bill has not yet seen the light of day in the Senate after in-party battles between moderates and progressives provoked by the wafer-thin Democratic majorities in each chamber. Midterm elections on 8 November 2022 may well define the scope of Biden’s policy agenda over the second half of his term. As well as the re-election of the entire House of Representatives, 34 Senate contests are due, with 20 of them held by Republicans. In theory, the Democrats have an opportunity to gain workable majorities. Right now though they are struggling, having lost the governor race in Virginia, while Biden’s approval ratings are highly negative. The midterms may instead be a battle to save the Democrat majorities and prevent total policy gridlock.

The key development in Europe this month was the unfortunate worsening of the pandemic picture. Covid-19 cases in many European countries are now at record highs. Vaccination rates are lower than in the UK in some places, but the key difference is lower herd immunity. A greater proportion of Brits has had the virus and developed antibodies. To curb pressures on healthcare systems, some countries are reintroducing restrictions. Austria, for example, entered a 20-day full national lockdown from 22 November. Extra restrictions in major players such as Germany are likely to dampen economic growth in the fourth quarter, but unless Omicron is a game changer, we do not expect them to last long or derail the recovery.

If anything, the most recent manufacturing data for November has been surprisingly strong. Following an expected rebound of 5.1% in 2021, the euro area is expected to put in another solid performance in 2022, with 4.6% growth. Consumer demand should stay a primary driver, as well as investment, which will be supported by further financing from the EU’s Recovery and Resilience Facility, where €166bn is still to be disbursed from the 2021-2022 grant allocation. However, the distribution will be uneven: Southern European countries such as Italy and Spain stand to receive outsized allocations. Green policies will also be a focus, with 37% of funds being allocated to green investments and reforms.

Despite this solid growth backdrop, and after what may well be further rises in inflation as 2021 draws to a close, Eurozone inflation looks set to fall at the start of 2022: Germany’s VAT rise and introduction of CO2 pricing on transport and heating in January 2021 means 2022 inflation at the beginning of next year may fall by half a percentage point. If energy prices drop as futures suggest, headline inflation could be below 2% in the fourth quarter of 2022, averaging 2.7% in 2022 as a whole. But underlying inflation may stay higher than prior to Covid-19 as wages increase, despite easing supply chain pressures. Clearly this outlook for inflation will be the key driver of monetary policy.

“Market pricing of a possible 2022 rate hike in the Eurozone looks overdone. Our view is that the ECB will wait until the last quarter of 2023 to lift the deposit rate.”

However, with the ECB’s three criteria for raising rates unlikely to be met in the near term, market pricing of a possible 2022 hike looks overdone. Our view is that the ECB will wait until the last quarter of 2023 to lift the deposit rate. However, there is still scope for policy adjustments in the short term, notably via a recalibration in December. The issues to address are the prospective end of the Pandemic emergency purchase programme (PEPP) in March and preventing a cliff edge in asset purchases when QE reverts to the Asset Purchase Programme (APP). We expect this will be addressed by an increase in the APP, helping the transition to a lower purchase pace, which ultimately should see QE ending in the fourth quarter of 2022. The Targeted Longer-Term Refinancing Operations III programme may also be extended given the support it has provided to financing conditions.

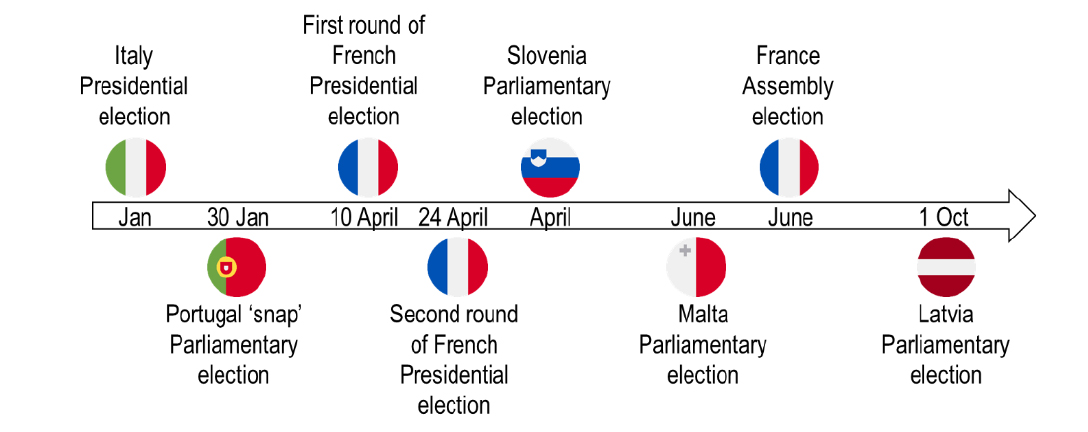

A number of political events are coming up in 2022 – some with event risk attached

Source: Investec

On the political front, there are a number of key upcoming events. The German ‘traffic light’ coalition government is due to take office before the end of the year. Beyond overcoming Covid-19, key priorities include supporting the energy transition, as well as higher minimum wages and tighter rent controls, while returning to fiscal discipline. In Italy, a new president is to be chosen in January. Mario Draghi has long been touted for the role, but it is not clear who could succeed him as prime minister without toppling the unity government. Meanwhile, Portugal has a snap election planned for 30 January. France will see presidential elections in April, in which Emmanuel Macron will see numerous challengers; the race so far looks open.

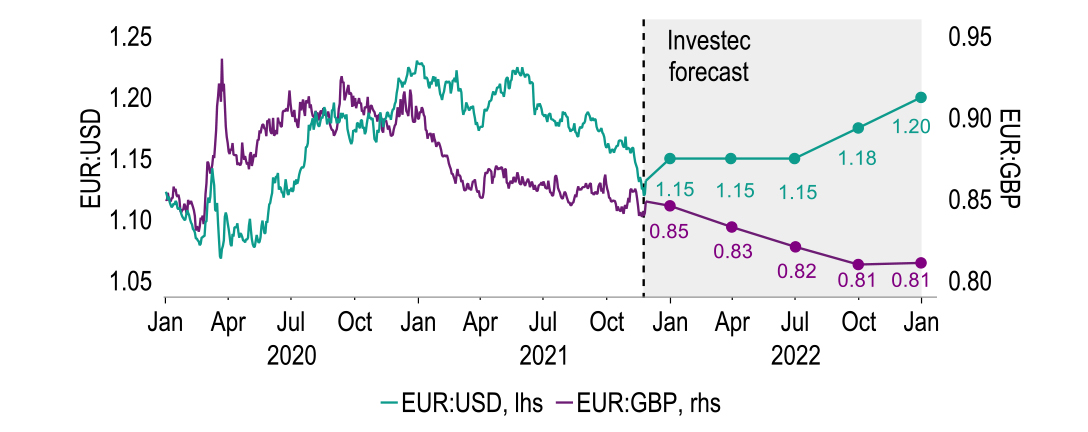

As far as the euro is concerned, we have downgraded our near-term forecasts, now expecting the single currency to end 2021 at $1.15. This would imply only a slight recovery vis-à-vis current levels, as the tougher social restrictions in response to the current surge in Covid-19 restrictions could hold back the currency. As 2022 progresses, however, we envisage that conditions for a potential 25 basis point rate hike by the ECB in late 2023 will come into view. This should allow for some strengthening in the euro, to perhaps $1.20 by the end of 2022. Against sterling, our forecasts are 85p by the end of 2021 and 81p by the end of 2022, but much will depend on how serious a threat the Omicron variant is.

The euro looks likely to gain ground over the course of 2022

Source: Investec and Macrobond

UK gross domestic product (GDP) looks poised to end 2021 with strong quarterly growth of 1.1% in the fourth quarter, adding up to full-year expansion of 6.9%. Even if vaccines are effective against Omicron, momentum in 2022 is unlikely to match this pace. Not only is GDP already close to pre-pandemic levels, the potential pool of labour to fuel expansion is less deep now that unemployment is low and inward migration more limited than before Brexit. Still, supply chains should gradually unclog, and, aided by tax incentives, ample scope remains for firms to invest. Through this capital deepening relative to the number of people employed, productivity can rise. But as interest rates increase, this incentive will diminish. We anticipate GDP growth of 4.3% in 2022.

Gauging how much spare capacity there is in the labour market is challenging. Headline data on how the jobs market fared following the end of furlough is not yet available. But employee figures based on real-time pay-as-you-earn (PAYE) returns are encouraging, pointing to jobs having risen by 160,000 in October. This strengthens our expectation that unemployment rose only marginally post furlough; we are looking for a peak rate of 4,5% and gentle declines thereafter. Still, there is little question that the labour market is very tight, as evidenced by the low ratio of unemployed per vacancy.

In this context, it seems increasingly a risk that firms competing for labour in this tight market will push up aggregate wage growth relative to labour productivity. This ‘unit labour cost growth’ is a key determinant of consumer price inflation, as firms may seek to pass these extra costs onto consumers. Rate hikes could – and, we expect, will – limit these dynamics, but their impact will mainly be felt from 2023. In our baseline forecasts, we foresee inflation rising to a peak of 5% in April and then falling gradually towards 2% by the end of 2022, resulting in an annual rate of 4.0%. This assumes a 15% rise in utility prices in April and a 15% fall in October. But other assumptions could yield a substantially different path.

“We foresee inflation in the UK rising to a peak of 5% in April and then falling gradually towards 2% by the end of 2022, resulting in an annual rate of 4%.”

With the Monetary Policy Committee (MPC) standing pat on the bank rate at 0.10% on 4 November, our attention turns to its next meeting on 16 December. Given signs that the labour market remains robust after the closure of the furlough scheme, a 15 basis point hike still looks likely. Through next year, the yield curve was pricing in the policy rate climbing up as far as 1.25%. Our forecast is still that it will close 2022 at 0.75%. We believe household balance sheets can withstand inflation rising to 5.0% next year, though the hit to purchasing power will have some impact on spending. We also note that the MPC will allow QE gilts to run off its portfolio once the bank rate reaches 0.50%, meaning it will not replace maturing gilts. This should result in outstanding QE falling by £37bn to £858bn by the end of 2022, down from £895bn.

A major change at the turn of the year is the scrapping of the long established LIBOR benchmark. In sterling markets, this will be replaced by risk free rate (RFR) measures, especially SONIA (Sterling Overnight Index Average) based benchmarks. For example, our forecasts of UK interbank rates will be based on equivalent SONIA swaps. This should not make a material difference to our projections. Other jurisdictions are following similar approaches, which will result, for example, in pound-dollar cross currency swaps based on SONIA/SOFR (the US Secured Overnight Financing Rate).

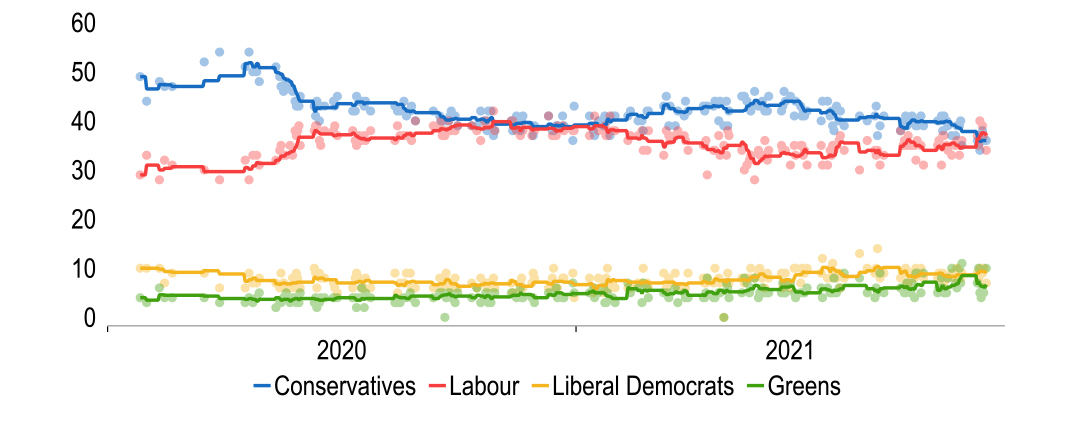

UK Prime Minister Boris Johnson’s popularity ratings have fallen recently, given his handling of various scandals and policy U-turns. A recent ComRes opinion poll showed the Conservatives trailing Labour by 6%. Mid-term blues? Perhaps, but there does seem to be disenchantment with the prime minister within his own party as well. Meanwhile, the Scottish National Party’s drive for a second independence referendum seems to have stalled. This should ease downside risks to sterling. Although our forecasts have been nudged lower, we still see the pound rising over 2022 with year-end targets of $1.48 and 81p against the euro. However, this depends on no further Covid-19 lockdowns and a prompt agreement on the post-Brexit Northern Ireland Protocol.

Mid-term blues? The Conservatives have slipped in the polls

Sources: Macrobond, Britain Elects

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.