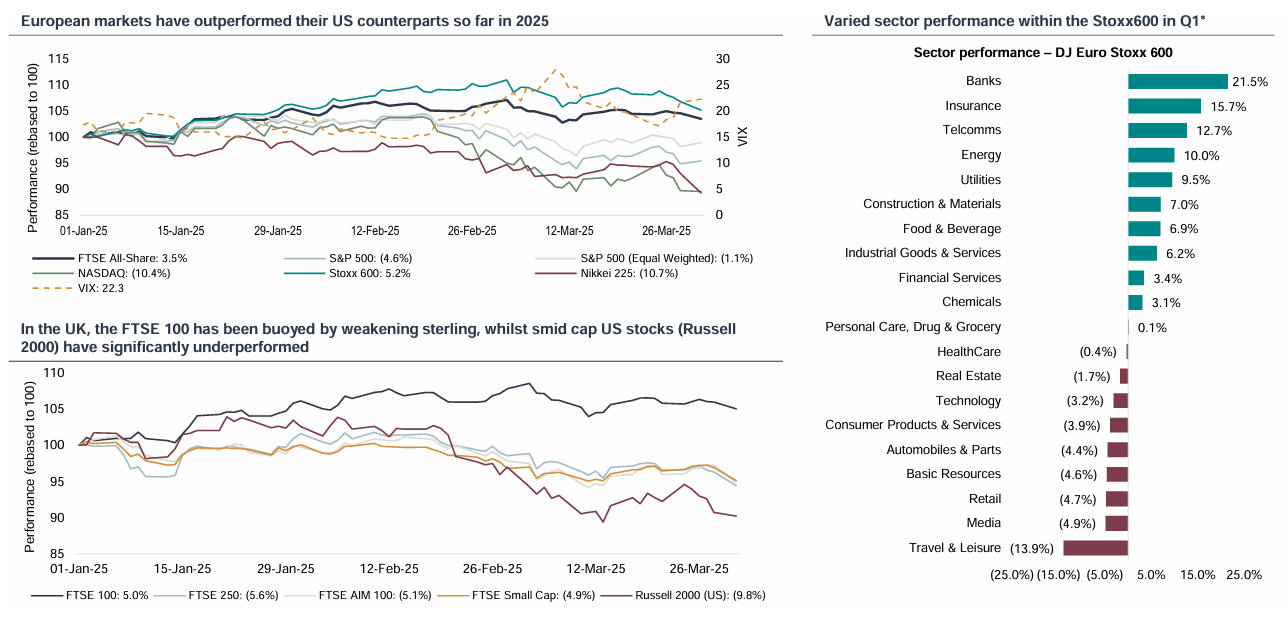

- For the month of March most European equity markets were down 2-4% but the DAX, IBEX and MIB managed to hang onto small gains as US Trade policy and the uncertainty it created unnerved investors. It was also another month of relative outperformance by European stocks over US counterparts. As at the end of Q125 the FTSE was up 5.0%, the Dax up 11.3% and the Stoxx600 up 5.2% but the S&P was down 4.6% and Nasdaq down 10.4%. Mid and smaller cap indices underperformed with the FTSE250 down 5.6% and the Russell 2000 down 9.8%.

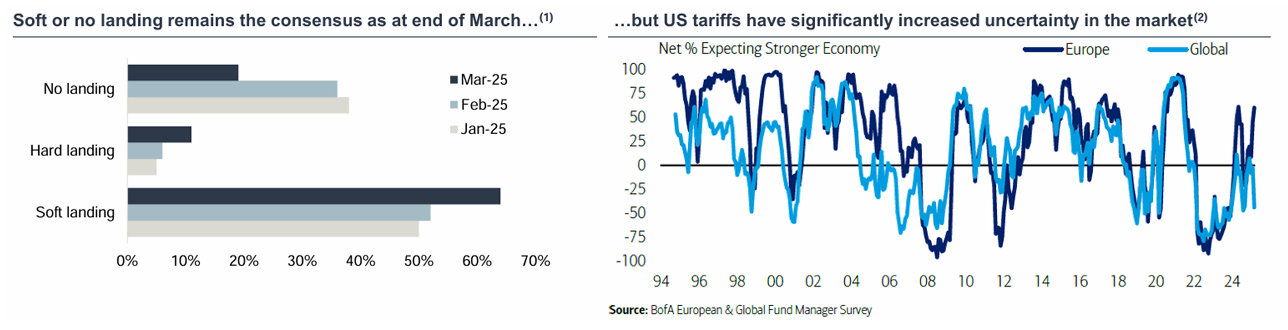

- US Government policy has been erratic and unpredictable over the first few months of the new Administration’s term, creating uncertainty in the US and beyond, impacting US consumer and business confidence. Whilst outright US recession was not predicted over the course of March, following the extensive US trade tariffs announced on April 2nd some are now predicting a very significant impact on confidence and growth (as well as higher prices) leading to a contraction in US GDP for 2025 (e.g. JPM reduced its forecast for US GDP growth for 2025 from 1.3% to -0.3%).

- March witnessed efforts by the US administration to end the Ukraine / Russia conflict but also a shift to a much more confrontational stance with Ukraine, raising fears in Europe that US support for NATO itself might be at risk. Following this, in Germany the likely new Chancellor obtained support to spend an extra €500bn on infrastructure and exempt defence spending from the ‘debt brake’, and the EU has announced plans to raise defence spending too. This fiscal boost has lifted EU growth expectations.

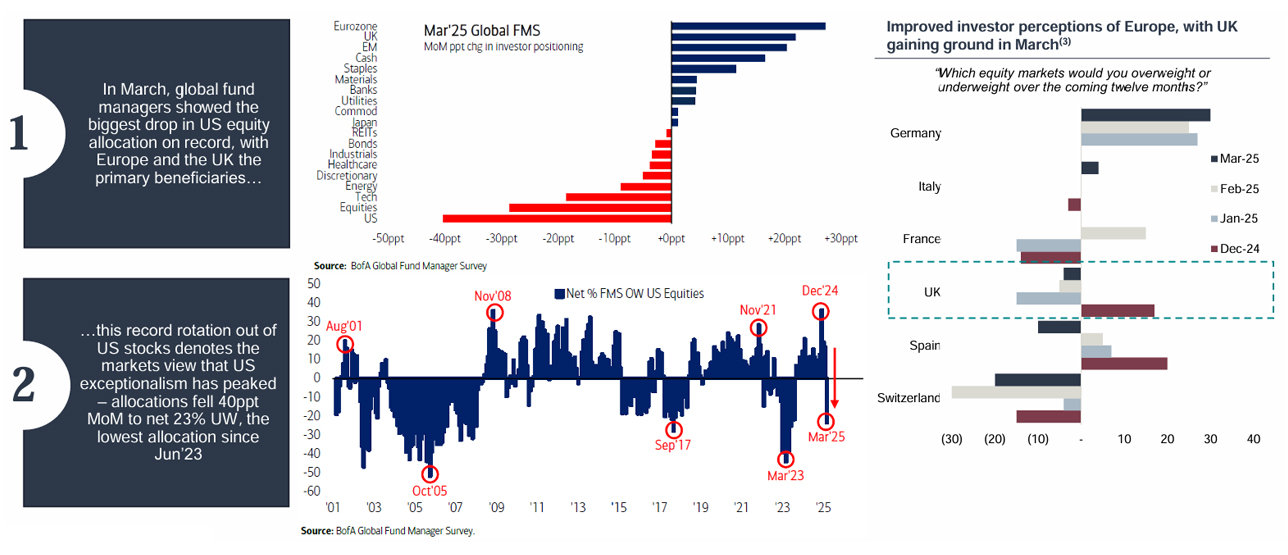

- The relative performance of European and US equity markets is reflected in the latest BAML fund manager survey which shows that over March investors increasingly removed funds from the US equity markets and chose a combination of cash, short term Treasuries and EU equities. Following President Trump’s latest tariff update government bonds, gold, and other defensive assets/sectors have outperformed - flows into these assets are likely to be reflected in the next BAML fund manager survey due later this month.

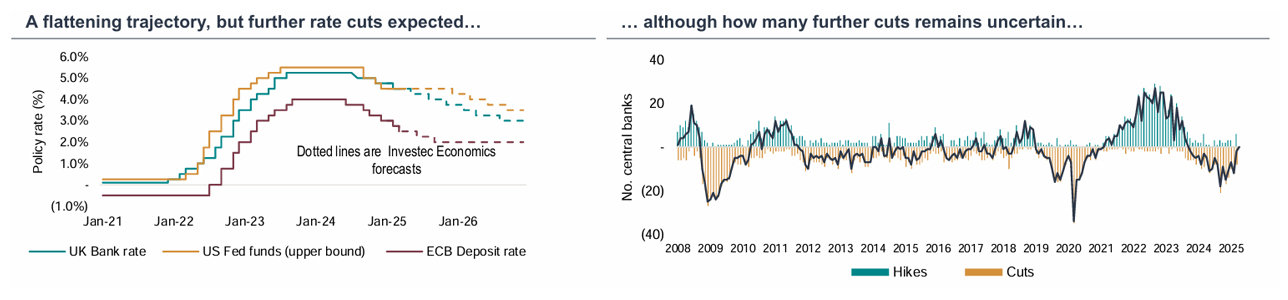

- Central banks were in focus over the month – the ECB cut the Deposit rate (as expected) by 25bps to 2.50%, the BoE left UK rates on hold at 4.50% (as expected) and the Fed held US rates at 4.25- 4.50% (as expected). Arguably the Fed’s position is the more challenged as they navigate what will likely be a negative impact of trade tariffs on economic activity as a result, but at the same time look set to face higher prices and possibly rising inflation expectations – and a President who is calling for lower rates.

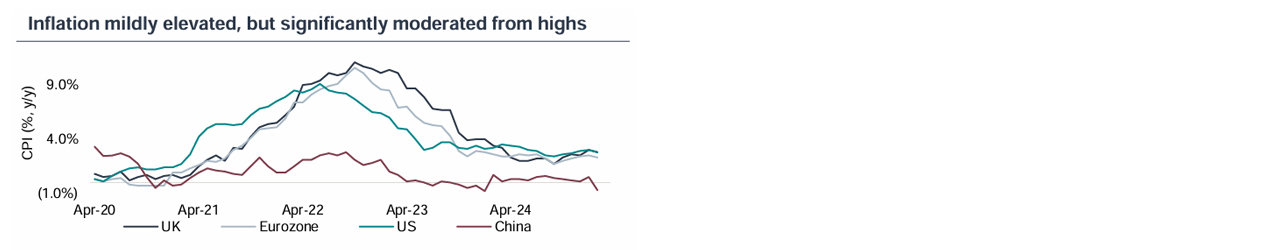

- February CPI data fell across the board after a tick up in January, with UK CPI at 2.8% (3.0% January), Eurozone CPI at 2.3% (2.5% January) and US CPI at 2.8% (3.0% January). March preliminary PMI data in the US, UK and EU was slightly better than expected and made progress relative to February which provided some support for equity markets in a volatile period. Over March the VIX averaged 22, versus c.17 in February and January, but has since hit an intraday 2025 peak of c.60 following ‘Liberation Day’.

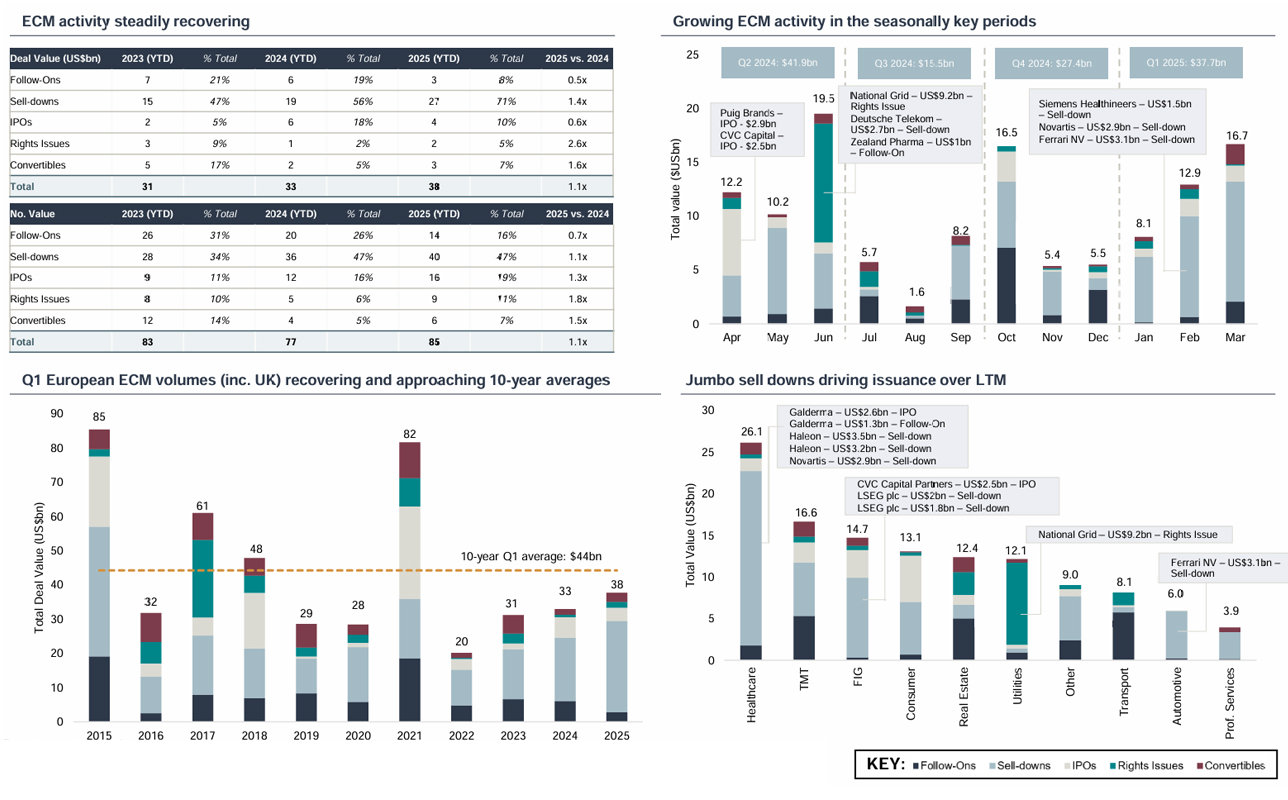

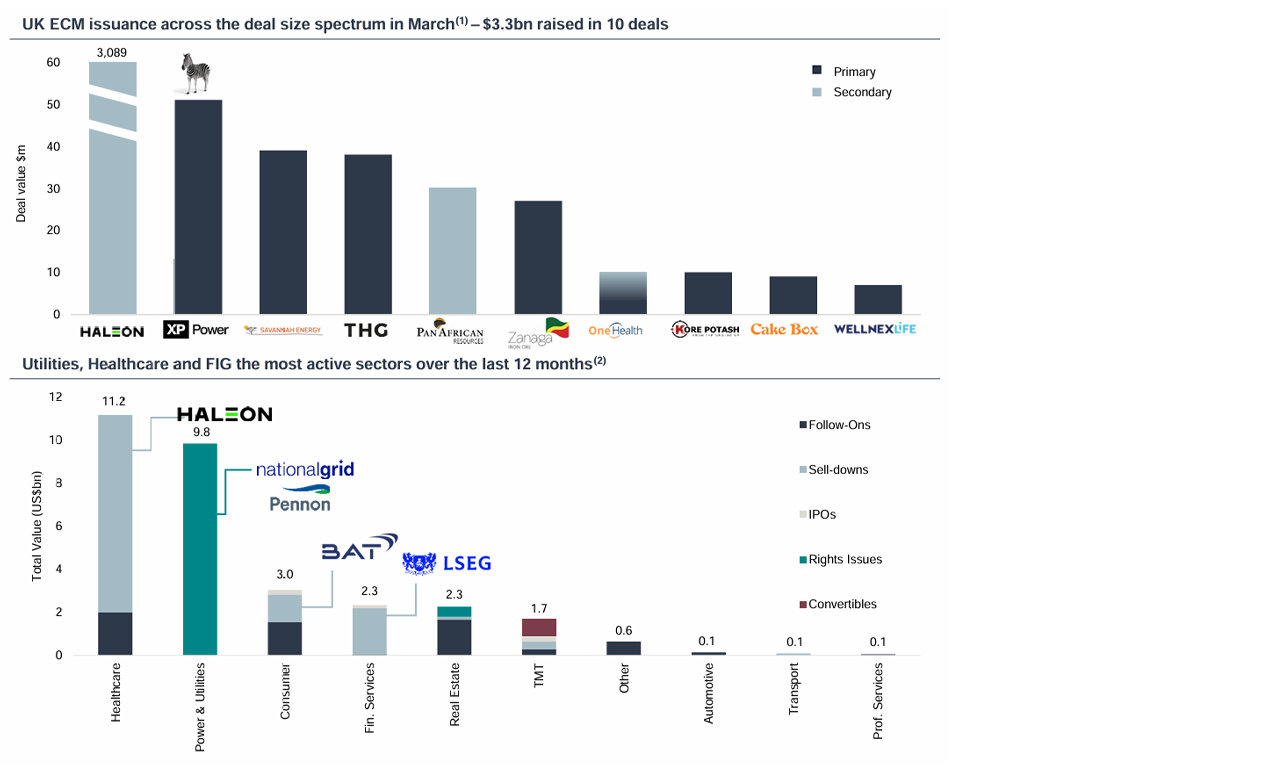

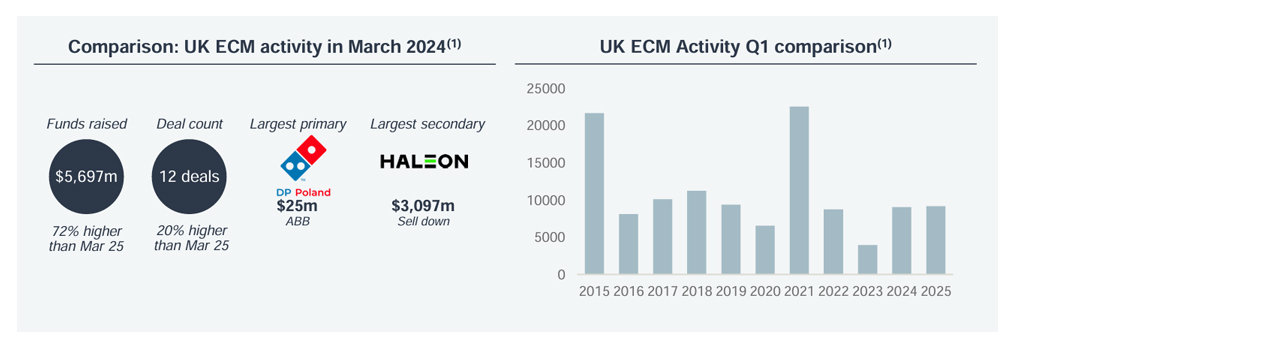

- European ECM activity in March rounded out a busy Q1 although the volume has been driven in large part by secondary sell downs in large cap stocks. European ECM volumes in 2025 are up vs 2024YTD, with $37.7bn of issuance so far in 2025, vs $32.9bn in 2024. In the UK, Haleon sell downs have driven a large portion of the ECM activity with US$6.1bn sold in Q1 2025.

- ECM IPO activity has continued to recover but remains below the 10-year average, as market uncertainty has pushed some IPO’s to later in the year. Whilst the number of IPO’s has continued to improve, activity is expected to remain muted in the near term given heightened market uncertainty as we enter Q2 2025. The US is experiencing a slow down in IPO activity, with US$2.3bn raised across seven IPO’s in March vs US$4.5bn raised across fourteen IPO’s in February, and a number of high profile transactions delayed.

Equity Market overview | European outperformance over March

European equity markets outperform in 2025, but US policy shifts having a significant impact

- European equity markets outperformed their US counterparts over March and continue to do so YTD, but US tariff policy updates, and in particular those announced on ‘Liberation Day’, have weighed heavily on all equity indices around the world. Investors have increasingly looked to diversify portfolios away from the US (and large cap technology related stocks in the US).

- Whilst there have been growing concerns over the course of the year with regard to President Trump’s policy agenda, ‘Liberation Day’ has heightened volatility and accelerated rotation. The heightened uncertainty was reflected in the VIX which climbed to a high of 27.5 in March following the introduction of tariffs on Mexico, Canada and China. Following Liberation Day, investor nervousness moved markedly higher and the VIX spiked to hit an intraday peak of c.60, the highest sustained level since the start of ‘Covid’ in 2020. Uncertainty about US policy broadly defined is not being well received by equity markets.

- In the UK, over March the FTSE 100 outperformance relative to its smaller cap counterparts widened, buoyed by a weakening sterling. After a jump in CPI to 3.0% in January, CPI fell back to 2.8% in February, below consensus for 2.9%, providing the market with stronger confidence of a rate cut in May.

- For the month of March, the FTSE was down 2.6%, FTSE 250 down 4.2%, Stoxx600 down 4.2%, S&P down 5.8%, Nasdaq down 8.2% and Russell 2000 down 7.0%.

Source: FactSet; Bloomberg | Note: *largest movers within Travel & Leisure: Carnival PLC -26.24%, Sodexo -25.33% and TUI AG -24.41%

Equity Market overview | Valuation disconnect remains

UK valuations continue to look attractive on a global and historic relative basis despite a sharp pullback for US equities

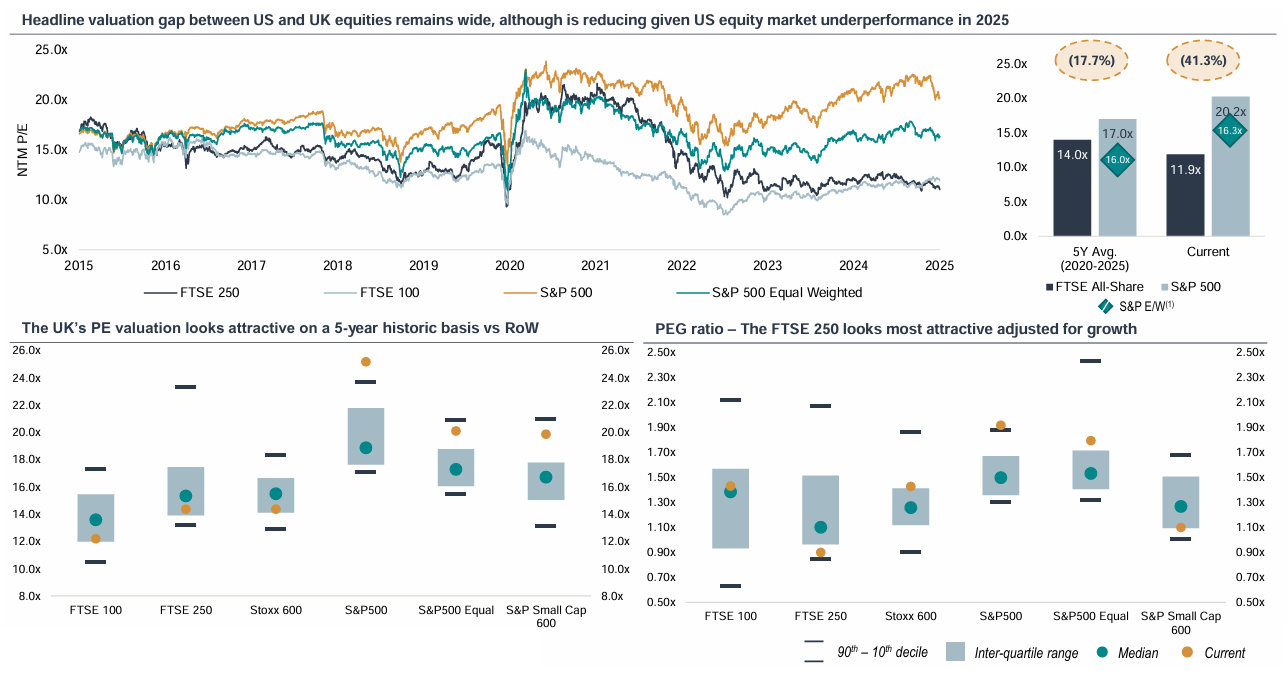

- As at the end of March, US equity markets were towards the top of historic valuation ranges and the headline valuation differential between US and UK / EU equity markets remains significant, although after adjusting for growth (and sector skew therefore...) that differential does reduce.

- Until recently Economists and Strategists predicted positive returns for global equities over 2025, including more modest gains for US equities (relative to prior years). Developments over the end of March and early April will likely influence those views, particularly in regards to US equities.

- The solid performance of the FTSE over Q12025 has started to close the valuation gap to US markets, but there is still a long way to go particularly for the FTSE250. Despite this improvement, as at the end of March, the FTSE All-Share still sits at a 41% discount to the S&P, and a 27% discount on an equal weighted basis (at a headline level). Continued US market underperformance in April has also reduced the gap a little further.

Source: FactSet; (1) S&P E/W refers to the S&P500 Equal Weighted index

Note: PE and PEG ratios are derived on a Next Twelve Months Ahead basis. FTSE 100 and FTSE 250 demonstrate greater variance in their PEG ratios given the domestic political activity over the last 5-years (including the Truss leadership). Note: the interquartile range excludes any values in the top and bottom quartiles, similarly the inter-decile range excludes to the top and bottom deciles to remove any outliers

Macro Outlook | US policy uncertainty impacting markets

Tariffs introduced by Trump may keep inflation and rates higher for longer and impact economic growth

- UK inflation for January fell to 2.8% y/y from 3.0% in February below consensus estimates of 2.9%. Service sector inflation remained elevated at 5.0%, with core falling to 3.5% from 3.7% marginally below consensus of 3.6%.

- Likewise, in the Eurozone preliminary CPI data for March decreased to 2.2% y/y from 2.3% in February. In the US CPI ticked down to 2.8% y/y in February from 3.0% in January.

- Following recent tariff announcements and market volatility, markets have rapidly reassessed the rate outlook, and are now looking for 3-4 rate cuts in the UK and Europe, with 4-5 expected in the US over the course of 2025.

- President Trump’s America First agenda and associated tariffs are likely to be inflationary as well as impacting growth. The shift in the geopolitical backdrop has prompted a large fiscal response in the EU. Whilst the hand of the UK Government is more fiscally constrained, efforts are being made to elevate the country’s growth agenda.

1 Inflation is trending towards central bank target levels…

2 …and the rate cutting cycle looks well underway…

3 ...but the near term macro-outlook is now less clear*

Source: FactSet; Macrobond; ONS; Investec Economics; BofA European Fund Manager Survey – (1) Global investors’ view on the global economy; (2) Global and European investors’ views on the European economy | Note: * data from BAML Survey provides investors view prior to ‘Liberation Day’

Prefer to download?

Click to download the complete Equity Market Overview.

Never miss an update

Subscribe to the Equity Market Overview.

UK Funds Flow Overview | Perceptions improving for Europe

Clear evidence of rotation in favour of European equities over the course of March

- Amongst global fund managers there has been a clear shift in sentiment to European equities as a result of improving growth expectations. According to the latest BAML survey, 60% project stronger European growth over the coming 12 months, up from 9% two months ago.

- As a result, a net 39% of respondents said they were overweight European equities, the highest since 2021, with 23% net underweight US equities the highest since mid-2023.

- Whilst global challenges remain, on a relative basis, the UK has continued to be viewed more positively. This was aided by positive macro data in March which included upward revisions to UK GDP for Q4 2023, Q1 2024 and Q2 2024, bringing full year GDP growth for 2024 to 1.1% from 0.9%. There has been continued elevation of the pro-growth rhetoric by the UK Government, plus a better expected inflation print for February at 2.8% vs 3.0% previously.

Source: (1) Calastone – fund flow data relates to UK mutual funds only; Note: Calastone data excludes any pan-European or Global funds with UK exposure, the data also excludes ETFs (2) Bloomberg; Chart shows increasing share count of Vanguard FTSE 250; (3) BofA European Fund Manager Survey

European Equity Issuance 2025 YTD | Improving trends in Q125

European equity issuance approaching 10-year averages, with YoY improvements continuing into Q1 2025

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels. Note: Large TMT deals include Atos ($3.1bh) and Deutsche Telekom $2.7bn

European IPO Issuance 2025 | Improving but near-term challenges

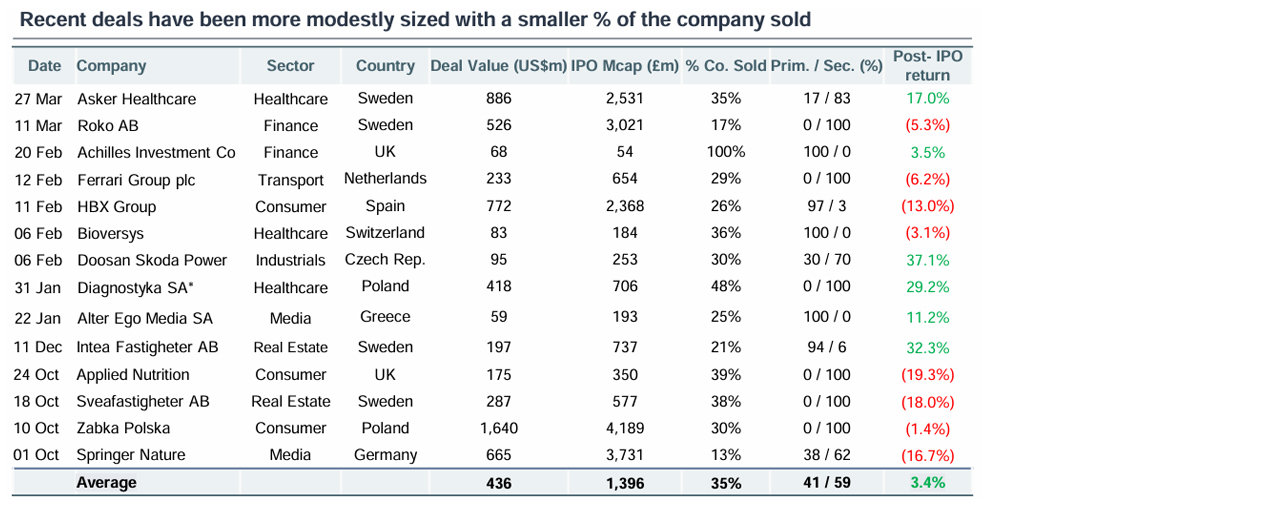

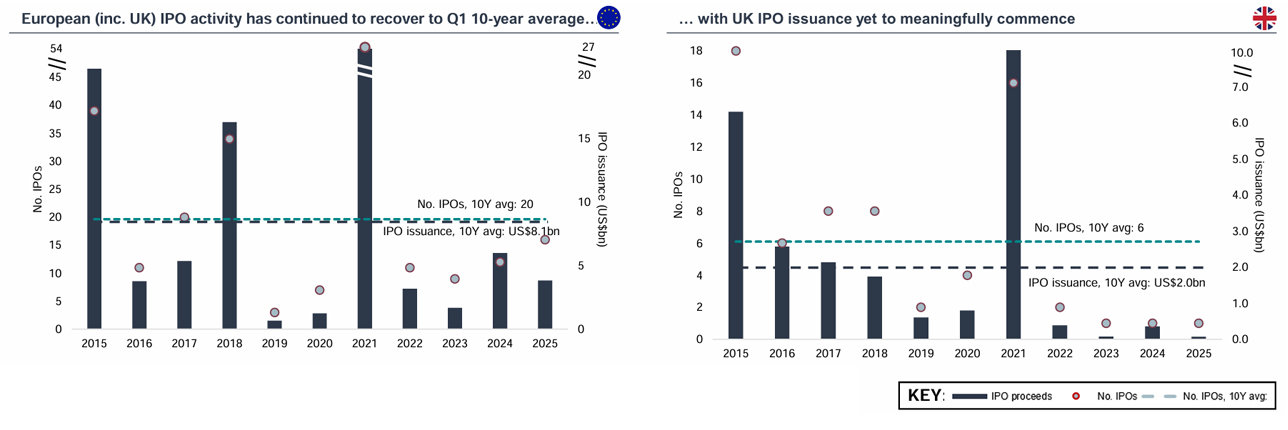

Although volumes remain below 10 year averages, there has been continued gradual improvement in IPO activity in Q1 2025. However market uncertainty will impact the pace of recovery in the near-term

IPO issuance in Europe

- US$1,492m raised across five IPO’s in March 2025, with two of those IPOs sub-US$50m. Average IPO size for 2025 has been US$143m.

- March saw three IPO’s over US$50m, Croatian housebuilder ING-Grad (US$66m), Swedish investment company Roko AB (US$526m), and Swedish medical product provider Asker Healthcare (US$886m).

- There were four IPOs over US$1bn in 2024, with Asker Healthcare now the largest IPO of 2025 at US$886m, surpassing HBX Group’s IPO of US$774m.

- Recent volatility in markets, particularly from Trump’s tariff uncertainty, has pushed many announced IPO’s to later in the year.

- In the UK IPO volumes are expected to be second half weighted. We continue to think that the FCA Listing Rule reforms will be helpful tailwinds for UK IPOs.

- Changes to the FTSE UK Index Series will heighten the attraction of a UK listing, allowing non-sterling denominated securities index inclusion, and a faster entry threshold for larger companies (market capitalisation greater than £1bn and market position greater than 225th).

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels. Note: there were 4 UK IPO’s greater than $50m in 2024; Air Astana, Raspberry Pi, Rosebank and Applied Nutrition.

UK ECM activity | March

UK ECM activity driven by large secondary sales

2025 UK ECM Q1 activity vs 2024 snapshot(1)

| 2025 YTD | 2024 YTD | Variance | |

| Total funds raised ($m) | 9,152 | 9,050 | +1% |

| Total no. transactions | 29 | 31 | (7%) |

Source: Dealogic; (1) Analysis and commentary only includes transactions greater or equal to $5m; (2) Analysis and commentary only includes transactions greater or equal to $US50m – chart above show year-to-date activity levels; IFR ECM

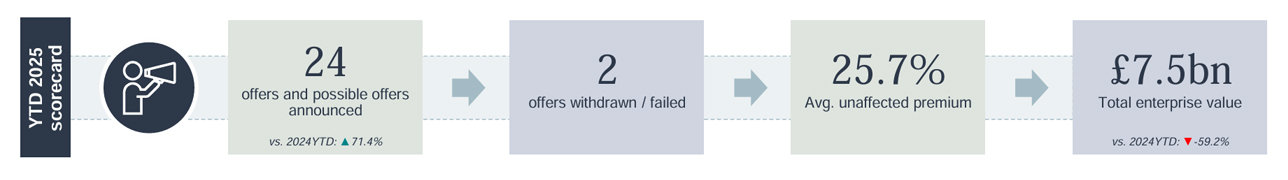

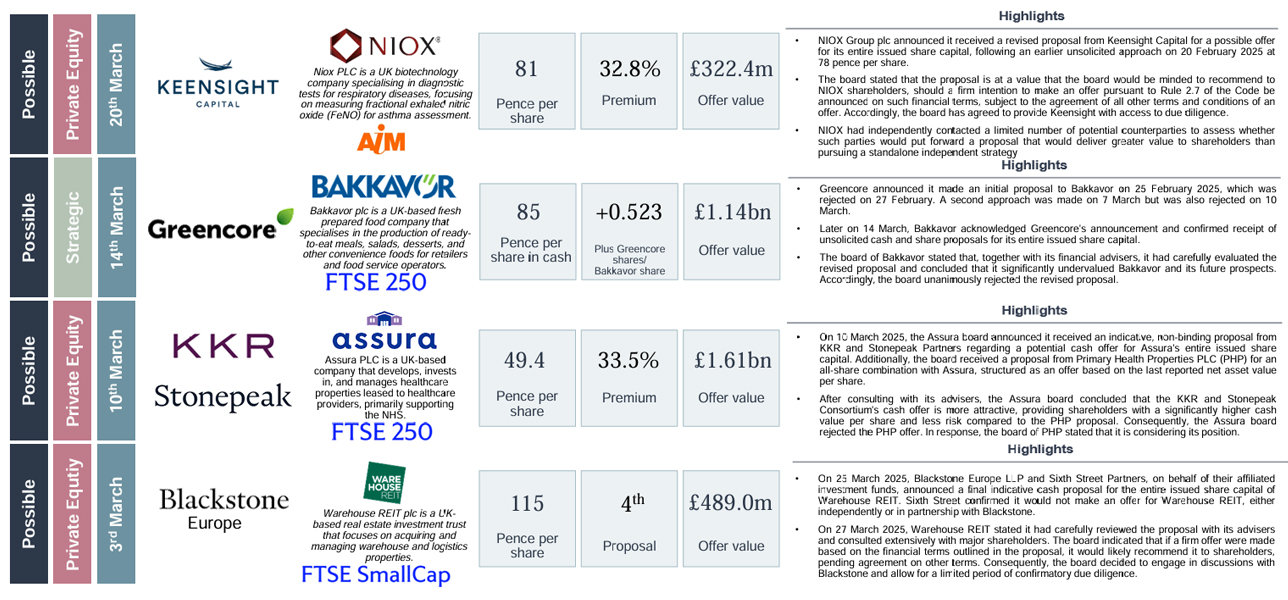

UK public M&A activity | March

UK public market valuations continue to attract significant interest from trade and private capital

Selected Deals

Source: Company announcements; FactSet; Practical Law

Note: Scorecard includes competing offers and withdrawn of companies subject to the Takeover Code quoted on AIM or the Main Market. Formal sales processes are not included unless a buyer has been identified. Only newly announced offers in the month are included in the count (i.e. possible offers announced in December 2025 will be included in that month even if it becomes a firm offer in January 2025)

Get the Investec Equity Market Overview delivered to your inbox

Browse articles in