European and UK Equity Capital Markets Review February 2025

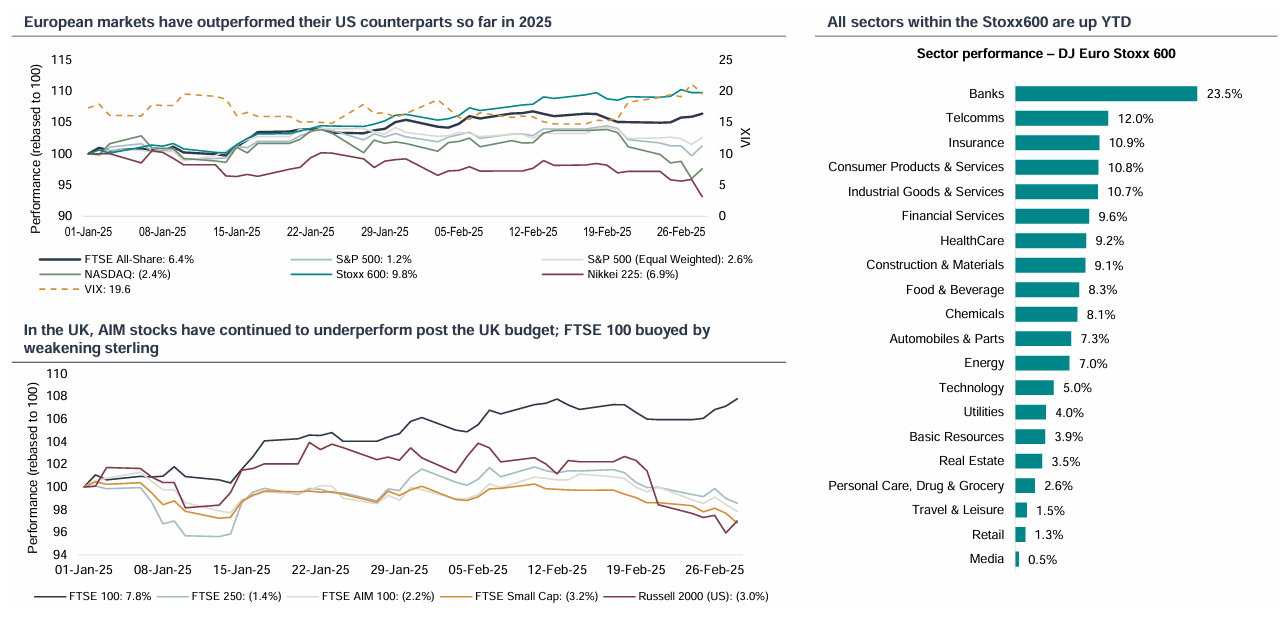

February was another month of progress for European equity markets. As was the case in January, US markets underperformed their European and Asian peers, not helped by what some see as a relatively chaotic month for US policy from President Trump’s incoming Administration (US markets are now in negative territory YTD). Strong ECM activity with 2025 volumes ahead of 2024 YTD.

- Over the course of the month the Stoxx600 rose 3.3%, the FTSE rose 1.6%, whilst the S&P500 fell -1.4% and Nasdaq -4.0%. Small and mid-caps continued to underperform their larger cap peers however, with the FTSE250 -3.0% and the Russell 2000 -5.4%

- YTD as of February close, the Stoxx600 is up 9.8%, the FTSE +7.8%, the FTSE250 -1.4%, the S&P500 +1.2%, Nasdaq -2.4% and the Russell 2000 -3.0%. The key development for February was President Trump and his various policy updates, both economic and foreign. He has certainly been busy and the full impact of his breakneck policy making is yet to be fully assimilated, but they are clearly starting to have an impact on markets to the downside

- For much of the month, markets took the latest developments in US policy in their stride, but over the past few weeks US equity market underperformance versus global peers hascontinued as President Trump’s first few months in office start to have a dampening effect on US sentiment - US Consumer Confidence in February fell to 98.3 versus expectationsof 102.5 and down from 104.1 in January (its steepest m/m decline since Aug 2021). Markets appear worried US activity could take a hit as a result. Meanwhile, Europe, led byGermany, has announced intentions of a huge step up in defence spending, contributing to driving European stock markets higher

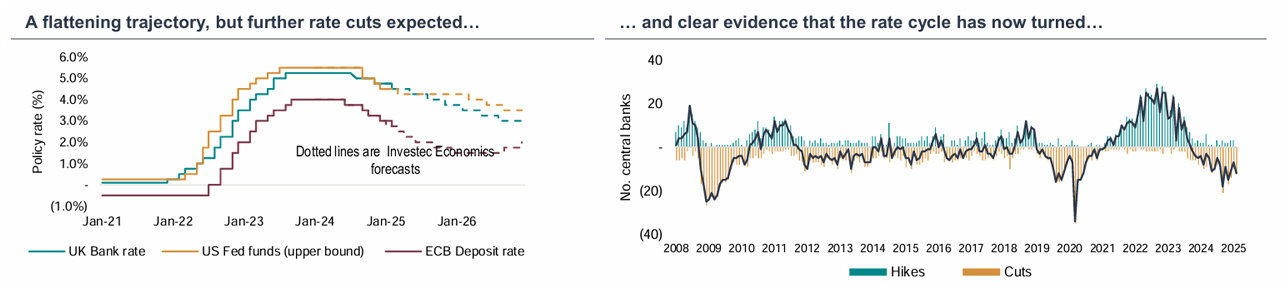

- On the inflation front, UK January CPI was slightly hotter than expected at 3% y/y, driven by a number of arguably one-off impacts (private school VAT, fuel etc), but the reading was not significant enough to deter the BoE from cutting rates (as expected) by 25bps taking UK Base rates to 4.5%. In the US, CPI data for January was also slightly elevated relative to expectations and the prior month at 3% y/y versus 2.9% in Dec and 2.9% expected. The Fed kept rates on hold at its Jan 29th meeting and the Fed minutes released on 19th February showed that the FOMC is minded to be cautious and data driven as regards future rate moves

- In addition, there is concern that US Tariff policy, which combined with the tax cuts that the President wants to enact, will ultimately be reflationary – markets were pricing one more US rate cut over the balance of 2025 (in late summer). However, as fears regarding activity have mounted, market expectations have rapidly changed over the last few weeks with 2+ Fed rate cuts now expected

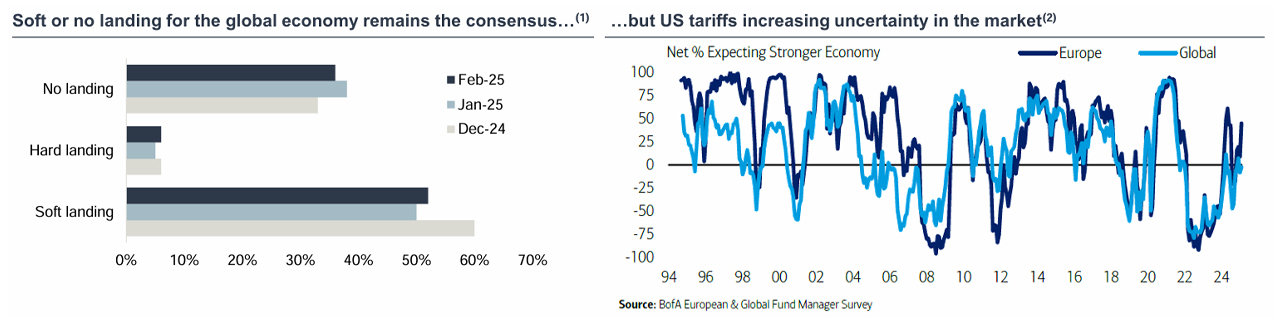

- The latest BAML survey of Global and European fund managers clearly points to a constructive view for equity markets in 2025, but in a change from prior years US equity markets are not expected to lead the way – EU and Asian equity markets have been the beneficiaries of a broadening investor interest amid a peaking in investor conviction of ‘US Exceptionalism’ (89% of Global investors in the survey see US equities as overvalued)

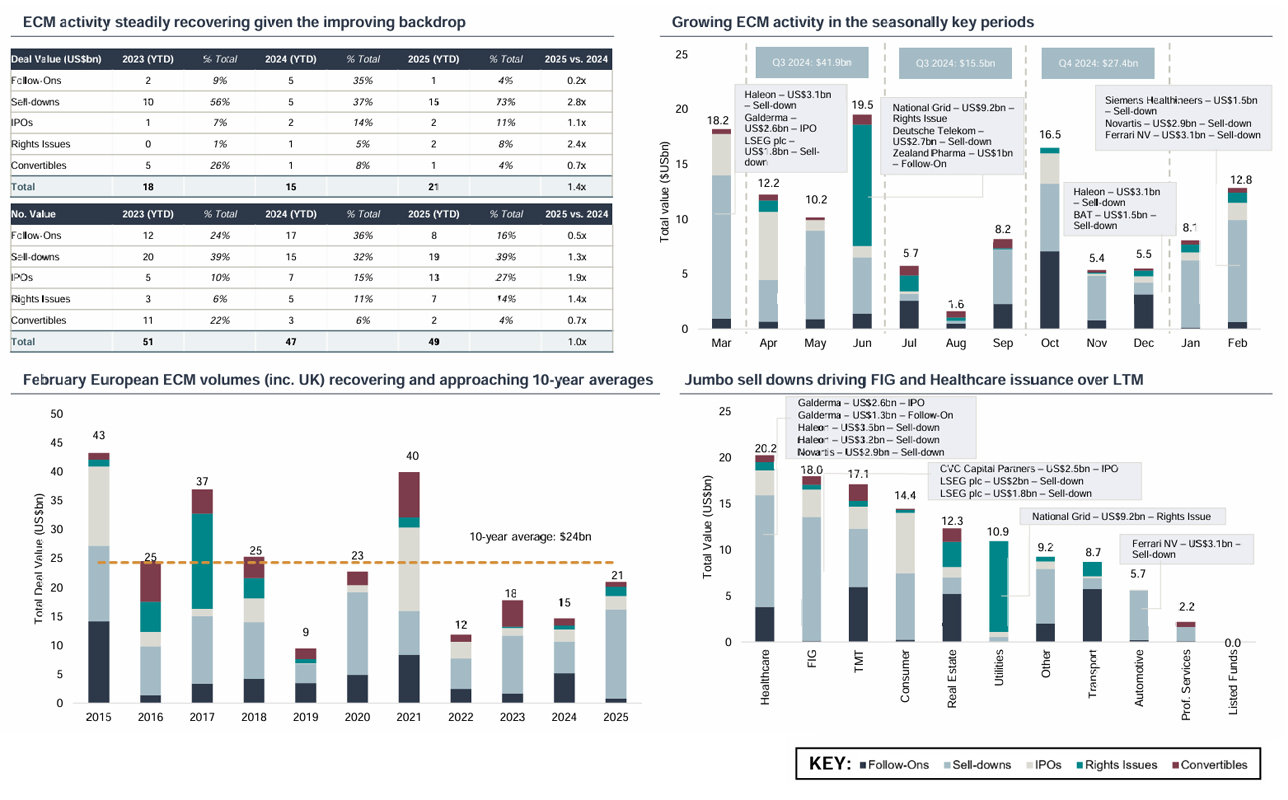

- European ECM volumes YTD are up on 2024 ($21bn versus $15bn) with February volumes up 58% relative to January. Significant transactions over the month include the $1.5bn sell down of Siemens Healthineers by Siemens and accelerated sell down of SigmaRoc’s shares by CRH ($143m). 8 notable European IPO’s priced over the month including HBX Group, Diagnostyka, Doosan Skoda and Bioversys. Post month end, Investec completed a £41m primary capital raise in the Industrials sector for long-standing client XP Power

- Along with on-going company results, US policy updates and geopolitical developments Central Banks will be in focus over March with the next Fed meeting on March 19th (expected to hold at 4.25-4.5%), BoE on March 20th (expected to hold at the current 4.5%) with the ECB cutting by 25bp on March 6th bringing the deposit rate to 2.50%

Equity Market overview | European outperformance

European equity markets continue to outperform in 2025 as policy uncertainty impacts US equities

- Despite growing concern about the new US Administration’s high speed policy making with respect to tariffs, European equity markets had another positive monthly performance over February

- US indices underperformed (as they did in January) as investors increasingly looked to diversify portfolios away from the US (and large cap technology related stocks in the US). Growing concerns with regard to President Trump’s policy agenda and the scope for it to be both reflationary and sentiment impacting are accelerating this rotation. The announcement of a plan for a huge fiscal boost in EU defence spending and in German infrastructure contributed too. The heightened uncertainty was reflected in the VIX which climbed over the course of the month

- In the UK, the large cap FTSE 100 outperformed its smaller cap counterpart, the FTSE 250. A jump in CPI to 3% in January did not dissuade the BOE from cutting rates and the Investec Economics team remains of the view that 2025 will see 3 further 25bps rate cuts

- By the close of the month the FTSE was up 1.6%, FTSE 250 down -3.0%, Stoxx600 up 3.3%, S&P down -1.4%, Nasdaq down -4.0% and Russell 2000 down -5.4%

Source: FactSet; Bloomberg

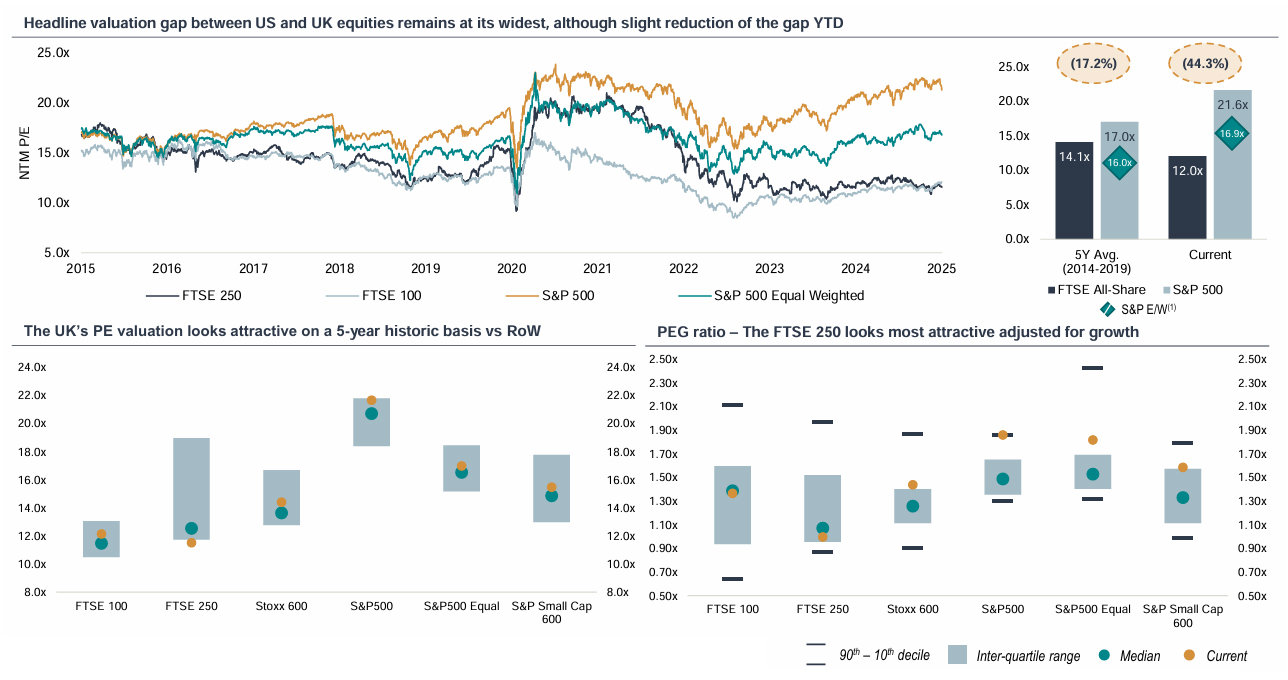

Equity Market overview | Valuation disconnect remains

UK valuations continue to look attractive on a global and historic relative basis

- US equity markets are currently towards the top of historic valuation ranges and the headline valuation differential between US and UK / EU equity markets remains as wide as it has ever been, although after adjusting for growth (and sector skew therefore...) that differential does reduce

- Economists and Strategists currently see positive returns in 2025 for equities, however, whilst a number highlight ‘US exceptionalism’ and the importance of AI, few expect US equity returns to match those seen in 2024 (or 2023)

- The robust FTSE performance YTD2025 has started to close the gap, but there is still a long way to go particularly for the FTSE250. Whilst there has been an improvement in the valuation disconnect, at a headline level, the FTSE All-Share still sits at a 44% discount to the S&P, and a 29% discount on an equal weighted basis

Source: FactSet; (1) S&P E/W refers to the S&P500 Equal Weighted index

Note: PE and PEG ratios are derived on a Next Twelve Months Ahead basis. FTSE 100 and FTSE 250 demonstrate greater variance in their PEG ratios given the domestic political activity over the last 5-years (including the Truss leadership). Note: the interquartile range excludes any values in the top and bottom quartiles, similarly the inter-decile range excludes to the top and bottom deciles to remove any outliers

Macro Outlook | US policy uncertainty impacting markets

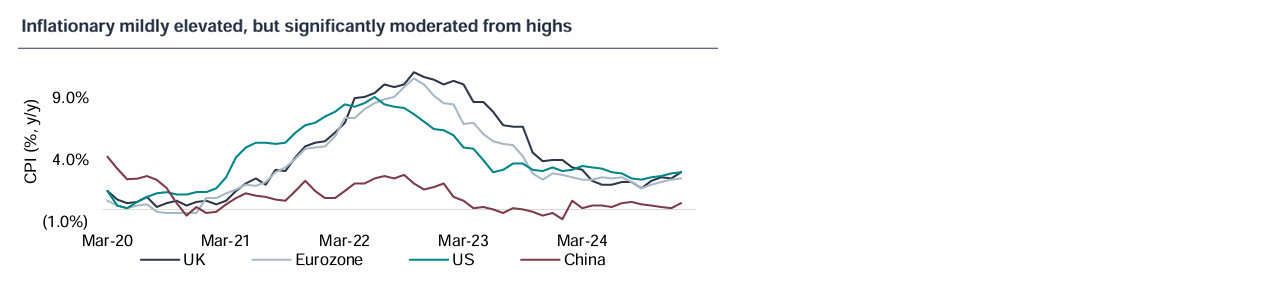

Mild inflation tick up in January, for now, while Trump related uncertainty is building

- UK inflation for January jumped to 3.0% y/y from 2.5% in December above consensus estimates of 2.8%. Service sector inflation climbed to 5.0% from 4.4%, with core climbing to 3.7% from 3.2% in line with consensus

- Likewise, in the Eurozone CPI for January increased to 2.5% y/y from 2.4% in December. In the US CPI ticked up to 3.0% y/y in January from 2.9% in December

- The US and Europe (inc. the UK) look set to decouple of terms of interest rate moves with markets expecting the ECB and BoE to reduce rates more actively than the Fed over 2025 (although expectations for US rate changes rapidly)

- With President Trump pursuing his America First agenda there is US policy unpredictability to navigate but also also evidence that the big shift in the geopolitical backdrop is prompting a large fiscal response in the EU. The hand of the UK Governments is more fiscally constrained, but efforts are made to elevate the country’s growth agenda through deregulation

1 Inflation is trending towards central bank target levels…

2 …and the rate cutting cycle looks well underway…

3 …supporting a more optimistic macro-outlook

Source: FactSet; Macrobond; ONS; Investec Economics; BofA European Fund Manager Survey – (1) Global investors’ view on the global economy; (2) Global and European investors’ views on the European economy

Prefer to download?

Click to download the complete Equity Market Overview.

Never miss an update

Subscribe to the Equity Market Overview.

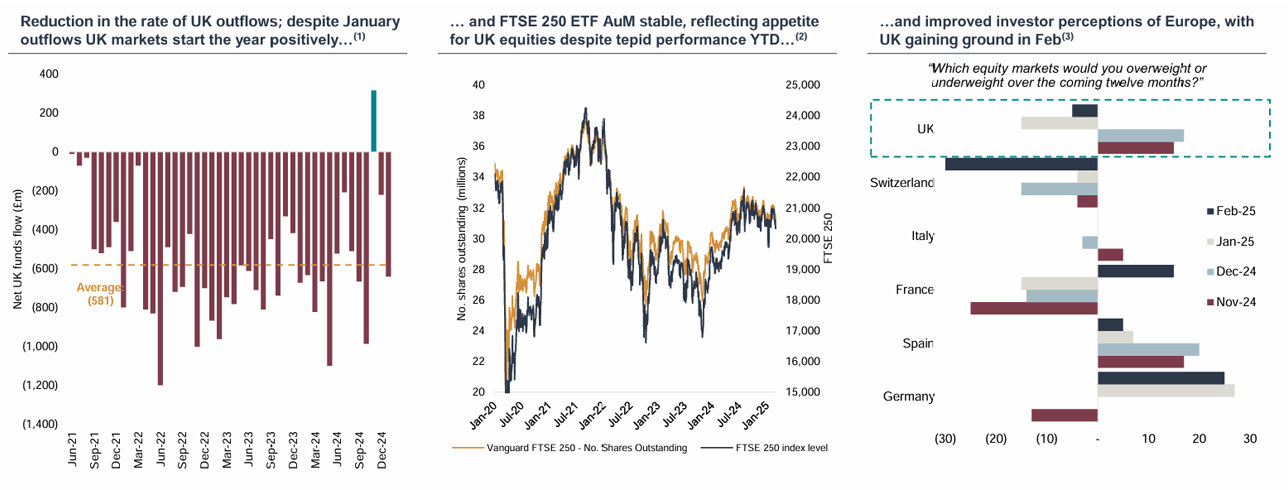

UK funds flow overview | Perceptions improving for Europe

Clear evidence of rotation in favour of European equities

- Amongst global fund managers there is a clear shift in sentiment to European equities. According to the latest BAML survey, 76% project upside for European equities over the coming 12 months, with a net 12% overweight European equities in a global context

- Most notable for UK markets, in November UK focused equity funds saw their first month of inflows since May 2021, breaking a 41-month stint of net selling

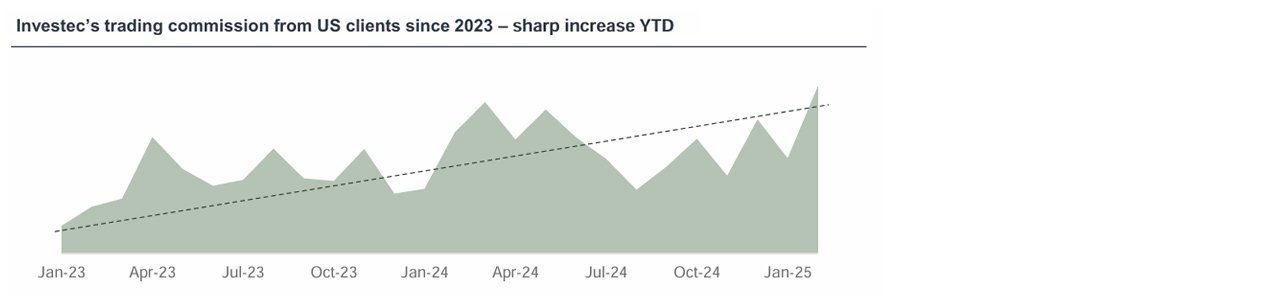

- Investec saw the highest commission from US clients since January 2023, as US investors assessed the impact of President Trump’s tariffs on global markets. The strong performance of UK equities vs US peers helped attract flows

- Investors have continued to view the UK more positively, with an improvement in February vs January. This was aided by positive macro data which included a UK Q4 GDP surprise to the upside (+0.1% vs con. -0.1%) and firmer than expected UK retail sales (+1.7% vs con. 0.5%) as well as continued elevation of the pro-growth rhetoric by the UK Government

Source: (1) Calastone – fund flow data relates to UK mutual funds only; Note: Calastone data excludes any pan-European or Global funds with UK exposure, the data also excludes ETFs (2) Bloomberg; Chart shows increasing share count of Vanguard FTSE 250; (3) BofA European Fund Manager Survey

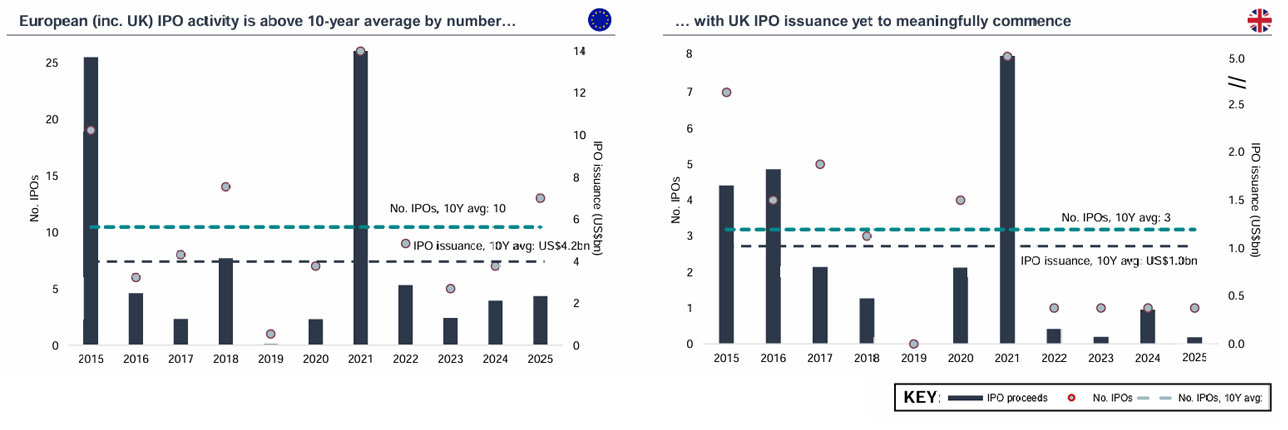

European Equity Issuance 2025 YTD | Improving trends

European equity issuance approaching 10-year averages, with YoY improvements continuing into 2025

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels. Note: Large TMT deals include Atos ($3.1bh) and Deutsche Telekom $2.7bn

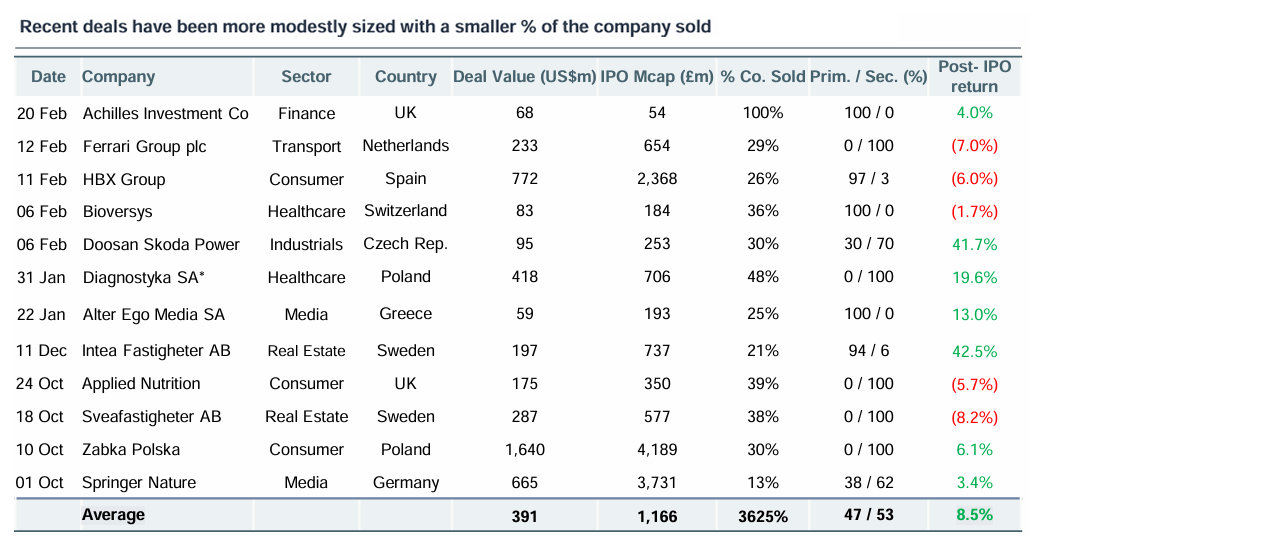

European IPO issuance 2025 | Improving outlook

Although volumes remain below 10 year averages, continued gradual improvement in IPO activity in February 2025

IPO issuance in Europe

- US$1,697m raised across 13 transactions in February 2025, with 5 of those IPOs sub-US$50m. Average IPO size so far this year of US$121m

- February saw eight IPO’s over US$50m, Turkish finance co. Destek Faktoring (US$109m), Czech manufacturer Doosan Skoda Power (US$95m), French biotech Bioversys (US$84m), Turkish solar panel manufacturer Kalyon Gunes Teknolojileri Uretim (US$90m), Spanish travel tech HBX Group (US$772m), Italian luxury shipping Ferrari Group (US$233m), Turkish hazelnut exporter Balsu Gida Sanayi ve Ticaret AS (US$135m) and British closed ended investment company Achilles Investment Co (US$68m)

- There were four IPOs over US$1bn in 2024, largest IPO so far in 2025 has been US$772m IPO of HBX Group

- In the UK IPO volumes are expected to be second half weighted. We continue to think that the FCA Listing Rule reforms will be helpful tailwinds for UK IPOs

- Changes to the FTSE UK Index Series will heighten the attraction of a UK listing, allowing non-sterling denominated securities index inclusion, and a faster entry threshold for larger companies (market capitalisation greater than £1bn and market position greater than 225th)

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels. Note: there were 4 UK IPO’s greater than $50m in 2024; Air Astana, Raspberry Pi, Rosebank and Applied Nutrition

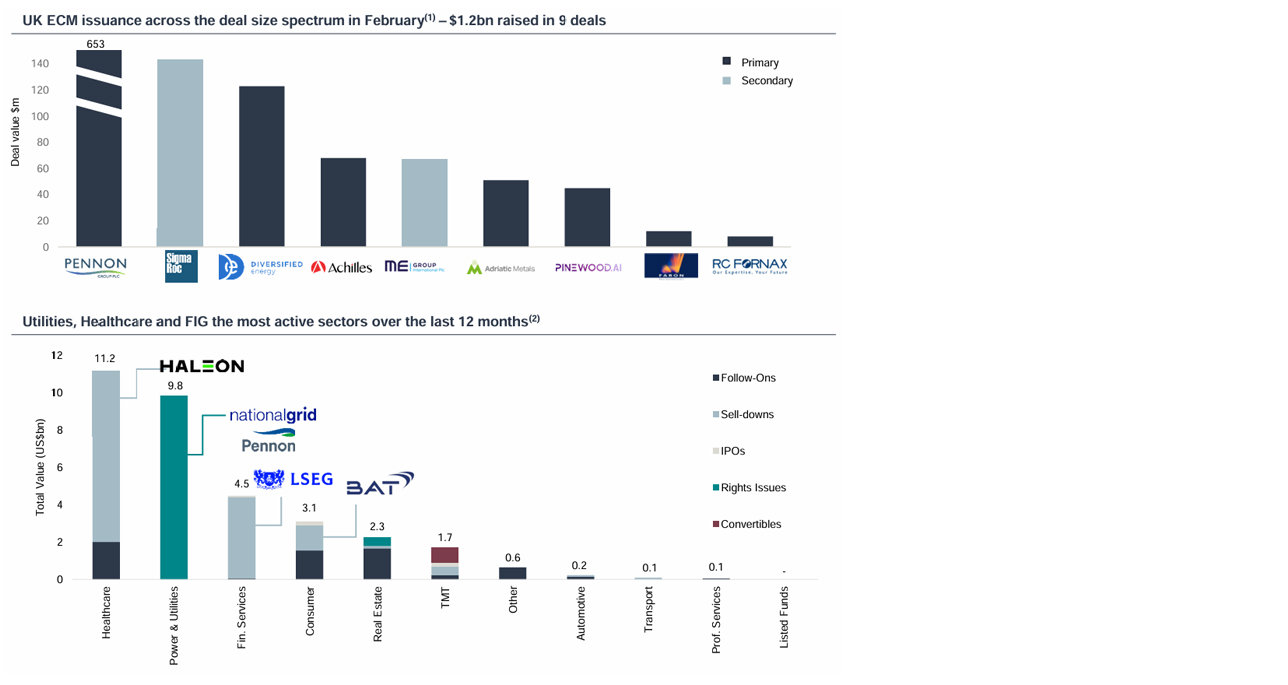

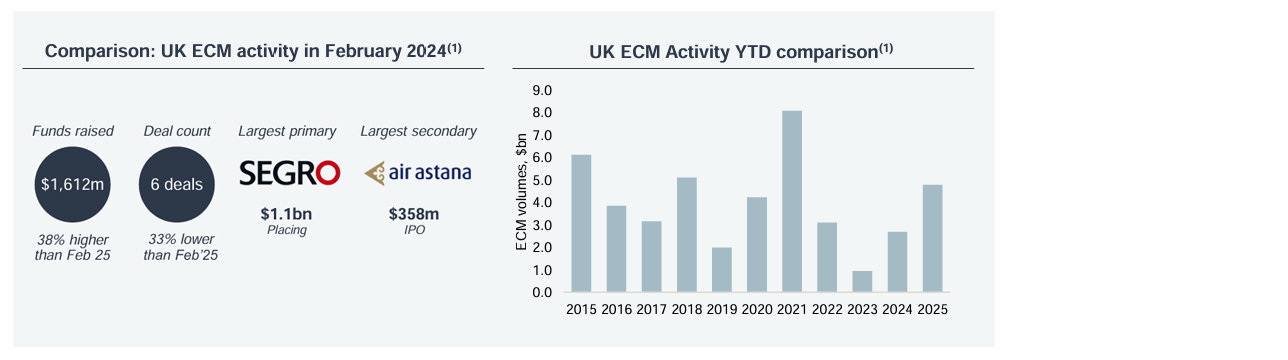

UK ECM activity | February

UK ECM activity off to a strong start, driven by large secondary sales in Haleon and BAT in January, and Pennon and Sigmaroc in February

2025 UK ECM YTD activity vs 2024 snapshot(1)

| 2025 YTD | 2024 YTD | Variance | |

| Total funds raised ($m) | 4,749 | 2,638 | +80% |

| Total no. transactions | 17 | 18 | 6% |

Source: Dealogic; (1) Analysis and commentary only includes transactions greater or equal to $5m; (2) Analysis and commentary only includes transactions greater or equal to $US50m – chart above show year-to-date activity levels; IFR ECM

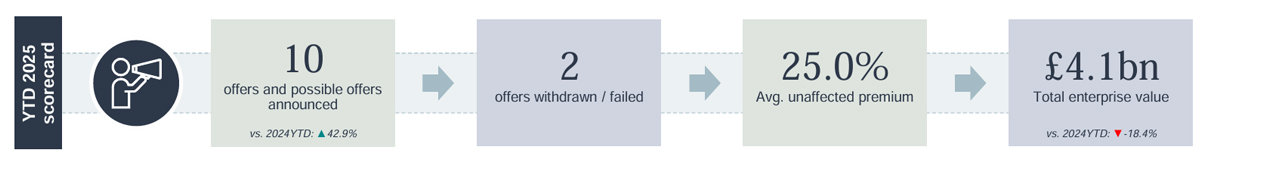

UK public M&A activity | February

UK public market valuations continue to attract significant interest from trade and private capital

Selected Deals

Source: Company announcements; FactSet; Practical Law.

Note: Scorecard includes competing offers and withdrawn of companies subject to the Takeover Code quoted on AIM or the Main Market. Formal sales processes are not included unless a buyer has been identified. Only newly announced offers in the month are included in the count (i.e. possible offers announced in December 2025 will be included in that month even if it becomes a firm offer in January 2025)

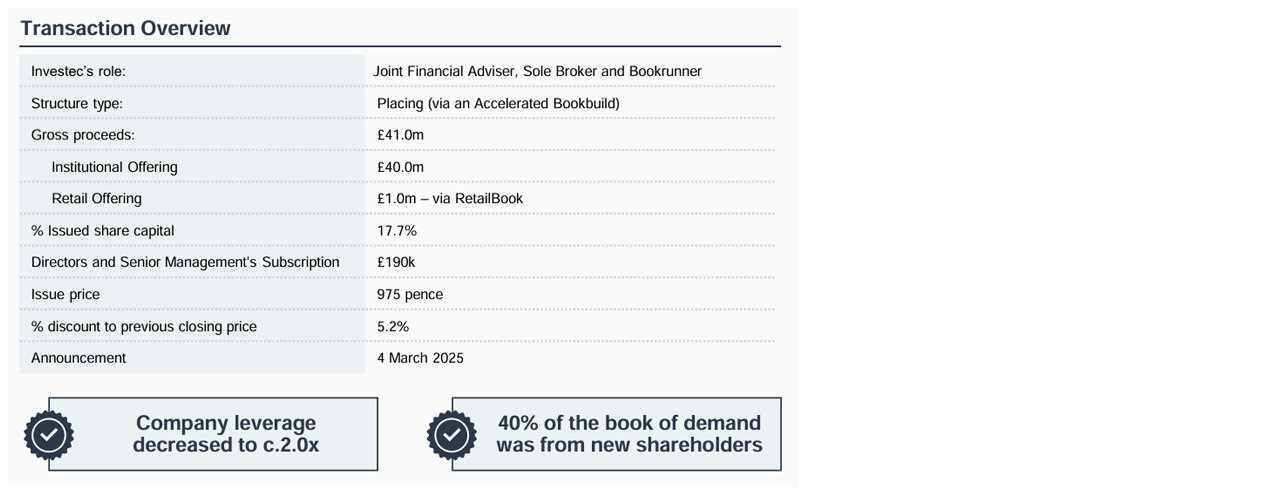

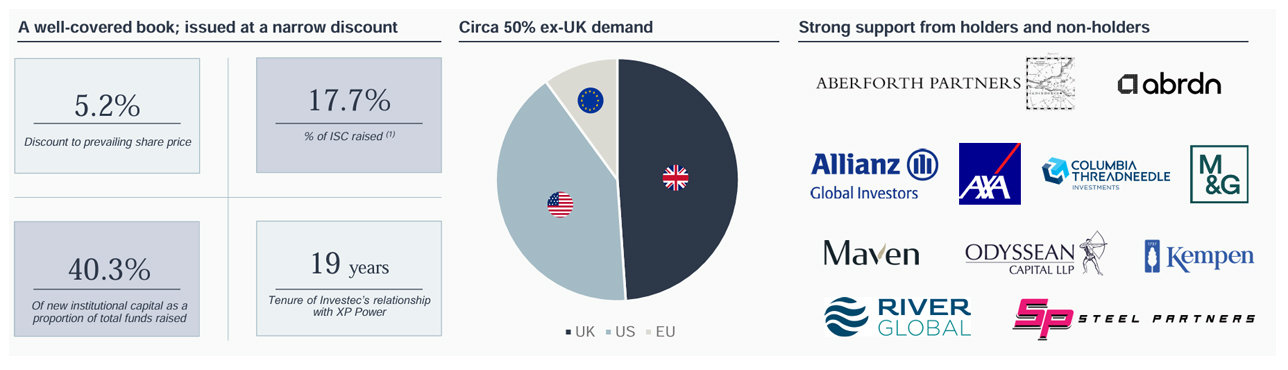

Investec Case Study | XP Power’s £40m Equity Placing, March 25

UK Equity Markets demonstrating strong support for a strategically significant fundraise

Overview of XP Power & background to the placing

- XP Power is one of the world's leading developers and manufacturers of critical power control components to the electronics industry and strategically focused on Industrial Technology, Semiconductor Manufacturing Equipment and Healthcare sectors

- The business is performing well operationally and financially, particularly in regard to cost control and strong cash generation, its end-markets remain slow due to ongoing industry-wide channel destocking however a recovery in demand is expected, but the timing is naturally uncertain.

- More recently, it has seen some macro headwinds emerge in Asia and received judgement on legal fees and interest payable in the Comet legal case.

- The Group has noted that a combination of these factors could have brought leverage close to its covenant limit of 3.0x. Therefore, the Board decided to prudently and proactively improve balance sheet resilience through

- i) the £40m ABB and,

- ii) the amendment of the covenants applicable to its borrowing facilities

- The net proceeds of the Placing will be used to reduce leverage and increase liquidity headroom And finance the Group’s committed capital expenditure in Malaysia.

Source: Company filings; FactSet

Notes:; (1) includes additional £1m RetailBook offer

Get the Investec Equity Market Overview delivered to your inbox

Browse articles in