Receive Focus insights straight to your inbox

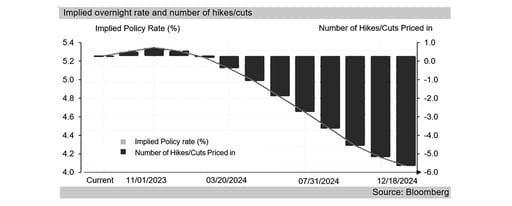

The FOMC (Federal Open Market Committee) left the federal funds target rate unchanged at 5.25% - 5.50% as expected, highlighting “inflation is still too high, ongoing progress in bringing it down is not assured, and the path forward is uncertain.”

The Fed did note “inflation has eased from its highs without a significant increase in unemployment. That is very good news. But inflation is still too high ... Restoring price stability is essential.”

“Our restrictive stance of monetary policy is putting downward pressure on economic activity and inflation. Over the past two years, we have raised our policy rate by 5-1/4 percentage points.”

The rapid tightening of the US interest rate cycle has been felt, with the housing market seeing subdued activity levels over the past year on high mortgage rates, and elevated borrowing costs also suppressing business fixed investment.

The FOMC did highlight “we believe that our policy rate is likely at its peak for this tightening cycle and that, if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”

“But the economy has surprised forecasters in many ways since the pandemic, and ongoing progress toward our 2 percent inflation objective is not assured.” The tone of the Fed is cautious, not dovish, but has become markedly less hawkish.

The rand strengthened slightly to R18.57USD in response, but has retraced today to R18.73USD, with markets having centered on May as the first rate cut, but will digest the FOMC statement in the remainder of this week.

The market expectations for the first FOMC cut are unlikely to change materially, i.e. be brought forward to the next (March 20) meeting, although US data releases in the interim will remain key for markets.

The Fed also notes “we are prepared to maintain the current target range for the federal funds rate for longer, if appropriate”, placing a quelling tone on market exuberance and seeking to prevent early rate cut expectations.

Consequently warning “that reducing policy restraint too soon or too much could result in a reversal of the progress we have seen on inflation and ultimately require even tighter policy to get inflation back to 2 percent.”

“The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. We will continue to make our decisions meeting by meeting”.

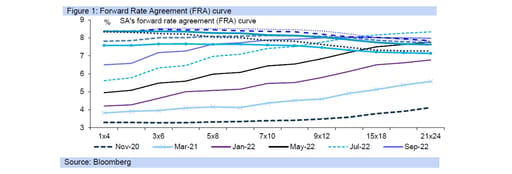

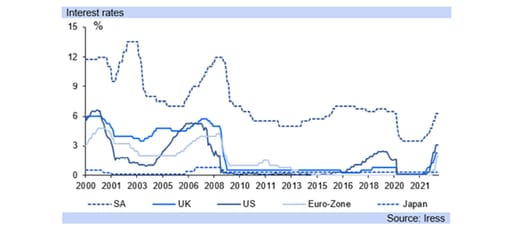

It remains likely the FOMC will not cut its interest rates before May at the earliest, potentially rather at its June meeting, and for SA the SARB is unlikely to cut before July, with the FRA (Forward Rate Agreement) curve aligned to a July cut (all -25bp).

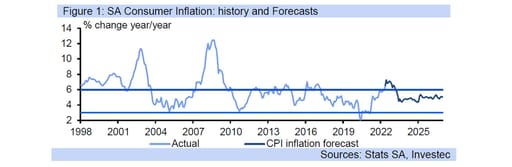

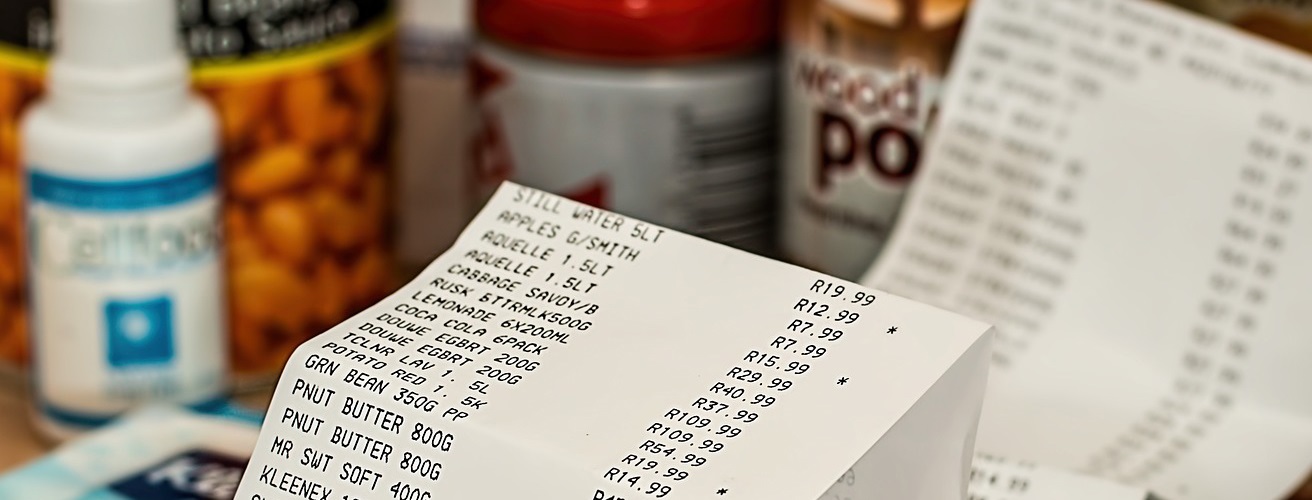

CPI update: inflation subsides to 5.1% y/y

24 January 2023

The fuel price had a moderating effect, with the petrol price dropping 65c/litre in December, along with private vehicle operation costs

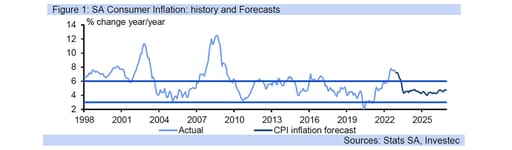

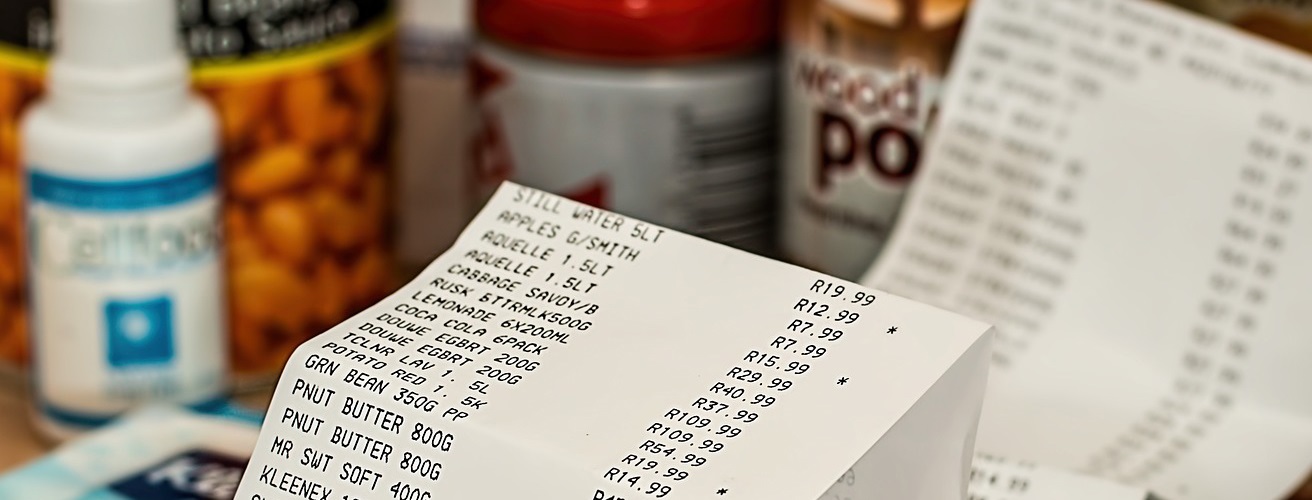

CPI inflation dropped, to 5.1% y/y (0.0% m/m) in December, from 5.5% y/y % in November, slightly below the Bloomberg market consensus of 5.2% y/y.

The fuel price had a moderating effect, with the petrol price dropping 65c/litre in December, along with private vehicle operation costs, and the transport category contributed -0.1% m/m alone to the flat (0.0% m/m) CPI outcome.

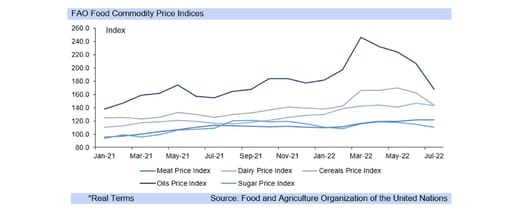

Food and non-alcoholic beverage prices did not contribute (0.0% m/m) to the inflation outcome. International (US dollar) agricultural food commodities prices fell by -3.1% m/m in December (Economist commodities index) while the rand saw only fractional weakness of 0.4% m/m against the US dollar.

The overall food (and non-alcoholic beverages) inflation rate came out at 8.5% y/y, from 9.0% y/y in December. Food (and non-alcoholic beverages) prices contributed over a quarter (1.5% y/y) of the overall CPI inflation rate (of 5.1% y/y) in December.

Housing and utilities saw a not unusual 0.1% contribution to the m/m CPI outcome, on some upwards price pressure from water costs and rentals, as December was the survey month for these costs.

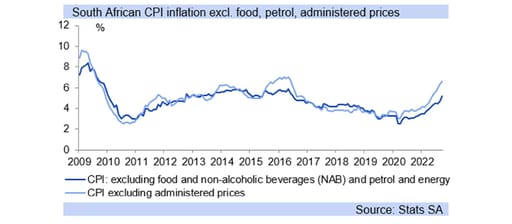

Core inflation (which excludes food, non-alcoholic beverages fuel and energy prices), remained at 4.5% y/y, showing underlying inflationary pressures are at the midpoint of the target range.

January recorded another petrol price cut, of -76c/litre, which will exert downwards pressure on the inflation outcome, although it is a price increase month, and in addition it suffers from a low base which will elevate inflation. February is currently on course for a small petrol price hike of 40c/litre.

The MPC meets tomorrow to make its interest rate decision, and will likely continue to have a hawkish tone, warning of inflation risks, although on balance is expected to keep interest rates unchanged.

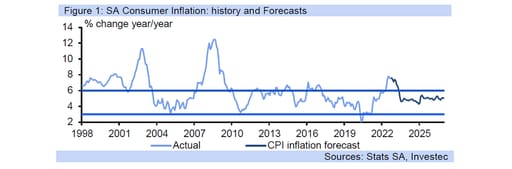

The MPC’s last meeting forecast CPI inflation at 5.0% y/y for 2024 and 4.5% y/y for 2025, and today’s figure is unlikely to change its 2024 view, with the SARB currently targeting inflation in 2024 and 2025.

Trade note: January 2024 sees rising global trade costs

16 January 2023

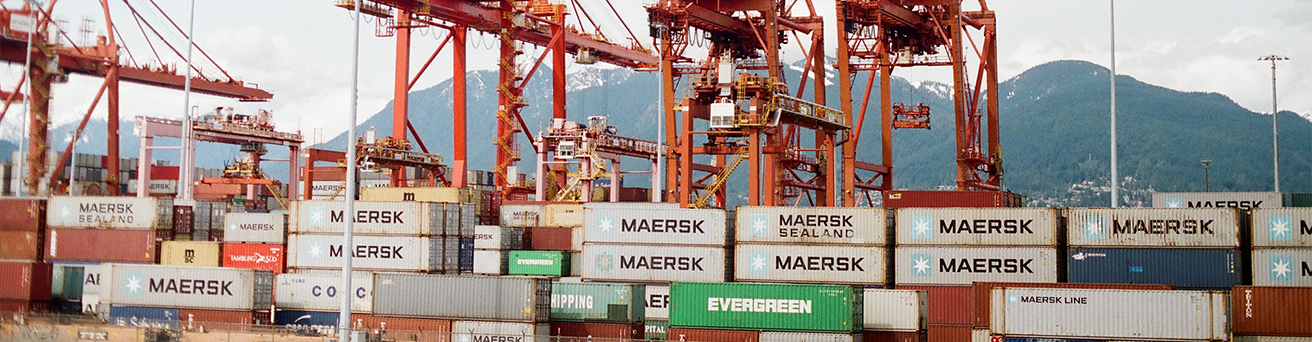

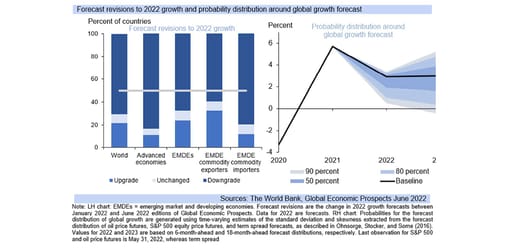

Global trade growth is expected to be weak in 2024 after 2023’s slowing, and supply chain capacity has already seen a high level of underutilisation

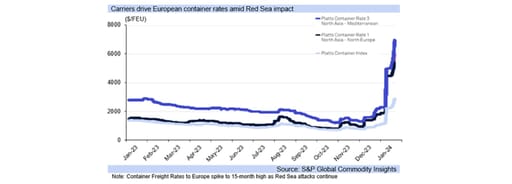

Global trade growth is expected to be weak in 2024 after 2023’s slowing, and supply chain capacity has already seen a high level of underutilisation, although some container freight rates recently rose substantiality as geopolitical tensions escalate.

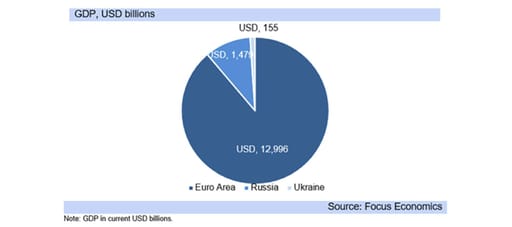

A slowdown in global trade growth in 2024 would contribute to the weaker outcome for global growth this year, with the escalation in the red sea conflict (particularly Iranian backed groups and the US) a downside risks to an already weaker outlook.

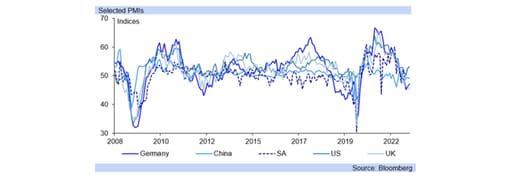

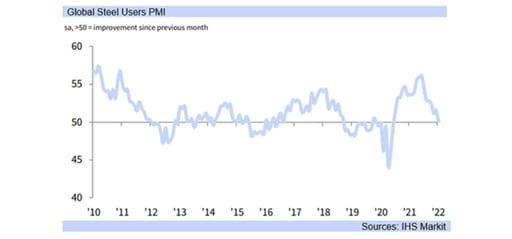

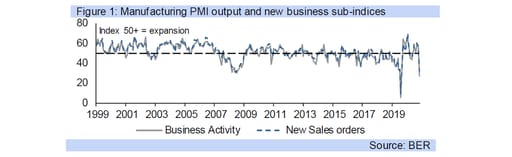

The latest data in the J.P. Morgan Global Manufacturing PMI survey saw a further fall in production in December (the seventh month in a row) as new business fell further (for the eighteenth month), and the pace of contraction overall quickened.

“Job losses were registered for the fourth successive month, with cuts seen in China, the euro area, the US and the UK (among others), while staffing levels were unchanged in Japan.” (J.P. Morgan Global Manufacturing PMI survey).

With the survey adding “price inflationary pressures continued to edge higher in December. Although rates of increase in both input costs and output charges remained relatively mild, they nonetheless accelerated slightly over the month.”

Inflationary concerns have also risen over the jump up in container freight to Europe on the attacks in the Red Sea’s Bab al-Mandab Strait by Yemen’s Houthi faction, lifting global risk aversion, strengthening the US dollar, and so weakening the rand.

The lengthened passage for ships to travel past the Cape of Good Hope instead of the Red Sea has pushed up container freight rates to reportedly fifteen-month highs and creating delays in deliveries as well as adding to port bottlenecks.

The Israeli- Hamas War, and that of Russia and Ukraine, are adding to geopolitical stresses, and concerns over disruptions to trade relations with SA, which is seen to have very cordial relations with Russia, causing some Western concerns.

With Agoa set to be renewed, South Africa is on the list of eligible countries for a ten year extension, but geopolitical tensions have raised concerns over the potential for SA to actually gain renewal, given its stance towards some of the US’s adversaries.

MPC preview: SARB likely to keep rates on hold again

9 January 2023

South Africa’s Reserve Bank (SARB) will decide on its interest rate stance at the MPC meeting on the last Thursday of this month

South Africa’s Reserve Bank (SARB) will decide on its interest rate stance at the MPC meeting on the last Thursday of this month, a few days before the FOMC meeting at the end of January.

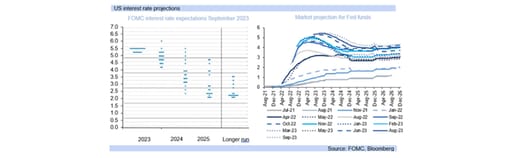

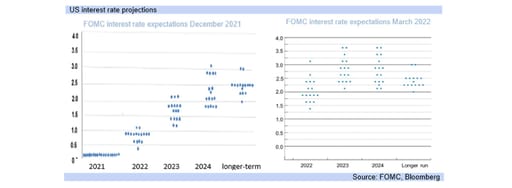

Both the MPC and the FOMC are expected to leave interest rates unchanged, with the FOMC minutes released last week (for the 13 December 2023 meeting), proving more cautious on the start of the US rate cut cycle than markets were hoping for.

The FOMC minutes highlighted “the importance of maintaining a careful and data-dependent approach to making monetary policy decisions and reaffirmed that it would be appropriate for policy to remain at a restrictive stance for some time.”

Financial markets tend to run ahead on exuberance, and the rand saw some strength early last week, then mild weakness post the FOMC minutes release, but largely traded relatively quietly overall.

The start of the US rate cut cycle is typically positive for investor appetite towards EM portfolio assets, bolstering EM currencies, but investor sentiment towards SA has been negatively affected by domestic issues.

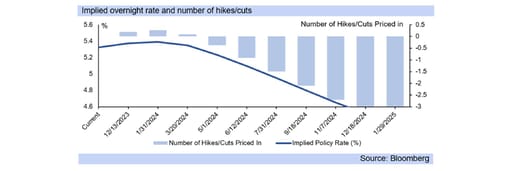

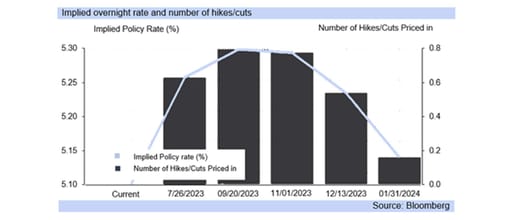

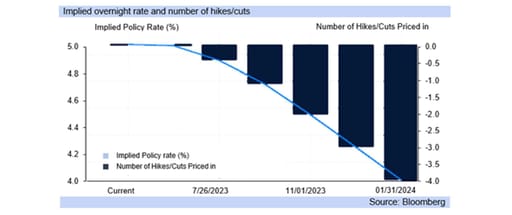

Financial markets have pulled back on expectations of the timing of the first US interest rate cut, from early last week’s view of close to a 75% chance of a 25bp cut in the fed funds rate at the 20 March FOMC meeting, to now around 50%.

Additionally, the previous 100% chance of close to two 25bp interest rate cuts in the US by the 1st of May FOMC meeting, has now dropped to around 87% chance of one. SA market expectations currently do not see a cut in Q1.24.

Instead, SA’s FRA curve factors in at least two 25bp cuts in H2.24. South Africa’s Reserve Bank tends to be on the hawkish side, and will view the CPI inflation rate above 5.0% y/y as a disincentive to any interest rate cuts in SA in the near-term.

The SARB has communicated its determination to see CPI inflation regain the mid-point, of 4.5% y/y, of the inflation target range. The latest print is at 5.5% y/y, and likely to remain above 5.0% y/y until March, only reaching 4.5% y/y in July.

Additionally, risks to the inflation outcome are to the upside, with CPI inflation likely to rise to around 5.8% y/y in January. We continue to forecast South Africa’s first interest rate cut in H2.24.

Inflation note: CPI inflation likely to average 4.5% y/y for 2024

5 January 2023

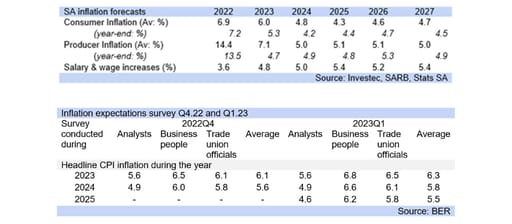

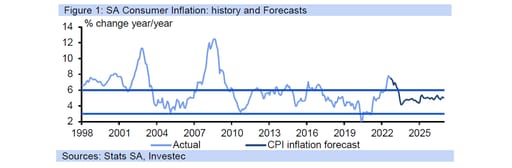

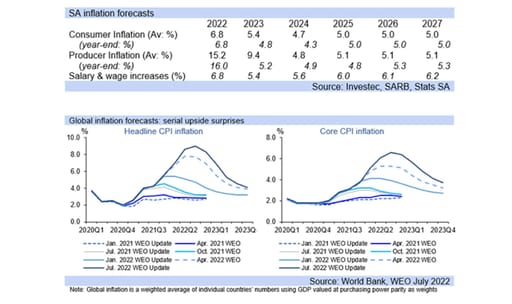

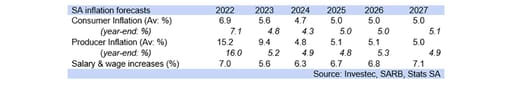

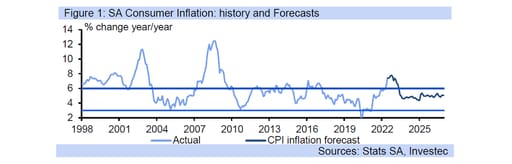

This year South Africa’s CPI inflation rate is currently likely to come out at 4.5% y/y, the midpoint of the inflation target range, although this average could face upside risks

This year South Africa’s CPI inflation rate is currently likely to come out at 4.5% y/y, the midpoint of the inflation target range, although this average could face upside risks, potentially from food prices, a weaker rand and higher global commodity prices.

Specifically, we currently forecast that CPI inflation will reach 4.5% y/y in July this year, dipping to 3.4% y/y in October and moving back towards 4.0% y/y in December on base effects, although the upside risks mentioned could derail this outcome.

An average of 4.5% y/y for 2024, and likely similar for 2025, if not slightly lower (currently the forecast is at 4.2% y/y for 2025), would imply interest rate cuts, with monetary policy increasingly restrictive from mid-Q1.24 without easing rates.

However, given the marked weakness in the rand, which has contributed significantly to higher inflation, South Africa’s MPC (Monetary Policy Committee) would likely favourably view rand strength in order to drive inflation lower.

The rand remains undervalued, over R3.00/USD removed from its fair (PPP) value against the USD. Such substantial weakness has been instrumental in contributing to higher fuel and food costs in SA, amongst other inflationary effects.

Should the US cut interest rates in H1.24, with March currently viewed as the first month this could likely occur, the rand could see some strength as the differential (difference) between US and SA Bank rates widens if SA does not cut.

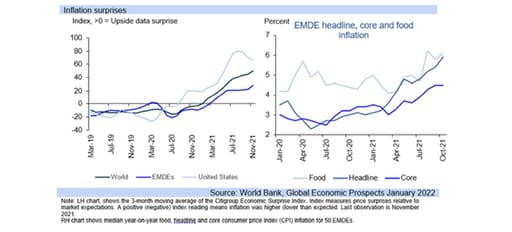

Inflationary pressures, globally and domestically, are on a general downwards trend, which is adding to expectations of interest rate cuts. This does not mean inflation consistently falls (at every print), but instead in general is tending to decline.

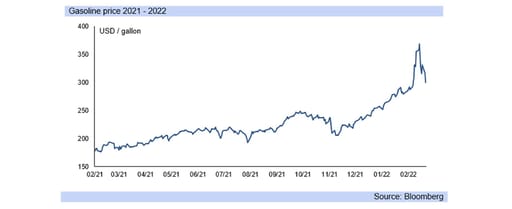

Fuel prices are key for SA’s inflation outcomes, and November’s large R1.78/litre cut in the petrol price helped pull inflation down to 5.5% y/y in November, from 5.9% y/y in October, and December’s -64c/litre cut should aid it lower, to around 5.2% y/y.

While inflation is likely to temporarily return to around 5.8% y/y in January’s outcome for this year, it should drop to near 5.3% y/y in February, and 4.7% y/y in March, as an overall downwards trend is maintained, allowing for interest rates cuts this year.

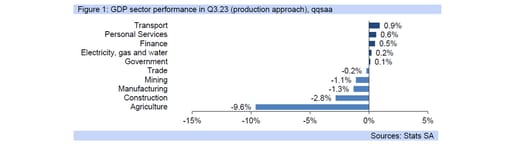

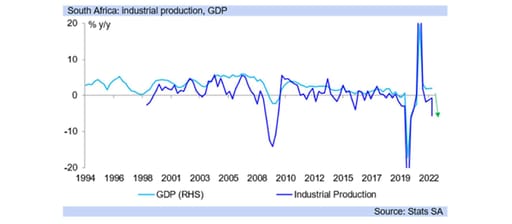

GDP Update: GDP fell by -0.2% qqsa in Q3.23

5 December 2023

The weak GDP outlook is reflective of the fragile economic environment which continues to be plagued by a number of challenges, predominantly inadequate electricity supply

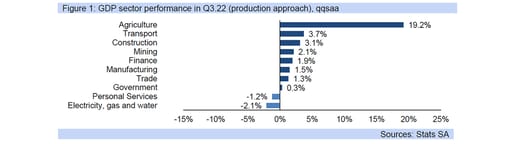

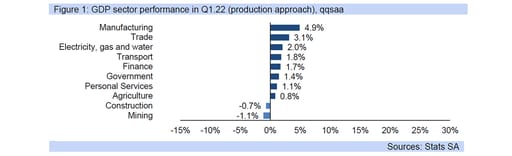

Headline GDP fell by -0.2% in the third quarter of 2023 when measured on a quarter on quarter seasonally adjusted (qqsa) basis. The outcome which was largely in line with consensus expectations (Bloomberg) follows Q2.23’s modest 0.5% qqsa (revised) lift. Measured on a year-on-year basis GDP contracted by -0.7% in the third quarter.

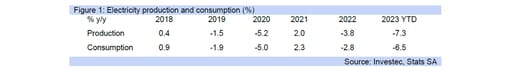

The weak GDP outlook is reflective of the fragile economic environment which continues to be plagued by a number of challenges, predominantly inadequate electricity supply and significant logistical constraints. Specifically electricity generation is down -6.0% year-to-date (to end September) when compared to the same period last year. Moreover, the N3 truck incidents that took place in July and the week-long Western Cape taxi strike in August will have contributed to the third quarter’s lacklustre growth outcome.

The agricultural sector was the worst performing sector in Q3.23, contracting by -9.6% qqsa and accordingly detracting -0.3 of a % point from the topline outcome. “A decline in output was recorded for field crops, animal products and horticulture products,” according to Stats SA. The agricultural sector continues to face a number of challenges impeding optimal activity, including the declining state of our roads, failing water infrastructure, electricity supply constraints and climate concerns.

Moreover, the mining and quarrying sector contracted by -1.1% qqsa in the third quarter. Indeed, the fragile global environment has weighed heavily on commodity demand, with the World Bank’s metals and minerals index down over -13.0% year-to-date (to end October). Overall, the primary sector of the economy declined by -4.4% qqsa.

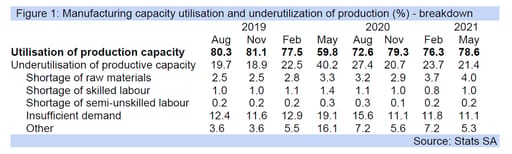

The secondary sector of the market contracted by -1.3% qqsa, weighed down by the manufacturing and construction industries which together detracted a further -0.2 of a % point from the GDP outcome. Specifically, manufacturing activity fell by -1.3% qqsa, largely underpinned by the performance of the the food, beverages & tobacco division. Notwithstanding the myriad of domestic challenges, including subdued demand, the fragile global manufacturing environment continues to undermine export potential.

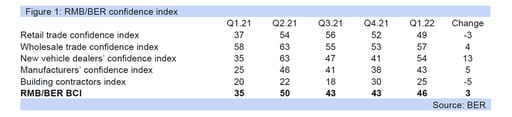

Activity in the construction sector fell by -2.8% qqsa, following a decline of -0.2% qqsa (revised) in Q2.23. “Decreases were reported for residential buildings, non-residential buildings and construction works,” according to Stats SA. The results of the BER’s Q3.23 building survey reveal that confidence amongst builders in the residential segment of the market fell further in the third quarter. Indeed, “the outlook for work deteriorated as based on respondents’ own expectations”.

The tertiary segment of the economy rose by a marginal 0.4% qqsa. The transport, personal services and finance sectors added a combined 0.3 of % point to the headline GDP outcome, on the back of modest growth of 0.9% qqsa, 0.6% qqsa and 0.5% qqsa respectively. Conversely, the trade sector fell by -0.2% qqsa. Although retail trade sales and tourism accommodation figures ticked up in the third quarter, the sector was weighed down by food and beverages, wholesale and motor trade activity.

Similarly, the expenditure approach to measuring GDP yielded an outcome of -0.1% qqsa in Q3.23, following Q2.23’s 0.7% qqsa (revised) lift. Household consumption expenditure, which makes up around two thirds of GDP declined over the quarter, falling by -0.3% qqsa and accordingly detracted -0.2 of a % point from the top line number.

The semi-durables category was the only positive contributor to the HCE reading, while non-durables, durables and services all declined over the quarter. The semi-durables retail category (which includes, clothing and footwear) appears “to be continuing the growth trend that has emerged since the lifting of lockdown restrictions”, according to the BER’s Q3.23 retail survey.

Indeed, the consumer remains highly constrained grappling with the elevated cost of living, while domestic interest rates are projected to remain higher for longer weighing on the indebted. Moreover, the unemployment rate is hovering at a still elevated 31.9%.

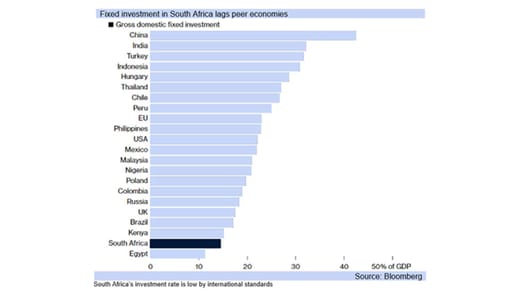

Government consumption grew by 0.3% qqsa in the third quarter adding 0.1 of a % point to the overall reading, while gross fixed capital formation (GFCF) declined by -3.4% qqsa, following seven consecutive months of growth and thereby detracted -0.5 of a % point from the quarter’s GDP result. The decrease was underpinned largely by the machinery and other equipment segment, which declined by -3.2% qqsa, (detracting -1.3% points). A notable pick-up in business confidence which slid further into depressed territory in Q4.23 is required to markedly boost investment. Security of electricity supply, a significant improvement in the logistics network, political certainty and an improvement in the ease of doing business are imperative in this regard.

FOMC note: rand gains further as an end to the US rate hike cycle seen supported

2 November 2023

The Federal Open Market Committee once again left the federal funds target rate unchanged as widely expected

The FOMC (Federal Open Market Committee) once again left the federal funds target rate unchanged at 5.25% - 5.50%, as widely expected, highlighting “the Committee is proceeding carefully” in its monetary policy approach.

The strength of the US economy was evident in the most recent GDP data, where activity levels expanded by 4.9% qqsaa, running above expectations, and against prior expectations some forecasters had of a recession in H2.23.

This is not to say that the effects of the rapid, tightening interest rate cycle have not been felt, with the housing market having flattened out below the levels of a year ago as high mortgage rates temper its momentum.

Business fixed investment has also seen the suppressing effect of higher borrowing costs while the labour market is seeing increasing balance between demand and supply conditions, but is still tight in areas.

Lastly the FOMC noted that inflation still remains above the long-run goal of 2.0%, with the core PCE deflator at 3.7% y/y, although “inflation has moderated since the middle of last year, and readings over the summer were quite favorable”.

However, “a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal. The process of getting inflation sustainably down to 2 percent has a long way to go.”

The rand strengthened to R18.46/USD in response to the outcome, with expectations that the US rate hike cycle has ended underscored, and that 2024 is still likely to see the beginning of the US interest rate cut cycle.

The FOMC next meets to deliver its interest rate decision on the 13th December, and after that at the end of January 2024. Markets have factored in no full expectations of another US rate hike this year, and the potential for cuts are building from Q2.24.

Chair Powell added “despite elevated inflation, longer-term inflation expectations appear to remain well anchored, as reflected in a broad range of surveys of households, businesses, and forecasters, as well as measures from financial markets”.

“Financial conditions have tightened significantly in recent months, driven by higher longer-term bond yields, among other factors. Because persistent changes in financial conditions can have implications for the path of monetary policy, we monitor financial developments closely”.

This tightening of financial conditions adds to the expectations that the US has seen its last interest rate hike. In South Africa, no further interest rate hikes are likely this year either.

Next year, SA is only expected to see an interest rate cut in Q3.24, of 25bp, with the FRA (Forward Rate Agreement) curve slow in factoring in rate cuts for SA, but we continue to believe a 125bp drop will occur beginning in 2024 and ending in 2025.

Oil note: falling supply, inventories, war boost prices

12 October 2023

Tightening supply of oil from OPEC+, US inventory rundown and the Israel-Hamas war raise oil prices

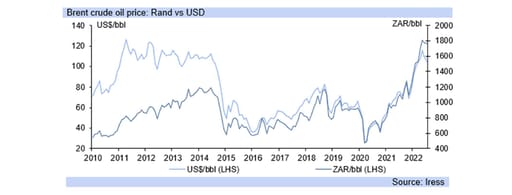

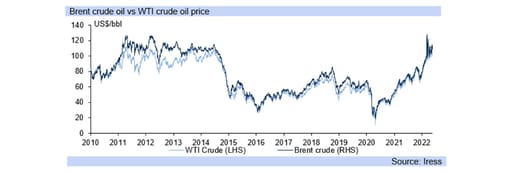

International oil prices climbed at the start of the week, to US$88.15/bbl for Brent crude, from US$84.07/bbl towards the end of last week, in reaction to the advent of the Israel-Hamas war over the weekend, but have not seen severe elevation.

Over September, oil prices had already reached US$94.43/bbl on tightening supply, with the US having drawn down its Strategic Petroleum Reserve (SPR) to limit oil price gains, but this has created worries now of shortages as the reserve is depleted.

The US’s emergency crude oil supply “established primarily to reduce the impact of disruptions in supplies of petroleum products”, and its “sheer size … makes it a significant deterrent to oil import cutoffs and a key tool in foreign policy.”

With “storage capacity of 714 million barrels”, the Energy Information Administration (EIA) reports the US’s Strategic Petroleum Reserve is at less than half its capacity, the last time it was at such a low was in May 1983 when it was first being filled.

The depletion of the US’s SPR reserves is adding to the lift in oil prices, with neither Israel nor Palestine key oil exporters, but risks for higher oil prices (with Brent reaching or exceeding US100/bbl) this year exist on the conflict widening to other regions, as the war intensifies currently.

Higher oil prices add directly to inflation, with markets having hoped that the upwards interest rate hike cycle had ended globally, even if rates are likely to stay higher for longer. The war could imperil the terminal rate having already been reached.

The IMF estimates “that a 10% increase in oil prices leads to inflation being 0.4 percentage points higher a year later. Under that scenario, global output falls by 0.15 percentage point.”

“That would add to an already difficult environment for inflation and growth that’s challenging central banks.” Additionally, US Treasury Secretary, Janet Yellen, said the war brings risks to an already weak global growth outlook, but a US soft landing is still likely.

Historically, sustained political instability in the Middle East has seen oil prices rise as trade routes and/or the supply of oil for export are interrupted. Upside risks for oil prices persist this year, adding to inflation concerns and central banks hawkishness.

Also supportive of US Treasury Secretary, Janet Yellen’s comments, the Fed’s FOMC member, Minneapolis Fed President Neel Kashkari, is reported to have concluded that "(w)e feel like we're on track for a soft landing”.

"Inflation has come down quite a bit, the labor market has remained strong, maybe we can get inflation all the way back down and avoid ,,, a deep recession". Dallas Fed President, Lorie Logan, said higher for longer could mean "less need" for another rate hike.

The IMF again advised “central banks to keep policy tight until there’s a durable easing in price pressures.” “Monetary policy needs to remain tight in most places until inflation is durably coming down towards targets”. “We’re not quite there.”

In addition, the IMF recently lifted “its projection for the pace of consumer price increases across the world to 5.8% for next year up from 5.2% seen three months ago” with “global growth of 2.9% for next year, down 0.1% from its outlook in July”.

US treasury ten year yields have risen substantially on the higher for longer communication for US interest rates, and this has added to higher long-term borrowing costs for consumers and corporates, supporting risks to the economy.

US Treasury Secretary, Yellen, adds “I haven’t seen any evidence of dysfunction in connection with the increase in interest rates. When rates are more volatile, sometimes you see some impact on market function, but that is pretty standard.”

On climate change and oil, the IEA (International Energy Association) has said demand for oil and other fossil fuels needs to drop sharply “to meet the goals of the Paris climate accord, which aims to limit global warming to 1.5 °C above pre-industrial levels”.

“As a result, in this scenario, no new oil or gas fields need to be approved for development. New coal mines or mine extensions are also not needed.” “The impacts of climate change are increasingly frequent and severe, and scientific warnings about the dangers of the current pathway continue to grow.”

“By 2035, emissions need to decline by 80% in advanced economies and 60% in emerging market and developing economies compared with 2022 levels. However, current Nationally Determined Contributions are not in line with countries’ own net zero emissions pledges – and those net zero pledges are not sufficient to build a decarbonised global energy system by 2050.”

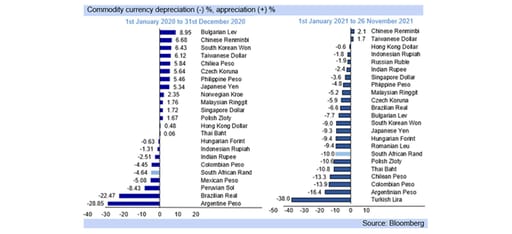

Commodity currencies: still facing risk-off, as central banks remain hawkish

6 October 2023

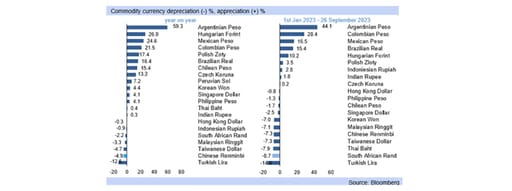

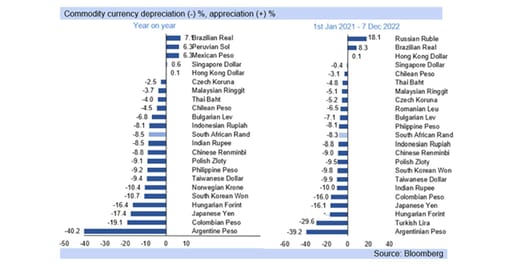

The rand has remained very weak this year, far removed from its fair value of closer to R15.00/USD. Substantial US dollar strength has been a key reason

The rand has remained very weak this year, far removed from its fair value of closer to R15.00/USD. Substantial US dollar strength has been a key reason (see Rand outlook, 5th October), but the currency has also underperformed on its own.

Compared to other commodities and EM currencies the rand is particularly weak on the year against the greenback, and has also depreciated against the key crosses, at R20.62/EUR and R23.84/GBP, versus R15.65/EUR and R18.77/GBP in H1.22.

The rand recorded R14.40/USD in H1.22, and has been beset by prolonged financial market risk-off since the second half of Q2.22, but also by internal fundamental (structural) weaknesses of the economy, particularly weak economic growth.

GDP growth is likely to come out around 0.5% y/y this year, and the World Bank supports this view highlighting “economic activity in South Africa is expected to be subdued, with growth decelerating sharply to 0.5(%) in 2023 from 1.9%.

“Scheduled power outages increased in 2023, holding back manufacturing and mining. Poor port and rail performance have stymied domestic and foreign trade limiting the ability of commodity exports to reach their destinations”.

Additionally, hawkish Central Bank commentary, also dulling EM and commodity currencies, persists to control inflation and reduce the need for a continuation of the severity of the interest rate hike cycles which have been under way.

That is, being able to manage inflation expectations by the tone (of hawkishness) of the communications of the Central Banks, instead of additional hikes, increases the chances of soft landings for economies, avoiding recessions.

The IMF adds “the more effective monetary policymakers are in influencing inflation expectations, the lower the cost in forgone output involved in central banks achieving their inflation objective.” Particularly when “inflation rises sharply or becomes volatile.”

For commodity currencies, and EM’s, what will be key is the advent of interest rate cuts, particularly in the US, expected in July 2024 currently, and a strengthening in production in the Chinese economy, which could continue to lag.

Countries with healthier government finances have stronger economic fundamentals and lower bond yields, contributing to faster economic growth and can become a virtuous cycle, which SA was in under President Mbeki in most of the 2000s.

“The World Bank warns “pressures for higher government spending in South Africa (in particular, social spending and an increase in the wage bill), weaker domestic growth, and a decline in commodity export prices are weighing on the budget deficit.”

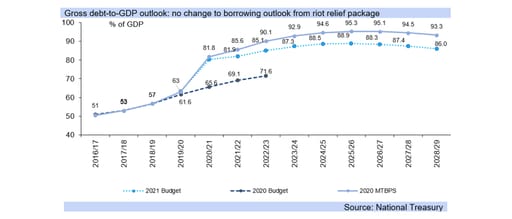

“Fiscal risks include the relief of the heavy debt burden of state power utility Eskom and increasing debt service costs. The fiscal deficit is expected to narrow slightly to 4.6 percent by 2025.”

“Nearly two-thirds of Sub-Saharan African Market-Access Countries (MACs) have tapped international markets over the past decade. Angola and South Africa are the largest issuers among the Sub-Saharan African MACs, which also include Côte d’Ivoire, Ghana, and Nigeria.”

“Now, however, the sell-off of developing countries’ Eurobonds and increasing investor fears about the global outlook amplify the risks for SubSaharan African countries facing large Eurobond redemptions.”

“Sovereign credit ratings, on average, deteriorated after 2018, and SubSaharan African countries tapped international markets amid worsening creditworthiness. Furthermore, countries lengthened the maturities of new bond issuances at marginally higher costs.”

Countries have been under strain as (non-oil) commodities prices weakened. Non-commodity exporters have seen benefits from rising demand for services, while manufacturing demand is weak in China, typically a main commodity importer.

The World Bank finds “growth of global trade in goods slowed in the first half of 2023 in tandem with weakening global industrial production, while (in contrast) services trade strengthened in the aftermath of the easing of pandemic-induced mobility restrictions that supported tourism.”

The delay in the global interest rate cut cycle, switch to services from goods (commodities) trade and the imbedded weakness in the Chinese economy limiting its recovery has stalked commodity prices, weakening currencies, with China’s growth expected to be services led.

FOMC note: US hike cycle expected to have ended

21 September 2023

The FOMC (Federal Open Market Committee) left the federal funds target rate unchanged at 5.25% - 5.50%, as widely expected.

The FOMC (Federal Open Market Committee) left the federal funds target rate unchanged at 5.25% - 5.50%, as widely expected and as already indicated at its July meeting, with the members concluding that recent data warranted its stance.

The projections materials showed a downwards revision in unemployment expectations, to 3.8% from 4.1% for this year, while the GDP growth figure was revised up, to 2.1% y/y from 1.0% y/y, highlighting the likelihood of a soft landing.

Fed Chair Powell noted that “recent indicators suggest that economic activity has been expanding at a solid pace, and so far this year, growth in real GDP has come in above expectations.”

And additionally, “recent readings on consumer spending have been particularly robust. Activity in the housing sector has picked up somewhat, though it remains well below levels of a year ago, largely reflecting higher mortgage rates.”

The projections for next year also showed a revision in unemployemt expectations, to 4.1% from 4.5% previously, while the GDP growth figure was revised up, to 1.5% y/y from 1.1% y/y, still representing some cooling next year.

Indeed, 2025 sees economic growth recover to 1.8% y/y in the FOMC forecasts, and the US unemployment rate remain at 4.1%, and then drop to 4.0% in 2026 (as the real GDP growth projection remains at 1.8% y/y in 2026).

The rand strengthened to R18.80/USD in response, from yesterday’s close of R18.84/USD, but the markets are likely to continue to digest the FOMC statements, and the rand consequently has room for further strength against the USD.

The FOMC next meets to deliver its interest rate decision on 1st November, and then its last meeting this year will be on the 13th December. Markets have factored in no full expectations of another US rate hike this year, and still see cuts next year.

Chair Powell added last night that “the labor market remains tight, but supply and demand conditions continue to come into better balance”, with the Fed showing less concern overall about the labour market”.

Indeed, he added, that “the unemployment rate ticked up in August but remains low, at 3.8 percent”, with the Fed previously having said that the labour market has to weaken substantially for inflation to cool.

Fed projections also show core PCE inflation nearing, then reaching, 2.0% over the next few years, as the Fed’s projections see inflation returning to the implied target, averaging 2.6% next year, from 3.7% y/y this year, then 2.3% y/y in 2025.

Changes in interest rates take a while to have an effect on inflation, with this lag potentially two to three quarters initially and the full effects coming through over a year to eighteen months.

The Fed itself says it “will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments”.

While the Fed members signal the possibility of another hike, this is likely aimed at quelling inflation expectations and is not widely expected to transpire. In SA as well markets expect no further hikes this year, and cuts from next year.

Inflation: likely near 5.0% y/y for the rest of 2023

5 September 2023

CPI inflation has likely reached its low point for 2023, coming in at 4.7% y/y in July, as it benefited from statistical base effects in its descent over most of this year (the first half of 2022 to July saw inflation rise sharply in SA).

The next few months (August to February 2024) will likely see inflation rise to, and then remain above, 5.0% y/y, before moving back towards 4.5% y/y for the remainder of 2024, potentially undershooting towards 4.0% y/y at the end.

Fuel prices saw modest changes in August, with the petrol price rising by only 37c/litre last month, but tomorrow it is set to rise by R1.71/litre while diesel prices rise by around R2.80/litre, which will place some upwards pressure on the CPI.

However, petrol prices account for 3.5% of the CPI basket, while diesel prices only make up 1.4%. The lower weighting of the diesel sub component will have some moderating effect, but still place upwards pressure on the September CPI outcome.

Otherwise, August sees medical costs surveyed for private sector hospitals, and municipal rates and taxes. The largest individual component of the CPI basket, which is made up of food prices, will likely have only a small impact in August.

That is, although US dollar based international agricultural commodity food prices would have contributed some downwards price pressure on the month, the rand weakened by about 3.3% m/m against the dollar, eradicating the impact.

The publication of the August figure (in September) is likely to see South Africa’s CPI inflation rate climbing towards 5.0% y/y - mainly as a consequence of statistical base effects as CPI inflation began to fall in general from August last year.

While CPI inflation is expected to average around 4.5% y/y in 2024 – we currently have 4.6% y/y, risks remain from food price inflation in a El Nino (below average rainfall) year, along with the costs of load shedding.

This year, CPI inflation is expected to come out just below 6.0% y/y, potentially at 5.8% y/y, while further out in the period to 2025 and 2026, inflation is expected closer to the mid-point of 4.5% y/y, but with pressure to move to 5.0% y/y.

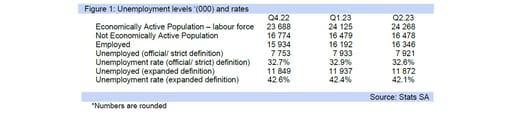

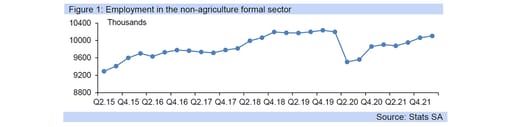

Unemployment slightly down at 32.6% in the second quarter

15 August 2023

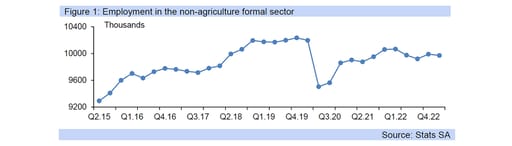

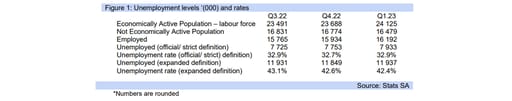

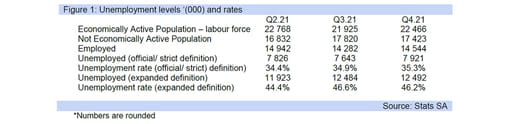

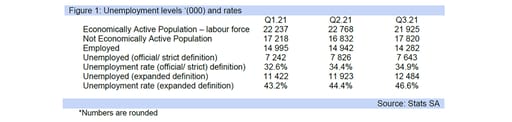

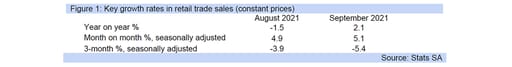

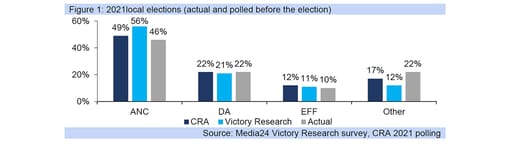

The official unemployment rate decreased marginally to 32.6% in the second quarter of 2023 from 32.9% logged in Q1.23. Although it has improved moderately from levels recorded during the pandemic, it remains at an elevated level.

A “number of persons moved from the "not economically active" and "unemployed" statuses to the "employed" category between the two quarters”, according to Stats SA, resulting in the 0.3 of a percentage point decline in the unemployment rate.

Accordingly, the labour force participation rate picked up slightly to 59.6% (previously 59.4%), however it remains below 60%, evincing the fragility of the South African economy, which is plagued by a number of structural challenges, significantly impeding activity and weighing heavily on confidence and growth.

The number of employed persons increased by 154 000 to 16.3 million (1.0% q/q) with the formal sector of the economy primarily absorbing these individuals. Moreover, employment gains were logged within the private households’ segment (37 000 positions). Conversely, the informal (non-agriculture) sector shed -33 000 positions (-1.1%) over the quarter, but employment in this category is still up when compared to the same period last year (2.2%).

A disaggregation of the data (formal employment) on an industry basis, indicates that q/q increases were logged in five of the eight industries surveyed, with the trade sector recording the largest number of job gains of 71 000, this following job losses of -44 000 in Q1.23. Moreover, the construction sector added a further 62 000 positions.

Conversely, the manufacturing sector shed -53 000 jobs in Q2.23. Structural challenges including persistent load shedding, subdued local demand and a fragile global environment have weighed on business activity and new order growth.

The youth category which comprises those aged 15-24 years are the most disadvantaged segment of the economy when it comes to finding sustainable employment in this subdued market, with many lacking the necessary skills and experience. Unemployment in this grouping did come down slightly in Q2.23 to 60.7% (from 62.1% previously) but remains at a critically elevated level. Improving the quality of and access to education and skills training programmes remains vital.

According to Stats SA, “of the 7,9 million unemployed persons in the second quarter of 2023, as many as 50.1% did not have matric” a worrying statistic, while 40.2% had completed matric. “Only 6,6% of the unemployed had other tertiary qualifications, while 2,4% of unemployed persons were graduates”.

While this is a priority area for government, gains will be felt over the longer term. Emphasis needs to be placed on areas of the economy which can rectified or improved in the near-term, thus boosting confidence, attracting investment and accordingly driving growth and job creation.

The expanded unemployment rate, (which includes individuals who desire employment regardless of whether they are actively seeking work) declined marginally to 42.1% (from 42.4% in Q1.23) but is a marked 12.6 percentage points higher than the rate logged during the same period in 2008, demonstrating the extent of SA’s unemployment predicament.

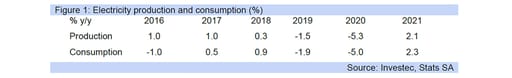

Electricity production and consumption readings eased in June

3 August 2023

Electricity production and consumption readings eased notably to -3.7% y/y and -3.2% in June, following May’s respective -8.7% y/y and -7.7% y/y declines.

A combination of factors, including improved wind generation capacity, reduced demand and lower planned maintenance, allowed Eskom to reduce load shedding during the month, offering some reprieve to households and businesses.

Indeed, the energy availability factor rose to over 59.0 during the week of the 5th to the 11th June, after falling to levels closer to 50.0 earlier in the year.

However, as temperatures plummeted, Eskom was again forced to up the stages of rotational load-shedding as demand climbed, while a loss of generating capacity exacerbated the situation.

Persistent load shedding continues to weigh heavily on both consumer and business confidence and has severely impeded economic activity in the country, with marginal growth predicted for this year.

Various initiatives to improve the dire electricity supply predicament are ongoing.

An Energy One Stop Shop and Energy Resilience Fund were recently launched by the Minister of Trade and Industry. He commented that these “are critical steps towards alleviating the challenges faced by our industries during this energy crisis” and stressed that they are “committed to fostering a resilient business environment and accelerating private-sector investment in electricity generation to secure a stable energy future.”

Nersa’s recent decision to assign a license to the National Transmission Company South Africa SOC Ltd (NTCSA) to operate the Transmission system was favourably received by Eskom. The utility commented that the “decision marks a significant milestone in the legal separation process of the Transmission Division”.

A recent release by the President reported on the progress achieved a year since the introduction of the Energy Action Plan to tackle South Africa’s load shedding emergency. “To ensure that we never experience power shortages again, we are implementing fundamental reforms to create a competitive electricity market and an independent national grid operator,” the President commented. He did however acknowledge that the loadshedding crisis “will not be resolved overnight” but stressed that “we are making clear progress towards reducing it and eventually bringing it to an end”.

Foreign appetite for SA bonds grows on global financial market risk-on sentiment

1 August 2023

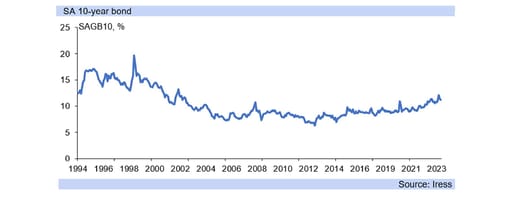

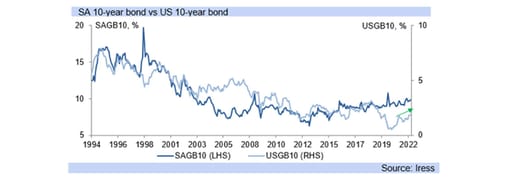

South African bonds have seen a further, modest recovery in yields, with the ten year benchmark yield reaching 11.10%, after some volatility in July

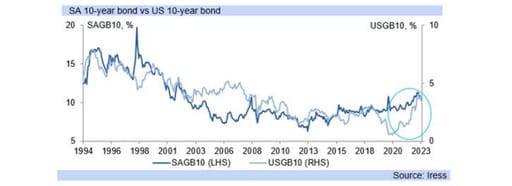

South African bonds have seen a further, modest recovery in yields, with the ten year benchmark yield reaching 11.10%, after some volatility in July when the yield reached 11.69%, while June started off at 11.99%.

Foreign investors have been net purchasers of SA government bonds in both June R14.5bn and July R11.4bn, after net selling of -R10.41bn in May, and indeed have been net purchasers for four months out of seven this year so far.

Overall non-residents have been net buyers of government bonds this year, at R7.5bn (settled trade data from Bloomberg, JSE), but with volatility month to month, and SA’s ten year yield is still 39bp higher than the start of the year.

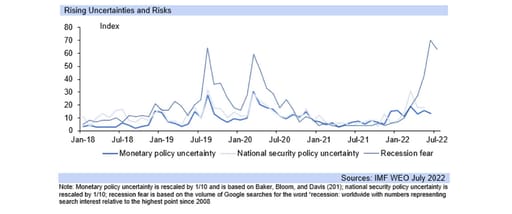

Markets have been constantly recalibrating interest rate expectations this year, leading the volatility, along with uncertainty about global growth outcomes, and concerns are still apparent on inflation for a number of advanced economies.

The tightening in monetary conditions is unlikely to see release this year, with inflation still sticky for most advanced economies, and markets wary, with some appetite for risk assets (risk-on) but not a full-scale shift away from risk aversion yet.

In particular, the slow descent (stickiness) of core inflation creates a risk for inflation expectations, which have tended to the optimistic side in markets recently. This, along with incoming economic growth data, leaves room for some volatility.

In South Africa, concerns over slowing growth on the electricity crisis reduced economic growth expectations and so had negatively impacted expectations as well over the revenue collection potential of government.

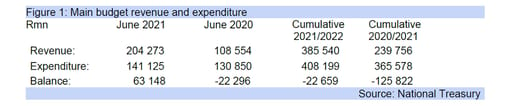

SA is seeing its revenue collection, at R406bn for the year to date below that of last year for the same period of R424bn, while expenditure has not been curtailed, at R453bn for the year to date well above the R412bn of the same period last year.

The risk of a deterioration in state finances persists, even with a possible marginal upwards revision for GDP growth this year, from 0.2% y/y to 0.3% y/y or even 0.4% y/y. The state is not trimming expenditure and increased bond issuance is a risk.

FOMC note: markets see no further hikes currently

27 July 2023

The FOMC lifted the federal funds target rate by 25bp and indicated that at the September meeting it could hold rates steady

The FOMC lifted the federal funds target rate by 25bp (to 5.25% - 5.50%) and indicated that at the September meeting it could hold rates steady if the data warranted it, although a lift was not impossible.

Fed Chair Powell noted, “we have been seeing the effects of our policy tightening on demand in the most interest-rate-sensitive sectors of the economy” but “it will take time for the full effects of our ongoing monetary restraint to be realized, especially on inflation.”

Adding “the economy is facing headwinds from tighter credit conditions for households and businesses, which are likely to weigh on economic activity, hiring, and inflation.”

“In determining the extent of additional policy firming that may be appropriate … the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

"We will continue to make our decisions meeting by meeting, based on the totality of incoming data and their implications for the outlook for economic activity and inflation as well as the balance of risks”.

The FOMC communications leave some possibility for a hike in the Fed funds rate in September, but currently the markets have essentially priced in no change for the remainder of this year, and continue to see US interest rate cuts from next year.

The rand consequently has retained much of its recent strength, reaching R17.56/USD today, and yesterday R17.52/USD on US dollar weakness, its strongest rate since February this year.

The FOMC next meets on 20th September, and then will deliver another interest rate decision on the 1st November. Markets have factored in only a 5bp hike at the September meeting, and by November for rates to have risen by only 10bp.

With the FOMC hiking by 25bp at the July meeting it is not expected to do the same again at the September meeting, and market expectations see no further hikes in the current cycle for the US.

The last meeting of the year is on 13th December, and market expectations have fallen by then for only a 6bp hike, i.e. no change in rates. The market expectations for the moves at each meeting are not cumulative, but a reading at a point in time.

It is consequently believed that the FOMC has now reached the end of its interest rate hike cycle, as per the implied Fed funds futures, with the January 2024 meeting seeing the first indications of markets leaning toward a cut instead of a hike.

However, only by the May 2024 FOMC meeting is a 25bp cut in the Fed funds rate fully factored in (with a 32bp fall implied), while the March 2024 FOMC meeting currently has a 16.5bp cut factored in – as markets see a cut more likely than a hold.

In South Africa, the FRAs have not priced in any further hikes in the repo rate this year, with the essentially flat trajectory extending over Q1.24. However, as US interest rate cut expectations grow, SA is seen as cutting as early as mid-2024.

The FRA (Forward Rate Agreement) curve currently shows expectations of a further 25bp cut in the repo rate by the end of 2024, making it a 50bp drop in interest rates in total, although market expectations are subject to rapid change.

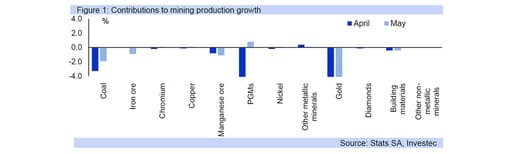

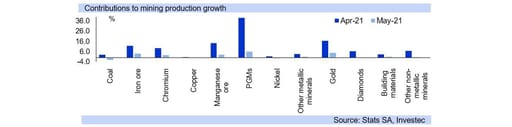

Mining Update: declines by -3.8% on a m/m seasonally adjusted basis in May

13 July 2023

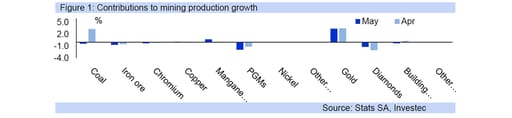

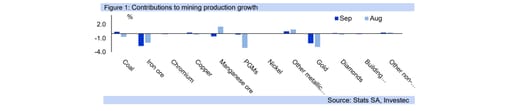

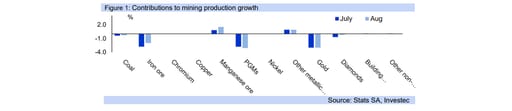

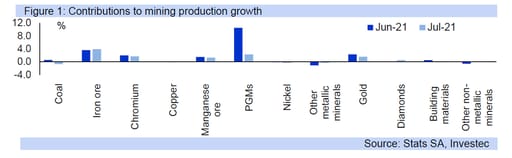

Mining output decreased by -0.8% y/y in May and by -3.8% when measured on a month-on month seasonally adjusted basis, as the mining industry continues to face a number of challenges domestically and grapples with a fragile global environment weighing on export potential.

The outcome was notably weaker than consensus (Bloomberg) expectations.

A breakdown of the annual production reading shows that PGMs contracted by -7.2% y/y and owing to their size in the mining basket (22.96%) detracted -1.9% points from the headline reading. Moreover, diamond production continued to decline y/y, dipping for the 8th consecutive month in May. It fell by a notable -31.4% y/y, slicing -1.2% points off the topline number.

Weak global economic conditions, with a slower than projected rebound in demand from China as Covid restrictions were lifted have weighed on diamond sales, while competition from the lab-grown diamond industry persists.

Conversely, gold output increased by a further 27.3% in May, following April’s 27.4% lift, adding a notable 3.4% points to the headline outcome and preventing a larger year-on-year slump. This is line with the performance of the World Bank’s Precious Metals index which grew by over 8.0% y/y in May.

Indeed, the energy intensive mining sector continues to deal with electricity supply challenges, hindering optimal operational performance. Specifically, electricity generation fell by a further -9.0% y/y in May, according to Stats SA. Year-to-date (until end of May) it is down -8.1%.

Eskom recently announced a return to higher stages of load shedding, owing “to the loss of additional generating units overnight, the extensive use of Open Gas Cycle Turbines and the inability to replenish pumped storage dam levels” according to Eskom. This following, a moderation over June, supported by (amongst other factors) heightened wind generation and lower anticipated demand.

Besides the electricity supply predicament, the mining sector continues to grapple with logistical hinderances, labour specific issues and policy uncertainty. Moreover, the subdued global environment continues to weigh on the country’s export potential. Advance indications provided by June’s JP Morgan Global Manufacturing PMI survey indicated that the manufacturing PMI reading slipped to a six-month low.

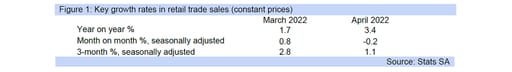

Employment Update: Non-farm employment fell marginally in Q1.23

27 June 2023

Formal sector, non-farm employment fell by -21 000 or -0.2% in March 2023 when measured on a quarter-on-quarter basis.

Declines were recorded in the trade, business services, construction and transport sectors.

Indeed, the trade sector (which encompasses retail sales and related industries) shed 36 000 positions over the quarter, this following an increase over the seasonally significant festive period. Job numbers in all other sectors covered grew q/q, but not by any significant amount (except community services), evincing the dire state of the economy.

Indeed, when measured on a year-year basis, total employment numbers fell by -97 000 or -1.0%, with the country’s numerous challenges continuing to impede growth. We forecast GDP at a marginal 0.2% for this year.

The Quarterly Employment Survey also provides detail on wage developments across economic sectors. Gross earnings paid to employees across all industry groups declined by R34.1bn or -4.0% q/q. The decline was broad based, with only the business services and mining sectors logging increases in gross earnings over the quarter.

Moreover, average monthly earnings (in real terms) for non-farm employees decreased by -3.7% q/q (incl. bonuses and overtime) in February to R23 451. Measured on an annual basis, average earnings were down -0.2%, adding to the predicament of already financially stretched households.

A notable lift in business confidence which has fallen further into depressed territory this year, is required to encourage investment, growth and accordingly job creation.

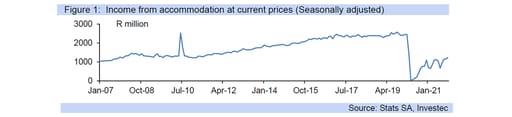

Tourism Update: income from tourist accommodation rose by 30.9% y/y in April

20 June 2023

Income derived from the domestic tourist accommodation industry grew by 30.9% y/y, evincing the notable rebound in this significant sector of the economy

Income derived from the domestic tourist accommodation industry (accommodation only) eased moderately when measured on an annual basis (in nominal terms) in April. However, it still grew by 30.9% y/y, evincing the notable rebound in this significant sector of the economy, with receipts nearing pre-pandemic levels.

All accommodation types surveyed rose on a y/y basis in April, however the primary contributors to April’s 30.9% y/y lift were the hotels category and the “other” accommodation category (which includes lodges, bed-and-breakfast establishments, self-catering establishments and ‘other’ establishments not elsewhere classified). Specifically, they increased by 31.3% y/y and 33.7% respectively.

Indeed, routine data gathered by the Department of Home Affairs’ (DHA) reveals that 2 676 540 travellers (arrivals, departures and transits) passed through South African ports of entry/exit during the month of April. This represents an increase of 9.5% m/m and 57.7% y/y respectively.

Looking at tourist numbers specifically, there was a notable 65.4% y/y climb between April 2023 and April 2022. Those emanating from ‘overseas’ countries rose by 34.4% y/y during the month, with travellers from Europe comprising the largest share (over 60% of all ‘overseas tourists’) led by the UK and Germany. Moreover, tourists travelling from African nations rose by 77.3% y/y in April, with those stemming from SADC countries making up the majority.

These numbers reflect a buoyant tourism industry with significant potential. Tourism Minister Patricia De Lille recently published a statement on progress in the industry. She stated that “… we are committed to doing more to grow the tourism numbers and the sector even more to make a greater contribution to the country’s Economic Reconstruction and Recovery Plan.”

She noted that in April, together with the President she signed a new performance agreement, containing “key priorities to recover and grow the tourism sector” and she elaborated on the progress in these key areas. Indeed, the reduction of red tape, Infrastructure development and maintenance, tourism safety, improving air access and branding and communication are imperative to increase the country’s competitive position and attract more travellers.

FOMC note: pause as expected, likely terminal rate reached

15 June 2023

The FOMC left the federal funds target rate unchanged (at 5.00% - 5.25%) as widely expected last night, to allow the “lags with which monetary policy affects economic activity and inflation, and economic and financial developments” to come through.

That is, with a two to three quarter lag between a change in interest rates and the effect on the economy, including inflation, the rapid interest rate hike cycle in the US has not had time to fully feed through into inflation and other economic data.

The unemployment rate in the US has only ticked up somewhat, and expectations are that the economic growth rate will slow, while both the consumer and producer price inflation rates are falling (disinflation is occurring).

“Since early last year, the FOMC has significantly tightened the stance of monetary policy. We have raised our policy interest rate by 5 percentage points” but “the full effects of our tightening have yet to be felt.”

“In light of how far we have come in tightening policy, the uncertain lags with which monetary policy affects the economy, and potential headwinds from credit tightening, today we decided to leave our policy interest rate unchanged”.

“Committee participants generally expect subdued growth … the median projection has real GDP growth at 1.0 percent this year and 1.1 percent next year, well below the median estimate of the longer-run normal growth rate.”

The rand strengthened to R18.24/USD yesterday on US dollar weakness from a close of R18.63/USD, but has since moved back to R18.31/USD, with markets concerned that the FOMC is signalling further interest rate hikes could occur.

In particular, Chair Powell said at the press conference that “(l)ooking ahead, nearly all Committee participants view it as likely that some further rate increases will be appropriate this year to bring inflation down to 2 percent over time”.

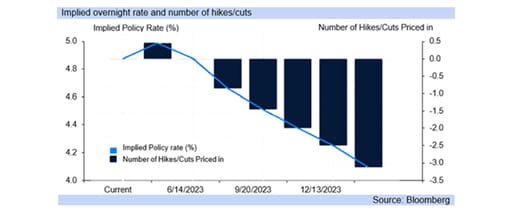

The FOMC next meets towards the end of July, and will deliver another interest rate decision on the 26th. Markets have factored in a 18bp hike at the meeting, and by September for rates to have risen by 21bp, not cumulatively (i.e. not 18bp + 21bp).

Instead, if the FOMC hikes by 25bp at the July meeting it is essentially not expected to do the same again at the September meeting, but rather instead only deliver one more 25bp hike in total in the current interest rate cycle as per market expectations.

However, it is likely that the FOMC will pause for longer then one meeting to assess the lagged effect of its interest rate hikes, given the two to three quarter lag noted above, and instead the Fed could keep interest rates flat out to Q4.23.

Towards the end of this year markets (Fed funds implied futures) are currently factoring in the possibility of interest rate cuts, from November, although this is unlikely to occur so soon, and the FOMC is more likely to wait until January.

While events can change in the next six months, economic data coming out in the US is likely to pull market sentiment closer to that of no further hikes in the US interest rate cycle, allowing the terminal (end) rate to have been reached already in May.

South Africa’s FRAs have currently only fully priced in a 25bp hike in SA’s repo rate by September, and then a flat trajectory thereafter, but as US interest rate hike expectations work out of the system this is likely to fall away too.

US says SA in danger of losing AGOA benefits due to Russian ties

13 June 2023

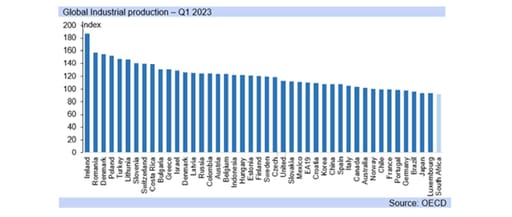

South Africa’s export trade ability has deteriorated substantially on the fall in rail and port capacity, which has negatively affected industrial production in SA

South Africa’s industrial (manufacturing, mining and electricity) production grew by a small 0.4% m/m (seasonally adjusted), in April 2.1% y/y with industrial production accounting for around 19.7% of GDP, while demand for trade weakened in April.

South Africa’s export trade ability has deteriorated substantially on the fall in rail and port capacity, which has negatively affected industrial production in SA and in part prompted the urgent partnership between government and organised business.

The partnership initiative, outlined yesterday in the rand note as well as in Friday’s note (contact details below) aims to dramatically improve the performance of SA’s logistical sector, as the country cannot consistently meet demand for its exports.

However, the bigger threat to South Africa’s industrial production, and so growth and existing jobs, is the loss of benefits from AGOA and secondary sanctions from Western countries, with the relationships not quickly and or easily repaired.

Russia accounts for a paltry 0.2% of SA’s global export trade, and the US, UK and EU combined 35%, with China only around 9%. South Africa has been playing with fire for its economy in participating in naval exercises with Russia and other activities.

A group of US bipartisan legislators said recently that “serious concerns with current plans to host this year's AGOA Forum in South Africa” and that “actions by South Africa call into question its eligibility for trade benefits under AGOA”.

This is the strongest communication coming from the US so far on SA’s allegiances to Russia, with AGOA’s “statutory requirement that beneficiary countries not engage in activities that undermine United States national security or foreign policy interests”.

The group added “while we understand that the AGOA eligibility review process for 2024 is underway and that decisions have not yet been made, we question whether a country in danger of losing AGOA benefits should have the privilege of hosting the 2023 AGOA Forum.”

SA imports and exports virtually nothing from Russia, at 0.2% and 0.1%, while risks losing up to 40% of its trade if sanctions are imposed against it by the West, which would drive the economy into a deep, severe recession, extreme rand weakness and collapse in government finances, most likely bankrupting the state. SA will likely face its worst economic crisis if it undergoes full sanctions from the West.

The US bipartisan legislators group further said “(h)osting the forum in another country in Sub-Saharan Africa would send a clear and important message that the United States continues to stand with Ukraine and will not accept our trading partners provision of aid to Russia's ongoing and brutal invasion.”

“We are seriously concerned that hosting the 2023 AGOA Forum in South Africa would serve as an implicit endorsement of South Africa's damaging support for Russia's invasion of Ukraine and possible violation of U.S. sanctions law.”

South Africa's government has “deepened its military relationship with Russia over the past year. Late last year, a Russian cargo vessel subject to U.S. sanctions docked in South Africa's largest naval port, and Intelligence suggests that the South African government used this opportunity to covertly supply Russia with arms and ammunition that could be used in its illegal war in Ukraine.”

“In February, South Africa held joint military exercises with Russia and China, and in April, authorized a Russian military cargo plane also subject to U.S. sanctions- to land at a South African air force base.”

“On top of this, in August, South Africa will host the BRICS Summit where the government aims to strengthen its ties with China and Russia and is working to facilitate the Participation of Russian President Vladimir Putin, despite the outstanding arrest warrant issued by the International criminal Court (ICC).”

South Africa needs to cease absolutely all and any military ties, relationships and activities with Russia if it does not want to lose the AGOA trade benefits and face sanctions from Western countries that will decimate its economy, socioeconomics and major sources of government funding.

South Africa is, worst case, risking becoming a bankrupt state for its relationship with Russia, which adds virtually nothing to the economy, state revenues, economic growth job creation or socioeconomic stability and investor sentiment.

The rand has depreciated this morning on the news, halting its rapid gains recently which means SA will lose out on what could have been a fuel cut for the population if the states allegiances with Russia had not negatively caught up with it as per the US brief. However, US disinflation figures aided some small rand strength this afternoon.

There remains poor understanding in South Africa of the absolutely dire consequences pursuing a relationship with Russia will have on the country in the current geopolitical climate, particularly looking to physically host President Putin in SA and seeking ways to avoid the ICC edict for his arrest.

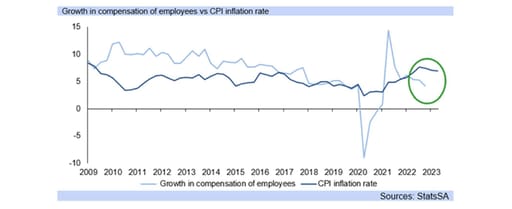

South Africans are getting poorer: salaries declining in real and nominal terms

9 June 2023

As living costs rise and salaries shrink, South Africans are finding it increasingly difficult to make ends meet. This alarming reality not only erodes individuals' purchasing power but also weakens the overall economy.

According to the BankservAfrica Take-home Pay Index (BTPI), the average nominal take-home pay of South Africans in April 2023 was R15,063, down from R15,335 in April 2021. In real terms, adjusted for inflation, take-home pay dropped even further to R13,524, marking a significant 10.4% decline compared to the previous year’s figure of R15,097. These downward trends are concerning, with salaries experiencing a 4.2% year-on-year decrease while the cost of living increased by 6.8% in April.

Poor economic fundamentals

South Africa has been grappling with a stagflationary environment characterised by weak economic activity and persistently high inflation. This, coupled with declining real wages, has significantly hindered economic growth and employment prospects. With muted demand and reduced non self-generation fixed investment, the economy finds itself in a precarious position. In this environment, companies find themselves in a prolonged "survival mode," which makes it difficult for them to retain existing staff, let alone increase wages or hire new people.

South Africa's electricity crisis, exacerbated by corruption scandals within Eskom and Transnet, has further hampered economic growth and employment prospects. Additionally, insufficient rail and port capacity has negatively impacted growth and job creation. Recognising the urgency, President Ramaphosa last week convened a meeting with business leaders in hopes that the private sector can help spearhead efforts to address these pressing issues.

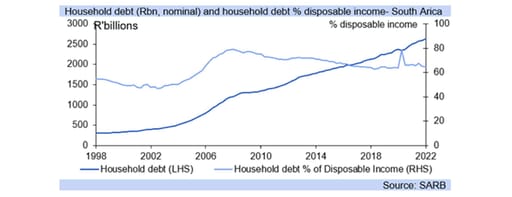

But power shortages and load shedding are not the sole causes of South Africa's current predicament. The drop in consumer affordability also plays a significant role in weakening the economy. Household Consumption Expenditure (HCE), which drives two-thirds of GDP, suffers when affordability declines, resulting in overall economic growth being affected. The BankservAfrica's Economic Transactions Index (BETI) confirms this trend, with a 7.4% year-on-year decline in HCE in May.

The burden of debt

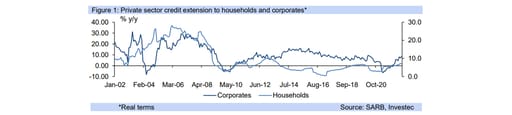

South African households are burdened with mounting debt stress. The impact of successive interest rate increases and elevated inflation levels is becoming increasingly evident in the state of consumer finances. Debt Busters reports that a significant portion of net incomes, reaching up to 65%, is now allocated to debt repayments. Disturbingly, even individuals earning R20,000 or more per month are forced to allocate 70% of their income towards debt repayment.

Unsecured debt levels in South Africa have reached unsustainable heights: on average, they are 30% higher than in 2016, with an even steeper increase of 67% for those earning R20,000 or more per month. This surge in unsecured debt is a direct consequence of falling take-home pay as consumers resort to credit to compensate for their diminishing income.

Impact on the economy

Salaries below the inflation rate do not contribute to strengthening the economy or driving demand for goods and services. On the contrary, this downward trend in personal earnings has been a key factor behind poor economic growth and employment outcomes in South Africa. Unless the country’s fundamental economic weaknesses are urgently addressed, by way of solutions to the energy and transport crises as well as far-ranging structural economic reforms, the country risks falling into a self-perpetuating spiral of increasing poverty and permanent economic malaise.

Marginal GDP increase amidst persistent challenges

6 June 2023

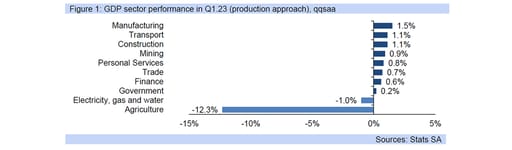

Lacklustre 0.4% rise in Q1 2023 GDP reflects electricity shortages and a -12.3% decline in the agricultural sector

The first quarter of 2023 saw a marginal rise of 0.4% in GDP when measured on a quarter-on-quarter seasonally adjusted basis. This outcome, in line with our and consensus expectations, follows a contraction of -1.1% in Q4 2022. On a year-on-year basis, GDP only increased by 0.2% during the first quarter.

The subdued GDP reading reflects the fragile economic environment, plagued by numerous challenges, with inadequate electricity supply being a persistent issue. In the first quarter, electricity generation declined by -7.7% year-on-year, significantly hampering the country's growth potential.

The agricultural sector experienced a sharp decline of -12.3% quarter-on-quarter, shaving 0.4% from the topline reading and effectively negating most of the gains recorded by other sectors. As a result, despite a modest 0.9% lift in mining output, the primary segment of the economy fell by -4.7% quarter-on-quarter.

On a more positive note, the secondary sector of the market showed an increase of 1.1% quarter-on-quarter, driven by the manufacturing and construction industries. Manufacturing activity rose by 1.5% quarter-on-quarter, with the food and beverages segment playing a significant role. Additionally, the construction sector increased by 1.1% quarter-on-quarter, with growth reported in both residential and non-residential building projects, according to Stats SA. This aligns with the Q1 2023 building survey conducted by BER, which indicated increased confidence among builders in both sectors.

The tertiary segment of the economy experienced a moderate rise of 0.7% quarter-on-quarter, with all sub-sectors contributing to the growth. The finance sector increased by 0.6% quarter-on-quarter and, due to its substantial size, added 0.2% to the headline GDP number. The trade sector also contributed 0.1% to the topline reading, with growth reported in wholesale trade, retail trade, and catering and accommodation, according to Stats SA.

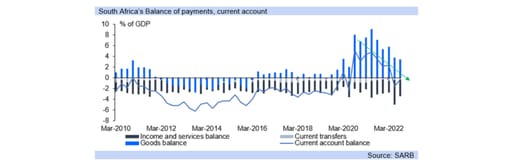

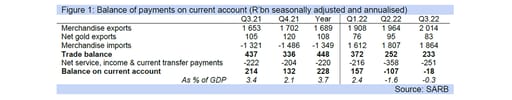

In terms of expenditure, the first quarter of 2023 also yielded a 0.4% increase quarter-on-quarter, following a decline of -1.1% in Q3 2022. Positive contributions from household consumption expenditure, government expenditure, and gross fixed capital formation were observed, although net exports detracted -0.2% from the overall result. Export growth of 4.1% underperformed import activity, which stood at 4.4% over the quarter. Domestic logistical constraints – notably the poor state of SA’s rail and ports – along with subdued global manufacturing demand, weighed on the country's export potential.

Household final consumption expenditure (HFCE), which comprises around two-thirds of GDP, rose by 0.4% quarter-on-quarter, contributing 0.3% to the overall number. Notably, semi-durable goods grew by 2.4% quarter-on-quarter, driven by a recovery in clothing and footwear sales, particularly for work attire and formal wear, as workers returned to offices and recreational activities normalised. Furthermore, the non-durables segment increased by 1.0% quarter-on-quarter. Despite this modest lift in HFCE, consumers continue to face financial constraints, grappling with the rising cost of living while unemployment remains at critically high levels.

Gross fixed capital formation increased by 1.4% quarter-on-quarter, following a lift of 1.5% in Q4 2022. This growth was primarily supported by the pick-up in the other assets category and the machinery and other equipment grouping. However, a notable improvement in business confidence, which further deteriorated in Q1 2023, is necessary to significantly boost private sector investment. This can only be achieved if visible gains are made in improving electricity supply, fixing transport infrastructure, restoring political stability and pushing through policy reforms that make it easier to do business.

Rand collapse and SA’s geopolitical choices jeopardise economic growth

1 June 2023

Load shedding and rand weakness threaten South Africa's inflation trajectory, hindering economic growth and necessitating urgent action to stabilise the currency and restore investor confidence.

South Africa's battle with inflation is facing unexpected headwinds, including the sharp depreciation of the rand, a rapidly deteriorating energy crisis and geopolitical choices that are alienating the country’s major trading partners.

The substantial depreciation of the rand over the past fourteen months has fueled higher inflation rates compared to what would have been seen in a more stable currency environment. This depreciation has had a cascading effect on consumer prices, pushing them upwards.

Load shedding, the scheduled power outages that have plagued South Africa, has placed severe strain on an already moribund economy. It has not only added to costs and inflationary pressures but also hampered economic growth, job creation, and business confidence. The Council for Scientific and Industrial Research (CSIR) highlights that power from generators can be up to 408% more expensive than power from the municipal grid. This increase in costs has hamstrung business activity and contributed to inflationary pressures. According to the South African Reserve Bank (SARB), load shedding could add an additional 0.5 percentage points to headline inflation in 2023.

The persistent concerns surrounding load shedding have also taken a toll on investor sentiment, causing an increase in South Africa's risk premium and putting pressure on the currency. The weakened rand raises the cost of imported goods, leading to higher prices for goods purchased in hard currency.

Moreover, South Africa's involvement with Russia on various fronts, including the prospective hosting of the Russian President at a BRICS summit this year, has further contributed to the rand's weakness. The country's graylisting and geopolitical choices have added to the uncertainties surrounding the economy.

Addressing these issues will require concerted efforts from policymakers to stabilise the currency, alleviate the strain caused by load shedding, and restore investor confidence. Failure to do so could prolong South Africa's struggle with inflation and further damage the country’s struggling economy.

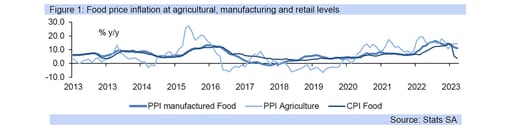

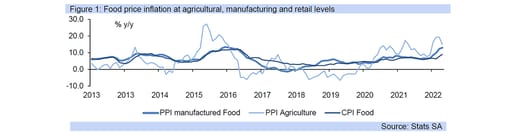

PPI update: SA inflation outlook improves on lower April PPI numbers

25 May 2023

April’s headline producer price inflation (PPI) reading eased to 8.6% from 10.6%, significantly below consensus forecasts

April’s headline producer price inflation (PPI) reading remained flat on the month, easing to 8.6% from 10.6% previously when measured on an annual basis. This was below consensus expectations (Bloomberg) of 9.0% y/y.

The monthly contribution from the coke, petroleum, chemical, rubber and plastic products grouping, in which fuel price dynamics are recorded fell by -0.4% in April, from an increase of 0.5% previously, supported by the drop in the diesel price at the beginning of April.

When measured on an annual basis, petrol price inflation decelerated to 4.5% y/y from 6.4% y/y previously, while diesel price inflation contracted by -1.4% on the year, after rising by 11.1% y/y in March. Accordingly, the contribution from this category of the PPI index, which makes up 22.7% eased notably to 1.6% points from 3.3% points previously.

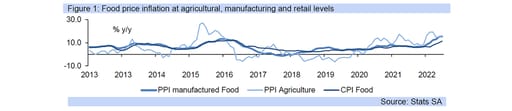

Manufactured food price inflation decelerated further in April to 11.1% y/y from 11.7% y/y and 13.7% y/y recorded in March and February respectively. According to Agbiz, while load-shedding continues to weigh heavily on optimal production, “various interventions to ease the load-shedding burden on farmers, such as load curtailment, expansion of the diesel rebate to the food value chain, and, most recently, the launch of the Agro-Energy Fund” have eased the burden somewhat. However, for those not fully benefiting from these support measures, costs “remain high because of all the necessary mitigation measures”.

A breakdown of the food basket indicates that meat and meat product inflation eased to 4.8% y/y from 6.1% y/y previously, while prices of grain mill products, starches and starch products, and animal feeds declined to 19.1% y/y from 22.0% y/y.

Moreover, the oils and fats category saw prices contract y/y by -8.9%. According to Agbiz this notable “moderation in the "oils and fats" products is in line with what we are seeing in the global environment, as South Africa still imports its palm oil usage”. Specifically, FAO's vegetable oil price index was 45% lower in April, when compared to the same time last year. However, it cautioned that “the weaker rand exchange remains an upside risk to prices”.

Price pressures also eased within the metals, machinery and equipment segment of the PPI basket from 9.2% y/y to 6.9% y/y, aided by the structural and fabricated metal products sub-category.

Tourism Update: strong recovery in tourist accommodation revenues in Q1.23

23 May 2023

South Africa's tourism industry is making a comeback. Y/y domestic tourist accommodation income was up 50% for the quarter, and traveller numbers in March increased by 73.4%

Tourism in South Africa is experiencing a notable uptick, following the pandemic's devastating impact on the travel industry. Income from domestic tourist accommodation rose by nearly 50% in Q1.23 compared to the same period last year. The hotels category and the "other" accommodation category, which includes lodges, bed-and-breakfast establishments, self-catering establishments, and other establishments not elsewhere classified, were the primary contributors to this increase.

In March, 2,445,237 travelers passed through South African ports of entry/exit, according to data from the Department of Home Affairs. This represents a month-over-month increase of 16.1% and a year-over-year increase of 73.4%. Looking specifically at tourist numbers, there was a significant 102.5% year-over-year climb between Q1.23 and Q1.22, with the majority of travelers originating from Europe. Travelers from African nations also rose by 99.3% year-over-year in Q1.23, with those stemming from SADC countries making up the majority.

The tourism industry is a valuable stream of foreign exchange, sustaining and creating jobs and enabling further investment in South Africa's tourism infrastructure. In a recent statement, the Presidency reinforced the fact that "the industry is making a strong and sustained comeback," adding that tourists "are also spending more during their visits - more than R25 billion in the first quarter of 2023." This is a valuable source of foreign exchange that can help sustain and create jobs while enabling further investment in the country's tourism infrastructure.

President Ramaphosa has emphasised the importance of growing this essential sector of the economy, which is a significant channel for job creation, with strong links to other key sectors. The government intends to forge ahead with the process of immigration reform to improve South Africa's competitiveness as a tourism destination.

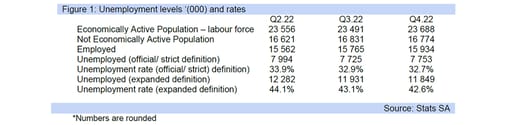

Labour Update: unemployment slightly up at 32.9% in the first quarter

16 May 2023

The overall labour participation rate is below 60% at 59.4% evincing the fragility of the South African economy

The official unemployment rate picked up marginally to 32.9% in the first quarter of 2023 from 32.7% logged in Q4.22. Although it has fallen from levels recorded during the pandemic, it remains at an elevated level. The overall labour participation rate is below 60% at 59.4% evincing the fragility of the South African economy, which is plagued by ongoing rotational load shedding, significantly impeding activity and weighing heavily on confidence and growth. Indeed, we expect GDP growth of just 0.2% this year with downside risks apparent.

A “number of persons moved from the "not economically active" category to "employed" and "unemployed" statuses between the two quarters” according to Stats SA, resulting in the 0.2 of a percentage lift in the unemployment rate.