Get Roger Lee’s Equities delivered to your inbox

One would generally ask two questions: “what do you expect to make from the investment” and “is it worth it”? Answering the ‘’what we are likely to make from an investment’’ is usually quite straight forward. Traditionally in equities, we would focus on the dividend received, but it could be cash generated from selling a product, rental income or any sort of return.

But the ‘’is it worth it’’ question is often a lot more complex because we have to be mindful of several factors. The costs associated with the investment, but not just the financial costs but the opportunity cost of pursuing one investment over another that have different return profiles and different risk factors.

So when appraising any investment to decide “is it worth it” we must consider all the costs associated with the investment to establish a minimum “required return” and then use that to somehow compare against the “expected returns”.

Finally, we also have to consider the return profile, the time value of money, receiving £100 in a year is preferable and so worth more than receiving £100 in 10 years and so on.

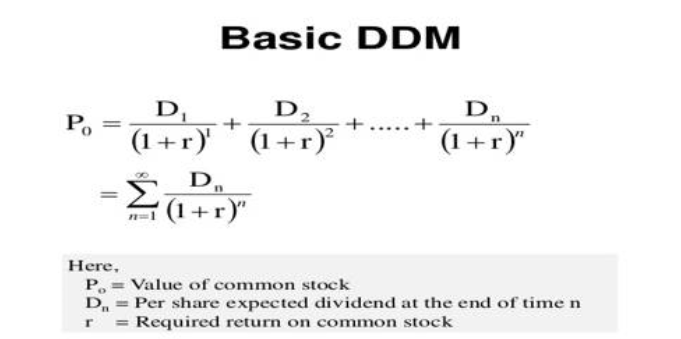

The combination of all the above is the basis for the fundamental methodology for valuing an equity and it’s called the Dividend Discount Model (DDM) and is usually represented in its most basic form by the formula below. The elegance of the DDM is that it captures the “what do you expect to make” from the investment and the “is it worth it” and by calculating a present value also takes account of the time value of money.

Or more formally when applied to equity valuation, the DDM discounts the sum of the “expected future dividends” by the “required return” over the life of the investment to arrive at the value of share today.

There has been a huge amount of academic work to define what “the required return” is for an equity investment. But in essence, the theoretical “required return” for an equity consists of three variables.

First the “beta” of the company to the market. If we think about the beta in terms of an individual company’s volatility, then it makes sense that we should require a higher return from more volatile companies than less volatile companies.

The second element is the long term market return. Our required return for an equity should have a reference and aim to exceed the long term historic return of the equity market as a whole.

The third element is again intuitive and that is the “risk-free rate”, the required return of investing in any asset should be relative to what we would earn with zero risk.

The combination of these three factors in determining the “required return” is known as the Capital Asset Pricing Model or “CAPM” and the 1990 Nobel Prize was awarded to Professors Markowitz, Miller and Sharpe for their work in the 1960s developing this concept.

So the beta is company or industry-specific and in most cases fairly constant over time. The long term return of the market is relatively stable.

The risk-free rate is usually taken as the benchmark government bond yield on 10 yr US Treasuries and in recent years anything but stable repricing every day and in recent months and years by significant amounts.

So firstly applying CAPM, when the risk-free rate or, as it is usually expressed, the yield on 10yr US Treasuries is falling, the “required return” falls. Then by using a lower ‘’required return’’ in the DDM formula above, if those future returns are unchanged, they are now worth more. “Price” would have to adjust upwards.

Conversely, if the yield on US Treasuries starts to rise then the “required return rises” and all other things being equal those future returns are worth less and “Price” should fall.

US Treasuries yields have always been relevant for equity valuation through this relationship between the “required return” and the “risk free-rate” as expressed in the fundamental equity valuation models of the DDM and CAPM.

However, since 2018 as fluctuations in US Treasury yields are proportionately a lot higher and therefore more impactful than in the past, so the risk-free rate has become more important to equity valuations.

Valuation methodologies haven’t changed its just one factor has become increasingly dominant.

Get Roger Lee’s Equities delivered to your inbox

Browse articles in