Get Focus insights straight to your inbox

Panel discussion: budget reaction

Implications of the Budget

The panel consisting of Investec's Annabel Bishop, David Gracey, and Ronelle Hutchinson convened at Investec Sandton to discuss the implications of the Budget on the political landscape of the past two months.

They summarised the budget's impact on South Africa's current economic landscape, investor and business confidence, and you as an individual.

Get all Investec's insights on the latest Budget Speech and SONA

Our economists, tax experts, personal finance and investment experts unpack what the latest fiscal measures mean for income, savings and daily expenses of individuals and businesses.

Justice Malala

Journalist and political commentator

Annabel Bishop

Investec chief economist

David Gracey

Head of currency and derivatives trading, Investec Corporate and Institutional Banking

Ronelle Hutchinson

Investec Wealth & Investment portfolio manager

David Gracey

David Gracey

All agreed that while the Budget marked an important change in path by the government – towards fiscal consolidation after years of rising spending and debt – much work remained.

"We're trying to be a progressive society, uplifting the poor, alleviating poverty, creating jobs – this budget doesn't do any of that at the moment, which is unavoidable given the state of national finances," says Gracey.

"If we go back 10 years or more, our budget deficit was closer to 30% than it is now. We're now closer to 60%, that's why I say it's going to take a long time to fix the problems of the past 10 years," he adds.

Ratings agencies - the elephant in the room

"If you see continued substantial borrowings AND you're borrowing to pay off your debt you fall into a debt trap," says Bishop, referring to what's happened in South Africa.

"That results in substantial fiscal problems down the line and that's why we've been getting the credit rating downgrades we have so far," she adds.

Listen to podcast: Downgrade averted?

So has the Finance Minister has done enough to avoid a downgrade? Investec Chief Economist Annabel Bishop believes so.

Certainties vs uncertainties in the market

Particularly important is the need to tackle the problems at the state-owned enterprises (SOEs).

"The assumption in the Budget is that there are no more bailouts for SOE’s but I’m not certain that’s achievable," argues Gracey.

“I’m very worried about the SOEs,” adds Bishop, highlighting the urgent need for improved governance. "The big issue is: Is it a going concern and who’ll fund it? That is important when you go to the debt markets and try raise the money."

Bishop reiterated what the Finance Minister had said: that these SOEs to be self-funding and cannot be a drag on government. She refers to a period in the 2000's where South Africa had high economic growth, fiscal consolidation and well-performing SOEs that managed to produce a profit.

"We actually got an upgrade in ratings to A grade in 2000's at a time when unemployment fell all the way down to 22%," Bishop adds, saying a return to those good growth years is achievable in order to sort out our SOEs but some hard decisions need to be made.

The risk factor around SOEs

David Gracey

David Gracey

The dismal state of government finances

"Government is now being forced to look at partial privatisation," says Gracey. " When your finances are in such a precarious state and you can’t borrow and you can’t fund, you HAVE to sell off these assets," he adds, highlighting non-core assets particularly.

Gracey says the country has effectively missed out on 10 years of activity due to policy uncertainty and poor stewardship of the economy.

"Our foundations are not strong, and need to be propped up ... in order to ensure we can alleviate poverty, that we can create some jobs, that we can meaningfully impact people’s lives," he adds.

Partial privatisation - the hard decisions around SOEs

Annabel Bishop

Rolling back on State Capture

Bishop likened the current situation to that in 1994, when the first democratic government faced similar problems of inheriting high debt and a budget deficit of 6%. It turned things around over the following years, achieving an investment grade rating for the country. With the right commitment, South Africa can do it again.

"Looking to roll back government finances and consolidate them in the manner that Trevor Manuel did, is something we might have to go through in order to get ourselves back on a firm footing so we can move forward," Bishop indicates.

The State Capture issue

David Gracey

David Gracey

Emerging Markets

The backdrop is good for the local equity market

While there's a bias towards favouring emerging markets from a global investor perspective, and while South Africa is a participant, Ronelle Hutchinson says that the country effectively missed out on the positive sentiment in 2017 by not capturing a lot of the emerging markets portfolio flow.

However, in the current environment, she says, there's a bias towards continued strength for the SA currency. "If you look at emerging market equities from a South African perspective, there is potential for inflows into the local equity market with all the positive developments," says Hutchinson.

Foreign investment portfolio flows into SA equity market

Ronelle Hutchinson

Ronelle Hutchinson

Offshore investments

This positive sentiment towards SA and emerging markets has provided a good opportunity to lift the prudential investment guidelines for offshore investment (pension funds and other institutional investments) by 5%.

Hutchinson hails this development: "If you look at extensive research into the optimal asset allocation that a South African investor needs to have in terms of offshore, that’s been at 30%. So moving the prudential investment guidelines from 25% to 30% now allows the South African investor to be at that optimal offshore allocation."

Coupled with a stronger rand, there is now greater capacity for the South African investor to go offshore, so a question raised is, could this impact local indexes negatively?

Hutchinson says while it's difficult to call whether or not there'll be a rush to go offshore, the current environment actually favours emerging markets, and South Africa always participates.

Will there be a big outflow?

Ronelle Hutchinson

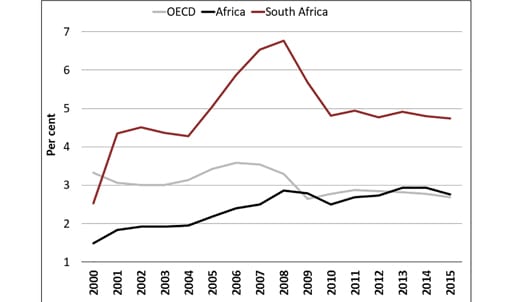

Bishop says, "28% is very high internationally, and if you look at it as a percentage-share of GDP, again we are above both OECD countries and the rest of Africa."

Is there any political risk in the tax decisions?

Annabel Bishop

Annabel Bishop

Personal income tax

In terms of the consumer, Bishop says 70% of personal income tax comes from 2 million people in South Africa out of 7.5 million people, which is indicative of the income spread.

There is also little relief for bracket creep, the point being, the more you tax, the less employment you get and the less likely you are to achieve the growth rate the country needs. Bishop says, if we get growth going, employment will improve and the financial burden on government will diminish.

Reserve Bank quite hawkish

Annabel Bishop

VAT

Our VAT is very low compared with an international standard, Bishop says. She says Treasury presented a budget which is "correct internationally but whether it’s going to be correct for our politics is something we're going to see down the line."

The VAT increase – the first in 25 years – will put some pressure on consumer inflation, but thanks to a strong rand the impact should not be too great.

"We had a very low [CPI] figure for January, at 4.4%, and being at the start of the year it pulls the index down for the whole year," Bishop says. Coupled with the VAT increase, we're back at 5% for CPI inflation for the year, which puts it within the Reserve Bank’s target range of 3% to 6%.” However, Bishop said, the Reserve Bank won’t cut more than it feels needs to.

The increase in VAT will negatively impact GDP growth, but Bishop doesn't think this is likely to quell the economic outlook or cause growth to drop down substantially.

"This 1.5% growth could well be a misnomer for this year because we haven’t actually seen that translate through into ACTUAL economic activity," Bishop says.

However, SOEs still remain a big threat to our govt finances, she argues. "If we do get a credit rating downgrade from Moody’s this quarter, it probably will be because of SOEs."

GDP forecast in the losing zone?

David Gracey

David Gracey

Policy certainty, policy clarity and political will

“We are not out the woods," says Gracey. "Gordhan alluded last year that probably R100bn, if not more has gone missing from state coffers. We’ve not claimed any of that money back."

But early signs are positive, he says, with the perception of unity in ANC a lot stronger than 3 months ago.

However, a lot still needs to be done, and there's a long road ahead, Gracey says. "It took us 10 yrs to get here; it will take hard work and policy clarity, but we’ve started on that trajectory and hopefully there's the political will to see this through."

Topics of discussion

Subscribe to Investec's podcasts on market and economy moves

Listen to regular interviews with experts from across the Investec group. Our channel is accessible wherever you currently listen to your podcasts.

Listen to each podcast individually or subscribe to get new episodes as they become available.

About the author

Angela Rettenbacher

Digital content specialist

Angela read for a Bachelor of Journalism degree at Rhodes University in Grahamstown in the early nineties, followed by a two-year stint at the SABC. Soon after, she went backpacking for 10 years! Prior to joining Investec's content team, Angela spent nine years as an Output Editor on the newsdesk at eNCA, both in TV news and Online. Before that, she spent eight years in the corporate sphere, in the Investment Banking and other divisions of Goldman Sachs both in London and Johannesburg.