- April was a month of heightened ‘President Trump impact’ as the new US Administration announced a far larger than expected rise in tariffs on ‘Liberation Day’ (2 April) which triggered a significant spike in volatility for capital markets broadly defined.

- As the month drew to a close that volatility reduced with most equity markets back within sight of where they started the month. However significant uncertainties remain and the attractiveness of the US as an investment destination has been impacted given the swings in policy and the impact that is having on US markets, US consumer confidence and US corporates.

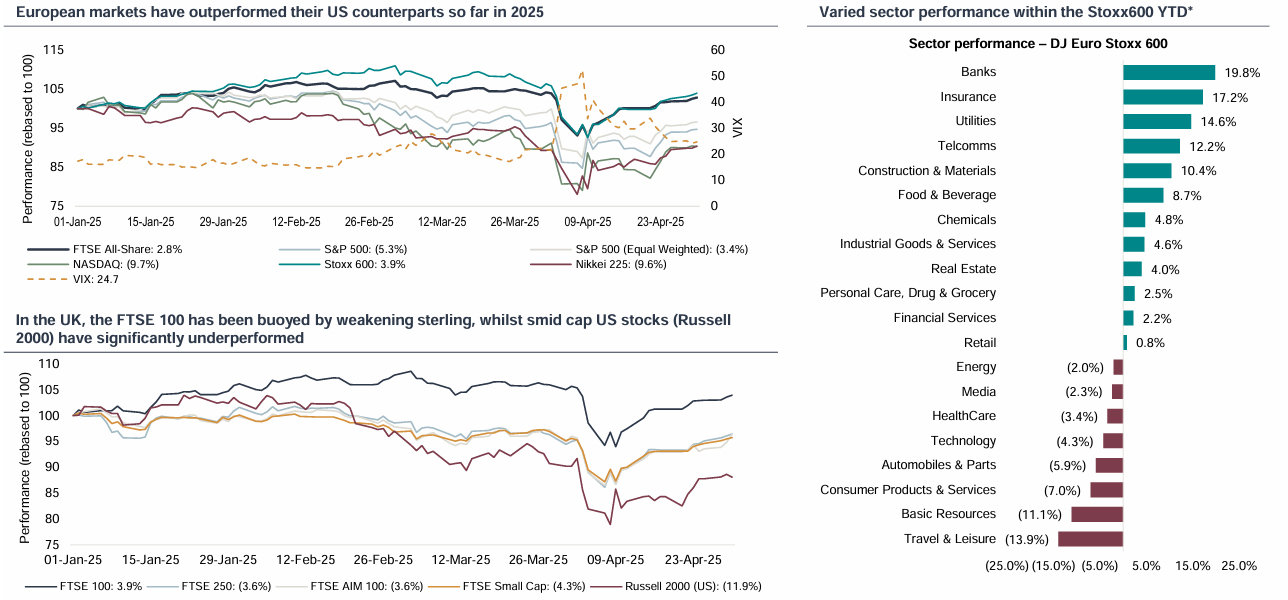

- For the month of April most European equity markets finished modestly down with the FTSE down 1.0%, the FTSE250 up 2.1%, and the Stoxx600 down 1.2%. In the US the S&P was down 0.8%, Nasdaq up 0.9% and the Russell 2000 down 2.4% for the month. All of these moves mask the volatility over the course of the month – the high to low over April for the S&P and the Stoxx600 was a c.13% spread. The VIX volatility index hit an intraday peak of 60 on 7th April (its highest level since 2020 and the onset of Covid) and averaged 32 over the month but closed at 24 on 30 April.

- Whilst all equity markets were volatile over April, European equity markets continue to outperform their US peers in 2025 with the Stoxx600 up 3.9% YTD, the DAX up 13% and the FTSE up 3.9% relative to the S&P which is down 5.3%, Nasdaq down 9.7% and the Russell 2000 down 11.9%.

- The speed of US policy implementation, and continual U-turns / changes, impacted US Treasury markets significantly over the month, with some knock-on effect to other Government bond markets. The 10-year UST yield hit 4% in early April, rose to almost 4.5% by the middle of the month but closed the month out at 4.18%. Tariff implementation would ordinarily suggest a strengthening USD and a reduction in yields, but a decline in confidence about the US Administration fuelled investor nervousness and a reduction in ownership of US assets. UK Gilt yields were also volatile over the month with the 10-year yield rising from 4.45% in early April to nearly 4.8% but closing the month at 4.4%

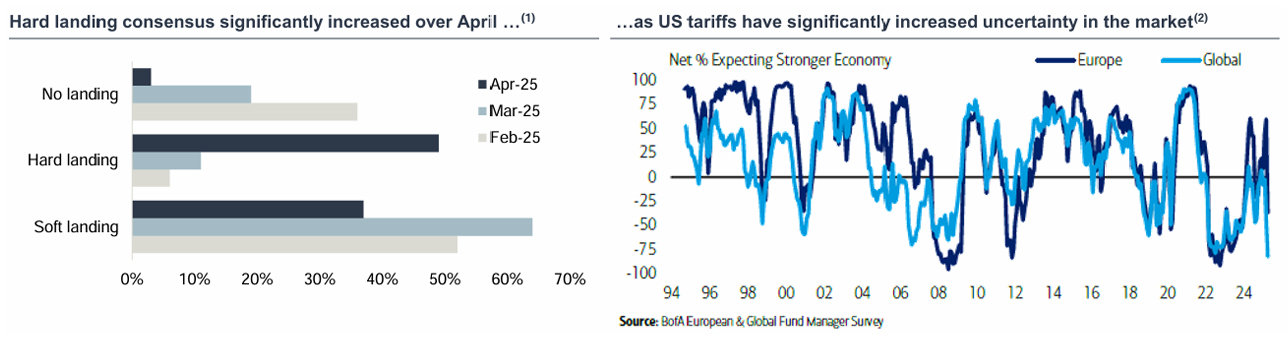

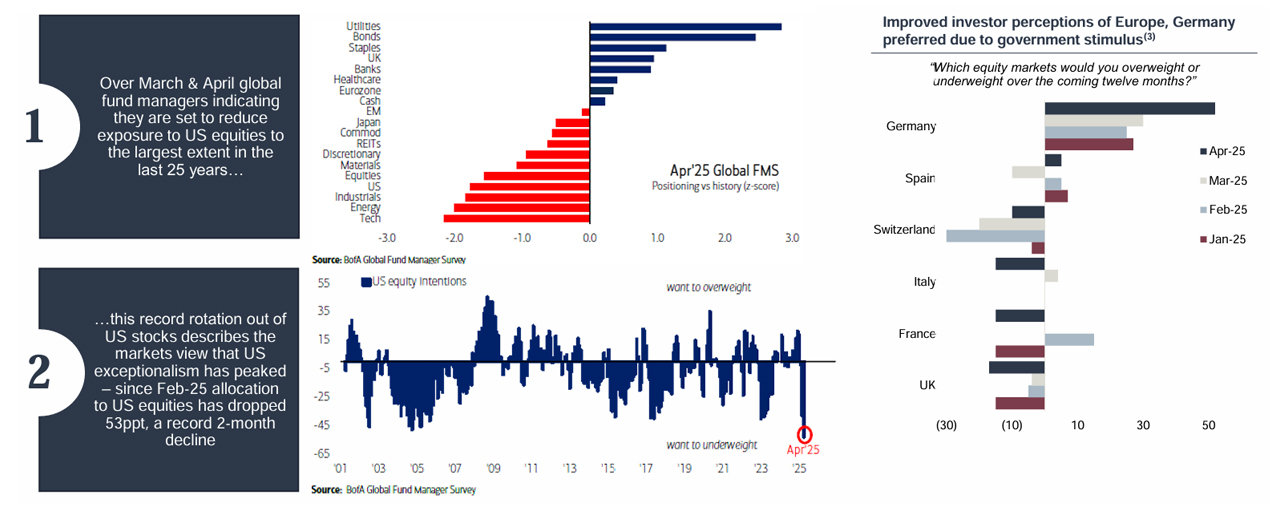

- The latest BAML fund manager survey shows the swift impact that US economic policy is having on investor sentiment with 49% of those surveyed now seeing a hard landing for the global economy (up from 11% in March) and US stock allocation seeing its largest 2 month drop in the history of the survey (25 years).

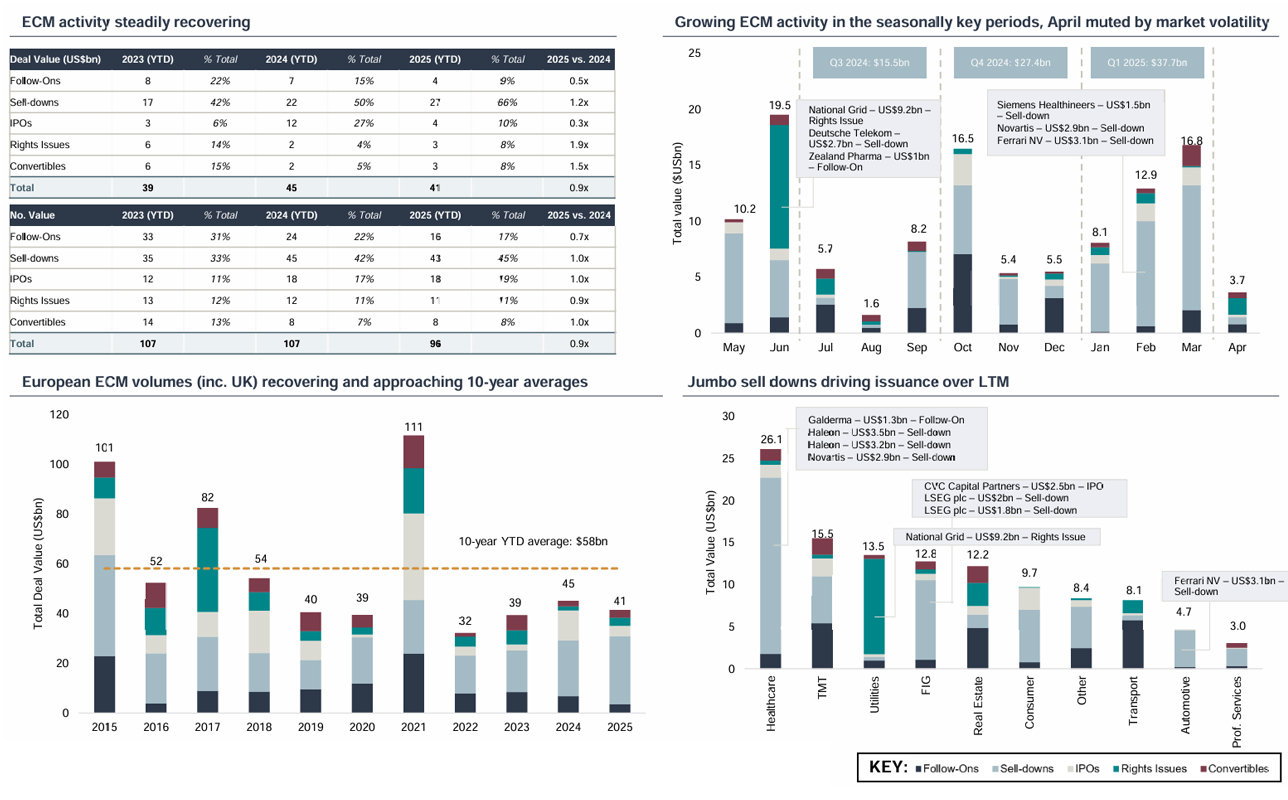

- Given the volatility over the month ECM activity was unsurprisingly muted with 8 transactions raising $3.1bn over the month. IPO activity was light as the market volatility led to the delay of some IPOs that were set to launch, although MHA the UK accountancy firm did complete its $124m LSE IPO, and GRK Infra completed its $106m IPO in Helsinki. Other smaller (sub $50m) IPOs in the month include Quantum Base’s £1m LSE IPO.

- Despite short term volatility and market challenges there is a case to be more constructive on UK equities over the medium term on an absolute and relative basis, with the US President helping to make the case for a reallocation of capital out of US equities.

Equity Market overview | European outperformance YTD

European equity markets outperform in 2025, but US policy shift impacted monthly performance

- European equity markets continue to outperform their US counterparts YTD, but markets globally were affected by tariff announcements on ‘Liberation Day’, which weighed heavily on equity indices around the world. Markets recovered somewhat over the course of April, as President Trump temporarily suspended the most punitive ‘reciprocal’ tariffs for all countries bar China for negotiations, however, the 90-day pause has meant that the market is still facing significant uncertainty. Investors have increasingly looked to diversify portfolios away from the US (and large cap technology related stocks in the US).

- Whilst there have been growing concerns over the course of the year with regard to President Trump’s policy agenda, ‘Liberation Day’ pushed volatility swiftly higher and accelerated rotation out of US equities. Whilst the VIX has pulled back from intra month highs, the ongoing US uncertainty could continue to weigh on markets.

- In the UK, over April the FTSE 250 outperformed its larger cap counterpart finishing the month up 2.1%, vs the FTSE 100 which finished down -1.0%, partly due to the FTSE’s larger exposure to the dollar and US earnings. For the month of April, the FTSE was down 1.0%, FTSE 250 up 2.1%, Stoxx600 down 1.2%, S&P down 0.8%, Nasdaq up 0.9% and Russell 2000 down 2.4%.

Source: FactSet; Bloomberg

Equity Market overview | Valuation disconnect remains

UK valuations continue to look low on a global and historic relative basis despite a sharp pullback for US equities

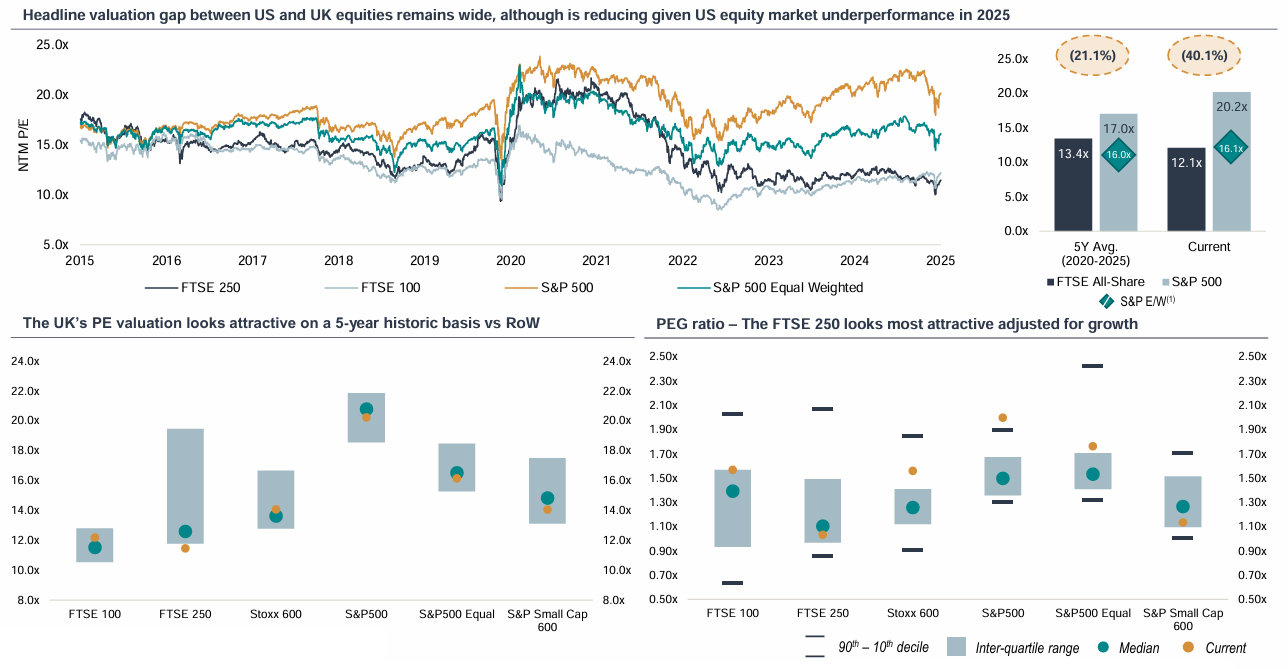

- Following the movement in markets over the course of April, US equity valuations have pulled back from historic highs. The headline valuation differential between US and UK / EU equity markets remains significant, however after adjusting for growth (and sector skew therefore...) that differential significantly reduces.

- Until recently Economists and Strategists predicted positive returns for global equities over 2025, including more modest gains for US equities (relative to prior years). Following the fallout from ‘Liberation Day’, global investors views on the US have significantly pivoted, with many pulling money from the US and into Europe (inc. UK) equities, cash, bonds and gold.

- The solid performance of the FTSE over 2025 has started to close the valuation gap to US markets, but there is still a long way to go particularly for the FTSE250. Despite this improvement, as at the end of April, the FTSE All-Share still sits at a 40% discount to the S&P, and a 25% discount on an equal weighted basis (at a headline level).

Source: FactSet; (1) S&P E/W refers to the S&P500 Equal Weighted index

Note: PE and PEG ratios are derived on a Next Twelve Months Ahead basis. FTSE 100 and FTSE 250 demonstrate greater variance in their PEG ratios given the domestic political activity over the last 5-years (including the Truss leadership). Note: the interquartile range excludes any values in the top and bottom quartiles, similarly the inter-decile range excludes to the top and bottom deciles to remove any outliers

Macro Outlook | US policy uncertainty impacting markets

Tariffs introduced by Trump may keep US inflation and rates higher for longer and impact economic growth globally

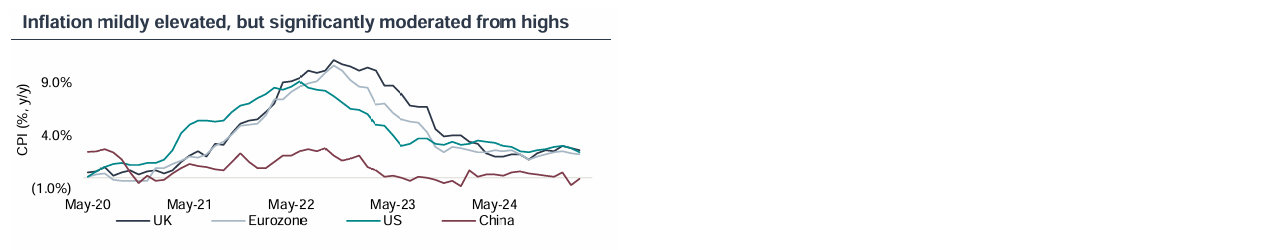

- UK inflation for March fell to 2.6% y/y from 2.8% in February below consensus estimates of 2.7%. Service sector inflation remained elevated at 4.7%, but below previous readings of 5.0%. Core fell to 3.4% from 3.5% in line with consensus of 3.4%.

- Likewise, in the Eurozone CPI data for March decreased to 2.2% y/y from 2.3% in February. In April it flatlined at 2.2%. In the US CPI fell to 2.4% y/y in March from 2.8% in February.

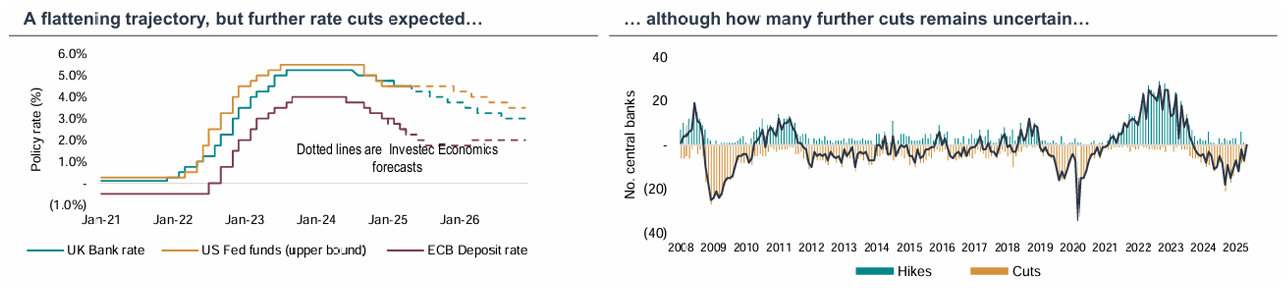

- Following recent tariff announcements and market volatility, markets have rapidly reassessed the rate outlook, and are now looking for 2-3 rate cuts in the Europe, with 3-4 expected in the US and UK over the course of 2025. This move in rate expectations is in response to fears of a US slowdown and recession despite potential price pressures from tariffs.

1 Inflation is trending towards central bank target levels…

2 …and the rate cutting cycle looks well underway…

3 ...but the near term macro-outlook is now less clear

Source: FactSet; Macrobond; ONS; Investec Economics; BofA European Fund Manager Survey – (1) Global investors’ view on the global economy; (2) Global and European investors’ views on the European economy

Prefer to download?

Click to download the complete Equity Market Overview.

Never miss an update

Subscribe to the Equity Market Overview.

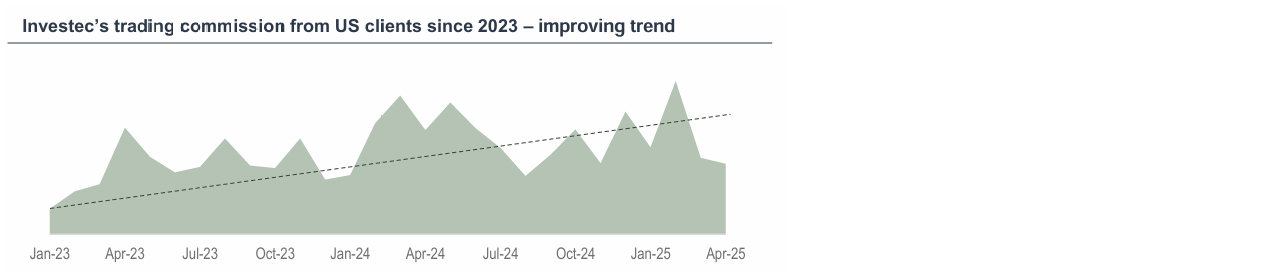

UK Funds Flow Overview | Perceptions improving for Europe

Clear evidence of a rotation out of US equities into bonds, cash, gold and European equities over the course of April

- Tariffs have increased uncertainty globally with investors now bracing for a global slowdown with 82% of respondents in the April BAML FM survey expecting the global economy to weaken over the coming year. However the extent of that slowdown is unclear with a wide range of possible outcomes forecast by different economists, strategists and investors.

- However European equities have been net beneficiaries of improving fundamentals and a growing view amongst investors that US exceptionalism has peaked. German fiscal stimulus and budgetary reform are viewed as a core catalyst for an improving growth outlook for the European economy. The latest BAML fund manager survey indicates that a net 22% of global investors are overweight European equities, and a net 36% underweight US equities.

- Whilst global challenges remain, on a relative basis, the UK has continued to be viewed more positively. There has been continued elevation of the pro-growth rhetoric by the UK Government, a better than expected inflation print for March and better monthly GDP prints than expected for Jan and Feb (Q1 data released 15th May).

Source: (1) Calastone – fund flow data relates to UK mutual funds only; Note: Calastone data excludes any pan-European or Global funds with UK exposure, the data also excludes ETFs (2) Bloomberg; Chart shows increasing share count of Vanguard FTSE 250; (3) BofA European Fund Manager Survey

European Equity Issuance 2025 YTD | April volumes muted

European equity issuance recovering towards 10 year averages but April volumes hampered by ‘Liberation Day’ induced market volatility

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels. Note: Large TMT deals include Atos ($3.1bh) and Deutsche Telekom $2.7bn

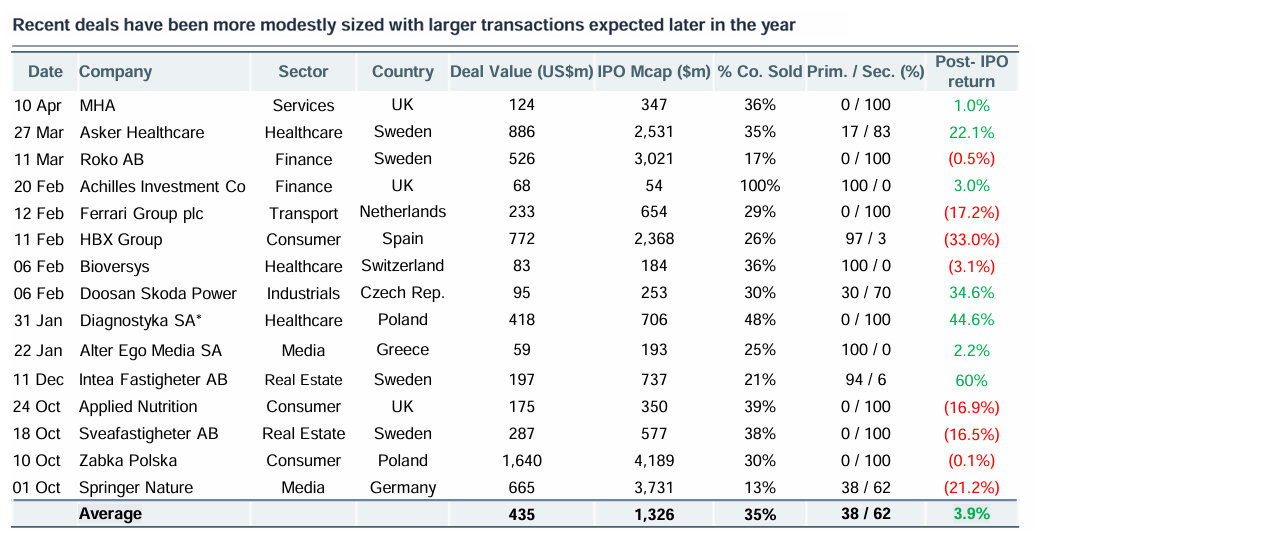

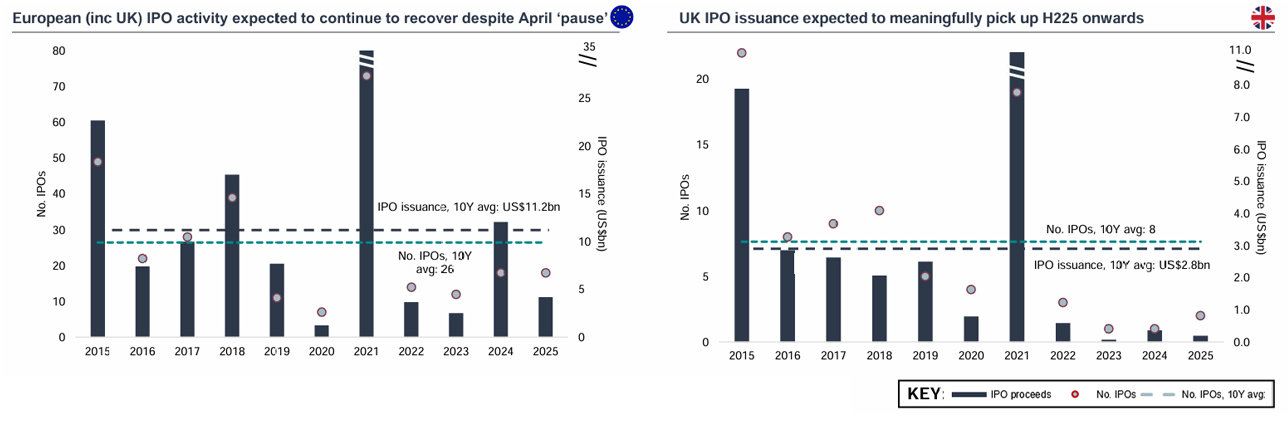

European IPO Issuance 2025 | Improving but near-term challenges

Although volumes remain below 10 year averages, there was continued gradual improvement in IPO activity over Q1 2025. However market uncertainty impacted April and the pace of recovery in the near-term

IPO issuance in Europe

- US$246m raised across five IPOs in April 2025, with three of those IPOs sub-US$50m. Of the 5 IPOs, 3 were listed in London: MHA, Quantum Base and Smarter Web. Average IPO size for 2025 has been US$134m.

- March saw two IPOs over US$50m, Finnish Construction and Infrastructure company GRK Infra (US$106m) and British accountancy firm MHA (US$124m).

- There were four IPOs over US$1bn in 2024, with Asker Healthcare now the largest IPO of 2025 at US$886m, surpassing HBX Group’s IPO of US$774m.

- Recent volatility has pushed a number of potential IPO launches from H125 into H225.

- In the UK IPO volumes are expected to be second half weighted. We continue to think that the FCA Listing Rule reforms will be helpful tailwinds for UK IPOs.

- Changes to the FTSE UK Index Series will heighten the attraction of a UK listing, allowing non-sterling denominated securities index inclusion, and a faster entry threshold for larger companies (market capitalisation greater than £1bn and market position greater than 225th).

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels. Note: there were 4 UK IPOs greater than $50m in 2024; Air Astana, Raspberry Pi, Rosebank and Applied Nutrition

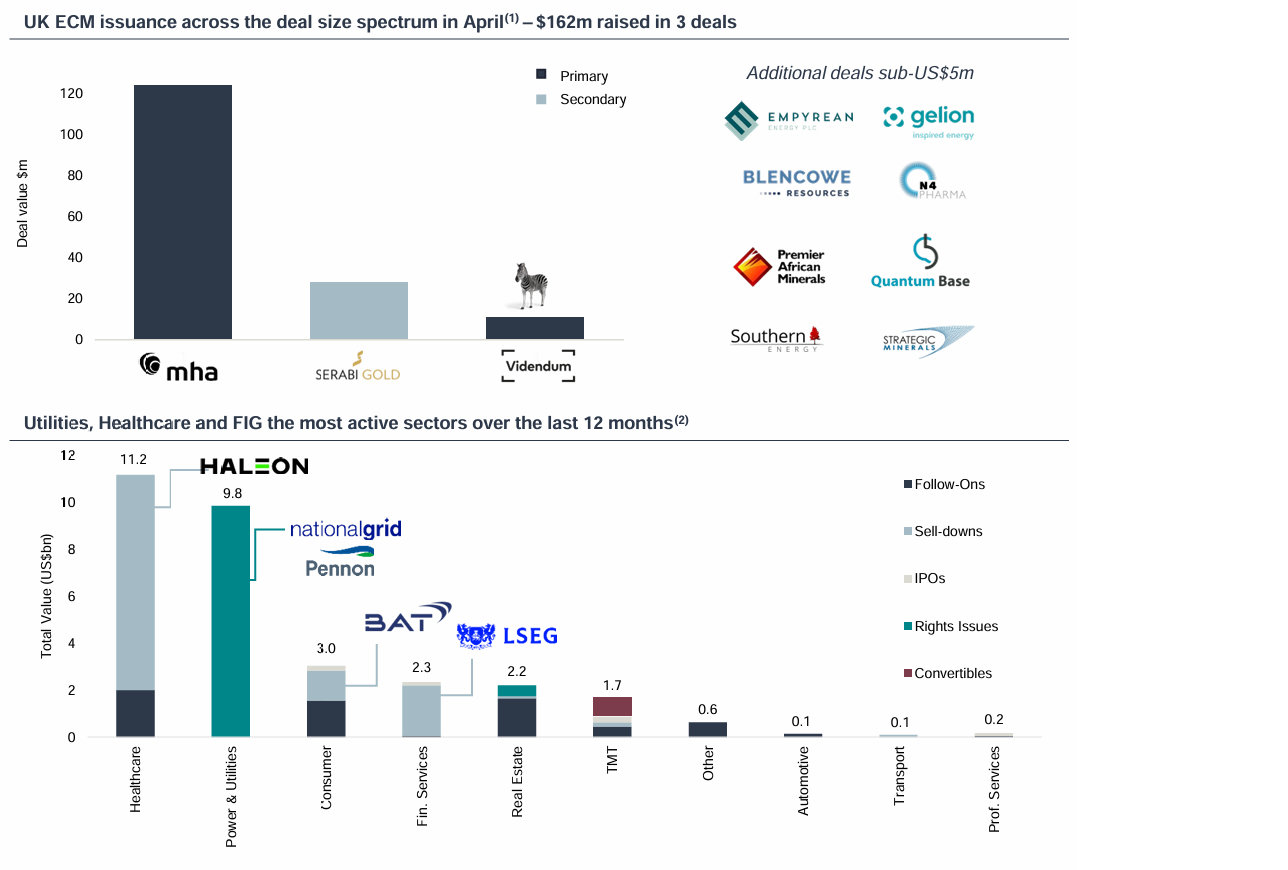

UK ECM activity | April

April UK issuance (as in other regions) was impacted by post ‘Liberation Day’ volatility

2025 UK ECM Q1 activity vs 2024 snapshot(1)

| 2025 YTD | 2024 YTD | Variance | |

| Total funds raised ($m) | 9,152 | 9,050 | +1% |

| Total no. transactions | 29 | 31 | (6%) |

Source: Dealogic; (1) Analysis and commentary only includes transactions greater or equal to $5m; (2) Analysis and commentary only includes transactions greater or equal to $US50m – chart above show year-to-date activity levels; IFR ECM

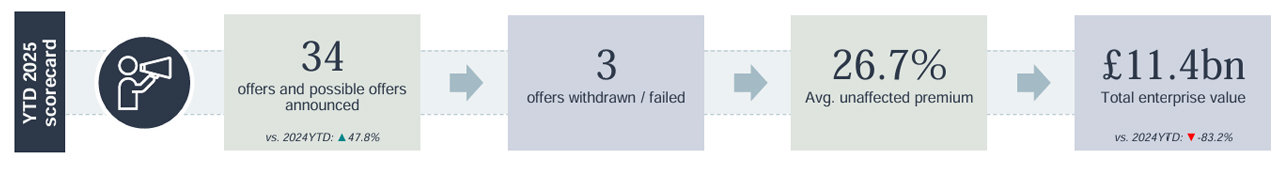

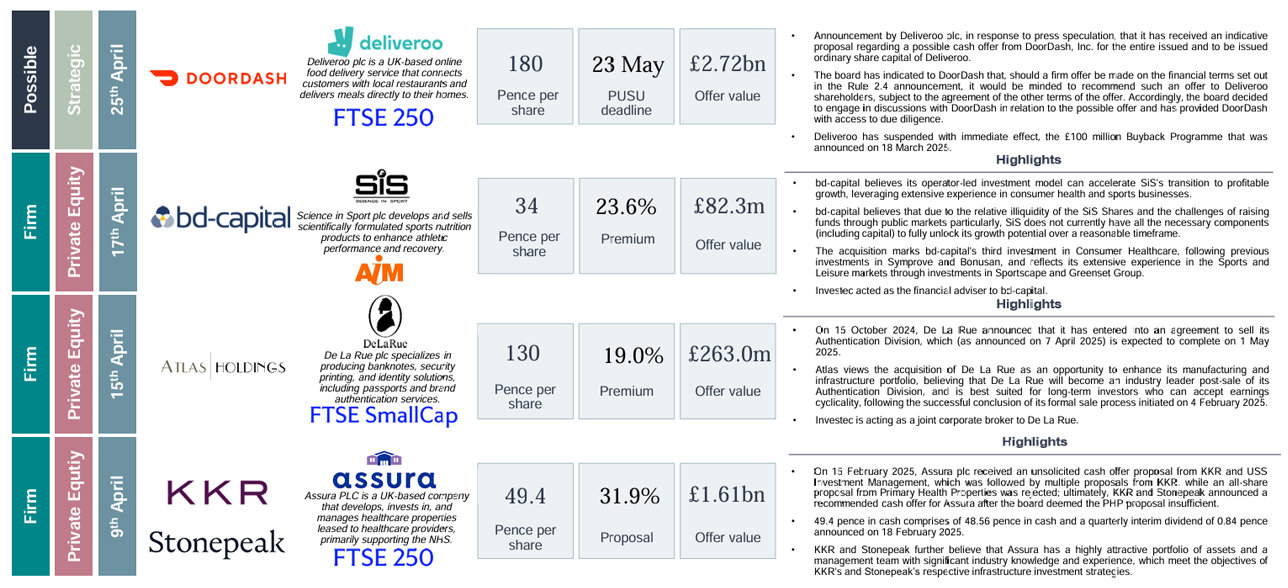

UK public M&A activity | April

UK public market valuations continue to attract significant interest from trade and private capital

Selected Deals

Source: Company announcements; FactSet; Practical Law

Note: Scorecard includes competing offers and withdrawn of companies subject to the Takeover Code quoted on AIM or the Main Market. Formal sales processes are not included unless a buyer has been identified. Only newly announced offers in the month are included in the count (i.e. possible offers announced in December 2025 will be included in that month even if it becomes a firm offer in January 2025)

Get the Investec Equity Market Overview delivered to your inbox

Browse articles in