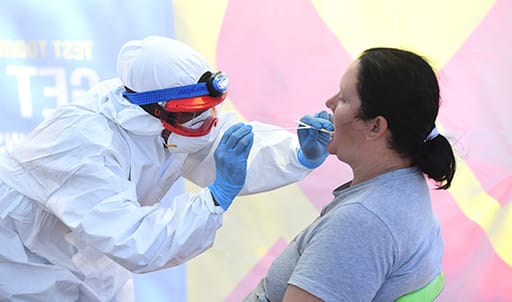

Now is the time to add risk to portfolios, according Investec Wealth & Investment’s Global Investment Strategy Group (GISG) in its latest Global Investment View.

The GISG believes that, after substantial falls in prices, risk assets (equities and corporate bonds in particular) have become attractively priced relative to their long-term prospects. The GISG’s view is that risk assets (equities) will outperform insurance assets (bonds) over the next 18 months.

This is based on the assumption that the financial system itself is resilient and that the monetary and fiscal policy measures taken by central banks and governments worldwide will substantially protect the fabric of the world economy while it is in voluntarily “shut down” (on a rolling basis) to control the viral load on healthcare systems.

Download the Global Investment View Q2 2020

A modest tilt towards more risk; long-term earning power of the global economy recognised

“When the smoke clears, we believe the intrinsic value (long-term earnings power) of the global economy will have been only modestly impaired by this traumatic, but temporary, experience,” argues John Haynes, chair of the GISG and head of research at Investec Wealth & Investment UK.

“This move does not call the bottom in share markets,” he continues. “In the next couple of months, the news flow will be appalling. It will be hard to hold fast, let alone increase risk exposures in such conditions.”

Haynes highlights that the risk-on tilt is modest. “If equity markets fall further and our central expectation that ‘this too will pass’ is not challenged, we would expect to add further to our recommended risk budget.”

This move does not call the bottom in share markets. In the next couple of months, the news flow will be appalling. It will be hard to hold fast, let alone increase risk exposures in such conditions.

South African government bonds looking very attractive

Looking at the SA investment positioning, Chris Holdsworth, chief investment strategist and member of the GISG, says the budget allocation has been predominantly to SA government bonds rather than equity.

“SA government debt currently trades at a significant premium to inflation as well as a significant premium to similarly rated peers,” he says.

“SA bond yields still look attractive relative to any grouping of peers. The slope of the yield curve is currently so steep that even should yields move up by 100bps over the next 12 months (which is not our view), long-dated bonds will outperform cash. Even if bond yields were to increase by 100bps per annum over the foreseeable future, SA bonds would still outperform cash.”

However, because of uncertainty around distribution growth (or negative growth), the recommended allocation to property has been reduced. Property has traditionally been considered a combination of a bond play and a yield play but this may no longer be the case, says Holdsworth. “Given the slowdown in the economy, a number of property counters may well have to reduce their distributions markedly.”

On the equity front, an offshore exposure in the equity market over domestic stocks, has been chosen.

“Overall, we believe Covid-19 related concerns will start to be priced out of equity markets within the next three months,” he adds.

Overall, we believe Covid-19 related concerns will start to be priced out of equity markets within the next three months.

In summary

Equities: While the committee’s risk score has improved and the team is looking to deploy cash, the preference at this point is for domestic bonds. Within equities, commodity price plays and global names are preferred given the increase in SA exposure through the bond allocation.

Bonds: SA bonds currently offer a large margin of safety. Yields are significantly above where we think inflation will be and significantly above peers (even similarly rated peers). Bond yields, both real and nominal, currently offer significant compensation for risk.

Cash: We expect further cuts to the repo rate over the coming 12 months.

Property: SA domestic property is likely to continue to come under pressure because of backwards revisions for retail space. There are also concerns about oversupply in the commercial space.

Our checklist for increasing our risk preference in SA looks like this:

- Sustained risk-on appetite globally

- Resumption of emerging market versus developed market outperformance (from a growth and earnings perspective)

- Coherent plan on how to deal with Eskom and other SOEs – we need a strong message on how the expenditure will be controlled. The current situation is unsustainable

- No more load-shedding from Eskom – this was a major constraint to growth in the first quarter

- More clarity on government policy, given the factionalism within the ruling party.

- Interest rate cut – other central banks (including emerging markets) are cutting rates. Our real interest rate is extremely high in this context and we have ample room to cut. SA risk assets typically perform very well in a downward interest rate environment

- Improvement in business confidence – We are unlikely to see job creation unless this improves

About the author

Patrick Lawlor

Editor

Patrick writes and edits content for Investec Wealth & Investment, and Corporate and Institutional Banking, including editing the Daily View, Monthly View, and One Magazine - an online publication for Investec's Wealth clients. Patrick was a financial journalist for many years for publications such as Financial Mail, Finweek, and Business Report. He holds a BA and a PDM (Bus.Admin.) both from Wits University.

Get Focus insights straight to your inbox