Executive summary

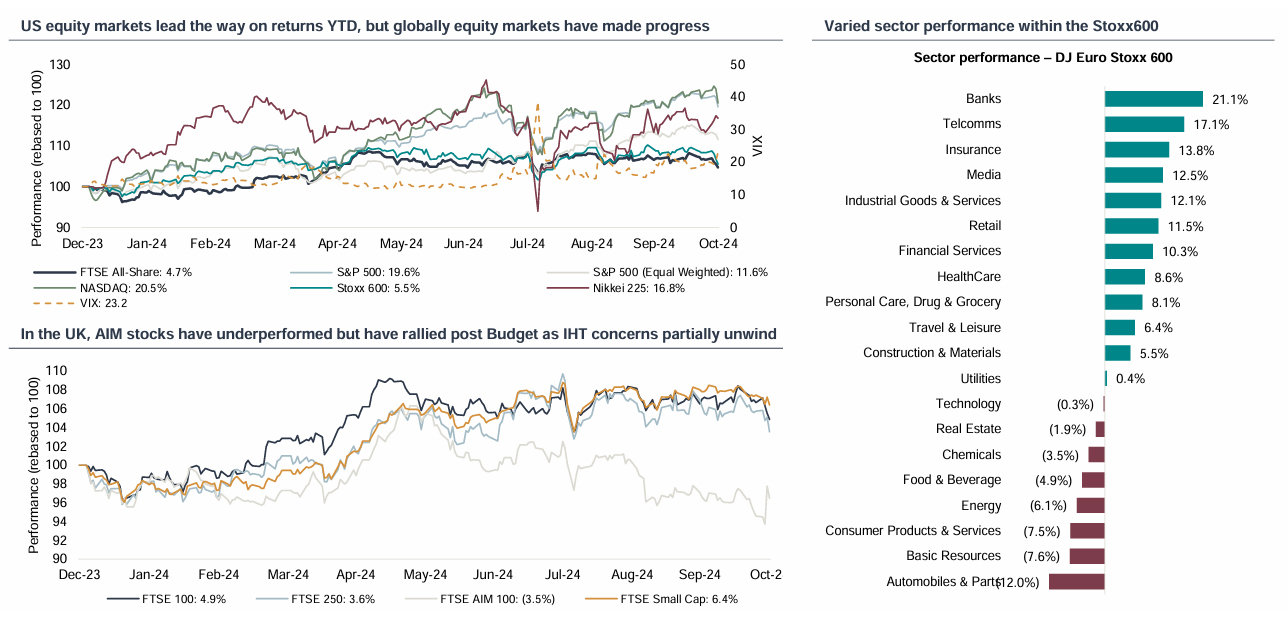

- Investors have had plenty to digest through October with a slew of (generally constructive) corporate results, macro data, uncertainty with respect to the US election, evolving geopolitics and in the UK, the first Labour budget in 14 years. Although indices have moved lower into month end, equity markets largely navigated much of that news flow and several indices once again made all-time highs earlier in the month (S&P500, DAX).

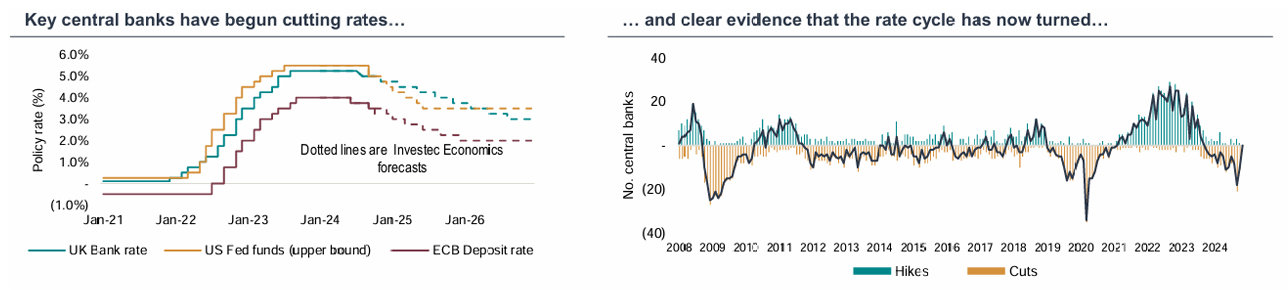

- Key macro events/data over the month included September UK CPI that (at the headline level) came in at 1.7% cementing expectations of a November 25bps BoE rate cut, the much awaited UK Budget, strong US Retail sales and Consumer Confidence data suggesting the US consumer is holding up well, a third 25bps cut in rates from the ECB (European Deposit rates now at 3.25%) and October flash PMI surveys.

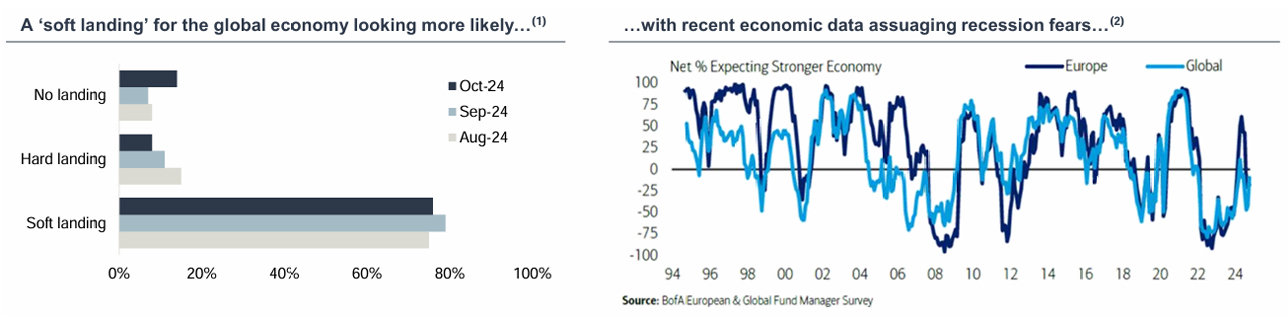

- Investors continue to see soft economic landings as the most likely dynamic over the next 12 months although the chances of a no-landing scenario, with more stubborn inflation keeping rates higher for longer, also growing marginally.

- Government bond yields moved higher over the month both in the US and in Europe. In the US the UST 10 year yield moved from 3.78% to close out the month at 4.28%, the UK 10 year moved from 3.99% to 4.44% and the German 10 year from 2.03% to 2.38%. In the US the 50bps rate cut combined with solid economic data suggest a slower path for the Fed whereas some concerns about increased Gilt issuance and the longer term implications of the budget pushed UK yields higher.

- Whilst there has been some broadening of performance at various points through the year, large caps (and mega cap US tech companies) have outperformed - the FTSE250 and the Russell 2000 closed October 16% and 10% from all time record highs (reached in 2021) whereas a number of larger cap indices made all time highs again last month.

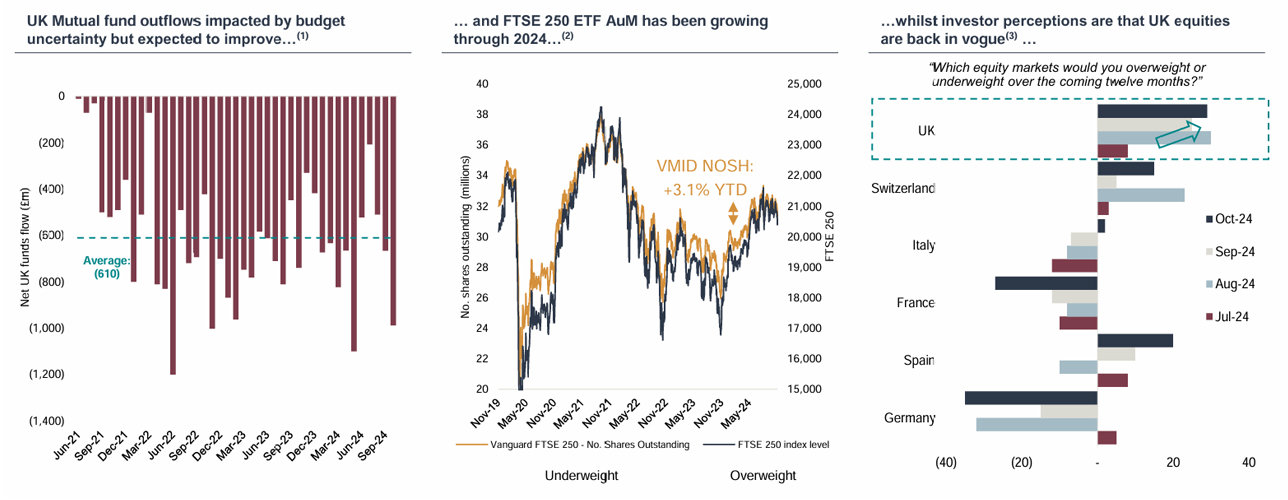

- Uncertainty surrounding the UK budget and downbeat Government commentary not only impacted UK Consumer Confidence in the run up to the budget (see October Gfk survey) but also will have contributed to funds flow into UK equities softening over the month. However the BAML survey for September continued to show that the UK remains the top pick in Europe for PMs over the next 12 months, and with the budget now out of the way (and arguably no worse than expected for UK plc) flows may continue to recover over the balance of the year.

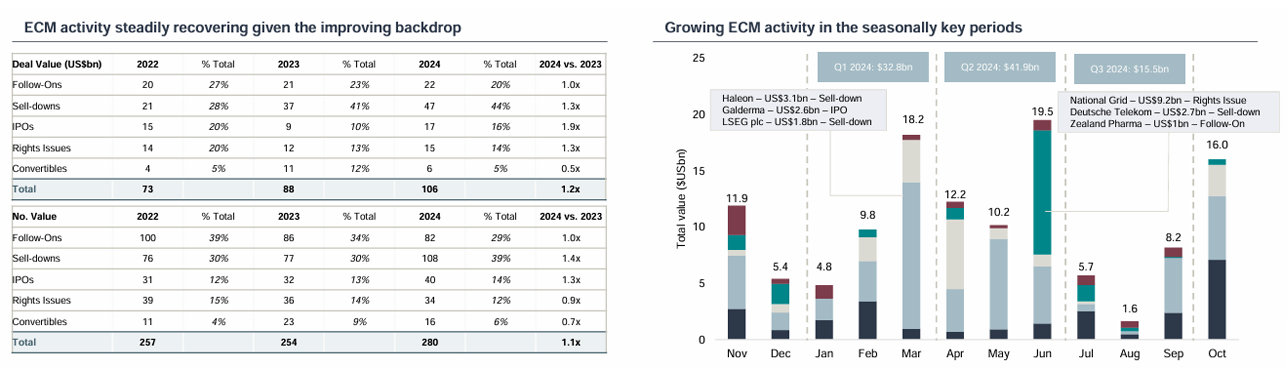

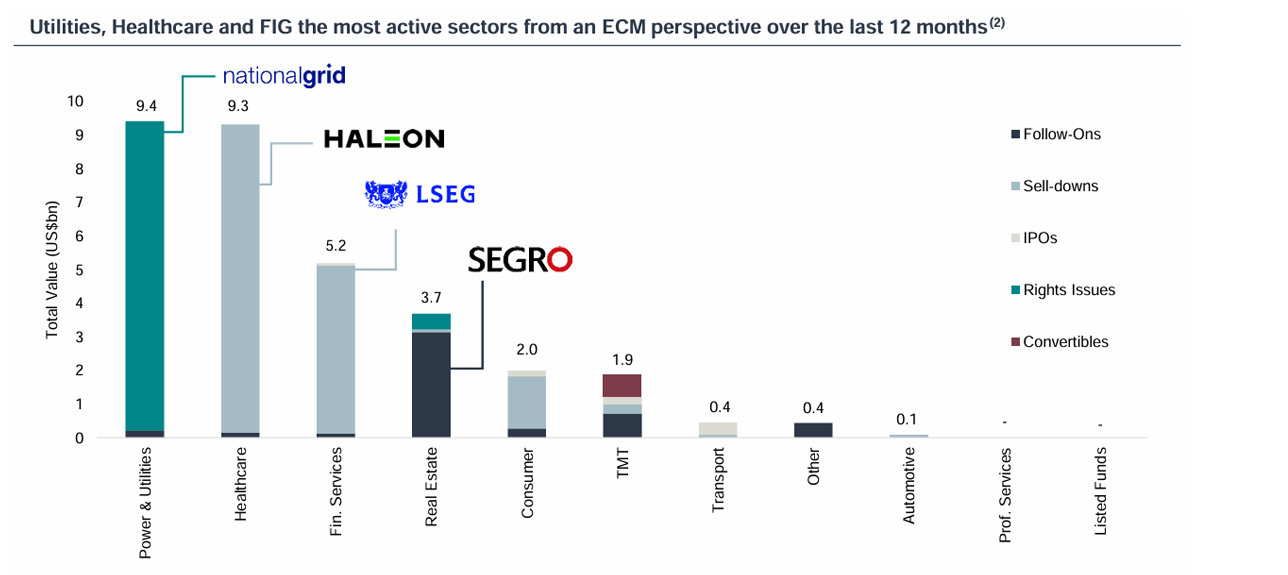

- ECM activity reached a total of $16bn from 29 transactions over the month, significantly ahead of the $8.1bn and 38 transactions for September and the busiest month in $ volume terms for European ECM since June. This puts 2024’s ECM activity year to date ahead of the full year volumes for 2023.

- European ECM volumes continue to be driven by follow-on and secondary sale activity but there were 4 IPOs in October that priced raising $2.8bn in total. In the UK, Applied Nutrition successfully floated on the LSE in its all secondary IPO that raised £157.5m with JD Sports and senior management selling down.

Source: Factset; 1 Dealogic – analysis only includes transactions greater or equal to $US50m; European ECM activity inclusive of UK

Equity Market Overview | Lower for October but still solid YTD

Confidence in soft landings remains intact with further rate cuts expected

- October saw US indices again making new highs, the DAX achieved the same and several European indices spent much of the month within touching distance of their record highs. However, by the close of the month all had given up gains and closed lower over the month – FTSE down -1.5%, FTSE250 down -3.2%, Stoxx600 down -3.3%, S&P down -1.0%.

- Equity markets have been relatively calm over much of October, although as the month end came into view investors pulled back given rising US election concerns, the UK budget, geopolitics and some slightly cautionary outlook commentary (relative to lofty expectations) from some of the US mega cap tech companies.

- In the UK AIM listed stocks have underperformed since Rishi Sunak called for the UK election with the AIM All Share down -11% in that period up until the Budget, relative to the FTSE 100 down just -2.5% over that period. With the UK Budget removing only half of the IHT tax relief, AIM has rallied 3% since markets were evidently fearing a worse outcome.

Source: FactSet; Bloomberg

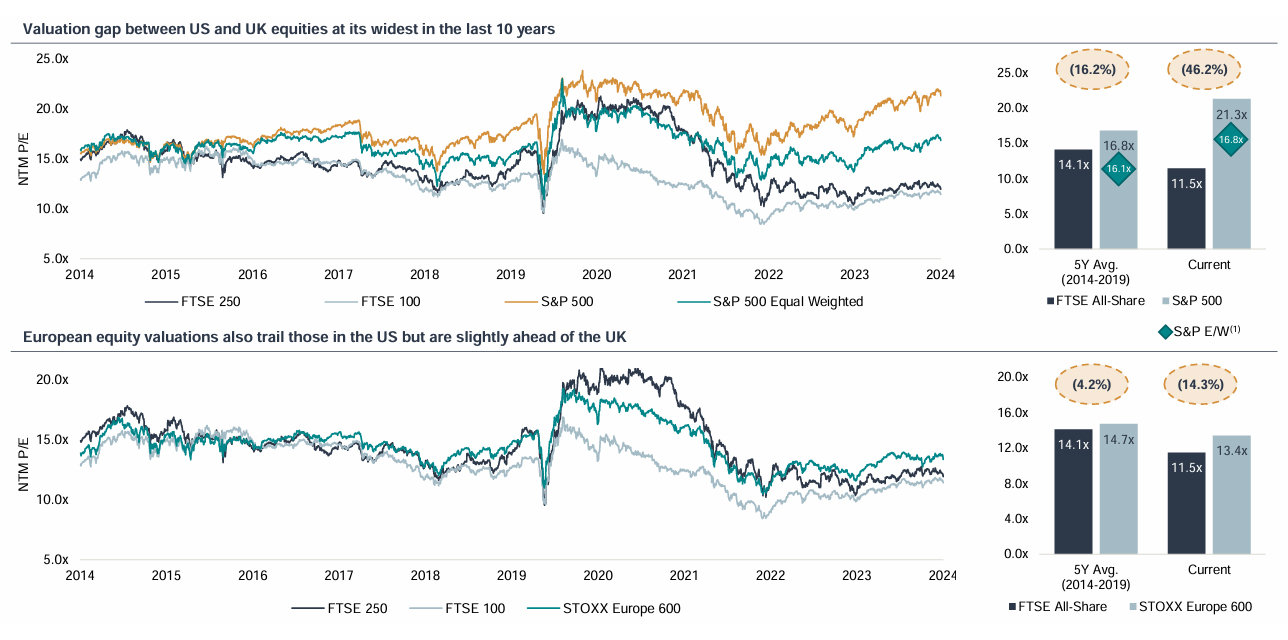

Equity Market Overview | valuation disconnect remains

UK valuations continue to look attractive on a global and historic relative basis

- As we know, since Brexit in 2016, the spread between UK and US equity valuations has increased with further divergence evident since the start of the pandemic and subsequently over the period of UK Government instability.

- Recent UK Government commentary regarding fiscal ‘black holes’ and uncertainty about what that would mean for the first Labour budget in 14 years impacted recovering UK sentiment that was evident immediately post the election in July – the September Gfk consumer sentiment survey clearly showed its impact on the consumer but the impact was more widespread with investors also holding off.

- With the budget now out of the way and taxation plans arguably no worse than expected (and in some regards better than feared) the removal of the ‘uncertainty’ should help the interest in UK equities, that has been on hold for several months, start to recover again.

Source: FactSet; (1) S&P E/W refers to the S&P500 Equal Weighted index

Macro Outlook | improving backdrop

Inflation continues to fall with further rate cuts anticipated

- In October UK inflation for September fell to 1.7% y/y from 2.2% in August and was lower than the 1.9% expected. Service sector inflation, although also continuing to fall, remains well above BoE targets at 4.9%.

- In the EU CPI for September fell to 1.7% y/y from 2.2% in August (although preliminary data shows it has edged back up to 2% in October, driven by fuel prices). In the US CPI fell to 2.4% y/y in September from 2.5% in August.

- Whilst the pace of further interest rate cuts may not be as quick as had been expected earlier in the year (particularly in the US), more are expected which supports confidence in the outlook and ‘soft economic landings’.

- Geopolitical uncertainty continues to be a significant feature although equity markets have so far navigated these challenges – is the next hurdle the US election outcome?

1 Inflation is trending towards central bank target levels…

2 …and the rate cutting cyclelooks wellunderway…

3 …supporting a more optimistic macro-outlook

Source: FactSet; Macrobond; ONS; Investec Economics; BofA European Fund Manager Survey – (1) Global investors’ view on the global economy; (2) Global investors’ view on the European economy

Prefer to download?

Click to download the full market review below.

Never miss an update

Subscribe to the monthly Market review

European Equity Issuance 2024 YTD | Improving trends

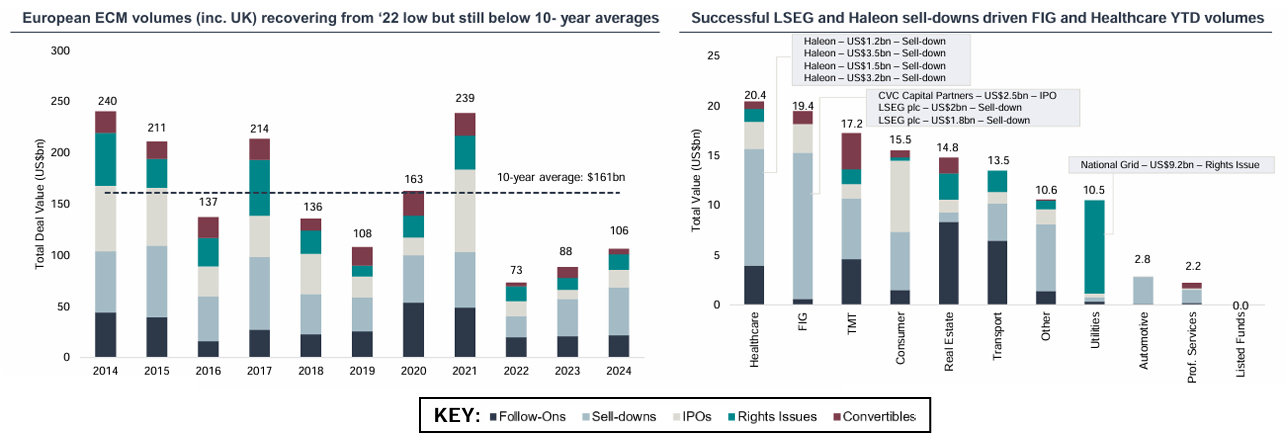

European equity issuance remains well below 10-year averages, but YoY improvements with 2024 YTD $ volume now ahead of FY 2023 volume

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels

European IPO Issuance 2024 YTD | Improving Outlook

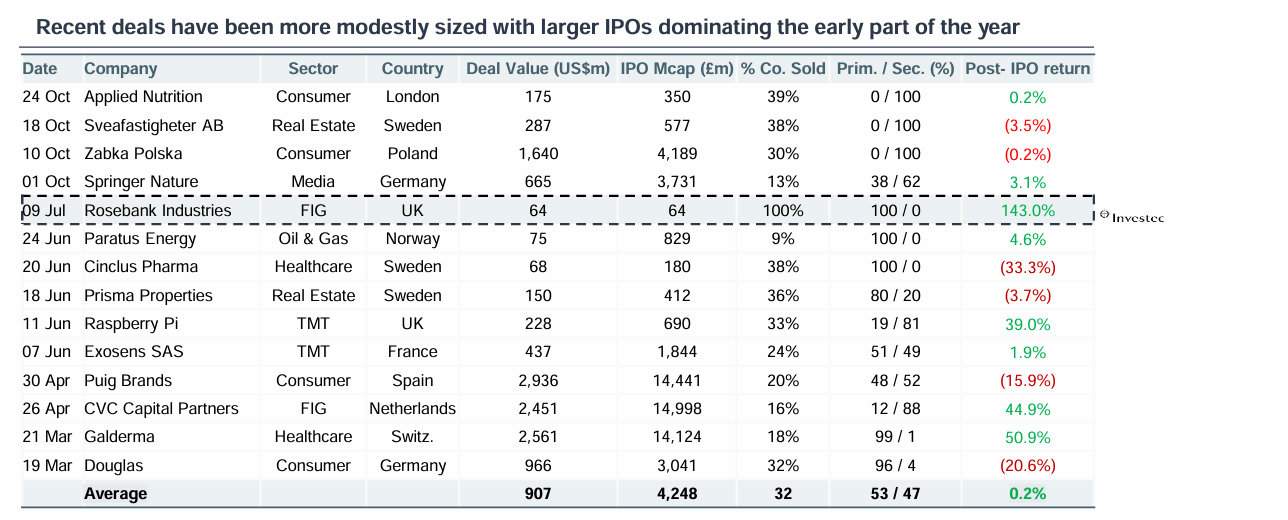

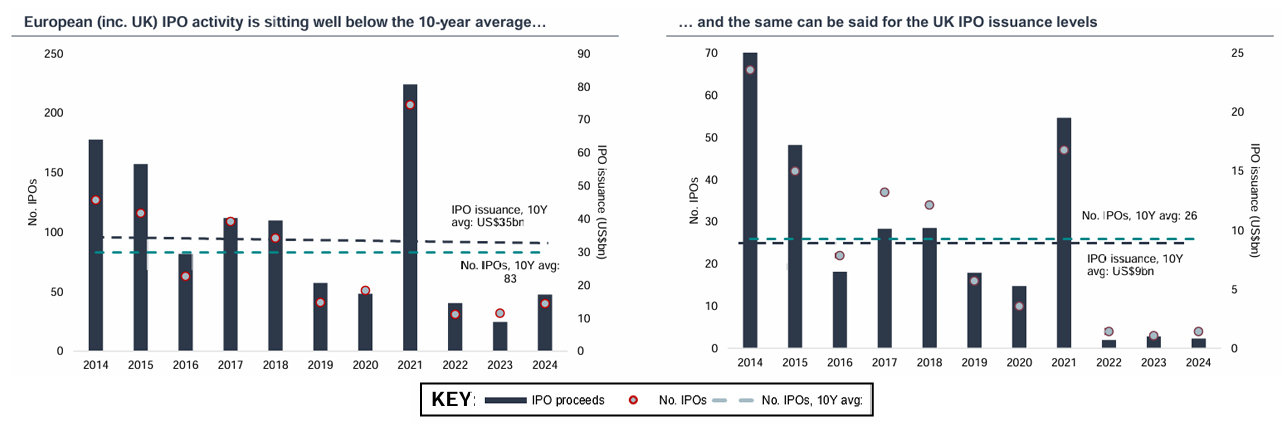

IPO volumes remain subdued across Europe relative to 10-year averages, however volumes are up YoY with October seeing $2.8bn raised from 4 notable IPOs

IPO issuance in Europe

- US$17bn raised across 40 transactions so far in 2024, up by 114% and 33% respectively versus the $8bn raised across 30 deals in 2023 YTD.

- Average IPO size so far this year of US$427m vs. US$278m last YTD.

- Average YTD post-IPO share price gain of c.12%. As of 31/10/24 16 transactions out of 40 have delivered positive after-market returns for shareholders.

- Consumer sector been busiest this year, raising US$6bn over 8 IPOs.

- There have been four IPOs over US$1bn this year: Spanish fashion company Puig Brands (US$2.4bn); consumer health and aesthetic solutions provider Galderma (US$2.6bn), private equity firm CVC (US$2.5bn) and Polish convenience store chain Zabka Polska (US$1.6bn).

- October saw four IPOs over US$50m, with the average deal size being US$691m.

- As we enter Q4 2024, we remain cautiously optimistic on the outlook for European and UK IPOs. Global equity markets continue to attract capital, and equity market performance has been robust so far this year. Additionally, we think this summer’s FCA Listing Rule reforms will serve as helpful tailwinds for UK IPOs.

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to $US50m. References to European ECM include the UK and exclude Middle East and Africa. Includes Investment Funds. Charts show year-to-date activity levels

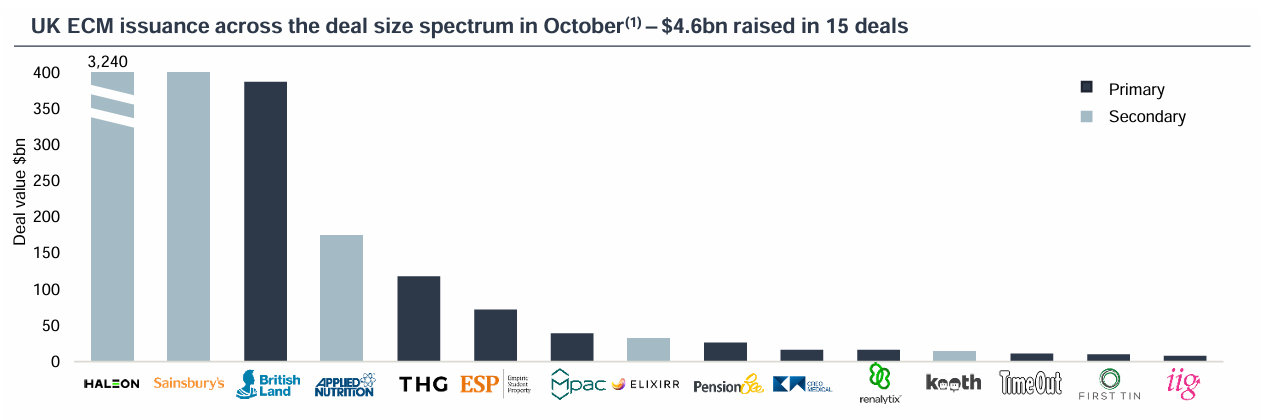

UK ECM activity | October

UK ECM issuance picked up in October with shareholder sell downs continuing to dominate but augmented by primary capital for M&A / expansion as well as an IPO

2024 UK ECM YTD activity vs 2023 snapshot

| 2024 YTD | 2023 YTD | Variance | |

| Total funds raised (£m) | 27,521 | 20,825 | +32.2% |

| Total no. transactions | 113 | 101 | +11.9% |

Source: Dealogic; (1) Analysis and commentary only includes transactions greater or equal to £5m; (2) Analysis and commentary only includes transactions greater or equal to $US50m – chart above show year-to-date activity levels; IFR ECM

UK Funds Flow Overview | Perceptions changing

Despite a challenging funds flow environment for UK equities since 2021, there are signs of improvement

- The 30th October Budget significantly disrupted UK equities, making October a 'lost month' for market performance. Uncertainties with regard to IHT and the impact on AIM, Capital Gains Tax, and the tax burden for individuals and companies naturally led to investors stepping back.

- The impact on investor flows of uncertainty over the UK budget and the more negative tone to Government rhetoric in the lead up to it can clearly be seen in the October funds flow data. However, with the budget now out of the way, interest in UK equities is expected to recover.

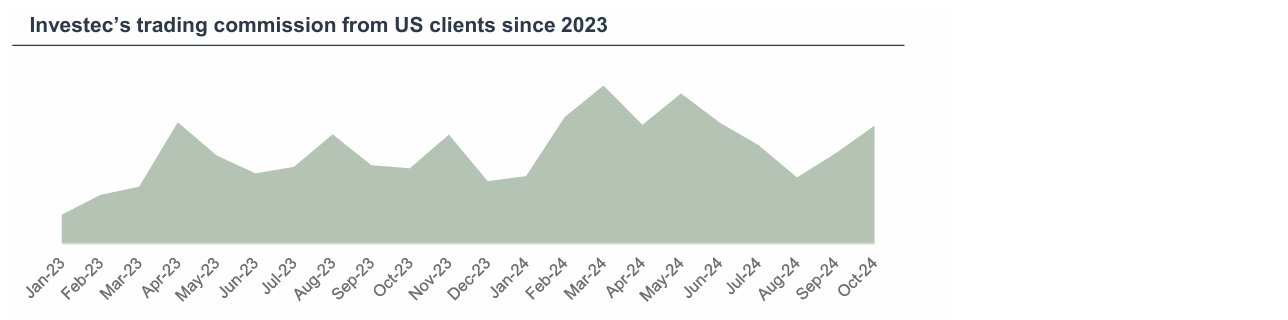

- Fund managers are adjusting their marketing strategies for 2025, maintaining a relative optimism that is now dependent on the BOE's interest rate cuts and messaging. US investors, while still showing interest in UK equities, have become a little more cautious over the past month given the budget and their own impending election.

Source: (1) Calastone – fund flow data relates to UK mutual funds only; Bloomberg; (2) Chart shows increasing share count of Vanguard FTSE 250; (3) BofA Global Fund Manager Survey

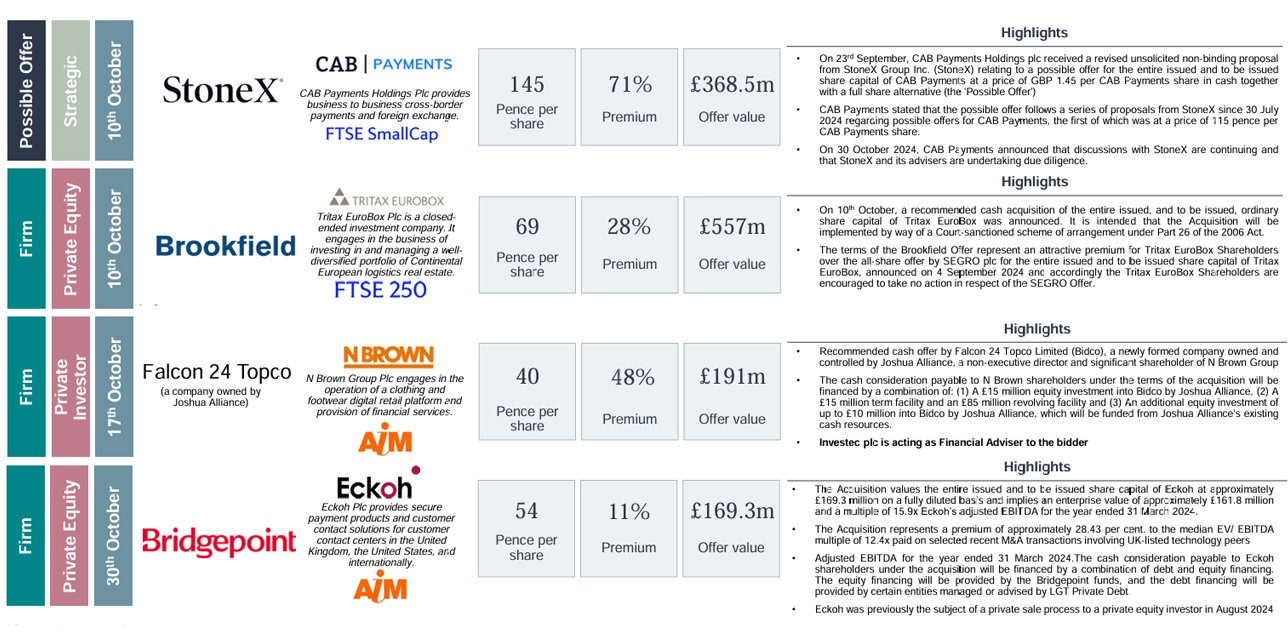

UK Public M&A activity | October

UK public market valuations continue to attract significant interest from trade and private capital

Selected Deals

Source: Company announcements; FactSet; Practical Law | Note: (1)Total Enterprise Value including the £36.7bn withdrawn Anglo American plc deal.

Scorecard includes competing offers and withdrawn of companies subject to the Takeover Code quoted on AIM or the Main Market. Formal sales processes are not included unless a buyer has been identified. Only newly announced offers in the month are included in the count (i.e. possible offers announced in December 2023 will be included in that month even if it becomes a firm offer in January 2024).

Get the monthly Investec Market Review delivered to your inbox

Browse articles in