Global Economic Overview – December 2023

Global Economic Overview

6 min read

We appreciate that FX is critical to the success of your business. Our unique risk modelling and analytics allow us to view your overall exposure with clarity, proactively spotting risks and opportunities. No blind spots, better decisions.

You know your business, but we know that currency markets can present uncertainty at times. We put you in the driving seat with easy access to the people and digital tools that will make a difference, all working together the way you need.

We offer our clients something unique: the deep expertise of an FX specialist alongside the breadth of products and capabilities of a global bank.

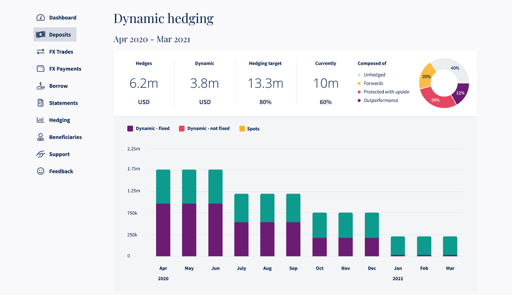

Investec ix is designed to perfectly complement your relationship with your dedicated FX dealer. We’ve used the latest technology to develop an intuitive, easy-to-use platform that puts you in control of your risk management strategy and execution.

Use innovative analytic tools to better understand your market risk.

FX execution at your fingertips for times when you just require a straightforward conversion.

Reduce the operational burden of implementing a systematic FX hedging program.

Make global payments seamlessly, whenever you need to.

Keep your finances in the right hands by managing and monitoring each team member’s access.

Speak to a member of the team today and see how Investec can help you and your business

Global Economic Overview

6 min read

Investec got to know our business extremely quickly, understanding the heartbeat of the operation and making us feel like we were the only client.

Additional solutions for business

Financial Services Compensation Scheme

Your eligible deposits are protected under the UK’s Financial Services Compensation Scheme (FSCS).