Get Focus insights straight to your inbox

The Battle for Basquiat

– Sotheby's

– Sotheby's

Is the art market up or down? It is a question that perennially occupies those who have staked a career in this flourishing multi-billion dollar global industry.

The question tends to overlook a noticeable shift in power from auction houses to private dealers and art fairs.

Over the past decade, headline earnings in what is essentially a luxury retail sector have followed broader economic trends and seesawed wildly.

In 2016, the most recent year for audited results, global sales were between $45 and $57 billion. Art fairs alone generated $13.3 billion in sales in 2016, up 5% year-on-year and 57% since 2010, according to the 2017 Art Basel/UBS art market report.

The numbers may be impressive, but the overall picture for 2016 was one of decline.

“The market peaked in 2014 at $68.2 million, beyond the peak in 2007 and more than doubling in size within a decade,” states the 2017 Art Basel/UBS art market report.

“While the US managed to keep the momentum, weak sales in China and continued stagnation in Europe led to an inevitable slowdown of sales in 2015, as certain sectors cooled and it became harder for the market as a whole to keep up the pace.”

But then came last year’s bumper crop of auction results.

They included the May 2017 sale of Jean-Michel Basquiat’s 1982 painting of a skull for $110.5 million, and the November 2017 sale of Leonardo da Vinci’s Salvator Mundi for a whopping $450.3 million.

Also read: For art’s sake - How good is art as an investment?

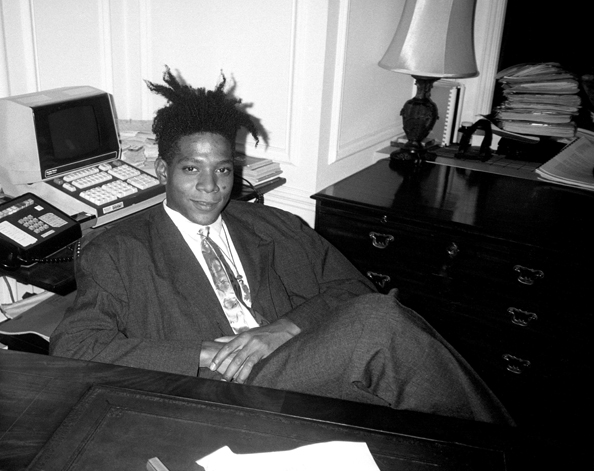

Jean-Michel Basquiat is pictured here in New York in 1985. His untitled 1982 work of a skull sold for $110.5m in 2017 making it the most expensive American painting ever.

The breathtaking $450 million (including buyer's premium) sale of Leonardo da Vinci’s Salvator Mundi generated headlines across the world

– Christie's

The breathtaking $450 million (including buyer's premium) sale of Leonardo da Vinci’s Salvator Mundi generated headlines across the world

– Christie's

Earlier this month, the New York Times reported that robust sales at Christie’s in 2017 saw the auction house achieve sales of $7.3 billion, a 26% increase on the previous year. Rival auctioneers Sotheby’s and Phillips have also reported strong growth for 2017.

The African continent represents a tiny fraction (less than 0.5%) of the global trade in art. Nonetheless, similar upward trends were discernable in South Africa with Strauss & Co, the country’s leading auction house, posting total sales of R329 million for 2017. The result marked a massive R114 million gain over its 2016 headline number, which had been exceptionally good.

Auction houses often benefit from a disproportionate amount of financial reporting.

There is a simple reason for this.

“Auction houses figures are readily available, yet the dealer side of the market is opaque and lacks transparency,” states the TEFAF Art Market Report 2017, a benchmark study prepared by an economics team at Maastricht University and underwritten by the European Fine Art Foundation in The Netherlands.

A notable trend flagged in both the latest TEFAF and Art Basel/UBS reports is the growing economic muscle of private dealers. It is estimated that dealer sales – be it through brick-and-mortar galleries, at art fairs such as the Investec Cape Town Art Fair (pictured below) or through online channels – accounted for between 57% and 62.5% of all art sales in 2016.

The Investec Cape Town Art Fair showcases the latest trends in African contemporary art.

The reasons for this upswing are diverse.

Auctioneers trade in luxury brand names and scarcity at set commissions, whereas dealers, especially in the contemporary market, sell high-risk innovation and novelty on negotiable terms.

But it is social factors, in particular, economic austerity and political tensions, which have transformed attributes of privacy and anonymity associated with dealers into attractive economic virtues.

This last statement might seem counterintuitive with the logic of art fairs, which have taken on the role of boisterous festivals of art where artists, dealers, and collectors openly mingle in a social atmosphere.

Art Basel is the world’s most important contemporary art fair. Three shows are staged annually, in Basel (Switzerland), Miami Beach, Florida (USA),

and Hong Kong. It began in 1970 and has expanded into the leading family of international art shows among experts and the general public.

But underlying the juggernaut of art fairs, which the Art Basel/UBS report describes as “one of the most significant trends in the art market in recent history,” is a business model premised discretion.

“Privacy and anonymity, in combination with greater access to information, is a driving force behind the growth in the art dealer segment, relative to auction markets,” reported TEFAF.

This shift, more so than the seesaw numbers, represents the most significant news of the moment.

About the author

Sean O'Toole

Art journalist

Sean is a Cape Town-based journalist and editor. He's also a contributor to Investec Focus content for the Investec Cape Town Art Fair. He holds separate degrees in English literature, law, and creative writing.