04 Oct 2021

Investing in equities

Are you interested in investing to protect your savings from inflation and to meet your other financial goals? Here’s how we can help.

Hopefully my two previous articles, Cash isn’t always king and Protection from inflation, explained that investing in equities can help to protect your savings from inflation, relative to holding cash. You may now be wondering how to start investing.

Selecting the right investments, in the right proportion, and reducing the risk of investment in equities by including other assets, is a complex process. Today I’ll outline Investec’s approach.

Understanding your goals

Your investment portfolio should be unique to you, so that you know it’s working towards your goals and no one else’s. So, before we make any recommendation on how you should consider investing, we need to understand what drives you, what you want to achieve, and what matters to you most.

At the beginning of our relationship, I dedicate time to getting to know you. We’ll start with an open and honest conversation about your needs, goals, and circumstances. Protection from inflation might be one part of the puzzle, but it may not be your primary goal. Instead, you and your family may be more focused on how to best pass on your wealth to the next generation, or you could be looking to generate an income from your savings to fund your lifestyle requirements.

This stage is not just about our questions for you, but also your questions for us. It’s crucial to establish trust in our client relationships so that we can achieve the best possible results for you.

Measuring your risk profile

The next part of our process is understanding your risk profile. This is made up of four elements, which will carry differing weights according to your circumstances:

- your investment objective, and the level of risk it is necessary to take to achieve it

- your risk tolerance (i.e. how much risk you are willing to accept)

- your risk capacity (i.e. how much loss you can withstand, if the value of your portfolio falls, without impacting your lifestyle)

- your previous experience of investment and level of understanding

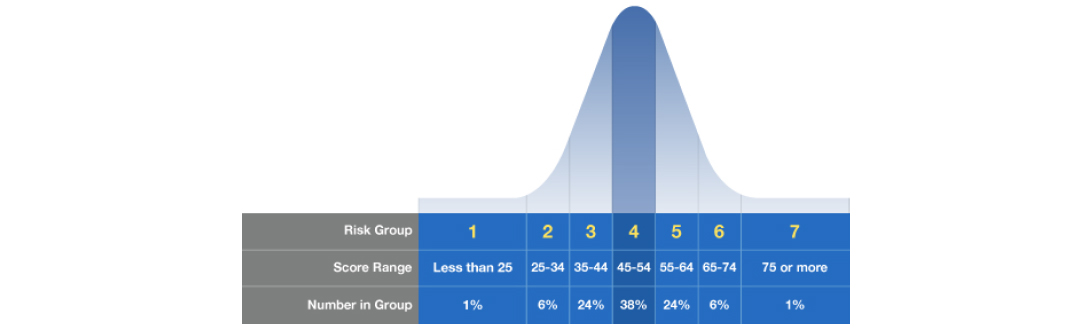

We do this with the help of an academically accredited questionnaire from FinaMetrica. This is designed to measure your attitude to risk and assign you a score of between 0 and 100. When all scores are graphed, as shown below, they follow the familiar bell-curve of normal distribution, with an average score of 50. 98% of scores are within 25 points of the average, with just 1% scoring below 25 and 1% scoring above 75.

Source: FinaMetrica

Selecting your investments

Based on all the information we’ve gathered we create a personalised portfolio. While we will often recommend the inclusion of equities for protection from inflation and for other purposes, we will likely also suggest the inclusion of other asset classes, depending on your objectives and risk profile. This is because different asset classes vary in their volatility and returns potential, so we’ll usually combine several to create a mix that’s suitable for you.

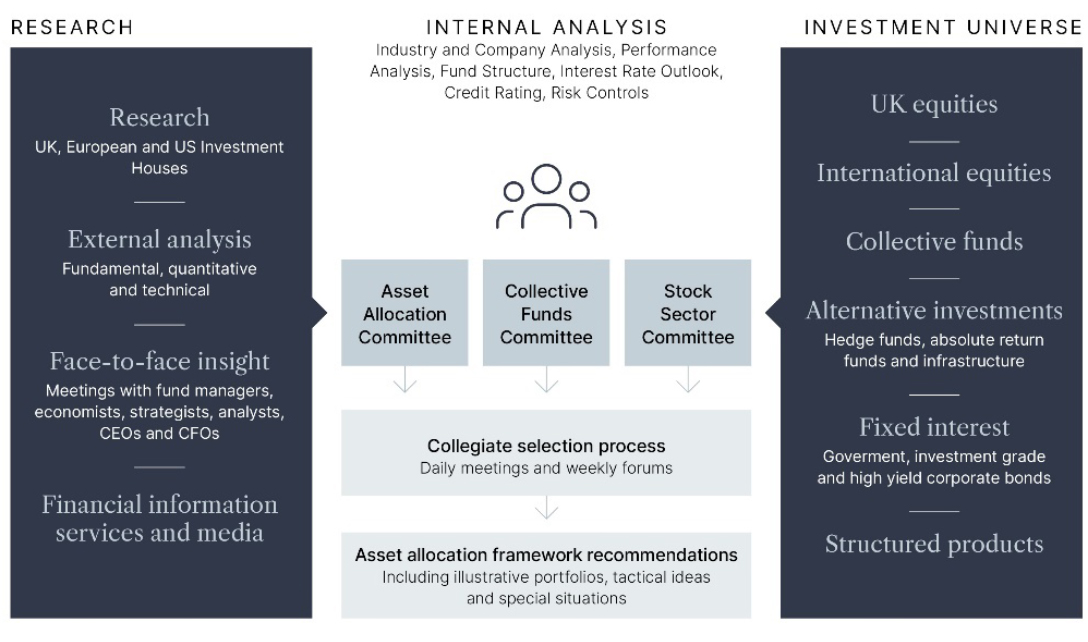

The individual investments selected for you will be based on the insight of our world-class research team. Investec has one of the largest and most experienced research teams in the UK. Team members have an average of 19 years of industry experience and specialise in various strategies and asset classes. Based on this extensive expertise, they create a list of preferred equities, funds, and bonds. Your portfolio combines all the best ideas Investec has to offer with your investment manager’s understanding of your circumstance and goals.

The research team incorporates environmental, social, and governance factors into our investment process. Investec was recently accepted as one of the first signatories of the revised UK Stewardship Code, which provides a set of principles for responsible investment. We aim to invest in the best interests of our clients, in line with our purpose to create enduring worth, living in society, not off it.

Aligning your strategy to economic conditions

The research team also advises on the asset allocation that’s appropriate for an individual client in the specific economic climate. Currently, we are considering the impact of these factors, amongst others:

COVID-19

The path of the economic recovery from the impact of the pandemic is uncertain, so our research team keeps a constant eye on changes to the situation and aims to foresee any future implications.

Monetary policy

We’ve recently seen quantitative easing at unprecedented levels in many economies, making the outcomes difficult to predict. Our research team includes experts on monetary policy who are among the best-placed people to understand how this will influence economies and markets in the future.

Inflation

As I’ve discussed in detail previously, we’re expected to see inflation at higher levels than we’ve become used to. Our research team uses data on how this has impacted different asset classes in the past to make recommendations on a robust asset allocation.

Interest rates

Interest rates have been falling for over thirty years and, having reached record lows, have little further to feasibly go. Whether they stay low or modestly increase, our research team must take a view on what could be a new paradigm from a rates perspective.

In the graphic below, you can see how various inputs from our global research team are combined to shape your investment strategy.

Continuing our relationship

The result of this thorough process is a portfolio backed by a robust and rigorous framework and designed to help you achieve your financial goals. You can be confident that the proportion of equities in your portfolio directly relates to the information you’ve given us about your circumstances and attitude to risk, and that the individual investments have been chosen for you.

However, this is just the start of our relationship. Our focus isn’t on portfolio creation as a one-off service, it’s on supporting you as your life continues and your circumstances evolve. After creating your portfolio, we’ll be with you for the long term, making any necessary changes and responding to any unpredicted economic conditions.

If you understand where you stand financially now and what this can help you achieve in the future, you know where life can take you.