Invest in world class companies dedicated to achieving the UN's Sustainable Development Goals (SDGs), and that we believe can provide you with attractive returns. The fund strives to have a 100% net positive SDG impact.*

___

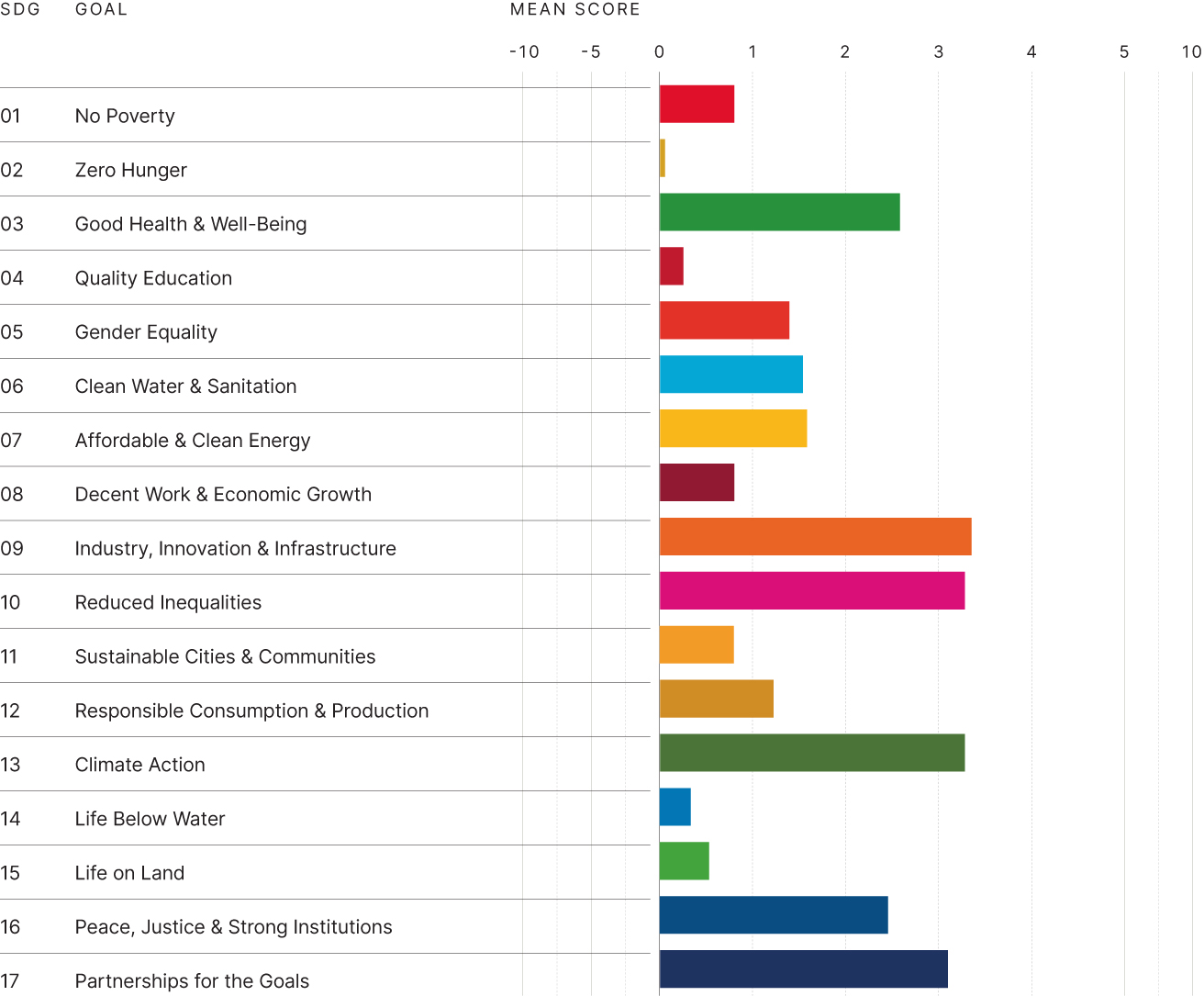

*Data verified by ISS SDG Impact Rating with scores ranging from -10 to +10.

Legacy

You are investing in building the future you want to see.

Sustainable Growth

You are participating in the growth of companies that are committed to protect resources for the next generation.

Impact

Your capital will help mobilise global sustainable development.

The Fund's Mission

The Investec Global Sustainable Equity Fund ("the Fund") seeks to capture the returns of businesses that are aligned to achieving one or more of the UN's Sustainable Development Goals. The UN Sustainable Development Goals (SDGs) provide a globally accepted framework through which businesses can align their strategic goals with ESG considerations.

The 17 SDGs are underpinned by 169 individual targets, which have been encoded into government action plans. They represent observable and tangible opportunities for companies to offer solutions and services to help achieve them. Through the Fund, investors are able to invest in companies that we believe can provide attractive investment returns over the long-term, through the lens of the SDG framework.

Start your sustainability journey with us

Partner with Investec’s team of investment experts to make smart choices to preserve and grow your wealth.

Example of fund impact on specific SDGs

Positive SDG impact - percentage by weight

*Data verified by ISS SDG Impact Rating with scores ranging from -10 to +10.

These show net impact considering positive and negative contributions of revenue, operations and controversies as at 31 March 2022.

Track performance, gain insight

The USD version of this fund is the Investec Global Sustainable Equity Fund

Download the Minimum Disclosure Document for the Investec Global Sustainable Equity Fund.

The ZAR version of this fund is the Investec BCI Global Sustainable Equity Fund

Download the Minimum Disclosure Document for the Investec BCI Global Sustainable Equity Fund.

The fund offers clients the opportunity to invest in the future of their own next generations and help achieve a more sustainable world, while at the same time delivering an attractive financial return on their investment.

It’s natural for well-managed, high-quality companies to incorporate sustainability into their long-term strategy, since these are companies that are most likely to have enduring and market-leading profitability. The United Nations Sustainable Development Goals provide us with the perfect framework to make this assessment, and a timeframe to work within to galvanise our efforts towards a better world for future generations.

The Investec Global Investment Process

We ensure that your investments leverage off our international network and benefit from a global perspective and experience across all markets.

Class of 2030

Follow a diverse mix of classmates as they embark on a learning journey of the UN's Sustainable Development Goals (SDGs) and learn how you can take action in creating a more sustainable world.

Awards

Ranked as the Best Private Bank and Wealth Manager in South Africa for 11 consecutive years by the Financial Times of London.

Invest for retirement

Invest offshore

Manage my investments for me

Property finance

Foreign exchange

Private capital

Enjoy Investec One Place™ with our local and international offering