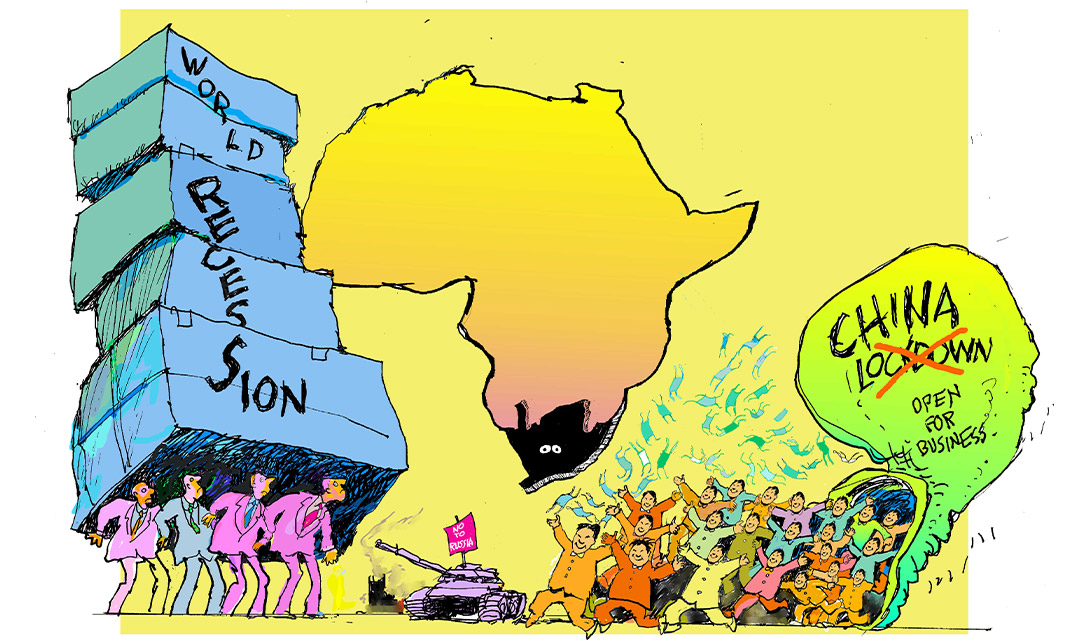

Last year was a memorable one on many fronts, from war in Ukraine to the return of high inflation. What does the rest of 2023 hold? Once again, we asked our panel of experts at Investec Wealth & Investment International to give their views on the year ahead, on many topics, including the inflation and interest rate outlook, and the likelihood of recession; US and global politics; the war in Ukraine; China’s growth and its relations with the rest of the world; South Africa’s economic and energy challenges; views on sectors and regional markets; as well as a few suggestions out of leftfield.

We are pleased to see a larger group of contributors this year, including one new face, Osagyefo Mazwai. The result is a longer edition than last year, but hopefully, one that gives a broad range of views and insights.

Speaking of a broad range of views, it’s always been our stance that a broad range of opinions is a strength rather than a weakness. Diversity in outlook implies robust and healthy debate and should result in a better, more nuanced outcome when it comes to setting strategy and choosing investments.

It also means that this Q&A should not be seen as some kind of “house view” – for that purpose, please refer to our latest Global Investment View, which provides a consolidated view of our Global Investment Strategy Group (GISG) and asset allocation teams.

(We should add that many of those who offered their views are members of the GISG and asset allocation teams, where their broad range of ideas and opinions contribute to the overall risk score, commentary and asset allocations of our different committees. The result is a well-distilled process that guides the way we manage your money.)

Our panel this year is made up of the following people:

- Annelise Peers (chief investment officer, Investec Switzerland)

- Professor Brian Kantor (economist and strategist)

- Barry Shamley (portfolio manager and head of the ESG Committee)

- Chris Holdsworth (chief investment strategist)

- John Wyn-Evans (head of investment strategy, Investec Wealth & Investment UK)

- Neil Urmson (wealth manager)

- Osagyefo Mazwai (investment strategist)

- Richard Cardo (portfolio manager responsible for the Global Leaders portfolio)

- Zenkosi Dyomfana (portfolio management assistant)

BK = Brian Kantor

BS = Barry Shamley

CH = Chris Holdsworth

JW-E = John Wyn-Evans

OM = Osagyefo Mazwai

NU = Neil Urmson

RC = Richard Cardo

ZD = Zenkosi Dyomfana

The differentiator will remain how well companies manage the data available to them - the opportunity is large.

The world we have become accustomed to over the last four decades is no longer valid and we are entering a new paradigm of structurally elevated inflation as a result of deglobalisation and high debt levels.

There are major demographic headwinds for China. Its population has started to decline and the working-age population has already been in decline for some time.

There’s an outside risk of China curtailing supplies of some commodities/goods to the West (“weaponisation of inflation”), but it can only do so much without hurting itself.

Where markets end up at the end of this year will largely depend on three Rs – where and when the Fed funds rate peaks, the extent of any recession, and earnings revisions.

I suspect we could see an unexpected resolution to the Ukrainian war this spring – the war is not going well for President Vladimir Putin. A peace deal between Russia and Ukraine will crush oil prices, but global equities will benefit.

About the author

Patrick Lawlor

Editor

Patrick writes and edits content for Investec Wealth & Investment, and Corporate and Institutional Banking, including editing the Daily View, Monthly View, and One Magazine - an online publication for Investec's Wealth clients. Patrick was a financial journalist for many years for publications such as Financial Mail, Finweek, and Business Report. He holds a BA and a PDM (Bus.Admin.) both from Wits University.

Get Focus insights straight to your inbox

Disclaimer

Although information has been obtained from sources believed to be reliable, Investec Wealth & Investment International (Pty) Ltd or its affiliates and/or subsidiaries (collectively “W&I”) does not warrant its completeness or accuracy. Opinions and estimates represent W&I’s view at the time of going to print and are subject to change without notice. Investments in general and, derivatives, in particular, involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. The information contained herein is for information purposes only and readers should not rely on such information as advice in relation to a specific issue without taking financial, banking, investment or other professional advice. W&I and/or its employees may hold a position in any securities or financial instruments mentioned herein. The information contained in this document does not constitute an offer or solicitation of investment, financial or banking services by W&I . W&I accepts no liability for any loss or damage of whatsoever nature including, but not limited to, loss of profits, goodwill or any type of financial or other pecuniary or direct or special indirect or consequential loss howsoever arising whether in negligence or for breach of contract or other duty as a result of use of the or reliance on the information contained in this document, whether authorised or not. W&I does not make representation that the information provided is appropriate for use in all jurisdictions or by all investors or other potential clients who are therefore responsible for compliance with their applicable local laws and regulations. This document may not be reproduced in whole or in part or copies circulated without the prior written consent of W&I.

Investec Wealth & Investment International (Pty) Ltd, registration number 1972/008905/07. A member of the JSE Equity, Equity Derivatives, Currency Derivatives, Bond Derivatives and Interest Rate Derivatives Markets. An authorised financial services provider, license number 15886. A registered credit provider, registration number NCRCP262.