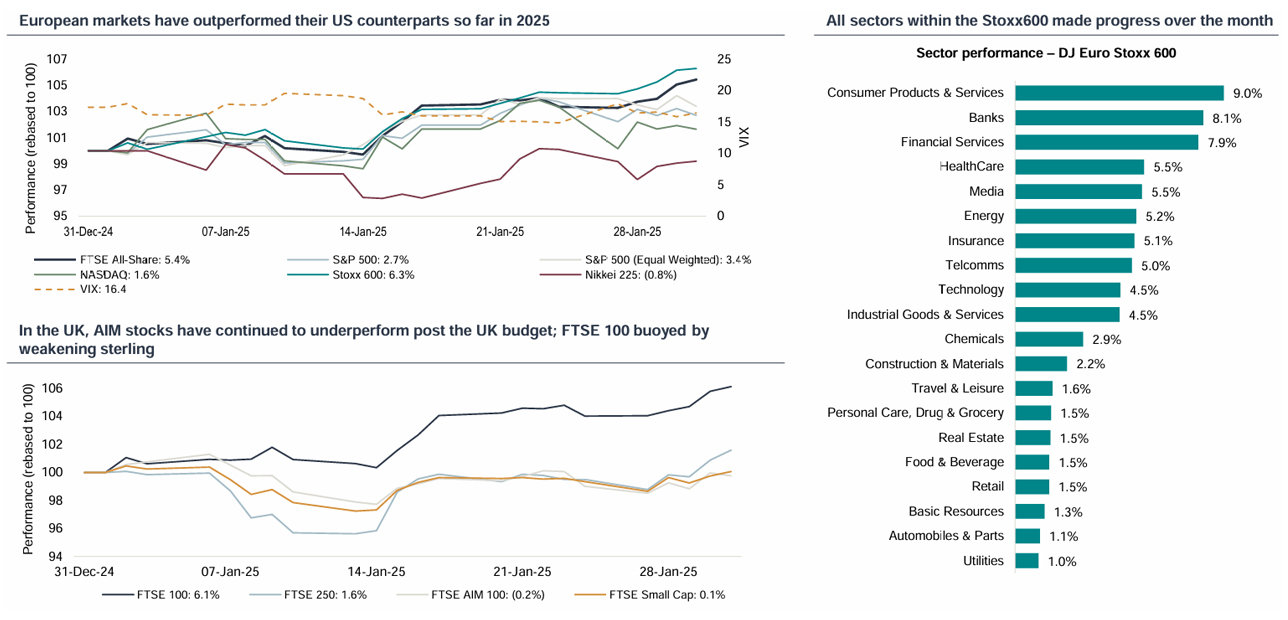

- After a strong full year 2024 performance (particularly in the US) global equity markets navigated Government bond volatility, Deepseek and a new US President to make further progress over January and post a strong start to 2025. European indices outperformed their North American peers with most European indices up 5-7% over the month versus US markets which were up 2-5%. The FTSE 100 had its best start to the year in 12 years, however global markets weakened at the start of February as US trade tariffs and their impact have increased uncertainty

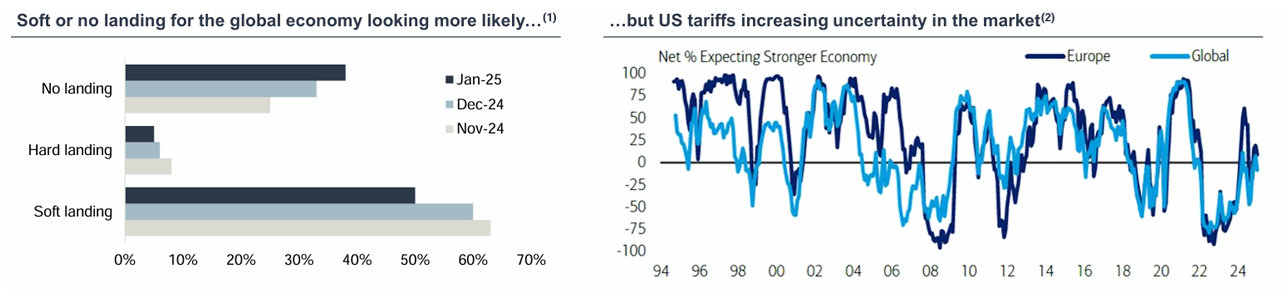

- 2025 consensus sees further gains in equity markets over the year, but most do not expect gains in US equity markets to match those seen in 2023 and 2024. Some are also concernedabout the concentration of US equity market returns within the ‘Mag 7’. This was evidenced in the latest BAML survey of portfolio managers that showed whilst investors remainedconstructive about the US economy, over the first part of January EU stocks had attracted significant interest from global investors as part of their strategy to diversify from US mega captech / AI orientated names

- In the final week of January a very sharp sell off for AI and semi-conductor related stocks took hold after Chinese AI company DeepSeek produced a Chatbot that can seemingly compete with the latest from Open AI and other leading platforms but has reportedly been developed at a fraction of the cost calling into question the (high…) value of the AI ecosystem and impacting stock prices from ASML to Nvidia, Siemens Energy, Schneider Electric and beyond

- Whilst the speed and extent of the moves highlighted extended valuations and robust future expectations, the really sharp moves lower were short lived and there was a partial recovery in the stock prices of those caught in the sell off by month end

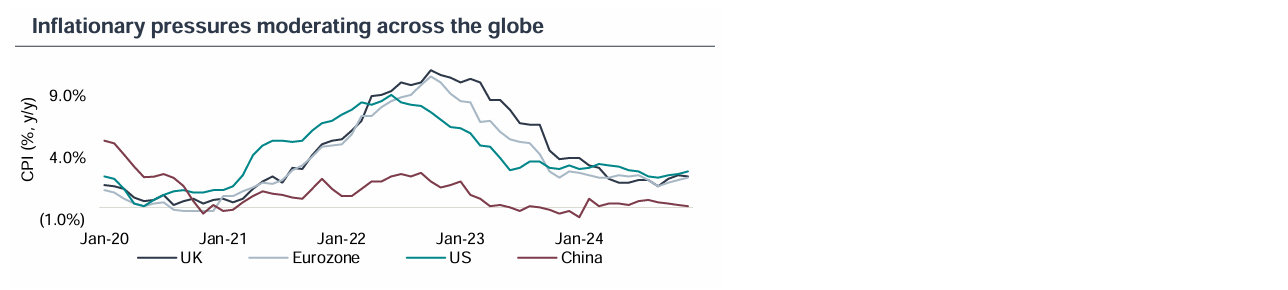

- CPI data for December in the US, EU and UK remained within sight of central bank targets for inflation of 2% with YoY readings of 2.9%, 2.4% and 2.5% respectively. However, the resilience of the US economy combined with concerns about President Trump’s proposed policies being inflationary has driven significant change in expectations for US rates

- Equity market performance over January 2025 came despite heightened volatility in government bond markets. Yields in the US and Europe moved sharply higher in the first 2 weeks of the month but have pulled back from recent highs in the last few weeks. 10 year UST yields moved c.30bps higher to hit c.4.8% on 14th January but closed on January 31st at 4.54%, and UK 10 year Gilt yields moved c.35bps higher to c.4.9% on 14th January before pulling back to close the month at 4.53%

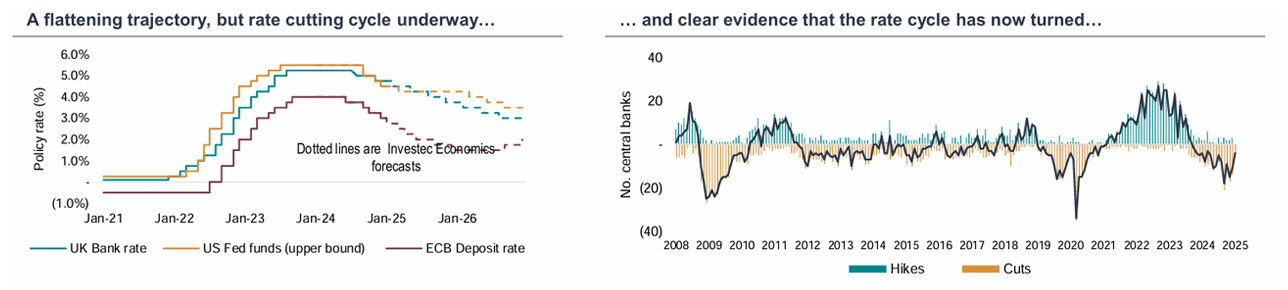

- On 29th January the Fed left rates on hold (Fed funds rate at 4.25-4.5%), and on 30th January the ECB cut by 25bps taking the ECB deposit rate to 2.75% - both decisions were widely expected. Attention turns to the BoE’s policy decision this Thursday - Investec expects the MPC to cut rates by 25bps to 4.5% (in line with consensus). Markets are currently expecting only 1-2 rate cuts from the Fed over 2025 – Investec’s economics team expects just one 25bps cut from the Fed (in March). Over the course of 2025 our team is forecasting 100bps of cuts in the UK and a further 125bps of cuts from the ECB

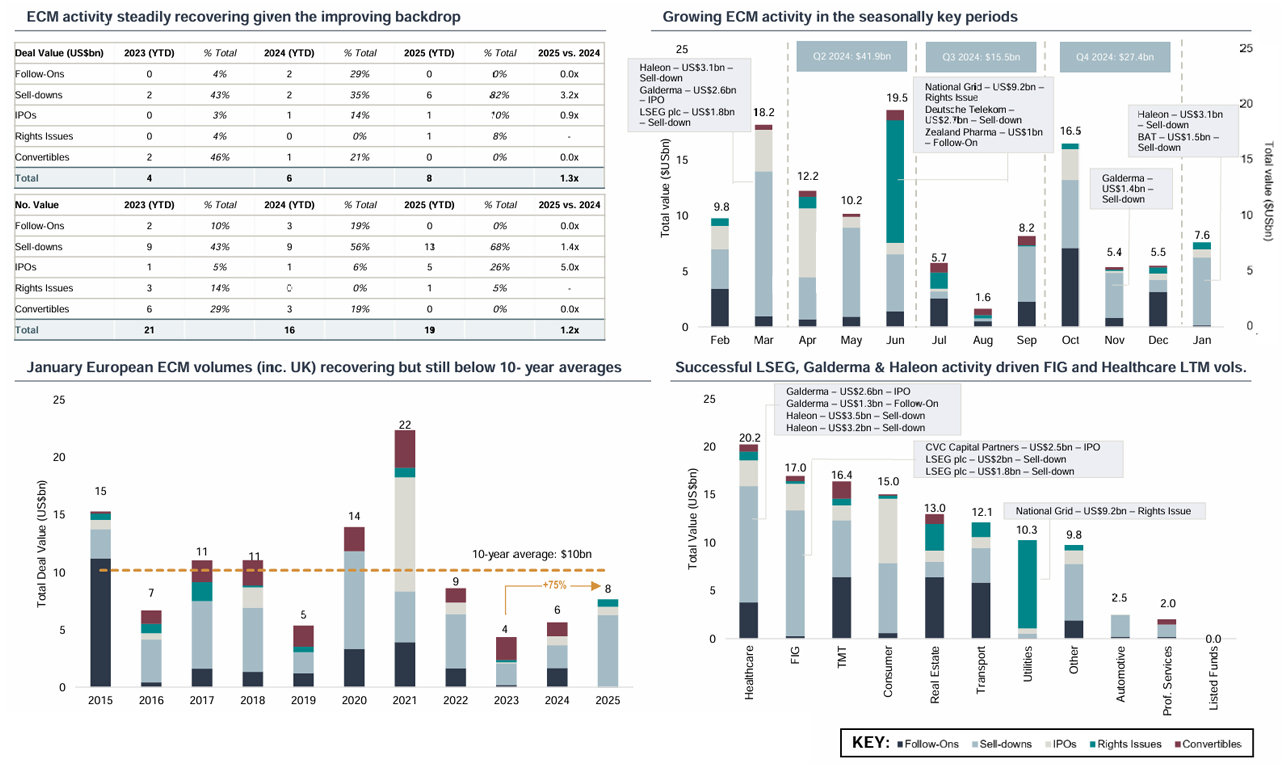

- ECM activity has started well in January, with EMEA volumes up c.75% relative to the prior year driven by significant and successful sell downs in 2 UK companies, consumer health business Haleon and Tobacco business BAT. 5 notable European IPOs launched over the course of the month, the largest of which is the €1bn+ Madrid IPO of HBX Group, a private equity backed Spanish travel tech business. US ECM activity has also started the year robustly although the $1.75bn IPO of US LNG business Venture Global had to go through a 40% reduction in price from its initial published range to successfully generate investor appetite

Equity Market overview | A strong start for equity markets

European equity markets outperform with some diversification away from the Mag 7

- After a strong year for equities in 2024, many global indices have continued to perform well despite heightened government bond volatility and a DeepSeek induced pullback for AI related stocks

- US markets have benefitted from optimism that President Trump’s Presidency will support further growth and momentum in the US economy, but there are lingering concerns that many of his proposed policies will be reflationary and impact the Fed’s ability and willingness to reduce US interest rates

- Whilst most are constructive on US equities for 2025, most do not forsee another year where performances match those seen over 2023 or 2024. January also witnessed a mild diversification away from the largest US (tech related) names into a broader set of US equities and other regions including the EU

- By the close of the month most indices finished in the green – FTSE up 6.1%, FTSE 250 up 1.6%, Stoxx600 up 6.3%, S&P up 2.7%, Nasdaq up 1.6%, Russell 2000 up 2.6%

- Other than a few brief intraday moves above 20 (mid-Jan – Govt bond yields, 27th Jan – DeepSeek) the VIX remained relatively subdued throughout January ending the month below 17

Source: FactSet; Bloomberg

Equity Market overview | Valuation disconnect remains

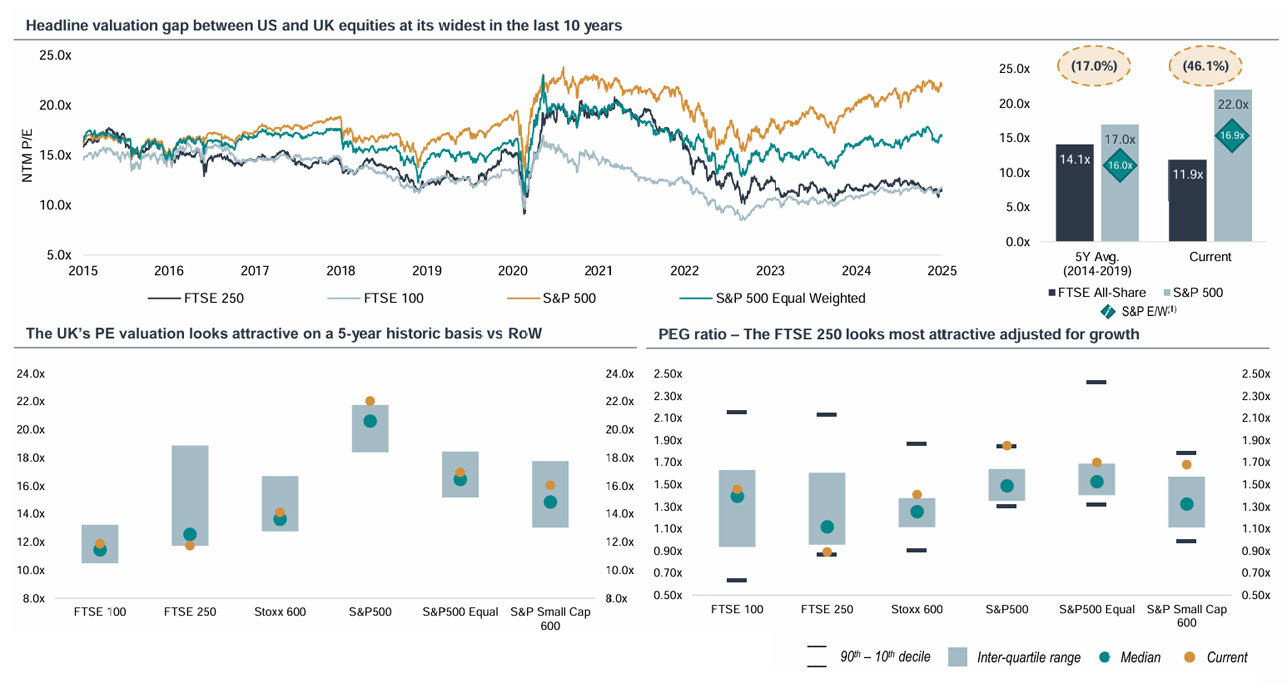

UK valuations continue to look attractive on a global and historic relative basis

- US equity markets are currently towards the top of historic valuation ranges and the headline valuation differential between US and UK / EU equity markets is as wide as it has ever been, although after adjusting for growth (and sector skew therefore...) that differential does reduce

- Economists and Strategists currently see positive returns in 2025 for equities, however, whilst a number highlight ‘US exceptionalism’ and the importance of AI, very few expect US equity returns to be as high as they have been in 2024 (or 2023)

- The robust FTSE performance YTD2025 has started to close the gap, but there is still a long way to go particularly for the FTSE250. Whilst there has been an improvement in the valuation disconnect, the FTSE All-Share still sits at a 46% discount to the S&P, and a 30% discount on an equal weighted basis

Source: FactSet; (1) S&P E/W refers to the S&P500 Equal Weighted index.

Note: PE and PEG ratios are derived on a Next Twelve Months Ahead basis. FTSE 100 and FTSE 250 demonstrate greater variance in their PEG ratios given the domestic political activity over the last 5-years (including the Truss leadership). Note: the interquartile range excludes any values in the top and bottom quartiles, similarly the inter-decile range excludes to the top and bottom deciles to remove any outliers.

Macro Outlook | Broadly supportive backdrop

Inflation has fallen significantly but remains slightly above target. The ECB & BoE are expected to de couple from the FED as EU/UK governments look to elevate their own growth agendas

- UK inflation for December fell to 2.5% y/y from 2.6% in November albeit still higher than the 2.3% print in October. Service sector inflation fell to 4.4% from 5.0%, but still well above what the BoE would consider target-consistent

- In the Eurozone CPI for January increased to 2.5% y/y from 2.4% in December. In the US CPI ticked up to 2.9% y/y in December from 2.7% in November

- The US and Europe (inc. the UK) look set to decouple of terms of interest rate moves with markets expecting the ECB and BoE to reduce rates more actively than the Fed over 2025 which should be supportive for equities in the region

- With President Trump pursuing his America First agenda there is US policy unpredictability to navigate but also some hope that this will galvanise EU and UK Governments into more aggressively elevating their own growth agendas

1 Inflation is trending towards central bank target levels…

2 …and the rate cutting cycle looks well underway…

3 …supporting a more optimistic macro-outlook

Source: FactSet; Macrobond; ONS; Investec Economics; BofA European Fund Manager Survey – (1) Global investors’ view on the global economy; (2) Global investors’ view on the European economy.

Prefer to download?

Click to download the complete Equity Market Overview.

Never miss an update

Subscribe to the Equity Market Overview.

UK funds flow overview | Perceptions gradually changing

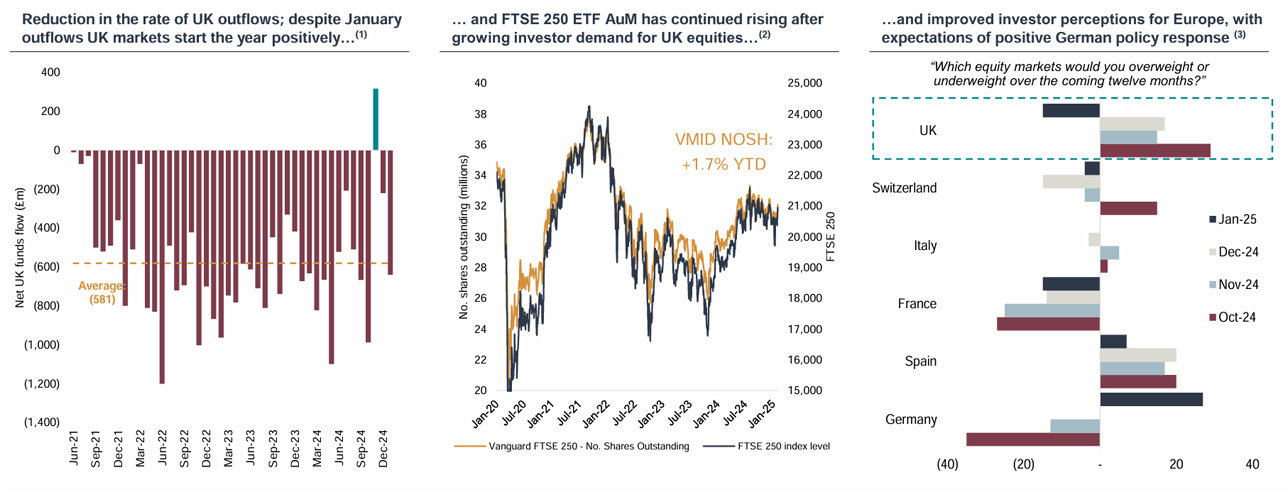

Despite a challenging funds flow environment for UK equities since 2021, there are signs of improvement

- The UK saw an improvement in the trend of flows in 2024 vs 2023, with £6.7bn of outflows vs £8.0bn in 2023

- Most notable for UK markets, in November UK focused equity funds saw their first month of inflows since May 2021, breaking a 41-month stint of net selling

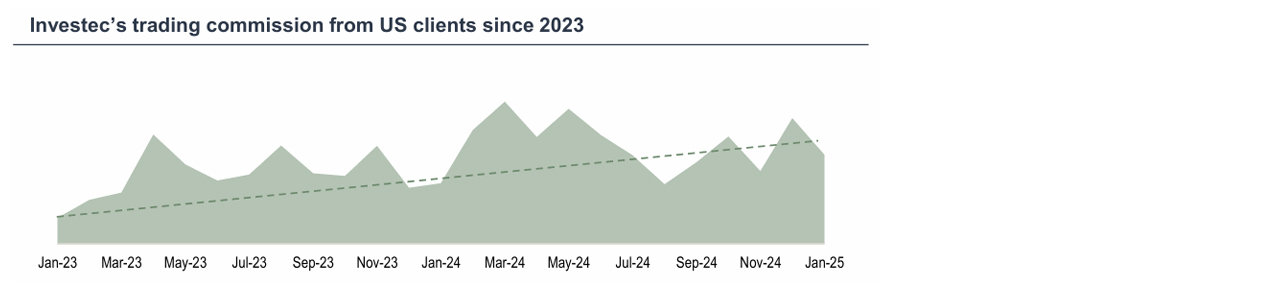

- Investec trading flows from US clients decreased in January as US institutions paused to assess the impact of President Trump’s tariffs on global markets. Despite this UK markets still outperformed US markets overall

- Investors have continued to view the UK more positively, aided by clarity from the UK Budget announcement. Germany’s investor sentiment was weighed down in 4Q24 by political dynamics, but hopes for change in 2025 has seen investors pivot their weighting to Germany, albeit from a relatively low base

Source: (1) Calastone – fund flow data relates to UK mutual funds only; Note: Calastone data excludes any pan-European or Global funds with UK exposure, the data also excludes ETFs (2) Bloomberg; Chart shows increasing share count of Vanguard FTSE 250; (3) BofA European Fund Manager Survey

European Equity Issuance 2025 YTD | Improving trends

European equity issuance remains below 10-year averages, but YoY improvements continue into 2025

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels.

Note: Large TMT deals include Atos ($3.1bh) and Deutsche Telekom $2.7bn.

European IPO issuance 2025 | Improving outlook

Although volumes remain below 10 year averages, continued gradual improvement in IPO activity in January 2025

IPO issuance in Europe

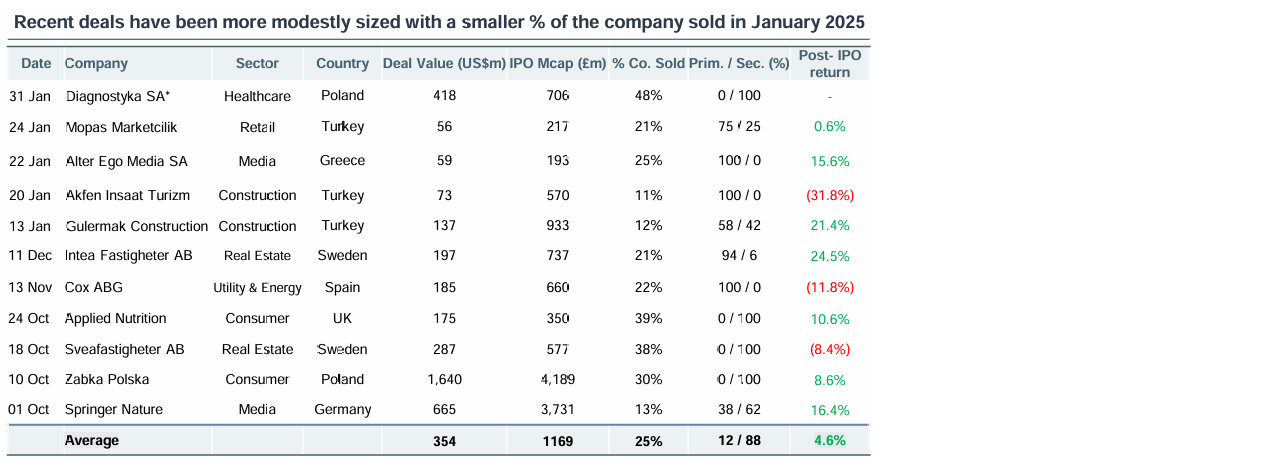

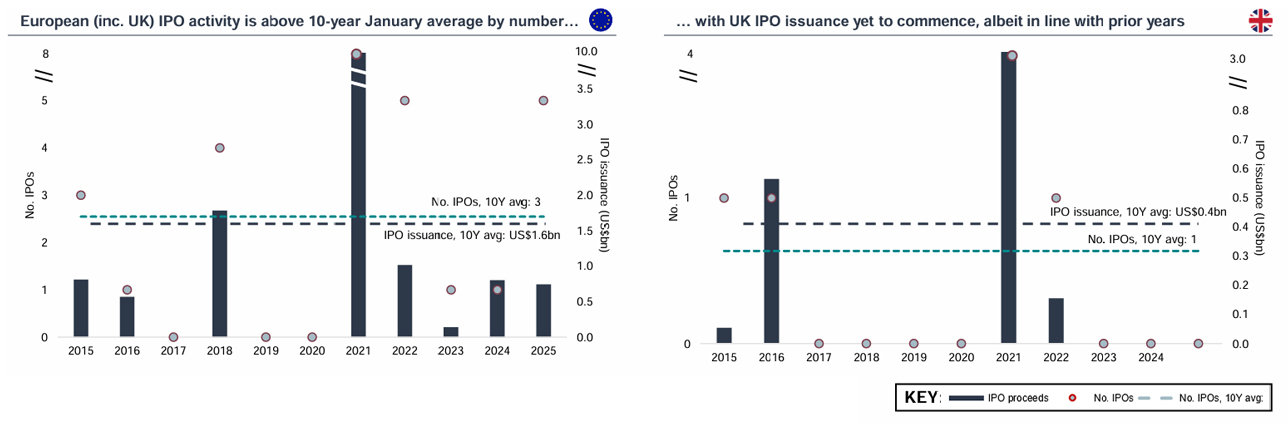

- US$846m raised across 8 transactions in January 2025, with 3 of those IPOs sub US$50m. Average IPO size so far this year of US$106m

- January saw five IPO’s over US$50m, Turkish construction engineer co. Gulermak Heavy Industries Construction & Contracting Co (US$137m), Turkish infrastructure co. Akfen Insaat Turizm ve Ticaret AS (US$73m), Greek media co. Alter Ego Media SA (US$59m), Turkish online supermarket Mopas Marketcilik Gida Sanayi ve Ticaret AS (US$56m) and Polish network of medical laboratories Diagnostyka SA (US$418m)

- Spanish travel tech business HBX launched its IPO and is expected to raise c.€1bn, with the majority a primary raise. Other European IPOs that are currently live and set to price include BioVersys (Swiss biopharma, $88m) and Doosan Skoda Power (Czech Republic industrial turbines, $105.5m)

- By the 31st December the 2024 vintage of European IPOs had returned an average of c.20% with 22 out of 46 transactions delivering a positive after market performance. In the UK Rosebank returned 250%, Raspberry Pi 123% and Applied Nutrition 11%

- There were four IPOs over US$1bn in 2024: Spanish fashion company Puig Brands (US$2.4bn); consumer health and aesthetic solutions provider Galderma (US$2.6bn), private equity firm CVC (US$2.5bn) and Polish convenience store chain Zabka Polska (US$1.6bn)

- In the UK IPO volumes are expected to be second half weighted. We continue to think that the FCA Listing Rule reforms will be helpful tailwinds for UK IPOs

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels.

Note: there were 4 UK IPO’s greater than $50m in 2024; Air Astana, Raspberry Pi, Rosebank and Applied Nutrition.

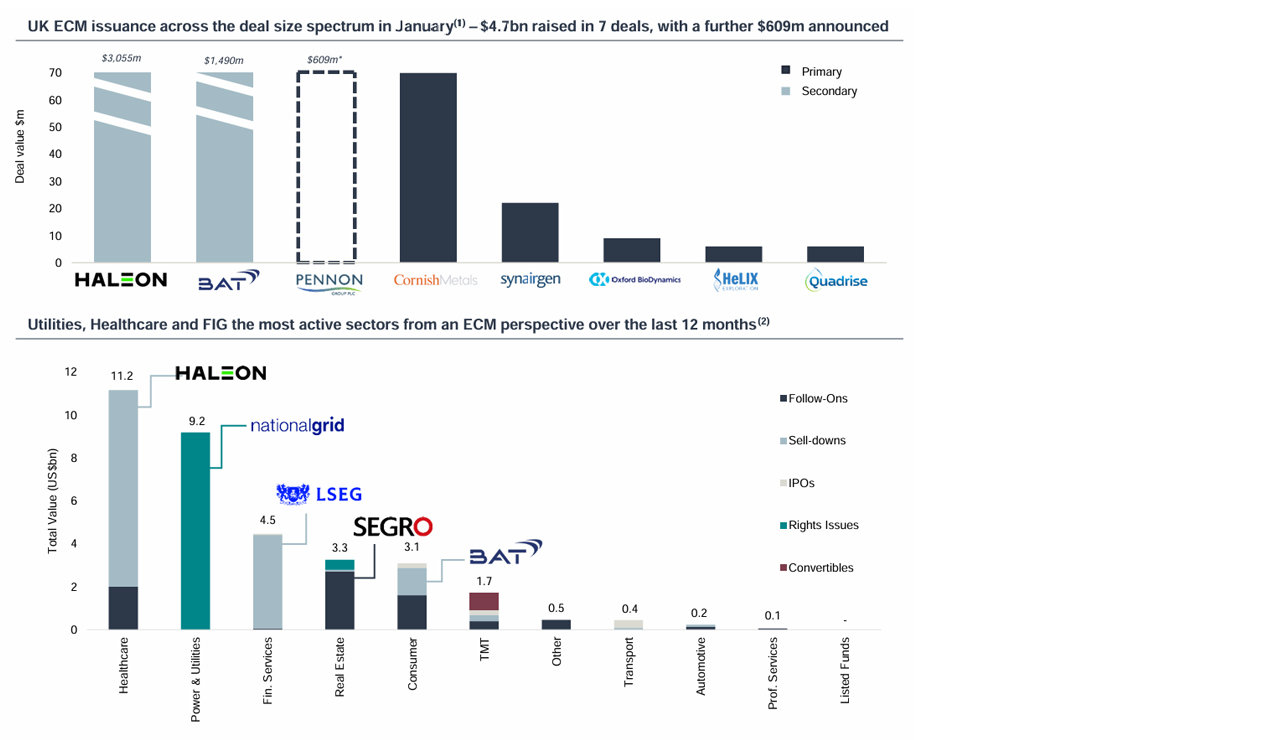

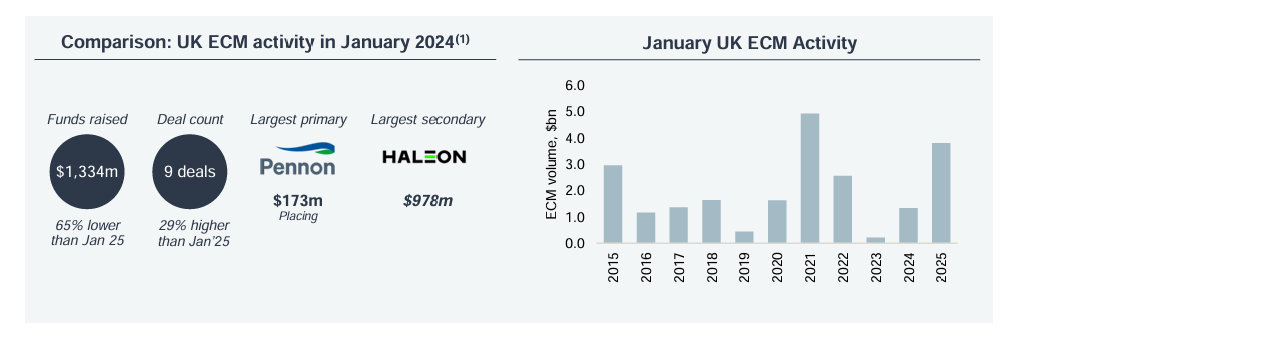

UK ECM activity | January

UK ECM activity off to a strong start, driven by large secondary sales in Haleon and BAT

2025 UK ECM YTD activity vs 2024 snapshot(1)

| 2025 YTD | 2024 YTD | Variance | |

| Total funds raised ($m) | 3,811 | 1,334 | +186% |

| Total no. transactions | 7 | 9 | 22% |

Source: Dealogic; (1) Analysis and commentary only includes transactions greater or equal to $5m; (2) Analysis and commentary only includes transactions greater or equal to $US50m – chart above show year-to-date activity levels; IFR ECM | Note: *dotted line denotes announced Pennon Rights Issue (GBP490m) 29 January 2025

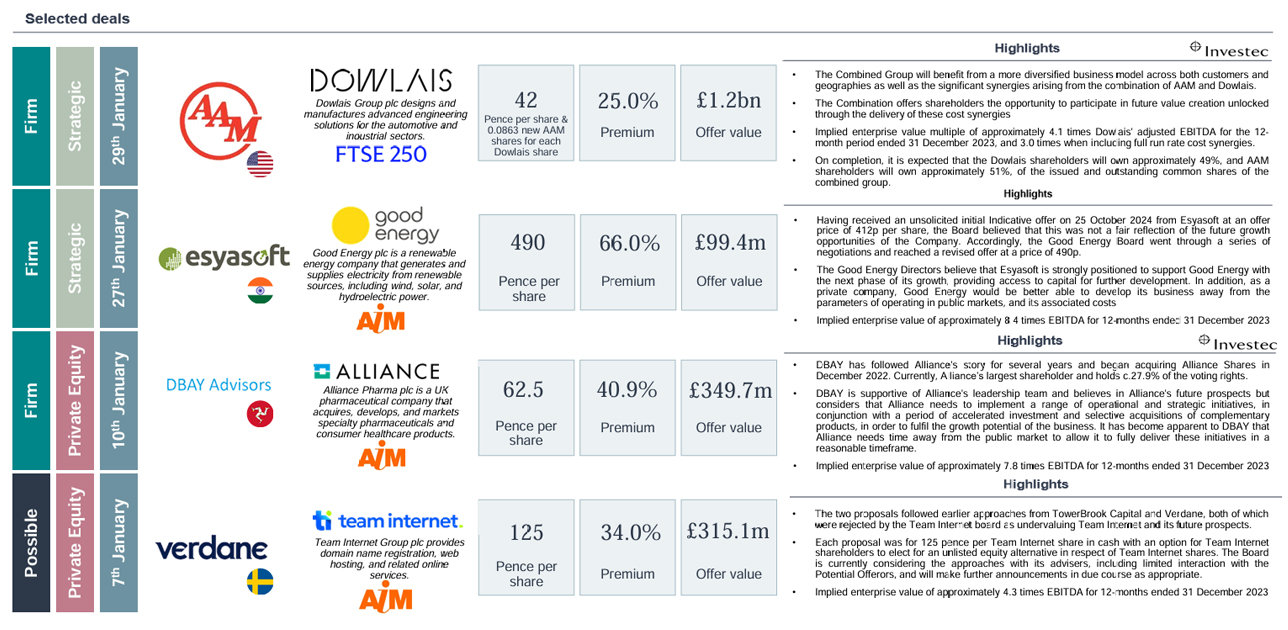

UK public M&A activity | January

Fastest start to UK PLC M&A since 2018

Selected Deals

Source: Company announcements; FactSet; Practical Law.

Note: Scorecard includes competing offers and withdrawn of companies subject to the Takeover Code quoted on AIM or the Main Market. Formal sales processes are not included unless a buyer has been identified. Only newly announced offers in the month are included in the count (i.e. possible offers announced in December 2025 will be included in that month even if it becomes a firm offer in January 2025)

Get the Investec Equity Market Overview delivered to your inbox

Browse articles in