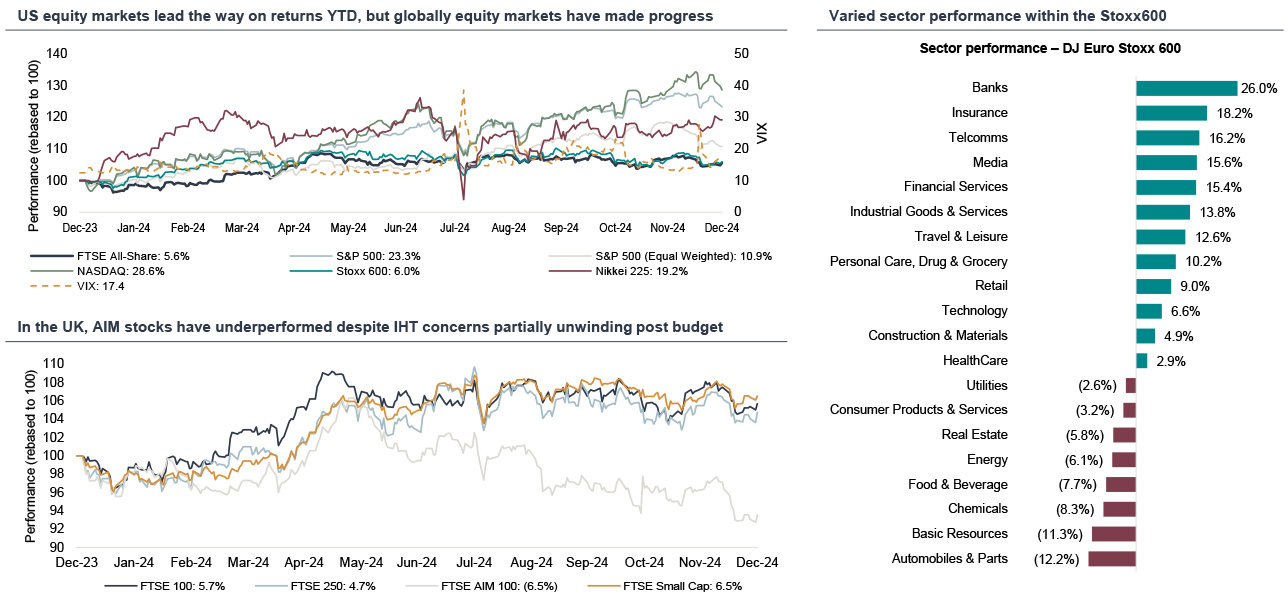

- Equity markets across the globe had another strong year in 2024 despite a mild sell off for some indices over the course of December as investors looked to take some profits ahead of year end.

- US equity markets bore the brunt of selling over December (S&P -2.5%, Nasdaq +47bps, Russell 2000 -8.4%) but have been the standout performers of 2024 with the S&P up 23%, Nasdaq up 29% and the Russell 2000 up 10% for the year (albeit the concentration of returns has been in large cap technology related stocks).

- European and UK equity market performance has been more modest with indices up from 6% (FTSE) to 18% (DAX) but, like their US peers, have now had 2 consecutive years of positive performance (other than the CAC which was down 2.2% in 2024 given political uncertainties).

- Government bond yields rose over December (c.25-40bps for 10 year maturities) and ended the year higher than where they started in January 2024 – whilst inflation has eased significantly it remains above central bank targets in most geographies and many see the potential for US policy implemented by President elect Trump to be ‘reflationary’.

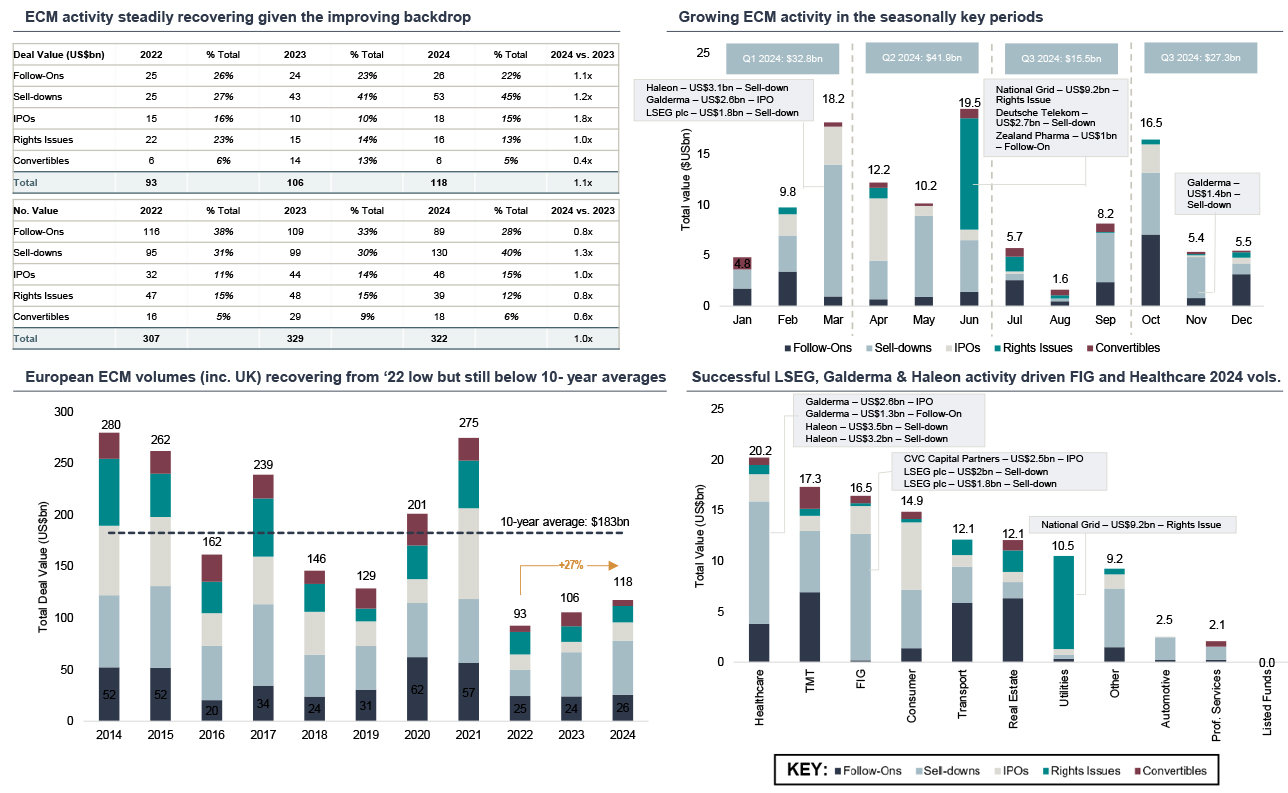

- ECM activity in December was muted, as is often the case given much of the month is a period of vacation for many regions, with $5.5bn of European and UK issuance across 18 transactions. Overall European and UK ECM issuance picked up in 2024 increasing to $118bn from $106bn in 2023.

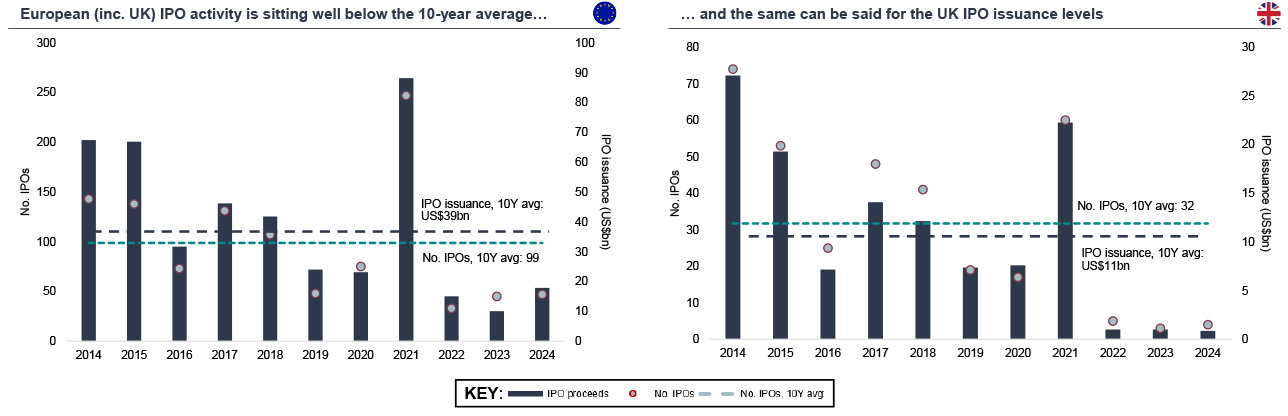

- There was muted IPO activity in Europe over December with 5 IPO’s for a total of $564m completed in December, and whilst 2024 saw $18bn of European IPO issuance, a large improvement over 2023, activity remained significantly below 10 year averages.

- In the US, ECM activity has demonstrated a similar trend to Europe and the UK, with some recovery in 2024 levels from 2023 but still below the 10 year average. The US saw $257bn of ECM activity in 2024, of which $41bn was IPO activity* – both below the 10 year averages of $295bn and $88bn respectively. Whilst there appears to be a narrative in the market regarding European companies considering a US listing, data from the LSEG suggests that international companies listed in the US display a weaker performance than domestic companies.

- There will be plenty for investors to consider through 2025 including the impact of a new US President, the path of inflation and central bank rates, how will near-term US optimism versus the relative attractiveness of UK equity markets ultimately play out, as well as various material geopolitical events and dynamics.

Source: Factset; 1 Dealogic – analysis only includes transactions greater or equal to $US50m; European ECM activity inclusive of UK.

Note: * excluding special acquisition companies, this falls to $32bn, Financial Times.

Equity Market overview | A weaker December, but still solid YTD

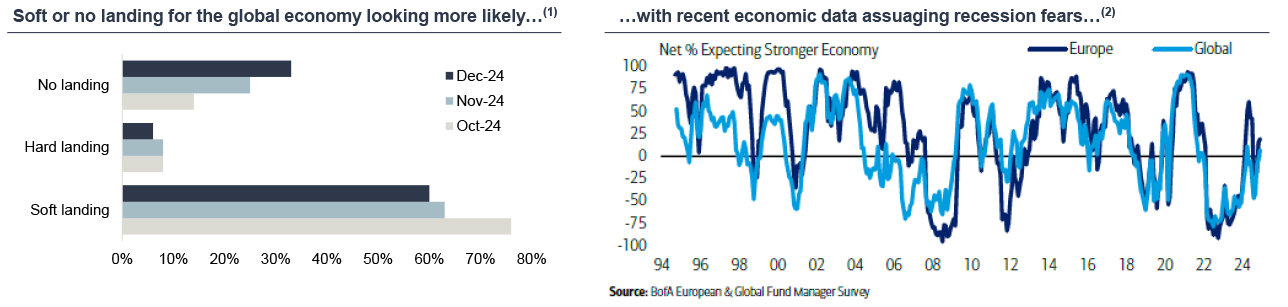

Confidence in soft / no landings remains intact with very limited expectation of a hard landing

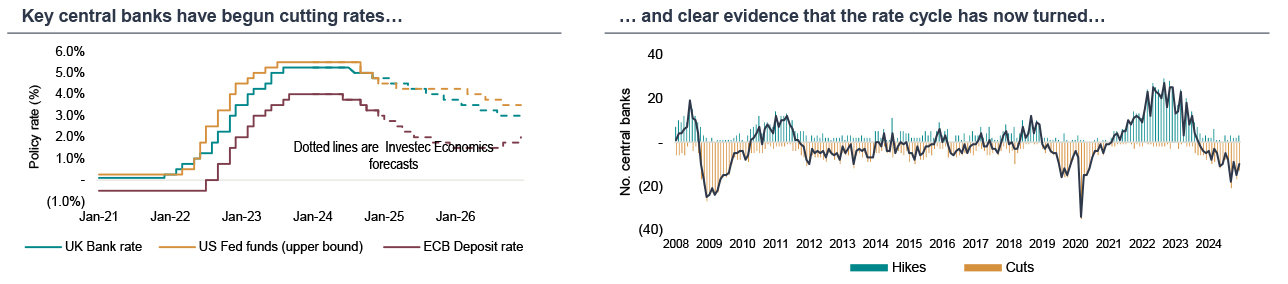

- After a strong year for equities, many global indices weakened in December, following the 18th December FOMC meeting which suggested US rate cuts would be slower than previously anticipated. Fed Chair Powell observed that inflation may remain sticky through 2025 and the median view in the ‘dot plot’ projected just 2 25bps cuts through the coming year.

- By the close of the month most indices finished in the red – FTSE down -1.4%, FTSE250 down -0.7%, Stoxx600 down -0.5%, S&P down -2.5%.

- Volatility has been subdued during much of 2024 with significant spikes in mid August and to a lesser extent in mid December, with a combination of high market levels and nervousness with respect to inflation and central bank policy driving market sell offs – these periods of elevated volatility were relatively short lived however.

Source: FactSet; Bloomberg

Equity Market overview | Valuation disconnect remains

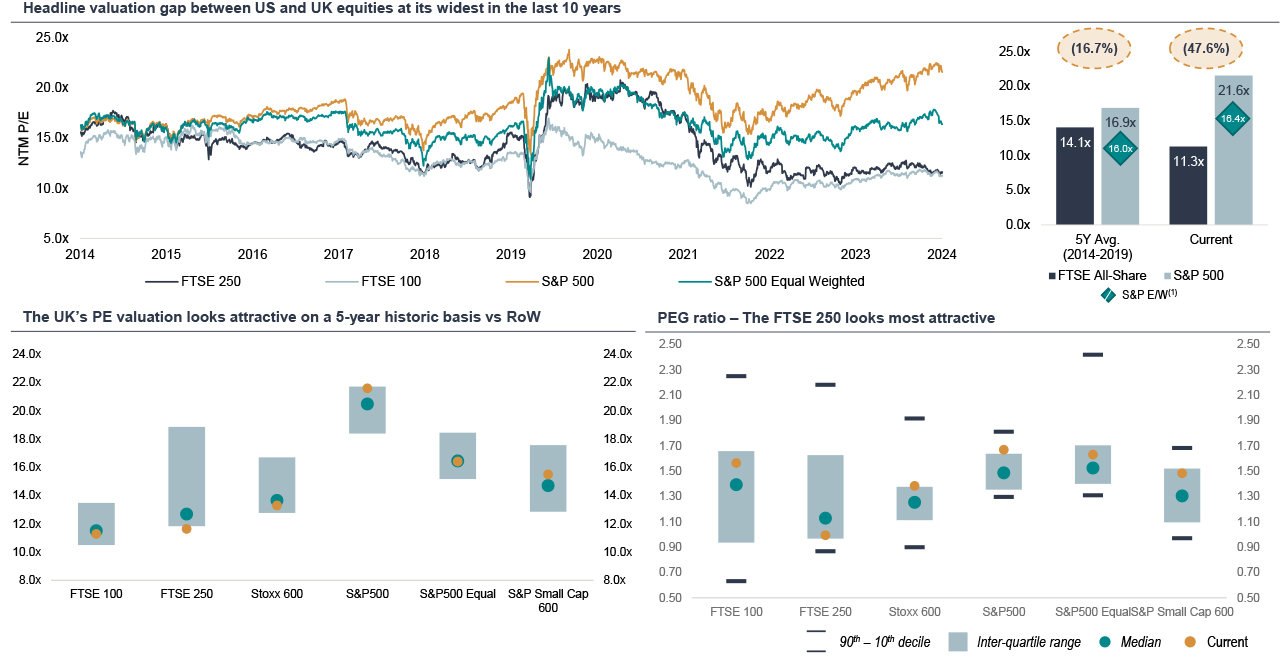

UK valuations continue to look attractive on a global and historic relative basis

- As we know, since Brexit in 2016, the spread between UK and US equity valuations has increased with further divergence evident since the start of the pandemic and subsequently over the period of UK Government instability.

- The UK budget could arguably have been more difficult but was still very much a ‘mixed bag’ for UK PLC with employer NI increases being the largest single hit for corporates. Companies have updated markets on what the impact of the Budget is expected to be for their businesses but there is seemingly some benefit for markets from clarity and removed uncertainty.

- US equity markets are currently towards the top of historic valuation ranges and the headline valuation differential between US and UK / EU equity markets is as wide as it has ever been, although after adjusting for growth (and sector skew therefore...) that differential does reduce.

- Economists and Strategists currently see positive returns in 2025 for equities, however, whilst a number highlight ‘US exceptionalism’ and the importance of AI, very few expect US equity returns to be as high as they have been in 2024 (or 2023).

Source: FactSet; (1) S&P E/W refers to the S&P500 Equal Weighted index.

Note: PE and PEG ratios are derived on a Next Twelve Months Ahead basis. FTSE 100 and FTSE 250 demonstrate greater variance in their PEG ratios given the domestic political activity over the last 5-years (including the Truss leadership). Note: the interquartile range excludes any values in the top and bottom quartiles, similarly the inter-decile range excludes to the top and bottom deciles to remove any outliers.

Macro Outlook | Broadly supportive backdrop

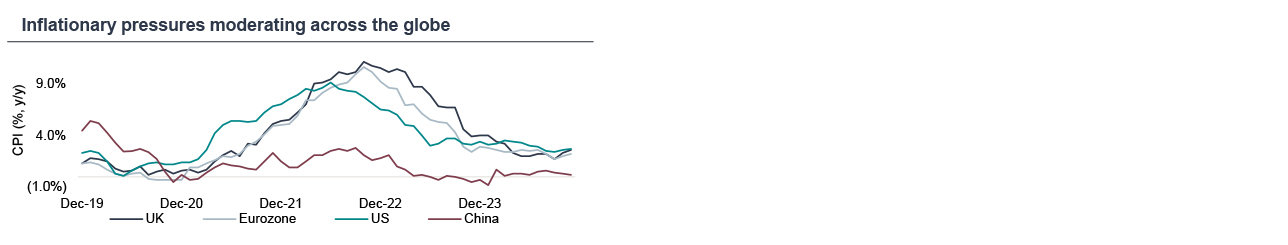

Inflation has fallen significantly but remains slightly above target. Further rate cuts expected albeit at a reduced pace

- UK inflation for November rose to 2.6% y/y from 2.3% in October and a further increase from the 1.7% print in September. Service sector inflation maintained its level at 5.0%, well above what the BoE would consider target-consistent.

- In the Eurozone CPI for November increased to 2.2% y/y from 2.0% in October. In the US CPI ticked up to 2.7% y/y in November from 2.6% in October.

- Whilst the pace of further interest rate cuts may not be as quick as had been expected earlier in the year (particularly in the US), more are expected which supports confidence in the outlook and ‘soft economic landings’.

- The next hurdle for equity markets is likely to be new US policy (with global trade challenges and sticky inflation seen by investors as the largest tail risks for markets). Ongoing political turmoil in France, German elections, the Middle East and Ukraine keeps geopolitical uncertainty on the agenda.

1 Inflation is trending towards central bank target levels…

2 …and the rate cutting cycle looks well underway…

3 …supporting a more optimistic macro-outlook

Source: FactSet; Macrobond; ONS; Investec Economics; BofA European Fund Manager Survey – (1) Global investors’ view on the global economy; (2) Global investors’ view on the European economy.

Prefer to download?

Click to download the complete Equity Market Overview.

Never miss an update

Subscribe to the Equity Market Overview.

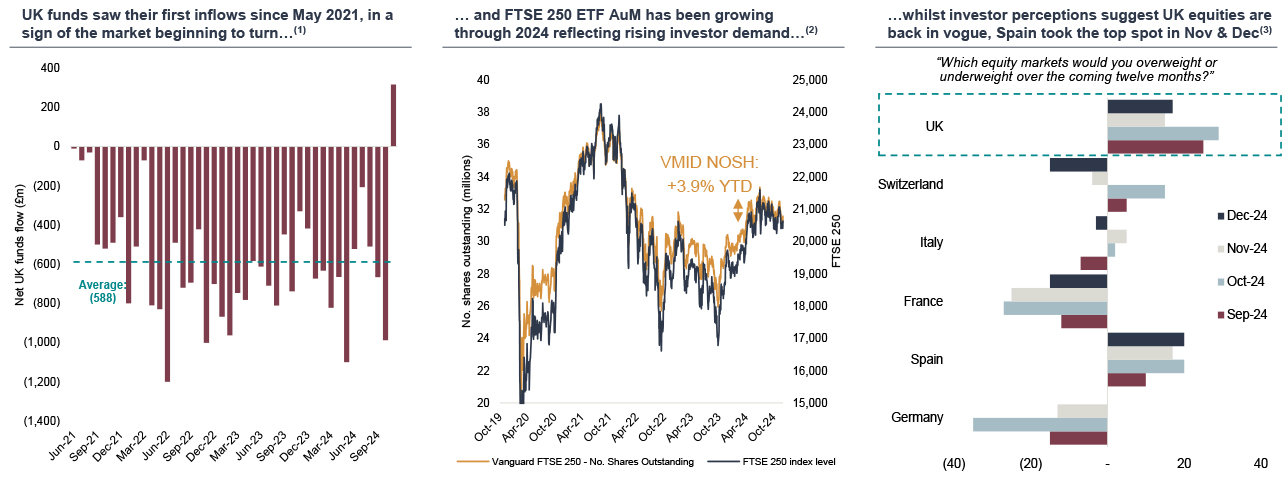

UK funds flow overview | Perceptions gradually changing

Despite a challenging funds flow environment for UK equities since 2021, there are signs of improvement

- The October Budget caused significant uncertainty, impacting flows into UK equities, but these have recovered with clarity provided.

- Most notable for UK markets, in November UK focused equity funds saw their first month of inflows since May 2021, breaking a 41-month stint of net selling.

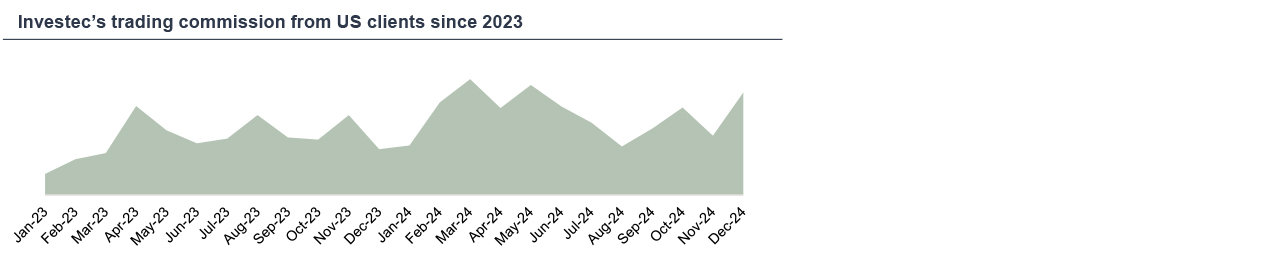

- Investec trading flows from US clients decreased in November as US institutions pivoted allocations to align with strong US equity performance post the election, but rebounded in December as UK equities outperformed US equities.

- As fund managers focus on their 2025 strategies, London listed equities may be positioned for recovery with UK equities the top choice for European PMs in 2 of the last 4 months, and only marginally behind Spain in November and December.

Source: (1) Calastone – fund flow data relates to UK mutual funds only; Bloomberg; (2) Chart shows increasing share count of Vanguard FTSE 250; (3) BofA European Fund Manager Survey.

European equity issuance 2024 YTD | Improving trends

European equity issuance remains well below 10-year averages, but YoY improvements with 2024 $ volume ahead of 2023 and some recovery in IPO volumes

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels.

Note: Large TMT deals include Atos ($3.1bh) and Deutsche Telekom $2.7bn.

European IPO issuance 2024 | Improving outlook

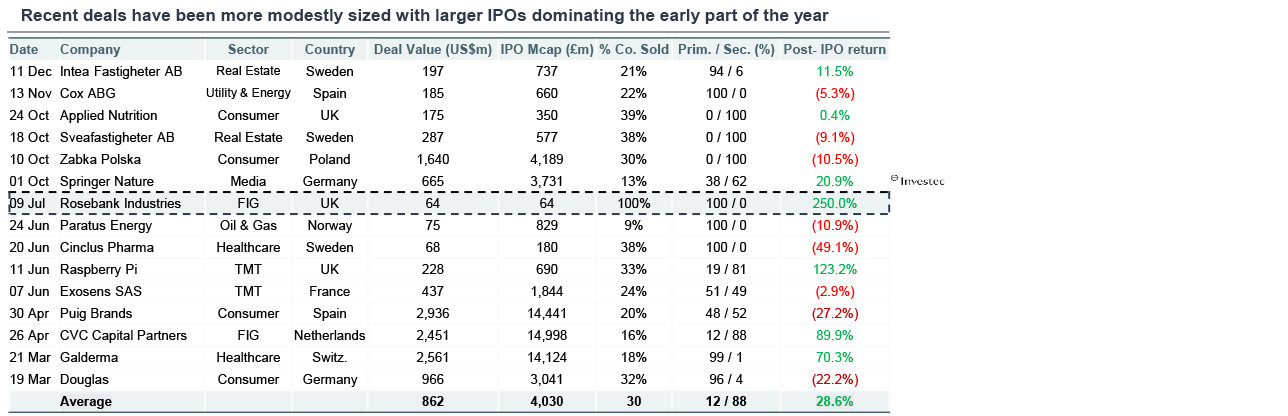

Gradual improvement in IPO activity, although volumes remain below 10-year averages. Volumes are up YoY with 5 IPOs completing in December

IPO issuance in Europe

- US$18bn raised across 46 transactions in 2024, up by 55% and 5% respectively versus the $11bn raised across 44 deals in 2023.

- Average IPO size so far this year of US$389m vs. US$228m for 2023.

- Average post-IPO share price gain of c.20%, which increases to c.80% for UK IPO’s. In 2024 22 transactions out of 46 delivered positive aftermarket performances, generating $3.4bn in returns for investors.

- There have been four IPOs over US$1bn this year: Spanish fashion company Puig Brands (US$2.4bn); consumer health and aesthetic solutions provider Galderma (US$2.6bn), private equity firm CVC (US$2.5bn) and Polish convenience store chain Zabka Polska (US$1.6bn).

- December saw five IPO’s over US$50m, Swedish online pharmacy Apotea (US$173m), Swedish property management company Intea Fastigheter (US$197m), Swedish polymer provider KB Components (US$51m), Norwegian engineering group Moreld (US$81m) and Turkish pulses provider Armas Gida Ticaret Sanayi (US$62m), and in the UK the introduction of Canal+ at an equity value of €6bn.

- Global equity markets continue to attract capital and equity market performance over the last 2 years has been robust. Additionally, we think the FCA Listing Rule reforms will be helpful tailwinds for UK IPOs.

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels.

Note: there were 4 UK IPO’s greater than $50m in 2024; Air Astana, Raspberry Pi, Rosebank and Applied Nutrition.

UK ECM activity | December

UK ECM issuance was muted in December as markets digested the UK October Budget and the US election results, but total issue volume and deal numbers in 2024 well ahead of 2023

2024 UK ECM YTD activity vs 2023 snapshot (2)

| 2024 YTD | 2023 YTD | Variance | |

| Total funds raised (£m) | 31,106 | 22,977 | +35.4% |

| Total no. transactions | 156 | 135 | +15.6% |

Source: Dealogic; (1) Analysis and commentary only includes transactions greater or equal to £5m; (2) Analysis and commentary only includes transactions greater or equal to $US50m – chart above show year-to-date activity levels; IFR ECM.

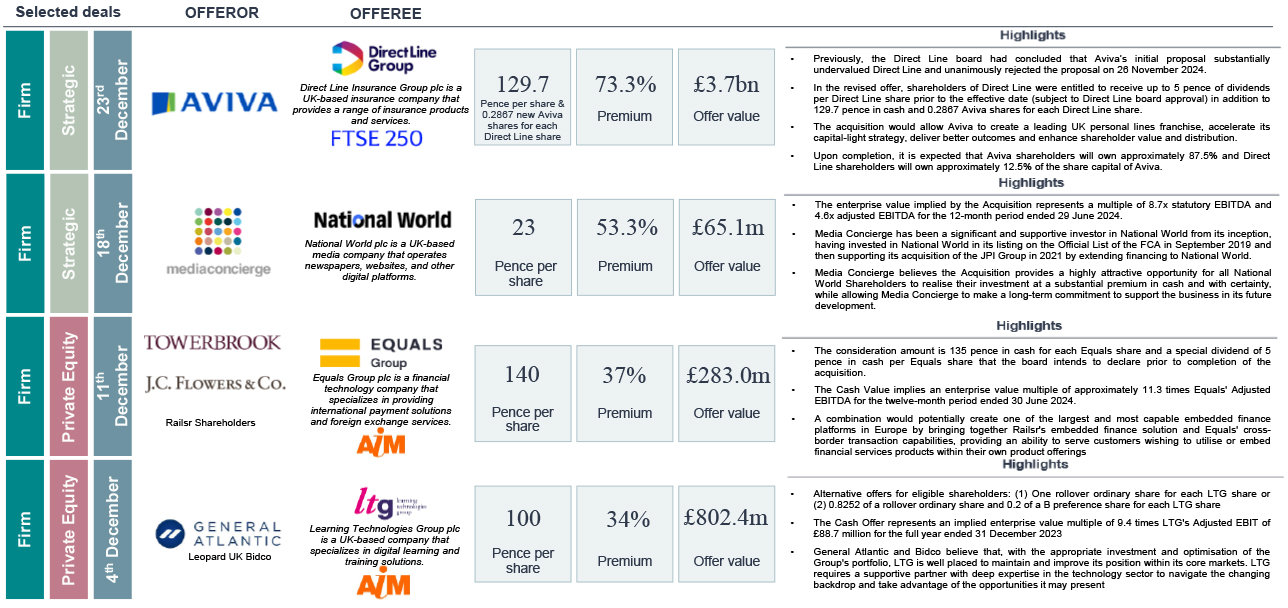

UK public M&A activity | December

UK public market valuations continue to attract significant interest from trade and private capital

Selected Deals

Source: Company announcements; FactSet; Practical Law | Note: (1)Total Enterprise Value including the £36.7bn withdrawn Anglo American plc deal.

Scorecard includes competing offers and withdrawn of companies subject to the Takeover Code quoted on AIM or the Main Market. Formal sales processes are not included unless a buyer has been identified. Only newly announced offers in the month are included in the count (i.e. possible offers announced in December 2023 will be included in that month even if it becomes a firm offer in January 2024).

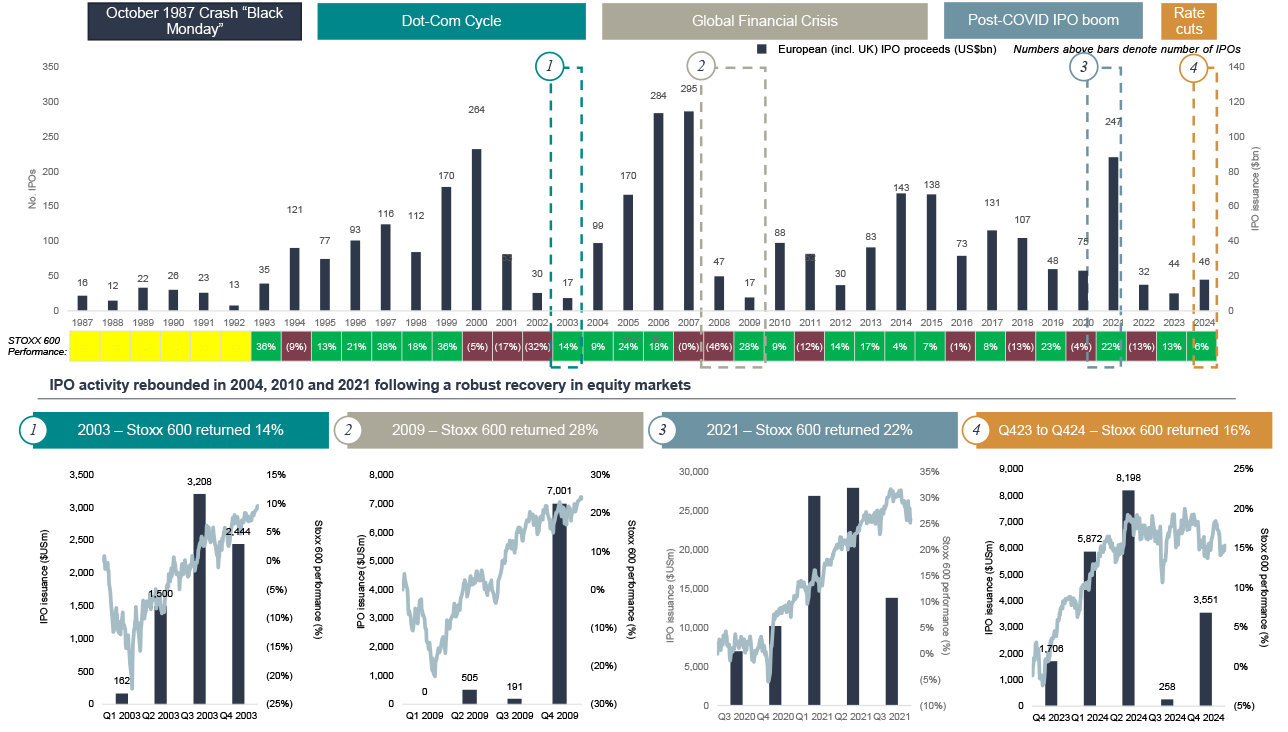

2025 Equity Issuance | Primed for recovery

Strong secondary market performance a precursor to a recovery in ECM volumes and very important for IPO activity

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels.

Note: Last rate rise occurred in 3Q23, the market narrative for rate cuts beginning in 4Q23, rate cuts only began in 3Q24.

Outlook for 2025 | Investec and Market Forecasts

We are factoring in some impact on the UK from a US ‘universal tariff’, but this may be fairly muted as British goods exports to the US account for just 2.3% of GDP. Inflation will probably rise close to 3.0% by mid-2025, partly on utility prices, but seems likely to fall close to 2.0% by end-year as services inflation continues to moderate. The MPC thus looks set to keep its strategy of gradual policy loosening intact and we still judge that the Bank rate will fall by a further 100bps to 3.75% by end-2025. GDP growth has lost momentum recently, but firm household income growth should support spending further ahead.

Sources: Macrobond, Investec forecasts.

Note: Shaded areas denote Investec forecasts.

Higher policy rates reinforce strong projected bond returns, while higher growth underpins equity returns. Our return projection of 6.4% for a USD global 60/40 stock-bond portfolio dips 60 basis points (bps)from last year – a forecast that is in line with the long-run average. Investors will need to manage a range of risks, not least from the geopolitical tensions that currently dominate headlines. But overall, our 2025 LTCMAs offer an optimistic outlook. As investment levels pick up and rates normalize, a healthy – even buoyant – economy will emerge, providing a strong foundation for asset markets.

Worldwide GDP is forecast to expand 2.7% next year on an annual average basis, just above the consensus forecast of economists and matching the estimated growth in 2024. The re-election of US President Donald Trump is predicted to result in higher tariffs on China and on imported cars, much lower immigration, some fresh tax cuts, and regulatory easing. The economic headwind from US trade policy is expected to be greater outside the US. In the euro area, a rise in trade policy uncertainty to the peak levels of the trade conflict in 2018-19 would subtract 0.3% from GDP in the US but as much as 0.9% in the euro area.

A global economy with moderate growth, disinflation and monetary easing should encourage investors to look to equities and other risk assets. Policy uncertainty in the U.S. will remain a factor worldwide, with potential deregulation as a positive, while tariffs and restrictions on immigration might disturb markets later in 2025. Equity valuations are more stretched than they were six months ago, but this is justified by company fundamentals and growing certainty about the economy.

Source: Investec Economics, Macrobond, Company Outlook Forecasts | Note: According to the Survey of International Economic Forecasts, current consensus GDP forecasts calendar year 2025 for US 2.0%, UK 1.3%, Eurozone 1.0% and Global 2.6%.

Get the Investec Equity Market Overview delivered to your inbox

Browse articles in