There is no shortage of reasons to justify being cautious about the outlook for domestic consumption expenditure over the year ahead. Eskom is a binding constraint on growth and will likely continue to put a handbrake on growth for some time. Domestic politics is murky at best and there are many unanswered questions regarding the sustainability of a suite of state-owned enterprises.

However, there are some strong mitigating factors that are worth highlighting. There may well be light at the end of the tunnel for consumer spend over the coming year, as we discuss below:

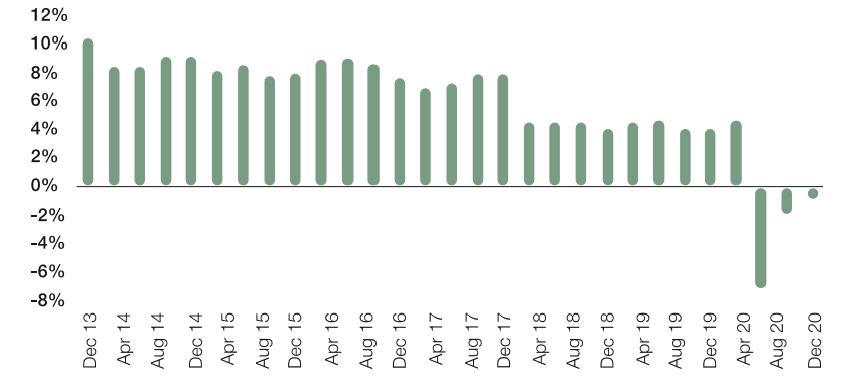

Employee Compensation (yoy%)

Source: Refinitiv, Investec Wealth & Investment. 23/03/2021

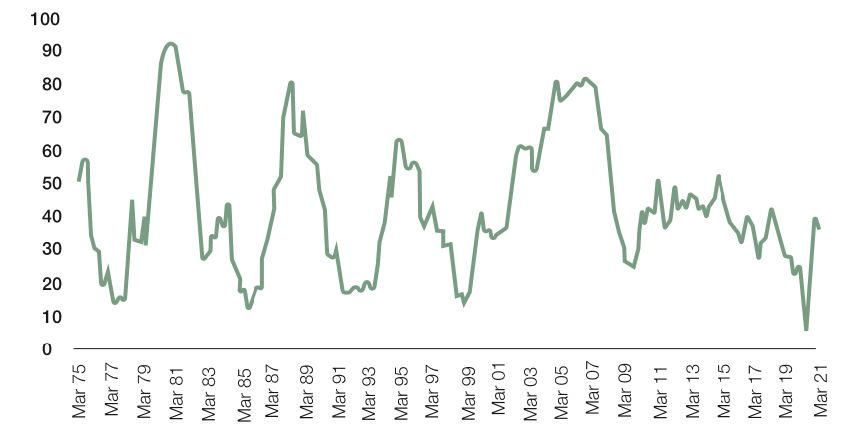

BER business confidence survey

Source: Thomas Reuters. 23/03/2021

Incomes have recovered

There are several data points suggesting that SA consumer incomes are back at pre-Covid levels. Employee tax receipts were up year-on-year in December. Data GDP release for the fourth quarter of 2020 suggest that total nominal wages were flat year-on-year in the fourth quarter; meanwhile retail sales were up 1.6% yearon-year in December.

The data for January was a bit weaker, as was to be expected after the renewed lockdown. If incomes had already recovered by December, then we can expect further growth over the year ahead, as vaccines are rolled out and lockdowns become less frequent and severe.

Business confidence has picked up

Both the SACCI Business Confidence Index and the BER Business Confidence Index are up year-on-year. These changes in business confidence are a key leading indicator for changes in private sector job creation. Given this strong rebound in business confidence, we can expect reasonably strong job creation over the coming 12 months, further aiding aggregate consumer income.

A change in approach by National Treasury

According to the February Budget, government revenue surprised on the upside by around R100bn. Part of the excess was used to reduce taxes for consumers by raising personal income tax brackets by more than inflation. Most importantly though, National Treasury highlighted that personal income tax in SA was high relative to peers, and hinted at the possibility of further tax relief for consumers over the coming years. This marks a shift in approach from previous years: personal income tax had been increased in five of the six years prior to the latest Budget.

Interest rates are at record lows

The SA Reserve Bank cut rates aggressively in response to the Covid-19 crisis and we do not expect to see any increases anytime soon. Inflation is likely to pick up shortly in SA – we expect the May print to be over 5% – but given the large output gap in SA and inflation that is still likely to be within the 3% to 6% band over the foreseeable future, we expect that rates will remain at record lows.

Putting it altogether, there are reasons to expect SA consumer incomes to pick up over the coming 12 months and for expenditure to follow suit. The question then is: what will SA consumers buy?

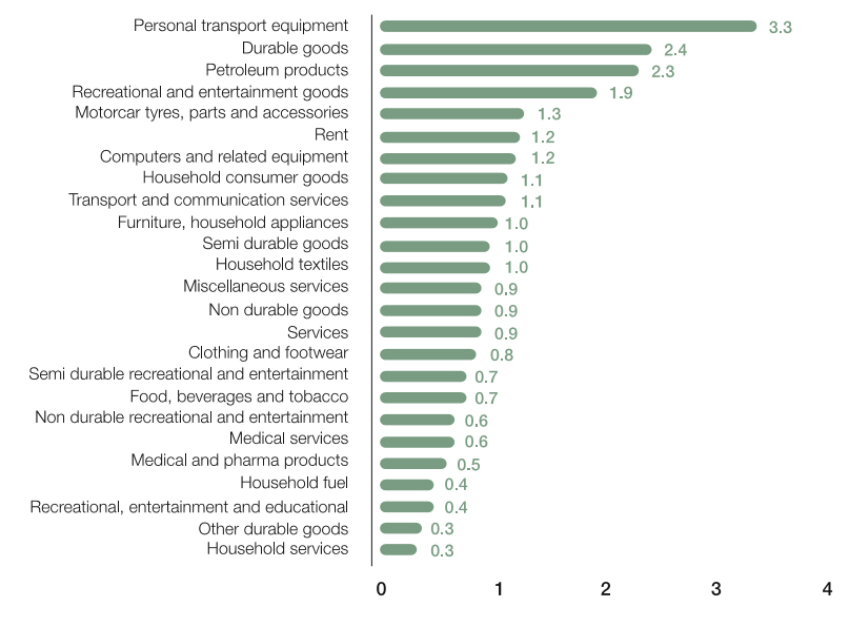

To answer this question we can rely on data from the SA Reserve Bank that breaks down annual consumer spending into its sub components. The data goes back to 1946 but the last 20 years of data is probably more representative of currently likely behaviour than the older data. If we regress changes in real expenditure of each subcomponent against changes in total real expenditure over the past 20 years we get the picture below.

Employee Compensation (yoy%)

Source: Refinitiv, Investec Wealth & Investment. 23/03/2021

The coefficient for personal transport equipment is 3.3, meaning that if total expenditure grows by 10%, expenditure on cars, bikes etc. grows by 33%. More broadly, expenditure on durables is a high beta play on increases in expenditure (that is, when expenditure rises, expenditure on durables rises by more). Semi-durables are less sensitive with a beta of 1, while non-durables and services have a slightly lower beta, at 0.9.

In summary, we expect that SA consumer expenditure will pick up meaningfully over the coming 12 months and durable goods retailers (cars, furniture etc) will be the largest beneficiaries. It is our view that the recovery in consumer activity over the coming 12 months is not fully priced into SA Inc shares, particularly those that are geared plays on SA consumers.

Download The Global Investment View for Q2: 2021 report

Chris Holdsworth's article is included in The Global Investment View for Q2: 2021 which distils the outcomes from the most recent meeting of Investec Wealth & Investment’s top strategic minds.

Get Focus insights straight to your inbox