The Global Investment View distils the thinking of the Global Investment Strategy Group that brings together the insights of Investec Wealth & Investment’s professionals in the UK, South Africa and Switzerland. The Group meets quarterly to map out our outlook over the following 18 months, setting a risk budget and identifying some of the potential icebergs that lie in the global investor’s path.

The Global Investment Strategy Group (GISG) maintains its neutral risk budget score (0 on a scale of +3 to -3) for the third quarter of 2021.

The global stimulus programmes launched over the past year have been wildly successful. Global GDP is likely to return to pre-Covid levels within a few months. Analysts and economists have, to a large degree, been caught off guard by material beats across the globe. However, ‘risk assets’ (equity, credit etc.) currently screen as the most expensive since 2001. The global quantitative easing impulse is slowing, suggesting growth has likely peaked.

We are probably also past peak inflation and, while we expect inflation will continue to surprise on the upside, we do not see it staying high enough to cause developed market central banks to call an early end to this cycle. The net result is that we continue to have a neutral allocation to risk with strong economic momentum offsetting elevated valuations.

Key highlights of our positioning:

Covid-19 – the investment and economic case remains closed. The global Covid-19 news flow continues to be incrementally positive. The global number of new cases has consistently declined since the end of April, and the vaccine rollout continues apace. Therapeutic treatments are improving too. While there may well be another wave before year end, we do not expect that it will be economically damaging.

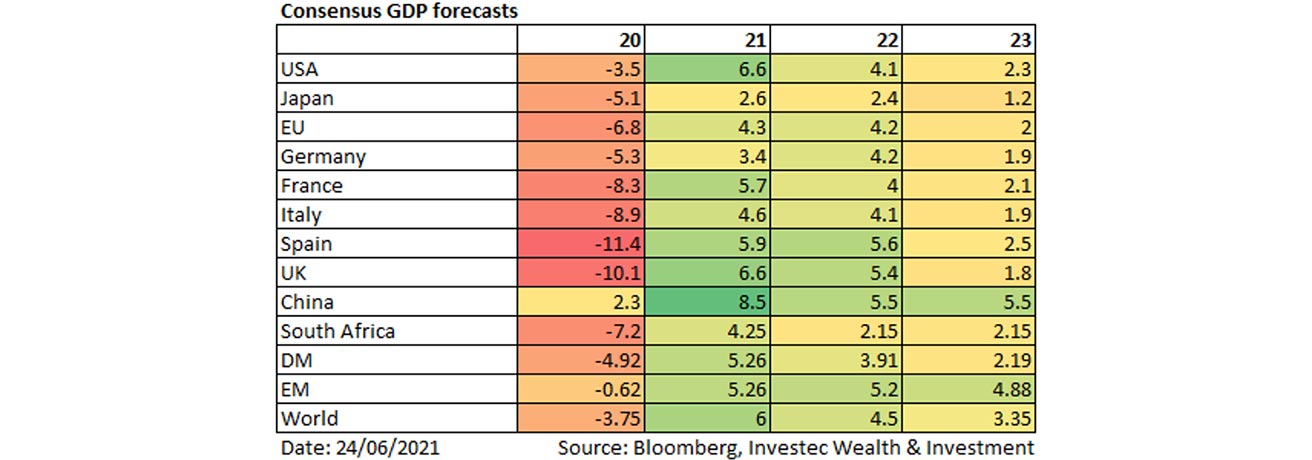

Economies continue to track an encouraging path. The global economy is set to expand by 6% this year and is expected to grow by 4.5% next year. The US economy is due to have returned to pre-Covid levels of production, after adjusting for inflation, by the end of Q2 this year. The rapid recovery in global GDP has not been fully anticipated by analysts – growth forecasts have been consistently revised upwards over the past six months.

The risk is to underestimate the extent of the bounce-back. The resilience of manufacturing and retail sales supports the optimistic assertion that the damage to employment and growth is largely limited to capital-light industries that sell “time” (the social economy). These industries can gear up (re-hire) quickly when demand re-appears. As the service sector is released in the second half of the year, 2021 will see a geographically widespread, closely synchronous (almost simultaneous) release of pent-up spending power.

Incomes in the US are already materially above pre-Covid levels and excess savings are high across the globe (approximately 6% of global GDP) suggesting further support for consumer spending over the years ahead.

About 90% of S&P 500 earnings releases for the first quarter beat consensus forecasts, the highest on record, and in aggregate S&P 500 earnings releases have been over 20% above the consensus forecast. Over the past three quarters, consensus forecasts have been consistently too low – underestimating both top-line growth and the ability of US corporates to maintain or increase margins.

The concern is valuation. The S&P 500 is trading at 25% above our estimate of fair value (our model uses dividends and the prevailing 10-year bond yield as inputs). That would not be an issue if dividends were expected to grow by 25% over the next year but that is not the case – the consensus forecast is for 5% growth in S&P 500 dividends over the coming 12 months. 25% above fair value is the highest we have seen in our analysis of the last 20 years. Even if dividends were to grow by 15% over the next year, well above consensus, there is a material risk that discount rates will increase too. There are other signs of elevated prices for risk assets – as an example, sub-investment grade bond spreads are at 13-year lows. Valuation is less of a concern outside of the US however, and even within the US, there are sectors that screen as cheap, but the broad US market offers little margin of safety at this point.

The inflation trajectory is uncertain. Inflation is notoriously difficult to forecast over anything longer than the shortest time horizons. While the large increase in US money supply and continuing supply chain issues point to higher than expected inflation, the longer-term drivers of lower inflation (technology, demographics etc.) remain firmly in place. While we continue to expect inflation to surprise on the upside, we also expect it to decline from this point and that it will not cause developed market central banks to hike any time soon. Material changes in the US deficit trajectory, rent increases or wages, would be triggers for us to reconsider our view of the inflation trajectory.

Fed to hang fire. There are now as many job openings in the US as there are people looking for employment. However, total employment in the US is still 5% off the pre-Covid peak and conditions suitable to merger and acquisition activity may see corporate action slowing the recovery in employment. The Fed’s focus on employment will likely see it allow the US economy to ‘run hot’ before acting. This may lead to an aggressive response from the Fed once it decides to hike, but we expect that is some way down the line.

Slowdown in credit extension in China. Global commodity prices have ramped up over the past year on the back of rising demand and continuing supply discipline from major producers. However, the credit impulse in China has rolled over, suggesting reduced tailwinds for commodities over the coming 12 months. The global quantitative easing impulse has slowed too, implying we are past peak global growth.

Geopolitical risks are on the rise. Increasing diplomatic strain between the US and China will likely spill over into continuing trade tension and further deglobalisation. While reduced competition may benefit some listed entities, broad equity markets are unlikely to respond well to this environment.

Risk of higher currency volatility. The possibility of an uncoordinated policy response across countries raises the risk of increasing currency volatility over the medium term.

A stock picker’s market. While the risk score of the committee is neutral, we expect that there will be a wide dispersion of stock and sector performances over the coming 12 to 18 months as growth and inflation slow, but remain high by recent standards.

The net result is that the world is still awash with liquidity and earnings and GDP continues to surprise on the upside. Risk assets offer little margin of safety though, and as a result, we think a neutral risk stance is currently appropriate.

SA market view and asset allocation – Maintaining our position as global recovery lifts the SA outlook

Overview

The asset allocation committee has retained its risk score at 1, with an overweight in SA assets in particular.

Key themes for the quarter:

Commodities are facing short-term headwinds, but longer-term structural support. Chinese total social finance growth has turned materially negative, pointing to weaker Chinese demand for commodities over the coming nine to 12 months. In addition, the Chinese authorities are increasingly attempting to cool commodity markets after the sizable rally over the past 12 months. However, the electrification of the drivetrain and roll out of renewable energy generation is likely to be very metal intensive, providing longer-term support for metal prices in an environment where commodity producers are continuing to exhibit supply discipline.

SA is benefiting from the global recovery. As of the end of the first quarter, the 12-month trade balance (surplus) in SA was sitting around +8% of GDP, the highest level since the late 1980s. This has largely come about due to the massive rally in commodity prices over the past 12 months, rather than an increase in the volume of exports or a decrease in imports. The trade balance is providing support for the rand and is feeding through to the broader economy. One of the ways it is already passing through to the broad economy is through tax receipts – miners are paying more tax and, as a result, the SA government fiscal position has improved materially over the past six months, and continues to improve.

The outlook for SA consumers is improving. Data from tax receipts, the GDP print and SA retail sales all point to SA consumer incomes having recovered to pre-Covid levels by December last year. Business confidence is above pre-Covid levels, suggesting an increase in employment over the coming 12 months too. Typically, a recovery in consumer income sees an outsized recovery in durable goods spend, especially car sales. We expect to see an uptick in credit extension too, as the consumer position further improves.

Expecting a mildly weaker rand. The recent strong recovery in commodity prices has improved SA’s terms of trade and has seen the trade-weighted, inflation-adjusted rand trade at near decade highs. However, we expect that commodity prices will face headwinds over the short term and while some of the structural impediments to growth in SA (particularly debt-to-GDP and electricity production) are being addressed, they are far from resolved. We believe there is currently little margin of safety in the rand and expect a gradual depreciation to around 15 to the US dollar over the coming 12 to 18 months.

Overview of the different asset classes:

Equities: Screen cheap. We remain overweight SA plays and SA resource counters.

Bonds: Screen cheap but rising US yields are likely to keep SA yields elevated.

Cash: Cash rates are currently low in both nominal and real terms in SA, so we prefer to allocate to risk through the domestic bond market.

Property: We prefer increased exposure to SA yields through the government bond market.

Gold: Overweight as a hedge against SA-specific risks. In addition, rapid money supply growth in developed markets may lead to inflation down the line.

Get Focus insights straight to your inbox