How discretionary investment services can help your business

04 September 2024

The ability to provide your clients with an investment service tailored to their needs allows you to align your business with Consumer Duty principles

03 Sep 2024

It’s important to understand your clients’ requirements and choose the most appropriate investment offerings for them.

Outsourcing your expertise can help you spend valuable time building and maintaining satisfying and rewarding relationships with your clients, giving them the personal attention they deserve. With so many different investment options available, how do you know what is right for your clients?

We believe those that require a tailored approach to their needs would benefit from a discretionary portfolio service. Meanwhile, those with more straightforward requirements are likely to find a managed portfolio service more appropriate.

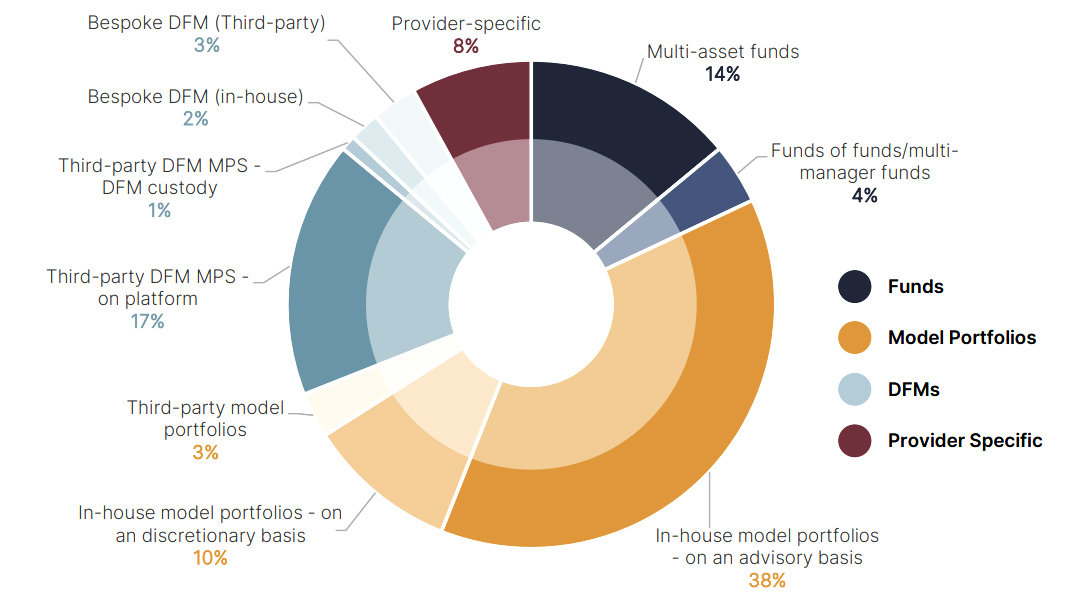

Source: Langcat State of the Adviser Nation – January 2022.

Discretionary fund management is a truly bespoke approach, following your guidance and focused on each client’s individual needs. Working together to understand their requirements, we will agree an investment strategy, as guided by you. We will then implement your advised strategy and entrust the day-to-day management of the portfolios with your local investment management team. This service includes regular reporting and communications, together with strategic review meetings at your request.

A discretionary service is particularly useful for those who are approaching retirement or have already retired, constructing a portfolio that balances a sustainable income with ongoing growth, including:

Through our Managed Portfolio Service we regularly review and rebalance your clients’ investments to ensure that the combination of funds remains suitable for them. We use our expertise and skills to buy and sell funds so that all portfolios are best positioned for what we believe will happen in markets over the short to medium term.

By outsourcing your investment services, you can spend more time with your clients, giving them a better plan for the right products at the right times. Our dedicated business development team will ensure you can understand how we are managing your clients’ money, as well as respond to their needs. We will allocate a dedicated business development manager to you, in addition to the Investment Management team, who will ensure you are kept abreast of all the services available at Investec Wealth & Investment (UK).

For advisers focused more on financial planning, partnering with an investment specialist separates investment performance from the adviser-client relationship. This allows advisers to focus fully on planning while the partner handles investments. A good investment partnership also provides advisers with access to expanded research and resources, including expertise in specialised areas like impact investing.

Partnering with a firm that is dedicated to investing and with extensive resources brings a powerful extra dimension to your client relationships. Investec Wealth & Investment (UK) is now part of Rathbones, making us the largest investment house in the UK with even greater access to resources.

Whatever your client’s goals and ambitions for their money, our flexible range of investment solutions helps enhance your reputation and reduce your administrative burdens. You’ll have more time to focus on financial planning and winning more business.

You can send us a message, or request a call from your local business development director. Whatever support you need, we're here to help.

Our first port of call is sitting down with you and understanding you and your business needs. Our highly experienced and award-winning business development team have worked successfully for many decades alongside a wide variety of financial adviser firms. With 15 locations throughout the UK and Channel Islands, our network is exactly where you need us to be.

The information contained within this brochure does not constitute financial advice or a personal recommendation. Investors should remember that the value of investments, and the income from them, can go down as well as up and that past performance is no guarantee of future returns. You may not recover what you invest. Tax treatment depends on individual circumstances. All statements concerning tax treatment are based upon our understanding of current tax law and HMRC practise and can be subject to change.

Award-winning solutions for financial advisers