Executive summary

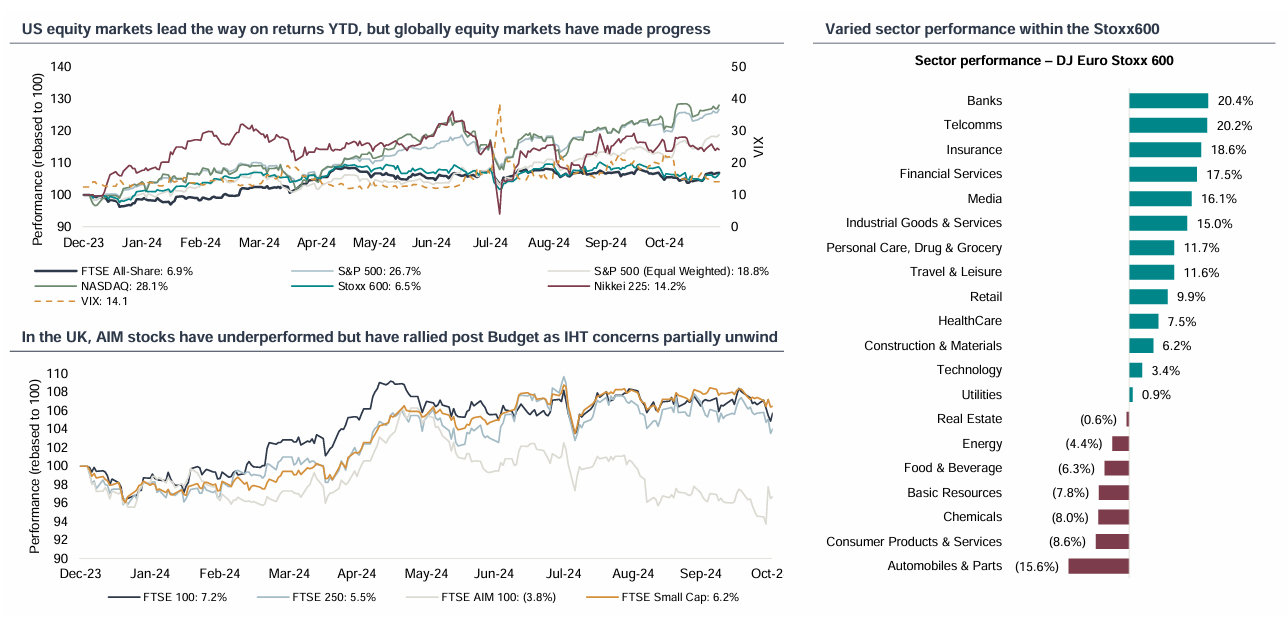

- November was a positive month for equities with the US election result arguably being the key event that has shaped equity (and broader capital) markets over the period. US, UK and most European equity markets made progress over November but US markets significantly outperformed.

- With President Elect Trump promising to impose tariffs on all goods imported to the US (with up to 60% tariffs planned for Chinese goods), it is clear that there is scope for significant change to global trading patterns. The prospect of a more aggressive ‘America First’ strategy has compounded the attractiveness of US equity markets (for now?) whereas the prospect of increased challenges for international trade has meant more muted performances for European indices.

- Since the US election on 5th November, the S&P500 has rallied 4.3%, Nasdaq 3.5% and the Russell 2000 7.7%. Whilst the S&P500 and Nasdaq have hit new all-time record highs many times this year, US small / mid caps have lagged. However the Russell 2000 did make a record all-time high on 25th November, surpassing its previous high point achieved in November 2021 – US smaller caps seen as net beneficiaries of likely President Elect Trump policies.

- European equity markets have made progress over November but gains have been much more modest than in the United States, impacted by a combination of slowing domestic economies in core countries combined with concerns about US trade tariffs. French equity markets have faced an additional headwind as a result of growing political uncertainty which has been building since its elections in July.

- UK equity markets have outperformed European peers now that the UK budget has passed and any US tariffs are seen as less impactful for UK PLC. The prospect of a lighter US burden on banking regulation and renewed Oil & Gas investment are also seen as potentially supportive for two important UK sectors. Whilst strategists continue to highlight the attractiveness of US equities, some see the UK as remaining good value and better placed to weather any fall out from future US economic and trade policy.

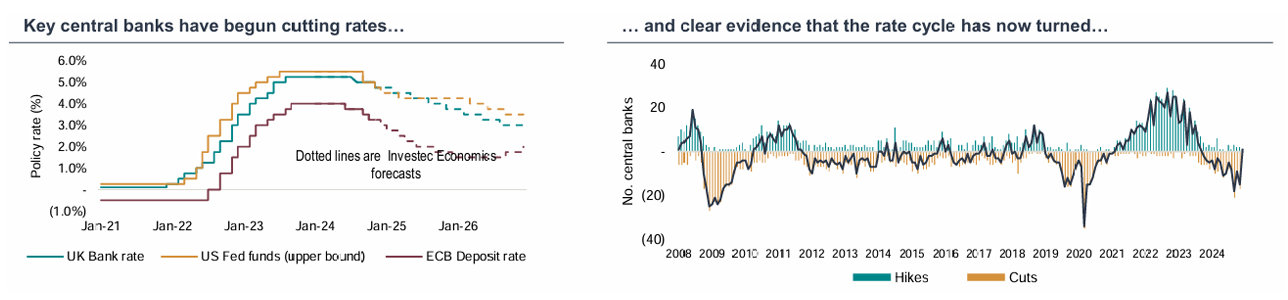

- The impact of anticipated President Elect Trump policies on future interest rates has moderated expectations for US rate cuts – markets now imply no cut in December 2024 and a further 72bps of cuts in 2025 versus expectations of 120bps of cuts to December 2025 immediately prior to the election. In the UK, Investec expects 100bps of cuts in 2025 taking the BoE base rate to 3.75% by December 2025 and in the EU Investec sees a more aggressive policy approach and now see the Deposit rate at 1.50% by the end of 2025.

- October CPI data showed that whilst inflation has fallen materially there is still some ‘stickiness’ – October US CPI came in at 2.6%, EU at 2%, UK at 2.3% (services inflation at 5%). PMIs for November suggest manufacturing remains under particular pressure (US 48.8, EU 45.2, UK 48.6) and broader slowdown in the EU but expansion in the US (Composite US 55.3, EU 48.1, UK 49.9)3.

- November was subdued in terms of ECM volumes both in North America and in Europe, with $5.1bn of issuance across Europe and the UK from 20 transactions. One IPO priced for Cox Energy

in Spain.

Source: Factset; 1 Dealogic – analysis only includes transactions greater or equal to $US50m; European ECM activity inclusive of UK

Equity Market overview | Recovery in November, still solid YTD

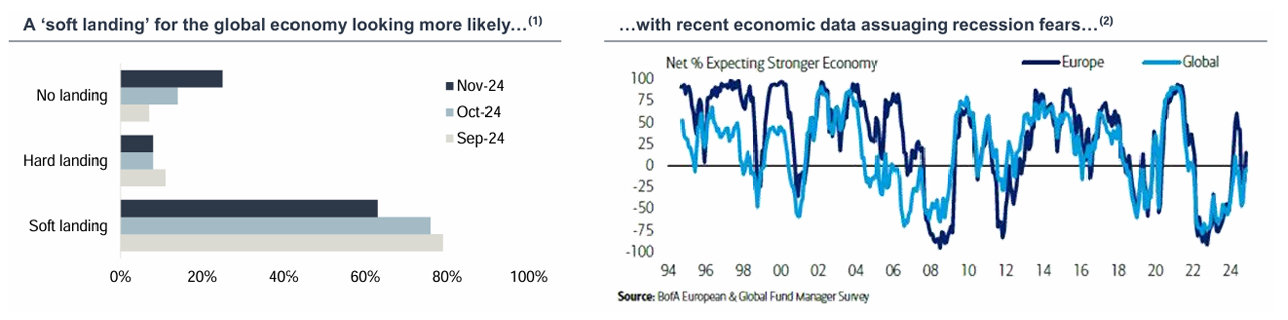

Confidence in soft / no landings remains intact with limited expectation of a hard landing

- November has seen US indices again making new highs following the US election. In the UK indices initially weakened post the Budget but have since recovered their poise and have outperformed European markets which are seen to be more at risk from potential US tariffs. French markets have significantly underperformed given the political instability that has been prevalent since July.

- By the close of the month most indices finished in the green – FTSE up +2.2%, FTSE250 up +1.8%, Stoxx600 up +0.7%, S&P up +6.1%, CAC -2.3%.

- In the UK AIM listed stocks have underperformed since Rishi Sunak called for the UK election with the AIM All Share down -11% in that period up until the Budget, relative to the FTSE 100 down just -2.5% over that period. With the UK Budget removing only half of the IHT tax relief, AIM has recovered some of the losses as markets were evidently fearing a worse outcome, but still underperformed wider UK markets.

Source: FactSet; Bloomberg

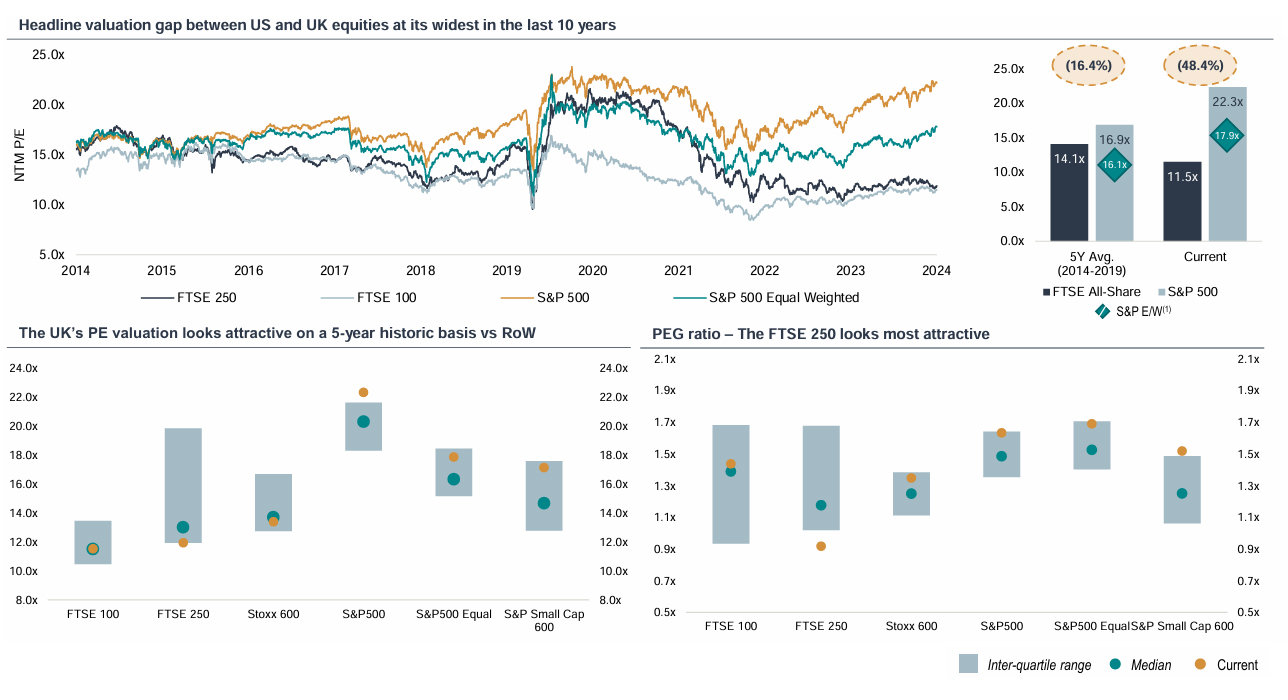

Equity Market overview | Valuation disconnect remains

UK valuations continue to look attractive on a global and historic relative basis

- As we know, since Brexit in 2016, the spread between UK and US equity valuations has increased with further divergence evident since the start of the pandemic and subsequently over the period of UK Government instability.

- The UK budget could arguably have been more difficult but was still very much a ‘mixed bag’ for UK PLC with employer NI increases being the largest single hit for corporates. Companies are updating markets on what the impact of the Budget is expected to be for their businesses but there is seemingly some benefit for markets from clarity and removed uncertainty.

- US equity markets are currently towards the top of historic valuation ranges and the headline valuation differential between US and UK / EU equity markets is as wide as it has ever been, although after adjusting for growth (and sector skew therefore...) that differential does reduce.

Source: FactSet; (1) S&P E/W refers to the S&P500 Equal Weighted index

Note: PE and PEG ratios are derived on a Next Twelve Months Ahead basis. FTSE 100 and FTSE 250 demonstrate greater variance in their PEG ratios given the domestic political activity over the last 5-years (including the Truss leadership), as well as the UK’s heavy exposure to banking and energy

Macro Outlook | Broadly supportive backdrop

Inflation continues to fall with further rate cuts anticipated, albeit at a slower pace

- UK inflation for October rose to 2.3% y/y from 1.7% in September and above the 2.2% expected driven partly by an increase in the energy price cap. Service sector inflation ticked up moderately to 5.0% from 4.9%, well above BoE targ.

- In the EU CPI for October increased to 2.0% y/y from 1.7% in September. In he US CPI ticked up to 2.6% y/y in October from 2.4% in September.

- Whilst the pace of further interest rate cuts may not be as quick as had been expected earlier in the year (particularly in the US), more are expected which supports confidence in the outlook and ‘soft economic landings.

- The next hurdle for equity markets is likely to be new US policy (with global nflation now seen by investors as the biggest tail risk for markets). Ongoing political turmoil in France, the Middle East and Ukraine keeps geopolitical broader uncertainty on the agenda.

1 Inflation is trending towards central bank target levels…

2 …and the rate cutting cycle looks well underway…

3 …supporting a more optimistic macro-outlook

Source: FactSet; Macrobond; ONS; Investec Economics; BofA European Fund Manager Survey – (1) Global investors’ view on the global economy; (2) Global investors’ view on the European economy

Prefer to download?

Click to download the complete Equity Market Overview.

Never miss an update

Subscribe to the Equity Market Overview.

UK funds flow overview | Perceptions gradually changing

Despite a challenging funds flow environment for UK equities since 2021, there are signs of improvement

- The 30th October Budget significantly disrupted UK equities, but recovered ground once the Budget uncertainty was removed from the market. Although uncertainties with regard to IHT has been removed, AIM stocks have been relatively flat on the month closing - 0.3%.

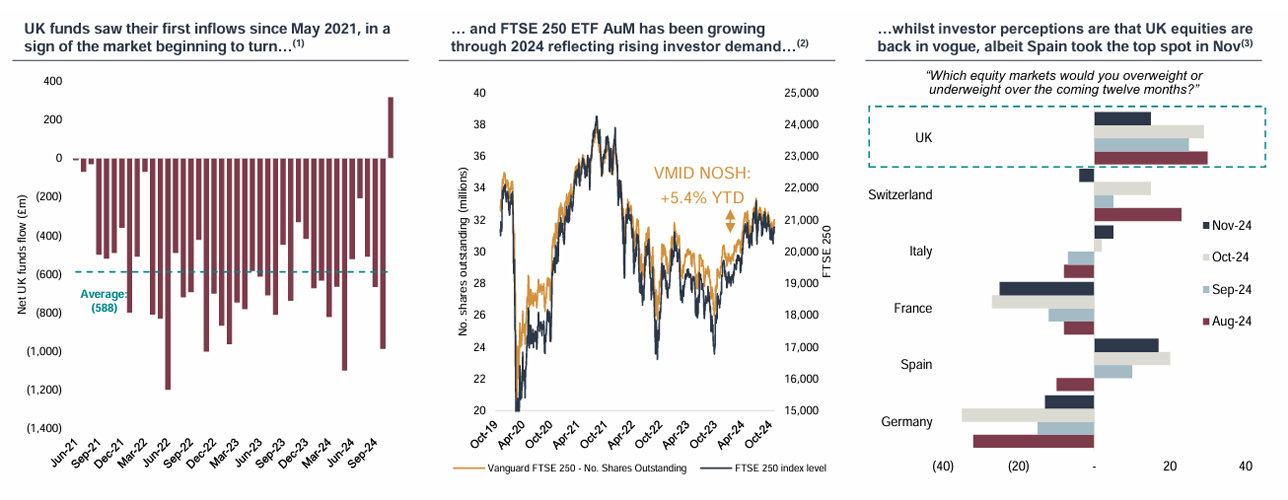

- Most notable for UK markets, funds saw their first month of inflows since May 2021, breaking a 41-month stint of net selling.

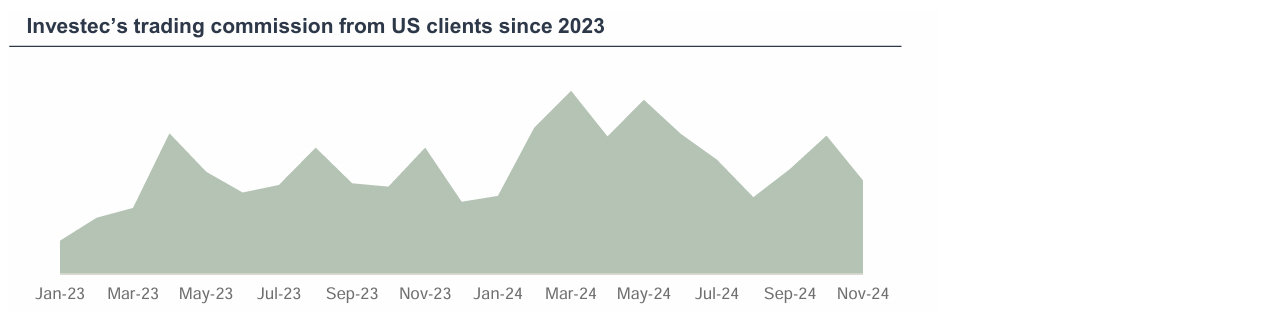

- Investec trading flows from US clients decreased in November as US institutions pivoted allocations to align with strong US equity performance post the election.

- As fund managers focus on their 2025 strategies, London listed equities may be positioned for recovery with UK equities the top choice for European PMs in 3 of the last 4 months. Spanish equities just edged those in the UK in early November with Spanish GDP growth helping underpin the local stock market.

Source: (1) Calastone – fund flow data relates to UK mutual funds only; Bloomberg; (2) Chart shows increasing share count of Vanguard FTSE 250; (3) BofA European Fund Manager Survey

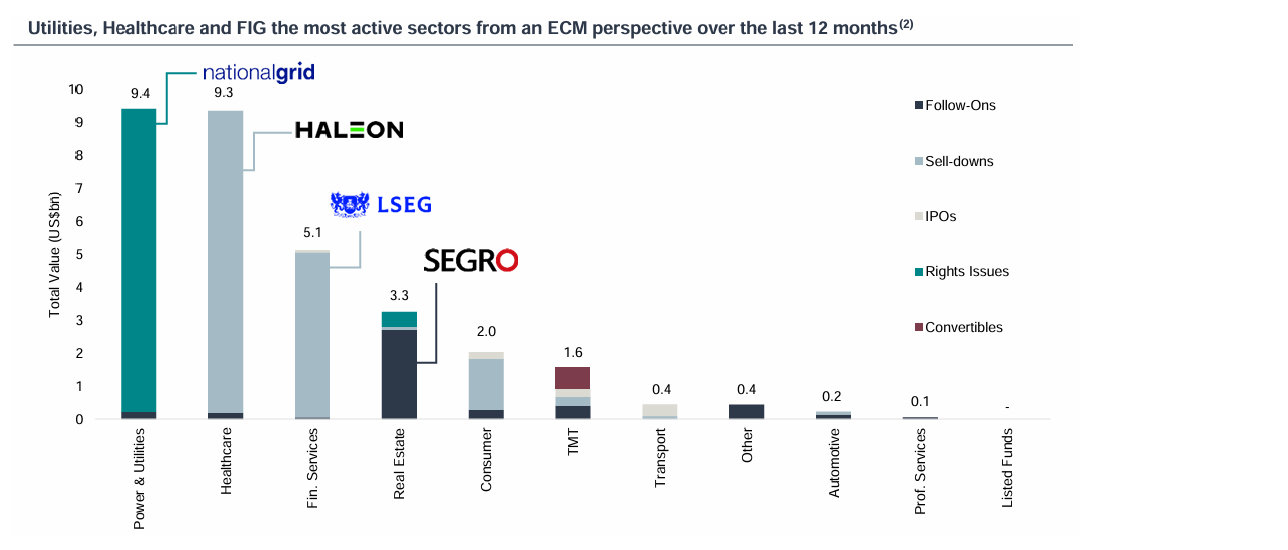

European equity issuance 2024 YTD | Improving trends

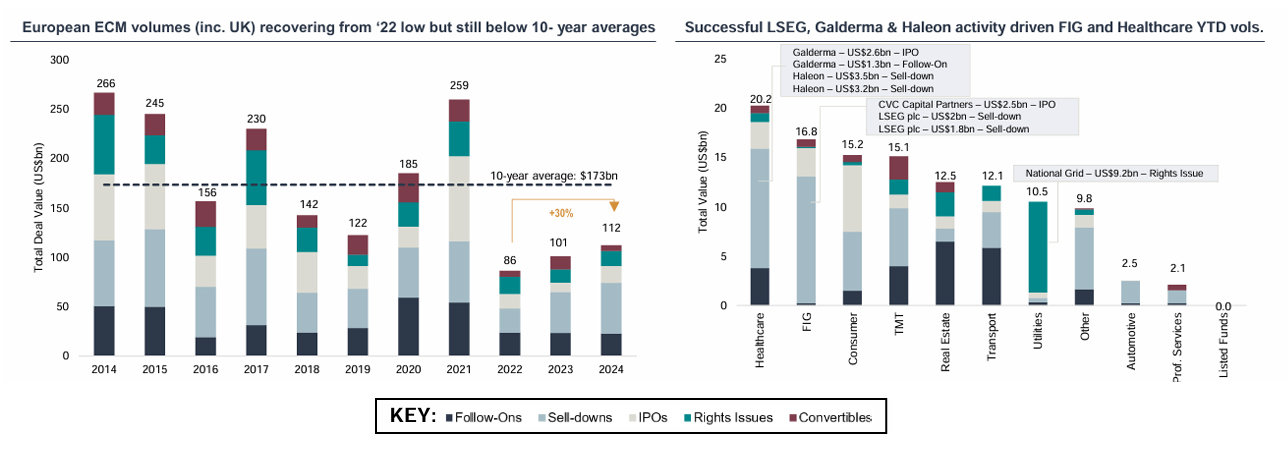

European equity issuance remains well below 10-year averages, but YoY improvements with 2024 $ volume and transaction number now ahead of FY 2023

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels

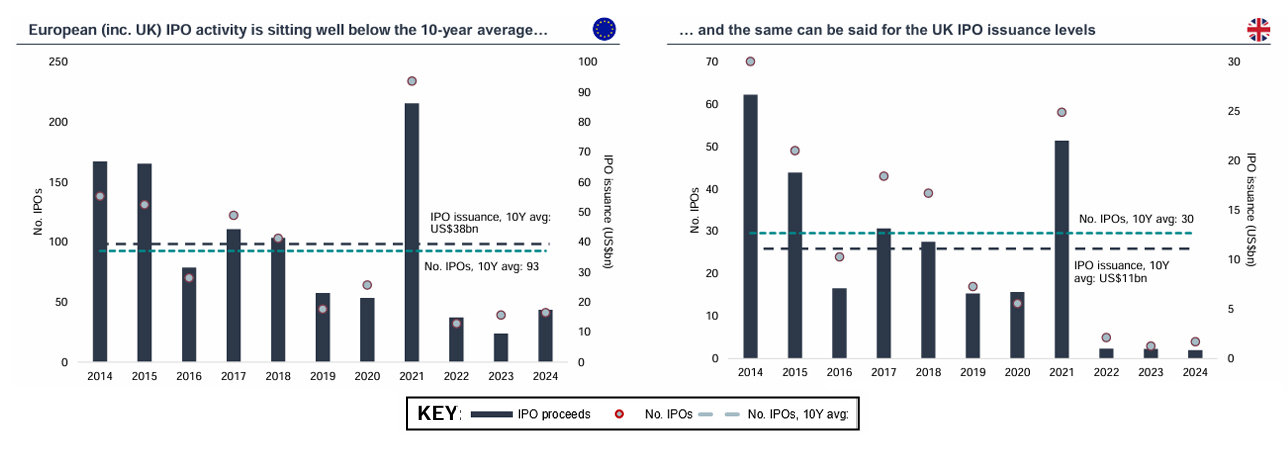

European IPO issuance 2024 YTD | Improving Outlook

IPO volumes remain subdued across Europe relative to 10-year averages. Volumes are up YoY although November volumes were subdued with 1 notable IPO pricing

IPO issuance in Europe

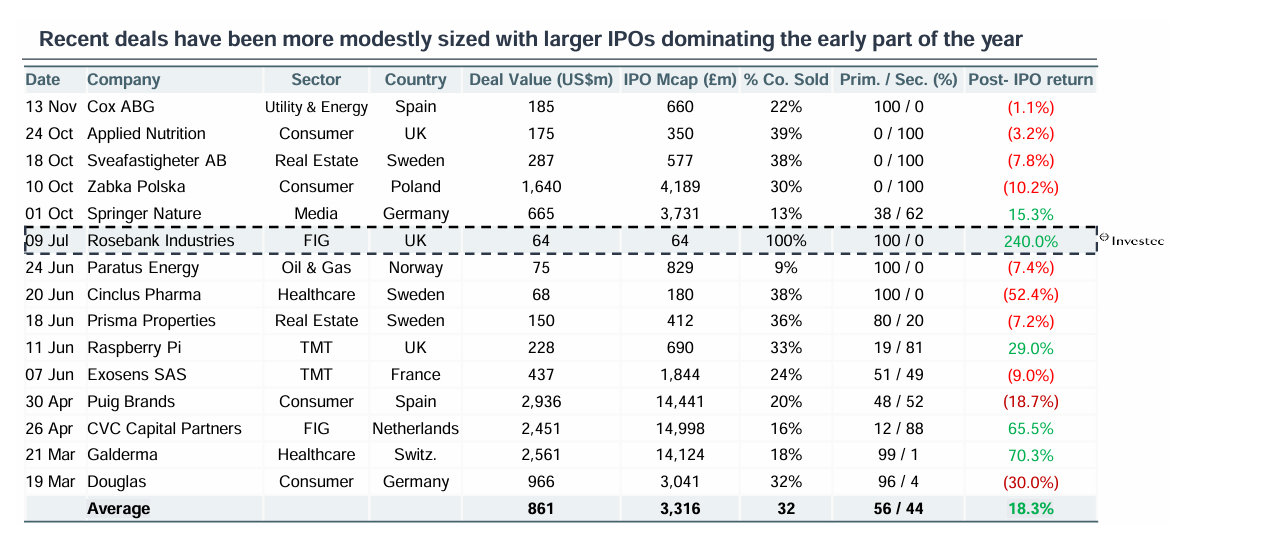

- US$17bn raised across 41 transactions so far in 2024, up by 86% and 14% respectively versus the $9bn raised across 37 deals in 2023 YTD.

- Average IPO size so far this year of US$422m vs. US$251m last YTD.

- Average YTD post-IPO share price gain of c.15%. As of 30/11/24 17 transactions out of 41 have delivered positive after-market returns for shareholders, equivalent to $2.9bn of alpha.

- There have been four IPOs over US$1bn this year: Spanish fashion company Puig Brands (US$2.4bn); consumer health and aesthetic solutions provider Galderma (US$2.6bn), private equity firm CVC (US$2.5bn) and Polish convenience store chain Zabka Polska (US$1.6bn.

- November saw just one IPO over US$50m, Cox ABG an integrated utility of water and energy company (US$185m), listed in Madrid.

- As we get to the close of 2024, we remain cautiously optimistic on the outlook for European and UK IPOs. Global equity markets continue to attract capital, and equity market performance has been robust so far this year. Additionally, we think this summer’s FCA Listing Rule reforms will serve as helpful tailwinds for UK IPOs.

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels

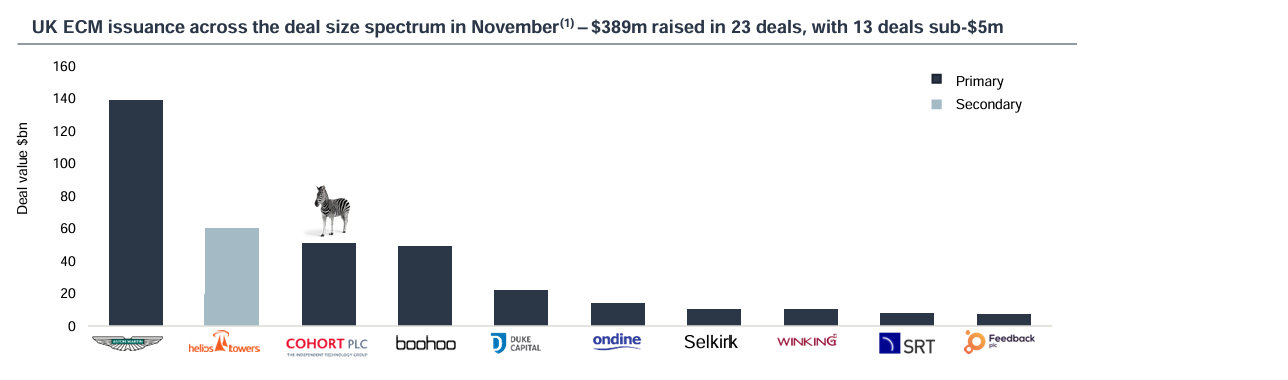

UK ECM activity | November

UK ECM issuance was muted in November as markets digested the UK October Budget and the US election results, but YTD value and deal numbers well ahead of 2023

2024 UK ECM YTD activity vs 2023 snapshot (2)

| 2024 YTD | 2023 YTD | Variance | |

| Total funds raised (£m) | 28,297 | 19,724 | +46.0% |

| Total no. transactions | 131 | 107 | +22.4% |

Source: Dealogic; (1) Analysis and commentary only includes transactions greater or equal to £5m; (2) Analysis and commentary only includes transactions greater or equal to $US50m – chart above show year-to-date activity levels; IFR ECM

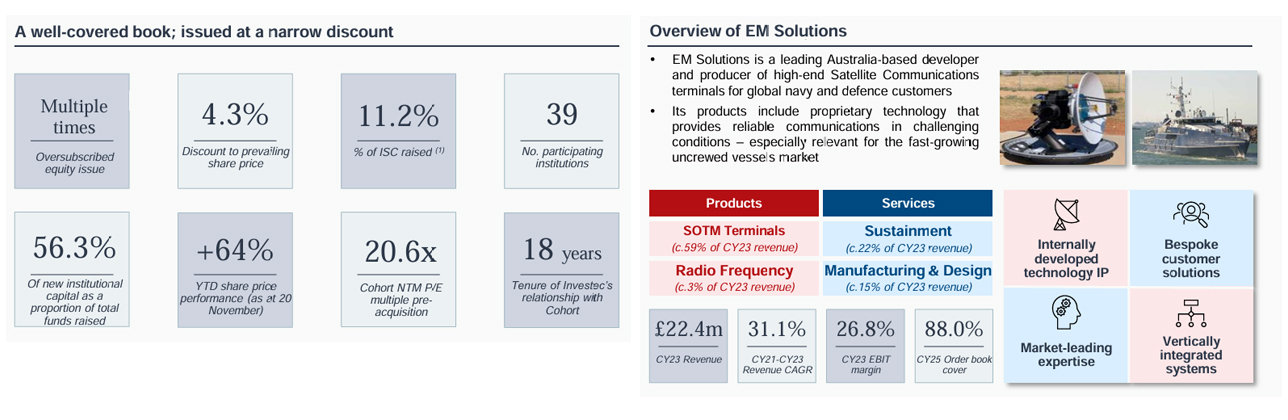

Cohort’s £75m acquisition of EM Solutions & £40m Equity Placing

UK Equity Markets demonstrating strong support for strategically aligned and earnings accretive M&A

Transaction Overview

- Cohort is acquiring EM Solutions for an enterprise value of AUD$144.0m (£75.0m) (the “Acquisition”) on a cash free debt free basis.

- Part-funded by £40m non-pre-emptive Placing with the balance provided by Cohort’s existing cash resources and debt facilities (the “Placing”).

- Incremental £1m PrimaryBid offer to retail investors.

- The Acquisition creates a materially larger Group and will be Cohort’s largest acquisition to date.

- It brings a new capability to the Cohort, strengthens its strategic geographic position, and has strong structural growth drivers.

- It enables Cohort to further establish its footprint in Australia, an increasingly important player in the global defence supply chain and a key strategic region for the Cohort Group.

Introduction of new high-quality institutions to the register

- The Placing was launched following a confidential marketing exercise to existing shareholders and new investors over the course of 4.5 days.

- Cohort’s shareholder register includes some good UK institutions but is 30% owned by ‘insiders’ and management, who were unable to participate given the Company was in a closed period, and also has +35% owned directly / indirectly by retail investors.

- These characteristics of the Company ownership created a requirement, and an opportunity, to introduce a broad range of non-holders onto the register.

- The book was multiple times subscribed via a combination of strong support from certain shareholders plus new investors looking to join the register.

- New investors joining the register included a number of the largest global investment managers, additional UK asset managers, US based asset managers and a European asset manager.

- Given the requirement for certain funds at the point of signing the acquisition Investec provided a hard underwriting commitment to Cohort.

- Investec acted as Sole Financial Adviser, Sole Broker, Sole Bookrunner, and Nomad to Cohort.

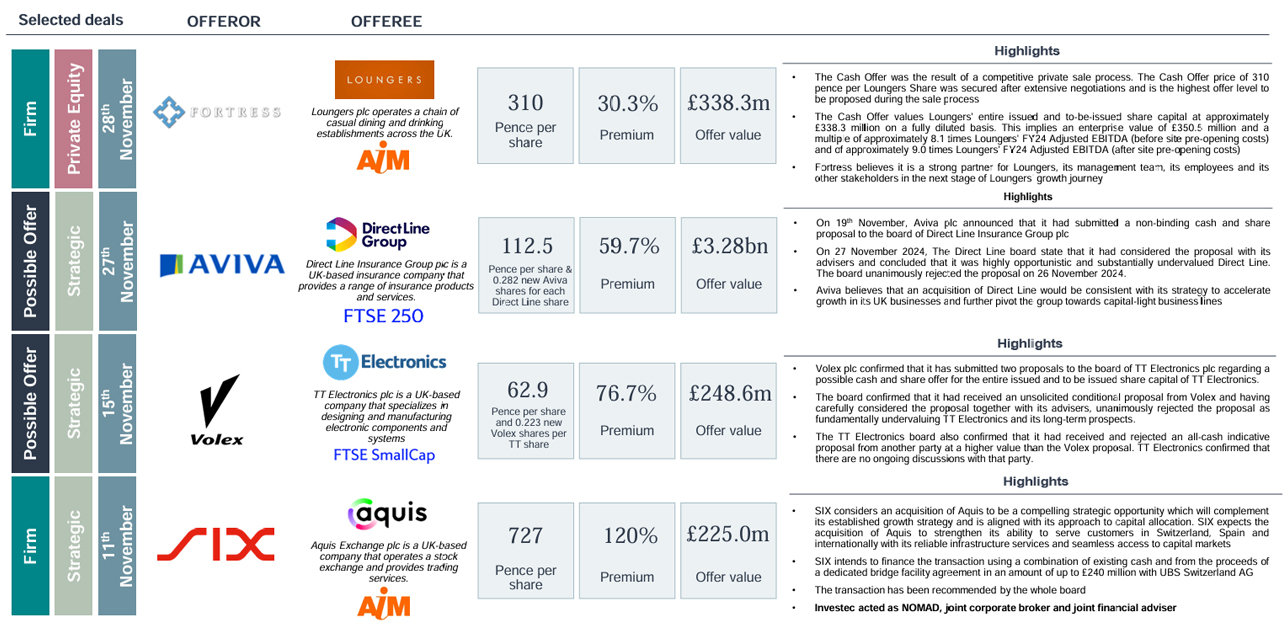

UK public M&A activity | November

UK public market valuations continue to attract significant interest from trade and private capital

Selected Deals

Source: Company announcements; FactSet; Practical Law | Note: (1)Total Enterprise Value including the £36.7bn withdrawn Anglo American plc deal.

Scorecard includes competing offers and withdrawn of companies subject to the Takeover Code quoted on AIM or the Main Market. Formal sales processes are not included unless a buyer has been identified. Only newly announced offers in the month are included in the count (i.e. possible offers announced in December 2023 will be included in that month even if it becomes a firm offer in January 2024).

Get the Investec Equity Market Overview delivered to your inbox

Browse articles in